Professional Documents

Culture Documents

Chapter 3: Forward and Futures Prices: Continuous Compounding

Chapter 3: Forward and Futures Prices: Continuous Compounding

Uploaded by

sunilp14Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 3: Forward and Futures Prices: Continuous Compounding

Chapter 3: Forward and Futures Prices: Continuous Compounding

Uploaded by

sunilp14Copyright:

Available Formats

CHAPTER 3: FORWARD AND FUTURES PRICES

In this chapter we discuss how forward prices and futures prices are related to the price of the underlying asset. Forward

contracts are generally easier to analyze than futures contracts because there is no daily settlement.

3.1 Some Preliminaries

Continuous Compounding

Consider an amount A invested for n years at an interest rate of R per annum. If the rate is compounded once per annum,

the terminal value of the investment is

( ) 1

n

A R +

If it is compounded m times per annum, the terminal value of the investment is

1

nm

R

A

m

| |

+

|

\ .

The limit as m tends to infinity is known as continuous compounding. With continuous compounding, it can be shown that an

amount A invested for n years at rate R grows to

Rn

Ae

Compounding a sum of money at a continuously compounded rate R for n years involves multiplying it by

Rn

e . Discounting it at a

continuously compounded rate R for n years involves multiplying by

Rn

e

.

Suppose that

c

R is a rate of interest with continuous compounding and

m

R is the equivalent rate with compounding m

times per annum. From the results in the last two equations we must have

1

1

c

c

mn

R n m

m

R m

R

Ae A

m

or

R

e

m

| |

= +

|

\ .

| |

= +

|

\ .

This means that

( )

ln 1

1

c

m

c

R m

m

R

R m

m

and

R m e

| |

= +

|

\ .

=

These equations can be used to convert a rate where the compounding frequency is m times per annum to a continuously

compounded rate, and vice versa.

Finally, we note that a rate expressed with a compounding frequency of

1

m can be converted to a rate with a compounding

frequency of

2

m .

1 2

1 2

1 2

1

2

1 2

2

1

1 1

1 1

m n m n

m m

m m

m

m

R R

A A

m m

so that

R

R m

m

| | | |

+ = +

| |

\ . \ .

(

| |

( = +

|

(

\ .

Short Selling

Some of the arbitrage strategies presented in this chapter involve short selling. This is a trading strategy that yields a profit

when the price of a security goes down and a loss when it goes up. It involves selling securities that are not owned and buying them

back later.

Assumptions

In this chapter we assume there are some market participants for which the following are true:

1. There are no transaction costs.

2. All trading profits (net of trading losses) are subject to the same tax rate.

3. The market participants can borrow money at the same risk-free rate of interest as they can lend money.

4. The market participants take advantage of arbitrage opportunities as they occur.

Repo Rate

The relevant risk-free rate of interest for many arbitrageurs operating in the futures market is what is known as the repo

rate. A repo or repurchase agreement is an agreement where the owner of securities agrees to sell them to a counterparty and buy

them back at a slightly higher price later. The counterparty is providing a loan. The difference between the price at which the

securities are sold and the price at which they are repurchased is the interest earned by the counterparty.

Notation

Some of the notation that will be used in this chapter is as follow:

: time when the forward contract matures (years)

: current times (years)

: price of asset underlying the forward contract at time t

: price of asset underlying the forward contract at time T (unknow

T

T

t

S

S n at t)

: delivery price in the forward contract

: value of a long forward contract at time t

: forward price at time t

: risk-free rate of interest per annum at time t, with continuous compounding,

fo

K

f

F

r

r an investment maturing at time T

It is important to realize that the forward price, F, is quite different from the value of the forward contract, f. The forward price at

any given time is the delivery price that would make the contract have a zero value. When a contract is initiated, the delivery price is

normally set equal to the forward price so that F=K and f=0. As time passes, both f and F change.

3.2 Forward Contracts on a Security that Provides no Income

For there to be no arbitrage opportunities, the relationship between the forward price and the spot price for a no-income

security must be

( ) r T t

F Se

=

We now use rather more formal arguments to provide a relationship between the value of a long forward contract, f, and its delivery

price, K. Consider the following two portfolios:

Portfolio A: one long forward contract on the security plus an amount of cash equal to

( ) r T t

Ke

Portfolio B: one unit of the security

In portfolio A, the cash, assuming that it is invested at the risk-free rate, will grow to an amount K at time T. It can then be used to

pay for the security at the maturity of the forward contract. Both portfolios will therefore consist of one unit of the security at time

T. It follows that they must be equally valuable at the earlier time, t. If this were not true, an investor could make a riskless profit by

buying the less expensive portfolio and shorting the more expensive one.

