Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

24 viewsSona Corporation India PVT LTD Vs Ingram Micro IndDE202003022016413680COM85190

Sona Corporation India PVT LTD Vs Ingram Micro IndDE202003022016413680COM85190

Uploaded by

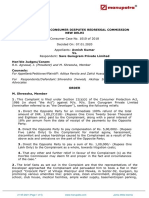

piyush bhardwajThis document summarizes a court case regarding a dispute between Sona Corporation India Pvt. Ltd. and Ingram Micro India Pvt. Ltd. over termination of lease agreements and damages. The court upheld the arbitrator's decision to recall an earlier order and require Sona Corporation to provide a bank guarantee or deposit funds as security. While the respondents were aware of loans secured by the property, the arbitrator found Sona Corporation should have disclosed all encumbrances to the court previously. No contempt was found but the arbitrator acted reasonably to ensure secure funds for any potential damages awarded.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Simple Guide for Drafting of Civil Suits in IndiaFrom EverandSimple Guide for Drafting of Civil Suits in IndiaRating: 4.5 out of 5 stars4.5/5 (4)

- Chapter 5 and 6 Business QuestionsDocument10 pagesChapter 5 and 6 Business QuestionsHibah AamirNo ratings yet

- Geeta Vs Mohd Raza and Ors 14112019 DELHCDE201903121916054943COM21606Document3 pagesGeeta Vs Mohd Raza and Ors 14112019 DELHCDE201903121916054943COM21606Nikita DatlaNo ratings yet

- Globe Detective Agencies PVT LTD and Ors Vs GammonTN2019020919160942209COM102058Document6 pagesGlobe Detective Agencies PVT LTD and Ors Vs GammonTN2019020919160942209COM102058omwjcclNo ratings yet

- Rattan Mehta & Anr. vs. Gayatri Shah & Ors.Document9 pagesRattan Mehta & Anr. vs. Gayatri Shah & Ors.Manish KumarNo ratings yet

- Nabinagar Power Generating Company LTD Vs Ram RataNL2023190423165007208COM549304Document9 pagesNabinagar Power Generating Company LTD Vs Ram RataNL2023190423165007208COM549304Dhananjai RaiNo ratings yet

- Bhavdipbhai Arunbhai Dave Vs Kotak Mahindra Bank LGJ2022090222165556143COM189934Document16 pagesBhavdipbhai Arunbhai Dave Vs Kotak Mahindra Bank LGJ2022090222165556143COM189934Sakshi ShettyNo ratings yet

- CPC ProjectDocument11 pagesCPC ProjectanshulNo ratings yet

- FIRAC On DLF Power Ltd. vs. Mangalore Refinery and Petrochemical LTDDocument13 pagesFIRAC On DLF Power Ltd. vs. Mangalore Refinery and Petrochemical LTDKartikey swamiNo ratings yet

- AS Patel Trust and Ors Vs Wall Street Finance LimiMH2019300719163147225COM459484Document10 pagesAS Patel Trust and Ors Vs Wall Street Finance LimiMH2019300719163147225COM459484ranjanjhallbNo ratings yet

- Delhi - Moneyline Credit V Sanjeev KumarDocument7 pagesDelhi - Moneyline Credit V Sanjeev KumarEkansh AroraNo ratings yet

- Annapurna Infrastructure PVT LTD and Ors Vs Soril NC201704041716045287COM832974Document9 pagesAnnapurna Infrastructure PVT LTD and Ors Vs Soril NC201704041716045287COM832974Mayank MishraNo ratings yet

- The - Royal Bank - of - Scotland - NV - Vs - Earnest - Business - MH2017091017162407329COM584482Document6 pagesThe - Royal Bank - of - Scotland - NV - Vs - Earnest - Business - MH2017091017162407329COM584482ranjanjhallbNo ratings yet

- R. Subbiah and R. Pongiappan, JJDocument9 pagesR. Subbiah and R. Pongiappan, JJayoNo ratings yet

- RNA Exotica Vrajesh Hirjee OrderDocument8 pagesRNA Exotica Vrajesh Hirjee OrderMoneylife FoundationNo ratings yet

- Maharera 439414Document16 pagesMaharera 439414Legal ClawsNo ratings yet

- Arbitration AwardDocument8 pagesArbitration AwardDevvrat garhwalNo ratings yet

- Renu Khanna Vs Emaar MGF Land Private Limited 2409SF2019211019171315366COM323980Document19 pagesRenu Khanna Vs Emaar MGF Land Private Limited 2409SF2019211019171315366COM323980Anany UpadhyayNo ratings yet

- 186292022161136164order22 Jun 2022 423599Document15 pages186292022161136164order22 Jun 2022 423599Ajay K.S.No ratings yet

- CB Grant Road Sheetal India OA 14122021Document23 pagesCB Grant Road Sheetal India OA 14122021Kanak KathuriaNo ratings yet

- Goregaon Pearl CHSL Vs Seema Mahadev Paryekar and MH2019051119175740228COM929702Document7 pagesGoregaon Pearl CHSL Vs Seema Mahadev Paryekar and MH2019051119175740228COM929702Visalakshy GuptaNo ratings yet

- State Bank of Patiala Vs Laxmi Narain Sharma and Dd120033COM149351Document4 pagesState Bank of Patiala Vs Laxmi Narain Sharma and Dd120033COM149351Keshav BahetiNo ratings yet

- Standard Chartered Bank Vs Dharminder Bhohi & Ors On 13 September, 2013Document12 pagesStandard Chartered Bank Vs Dharminder Bhohi & Ors On 13 September, 2013vishalbalechaNo ratings yet

- DRT DRAFT Case 1Document14 pagesDRT DRAFT Case 1Dvs Suraj50% (2)

- MB Chander and Ors Vs Balakrishna Rao Charitable TAP20162112161604211COM607757Document15 pagesMB Chander and Ors Vs Balakrishna Rao Charitable TAP20162112161604211COM607757kalyanighayalNo ratings yet

- ArbitrationPetition Sahil BrothersDocument28 pagesArbitrationPetition Sahil BrothersTauheedAlamNo ratings yet

- Dr. Dhananjaya Y. Chandrachud Surya Kant, JJDocument6 pagesDr. Dhananjaya Y. Chandrachud Surya Kant, JJjags jainNo ratings yet

- Avnish Kumar Sare GurugramDocument5 pagesAvnish Kumar Sare GurugramSai VijitendraNo ratings yet

- SocDocument4 pagesSocvadodaraNo ratings yet

- DRT 501373Document26 pagesDRT 501373Prasad VaidyaNo ratings yet

- In The High Court of Delhi at New DelhiDocument5 pagesIn The High Court of Delhi at New DelhiRakeshNo ratings yet

- Kamla Engg and Steel Industries Vs Punjab NationalPH2020100221160701236COM616350Document33 pagesKamla Engg and Steel Industries Vs Punjab NationalPH2020100221160701236COM616350MALKANI DISHA DEEPAKNo ratings yet

- Sanjeev Shriya and Ors Vs State Bank of India and UP2017180917161040203COM366947Document22 pagesSanjeev Shriya and Ors Vs State Bank of India and UP2017180917161040203COM366947Rahul BarnwalNo ratings yet

- Display PDF - PHPDocument8 pagesDisplay PDF - PHPshraddhaahir1998No ratings yet

- Ramanand and Ors Vs Girish Soni and Ors 21052020 DE202010062015043218COM681787Document12 pagesRamanand and Ors Vs Girish Soni and Ors 21052020 DE202010062015043218COM681787Faraz ahmad KhanNo ratings yet

- SocDocument4 pagesSocvadodaraNo ratings yet

- Rohin Arora & Another vs. D.D.A PDFDocument6 pagesRohin Arora & Another vs. D.D.A PDFCA Himanshu GuptaNo ratings yet

- R.D. Saxena CaseDocument6 pagesR.D. Saxena CaseAbhu4767No ratings yet

- Imam Din (Written Reply)Document4 pagesImam Din (Written Reply)api-3745637No ratings yet

