Professional Documents

Culture Documents

Sales Tax Return Report

Sales Tax Return Report

Uploaded by

Hassaan 19Copyright:

Available Formats

You might also like

- Gasbill 3622988824 202307 20230803073625Document1 pageGasbill 3622988824 202307 20230803073625gdrive.r859abNo ratings yet

- Gasbill 2017691000 202305 20230606215545Document1 pageGasbill 2017691000 202305 20230606215545gdrive.r859abNo ratings yet

- MulapetaDocument16 pagesMulapetab9042192No ratings yet

- Gasbill 3622988824 202305 20230604115618Document1 pageGasbill 3622988824 202305 20230604115618gdrive.r859abNo ratings yet

- SP21Document2 pagesSP21adithya stone&msandNo ratings yet

- Amity Homes 2Document1 pageAmity Homes 2sway.maddyNo ratings yet

- National Treasury Has Blacklisted Glomix House Brokers.Document1 pageNational Treasury Has Blacklisted Glomix House Brokers.Kevin FlynnNo ratings yet

- Rompalle 2023-24 FTODocument10 pagesRompalle 2023-24 FTOb9042192No ratings yet

- FinanceDocument1 pageFinancePhysics FunNo ratings yet

- KaranjaDocument2 pagesKaranjavoipus12No ratings yet

- Gasbill 6191371000 202307 20230809144202Document1 pageGasbill 6191371000 202307 20230809144202kamran.mhrbprNo ratings yet

- Partner Ledger Report: User Date From Date ToDocument2 pagesPartner Ledger Report: User Date From Date ToNazar abbas Ghulam faridNo ratings yet

- Common Approval For Temporary Limit Extension of Customer of Different Branches Under BBDDocument10 pagesCommon Approval For Temporary Limit Extension of Customer of Different Branches Under BBDWahidul Alam SrijonNo ratings yet

- LungaparthiDocument6 pagesLungaparthib9042192No ratings yet

- Gasbill 4560471000 202305 20230618132252Document1 pageGasbill 4560471000 202305 20230618132252VinayNo ratings yet

- To Whom It ConcernDocument1 pageTo Whom It ConcernNavam JainNo ratings yet

- 31st March 2023Document136 pages31st March 2023Vijay LandageNo ratings yet

- Claims Report by Claim No#1858Document3 pagesClaims Report by Claim No#1858Sanjeet KumarNo ratings yet

- Dividend Summary Report 1510807Document2 pagesDividend Summary Report 1510807Murtaza LakhaNo ratings yet

- Agency Cash BookDocument18 pagesAgency Cash Bookpanjoli kalanNo ratings yet

- Insurance 2022-23 (Utility Dept.)Document5 pagesInsurance 2022-23 (Utility Dept.)Saurabh Kumar SinghNo ratings yet

- Gasbill 5052269083 202310 20231028080031Document1 pageGasbill 5052269083 202310 20231028080031Shakeel AhmedNo ratings yet

- SHVINAIUDocument9 pagesSHVINAIUaccounts02No ratings yet

- Acc - Stmtpolycraftpuf Machine PVT LTDDocument3 pagesAcc - Stmtpolycraftpuf Machine PVT LTDvikasdraneNo ratings yet

- Gasbill 8487932945 202306 20230628163515Document1 pageGasbill 8487932945 202306 20230628163515Physics FunNo ratings yet

- Gasbill 2864608891 202307 20230721180052Document1 pageGasbill 2864608891 202307 20230721180052Shahhussain HussainNo ratings yet

- Gasbill 2049452051 202302 20230313223937 PDFDocument1 pageGasbill 2049452051 202302 20230313223937 PDFBLACK SQUADNo ratings yet

- Gasbill 5487031000 202309 20231023052136Document1 pageGasbill 5487031000 202309 20231023052136sfariq_raza6184No ratings yet

- Insura Nce CGS 2022Document20 pagesInsura Nce CGS 2022Mohayman AbdullahNo ratings yet

- Gas Bill (July)Document1 pageGas Bill (July)Khyber AutosNo ratings yet

- Demand NoticeDocument2 pagesDemand Noticeighulamnabi13No ratings yet

- Excel ReportDocument10 pagesExcel ReportPT Sejahtera Inti SentosaNo ratings yet