It follows that

( )

( )

r T t

r T t

f Ke S

or

f S Ke

+ =

=

When a forward contract is initiated, the forward price equals the delivery price specified in the contract and is chosen so that the

value of the contract is zero. The forward price, F, is therefore that value of K which makes f=0 in the last equation, that is,

( ) r T t

F Se

=

3.3 Forward Contracts on a security that provides a known cash income

Define I as the present value, using the risk-free discount rate, of income to be received during the life of the forward

contract.

For there to be no arbitrage, the relationship between F and S must be

( )

( ) r T t

F S I e

=

Again we can use formal arguments to relate the value of a long forward contract, f, to its delivery price, K. We change portfolio B

in the preceding section to:

Portfolio B: one unit of the security plus borrowings of amount I at the risk-free rate.

The income from the security can be used to repay the borrowings so that this portfolio has the same value as one unit of the

security at time T. Portfolio A also has this value at time T. The two portfolios must therefore have the same value at time t, that is,

( )

( )

r T t

r T t

f Ke S I

or

f S I Ke

+ =

=

The forward price, F, is, as above, the value of K that makes f zero. Using this last equation we obtain

( )

( ) r T t

F S I e

=

3.4 Forward Contracts on a Security that Provides a Known Dividend Yield

A known dividend yield means that the income when expressed as a percentage of the security price is known. We assume

that the dividend is paid continuously at an annual rate q. To value the forward contract, portfolio B in section 3.2 can be replaced

by:

Portfolio B:

( ) q T t

e

of the security with all income being reinvested in the security

The security holding in portfolio B grows as a result of the dividends that are paid, so that at time T exactly one unit of the security

is held. Portfolios A and B are therefore worth the same at time T. From equating their values at time t, we obtain

( ) ( )

( ) ( )

r T t q T t

q T t r T t

f Ke Se

or

f Se Ke

+ =

=

And the forward price is given by the value of K hat makes f zero:

( )( ) r q T t

F Se

=

Note that if the dividend yield rate varies during the life of the forward contract, this equation is still correct with q equal to the

average dividend yield rate.

3.5 General Result

The value of a forward contract at the time it is first entered into is zero. At a later stage it may prove to have a positive or a

negative value. There is a general result, applicable to all forward contracts, that gives the value of a long forward contract in terms

of the originally negotiated delivery price and the current forward price. This is

( )

( ) r T t

f F K e

=

3.6 Forward Prices versus Futures Prices

Appendix 3A provides an arbitrage argument to show that when the risk-free interest rate is constant and the same for all

maturities, the forward price for a contract with a certain delivery date is the same as the futures price for a contract with the same

delivery date. The argument in Appendix 3A can be extended to cover situations where the interest rate is a known function of time.

When interest rates vary unpredictable (as they do in the real world), forward and futures prices are in theory no longer the

same. We can get a sense of the nature of the relationship by considering the situation where the price of the underlying asset, S, is

strongly positively correlated with interest rates. When S increases, an investor who holds a long futures position makes an

immediate gain because of the daily settlement procedure. Since increases in S tend to occur at the same time as increases in the

interest rate, this gain will tend to be invested at a higher-than-average rate of interest. Similarly, when S decreases, the investor will

make an immediate loss. This loss will tend to be financed at a lower-than-average rate of interest. An investor holding a forward

contract rather than a futures contract is not affected in this way by interest rate movements. It follows that, ceteris paribus, a long

futures contract will be more attractive than a long forward contract. Hence, when S is strongly positively correlated with interest

rates, futures prices will tend to be higher than forward prices. When S is strongly negatively correlated with interest rates, a similar

argument shows that forward prices will tend to be higher than futures prices.

3.7 Stock Index Futures

A stock index tracks the changes in the value of a hypothetical portfolio of stocks. The weight of a stock in the portfolio

equals the proportion of the portfolio invested in the stock. A stock index is not usually adjusted for cash dividends.

