Professional Documents

Culture Documents

PAPA Session 5

PAPA Session 5

Uploaded by

Thomas KariukiCopyright:

Available Formats

You might also like

- Financial Planning Pinoy Style by Randell TiongsonDocument7 pagesFinancial Planning Pinoy Style by Randell TiongsonCHEN-CHEN OFALSA100% (1)

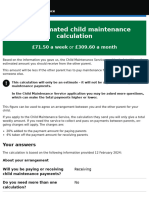

- Child Maintenance Calculation 12 February 2024Document3 pagesChild Maintenance Calculation 12 February 2024rumbidzamakuvazaNo ratings yet

- Daycare 101Document69 pagesDaycare 101Sagari Isukapalli100% (1)

- Child Care Subsidy Literature ReviewDocument7 pagesChild Care Subsidy Literature Reviewgw1wayrw100% (1)

- How We Work Out Child Maintenance: A Step-By-Step GuideDocument48 pagesHow We Work Out Child Maintenance: A Step-By-Step GuideThanasis AnthopoulosNo ratings yet

- Unemployment and Other Assistance ProgramDocument10 pagesUnemployment and Other Assistance ProgramMaimai Durano100% (1)

- How We Work Out Child Maintenance: A Step-By-Step GuideDocument48 pagesHow We Work Out Child Maintenance: A Step-By-Step GuideNatsu KitaNo ratings yet

- Needs Assessment: Preparing A Business PlanDocument2 pagesNeeds Assessment: Preparing A Business Plansobiakhan2356No ratings yet

- Phoenix Family Law LawyerDocument8 pagesPhoenix Family Law LawyerphoenixfamilylawNo ratings yet

- 26 Retirement 1 AssignmentsDocument4 pages26 Retirement 1 AssignmentsEkta ParabNo ratings yet

- Municipal Briefing NotesDocument7 pagesMunicipal Briefing NotesACORN_CanadaNo ratings yet

- Daycare BusinessDocument5 pagesDaycare BusinessAminul IslamNo ratings yet

- Financial Assistance For Single Mothers May Just Be What You NeedDocument5 pagesFinancial Assistance For Single Mothers May Just Be What You NeedSingleNo ratings yet

- StretchyourdollarsDocument36 pagesStretchyourdollarsapi-200845891No ratings yet

- Personal Budgets: The Essential Question How Does Budgeting Help You Achieve Your Financial Goals?Document12 pagesPersonal Budgets: The Essential Question How Does Budgeting Help You Achieve Your Financial Goals?JamNo ratings yet

- Northside Chicago Standard 09Document5 pagesNorthside Chicago Standard 09Social IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- How to Control Your Finances: Save Money, Increase Income, Invest, & Grow your NetworthFrom EverandHow to Control Your Finances: Save Money, Increase Income, Invest, & Grow your NetworthNo ratings yet

- Week 5 Safety Net Spring 2023Document2 pagesWeek 5 Safety Net Spring 2023zoe gaughanNo ratings yet

- North Suburban Cook Standard 09Document5 pagesNorth Suburban Cook Standard 09Social IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- South Suburban Cook Standard 09Document5 pagesSouth Suburban Cook Standard 09Social IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Why Georgia's Child Support Guidelines Are UnconstitutionalDocument11 pagesWhy Georgia's Child Support Guidelines Are UnconstitutionalextemporaneousNo ratings yet

- Bond Standard 09Document4 pagesBond Standard 09Social IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- DeKalb Standard 09Document4 pagesDeKalb Standard 09Social IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Michigan Welfare 101: Myth 01Document1 pageMichigan Welfare 101: Myth 01Beverly TranNo ratings yet

- Self-Sufficiency in Jackson County, IllinoisDocument4 pagesSelf-Sufficiency in Jackson County, IllinoisSocial IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Self-Sufficiency in Hancock County, IllinoisDocument4 pagesSelf-Sufficiency in Hancock County, IllinoisSocial IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Family Budget ProjectDocument10 pagesFamily Budget Projectjunaid73% (22)

