Professional Documents

Culture Documents

Complete Foreclosure Intake Packet - 01.26.22 (Fillable)

Complete Foreclosure Intake Packet - 01.26.22 (Fillable)

Uploaded by

Johnny LolCopyright:

Available Formats

You might also like

- Click File - Download - The Corporate Finance Cheat Sheet - Oana Labes, MBA, CPADocument9 pagesClick File - Download - The Corporate Finance Cheat Sheet - Oana Labes, MBA, CPAMessias MorettoNo ratings yet

- Find Cusip NumberDocument2 pagesFind Cusip NumberJohnny Lol92% (12)

- Documentdownload PDFDocument4 pagesDocumentdownload PDFJohnny PackardNo ratings yet

- Bad News Letter ExamplesDocument8 pagesBad News Letter ExamplesMoAzzam HassanNo ratings yet

- Cost of Capital QDocument2 pagesCost of Capital QPrinkeshNo ratings yet

- CAF 1 - Accounting For PartnershipDocument48 pagesCAF 1 - Accounting For PartnershipAhsan Kamran100% (1)

- Basic Elements of ControlDocument8 pagesBasic Elements of Controltanvir09100% (2)

- Probono Bankruptcy Programs-2Document39 pagesProbono Bankruptcy Programs-2chrissyxsnjNo ratings yet

- Jason Schmit 4 Snowapple Irvine, CA 92614Document3 pagesJason Schmit 4 Snowapple Irvine, CA 92614JRSNo ratings yet

- Application File Created For:: Cesar QueenDocument8 pagesApplication File Created For:: Cesar Queenviolinist1100No ratings yet

- Jason Schmit 4 Snowapple Irvine, CA 92614Document3 pagesJason Schmit 4 Snowapple Irvine, CA 92614tonyNo ratings yet

- 2020 SATU MARE Casual Employee Agreement Fillable PDFDocument13 pages2020 SATU MARE Casual Employee Agreement Fillable PDFAnnie LamNo ratings yet

- CEP Money Action Day at AuroraDocument2 pagesCEP Money Action Day at AuroraCenter for Economic ProgressNo ratings yet

- Classified Deadline: Now Hiring!Document2 pagesClassified Deadline: Now Hiring!Tara SmithNo ratings yet

- CayugaApp 2014condensedDocument2 pagesCayugaApp 2014condensedcayugahrNo ratings yet

- Homeless Resources SLODocument9 pagesHomeless Resources SLOJason MontgomeryNo ratings yet

- Pinecone November 2009Document8 pagesPinecone November 2009Raleigh Association of Insurance ProfessionalsNo ratings yet

- Rental Application: OptionalDocument5 pagesRental Application: OptionalCrystal KleistNo ratings yet

- Community Resource Assistance Guide Johnston CountyDocument37 pagesCommunity Resource Assistance Guide Johnston Countyapi-295387342No ratings yet

- Client Number:: To Contact Us Visit WWW - Workandincome.govt - Nz/contactDocument3 pagesClient Number:: To Contact Us Visit WWW - Workandincome.govt - Nz/contactGhazanfarNo ratings yet

- To Contact Us Visit WWW - Workandincome.govt - Nz/contact: Are You Interested in Working?Document2 pagesTo Contact Us Visit WWW - Workandincome.govt - Nz/contact: Are You Interested in Working?ch4ind4wg13No ratings yet

- Pearmanfaithpromise PDFDocument1 pagePearmanfaithpromise PDFJosh PearmanNo ratings yet

- MAGI ApprovalDocument2 pagesMAGI Approvalbigboy6669000No ratings yet

- National Customer Services Clerk Advert 25.06.2024_FinalDocument3 pagesNational Customer Services Clerk Advert 25.06.2024_Finalashleynyakarize01No ratings yet

- Bank Credit InformationDocument1 pageBank Credit InformationplayerwheelNo ratings yet

- John R. Conder 270-80-0623 (903) - 720-7624 CA330325221711688953 04/28/2023 217059458 E-MailDocument4 pagesJohn R. Conder 270-80-0623 (903) - 720-7624 CA330325221711688953 04/28/2023 217059458 E-MailJohn ConderNo ratings yet

- Bad News Letter ExamplesDocument11 pagesBad News Letter ExamplesBOsch VakilNo ratings yet

- Risima Apllication FormDocument11 pagesRisima Apllication FormdulciholdingsNo ratings yet

- Shelter Island Reporter Classifieds: Jan. 19, 2017Document1 pageShelter Island Reporter Classifieds: Jan. 19, 2017TimesreviewNo ratings yet

- Huron Hometown News Ads - February 7, 2013Document25 pagesHuron Hometown News Ads - February 7, 2013Catawba SecurityNo ratings yet

- 11-19-14 Classifieds PDFDocument1 page11-19-14 Classifieds PDFthevillagereporterNo ratings yet

- Read The Instructions Completely Before Filling Out This Application. Please Print in Black Ink or Type AnswersDocument2 pagesRead The Instructions Completely Before Filling Out This Application. Please Print in Black Ink or Type AnswersTerry PopeNo ratings yet

- Studylink DocsDocument2 pagesStudylink Docsrico saundersNo ratings yet

- 5 28 14 ClassifiedsDocument1 page5 28 14 ClassifiedsthevillagereporterNo ratings yet

- ApplicationDocument2 pagesApplicationapi-247063038No ratings yet

- Shamong - 0311 PDFDocument16 pagesShamong - 0311 PDFelauwitNo ratings yet

- Tina Robinson Employment Application ModelDocument3 pagesTina Robinson Employment Application Modelapi-394226065No ratings yet

- Application, Supplemental Nutrition Assistance Program BenefitsDocument32 pagesApplication, Supplemental Nutrition Assistance Program BenefitsLVNewsdotcomNo ratings yet

- Enrollment 9703cc757dDocument1 pageEnrollment 9703cc757dKai MeiwesNo ratings yet

- 71 Interim Report Reminder 20230120233759 185d29e7b01-44f72099Document4 pages71 Interim Report Reminder 20230120233759 185d29e7b01-44f72099ELLA PATTERSONNo ratings yet

- Shelter Island Reporter Classifieds and Homeowners Network: Nov. 12, 2015Document3 pagesShelter Island Reporter Classifieds and Homeowners Network: Nov. 12, 2015TimesreviewNo ratings yet

- New Application Form PDFDocument3 pagesNew Application Form PDFAnonymous WvGJn3rNo ratings yet

- Epever Solar ControllerDocument2 pagesEpever Solar ControllerJason KettleNo ratings yet

- Random Acts of CounsellingDocument2 pagesRandom Acts of CounsellingSharon A StockerNo ratings yet