It is worth noting that if the hypothetical portfolio of stocks remains fixed, the weights assigned to individual stocks in the

portfolio do not remain fixed. A corollary to this is that if the weights of the stocks in the portfolio are specified as constant over

time, the hypothetical portfolio will change each day. If the price of one particular stock in the portfolio rises more sharply than

others, the holding of the stock must be reduced to maintain the weighting.

Futures Prices of Stock Indices

Most indices can be thought of as securities that pay dividends. The security is the portfolio of stocks underlying the index,

and the dividends paid by the security are the dividends that would be received by the holder of this portfolio. To a reasonable

approximation, the dividends can be assumed to be paid continuously. If q is the dividend yield rate, the futures price is defined as

( )( ) r q T t

F Se

=

In practice, the dividend yield on the portfolio underlying an index varies week by week throughout the year. The value of q that is

used should represent the average annualized dividend yield during the life of the contract. The dividends used for estimating q

should be those for which the ex-dividend date is during the life of the futures contract.

Index Arbitrage

If

( )( ) r q T t

F Se

> , profits can be made by buying the stocks underlying the index and shorting futures contracts. If

( )( ) r q T t

F Se

< , profits can be made by doing the reserve. These strategies are known as index arbitrage. For indices involving

many stocks, index arbitrage is sometimes accomplished by trading a relatively small representative sample of stocks whose

movements closely mirror those of the index. Often, index arbitrage is implemented using program trading.

The Growth Rate of Index Futures Prices

In this section we show that the growth rate of an index futures price equals the excess return of the underlying index over

the risk-free rate. We consider the futures price at some earlier time t . Define:

: index futures price at time

: spot price of index at time

F

S

t

t

t

t

If the portfolio underlying the index provides an excess return over the risk-free rate of x, the total return is x+r. Of this, q is

realized in the form of dividends and x+r-q is realized in the form of capital gains. Hence

( )( )

( )( ) ( )( )

so if

and

x r q t

r q T t r q T

S Se

F Se F S e

t

t

t

t t

+

=

= =

It follow from these three equations that

( ) x t

F Fe

t

t

=

Showing that the growth rate of the futures prices equals the excess return on the index.

Hedging Using Index Futures

Stock index futures can be used to hedge the risk in a well-diversified portfolio of stocks. The relationship between the

return on a portfolio of stocks and the return on the market is described by a parameter | . The analysis in the preceding section

shows that the excess return on the index over the risk-free rate equals the growth rate of the futures price. The return on the index is

a reasonable proxy for the return on the market. The growth rate of an index futures price can therefore be considered to be equal to

the excess return of the market over the risk-free rate. It follows from the capital asset pricing model that the expected excess return

on a portfolio is its | times the proportional change in an index futures price. To hedge a portfolio we therefore need to use index

futures contracts with a total underlying asset value equal to the portfolios beta times the value of the portfolio. Define:

: value of the portfolio

: underlying asset value of one futures contract (if one futures contract is on

m times the index, ) mF

[

=

It follows that the optimal number of contracts to short when hedging is

|

[

A stock index hedge, if effective, should result in the value of the hedge position growing at close to the risk-free interest

rate. The excess return on the portfolio (whether positive or negative) is offset by the gain or loss on the futures. It is natural to ask

why the hedger should go to the trouble of using futures contracts. If the hedgers objective is to earn the risk-free interest rate, he or

she can simply sell the portfolio and invest the proceeds in Treasury bills.

One possibility is that the hedger feels that the stocks in the portfolio have been chosen well. He or she might be very

uncertain about the performance of the market as a whole but confident that the stocks in the portfolio will outperform the market

(after appropriate adjustments have been made for the | of the portfolio). A hedge using index futures removes the risk arising

from market moves and leaves the hedger exposed only to the performance of the portfolio relative to the market. Another

possibility is that the hedger is planning to hold a portfolio for a long period of time and requires short-term protection in an

uncertain market situation. The alternative strategy of selling the portfolio and buying it back later might involve unacceptably high

transaction costs.

Changing Beta

Stock index futures can be used to change the beta of a portfolio. In general, to change the beta of the portfolio from | to

| *, a short position in

( )

*

| |

[

Contracts is required. When | < | *, a long position in

( )

*

| |

[

Is required.

3.8 Forward and Futures Contracts on Currencies

The variable, S, is the current price in dollars of one unit of the foreign currency; K is the delivery price agreed to in the

forward contract. A foreign currency has the property that the holder of the currency can earn interest at the risk-free interest rate

prevailing in the foreign country. We define

f

r as the value of this foreign risk-free interest rate with continuous compounding.