- 0400007274988aug 2023Document2 pages0400007274988aug 2023M AdnanNo ratings yet

- 2223TBS0002651Document2 pages2223TBS0002651Huskee CokNo ratings yet

- Gasbill 3622988824 202309 20231005050717Document1 pageGasbill 3622988824 202309 20231005050717gdrive.r859abNo ratings yet

- OpTransactionHistory18 03 2024Document6 pagesOpTransactionHistory18 03 2024vallivelvmNo ratings yet

- Vehicle PolicyDocument4 pagesVehicle PolicyVarun RajakNo ratings yet

- Ledger CardDocument1 pageLedger CardApuNo ratings yet

- Tax Invoice: Techmatters Technologies and Consulting Private LTDDocument1 pageTax Invoice: Techmatters Technologies and Consulting Private LTDDipan MehtaNo ratings yet

- Sattar QuotationDocument1 pageSattar Quotationmukid123No ratings yet

- RSP Learning2Document3 pagesRSP Learning2cdodbgNo ratings yet

- Gasbill 6191371000 202310 20231102185048Document1 pageGasbill 6191371000 202310 20231102185048kamran.mhrbprNo ratings yet

- Convenyence March 31Document1 pageConvenyence March 31Mohammad SharifNo ratings yet

- Gulshan Branch: Nabil Naba Foods LimitedDocument2 pagesGulshan Branch: Nabil Naba Foods Limitedmehedi hasanNo ratings yet

- Gasbill 7026455084 202311 20231128203812Document1 pageGasbill 7026455084 202311 20231128203812kirilish208No ratings yet

- Maurice Peter Siminyu & 14others - 31491913 - 20231010072601424067Document1 pageMaurice Peter Siminyu & 14others - 31491913 - 20231010072601424067kevinkingili450No ratings yet

- SARWAQDocument1 pageSARWAQmuhammadsaeed11996No ratings yet

- 2223TBS0002652Document2 pages2223TBS0002652Huskee CokNo ratings yet

- Act No. 1 of 2023: Legal Supplement Part A To The "Trinidad and Tobago Gazette", Vol. 62, NDocument2 pagesAct No. 1 of 2023: Legal Supplement Part A To The "Trinidad and Tobago Gazette", Vol. 62, NERSKINE LONEYNo ratings yet

- Shri Shyam Kripa Appartment - Register-1675503227174Document3 pagesShri Shyam Kripa Appartment - Register-1675503227174Neelam KumawatNo ratings yet

- ڈپلیکیٹ بل - Jul-2023 - 0400024512876Document2 pagesڈپلیکیٹ بل - Jul-2023 - 0400024512876Adnan Ahmed KidwaiNo ratings yet

- Gasbill 9162144733 202304 20230415124452Document1 pageGasbill 9162144733 202304 20230415124452Aamir Ali SeelroNo ratings yet

- Hotel DraftDocument2 pagesHotel DraftaccountsNo ratings yet

- Gasbill 5407032300 202306 20230713102629Document1 pageGasbill 5407032300 202306 20230713102629Abro KhaNo ratings yet

- ENC Demand NoticeDocument2 pagesENC Demand Noticem.haseeb34566No ratings yet

- UntitledDocument4 pagesUntitledYakshit JainNo ratings yet

- BillDocument1 pageBillEngineer Salman ShaikhNo ratings yet

- Gasbill 3622988824Document1 pageGasbill 3622988824gdrive.r859abNo ratings yet

- Transfer Flow ReportDocument4 pagesTransfer Flow ReportDavina TantryNo ratings yet

Sales Tax Return Report

Sales Tax Return Report

Uploaded by

Hassaan 19Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sales Tax Return Report

Sales Tax Return Report

Uploaded by

Hassaan 19Copyright:

Available Formats

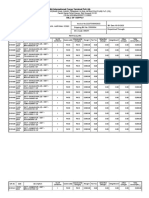

Recovery/adjustment of provisionally allowed input tax credit

If a supplier has not so far declared the purchases of buyer in their sales tax and federal excise returns, however, the buyer allowed provisional adjustment of input tax against

their invoices but the supplier has failed to file their returns by the 10th day of the next month, therefore, the buyer’s said inadmissible input tax credit is adjusted/recovered in

terms of proviso to section 7(2)(i) read with section 8(1)(l) of the Sales Tax Act, 1990. The buyer, therefore, is advised to contact the said suppliers and persuade them to

declared the said purchases and file their returns so that the buyer can get input tax credit of the said purchases.