- 1481546265426Document3 pages1481546265426api-370784582No ratings yet

- View FileDocument4 pagesView FileJerrod JohnsonNo ratings yet

- Traditional Southern BarbequeDocument1 pageTraditional Southern BarbequeBill Gram-ReeferNo ratings yet

- Winter Energy Payment: To Contact Us Visit WWW - Workandincome.govt - Nz/contactDocument2 pagesWinter Energy Payment: To Contact Us Visit WWW - Workandincome.govt - Nz/contactCharlotte MunroNo ratings yet

- Client Number:: To Contact Us Visit WWW - Workandincome.govt - Nz/contactDocument3 pagesClient Number:: To Contact Us Visit WWW - Workandincome.govt - Nz/contactRupert GilliandNo ratings yet

- Leisure Guide Fall 2010 English WEB1Document60 pagesLeisure Guide Fall 2010 English WEB1Tyler SamsonNo ratings yet

- Deed in LieuDocument33 pagesDeed in LieuSteven WhitfordNo ratings yet

- Legal Aid Application FormDocument16 pagesLegal Aid Application FormHsgceNo ratings yet

- Shelter Island Reporter Classifieds: Nov. 27, 2014Document2 pagesShelter Island Reporter Classifieds: Nov. 27, 2014TimesreviewNo ratings yet

- CCAWV Members Vote NO 2014 Salary HikeDocument4 pagesCCAWV Members Vote NO 2014 Salary HikeKyle LangsleyNo ratings yet

- Wait List Application Oregon HousesDocument7 pagesWait List Application Oregon HousesJacob JohnstonNo ratings yet

- Homework Rocky River OhioDocument4 pagesHomework Rocky River Ohioafmtbioei100% (1)

- SPOFR Volunteer ApplicationDocument9 pagesSPOFR Volunteer ApplicationharshmehtaroyofficalNo ratings yet

- Client Number:: To Contact Us Visit WWW - Workandincome.govt - Nz/contactDocument4 pagesClient Number:: To Contact Us Visit WWW - Workandincome.govt - Nz/contactJason KettleNo ratings yet

- Reflection PaperDocument7 pagesReflection Paperapi-611520408No ratings yet

- 2960-EG - Application For Health InsuranceDocument14 pages2960-EG - Application For Health InsuranceKristopher KrodyNo ratings yet

- Hyosung Americas New Hire FormsDocument15 pagesHyosung Americas New Hire FormsSarfaraz KhanNo ratings yet

- ApplicationDocument2 pagesApplicationapi-247057647No ratings yet

- (A) Applicant (B) Co-ApplicantDocument3 pages(A) Applicant (B) Co-ApplicantYvonne Romine CameronNo ratings yet

- Your U.S. Citizenship Guide: What You Need to Know to Pass Your U.S. Citizenship TestFrom EverandYour U.S. Citizenship Guide: What You Need to Know to Pass Your U.S. Citizenship TestRating: 1 out of 5 stars1/5 (1)

- The Complete Guide to Planning Your Estate in North Carolina: A Step-by-Step Plan to Protect Your Assets, Limit Your Taxes, and Ensure Your Wishes are Fulfilled for North Carolina ResidentsFrom EverandThe Complete Guide to Planning Your Estate in North Carolina: A Step-by-Step Plan to Protect Your Assets, Limit Your Taxes, and Ensure Your Wishes are Fulfilled for North Carolina ResidentsNo ratings yet

- About - Securitization AuditDocument6 pagesAbout - Securitization AuditJohnny LolNo ratings yet

- Agreement To Vacate - 13644 AgateDocument1 pageAgreement To Vacate - 13644 AgateJohnny LolNo ratings yet

- Schott V BAC Home LoansDocument25 pagesSchott V BAC Home LoansJohnny Lol100% (1)

- What Is A Cusip Number and What Does It Mean - ThestreetDocument6 pagesWhat Is A Cusip Number and What Does It Mean - ThestreetJohnny LolNo ratings yet

- Marketables Securities Glossary For Treasurydirect Account Holders - TreasurydirectDocument12 pagesMarketables Securities Glossary For Treasurydirect Account Holders - TreasurydirectJohnny Lol100% (1)

- Cusip Numbers and How To Look Them UpDocument13 pagesCusip Numbers and How To Look Them UpJohnny Lol0% (1)

- Cusip Identification NumberDocument2 pagesCusip Identification NumberJohnny LolNo ratings yet

- People Living at 13644 Agate RD Eagle Point orDocument8 pagesPeople Living at 13644 Agate RD Eagle Point orJohnny LolNo ratings yet

- Cusip Number - Investor - GovDocument1 pageCusip Number - Investor - GovJohnny LolNo ratings yet

- Document 2018-15269Document2 pagesDocument 2018-15269Johnny LolNo ratings yet

- Property Valuation of Agate Road, Eagle Point, OR: 13151, 13371, 13474, 13555, 13555, 13615, 13644, 13777, 13777, 13955 (Tax Assessments)Document6 pagesProperty Valuation of Agate Road, Eagle Point, OR: 13151, 13371, 13474, 13555, 13555, 13615, 13644, 13777, 13777, 13955 (Tax Assessments)Johnny LolNo ratings yet

- Cusip - Isin - Cusip - Lei - Sedol - WKN - Cfi Codes - Database Securities Apply Application RegisterDocument2 pagesCusip - Isin - Cusip - Lei - Sedol - WKN - Cfi Codes - Database Securities Apply Application RegisterJohnny Lol50% (2)

- Document 2017-32203Document1 pageDocument 2017-32203Johnny LolNo ratings yet

- Cusip For A Loan - Isin - Cusip - Lei - Sedol - WKN - Cfi Codes - Database Securities Apply Application RegisterDocument1 pageCusip For A Loan - Isin - Cusip - Lei - Sedol - WKN - Cfi Codes - Database Securities Apply Application RegisterJohnny LolNo ratings yet

- Cusip - Working With Data - Libguides at Vu AmsterdamDocument1 pageCusip - Working With Data - Libguides at Vu AmsterdamJohnny LolNo ratings yet

- Home-Land Fencing - Better Business Bureau® ProfileDocument2 pagesHome-Land Fencing - Better Business Bureau® ProfileJohnny LolNo ratings yet

- Eagle Point Homes - Listing Report - Rogue Real EstateDocument5 pagesEagle Point Homes - Listing Report - Rogue Real EstateJohnny LolNo ratings yet

- Glossary of Terms - Jackson County - MiDocument88 pagesGlossary of Terms - Jackson County - MiJohnny LolNo ratings yet

- Eric L Lierman - (541) 664-4969 - Eagle Point - Public Records InstantlyDocument8 pagesEric L Lierman - (541) 664-4969 - Eagle Point - Public Records InstantlyJohnny LolNo ratings yet