The two portfolios that enable us to price a forward contract on a foreign currency are

Portfolio A: one long forward contract plus an amount of cash equal to

( ) r T t

Ke

Portfolio B: an amount

( )

f

r T t

e

of the foreign currency

Both portfolios will become worth the same as one unit of the foreign currency at time T. They must therefore be equally valuable at

time t. Hence

( ) ( )

( ) ( )

f

f

r T t r T t

r T t r T t

f Ke Se

or

f Se Ke

+ =

=

The forward price is the value of K that makes f=0 in this last equation. Hence

( )( )

f

r r T t

F Se

=

This is the well-known interest rate parity relationship from the field of international finance.

Note that the last two equations are identical to those used by a security that yields dividends. When the foreign interest

rate is greater than the domestic interest rate, F is always less than S and decreases as the maturity of the contract increases.

Similarly, when the domestic interest rate is greater than the foreign interest rate F is always greater than S and increases over time.

3.9 Futures on Commodities

Here it will prove to be important to distinguish between commodities that are held by a significant number of investors

solely for investment and those that are held primarily for consumption. Arbitrage arguments can be used to obtain exact futures

prices in the case of investment commodities. However, it turns out that they can only be used to give an upper bound to the futures

price in the case of consumption commodities.

Gold and Silver

If storage costs are zero, they can be considered as being analogous to securities paying no income. The futures price, F,

should be given by

( ) r T t

F Se

=

Storage costs can be regarded as negative income. If U is the present value of all storage costs that will be incurred during the life of

a futures contract, it follows that

( )

( ) r T t

F S U e

= +

If the storage costs incurred at any time are proportional to the price of the commodity, they can be regarded as providing a negative

dividend yield. In this case

( )( ) r u T t

F Se

+

=

Other Commodities

For commodities that are not held primarily for investment purposes, suppose that instead of ( )

( ) r T t

F S U e

= + we have

( )

( ) r T t

F S U e

> + . To take advantage of this, an arbitrageur should implement the following strategy:

1. Borrow an amount S+U at the risk-free rate and use it to purchase one unit of the commodity and to pay storage costs.

2. Short a futures contract on one unit of the commodity.

There is no problem implementing the strategy for any commodity. However, as arbitrageurs do so, there will be a tendency for S to

increase and F to decrease until the equation is no longer true. We conclude that this equation cannot hold for any significant length

of time.

Suppose next that

( )

( ) r T t

F S U e

< +

We might try to take advantage of this using a strategy analogous to that for a forward contract on a non-dividend-paying stock

when the forward price is too low. However, this would involve shorting the commodity in such a way that the storage costs are

paid to the person with the short position. This is not usually possible.

For investors who hold the commodity solely for investment, when the inequality is observer, they will find it profitable to:

1. Sell the commodity, save the storage costs, and invest the proceeds at the risk-free interest rate.

2. Buy the futures contract.

For commodities that are not, to any significant extent, held for investment, this argument cannot be used. Individuals and

companies who keep the commodity in inventory do so because of its consumption value not because of its value as an investment.

They are reluctant to sell the commodity and buy futures contracts since futures contracts cannot be consumed. There is therefore

nothing to stop ( )

( ) r T t

F S U e

< + from holding. Since ( )

( ) r T t

F S U e

> + cannot hold, all we can asset for a consumption

commodity is

( )

( ) r T t

F S U e

s +

If storage costs are expressed as a proportion of the spot price, the equivalent result is

( )( ) r u T t

F Se

+

s

Convenience Yields

When

( )( ) r u T t

F Se

+

< , users of the commodity must feel that there are benefits from ownership of the physical commodity

that are not obtained by the holder of a futures contract. These benefits may include the ability to profit from temporary local

shortages or the ability to keep a production process running. The benefits are sometimes referred to as the convenience yield

provided by the product. If the dollar amount of storage costs is known and has a present value, U, the convenience yield, y, is

defined so that

( )

( )

( )

( ) ( )( )

( )( )

y T t r T t

y T t r u T t

r u y T t

Fe S U e

or

Fe Se

So

F Se

+

+

= +

=

=

The convenience yield reflects the markets expectations concerning the future availability of the commodity. The greater

the possibility that shortages will occur during the life of the futures contract, the higher the convenience yield.