- Livingston Standard 09Document4 pagesLivingston Standard 09Social IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Family BudgetDocument7 pagesFamily BudgetDinesh Hadwale50% (4)

- Self-Sufficiency in Christian County, IllinoisDocument4 pagesSelf-Sufficiency in Christian County, IllinoisSocial IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Self-Sufficiency in Massac County, IllinoisDocument4 pagesSelf-Sufficiency in Massac County, IllinoisSocial IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Budget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.From EverandBudget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.Rating: 5 out of 5 stars5/5 (38)

- Financial Intelligence: A Guidebook On Getting Your Finances In Order Once And For AllFrom EverandFinancial Intelligence: A Guidebook On Getting Your Finances In Order Once And For AllNo ratings yet

- Kane Standard 09Document4 pagesKane Standard 09Social IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- The Importance of Financial WellDocument4 pagesThe Importance of Financial WellSaseela BalagobeiNo ratings yet

- Self-Sufficiency in Kendall County, IllinoisDocument4 pagesSelf-Sufficiency in Kendall County, IllinoisSocial IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- How To Survive Financially As A Single Mom - Clever Girl FinanceDocument27 pagesHow To Survive Financially As A Single Mom - Clever Girl FinanceBarely LegalNo ratings yet

- Henry Standard 09Document4 pagesHenry Standard 09Social IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Everyone Needs Help Sometimes Everyone Needs Help Sometimes: Nova Scotia'sDocument44 pagesEveryone Needs Help Sometimes Everyone Needs Help Sometimes: Nova Scotia'ssdsdadfdNo ratings yet

- A - Comprehensive Guide To Tax Free ChildcareDocument19 pagesA - Comprehensive Guide To Tax Free Childcaredolors.mayencoNo ratings yet

- Bureau Standard 09Document4 pagesBureau Standard 09Social IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Pike Standard 09Document4 pagesPike Standard 09Social IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- 13-441a English BrochureDocument16 pages13-441a English Brochureapi-97071804No ratings yet

- Self-Sufficiency in Dewitt County, IllinoisDocument4 pagesSelf-Sufficiency in Dewitt County, IllinoisSocial IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- 7 Ways To Combat Crazy ChildDocument3 pages7 Ways To Combat Crazy ChildFelipeBFFerreiraNo ratings yet

- Knox Standard 09Document4 pagesKnox Standard 09Social IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- How Much Do Babies Generally Cost For A Year - Google SearchDocument1 pageHow Much Do Babies Generally Cost For A Year - Google SearchsandlinpenelopeNo ratings yet

- Chapter 2 4 IntlDocument5 pagesChapter 2 4 IntlChris FloresNo ratings yet

- Greene Standard 09Document4 pagesGreene Standard 09Social IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Self-Sufficiency in Richland County, IllinoisDocument4 pagesSelf-Sufficiency in Richland County, IllinoisSocial IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Making Money Work For YouDocument20 pagesMaking Money Work For YouAnthony Diaz GNo ratings yet

- Money Management CycleDocument25 pagesMoney Management CycleabieNo ratings yet

- Self-Sufficiency in Mcdonough County, IllinoisDocument4 pagesSelf-Sufficiency in Mcdonough County, IllinoisSocial IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Self-Sufficiency in Henderson County, IllinoisDocument4 pagesSelf-Sufficiency in Henderson County, IllinoisSocial IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Child Support Policy: Taking Care of Nations' Children: by Adam Calvert 100777259Document18 pagesChild Support Policy: Taking Care of Nations' Children: by Adam Calvert 100777259Adam'and'Stephanie CalvertNo ratings yet

- Pope Standard 09Document4 pagesPope Standard 09Social IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Clark Standard 09Document4 pagesClark Standard 09Social IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- PAPA Session #9Document8 pagesPAPA Session #9Thomas KariukiNo ratings yet

- Chapter 21 PacketDocument4 pagesChapter 21 PacketThomas KariukiNo ratings yet

- Chapt 22 Alcohol WK SheetDocument4 pagesChapt 22 Alcohol WK SheetThomas KariukiNo ratings yet