- Eagle Point Property Records by AddressDocument2 pagesEagle Point Property Records by AddressJohnny LolNo ratings yet

- Agate RD - Eagle Point - or 97524Document24 pagesAgate RD - Eagle Point - or 97524Johnny LolNo ratings yet

- Agate RD - Eagle PT - or 97524 - TruliaDocument64 pagesAgate RD - Eagle PT - or 97524 - TruliaJohnny LolNo ratings yet

- Phony Foreclosure Advocates ExposedDocument3 pagesPhony Foreclosure Advocates ExposedJohnny LolNo ratings yet

- ENotes OriginatorDocument1 pageENotes OriginatorJohnny LolNo ratings yet

- Document 2018-15270Document3 pagesDocument 2018-15270Johnny LolNo ratings yet

- Foreclosure FraudDocument3 pagesForeclosure FraudJohnny LolNo ratings yet

- MersincDocument1 pageMersincJohnny LolNo ratings yet

- 41 DIGEST International Corporate Bank v. Spouses GuecoDocument3 pages41 DIGEST International Corporate Bank v. Spouses GuecoPrincess Aileen EsplanaNo ratings yet

- Public Finance Term Paper TopicsDocument4 pagesPublic Finance Term Paper Topicsafmzubsbdcfffg100% (1)

- Cash Flow Statement ExerciseDocument3 pagesCash Flow Statement ExerciseVikas YadavNo ratings yet

- Metrics in HospitalityDocument10 pagesMetrics in HospitalityPaulo OliveiraNo ratings yet

- Lendsqr WorkDocument6 pagesLendsqr WorkitzsleekmayNo ratings yet

- Project - 8: Finance &risk Analytics - India Credit RiskDocument28 pagesProject - 8: Finance &risk Analytics - India Credit RiskpsyishNo ratings yet

- Introverted Intuitive Thinking Judging: Intjs Can Improve This T-ShirtDocument5 pagesIntroverted Intuitive Thinking Judging: Intjs Can Improve This T-ShirtDeepakNo ratings yet

- 56465bos45796cp4u2 PDFDocument49 pages56465bos45796cp4u2 PDFNarendra VasavanNo ratings yet

- Industrial Visit in Lunar Private (Sivya)Document20 pagesIndustrial Visit in Lunar Private (Sivya)Sivya SolomonNo ratings yet

- Worksheet ch7 ch8 Without AnswersDocument9 pagesWorksheet ch7 ch8 Without Answerssahar201121999No ratings yet

- Julien Day School FeesDocument22 pagesJulien Day School Fees32.Soumik AdakNo ratings yet

- Employee Benefits 2 Employee Benefits 2Document4 pagesEmployee Benefits 2 Employee Benefits 2XNo ratings yet

- Trust Fund DoctrineDocument3 pagesTrust Fund DoctrineClaudine SumalinogNo ratings yet

- Brattleboro Retreat 2018 Form 990 990-T PublicDocument112 pagesBrattleboro Retreat 2018 Form 990 990-T PublicThe Berkshire EagleNo ratings yet

- Obstacles, Predictions and Market DirectionDocument22 pagesObstacles, Predictions and Market DirectionRui AlmeidaNo ratings yet

- Maramag Water District Bukidnon Executive Summary 2020Document6 pagesMaramag Water District Bukidnon Executive Summary 2020cpa126235No ratings yet

- Premises MOU NewDocument2 pagesPremises MOU NewRehanNo ratings yet

- Case 08 16e, Oct 20th, 2023Document4 pagesCase 08 16e, Oct 20th, 2023Itzel OvalleNo ratings yet

- Particulars Amount Amount Particulars Particulars AmountDocument1 pageParticulars Amount Amount Particulars Particulars AmountBetter idontbeNo ratings yet

- Negotiated-Market 045808Document4 pagesNegotiated-Market 045808quinnia.rainiiNo ratings yet

- System Dynamics Approach in Analyzing Impact of deDocument9 pagesSystem Dynamics Approach in Analyzing Impact of deCassia MontiNo ratings yet

- Financial Report For BBA AVIATIONDocument8 pagesFinancial Report For BBA AVIATIONPaul NdegNo ratings yet

- Debt Securities ReviewerDocument30 pagesDebt Securities Reviewerjhie boterNo ratings yet

- SV58410192400 2023 12Document6 pagesSV58410192400 2023 12andreeaNo ratings yet

- IAS 7 - Article For Statement of CashflowsDocument4 pagesIAS 7 - Article For Statement of CashflowsonyeonwuNo ratings yet

- Political Ideology and FDI: Radical ViewDocument11 pagesPolitical Ideology and FDI: Radical ViewInciaNo ratings yet

Complete Foreclosure Intake Packet - 01.26.22 (Fillable)

Complete Foreclosure Intake Packet - 01.26.22 (Fillable)

Uploaded by

Johnny LolOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Complete Foreclosure Intake Packet - 01.26.22 (Fillable)

Complete Foreclosure Intake Packet - 01.26.22 (Fillable)

Uploaded by

Johnny LolCopyright:

Available Formats

Coastal Housing Center Main Office

768 Virginia Ave Suite A 605 SE Kane St.

North Bend, OR 97459 Roseburg, OR 97470

Phone: 541-756-1000 Phone: 541-673-4909

Dear Homeowner,

You are not alone:

Thank you for contacting NeighborWorks Umpqua, we understand that no one enters into their mortgage loan

expecting to have trouble making their payments. Life changes and unexpected hardships can suddenly happen,

catching even the most prepared off guard. Dealing with being in default with your mortgage can be a difficult

life experience but you don't have to go through it alone.

Who we are:

o NeighborWorks Umpqua was established in 1991 and provides educational classes, housing rehab

opportunities, and counseling services throughout Coos, Curry, Douglas, Jackson and Josephine Counties.

o In response to the foreclosure crisis NeighborWorks Umpqua became a part of the National Foreclosure

Mitigation Counseling Program in 2008. In 2012 NeighborWorks Umpqua became part of the Oregon

Foreclosure Avoidance Program. Which we currently participate in.

Key points to know:

• There is no cost to you for any of our Default Intervention Services.

• To follow is a checklist and all the necessary forms you will need to get you started, if you have any

questions, please contact our Intake Specialist.

• Once a complete intake packet and all supporting documentation has been submitted to our office, it will be

reviewed for completeness and then assigned to a counselor. Please use the attached Document Checklist.

• After the counselor has completed a review of your documentation and done an analysis of your situation,

you will be contacted by our office to schedule your first appointment with your counselor.

• It is very important that you establish a relationship and communicate with our office throughout this

process.

• Failure to provide all requested documentation, or respond to follow up requests, will result in your file

being closed.