- Civil Writ Maya DeviDocument15 pagesCivil Writ Maya DevisdvyasadvocateNo ratings yet

- Vikash Kumar Mishra & Ors. v. Orbis Trusteeship Service Private Limited & AnrDocument6 pagesVikash Kumar Mishra & Ors. v. Orbis Trusteeship Service Private Limited & AnrJayant SharmaNo ratings yet

- Test 8Document5 pagesTest 8KONINIKA BHATTACHARJEE 1950350No ratings yet

- Uttam Galva Steels LTD Vs Bank of India and Ors 3DR080002COM676503Document4 pagesUttam Galva Steels LTD Vs Bank of India and Ors 3DR080002COM676503sssNo ratings yet

- Supreme Court: Proof of Ownership Varies in Landlord - Tenant Litigation and Title Suit.Document19 pagesSupreme Court: Proof of Ownership Varies in Landlord - Tenant Litigation and Title Suit.Manan BhattNo ratings yet

- Bombay High Court Commercial Suit JudgmentDocument42 pagesBombay High Court Commercial Suit JudgmentranjanjhallbNo ratings yet

- Ramesh Kumar Vs The State of NCT of DelhiDocument9 pagesRamesh Kumar Vs The State of NCT of Delhiagrud.partners2023No ratings yet

- R.D. Saxena Vs Balram Prasad Sharma On 22 August, 2000Document5 pagesR.D. Saxena Vs Balram Prasad Sharma On 22 August, 2000kshitijsaxenaNo ratings yet

- Ashok Bhushan and K.M. Joseph, JJDocument3 pagesAshok Bhushan and K.M. Joseph, JJSiddhantNo ratings yet

- Suman Chadha Vs Central Bank of India On 9 August 2021Document9 pagesSuman Chadha Vs Central Bank of India On 9 August 2021SHIVANSHI SHUKLANo ratings yet

- Arbitration Final Award-JDF.1005.2024Document12 pagesArbitration Final Award-JDF.1005.2024vadodaraNo ratings yet

- First Nationa Bank T. LTD VS Miles Comm Case No.108 of 2017 Hon - Mruma, JDocument11 pagesFirst Nationa Bank T. LTD VS Miles Comm Case No.108 of 2017 Hon - Mruma, JEmmanuel madahaNo ratings yet

- K.T. Thomas and R.P. Sethi, JJ.: Equiv Alent Citation: AIR2000SC 2912Document11 pagesK.T. Thomas and R.P. Sethi, JJ.: Equiv Alent Citation: AIR2000SC 2912Deeptangshu KarNo ratings yet

- Environment and Land Case 17 of 2018 OsDocument6 pagesEnvironment and Land Case 17 of 2018 OsclintonNo ratings yet

- Virender Kumar Jain vs. Alumate - IndiaDocument3 pagesVirender Kumar Jain vs. Alumate - IndiaXyz WxyNo ratings yet

- Sumitra EviDocument8 pagesSumitra EviBhalla & BhallaNo ratings yet

- Anthony Samy v. SBI, 2023 SCC OnLine DRAT 650 at para 5-10Document5 pagesAnthony Samy v. SBI, 2023 SCC OnLine DRAT 650 at para 5-10Pival K. PeddireddiNo ratings yet

- Yamuna Cable Accessories PVT LTD Vs Gujarat ChambeGJ201829121814435823COM437971Document9 pagesYamuna Cable Accessories PVT LTD Vs Gujarat ChambeGJ201829121814435823COM437971xoNo ratings yet

- Mohan Lal Saraf vs. Chairperson, Debts Recovery Appellate Tribunal and Ors.Document20 pagesMohan Lal Saraf vs. Chairperson, Debts Recovery Appellate Tribunal and Ors.Suraj AgarwalNo ratings yet

- OTgw MJ EDocument27 pagesOTgw MJ Ebookmarkbuddy365No ratings yet

- R.D. Saxena CaseDocument7 pagesR.D. Saxena CaseMayank Jain74% (19)

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- 14) Digest-Republic V Carlito LacapDocument1 page14) Digest-Republic V Carlito LacapJane MaribojoNo ratings yet

- Course Title: Course Code: CSIT660 Credit Units: 3 Level: PGDocument4 pagesCourse Title: Course Code: CSIT660 Credit Units: 3 Level: PGAkash Singh RajputNo ratings yet

- EFFICACY OF MERGER AND ACQUISITION IN INDIAN BANKING INDUSTRY - Scholar - Kalaichelvan, Commerce DDocument253 pagesEFFICACY OF MERGER AND ACQUISITION IN INDIAN BANKING INDUSTRY - Scholar - Kalaichelvan, Commerce Dcity9848835243 cyberNo ratings yet

- Interesting Design ServicesDocument21 pagesInteresting Design ServicesMad MateNo ratings yet

- History of Pharmaceutical Development in Nepal: Review ArticleDocument8 pagesHistory of Pharmaceutical Development in Nepal: Review ArticleDinesh Kumar YadavNo ratings yet

- Ndpe Irf - 31032023Document7 pagesNdpe Irf - 31032023Afrah AzrinaNo ratings yet

- Department of Education - Division of PalawanDocument27 pagesDepartment of Education - Division of PalawanJasmen Garnado EnojasNo ratings yet

- What Is A Tangible Asset Comparison To Non-Tangible AssetsDocument7 pagesWhat Is A Tangible Asset Comparison To Non-Tangible AssetshieutlbkreportNo ratings yet

- Information Asset Register Template - 0Document14 pagesInformation Asset Register Template - 0LinuxPowerNo ratings yet

- FYP - Recruitment and Selection FibremarxDocument57 pagesFYP - Recruitment and Selection FibremarxPrateek GoyalNo ratings yet

- Anuraj Nakarmi: Effect of Sales Promotion On Consumer BehaviorDocument44 pagesAnuraj Nakarmi: Effect of Sales Promotion On Consumer BehaviorravenNo ratings yet

- Silvertown Tunnel: Document TitleDocument12 pagesSilvertown Tunnel: Document TitlemeskiNo ratings yet

- Business Plan Presentation V4Document40 pagesBusiness Plan Presentation V4Shakil Jowad RahimNo ratings yet

- Artificial Intelligence & It's Applications in Banking SectorDocument61 pagesArtificial Intelligence & It's Applications in Banking SectorClassic PrintersNo ratings yet

- BanksDocument34 pagesBanksabhikaamNo ratings yet

- Resource Allocation MethodsDocument3 pagesResource Allocation MethodsFASIHANo ratings yet

- Dcache Book 2.6Document245 pagesDcache Book 2.6waltrapillasaNo ratings yet

- Tarptautinės Rinkodaros Strategijos - Rūšys, Pasirinkimo Motyvai Bei TaikymasDocument37 pagesTarptautinės Rinkodaros Strategijos - Rūšys, Pasirinkimo Motyvai Bei TaikymasDomas GreičiūnasNo ratings yet

- Michael Irwin ResumeDocument2 pagesMichael Irwin Resumeapi-500455900No ratings yet

- 2.1.1.A DesignFlawsDocument2 pages2.1.1.A DesignFlawsEthan SextonNo ratings yet

- Activity Exemplar - Communication PlanDocument5 pagesActivity Exemplar - Communication PlanJordan K WellsNo ratings yet

- 23062000295097KKBK ChallanReceiptDocument2 pages23062000295097KKBK ChallanReceiptAbhilash Bhavan SasiNo ratings yet

- SITW School Bus UseDocument7 pagesSITW School Bus UseWTKR News 3No ratings yet

- Science Club by LawsDocument5 pagesScience Club by LawsMarjorie Baya BidlanNo ratings yet

- Entries For Perpetual and Periodic InventoryDocument2 pagesEntries For Perpetual and Periodic InventoryRACHEL RIANNE ANTONENo ratings yet