- Vaping Ad ActivityDocument1 pageVaping Ad ActivityThomas KariukiNo ratings yet

- Group A FinalDocument2 pagesGroup A Finalapi-380281979No ratings yet

- CFASDocument4 pagesCFASMary Jhel QuiddamNo ratings yet

- Human Resource ManagementDocument24 pagesHuman Resource ManagementOrnella HallidayNo ratings yet

- Kalamba Games - 51% Majority Stake Investment Opportunity - July23Document17 pagesKalamba Games - 51% Majority Stake Investment Opportunity - July23Calvin LimNo ratings yet

- Academic Affairs: Western Philippines UniversityDocument4 pagesAcademic Affairs: Western Philippines UniversityRicoyan YanNo ratings yet

- A031191120 - Rezky Aprilianti (Latihan Soal P.2-5 & P.2-8)Document2 pagesA031191120 - Rezky Aprilianti (Latihan Soal P.2-5 & P.2-8)Rezky ApriliantiNo ratings yet

- Imt 09Document4 pagesImt 09nikhilanand13No ratings yet

- Class 12 Accountancy 2023 24 Notes Chapter 2 Accounting For PartnershipDocument33 pagesClass 12 Accountancy 2023 24 Notes Chapter 2 Accounting For Partnershipshuklajaya349No ratings yet

- Itaewon Class Is More Than Just A Revenge Story. The Series Portrays How We Get Through Life MistakesDocument4 pagesItaewon Class Is More Than Just A Revenge Story. The Series Portrays How We Get Through Life Mistakesmarichu apiladoNo ratings yet

- Job Description - Organization DevelopmentDocument2 pagesJob Description - Organization DevelopmentandrieNo ratings yet

- Spokesperson, Honda Motorcycle & Scooter India Pvt. LTD., in 2005Document4 pagesSpokesperson, Honda Motorcycle & Scooter India Pvt. LTD., in 2005Sheetal Shinde YewaleNo ratings yet

- BONEO Pup Receivables3 SRC 2 1Document13 pagesBONEO Pup Receivables3 SRC 2 1hellokittysaranghaeNo ratings yet

- Job Description - Head ChefDocument3 pagesJob Description - Head ChefberdaespassiaNo ratings yet

- Engagement Opportunity GuideDocument40 pagesEngagement Opportunity GuideDavid BriggsNo ratings yet

- Sustainable Business: - Case Studies From Finnish ForerunnersDocument50 pagesSustainable Business: - Case Studies From Finnish ForerunnersmikaNo ratings yet

- FRI AssignmentDocument18 pagesFRI AssignmentHaider SaleemNo ratings yet

- GHMPI - PSE Exhibit 10 Preliminary Prospectus PDFDocument163 pagesGHMPI - PSE Exhibit 10 Preliminary Prospectus PDFFrancis Augustus RagatNo ratings yet

- (Cpar2016) Tax-8002 (Individual Taxpayer)Document10 pages(Cpar2016) Tax-8002 (Individual Taxpayer)Ralph SantosNo ratings yet

- Trade DiversionDocument2 pagesTrade DiversionJae-wook LeeNo ratings yet

- SWOT Titan FinalDocument29 pagesSWOT Titan FinalMukesh Manwani100% (1)

- Chapter 8 ProductDocument48 pagesChapter 8 Productqdrsnbk85mNo ratings yet

- Night Report - 10.01.2023Document1 pageNight Report - 10.01.2023Vivek BhadviyaNo ratings yet

- Certificate of DepositsDocument23 pagesCertificate of DepositssashaathrgNo ratings yet

- A Practical Guide For Cloud Migration ReadinessDocument17 pagesA Practical Guide For Cloud Migration Readinesssundeep_dubeyNo ratings yet

- Ca Final SFM (New) Chapterwise Abc & Marks Analysis - Ca Ravi AgarwalDocument2 pagesCa Final SFM (New) Chapterwise Abc & Marks Analysis - Ca Ravi AgarwalG KNo ratings yet

- Economics P1 Feb-March 2017 EngDocument12 pagesEconomics P1 Feb-March 2017 EngShexe VnoNo ratings yet