3.10 The Cost of Carry

The relationship between futures prices and spot prices can be summarized in terms of what is known as the cost of carry.

This measures the storage cost plus the interest that is paid to finance the asset less the income earned on the asset. For a non-

dividend-paying stock, the cost of carry is r since there are no storage costs and no income is earned; for a stock index, it is r-q since

income is earned at rate q on the asset; for a currency, it is

f

r r ; for a commodity with storage costs that are a proportion u of the

price, it is r+u; and so on.

Define the cost of carry as c. For an investment asset, the futures price is

( ) c T t

F Se

= . For a consumption asset, it is

( )( ) c y T t

F Se

= .

3.11 Delivery Choices

Whereas a forward contract normally specifies that delivery is to take place on a particular day, a futures contract often

allows the party with the short position to choose to deliver at any time during a certain period. This introduces a complication into

the determination of futures prices. Should the maturity of the futures contract be assumed to be the beginning, middle, or end of the

delivery period? Even though most futures contracts are closed out prior to maturity, it is important to know when delivery would

have taken place, in order to calculate the theoretical futures price.

If the futures price is an increasing function of the time to maturity, the benefits from holding the asset (including

convenience yield and net of storage costs) are less than the risk-free rate. It is then usually optimal for the party with the short

position to deliver as early as possible. This is because the interest earned on the cash received outweighs the benefits of holding the

asset. As a general rule, futures prices in these circumstances should therefore be calculated on the basis that delivery will take place

at the beginning of the delivery period. If futures prices are decreasing as maturity increases, the reverse is true.

3.12 Futures Prices and the Expected Future Spot Price

The situation where the futures price is below the expected future spot price is known as normal backwardation; the

situation where futures price is above the expected future spot price is known as contango. We now consider the factors determining

normal backwardation and contango from the point of view of the trade-offs that have to be made between risk and return in capital

markets.

Risk and Return

In general, the higher the risk of an investment, the higher the expected return demanded. There are two types of risk in the

economy. Nonsystematic risk should not be important. This is because it can be almost completely eliminated. Systematic risk,

instead, cannot be diversified away. An investor in general requires a higher expected return than the risk-free interest rate for

bearing positive amounts of systematic risk.

The Risk in a Futures Position

Consider a speculator who takes a long futures position in the hope that the price of the asset will be above the futures price

at maturity. We suppose that the speculator puts the present value of the futures price into a risk-free investment at time t while

simultaneously taking a long futures position. We assume that the futures contract can be treated as a forward contract and that the

delivery date is T. The proceeds of the risk-free investment are used to buy the asset on the delivery date. The asset is then

immediately sold for its market price. This means that the cash flows to the speculator are

Time t:

( ) r T t

Fe

Time T:

T

S +

The present value of this investment is

( )

( )

( ) r T t k T T

T

Fe E S e

+

Where k is the discount rate appropriate for the investment. Assuming that all investment opportunities in securities markets have

zero net present value,

( )

( )

( )

( )

( )( )

0

r T t k T t

T

r k T t

T

Fe E S e

or

F E S e

+ =

=

The value of k depends on the systematic risk of the investment. If

T

S is uncorrelated with the level of the stock market, the

investment has zero systematic risk. In this case, k=r and ( )

T

F E S = . If

T

S is positively correlated then k>r and ( )

T

F E S < .

Finally, if

T

S is negatively correlated with the stock market, the investment has negative systematic risk. This means that k<r and

( )

T

F E S > .

Appendix 3A: Proof that Forward and Futures Prices are equal when Interest Rates are Constant

Suppose that a futures contract lasts for n days and that

i

F is the futures price at the end of day i ( ) 0 i n < < . Define o as

the risk-free rate per day (assumed constant). Consider the following strategy:

1. Take a long futures position of e

o

at the end of day 0.

2. Increase the long position to

2

e

o

at the end of day 1.

3. Increase the long position to

3

e

o

at the end of day 2.

And so on.

By the beginning of day i, the investor has a long position of

i

e

o

. The profit (possibly negative) from the position on day i

is

( )

1

i

i i

F F e

o

Assume that this is compounded at the risk-free rate until the end of day n. Its value at the end of day n is

( )

( )

( )

1 1

n i i n

i i i i

F F e e F F e

o o o

=

The value at the end of day n of the entire investment strategy is therefore

( ) ( )

1 0

1

n

n n

i i n

i

F F e F F e

o o

=

=

Since

n

F is the same as the terminal asset price,

T

S , the terminal value of the investment strategy can be written

( )

0

n

T

S F e

o

An investment of

0

F in a risk-free bond combined with the strategy just given yields

( )

0 0

n n n

T T

F e S F e S e

o o o

+ =

At time T. No investment is required for all the long futures positions described. It follows that an amount

0

F can be invested to

given an amount

n

T

S e

o

at time T.