- Marketing PlanDocument21 pagesMarketing PlanNurullah Mohiuddin MalekNo ratings yet

- 20 Question PeparDocument6 pages20 Question PeparAnonymous 69No ratings yet

- 10.library Book List PDFDocument108 pages10.library Book List PDFT Sharanya NayakNo ratings yet

- Midterm Module Lesson 2Document31 pagesMidterm Module Lesson 2Kevin RoveroNo ratings yet

Sona Corporation India PVT LTD Vs Ingram Micro IndDE202003022016413680COM85190

Sona Corporation India PVT LTD Vs Ingram Micro IndDE202003022016413680COM85190

Uploaded by

piyush bhardwaj0 ratings0% found this document useful (0 votes)

24 views10 pagesThis document summarizes a court case regarding a dispute between Sona Corporation India Pvt. Ltd. and Ingram Micro India Pvt. Ltd. over termination of lease agreements and damages. The court upheld the arbitrator's decision to recall an earlier order and require Sona Corporation to provide a bank guarantee or deposit funds as security. While the respondents were aware of loans secured by the property, the arbitrator found Sona Corporation should have disclosed all encumbrances to the court previously. No contempt was found but the arbitrator acted reasonably to ensure secure funds for any potential damages awarded.

Original Description:

sona corporation

Original Title

Sona_Corporation_India_Pvt_Ltd_vs_Ingram_Micro_IndDE202003022016413680COM85190

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document summarizes a court case regarding a dispute between Sona Corporation India Pvt. Ltd. and Ingram Micro India Pvt. Ltd. over termination of lease agreements and damages. The court upheld the arbitrator's decision to recall an earlier order and require Sona Corporation to provide a bank guarantee or deposit funds as security. While the respondents were aware of loans secured by the property, the arbitrator found Sona Corporation should have disclosed all encumbrances to the court previously. No contempt was found but the arbitrator acted reasonably to ensure secure funds for any potential damages awarded.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

24 views10 pagesSona Corporation India PVT LTD Vs Ingram Micro IndDE202003022016413680COM85190

Sona Corporation India PVT LTD Vs Ingram Micro IndDE202003022016413680COM85190

Uploaded by

piyush bhardwajThis document summarizes a court case regarding a dispute between Sona Corporation India Pvt. Ltd. and Ingram Micro India Pvt. Ltd. over termination of lease agreements and damages. The court upheld the arbitrator's decision to recall an earlier order and require Sona Corporation to provide a bank guarantee or deposit funds as security. While the respondents were aware of loans secured by the property, the arbitrator found Sona Corporation should have disclosed all encumbrances to the court previously. No contempt was found but the arbitrator acted reasonably to ensure secure funds for any potential damages awarded.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 10

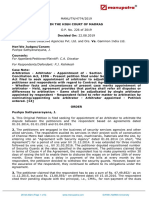

MANU/DE/0247/2020

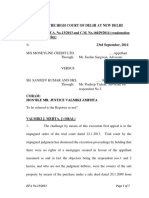

IN THE HIGH COURT OF DELHI

Arb. A. COMM. 4/2019

Decided On: 20.01.2020

Appellants: Sona Corporation India Pvt. Ltd.

Vs.

Respondent: Ingram Micro India Pvt. Ltd. and Ors.

Hon'ble Judges/Coram:

Jyoti Singh, J.

Counsels:

For Appellant/Petitioner/Plaintiff: A.K. Singla, Sr. Advocate and Rahul Shukla, Advocate

For Respondents/Defendant: Sudhir Kumar, Pulkit Srivastava and Ashna Abool,

Advocates

Case Note:

Arbitration - Bank Guarantee - Section 17 of Arbitration and Conciliation Act,

1996 (A&C Act) - Arbitral Tribunal directed Appellant to furnish Bank

Guarantee of Rs. 2.70 Crores or deposit said amount in a Fixed Deposit that it

would be payable only as per directions of Tribunal - Hence, present appeal -

Whether any infirmity can be found in exercise of discretion by Tribunal under

Section 17 of A&C Act - Held, Tribunal has rightly come to a conclusion that

Respondents were aware of property being mortgaged with Vijaya Bank -

Thus, it is not enough for Appellant to contend that only because Respondents

were aware of encumbrances, impugned order is erroneous - It is purely in

domain of Tribunal to exercise its discretion in deciding nature of security to

preserve subject matter involved in arbitral proceedings - Therefore, no

infirmity can be found in exercise of discretion by Tribunal under Section 17

of A&C Act - Appeal dismissed. [28], [32]

DECISION

Jyoti Singh, J.

ARB. A COMM 4/2019

1 . The present appeal has been filed under Section 37(2) of the Arbitration and

Conciliation Act, 1996 (Act) against the order dated 26.02.2019 passed by the Arbitrator

on an application filed by the respondents herein under Section 17 of the Act, thereby

recalling its earlier order dated 11.12.2018.

2 . Shorn of unnecessary details, the brief facts are that disputes arose between the

parties on a unilateral termination of two registered Lease Deeds, both dated

18.06.2013, executed between the appellant as a lessor and the respondents as lessees.

The disputes were also with respect to violation of certain terms and conditions of the

Lease Deeds, including vacating the premises in a damaged condition.

3. The disputes were referred to the Arbitral Tribunal appointed by this Court vide order

dated 06.09.2018. The appellant has submitted its statement of claim and claimed Rs.

02-05-2023 (Page 1 of 10) www.manupatra.com Lex Stone Group

23,21,58,854/- against the respondents making them jointly and severely liable. The

respondents filed a counter claim to the tune of Rs. 2,70,00,000/-.

4. In the course of proceedings, the respondents preferred an application under Section

17 of the Act dated 06.11.2018, praying for directions against the appellant to refund a

sum of Rs. 2,70,00,000/- being a sum equivalent to security deposit made under terms

of the Lease Deeds.

5 . The application was disposed of by the Tribunal vide order dated 11.12.2018 by

taking on record the statement of the appellant. The operative part of the order reads as

under: -

"..........In order to secure the refund of Interest Free Refundable Security

Deposit in terms of the clauses of the Lease Deed the learned counsel for the

Claimant has given a statement to the effect that the Claimant Company shall

not transfer by way of sale or in any other manner except leasing out the

Property No. G-9 Block B-1, Mohan Cooperative Industrial Estate, Mathura

Road, New Delhi-110044 or put the property under any encumbrance without

the orders of this Tribunal till the decision of these Arbitration proceedings. The

Claimant shall comply with the requirements of the Companies Act, 2013 in this

regard. The Claimant shall be bound by the undertaking. The application U/S.

17 of A&C Act, 1996 is disposed off accordingly."

6 . It is the case of the appellant that the immovable property mentioned above is

owned by the appellant company and is also subject matter of the registered lease

deeds executed between the parties. The property was occupied by the respondents as

lessees at a rent of Rs. 27 Lakhs per month, excluding taxes. The respondents vacated

the property on 02.11.2018.

7. After the said order was passed by the Tribunal, on 14.01.2019 the respondents filed

a second application under Section 17 of the Act praying for a fresh order on the ground

that the property given as security as recorded in the order dated 11.12.2018 was found

to have been mortgaged by the appellant for a total loan of Rs. 73,79,50,000/-. It is the

case of the appellant that in its reply to the application, the appellant clarified that no

such loan was availed and the property has a market value of Rs. 44.79 Crores. The

property carried an encumbrance of value of Rs. 13,22,00,529/-, as per bank certificate

dated 21.01.2019. It is averred in the appeal that it was further stated in the reply that

prime security for said loan account with nomenclature as "V-Rent Account" was

actually the rent payable by the respondents and EMDTD of the property, valued at Rs.

44.79 Crores was the alternate primary security. It was also clarified that the loans

availed by the Directors were availed in their personal capacity and secured by their

other properties. The appellant also claims to have produced a letter dated 25.10.2013

to show that the respondents were well aware on 11.12.2018 about the loan taken by

the appellant and the statement of the appellant on 11.12.2018 was recorded in the

presence of the respondents' representative and its counsel.