- Pride of CowsDocument92 pagesPride of CowsSurbhi GargNo ratings yet

- Ebook PDF Contemporary Financial Management 13th Edition PDFDocument41 pagesEbook PDF Contemporary Financial Management 13th Edition PDFlori.parker237100% (43)

- A Study On Advertisement and Sales Promotion at Asian PaintsDocument68 pagesA Study On Advertisement and Sales Promotion at Asian PaintsJalpa BhattNo ratings yet

- ExampleDocument91 pagesExampleally gelNo ratings yet

PAPA Session 5

PAPA Session 5

Uploaded by

Thomas KariukiOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PAPA Session 5

PAPA Session 5

Uploaded by

Thomas KariukiCopyright:

Available Formats

Session 5: Child Support

Introduction

When parents separate and one of them has custody of the child, the noncustodial parent has to pay child

support. Child support is defined as regular payments of money, in an amount set by a court, paid by the

noncustodial parent (NCP) to the custodial parent (CP) of a child. A noncustodial parent can be a mother or a

father.

Children need and deserve the financial support of both of their parents. If parents aren’t living together, the

noncustodial parent is legally responsible for paying child support.

The actual amount of child support to be paid is based on the noncustodial parent’s net income - total income

minus federal income tax, Social Security (6.2%), Medicare (1.45%), union dues and expenses for health care

coverage for the child. According to Texas Child Support guidelines, the amount of child support owed is as

follows:

1 child 20% of net income

2 children 25%

3 children 30%

4 children 35%

5 or more children 40%

*These amounts are for multiple children with the same two biological parents.

p.a.p.a. Student Workbook page • 21

ACTIvity: Calculate Child Support Owed

The amount of federal income tax is provided in each of the story problems below. For each of the noncusto-

dial parents below, figure out gross income (assuming a 40-hour work week) and subtract federal income

tax, Social Security and Medicare tax to arrive at net income. The guidelines will then tell you the amount of

child support owed monthly. This is how much you’d have to pay each month if you had a child you didn’t live

with. Or, it’s the amount you would receive in child support if you were the custodial parent in the example.

1. Calculate the child support for a noncustodial parent earning $7.25 per hour with two children.

(Federal income tax - $42.00, S.S. – 6.2%, Medicare - 1.45%) __________

2. Calculate the child support for a noncustodial parent earning $10 per hour with one child.

(Federal income tax - $108.00, S.S. - 6.2%, Medicare - 1.45%) __________

3. Calculate the child support for a noncustodial parent earning $10 per hour with two children.

(Federal income tax - $108.00, S.S. - 6.2%, Medicare - 1.45%) __________

How to calculate:

Multiply the hourly wage by 40; then multiply by 52; then divide by 12 to get gross monthly income.

$_____ X 40 = $_____ $______ X 52 = $_____ $_____ ÷ 12 = $_____

Round that amount to the nearest whole dollar. Multiply gross income by .062 (6.2% Social Security) and by

.0145 (1.45% for Medicare). Add these two numbers to the federal income tax and subtract the sum from the

gross income in order to get the net income.

Consult the guidelines to figure child support amounts based on the number of children in each story.

p.a.p.a. Student Workbook page • 22

ACTIvity: Revise Your Budget

Get your completed budget from the last session. Now imagine that you just became a noncustodial parent

with one child. Don’t worry about whether that sounds realistic or not. Just figure out how much child

support you would pay based on your net monthly income.

Add the amount you owe monthly for child support as a must-have expense. Then, revise your budget

accordingly. You’ll probably have to give up some want-to expenses.

How do you feel about your budget now?