Suppose next that the forward price at the end of day 0 is

0

G . By investing

0

G in a riskless bond and taking a long forward

position of

n

e

o

forward contracts, an amount

n

T

S e

o

is also guaranteed at time T. Thus, there are two investment strategies, one

requiring an initial outlay of

0

F , the other requiring an initial outlay of

0

G , both of which yield

n

T

S e

o

at time T. It follows that in

the absence of arbitrage opportunities

0 0

F G =

In other words, the futures price and the forward price are identical.

You might also like

- 3 The Pricing of Commodity ContractsDocument13 pages3 The Pricing of Commodity ContractsTze Shao0% (1)

- DMFAS 6 User's Guide PDFDocument263 pagesDMFAS 6 User's Guide PDFRandi Nugraha100% (1)

- Ben & Jerry Case StudyDocument38 pagesBen & Jerry Case Studyjennifah_noordin442394% (18)

- Stochastic Methods in Finance: Lecture Notes For STAT3006 / STATG017Document27 pagesStochastic Methods in Finance: Lecture Notes For STAT3006 / STATG017doomriderNo ratings yet

- Financial Risk Management: A Simple IntroductionFrom EverandFinancial Risk Management: A Simple IntroductionRating: 4.5 out of 5 stars4.5/5 (7)

- CH3 Derivatives PPDocument61 pagesCH3 Derivatives PPvincenzo21010No ratings yet

- Forward ContractDocument21 pagesForward ContractAmit KumarNo ratings yet

- Hull Fund 9 e CH 05 Problem SolutionsDocument10 pagesHull Fund 9 e CH 05 Problem Solutionsnandkishore patankarNo ratings yet

- Mafs5030 Topic 1Document168 pagesMafs5030 Topic 1nyj martinNo ratings yet

- Forward and Future Pricing 2 FinalDocument24 pagesForward and Future Pricing 2 FinalRahul Singh100% (1)

- Module 7 - Valuing Forward ContractsDocument18 pagesModule 7 - Valuing Forward Contractshexmen2No ratings yet

- L2 DRM - PricingDocument58 pagesL2 DRM - PricingAjay Gansinghani100% (1)

- Chapter 5 Solutions Tamzidul IslamDocument18 pagesChapter 5 Solutions Tamzidul IslamTamzidul IslamNo ratings yet

- Corporate Treasury Risk Management - Cheat SheetDocument14 pagesCorporate Treasury Risk Management - Cheat SheetHicham NassitNo ratings yet

- LM06 Pricing and Valuation of Futures Contracts IFT NotesDocument7 pagesLM06 Pricing and Valuation of Futures Contracts IFT NotesRidhtang DuggalNo ratings yet

- Financial Derivatives NotesDocument26 pagesFinancial Derivatives NotesManish RaiNo ratings yet

- L1 R46 HY NotesDocument6 pagesL1 R46 HY Notesayesha ansariNo ratings yet

- Lesson Two-3Document10 pagesLesson Two-3Ruth NyawiraNo ratings yet

- MBF Lecture 9Document27 pagesMBF Lecture 9Nazar WelkakayewNo ratings yet

- Cost of Carry ModelDocument12 pagesCost of Carry Modeljyo23No ratings yet

- Equity Forward ContractDocument6 pagesEquity Forward Contractbloomberg1234No ratings yet

- FIN553 - Ch3 - Interest RatesDocument8 pagesFIN553 - Ch3 - Interest Rates222420087No ratings yet

- Risk ManagementDocument24 pagesRisk ManagementSoujanya NagarajaNo ratings yet

- Energy Derivatives - Pricing and Risk Managment - Chapter 1Document16 pagesEnergy Derivatives - Pricing and Risk Managment - Chapter 1Sweta BanwariNo ratings yet

- Answers On Financial ManagementDocument4 pagesAnswers On Financial ManagementArjunSharmaNo ratings yet

- Pricing Swaps Including Funding CostsDocument19 pagesPricing Swaps Including Funding CostsobrefoNo ratings yet