We look forward to working with you,

- NeighborWorks Umpqua Housing Stability Staff

Date Revised: 01/13/2022

Equal Housing Opportunity and Equal Housing Lender

www.nwumpqua.org | CCB# 15199 | NMLS# 255912

Coastal Housing Center Main Office

768 Virginia Ave Suite A 605 SE Kane St.

North Bend, OR 97459 Roseburg, OR 97470

Phone: 541-756-1000 Phone: 541-673-4909

Client Bill of Rights and Responsibilities

NeighborWorks Umpqua is committed to providing you with high quality professional services. NeighborWorks

Umpqua does not discriminate in the selection and participation of clients in its programs with respect to race,

religion, color, gender, age, national origin, or disability.

Client Rights

o To be treated with dignity and respect

o To have your information treated with confidentiality

o To be actively involved in any plan developed for you

o To have program requirements explained to you

o To have any complaints addressed in a timely manner

o To ask questions and be informed of your rights

o To discontinue your relationship with us at anytime

o To be presented with all options and programs available to you

Client Responsibilities

To speak in a respectful manner to have your concerns addressed

To provide accurate up to date information to the person(s) assisting you

To understand the requirements of the program(s) you are participating in and to fulfill them promptly

To ask questions when you need clarification

To keep your appointments and when unable to do so provide 24 hrs. advance notice

To arrive on time for your appointments

To provide all requested documentation by deadline

To maintain active communication with NeighborWorks Umpqua staff

Date Revised: 01/13/2022

Equal Housing Opportunity and Equal Housing Lender

www.nwumpqua.org | CCB# 15199 | NMLS# 255912

Coastal Housing Center Main Office

768 Virginia Ave Suite A 605 SE Kane St.

North Bend, OR 97459 Roseburg, OR 97470

Phone: 541-756-1000 Phone: 541-673-4909

Documentation Checklist

NeighborWorks Umpqua cannot process your application and schedule your appointment with a counselor

without all the required documentation. If you have questions about what is being asked of you, please reach

out to your Intake Specialist

NeighborWorks Umpqua Forms:

□ Intake Form

□ Default Intervention Application

□ Referral For Translation Services Form

□ Client/Counselor Agreement

□ Disclosure and Authorization to Release Information

□ Credit Report Authorization Form

□ Privacy Policy and Practices

□ Personal Monthly Budget

□ Expense Priority Wheel

Personal Documentation (Single Sided Copies Only):

□ Mortgage Note and/or Deed of Trust All pages

□ Mortgage Statements Most recent, ALL pages for ALL Mortgages

□ Most Recent Letter(s) from your lender regarding your delinquency - within last 90 days

□ Utility Bill Most recent, needed to prove residency

□ Monthly Bank Statements Last 2 Months, for ALL accounts, ALL pages

□ Federal Tax Returns Last 2 Years, 1040 Form must be signed & dated by all borrowers

□ Valid Photo ID

□ 1 Month Proof of Income(s)

□ Paystubs for the last 30 days

□ Social Security Award Letter

□ Pension Award Letter

□ Unemployment Benefit Statement

□ Rental Income: Rental Agreement, YTD Profit and Loss Statement (PNL)

□ Self-Employed: YTD PNL, Last 2 Months Business Bank Statements, Last 2 Years Business Taxes

□ SNAP: Award Letter, 12 Months Proof of Receipt

□ Other Income: ___________________________

Date Revised: 01/13/2022

Equal Housing Opportunity and Equal Housing Lender

www.nwumpqua.org | CCB# 15199 | NMLS# 255912

Roseburg Office: 605 SE Kane St, Roseburg OR 97470 Ph: 541-673-4909 Fax: 541-673-5023

North Bend Office: 1984 Sherman Ave, North Bend OR 97459 Ph: 541-756-1000 Fax: 866-572-1970

www.nwumpqua.org

APPLICANT 1 DEFAULT INTERVENTION INTAKE FORM Please Print Clearly

Name:

First Middle Initial Last

Address:

Street Address PO Box

City State Zip County

Home Ph: Work Ph: Cell Ph: Other Ph:

Email: Preferred Language:

Birth Date: Last 4 digits of Social Security Number:

Gender: Male Female Other / Non-Conforming

How did you hear about us?

Please Check All That Apply

Race: Alaskan Native / American Indian Asian Black / African American

Native Hawaiian / Other Pacific Islander White More than one race

Hispanic Non-Hispanic Chose not to respond

Please Check Highest Level of Education Completed

Education: Graduate School College Vocational Junior College

High School / GED Junior High School Primary Other

Unknown None Chose not to respond

Please Check

Marital Status: Single Adult Married w/ Children Married w/o Children

Divorced Separated Widowed

Unrelated Adults Unknown Chose not to respond

Please Check All That Apply

Sources of Income: Employment Self Employment SSI/SSD Pension

Unemployment Rental Income Alimony / Child Support SNAP

Other: _________________________________________

Please Put Annual Gross Income for Entire Household

Total Household Gross Annual Income: $_______________________________

Date Revised - 01/13/2022 Page 1 of 3

APPLICANT 1 CONT. DEFAULT INTERVENTION INTAKE FORM Please Print Clearly

Please Check

Type of Housing: Single Family Condominium Apartment

Mobile In Park Mobile On Land Rental

Multi-Family (2-4 units) Chose not to respond

Please Answer All Questions

Were you born in the United States? Yes No Are you a Veteran? Yes No

Are you Disabled? Yes No Disabled Dependents? Yes No

Is Applicant 1 Head of Household? Yes No Do you live in a Rural Area? Yes No

Are you English Proficient? Yes No Are you in the Active Military? Yes No

Total Number of People Living in Household?

Ages of Dependents: _______ _______ _______ _______ _______ _______ _______ _______ _______ _______

APPLICANT 1 EMPLOYMENT Please Print Clearly

Employer: Hire Date:

Your Title: Business Type:

Monthly Gross Income: Monthly Net Income:

Paid: Hourly Weekly Bi-Weekly Semi-Monthly Monthly

APPLICANT 2 Please Print Clearly

Name:

First Middle Initial Last

Home Ph: Work Ph: Cell Ph: Other Ph:

Email: Preferred Language:

Birth Date: Last 4 digits of Social Security Number:

Gender: Male Female Other / Non-Conforming

Please Check All That Apply

Race: Alaskan Native / American Indian Asian Black / African American

Native Hawaiian / Other Pacific Islander White More than one race

Hispanic Non-Hispanic Chose not to respond

Please Check Highest Level of Education Completed

Education: Graduate School College Vocational Junior College

High School / GED Junior High School Primary Other

Unknown None Chose not to respond

Date Revised - 01/13/2022 Page 2 of 3

APPLICANT 2 CONT. DEFAULT INTERVENTION INTAKE FORM Please Print Clearly

Please Check

Marital Status: Single Adult Married w/ Children Married w/o Children

Divorced Separated Widowed

Unrelated Adults Unknown Chose not to respond

Please Circle All That Apply

Sources of Income: Employment Self Employment SSI/SSD Pension

Unemployment Rental Income Alimony / Child Support SNAP

Other: _________________________________________

Please Circle All That Apply

Relationship to Spouse / Partner Sibling Employer

Applicant 1: Friend Parent Other: ____________________________________

Please Answer All Questions

Were you born in the United States? Yes No Are you a Veteran? Yes No

Are you Disabled? Yes No Disabled Dependents? Yes No

Are you in the Active Military? Yes No Are you English Proficient? Yes No

APPLICANT 2 EMPLOYMENT Please Print Clearly

Employer: Hire Date:

Your Title: Business Type:

Monthly Gross Income: Monthly Net Income:

Paid: Hourly Weekly Bi-Weekly Semi-Monthly Monthly

AUTHORIZATION Please Print Clearly

I authorize NeighborWorks Umpqua to:

Obtain a copy of the Final Closing Disclosure, Appraisal, and Real Estate Note(s) when I purchase/refinance a home from the lender

who made me a loan and/or Title Company that closed the loan.

I hereby verify this information to be true and accurate to the best of my knowledge, and if asked can prove accuracy of the information. I

understand the fee I am paying is non-refundable. I identify the person(s) signing the registration form to be the customer(s) receiving services

from NeighborWorks Umpqua.

Applicant 1 Date

Applicant 2 Date

Date Revised - 01/13/2022 Page 3 of 3

Default Intervention Application

Client Information

What is the current status of your credit? Excellent Good Bad Do not have any Do not know

Has your income changed since you originally got your current mortgage loan? Yes ( Increase or Decrease) No

What is your ideal situation for your home? Keep Sell Unsure

Was the reason for default realted to COVID19? Yes No

Are you still living in your home? Yes No

Financial Situation

Can you document your child support/alimony income? Yes No If yes, how long will it continue?

Are you currently in Chapter 13 Bankruptcy? Yes No

If yes, when did it begin? If yes, when will it be paid out?

If yes, how much is the payment? $

Have you had a Chapter 7 Bankruptcy? Yes No If yes, when was it discharged?

Are there any non-tax liens or judgments' against you or your property? Yes No

If yes, who is the lien holder?

If yes, what is the amount of the lien/judgment? $

Do you have any collections? Yes No

If yes, who is the collection agency?

If yes, what is the amount of the collection? $

Any Unpaid Federal Debts, Liens, or Unpaid Taxes? Yes No

If Yes, how much? $

Current Total Debt on Property $

Estimated Property Value $

Scam Information

Has anyone offered to modify or refinance your mortgage, either directly, through advertising, by mail or by any Yes No

other means such as a flyer?

Have you ever been guaranteed a loan modification, or asked to do any of the following:

Sign a contract Sign over the title to your property Redirect your mortgage payments

Told you to stop making your loan payments Pay a fee for assistance or counseling

Date Revised - 01/13/2022

Coastal Housing Center Main Office

768 Virginia Ave Suite A 605 SE Kane St.

North Bend, OR 97459 Roseburg, OR 97470

Phone: 541-756-1000 Phone: 541-673-4909

Referral For Translation Services

For clients requiring any non-English speaking services the following list of resources is being made available

to you:

ALTA Language Services, Inc

Tel: (404) 920-3800

Fax: (404) 920-3801

www.altalang.com

By signing below, I am acknowledging that this list has been provided to me.

_________________________________________ _________________

Homeowner Signature Date

_________________________________________ _________________

Counselor Signature Date

Date Revised: 01/13/2022

Equal Housing Opportunity and Equal Housing Lender

www.nwumpqua.org | CCB# 15199 | NMLS# 255912

Coastal Housing Center Main Office

768 Virginia Ave Suite A 605 SE Kane St.

North Bend, OR 97459 Roseburg, OR 97470

Phone: 541-756-1000 Phone: 541-673-4909

Client/Counselor Agreement

NeighborWorks Umpqua and its staff agree to provide the following services:

▬ Analysis of the mortgage default, including the amount and cause of default.

▬ Presentation and explanation of reasonable options available to the homeowner.

▬ Assistance communicating with the mortgage servicer and other creditors.

▬ Timely completion of promised action.

▬ Explanation of collection and foreclosure process.

▬ Identification of assistance resources.

▬ Referrals to needed resources.

▬ Confidentiality, honesty, respect, and professionalism in all services.

▬ Guidance in developing a realistic spending plan, based on homeowner decisions and choices in spending.

▬ Assistance in escalating any legitimate issues with the mortgage company. (This does not include

assistance in escalation of cases where the homeowner disagrees with the mortgage company's decision

but there is no factual basis for escalation)

▬ Counselors may answer questions and provide information but will not give legal advice. If I want legal

advice, recommendation will be that I seek legal assistance from the appropriate entities.

I/We, ________________________________________ agree to the following terms of services:

I/We will always provide honest and complete information to my/our counselor, whether verbally or in

writing.

I/We will provide all necessary documentation and follow-up information within the timeframe requested.

I/We will be on time for appointments and understand that if I/we are late for an appointment, the

appointment will still end at the scheduled time.

I/We will call within 24 hours of a scheduled appointment if I/we will be unable to attend an appointment.

I/We will understand that breaking this agreement may cause the counseling organization to sever its

service assistance to me/us.

I/We will be honest, respectful, and courteous in all forms of communication with staff.

I/We will contact the counselor when the mortgage company contacts us with questions, document

requests, or loss mitigation offers. (Such as a Trial Period Plan or Modification)

Date Revised: 01/13/2022

Equal Housing Opportunity and Equal Housing Lender

www.nwumpqua.org | CCB# 15199 | NMLS# 255912

Coastal Housing Center Main Office

768 Virginia Ave Suite A 605 SE Kane St.

North Bend, OR 97459 Roseburg, OR 97470

Phone: 541-756-1000 Phone: 541-673-4909

I give NeighborWorks Umpqua permission to use my name in any current and future publications or reporting.

Furthermore, since NeighborWorks Umpqua is a non-profit organization, I hereby release, hold harmless, and

waive all claims associated with these publications and marketing materials which I may have against

NeighborWorks Umpqua and its employees.