What would it be like to manage your life with this budget?

p.a.p.a. Student Workbook page • 23

You might also like

- Financial Planning Pinoy Style by Randell TiongsonDocument7 pagesFinancial Planning Pinoy Style by Randell TiongsonCHEN-CHEN OFALSA100% (1)

- Child Maintenance Calculation 12 February 2024Document3 pagesChild Maintenance Calculation 12 February 2024rumbidzamakuvazaNo ratings yet

- Daycare 101Document69 pagesDaycare 101Sagari Isukapalli100% (1)

- Child Care Subsidy Literature ReviewDocument7 pagesChild Care Subsidy Literature Reviewgw1wayrw100% (1)

- How We Work Out Child Maintenance: A Step-By-Step GuideDocument48 pagesHow We Work Out Child Maintenance: A Step-By-Step GuideThanasis AnthopoulosNo ratings yet

- Unemployment and Other Assistance ProgramDocument10 pagesUnemployment and Other Assistance ProgramMaimai Durano100% (1)

- How We Work Out Child Maintenance: A Step-By-Step GuideDocument48 pagesHow We Work Out Child Maintenance: A Step-By-Step GuideNatsu KitaNo ratings yet

- Needs Assessment: Preparing A Business PlanDocument2 pagesNeeds Assessment: Preparing A Business Plansobiakhan2356No ratings yet

- Phoenix Family Law LawyerDocument8 pagesPhoenix Family Law LawyerphoenixfamilylawNo ratings yet

- 26 Retirement 1 AssignmentsDocument4 pages26 Retirement 1 AssignmentsEkta ParabNo ratings yet

- Municipal Briefing NotesDocument7 pagesMunicipal Briefing NotesACORN_CanadaNo ratings yet

- Daycare BusinessDocument5 pagesDaycare BusinessAminul IslamNo ratings yet

- Financial Assistance For Single Mothers May Just Be What You NeedDocument5 pagesFinancial Assistance For Single Mothers May Just Be What You NeedSingleNo ratings yet

- StretchyourdollarsDocument36 pagesStretchyourdollarsapi-200845891No ratings yet

- Personal Budgets: The Essential Question How Does Budgeting Help You Achieve Your Financial Goals?Document12 pagesPersonal Budgets: The Essential Question How Does Budgeting Help You Achieve Your Financial Goals?JamNo ratings yet

- Northside Chicago Standard 09Document5 pagesNorthside Chicago Standard 09Social IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- How to Control Your Finances: Save Money, Increase Income, Invest, & Grow your NetworthFrom EverandHow to Control Your Finances: Save Money, Increase Income, Invest, & Grow your NetworthNo ratings yet

- Week 5 Safety Net Spring 2023Document2 pagesWeek 5 Safety Net Spring 2023zoe gaughanNo ratings yet

- North Suburban Cook Standard 09Document5 pagesNorth Suburban Cook Standard 09Social IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- South Suburban Cook Standard 09Document5 pagesSouth Suburban Cook Standard 09Social IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Why Georgia's Child Support Guidelines Are UnconstitutionalDocument11 pagesWhy Georgia's Child Support Guidelines Are UnconstitutionalextemporaneousNo ratings yet

- Bond Standard 09Document4 pagesBond Standard 09Social IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- DeKalb Standard 09Document4 pagesDeKalb Standard 09Social IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Michigan Welfare 101: Myth 01Document1 pageMichigan Welfare 101: Myth 01Beverly TranNo ratings yet

- Self-Sufficiency in Jackson County, IllinoisDocument4 pagesSelf-Sufficiency in Jackson County, IllinoisSocial IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Self-Sufficiency in Hancock County, IllinoisDocument4 pagesSelf-Sufficiency in Hancock County, IllinoisSocial IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Family Budget ProjectDocument10 pagesFamily Budget Projectjunaid73% (22)

- Livingston Standard 09Document4 pagesLivingston Standard 09Social IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Family BudgetDocument7 pagesFamily BudgetDinesh Hadwale50% (4)

- Self-Sufficiency in Christian County, IllinoisDocument4 pagesSelf-Sufficiency in Christian County, IllinoisSocial IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Self-Sufficiency in Massac County, IllinoisDocument4 pagesSelf-Sufficiency in Massac County, IllinoisSocial IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Budget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.From EverandBudget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.Rating: 5 out of 5 stars5/5 (38)