- Lecture 3Document10 pagesLecture 3Nhung Phuong Ha Nguyen100% (1)

- Forward and FuturesDocument24 pagesForward and FuturesasifanisNo ratings yet

- Forward ContractsDocument11 pagesForward ContractsLangat LangsNo ratings yet

- Interest Rate RiskDocument11 pagesInterest Rate Riskmalikrocks3436No ratings yet

- SK TP RMDocument11 pagesSK TP RMSrinidhi RangarajanNo ratings yet

- Forward & Futures PricingDocument41 pagesForward & Futures Pricingasifanis100% (3)

- CHAPTER 4: Trading Futures: 4.1 Pay-Off of FuturesDocument1 pageCHAPTER 4: Trading Futures: 4.1 Pay-Off of Futuresmanishpawar11No ratings yet

- D. Treasury Bond Futures: Illustration 34.3: Calculation Conversion Factors For T.Bond FuturesDocument2 pagesD. Treasury Bond Futures: Illustration 34.3: Calculation Conversion Factors For T.Bond FuturesPratichi SharanNo ratings yet

- Edge Study ProgramDocument34 pagesEdge Study ProgramBuhle Sibonelo KonkiNo ratings yet

- Derivative Market: Futures Forwards OptionsDocument31 pagesDerivative Market: Futures Forwards OptionsAjmal KhanNo ratings yet

- Fixed-Income Securities and The Term-Structure of Interest RatesDocument22 pagesFixed-Income Securities and The Term-Structure of Interest RatesmounabsNo ratings yet

- Chapter 15 The Term Structure of Interest Rates A. Yield-To-MaturityDocument6 pagesChapter 15 The Term Structure of Interest Rates A. Yield-To-MaturityGauravNo ratings yet

- Futures and Options Final TestDocument15 pagesFutures and Options Final TestCarolina SáNo ratings yet

- Chapter 5 - Determination of Forward and Futures PricesDocument5 pagesChapter 5 - Determination of Forward and Futures PriceskliouliouNo ratings yet

- Formulas For SOA/CAS Exam FM/2Document15 pagesFormulas For SOA/CAS Exam FM/2jeff_cunningham_11100% (3)

- Fins2624 Week 2Document6 pagesFins2624 Week 2Wahaaj RanaNo ratings yet

- Futures Market and Prices: 2.1 Warming UpDocument15 pagesFutures Market and Prices: 2.1 Warming Upcharles luisNo ratings yet

- Chapter 5 - Pricing Forwards and Futures (S.V.)Document39 pagesChapter 5 - Pricing Forwards and Futures (S.V.)flippy23No ratings yet

- DerivativesDocument3 pagesDerivativessachin.saroa.1No ratings yet

- Future Pricing ModelDocument11 pagesFuture Pricing ModelMister MarlegaNo ratings yet

- R35 The Term Structure and Interest Rate Dynamics Slides PDFDocument53 pagesR35 The Term Structure and Interest Rate Dynamics Slides PDFPawan RathiNo ratings yet

- Cash-Settled Swaptions A Review of Cash-Settled Swaption PricingDocument15 pagesCash-Settled Swaptions A Review of Cash-Settled Swaption PricingRaphaël FromEverNo ratings yet

- Estimation of Forwards & Futures Price MBADocument91 pagesEstimation of Forwards & Futures Price MBAPRANJAL BANSALNo ratings yet

- Chapter 5 Financial Forwards and FuturesDocument16 pagesChapter 5 Financial Forwards and FutureshardrockerseanNo ratings yet

- Fin 413 - Risk Management: Forward and Futures PricesDocument104 pagesFin 413 - Risk Management: Forward and Futures Pricesanujalives1No ratings yet

- Rowe Lawler CookeDocument10 pagesRowe Lawler CookeDesi DiPierroNo ratings yet

- Points From B3 Question BanksDocument27 pagesPoints From B3 Question Banksapurv 11 jainNo ratings yet

- Derivatives - 3 - MFIN - Forward and FuturesDocument50 pagesDerivatives - 3 - MFIN - Forward and FuturesMavisNo ratings yet

- Forward and FuturesDocument8 pagesForward and Futures杨杨柳No ratings yet

- Valuation and Hedging of Weather Derivatives On Monthly Average TemperatureDocument25 pagesValuation and Hedging of Weather Derivatives On Monthly Average TemperatureGiang Nguyễn HươngNo ratings yet