8 . As the chronology goes, the Arbitral Tribunal vide order dated 26.02.2019 recalled

its earlier order dated 11.12.2018 and has directed the appellant to either furnish Bank

Guarantee of Rs. 2.70 Crores valid for 12 months or deposit the said amount in a Fixed

Deposit with an endorsement on the FDR that it would be payable only as per directions

of the Tribunal.

9. Aggrieved with the said order, the appellant has filed the present appeal.

02-05-2023 (Page 2 of 10) www.manupatra.com Lex Stone Group

10. The genesis of the impugned order are two applications both dated 14.01.2019,

filed by the respondents herein. The first application was an application under Section

17 of the Act for securing the sum equivalent to an amount of Rs. 2.70 Crores towards

Interest Free Refundable Security Deposit (IFRSD) and the second application was

under Section 27(5) of the Act for initiating contempt proceedings against the appellant

and its Directors for violating the order and undertaking, both dated 11.12.2018.

11. The grievance of the respondents in the said applications was that on a perusal of

the balance sheets, the Company Master Data, Directors' report, as well as other

documents filed by the appellant company on the website of Ministry of Corporate

Affairs, the respondents discovered that the property with respect to which the

undertaking had been given on 11.12.2018 was already mortgaged for total loan of Rs.

73,79,50,000/- with Vijaya Bank and the said Bank had first and exclusive charge on

the property. Further, the appellant was required to seek permission from the Bank

before creating any further charge/lien over the said property. It was contended that the

records also suggested that equitable mortgage had also been created on the said

property for loans taken by the Promoters and Shareholders of the Company,

aggregating to Rs. 25 Crores. The property as per the valuation carried out by Vijaya

Bank as on 17.11.2017 was assessed at Rs. 39,37,00,000/-. It was further alleged in

the application that at the time of giving the undertaking before the Tribunal on

11.12.2018, the appellant had deliberately concealed the said mortgage and had played

a fraud on the respondent and the Tribunal. It was thus prayed that the appellant be

directed to give an effective and alternate security for the amount due to the

respondents and be punished for contempt.

1 2 . The Tribunal heard both the applications. It came to a finding that from the

documents it was clear that the appellant had taken a loan from Vijaya Bank for which

the primary security was the rent receivable from the said property and the property

was a collateral security. Since the rent payable by the respondents was the primary

security, the appellant had executed General Power of Attorney in favour of the Bank,

authorizing it to receive rent from the respondents, and letters had been issued to the

respondents, to remit the rent to Vijaya Bank, directly. Thus, the respondents were well

aware of the loan taken against the said property. The Tribunal also came to a finding

that having been aware of the said loan, the respondent had chosen not to object to the

property being offered as security when the undertaking was given on 11.12.2018 and

on that basis the order was passed by the Tribunal. Based on this finding the Tribunal

concluded that no case for reference of contempt to the High Court was made out.

13. However, having arrived at the said finding, the Tribunal took serious note of the

fact that the appellant was obliged to inform the Tribunal about the various loans taken

by it and its Directors and any lien on the property being offered as security before the

order was passed. The Tribunal in its wisdom felt that the property with its

encumbrances was not a security which inspired confidence and therefore, directed the

appellant herein to furnish a Bank Guarantee or deposit Rs. 2.70 Crores in a Fixed

Deposit, with an endorsement as aforementioned.

14. Learned senior counsel for the appellant submits that the respondents had applied

for recall of the earlier order dated 11.12.2018 by raising three grounds which are as

under: -

"(i) On perusal of Company Master Data as well as other documents on the

website of Ministry of Corporate Affairs states that property offered as security

is already mortgaged with various Banks much before 11.12.2018, amounts to

02-05-2023 (Page 3 of 10) www.manupatra.com Lex Stone Group

concealment.

(ii) The property is found to be mortgaged for a total loan of Rs.

73,79,50,000/- with Vijaya Bank with charge created way-back on 11.12.2018.

(iii) The value of the property as on 17.11.2017 is found to be Rs. 39.37 Cr."

15. The appellant had opposed the applications on the following grounds: -

"(i) 2nd Application for same relief is not maintainable. Factum of mortgage of

property with the Bank was well in the knowledge of respondents besides

incorporated by way of covenants in the lease deeds itself.

(ii) The plea of property mortgaged for loan aggregating over Rs.

73,79,50,000/- is against record as certified by Bank. Reliance is placed on

correspondences with the Bank.

(iii) The value of property as on making of statement is Rs. 44.79 Cr. with loan

outstanding being Rs. 13,22,00529/-. The other loan of claimant company is

against security of the vehicle as stated in Bank's letter dated 21.01.2019."

16. It is argued that vide the impugned order, the Tribunal has negated all the three

grounds raised by the respondents. The Tribunal concluded that none of the grounds

made out in the application were correct and there was no concealment by the

appellant. Respondents were not only well aware of the encumbrance on the property,

but also took no objection at the time when the undertaking was given. In these

circumstances, there was no ground for the Tribunal to recall the order.

1 7 . The next contention of the learned senior counsel is that even otherwise the

Tribunal has no power to recall its order as it amounts to exercise of power of review

on the merits of a case which is impermissible and Review can only be for correcting

errors apparent on the face of the record. Reliance is placed on the judgment of the

Supreme Court in Srei Infrastructure Finance Limited v. Tuff Drilling Private Limited

reported as MANU/SC/1272/2017 : (2018) 11 SCC 470.

18. It is next contended by the appellant that when the first application was filed by the

respondents under Section 17 of the Act, the Tribunal had directed that the appellant

will not transfer by way of sale or in any other manner the property in question and a

detailed order was passed on 11.12.2018 recording the undertaking of the appellant.

Learned senior counsel vehemently contends that the Tribunal has adopted different

yardsticks and different standards to decide the application under Section 17 filed by

the appellant and that filed by the respondents. It is pointed out that vide an order

dated 26.02.2019, the same date as of the impugned order, the Tribunal had decided

the application filed by the appellant under Section 17 of the Act. The stand of the

appellant therein was that it has a claim of about Rs. 23 Crores against the respondents

which is covered by the clauses of the Lease Deeds. The respondents did not have any

registered office within the territorial jurisdiction of Delhi and the balance sheet

submitted to the ROC also indicated that there was no property/asset in Delhi. Since the

execution proceedings would have to be filed in Delhi, interim order be passed directing

the respondents to secure the amounts.

19. The respondents in reply had taken a stand that the respondents 1 and 2 are Group

Companies and their balance sheet reflects healthy state of affairs. In the financial year

2017-18, respondent no. 1 had generated a revenue of Rs. 328 Crores and paid a tax of

02-05-2023 (Page 4 of 10) www.manupatra.com Lex Stone Group

Rs. 117.6 Crores. The Tribunal while deciding the said application had solely relied on

the balance sheet of respondent no. 1 and the fact that respondents were Group

Company and confirming party, respectively for each other under the lease deeds. On a

mere statement of the respondents that they will be able to satisfy the awarded amount,

the application was dismissed.

20. Per contra, learned counsel for the respondents submits that during the course of

arguments on the application under Section 17 of the Act before the Tribunal, the

appellant had voluntarily given an undertaking that it would not transfer or in any other

manner create third party rights in the property in question except for leasing out the

same. After the said undertaking was given, the respondents came across documents

relating to the appellant on the website of the Ministry of Corporate Affairs which

revealed that the property in question had been mortgaged with Vijaya Bank against a

loan of Rs. 14.60 Crores and the bank had the first charge over the property. The

respondents were thus compelled to file another application under Section 17 to secure

the IFRSD amount through an alternative security of a Bank Guarantee or deposit in an

FDR. Learned counsel submits that there is no infirmity in the impugned order which

was passed by the Arbitrator after considering all the documents filed by the parties and

hearing them at length. The Tribunal was of the view that the appellant was obliged to

inform the Tribunal about the various loans and the encumbrances with respect to the

property in question. The Tribunal in its wisdom felt that encumbered property may not

be sufficient security and therefore, modified its earlier order. Learned counsel points

out that since the Bank has first charge over the property, the respondents can never

have any right in the same till the first charge of the Bank exists. Even as per the

SARFAESI Act, 2002 till the charge of the Bank is satisfied, no Court or judicial Forum

can exercise jurisdiction over the subject matter.