- Financial Intelligence: A Guidebook On Getting Your Finances In Order Once And For AllFrom EverandFinancial Intelligence: A Guidebook On Getting Your Finances In Order Once And For AllNo ratings yet

- Kane Standard 09Document4 pagesKane Standard 09Social IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- The Importance of Financial WellDocument4 pagesThe Importance of Financial WellSaseela BalagobeiNo ratings yet

- Self-Sufficiency in Kendall County, IllinoisDocument4 pagesSelf-Sufficiency in Kendall County, IllinoisSocial IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- How To Survive Financially As A Single Mom - Clever Girl FinanceDocument27 pagesHow To Survive Financially As A Single Mom - Clever Girl FinanceBarely LegalNo ratings yet

- Henry Standard 09Document4 pagesHenry Standard 09Social IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Everyone Needs Help Sometimes Everyone Needs Help Sometimes: Nova Scotia'sDocument44 pagesEveryone Needs Help Sometimes Everyone Needs Help Sometimes: Nova Scotia'ssdsdadfdNo ratings yet

- A - Comprehensive Guide To Tax Free ChildcareDocument19 pagesA - Comprehensive Guide To Tax Free Childcaredolors.mayencoNo ratings yet

- Bureau Standard 09Document4 pagesBureau Standard 09Social IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Pike Standard 09Document4 pagesPike Standard 09Social IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- 13-441a English BrochureDocument16 pages13-441a English Brochureapi-97071804No ratings yet

- Self-Sufficiency in Dewitt County, IllinoisDocument4 pagesSelf-Sufficiency in Dewitt County, IllinoisSocial IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- 7 Ways To Combat Crazy ChildDocument3 pages7 Ways To Combat Crazy ChildFelipeBFFerreiraNo ratings yet

- Knox Standard 09Document4 pagesKnox Standard 09Social IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- How Much Do Babies Generally Cost For A Year - Google SearchDocument1 pageHow Much Do Babies Generally Cost For A Year - Google SearchsandlinpenelopeNo ratings yet

- Chapter 2 4 IntlDocument5 pagesChapter 2 4 IntlChris FloresNo ratings yet

- Greene Standard 09Document4 pagesGreene Standard 09Social IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Self-Sufficiency in Richland County, IllinoisDocument4 pagesSelf-Sufficiency in Richland County, IllinoisSocial IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Making Money Work For YouDocument20 pagesMaking Money Work For YouAnthony Diaz GNo ratings yet

- Money Management CycleDocument25 pagesMoney Management CycleabieNo ratings yet

- Self-Sufficiency in Mcdonough County, IllinoisDocument4 pagesSelf-Sufficiency in Mcdonough County, IllinoisSocial IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Self-Sufficiency in Henderson County, IllinoisDocument4 pagesSelf-Sufficiency in Henderson County, IllinoisSocial IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Child Support Policy: Taking Care of Nations' Children: by Adam Calvert 100777259Document18 pagesChild Support Policy: Taking Care of Nations' Children: by Adam Calvert 100777259Adam'and'Stephanie CalvertNo ratings yet

- Pope Standard 09Document4 pagesPope Standard 09Social IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Clark Standard 09Document4 pagesClark Standard 09Social IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- PAPA Session #9Document8 pagesPAPA Session #9Thomas KariukiNo ratings yet

- Chapter 21 PacketDocument4 pagesChapter 21 PacketThomas KariukiNo ratings yet

- Chapt 22 Alcohol WK SheetDocument4 pagesChapt 22 Alcohol WK SheetThomas KariukiNo ratings yet

- Vaping Ad ActivityDocument1 pageVaping Ad ActivityThomas KariukiNo ratings yet

- Group A FinalDocument2 pagesGroup A Finalapi-380281979No ratings yet

- CFASDocument4 pagesCFASMary Jhel QuiddamNo ratings yet

- Human Resource ManagementDocument24 pagesHuman Resource ManagementOrnella HallidayNo ratings yet

- Kalamba Games - 51% Majority Stake Investment Opportunity - July23Document17 pagesKalamba Games - 51% Majority Stake Investment Opportunity - July23Calvin LimNo ratings yet