_________________________________________ _________________

Homeowner Signature Date

_________________________________________ _________________

Homeowner Signature Date

_________________________________________ _________________

Counselor Signature Date

Date Revised: 01/13/2022

Equal Housing Opportunity and Equal Housing Lender

www.nwumpqua.org | CCB# 15199 | NMLS# 255912

Coastal Housing Center Main Office

768 Virginia Ave Suite A 605 SE Kane St.

North Bend, OR 97459 Roseburg, OR 97470

Phone: 541-756-1000 Phone: 541-673-4909

Disclosure and Authorization to Release Information

In order to provide the best possible services, it may be necessary for NeighborWorks Umpqua to

communicate with individuals or agencies that may be able to assist you. By signing below, you acknowledge

your understanding of NeighborWorks Umpqua policies.

I/We understand (NeighborWorks Umpqua) provides housing counseling after which I/we will receive a

written action plan consisting of recommendations for handling my/our situation, possibly including referrals

to other housing agencies as appropriate.

______ I/We Choose to Opt Out

I/We understand NeighborWorks Umpqua receives Congressional funds through the Housing Stability

Counseling Program (HSCP), Homeownership Assistance Program (HOAP), and Housing and Urban

Development (HUD) programs and, as such, is required to share some of my/our personal information with

HSCP, HOAP and HUD program administration or their agents for purposes of program monitoring,

compliance, and evaluation.

______ I/We Choose to Opt Out

I/We give permission for HSCP, HOAP and HUD program administrators and/or their agents to follow-up with

me/us between now and June 30, 2026, for the purposes of program evaluation.

______ I/We Choose to Opt Out

I/We understand NeighborWorks Umpqua provides information and education on numerous loan products

and housing programs, and I/we further understand that the housing counseling I/we receive from

NeighborWorks Umpqua in no way obligates me/us to choose any of these particular loan products or housing

programs.

______ I/We Choose to Opt Out

I/We release NeighborWorks Umpqua’s Board of Directors, officers, and employees from any and all claims,

demands and liability of any sort resulting from the release of such information.

______ I/We Choose to Opt Out

Date Revised: 01/26/2022

Equal Housing Opportunity and Equal Housing Lender

www.nwumpqua.org | CCB# 15199 | NMLS# 255912

Coastal Housing Center Main Office

768 Virginia Ave Suite A 605 SE Kane St.

North Bend, OR 97459 Roseburg, OR 97470

Phone: 541-756-1000 Phone: 541-673-4909

I/We understand NeighborWorks Umpqua provides homeownership education and counseling, individual

development accounts, affordable housing opportunities, foreclosure intervention counseling, down payment

assistance grants and/or loans, and low-income housing rehab assistance. NeighborWorks Umpqua partners

with for-profit and non-profit organizations, which may include financial institutions, realtors, lenders,

contractors, title companies and other community entitles.

I/We understand a counselor may answer questions and provide me information, but not give legal advice. If

I/we want legal advice, I/we will be referred for appropriate assistance.

I/We may be referred to other housing services of the organization or other agency or agencies as appropriate

that may be able to assist with concerns that have been identified. I/We understand that I/we am/are not

obligated to use any of the services offered to me/us.

I/We acknowledge that I/we have received a copy of (NeighborWorks Umpqua) privacy policy.

By signing this form, you acknowledge that you are entering into a counseling agreement with NeighborWorks

Umpqua. We will make all attempts to resolve your situation and to guide you through the process of

reviewing your options. This is in no way a guarantee of results and NeighborWorks Umpqua is in no way

legally responsible for the outcome of this counseling. By not signing this form, you understand that

NeighborWorks Umpqua may not perform any default counseling services on your behalf.

This consent to disclose may be revoked by me/us at any time by written, signed, and dated notice to

NeighborWorks Umpqua that consent is revoked.

_________________________________________ _________________

Homeowner Signature Date

_________________________________________ _________________

Homeowner Signature Date

Date Revised: 01/26/2022

Equal Housing Opportunity and Equal Housing Lender

www.nwumpqua.org | CCB# 15199 | NMLS# 255912

Coastal Housing Center Main Office

768 Virginia Ave Suite A 605 SE Kane St.

North Bend, OR 97459 Roseburg, OR 97470

Phone: 541-756-1000 Phone: 541-673-4909

Credit Report Authorization Form

I hereby authorize and instruct NEIGHBORWORKS UMPQUA. (hereinafter “NEIGHBORWORKS UMPQUA”) to

obtain and review my credit report at the time of intake. My credit report will be obtained from a credit

reporting agency chosen by NEIGHBORWORKS UMPQUA. I understand and agree that NEIGHBORWORKS

UMPQUA intends to use the credit report for the purpose of evaluating my financial situation.

My signature below also authorizes the release to credit reporting agencies of financial or other information

that I have supplied to NEIGHBORWORKS UMPQUA in connection with such evaluation. Authorization is

further granted to the credit reporting agency to use a copy of this form to obtain any information the credit

reporting agency deems necessary to complete my credit report.

I understand that I may revoke my consent to these disclosures by notifying NEIGHBORWORKS UMPQUA in

writing.

I authorize NeighborWorks Umpqua to send me a copy of my credit report via the following methods (check

all that apply):

- US Mail

- Encrypted Email

- Fax

*Please note: if no box is checked, US Mail will be the default method of delivery.

Residential Address: _________________________________________________________________________

Applicant 1 SSN: ____________________ Applicant 1 Date of Birth: _____________________

Applicant 2 SSN: ____________________ Applicant 2 Date of Birth: _____________________

_________________________________________ __________________________________________

Full Legal Name Signature Date

_________________________________________ __________________________________________

Full Legal Name Signature Date

Date Revised: 01/13/2022

Equal Housing Opportunity and Equal Housing Lender

www.nwumpqua.org | CCB# 15199 | NMLS# 255912

Coastal Housing Center Main Office

768 Virginia Ave Suite A 605 SE Kane St.

North Bend, OR 97459 Roseburg, OR 97470

Phone: 541-756-1000 Phone: 541-673-4909

Privacy Policy and Practices of NeighborWorks Umpqua

We at NeighborWorks Umpqua value your trust and are committed to the responsible management, use and

protection of personal information. This notice describes our policy regarding the collection and disclosure of

personal information. Personal information, as used in this office, means information that identifies an

individual personally and is not otherwise publicly available information. This includes personal financial

information such as credit history, income, employment history, financial assets, bank account information

and financial debts. It also includes your social security number and other information you have provided us

on any applications or forms that you have completed.

Information We Collect

We collect personal information to support our lending operations, counseling, services, and to aid you in

shopping for and obtaining a home mortgage from a conventional lender. We collect personal information

about you from the following sources:

Information we receive from you on applications or other forms,

Information about your transactions with us, our affiliates, or others,

Information we receive from a consumer reporting agency, and

Information we receive from personal and employment references.

Information We Disclose

We may disclose the following kinds of personal information about you:

Information we receive from you on applications or other forms, such as your name, address, social

security number, employer, occupation, assets, debts, and income.