21. Learned counsel for the respondents vehemently argued that as on 21.01.2019 a

loan of Rs. 13,22,00,529/- exists on the property. The property is a collateral security

against the home loan of Rs. 24.46 Crores, obtained in the personal name of the

Directors of the Company and which is outstanding to the tune of Rs. 19,33,10,345.40/-

. It is thus contended that as against the total value of the property which is valued at

Rs. 41.29 Crores as per valuation report dated 19.09.2017, it admittedly stands

mortgaged with the Bank to the extent of Rs. 32.55 Crores.

22. Learned counsel for the respondents has relied upon various judgments such as in

the case of Indian Steel and Wire Products vs. BIFR MANU/DE/1282/2003 : 110 (2004)

DLT 186, Cont. Pet. (C) 148/2003 titled Rama Narang vs. Ramesh Narang & Anr.,

decided on 15.03.2007 by Supreme Court, Cont. Cas (C) 531/2015 titled Central Bank

of India vs. Suman Chaddha & Ors. decided by this Court, Cont. Pet. 782/2012 titled V.

Thirulokachandar vs. E. Kanan & Anr. decided by Madras High Court on 18.07.2013 and

S. Balasubramaniyam vs. P. Janakaraju & Anr. MANU/KA/0140/2004 : ILR 2004 KAR.

2442 to contend that breach of an undertaking given to a Court is a serious misconduct

amounting to contempt and should be dealt with by awarding a severe sentence to the

contemnor.

23. I have heard the counsels for the parties.

2 4 . The main contention of the learned senior counsel for the appellant is that the

respondents were all through aware that the property which was sought to be offered as

security, before the Tribunal was mortgaged with Vijaya Bank. In fact, the rent payable

by the respondents was the primary security and the appellant had executed a General

Power of Attorney, in favour of the Bank authorizing it to receive rent from the

02-05-2023 (Page 5 of 10) www.manupatra.com Lex Stone Group

respondents. The Tribunal had negated all the grounds on which the application for

recall of the order was filed and having held that the appellant was not guilty of

contempt could not have modified the order. Argument is also raised on different

yardsticks adopted by the Tribunal while dealing with similar applications by the

parties.

2 5 . The respondents, on the other hand, contend that the appellant ought to have

disclosed the encumbrances on the property to the Tribunal and in any case the

encumbrances are of a nature that the property would not be an adequate security to

secure the amount due and payable to the respondents, if ultimately the award was

rendered in their favour. It is also contended that the order calls for no interference in a

jurisdiction exercised by this Court under Section 37 of the Act as the impugned order is

a well-reasoned order and has been passed by the Tribunal considering all the facts and

the documents.

26. It is no doubt true that the Tribunal has negated the grounds on which the second

application under Section 17 of the Act was filed by the respondents. The Tribunal has

rightly come to a conclusion that the respondents were aware of the property being

mortgaged with the Vijaya Bank. In fact, the prime security for the loan was the rent

payable by the respondents and the Bank had been authorized by the appellant to

receive the rent directly from the respondents. It is in this context that the Tribunal had

held that the appellant was not guilty of any contempt. However, the question which the

Tribunal was required to examine was primarily, how to secure the amount payable to

the respondents in case they succeed in the arbitration proceedings. The Tribunal while

noticing that the respondents were aware of the encumbrances observed that the

appellants had not disclosed the said fact to the Tribunal. The initial order was passed

by the Tribunal on 11.12.2018 recording the undertaking of the appellant that it would

not create any encumbrance on the property. Looking at the valuation of the property

and considering the fact that the property was unencumbered, the Tribunal accepted the

undertaking as it was of the view that the property was sufficient security. Once,

however, it came to the notice of the Tribunal that the property was mortgaged with

Vijaya Bank, who had first charge on the property and the fact that no charge could be

created further without the permission of the bank, the Tribunal in its wisdom was of

the opinion that the property was no longer a solvent security. Various complications

that are linked to the property under the SARFAESI Act, were also brought to the notice

of the Tribunal by the respondents. Thus, it is not enough for the appellant to contend

that only because the respondents were aware of the encumbrances, the impugned

order is erroneous. As rightly contended by the respondents if the fact of encumbrance

would have been placed before the Tribunal in the first application, perhaps the Tribunal

may not have accepted the undertaking of the appellant.

27. Vide the impugned order, the Tribunal has only directed the appellant to furnish a

Bank Guarantee or deposit the amount of Rs. 2,70,00,000/- in a Fixed Deposit which, in

the opinion of the Tribunal, is important to secure and preserve the subject matter of

the dispute during the arbitral proceedings.

28. Insofar as the contention of the appellant that the Tribunal has applied different

yardsticks to the two similar applications between the parties, is concerned, the

contention only merits rejection. The contention of the appellant in defence to the

application under Section 17 of the Act filed by the respondents was that the

respondents did not have any registered office within the jurisdiction of Delhi and even

the balance sheets did not show any asset in Delhi. It was not the stand of the appellant

that the respondents had no property in any part of the country which could be a

02-05-2023 (Page 6 of 10) www.manupatra.com Lex Stone Group

security in case the appellant was to succeed. It was also not the case of the appellant

that the respondents had taken loans and were indebted to any bank and thus were not

in a healthy condition financially to satisfy the award, in case the same was in favour of

the appellants. The Tribunal had on a perusal of the balance sheets found as a matter of

fact that in the financial year 2017-2018, respondent no. 1 had generated a revenue of

Rs. 328 Crores and had paid a tax of Rs. 117.6 Crores. Contrary to this, the status of

the property of the appellant and the encumbrances on the property sought to be

offered as security did not inspire confidence in the Tribunal. It is purely in the domain

of the Arbitral Tribunal to exercise its discretion in deciding the nature and the extent of

security to preserve the subject matter involved in the arbitral proceedings.

29. Section 17 of the Act has been held akin to the jurisdiction of this Court under

Section 9 by the High Court of Bombay in the case of Shakti International Private

Limited v. Excel Metal Processors MANU/MH/0452/2017. Court has summed up the

scope of power under Section 17 of the Act as under:

"48. Even after the enactment of the 1996 Act, as pointed out by Mr. Jagtiani,

different Courts took different views and approaches on the scope of the arbitral

tribunals' power to grant interim reliefs or 'interim measures of protection'

under Section 17 of the 1996 Act. For instance, in the case of Intertoll ICS

Cecons O & M Co. Pvt. Ltd. v. National Highways Authority of India (supra), the

Delhi High Court at paragraphs 15-18 on pages 1026-1027 dealt with the scope

of powers under Sections 9 and 17 of the Act. In brief the Court expressed the

view that the powers of an arbitral tribunal under Section 17 of the 1996 Act

are much narrower than that of a Court under Section 9 of the Act, although

there may be some overlap. The Court in Intertoll (supra), held that an arbitral

tribunal can only protect the subject matter of the dispute, which must be

tangible property, and therefore it cannot order the furnishing of a security for

securing a money claim.

49. As against this, this Court in Baker Hughes Singapore Pte. v. Shiv-Vani Oil

and Gas Exploration Services Ltd. (supra) took a broader view (at paragraphs

40, 50-51) of the arbitral tribunals powers under Section 17 of the 1996 Act.

This Court also distinguished the Judgment in the case of Intertoll (supra). This

Court held, in Baker Hughes (supra), that an arbitral tribunal can, in a given

case, make an appropriate order of security.