- Academic Affairs: Western Philippines UniversityDocument4 pagesAcademic Affairs: Western Philippines UniversityRicoyan YanNo ratings yet

- A031191120 - Rezky Aprilianti (Latihan Soal P.2-5 & P.2-8)Document2 pagesA031191120 - Rezky Aprilianti (Latihan Soal P.2-5 & P.2-8)Rezky ApriliantiNo ratings yet

- Imt 09Document4 pagesImt 09nikhilanand13No ratings yet

- Class 12 Accountancy 2023 24 Notes Chapter 2 Accounting For PartnershipDocument33 pagesClass 12 Accountancy 2023 24 Notes Chapter 2 Accounting For Partnershipshuklajaya349No ratings yet

- Itaewon Class Is More Than Just A Revenge Story. The Series Portrays How We Get Through Life MistakesDocument4 pagesItaewon Class Is More Than Just A Revenge Story. The Series Portrays How We Get Through Life Mistakesmarichu apiladoNo ratings yet

- Job Description - Organization DevelopmentDocument2 pagesJob Description - Organization DevelopmentandrieNo ratings yet

- Spokesperson, Honda Motorcycle & Scooter India Pvt. LTD., in 2005Document4 pagesSpokesperson, Honda Motorcycle & Scooter India Pvt. LTD., in 2005Sheetal Shinde YewaleNo ratings yet

- BONEO Pup Receivables3 SRC 2 1Document13 pagesBONEO Pup Receivables3 SRC 2 1hellokittysaranghaeNo ratings yet

- Job Description - Head ChefDocument3 pagesJob Description - Head ChefberdaespassiaNo ratings yet

- Engagement Opportunity GuideDocument40 pagesEngagement Opportunity GuideDavid BriggsNo ratings yet

- Sustainable Business: - Case Studies From Finnish ForerunnersDocument50 pagesSustainable Business: - Case Studies From Finnish ForerunnersmikaNo ratings yet

- FRI AssignmentDocument18 pagesFRI AssignmentHaider SaleemNo ratings yet

- GHMPI - PSE Exhibit 10 Preliminary Prospectus PDFDocument163 pagesGHMPI - PSE Exhibit 10 Preliminary Prospectus PDFFrancis Augustus RagatNo ratings yet

- (Cpar2016) Tax-8002 (Individual Taxpayer)Document10 pages(Cpar2016) Tax-8002 (Individual Taxpayer)Ralph SantosNo ratings yet

- Trade DiversionDocument2 pagesTrade DiversionJae-wook LeeNo ratings yet

- SWOT Titan FinalDocument29 pagesSWOT Titan FinalMukesh Manwani100% (1)

- Chapter 8 ProductDocument48 pagesChapter 8 Productqdrsnbk85mNo ratings yet

- Night Report - 10.01.2023Document1 pageNight Report - 10.01.2023Vivek BhadviyaNo ratings yet

- Certificate of DepositsDocument23 pagesCertificate of DepositssashaathrgNo ratings yet

- A Practical Guide For Cloud Migration ReadinessDocument17 pagesA Practical Guide For Cloud Migration Readinesssundeep_dubeyNo ratings yet

- Ca Final SFM (New) Chapterwise Abc & Marks Analysis - Ca Ravi AgarwalDocument2 pagesCa Final SFM (New) Chapterwise Abc & Marks Analysis - Ca Ravi AgarwalG KNo ratings yet

- Economics P1 Feb-March 2017 EngDocument12 pagesEconomics P1 Feb-March 2017 EngShexe VnoNo ratings yet

- Pride of CowsDocument92 pagesPride of CowsSurbhi GargNo ratings yet

- Ebook PDF Contemporary Financial Management 13th Edition PDFDocument41 pagesEbook PDF Contemporary Financial Management 13th Edition PDFlori.parker237100% (43)

- A Study On Advertisement and Sales Promotion at Asian PaintsDocument68 pagesA Study On Advertisement and Sales Promotion at Asian PaintsJalpa BhattNo ratings yet

- ExampleDocument91 pagesExampleally gelNo ratings yet