- SSRN Id3929583Document40 pagesSSRN Id3929583dotarNo ratings yet

- CH 18Document46 pagesCH 18Michelle LindsayNo ratings yet

- Ch9 2016 1Document48 pagesCh9 2016 1Mari MSNo ratings yet

- Unit 03 - Future Contract - Principle of Future ContractDocument6 pagesUnit 03 - Future Contract - Principle of Future ContractAugusto SaavedraNo ratings yet

- SIB 675 - Money Market Hedge and Currency OptionsDocument5 pagesSIB 675 - Money Market Hedge and Currency OptionsKarina MontesNo ratings yet

- APLI - Annual Report - 2017 PDFDocument156 pagesAPLI - Annual Report - 2017 PDFMichelle Hartasya SitompulNo ratings yet

- Original Ketar BP EditedDocument19 pagesOriginal Ketar BP EditedlemadanielNo ratings yet

- Annex A C of RMC No. 57 2015Document13 pagesAnnex A C of RMC No. 57 2015Cheresse Agrabio RanarioNo ratings yet

- Senior Staff Forensic Accountant in New York City Resume Yosef HochmanDocument1 pageSenior Staff Forensic Accountant in New York City Resume Yosef HochmanYosefHochmanNo ratings yet

- Letter of CreditDocument11 pagesLetter of CreditPalani RajanNo ratings yet

- Account Statement From 1 Apr 2021 To 19 Jun 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument9 pagesAccount Statement From 1 Apr 2021 To 19 Jun 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceNrusingha Prasad MishraNo ratings yet

- Submission#5 Company Assigned: UCO Bank 1) : Non-Current AssetsDocument2 pagesSubmission#5 Company Assigned: UCO Bank 1) : Non-Current AssetsKummNo ratings yet

- Crop 2020Document21 pagesCrop 2020AGM Planning UdaipurNo ratings yet

- Principles of Accounting Chapter 1 QuestionsDocument45 pagesPrinciples of Accounting Chapter 1 Questionsahmed156039No ratings yet

- Indian Hotel JPMDocument25 pagesIndian Hotel JPMViet VuNo ratings yet

- Working Capital Financing PDFDocument20 pagesWorking Capital Financing PDFRohan Garud100% (1)

- Lectures On Stochastic Calculus With Applications To FinanceDocument135 pagesLectures On Stochastic Calculus With Applications To Financethava477cegNo ratings yet

- Government of India 2017-2018 Short Term Training ProgrammesDocument8 pagesGovernment of India 2017-2018 Short Term Training ProgrammesnidhinNo ratings yet

- HB 1250 Housing Trust FundDocument2 pagesHB 1250 Housing Trust FundKING 5 NewsNo ratings yet

- Black Money: Team: Blindfold Chess Deen Mohammad Saurabh SinghDocument15 pagesBlack Money: Team: Blindfold Chess Deen Mohammad Saurabh SinghNavneet MayankNo ratings yet

- Intermediate Accounting Chapter 1 Exercises - ValixDocument46 pagesIntermediate Accounting Chapter 1 Exercises - ValixAbbie ProfugoNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToShankara NarayananNo ratings yet

- Auditing Problems Summer 2011: Problem 1Document37 pagesAuditing Problems Summer 2011: Problem 1Iscandar Pacasum DisamburunNo ratings yet

- 2024 Budget 12.5.23Document1 page2024 Budget 12.5.23Helen BennettNo ratings yet

- Esop FinalDocument31 pagesEsop Finalansh384100% (2)

- F 8308Document2 pagesF 8308IRSNo ratings yet

- 10 March AssignmnetDocument4 pages10 March Assignmnetkevin kipkemoiNo ratings yet

- Class 11 Accountancy LLDocument236 pagesClass 11 Accountancy LLMandeepSinghNo ratings yet

- Taxation Workbook 2022Document204 pagesTaxation Workbook 2022Navya GulatiNo ratings yet

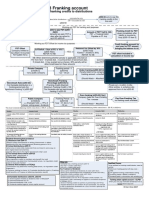

- 3-3 Franking AccountDocument1 page3-3 Franking Accountoddsey0713No ratings yet

- Valaution - ICAIDocument174 pagesValaution - ICAIhindustani888No ratings yet

- CH 15Document51 pagesCH 15HaseebAhmedNo ratings yet