5 0 . A perusal of these decisions is helpful because it brings into focus the

reason why Section 17 as amended, was enacted.

51. Under the 1940 Act, the position was, as stated by the Hon'ble Supreme

Court in MD, Army Welfare Housing Organization (supra), that an arbitral

tribunal is not a Court of law and its orders are not judicial orders and its

functions are not judicial functions.

52. This position changed under the 1996 Act, but in relation to Section 17 of

the 1996 Act, the same Judgment of Army Welfare (supra), says that the power

is a limited one, and that the arbitral tribunal has no power to enforce its own

order nor is it made judicially enforceable.

53. Even though different Courts may have taken different views on the scope

of the powers under Section 17 of the 1996 Act, it is very clear that the powers

were narrower than Section 9 of the 1996 Act. Ex facie, Section 17 of the 1996

Act did not provide for any power for the appointment of a Receiver. Also, as

02-05-2023 (Page 7 of 10) www.manupatra.com Lex Stone Group

noted by the Hon'ble Supreme Court, there were difficulties in matters relating

to the enforcement of order passed by an arbitral tribunal under Section 17 of

the Act.

54. Whereas Section 9 of the 1996 Act expressly provided for various interim

orders that a Court could pass, Section 17 of the 1996 used the expression 'any

interim measure of protection as the arbitral tribunal may consider necessary in

respect of the subject matter of the dispute'. Therefore, it was always necessary

for a party applying for interim relief before an arbitral tribunal to show that a

specific interim orders, covered by the express provisions of Section 9, was

also covered by the limited language of Section 17 of the 1996 Act. These

challenges and difficulties perhaps led to parties applying for interim measures

to a Court under Section 9 of the 1996 Act, even after a tribunal had been

constituted.

55. It is in this background that Section 17 of the Amended Act obviously came

to be enacted. Section 17 of the Amended Act is now in pari materia or very

similar in content to the provisions of Section 9 of the Amended Act. The

powers to make different types of interim orders of protection are now

enumerated in Section 17 of the Amended Act, as they are under Section 9 of

the Amended Act.

56. The powers, of an arbitral tribunal, to make orders is put on par with that

of a court. The language appearing after Section 17(1)(ii)(e) of the Amended

Act makes this clear. It states "and the arbitral tribunal shall have the same

power for making orders, as the court has for the purpose of, and in relation to,

any proceeding before it."

57. The issue of enforceability of such orders is now expressly addressed by

Section 17(2) of the Amended Act, which provides that such orders of the

arbitral tribunal, "... shall be deemed to be an order of the Court for all

purposes and shall be enforceable under the Code of Civil Procedure, 1908 (5

of 1908), in the same manner as if it were an order of the Court."

58. In light of the enhanced powers and efficacy of recourse under Section 17

of the Amended Act, there have been corresponding changes to Section 9 of the

Amended Act as well. Section 9(3) of the Amended Act states that, "once the

arbitral tribunal has been constituted, the Court shall not entertain an

application under sub-section (1), unless the Court finds that circumstances

exist which may not render the remedy provided under section 17 efficacious."

30. It is also no longer res integra that the scope of judicial review under Section 37 is

limited as held by a Co-ordinate Bench of this Court in the case of Green Infra Wind

Energy Limited vs. Regen Powertech Private Limited MANU/DE/1348/2018. Relevant

para of the judgment reads as under: -

"16. In my view, the Arbitral Tribunal has balanced the equity between the

parties and has considered the submissions made by the parties before the

Arbitral Tribunal. This Court in exercise of its power under Section 37 of the Act

cannot interfere with the order passed by the Arbitral Tribunal under Section 17

of the Act unless the discretion exercised by the Tribunal is found to be

perverse or contrary to law. As an Appellate Court, the interference is not

warranted merely because the Appellate Court in exercise of its discretion

would have exercised the same otherwise. "

02-05-2023 (Page 8 of 10) www.manupatra.com Lex Stone Group

xxx xxx xxx

"20. In view of the above, the Arbitral Tribunal having exercised its discretion

and found a balance of equity between the parties, this Court in exercise of its

power under Section 37(2)(b) of the Act would not interfere with the same

unless it is shown that the discretion so exercised is perverse in any manner or

contrary to the law. In the present case, no such exception has been made out

by the appellant."

31. The Court relied upon the various judgments as under:

"17. In Wander Ltd. v. Antox India P. Ltd., MANU/SC/0595/1990 : 1990 Supp

SCC 727, the Supreme Court while dealing with the power of the Appellate

Court under the Code of Civil Procedure, 1908 has held as under:

"13. On a consideration of the matter, we are afraid, the Appellate

Bench fell into error on two important propositions. The first is a

misdirection in regard to the very scope and nature of the appeals

before it and the limitations on the powers of the Appellate Court to

substitute its own discretion in an appeal preferred against a

discretionary order. The second pertains to the infirmities in the

ratiocinations as to the quality of Antox's alleged user of the trade-

mark on which the passing-off action is founded. We shall deal with

these two separately.

14. The appeals before the Division Bench were against the exercise of

discretion by the Single Judge. In such appeals, the Appellate Court

will not interfere with the exercise of discretion of the court of first

instance and substitute its own discretion except where the discretion

has been shown to have been exercised arbitrarily, or capriciously or

perversely or where the court had ignored the settled principles of law

regulating grant or refusal of interlocutory injunctions. An appeal

against exercise of discretion is said to be an appeal on principle.

Appellate Court will not reassess the material and seek to reach a

conclusion different from the one reached by the court below if the one

reached by that court was reasonably possible on the material. The

appellate court would normally not be justified in interfering with the

exercise of discretion under appeal solely on the ground that if it had

considered the matter at the trial stage it would have come to a

contrary conclusion. If the discretion has been exercised by the Trial

Court reasonably and in a judicial manner the fact that the appellate

court would have taken a different view may not justify interference

with the trial court's exercise of discretion. After referring to these

principles Gajendragadkar, J. in Printers (Mysore) Private Ltd. v. Pothan

Joseph: (SCR 721)

"... These principles are well established, but as has been

observed by Viscount Simon in Charles Osention & Co. v.

Jhanaton ...the law as to the reversal by a court of appeal of an

order made by a judge below in the exercise of his discretion is

well established, and any difficulty that arises is due only to

the application of well settled principles in an individual case."

The appellate judgment does not seem to defer to this principle."

02-05-2023 (Page 9 of 10) www.manupatra.com Lex Stone Group

1 8 . Recently in Ascot Hotels and Resorts Pvt. Ltd. v. Connaught Plaza

Restaurants Pvt. Ltd., Arb. A. (Comm) 12/2017, this Court again reiterated the

above mentioned principle.

1 9 . This Court in Bakshi Speedways v. Hindustan Petroleum Corporation,

MANU/DE/2046/2009, has held that the same principles will apply even in case

of an appeal under Section 37(2)(b) of the Act. Paragraph 4 of the said

judgment is quoted herein below:

"4. The principles applicable to an appeal under Section 37(2)(b) in my

view ought to be the same as the principles in an appeal against an

order under Order 39 Rules 1 and 2, CPC i.e., unless the discretion

exercised by the Court against whose order the appeal is preferred is

found to have been exercised perversely and contrary to law, the

appellate Court ought not to interfere with the order merely because

the appellate court in the exercise of its discretion would have

exercised so otherwise. I had at the beginning of the hearing itself

inquired from the senior counsel for the appellant as to what could be

said to be perverse in the exercise of discretion by the Arbitral Tribunal

in the exercise of powers under Section 17 of the Act and as to how the

said interim measures granted by the Arbitral Tribunal could be said to

be contrary to law; it was further pointed out that in the opinion of this

court, on the perusal of the memorandum of appeal, the only ground

which appeared to have some force was the ground taken in the

memorandum of appeal of the arbitrator as on the date of making of

the order having become functus officio."