Name of Supplier Registration No. Tax Period Sales tax claimed on purchases

GRANADA TEXTILE MILLS (PUBLIC )

0225868 Mar-2023 130500

LIMITED

GRANADA TEXTILE MILLS (PUBLIC )

0225868 Mar-2023 184500

LIMITED

GRANADA TEXTILE MILLS (PUBLIC )

0225868 Mar-2023 234900

LIMITED

GRANADA TEXTILE MILLS (PUBLIC )

0225868 Mar-2023 177120

LIMITED

Total: 727020

Page 1 of 1 Printed on : Wed, 10 May 2023 10:26:36

You might also like

- Gasbill 3622988824 202307 20230803073625Document1 pageGasbill 3622988824 202307 20230803073625gdrive.r859abNo ratings yet

- Gasbill 2017691000 202305 20230606215545Document1 pageGasbill 2017691000 202305 20230606215545gdrive.r859abNo ratings yet

- MulapetaDocument16 pagesMulapetab9042192No ratings yet

- Gasbill 3622988824 202305 20230604115618Document1 pageGasbill 3622988824 202305 20230604115618gdrive.r859abNo ratings yet

- SP21Document2 pagesSP21adithya stone&msandNo ratings yet

- Amity Homes 2Document1 pageAmity Homes 2sway.maddyNo ratings yet

- National Treasury Has Blacklisted Glomix House Brokers.Document1 pageNational Treasury Has Blacklisted Glomix House Brokers.Kevin FlynnNo ratings yet

- Rompalle 2023-24 FTODocument10 pagesRompalle 2023-24 FTOb9042192No ratings yet

- FinanceDocument1 pageFinancePhysics FunNo ratings yet

- KaranjaDocument2 pagesKaranjavoipus12No ratings yet

- Gasbill 6191371000 202307 20230809144202Document1 pageGasbill 6191371000 202307 20230809144202kamran.mhrbprNo ratings yet

- Partner Ledger Report: User Date From Date ToDocument2 pagesPartner Ledger Report: User Date From Date ToNazar abbas Ghulam faridNo ratings yet

- Common Approval For Temporary Limit Extension of Customer of Different Branches Under BBDDocument10 pagesCommon Approval For Temporary Limit Extension of Customer of Different Branches Under BBDWahidul Alam SrijonNo ratings yet

- LungaparthiDocument6 pagesLungaparthib9042192No ratings yet

- Gasbill 4560471000 202305 20230618132252Document1 pageGasbill 4560471000 202305 20230618132252VinayNo ratings yet

- To Whom It ConcernDocument1 pageTo Whom It ConcernNavam JainNo ratings yet

- 31st March 2023Document136 pages31st March 2023Vijay LandageNo ratings yet

- Claims Report by Claim No#1858Document3 pagesClaims Report by Claim No#1858Sanjeet KumarNo ratings yet

- Dividend Summary Report 1510807Document2 pagesDividend Summary Report 1510807Murtaza LakhaNo ratings yet

- Agency Cash BookDocument18 pagesAgency Cash Bookpanjoli kalanNo ratings yet

- Insurance 2022-23 (Utility Dept.)Document5 pagesInsurance 2022-23 (Utility Dept.)Saurabh Kumar SinghNo ratings yet

- Gasbill 5052269083 202310 20231028080031Document1 pageGasbill 5052269083 202310 20231028080031Shakeel AhmedNo ratings yet

- SHVINAIUDocument9 pagesSHVINAIUaccounts02No ratings yet

- Acc - Stmtpolycraftpuf Machine PVT LTDDocument3 pagesAcc - Stmtpolycraftpuf Machine PVT LTDvikasdraneNo ratings yet

- Gasbill 8487932945 202306 20230628163515Document1 pageGasbill 8487932945 202306 20230628163515Physics FunNo ratings yet

- Gasbill 2864608891 202307 20230721180052Document1 pageGasbill 2864608891 202307 20230721180052Shahhussain HussainNo ratings yet