Information about your transactions with us, our affiliates, or others, such as your account balance,

payment history and parties to your transactions; and

Information we receive from a consumer reporting agency, such as your credit bureau reports, your credit

history and your creditworthiness.

To Whom Do We Disclose

We may disclose your personal information to the following types of unaffiliated third parties:

Financial service providers, such as companies engaged in providing home mortgage or home equity loans,

Others, such as nonprofit organizations involved in community development, but only for program review,

auditing, research, and oversight purposes.

We may also disclose personal information about you to third parties as permitted by law.

Prior to sharing personal information with unaffiliated third parties, except as described in this policy, we will

give you an opportunity to direct that such information is not disclosed.

Date Revised: 01/26/2022

Equal Housing Opportunity and Equal Housing Lender

www.nwumpqua.org | CCB# 15199 | NMLS# 255912

Coastal Housing Center Main Office

768 Virginia Ave Suite A 605 SE Kane St.

North Bend, OR 97459 Roseburg, OR 97470

Phone: 541-756-1000 Phone: 541-673-4909

Confidentiality and Security

We restrict access to personal information about you to those of our employees who need to know that

information to provide products and services to you and to help them do their jobs. Which includes

underwriting and servicing of loans, making loan decisions, aiding you in obtaining loans from others, and

financial counseling. We maintain physical and electronic security procedures to safeguard the confidentiality

and integrity of personal information in our possession and to guard against unauthorized access. We use

locked files, user authentication and detection software to protect your information. Our safeguards comply

with federal regulations to guard your personal information.

I/We have read and understand the terms of the above policy:

_________________________________________ _________________

Homeowner Signature Date

_________________________________________ _________________

Homeowner Signature Date

Date Revised: 01/26/2022

Equal Housing Opportunity and Equal Housing Lender

www.nwumpqua.org | CCB# 15199 | NMLS# 255912

Roseburg Office: 605 SE Kane St, Roseburg OR 97470 Ph: 541-673-4909 Fax: 541-673-5023

North Bend Office: 1984 Sherman Ave, North Bend OR 97459 Ph: 541-756-1000 Fax: 866-572-1970

www.nwumpqua.org

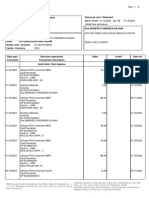

Personal Monthly Budget

Gross Income Net Income

Income Source Amount Income Source Amount

Total Monthly Gross Income: 0 Total Monthly Net Income: 0

Surplus/Deficit 0 Surplus/Deficit 0

HOUSING Amount DEBTS Amount SAVINGS Amount

First Mortgage Car Payment 1 College Fund

Second Mortgage Car Payment 2 Savings Account

Real Estate Taxes Credit Card 1 Retirement Account

Association Dues Credit Card 2 Subtotal 0

Rent Credit Card 3 Percentage of Budget: NaN

Repairs/Maintenance Credit Card 4 *10-15%

Subtotal 0 Credit Card 5 CHARITY Amount

Percentage of Budget: NaN Motorcycle Charity & Offerings

*25-35% Personal Loan Tithes

UTILITIES Amount RV Other: _____________

Cable Student Loan 1 Subtotal 0

Electricity Student Loan 2 Percentage of Budget: NaN

Gas Student Loan 3 *10-15%

Internet Student Loan 4 LEGAL Amount

Pellets Other: _____________ Attorney

Phone Other: _____________ Liens/Judgments

Trash Subtotal 0 Other: _____________

Water/Sewer Percentage of Budget: NaN Subtotal 0

Wood *5-10% Percentage of Budget: NaN

Subtotal 0 TAXES Amount *1-5%

Percentage of Budget: NaN Federal MEDICAL/HEALTH Amount

*5-10% State Dentist

TRANSPORTATION Amount Local Doctor Bills

Gas & Oil Subtotal 0 Medications

Repairs & Tires Percentage of Budget: NaN Optometrist

License & Taxes *1-5% Vitamins/Supplements

Car Replacement PERSONAL Amount Other: _____________

Other: _____________ Alimony Other: _____________

Subtotal 0 Baby Supplies Subtotal 0

Percentage of Budget: NaN Books/Supplies Percentage of Budget: NaN

*10-15% Child Care/Sitter *5-10%

INSURANCE Amount Child Support RECREATION Amount

Auto Insurance Cosmetics/Hair Care Entertainment

Disability Insurance Education/Tuition Vacation

Health Insurance Gifts (inc. Christmas) Subtotal 0

Homeowner Insurance Miscellaneous Percentage of Budget: NaN

Identity Theft Music/Technology *5-10%

Life Insurance Organization Dues CLOTHING Amount

Long-Term Care Pet Supplies Adults

Rental Insurance Pocket Money (Hers) Children

Other: _____________ Pocket Money (His) Cleaning/Laundry

Subtotal 0 Replace Furniture Subtotal 0

Percentage of Budget: NaN Subscriptions Percentage of Budget: NaN

*10-25% Toiletries *2-7%

FOOD Amount Other: _____________

Groceries Other: _____________ TOTAL EXPENSES 0

Dining out Subtotal 0

Other: _____________ Percentage of Budget: NaN

Subtotal 0 *5-10% *Recommended Percentages

Percentage of Budget: NaN

*10-25% Affordability Ratios

Housing Payment PITI Front-End Ratio Total Debt Back-End Ratio

0 NaN 0 NaN

Date Revised - 01/13/2022

Satisfaction Wheel

Housing Food

Utilities

Income

Clothing Transportation

Mental Health

Employment

Physical Health Education/School

WHEEL INSTRUCTIONS:

The 10 sections in this Wheel represent the different areas of your life.

Taking the center of the wheel as zero and the outer edge as 10, please rank your level of satisfaction with each

area out of 10 by placing a dot in each category to show your level of satisfaction. Zero is least satisfied and 10 is

most satisfied. There is no limit to the amount of any number you assign to categories.

You are not rating the categories as 0-10, you are rating each category separate from the others.