32. Having analyzed the impugned order, this court is of the opinion that no infirmity

can be found in the exercise of discretion by the Tribunal under Section 17 of the Act.

33. There is no merit in the appeal and the same is accordingly dismissed with no order

as to costs.

I.A. No. 3985/2019

Present application is hereby dismissed in view of the order passed in the appeal.

© Manupatra Information Solutions Pvt. Ltd.

02-05-2023 (Page 10 of 10) www.manupatra.com Lex Stone Group

You might also like

- Simple Guide for Drafting of Civil Suits in IndiaFrom EverandSimple Guide for Drafting of Civil Suits in IndiaRating: 4.5 out of 5 stars4.5/5 (4)

- Chapter 5 and 6 Business QuestionsDocument10 pagesChapter 5 and 6 Business QuestionsHibah AamirNo ratings yet

- Geeta Vs Mohd Raza and Ors 14112019 DELHCDE201903121916054943COM21606Document3 pagesGeeta Vs Mohd Raza and Ors 14112019 DELHCDE201903121916054943COM21606Nikita DatlaNo ratings yet

- Globe Detective Agencies PVT LTD and Ors Vs GammonTN2019020919160942209COM102058Document6 pagesGlobe Detective Agencies PVT LTD and Ors Vs GammonTN2019020919160942209COM102058omwjcclNo ratings yet

- Rattan Mehta & Anr. vs. Gayatri Shah & Ors.Document9 pagesRattan Mehta & Anr. vs. Gayatri Shah & Ors.Manish KumarNo ratings yet

- Nabinagar Power Generating Company LTD Vs Ram RataNL2023190423165007208COM549304Document9 pagesNabinagar Power Generating Company LTD Vs Ram RataNL2023190423165007208COM549304Dhananjai RaiNo ratings yet

- Bhavdipbhai Arunbhai Dave Vs Kotak Mahindra Bank LGJ2022090222165556143COM189934Document16 pagesBhavdipbhai Arunbhai Dave Vs Kotak Mahindra Bank LGJ2022090222165556143COM189934Sakshi ShettyNo ratings yet

- CPC ProjectDocument11 pagesCPC ProjectanshulNo ratings yet

- FIRAC On DLF Power Ltd. vs. Mangalore Refinery and Petrochemical LTDDocument13 pagesFIRAC On DLF Power Ltd. vs. Mangalore Refinery and Petrochemical LTDKartikey swamiNo ratings yet

- AS Patel Trust and Ors Vs Wall Street Finance LimiMH2019300719163147225COM459484Document10 pagesAS Patel Trust and Ors Vs Wall Street Finance LimiMH2019300719163147225COM459484ranjanjhallbNo ratings yet

- Delhi - Moneyline Credit V Sanjeev KumarDocument7 pagesDelhi - Moneyline Credit V Sanjeev KumarEkansh AroraNo ratings yet

- Annapurna Infrastructure PVT LTD and Ors Vs Soril NC201704041716045287COM832974Document9 pagesAnnapurna Infrastructure PVT LTD and Ors Vs Soril NC201704041716045287COM832974Mayank MishraNo ratings yet

- The - Royal Bank - of - Scotland - NV - Vs - Earnest - Business - MH2017091017162407329COM584482Document6 pagesThe - Royal Bank - of - Scotland - NV - Vs - Earnest - Business - MH2017091017162407329COM584482ranjanjhallbNo ratings yet

- R. Subbiah and R. Pongiappan, JJDocument9 pagesR. Subbiah and R. Pongiappan, JJayoNo ratings yet

- RNA Exotica Vrajesh Hirjee OrderDocument8 pagesRNA Exotica Vrajesh Hirjee OrderMoneylife FoundationNo ratings yet

- Maharera 439414Document16 pagesMaharera 439414Legal ClawsNo ratings yet

- Arbitration AwardDocument8 pagesArbitration AwardDevvrat garhwalNo ratings yet

- Renu Khanna Vs Emaar MGF Land Private Limited 2409SF2019211019171315366COM323980Document19 pagesRenu Khanna Vs Emaar MGF Land Private Limited 2409SF2019211019171315366COM323980Anany UpadhyayNo ratings yet

- 186292022161136164order22 Jun 2022 423599Document15 pages186292022161136164order22 Jun 2022 423599Ajay K.S.No ratings yet

- CB Grant Road Sheetal India OA 14122021Document23 pagesCB Grant Road Sheetal India OA 14122021Kanak KathuriaNo ratings yet

- Goregaon Pearl CHSL Vs Seema Mahadev Paryekar and MH2019051119175740228COM929702Document7 pagesGoregaon Pearl CHSL Vs Seema Mahadev Paryekar and MH2019051119175740228COM929702Visalakshy GuptaNo ratings yet

- State Bank of Patiala Vs Laxmi Narain Sharma and Dd120033COM149351Document4 pagesState Bank of Patiala Vs Laxmi Narain Sharma and Dd120033COM149351Keshav BahetiNo ratings yet

- Standard Chartered Bank Vs Dharminder Bhohi & Ors On 13 September, 2013Document12 pagesStandard Chartered Bank Vs Dharminder Bhohi & Ors On 13 September, 2013vishalbalechaNo ratings yet

- DRT DRAFT Case 1Document14 pagesDRT DRAFT Case 1Dvs Suraj50% (2)

- MB Chander and Ors Vs Balakrishna Rao Charitable TAP20162112161604211COM607757Document15 pagesMB Chander and Ors Vs Balakrishna Rao Charitable TAP20162112161604211COM607757kalyanighayalNo ratings yet

- ArbitrationPetition Sahil BrothersDocument28 pagesArbitrationPetition Sahil BrothersTauheedAlamNo ratings yet

- Dr. Dhananjaya Y. Chandrachud Surya Kant, JJDocument6 pagesDr. Dhananjaya Y. Chandrachud Surya Kant, JJjags jainNo ratings yet

- Avnish Kumar Sare GurugramDocument5 pagesAvnish Kumar Sare GurugramSai VijitendraNo ratings yet

- SocDocument4 pagesSocvadodaraNo ratings yet

- DRT 501373Document26 pagesDRT 501373Prasad VaidyaNo ratings yet

- In The High Court of Delhi at New DelhiDocument5 pagesIn The High Court of Delhi at New DelhiRakeshNo ratings yet

- Kamla Engg and Steel Industries Vs Punjab NationalPH2020100221160701236COM616350Document33 pagesKamla Engg and Steel Industries Vs Punjab NationalPH2020100221160701236COM616350MALKANI DISHA DEEPAKNo ratings yet

- Sanjeev Shriya and Ors Vs State Bank of India and UP2017180917161040203COM366947Document22 pagesSanjeev Shriya and Ors Vs State Bank of India and UP2017180917161040203COM366947Rahul BarnwalNo ratings yet

- Display PDF - PHPDocument8 pagesDisplay PDF - PHPshraddhaahir1998No ratings yet

- Ramanand and Ors Vs Girish Soni and Ors 21052020 DE202010062015043218COM681787Document12 pagesRamanand and Ors Vs Girish Soni and Ors 21052020 DE202010062015043218COM681787Faraz ahmad KhanNo ratings yet

- SocDocument4 pagesSocvadodaraNo ratings yet

- Rohin Arora & Another vs. D.D.A PDFDocument6 pagesRohin Arora & Another vs. D.D.A PDFCA Himanshu GuptaNo ratings yet

- R.D. Saxena CaseDocument6 pagesR.D. Saxena CaseAbhu4767No ratings yet

- Imam Din (Written Reply)Document4 pagesImam Din (Written Reply)api-3745637No ratings yet

- Civil Writ Maya DeviDocument15 pagesCivil Writ Maya DevisdvyasadvocateNo ratings yet

- Vikash Kumar Mishra & Ors. v. Orbis Trusteeship Service Private Limited & AnrDocument6 pagesVikash Kumar Mishra & Ors. v. Orbis Trusteeship Service Private Limited & AnrJayant SharmaNo ratings yet