- Gasbill 2049452051 202302 20230313223937 PDFDocument1 pageGasbill 2049452051 202302 20230313223937 PDFBLACK SQUADNo ratings yet

- Gasbill 5487031000 202309 20231023052136Document1 pageGasbill 5487031000 202309 20231023052136sfariq_raza6184No ratings yet

- Insura Nce CGS 2022Document20 pagesInsura Nce CGS 2022Mohayman AbdullahNo ratings yet

- Gas Bill (July)Document1 pageGas Bill (July)Khyber AutosNo ratings yet

- Demand NoticeDocument2 pagesDemand Noticeighulamnabi13No ratings yet

- Excel ReportDocument10 pagesExcel ReportPT Sejahtera Inti SentosaNo ratings yet

- 0400007274988aug 2023Document2 pages0400007274988aug 2023M AdnanNo ratings yet

- 2223TBS0002651Document2 pages2223TBS0002651Huskee CokNo ratings yet

- Gasbill 3622988824 202309 20231005050717Document1 pageGasbill 3622988824 202309 20231005050717gdrive.r859abNo ratings yet

- OpTransactionHistory18 03 2024Document6 pagesOpTransactionHistory18 03 2024vallivelvmNo ratings yet

- Vehicle PolicyDocument4 pagesVehicle PolicyVarun RajakNo ratings yet

- Ledger CardDocument1 pageLedger CardApuNo ratings yet

- Tax Invoice: Techmatters Technologies and Consulting Private LTDDocument1 pageTax Invoice: Techmatters Technologies and Consulting Private LTDDipan MehtaNo ratings yet

- Sattar QuotationDocument1 pageSattar Quotationmukid123No ratings yet

- RSP Learning2Document3 pagesRSP Learning2cdodbgNo ratings yet

- Gasbill 6191371000 202310 20231102185048Document1 pageGasbill 6191371000 202310 20231102185048kamran.mhrbprNo ratings yet

- Convenyence March 31Document1 pageConvenyence March 31Mohammad SharifNo ratings yet

- Gulshan Branch: Nabil Naba Foods LimitedDocument2 pagesGulshan Branch: Nabil Naba Foods Limitedmehedi hasanNo ratings yet

- Gasbill 7026455084 202311 20231128203812Document1 pageGasbill 7026455084 202311 20231128203812kirilish208No ratings yet

- Maurice Peter Siminyu & 14others - 31491913 - 20231010072601424067Document1 pageMaurice Peter Siminyu & 14others - 31491913 - 20231010072601424067kevinkingili450No ratings yet

- SARWAQDocument1 pageSARWAQmuhammadsaeed11996No ratings yet

- 2223TBS0002652Document2 pages2223TBS0002652Huskee CokNo ratings yet

- Act No. 1 of 2023: Legal Supplement Part A To The "Trinidad and Tobago Gazette", Vol. 62, NDocument2 pagesAct No. 1 of 2023: Legal Supplement Part A To The "Trinidad and Tobago Gazette", Vol. 62, NERSKINE LONEYNo ratings yet

- Shri Shyam Kripa Appartment - Register-1675503227174Document3 pagesShri Shyam Kripa Appartment - Register-1675503227174Neelam KumawatNo ratings yet

- ڈپلیکیٹ بل - Jul-2023 - 0400024512876Document2 pagesڈپلیکیٹ بل - Jul-2023 - 0400024512876Adnan Ahmed KidwaiNo ratings yet

- Gasbill 9162144733 202304 20230415124452Document1 pageGasbill 9162144733 202304 20230415124452Aamir Ali SeelroNo ratings yet

- Hotel DraftDocument2 pagesHotel DraftaccountsNo ratings yet

- Gasbill 5407032300 202306 20230713102629Document1 pageGasbill 5407032300 202306 20230713102629Abro KhaNo ratings yet

- ENC Demand NoticeDocument2 pagesENC Demand Noticem.haseeb34566No ratings yet

- UntitledDocument4 pagesUntitledYakshit JainNo ratings yet

- BillDocument1 pageBillEngineer Salman ShaikhNo ratings yet

- Gasbill 3622988824Document1 pageGasbill 3622988824gdrive.r859abNo ratings yet

- Transfer Flow ReportDocument4 pagesTransfer Flow ReportDavina TantryNo ratings yet