- Test 8Document5 pagesTest 8KONINIKA BHATTACHARJEE 1950350No ratings yet

- Uttam Galva Steels LTD Vs Bank of India and Ors 3DR080002COM676503Document4 pagesUttam Galva Steels LTD Vs Bank of India and Ors 3DR080002COM676503sssNo ratings yet

- Supreme Court: Proof of Ownership Varies in Landlord - Tenant Litigation and Title Suit.Document19 pagesSupreme Court: Proof of Ownership Varies in Landlord - Tenant Litigation and Title Suit.Manan BhattNo ratings yet

- Bombay High Court Commercial Suit JudgmentDocument42 pagesBombay High Court Commercial Suit JudgmentranjanjhallbNo ratings yet

- Ramesh Kumar Vs The State of NCT of DelhiDocument9 pagesRamesh Kumar Vs The State of NCT of Delhiagrud.partners2023No ratings yet

- R.D. Saxena Vs Balram Prasad Sharma On 22 August, 2000Document5 pagesR.D. Saxena Vs Balram Prasad Sharma On 22 August, 2000kshitijsaxenaNo ratings yet

- Ashok Bhushan and K.M. Joseph, JJDocument3 pagesAshok Bhushan and K.M. Joseph, JJSiddhantNo ratings yet

- Suman Chadha Vs Central Bank of India On 9 August 2021Document9 pagesSuman Chadha Vs Central Bank of India On 9 August 2021SHIVANSHI SHUKLANo ratings yet

- Arbitration Final Award-JDF.1005.2024Document12 pagesArbitration Final Award-JDF.1005.2024vadodaraNo ratings yet

- First Nationa Bank T. LTD VS Miles Comm Case No.108 of 2017 Hon - Mruma, JDocument11 pagesFirst Nationa Bank T. LTD VS Miles Comm Case No.108 of 2017 Hon - Mruma, JEmmanuel madahaNo ratings yet

- K.T. Thomas and R.P. Sethi, JJ.: Equiv Alent Citation: AIR2000SC 2912Document11 pagesK.T. Thomas and R.P. Sethi, JJ.: Equiv Alent Citation: AIR2000SC 2912Deeptangshu KarNo ratings yet

- Environment and Land Case 17 of 2018 OsDocument6 pagesEnvironment and Land Case 17 of 2018 OsclintonNo ratings yet

- Virender Kumar Jain vs. Alumate - IndiaDocument3 pagesVirender Kumar Jain vs. Alumate - IndiaXyz WxyNo ratings yet

- Sumitra EviDocument8 pagesSumitra EviBhalla & BhallaNo ratings yet

- Anthony Samy v. SBI, 2023 SCC OnLine DRAT 650 at para 5-10Document5 pagesAnthony Samy v. SBI, 2023 SCC OnLine DRAT 650 at para 5-10Pival K. PeddireddiNo ratings yet

- Yamuna Cable Accessories PVT LTD Vs Gujarat ChambeGJ201829121814435823COM437971Document9 pagesYamuna Cable Accessories PVT LTD Vs Gujarat ChambeGJ201829121814435823COM437971xoNo ratings yet

- Mohan Lal Saraf vs. Chairperson, Debts Recovery Appellate Tribunal and Ors.Document20 pagesMohan Lal Saraf vs. Chairperson, Debts Recovery Appellate Tribunal and Ors.Suraj AgarwalNo ratings yet

- OTgw MJ EDocument27 pagesOTgw MJ Ebookmarkbuddy365No ratings yet

- R.D. Saxena CaseDocument7 pagesR.D. Saxena CaseMayank Jain74% (19)

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- 14) Digest-Republic V Carlito LacapDocument1 page14) Digest-Republic V Carlito LacapJane MaribojoNo ratings yet

- Course Title: Course Code: CSIT660 Credit Units: 3 Level: PGDocument4 pagesCourse Title: Course Code: CSIT660 Credit Units: 3 Level: PGAkash Singh RajputNo ratings yet

- EFFICACY OF MERGER AND ACQUISITION IN INDIAN BANKING INDUSTRY - Scholar - Kalaichelvan, Commerce DDocument253 pagesEFFICACY OF MERGER AND ACQUISITION IN INDIAN BANKING INDUSTRY - Scholar - Kalaichelvan, Commerce Dcity9848835243 cyberNo ratings yet

- Interesting Design ServicesDocument21 pagesInteresting Design ServicesMad MateNo ratings yet

- History of Pharmaceutical Development in Nepal: Review ArticleDocument8 pagesHistory of Pharmaceutical Development in Nepal: Review ArticleDinesh Kumar YadavNo ratings yet

- Ndpe Irf - 31032023Document7 pagesNdpe Irf - 31032023Afrah AzrinaNo ratings yet

- Department of Education - Division of PalawanDocument27 pagesDepartment of Education - Division of PalawanJasmen Garnado EnojasNo ratings yet

- What Is A Tangible Asset Comparison To Non-Tangible AssetsDocument7 pagesWhat Is A Tangible Asset Comparison To Non-Tangible AssetshieutlbkreportNo ratings yet

- Information Asset Register Template - 0Document14 pagesInformation Asset Register Template - 0LinuxPowerNo ratings yet

- FYP - Recruitment and Selection FibremarxDocument57 pagesFYP - Recruitment and Selection FibremarxPrateek GoyalNo ratings yet

- Anuraj Nakarmi: Effect of Sales Promotion On Consumer BehaviorDocument44 pagesAnuraj Nakarmi: Effect of Sales Promotion On Consumer BehaviorravenNo ratings yet

- Silvertown Tunnel: Document TitleDocument12 pagesSilvertown Tunnel: Document TitlemeskiNo ratings yet

- Business Plan Presentation V4Document40 pagesBusiness Plan Presentation V4Shakil Jowad RahimNo ratings yet

- Artificial Intelligence & It's Applications in Banking SectorDocument61 pagesArtificial Intelligence & It's Applications in Banking SectorClassic PrintersNo ratings yet

- BanksDocument34 pagesBanksabhikaamNo ratings yet

- Resource Allocation MethodsDocument3 pagesResource Allocation MethodsFASIHANo ratings yet

- Dcache Book 2.6Document245 pagesDcache Book 2.6waltrapillasaNo ratings yet

- Tarptautinės Rinkodaros Strategijos - Rūšys, Pasirinkimo Motyvai Bei TaikymasDocument37 pagesTarptautinės Rinkodaros Strategijos - Rūšys, Pasirinkimo Motyvai Bei TaikymasDomas GreičiūnasNo ratings yet

- Michael Irwin ResumeDocument2 pagesMichael Irwin Resumeapi-500455900No ratings yet

- 2.1.1.A DesignFlawsDocument2 pages2.1.1.A DesignFlawsEthan SextonNo ratings yet

- Activity Exemplar - Communication PlanDocument5 pagesActivity Exemplar - Communication PlanJordan K WellsNo ratings yet

- 23062000295097KKBK ChallanReceiptDocument2 pages23062000295097KKBK ChallanReceiptAbhilash Bhavan SasiNo ratings yet

- SITW School Bus UseDocument7 pagesSITW School Bus UseWTKR News 3No ratings yet

- Science Club by LawsDocument5 pagesScience Club by LawsMarjorie Baya BidlanNo ratings yet

- Entries For Perpetual and Periodic InventoryDocument2 pagesEntries For Perpetual and Periodic InventoryRACHEL RIANNE ANTONENo ratings yet

- Marketing PlanDocument21 pagesMarketing PlanNurullah Mohiuddin MalekNo ratings yet

- 20 Question PeparDocument6 pages20 Question PeparAnonymous 69No ratings yet

- 10.library Book List PDFDocument108 pages10.library Book List PDFT Sharanya NayakNo ratings yet

- Midterm Module Lesson 2Document31 pagesMidterm Module Lesson 2Kevin RoveroNo ratings yet