Date Revised: 01/10/2022

You might also like

- Click File - Download - The Corporate Finance Cheat Sheet - Oana Labes, MBA, CPADocument9 pagesClick File - Download - The Corporate Finance Cheat Sheet - Oana Labes, MBA, CPAMessias MorettoNo ratings yet

- Find Cusip NumberDocument2 pagesFind Cusip NumberJohnny Lol92% (12)

- Documentdownload PDFDocument4 pagesDocumentdownload PDFJohnny PackardNo ratings yet

- Bad News Letter ExamplesDocument8 pagesBad News Letter ExamplesMoAzzam HassanNo ratings yet

- Cost of Capital QDocument2 pagesCost of Capital QPrinkeshNo ratings yet

- CAF 1 - Accounting For PartnershipDocument48 pagesCAF 1 - Accounting For PartnershipAhsan Kamran100% (1)

- Basic Elements of ControlDocument8 pagesBasic Elements of Controltanvir09100% (2)

- Probono Bankruptcy Programs-2Document39 pagesProbono Bankruptcy Programs-2chrissyxsnjNo ratings yet

- Jason Schmit 4 Snowapple Irvine, CA 92614Document3 pagesJason Schmit 4 Snowapple Irvine, CA 92614JRSNo ratings yet

- Application File Created For:: Cesar QueenDocument8 pagesApplication File Created For:: Cesar Queenviolinist1100No ratings yet

- Jason Schmit 4 Snowapple Irvine, CA 92614Document3 pagesJason Schmit 4 Snowapple Irvine, CA 92614tonyNo ratings yet

- 2020 SATU MARE Casual Employee Agreement Fillable PDFDocument13 pages2020 SATU MARE Casual Employee Agreement Fillable PDFAnnie LamNo ratings yet

- CEP Money Action Day at AuroraDocument2 pagesCEP Money Action Day at AuroraCenter for Economic ProgressNo ratings yet

- Classified Deadline: Now Hiring!Document2 pagesClassified Deadline: Now Hiring!Tara SmithNo ratings yet

- CayugaApp 2014condensedDocument2 pagesCayugaApp 2014condensedcayugahrNo ratings yet

- Homeless Resources SLODocument9 pagesHomeless Resources SLOJason MontgomeryNo ratings yet

- Pinecone November 2009Document8 pagesPinecone November 2009Raleigh Association of Insurance ProfessionalsNo ratings yet

- Rental Application: OptionalDocument5 pagesRental Application: OptionalCrystal KleistNo ratings yet

- Community Resource Assistance Guide Johnston CountyDocument37 pagesCommunity Resource Assistance Guide Johnston Countyapi-295387342No ratings yet

- Client Number:: To Contact Us Visit WWW - Workandincome.govt - Nz/contactDocument3 pagesClient Number:: To Contact Us Visit WWW - Workandincome.govt - Nz/contactGhazanfarNo ratings yet

- To Contact Us Visit WWW - Workandincome.govt - Nz/contact: Are You Interested in Working?Document2 pagesTo Contact Us Visit WWW - Workandincome.govt - Nz/contact: Are You Interested in Working?ch4ind4wg13No ratings yet

- Pearmanfaithpromise PDFDocument1 pagePearmanfaithpromise PDFJosh PearmanNo ratings yet

- MAGI ApprovalDocument2 pagesMAGI Approvalbigboy6669000No ratings yet

- National Customer Services Clerk Advert 25.06.2024_FinalDocument3 pagesNational Customer Services Clerk Advert 25.06.2024_Finalashleynyakarize01No ratings yet

- Bank Credit InformationDocument1 pageBank Credit InformationplayerwheelNo ratings yet

- John R. Conder 270-80-0623 (903) - 720-7624 CA330325221711688953 04/28/2023 217059458 E-MailDocument4 pagesJohn R. Conder 270-80-0623 (903) - 720-7624 CA330325221711688953 04/28/2023 217059458 E-MailJohn ConderNo ratings yet

- Bad News Letter ExamplesDocument11 pagesBad News Letter ExamplesBOsch VakilNo ratings yet

- Risima Apllication FormDocument11 pagesRisima Apllication FormdulciholdingsNo ratings yet

- Shelter Island Reporter Classifieds: Jan. 19, 2017Document1 pageShelter Island Reporter Classifieds: Jan. 19, 2017TimesreviewNo ratings yet

- Huron Hometown News Ads - February 7, 2013Document25 pagesHuron Hometown News Ads - February 7, 2013Catawba SecurityNo ratings yet

- 11-19-14 Classifieds PDFDocument1 page11-19-14 Classifieds PDFthevillagereporterNo ratings yet

- Read The Instructions Completely Before Filling Out This Application. Please Print in Black Ink or Type AnswersDocument2 pagesRead The Instructions Completely Before Filling Out This Application. Please Print in Black Ink or Type AnswersTerry PopeNo ratings yet

- Studylink DocsDocument2 pagesStudylink Docsrico saundersNo ratings yet

- 5 28 14 ClassifiedsDocument1 page5 28 14 ClassifiedsthevillagereporterNo ratings yet

- ApplicationDocument2 pagesApplicationapi-247063038No ratings yet

- Shamong - 0311 PDFDocument16 pagesShamong - 0311 PDFelauwitNo ratings yet

- Tina Robinson Employment Application ModelDocument3 pagesTina Robinson Employment Application Modelapi-394226065No ratings yet

- Application, Supplemental Nutrition Assistance Program BenefitsDocument32 pagesApplication, Supplemental Nutrition Assistance Program BenefitsLVNewsdotcomNo ratings yet

- Enrollment 9703cc757dDocument1 pageEnrollment 9703cc757dKai MeiwesNo ratings yet

- 71 Interim Report Reminder 20230120233759 185d29e7b01-44f72099Document4 pages71 Interim Report Reminder 20230120233759 185d29e7b01-44f72099ELLA PATTERSONNo ratings yet

- Shelter Island Reporter Classifieds and Homeowners Network: Nov. 12, 2015Document3 pagesShelter Island Reporter Classifieds and Homeowners Network: Nov. 12, 2015TimesreviewNo ratings yet

- New Application Form PDFDocument3 pagesNew Application Form PDFAnonymous WvGJn3rNo ratings yet

- Epever Solar ControllerDocument2 pagesEpever Solar ControllerJason KettleNo ratings yet

- Random Acts of CounsellingDocument2 pagesRandom Acts of CounsellingSharon A StockerNo ratings yet

- 1481546265426Document3 pages1481546265426api-370784582No ratings yet

- View FileDocument4 pagesView FileJerrod JohnsonNo ratings yet

- Traditional Southern BarbequeDocument1 pageTraditional Southern BarbequeBill Gram-ReeferNo ratings yet

- Winter Energy Payment: To Contact Us Visit WWW - Workandincome.govt - Nz/contactDocument2 pagesWinter Energy Payment: To Contact Us Visit WWW - Workandincome.govt - Nz/contactCharlotte MunroNo ratings yet

- Client Number:: To Contact Us Visit WWW - Workandincome.govt - Nz/contactDocument3 pagesClient Number:: To Contact Us Visit WWW - Workandincome.govt - Nz/contactRupert GilliandNo ratings yet

- Leisure Guide Fall 2010 English WEB1Document60 pagesLeisure Guide Fall 2010 English WEB1Tyler SamsonNo ratings yet

- Deed in LieuDocument33 pagesDeed in LieuSteven WhitfordNo ratings yet

- Legal Aid Application FormDocument16 pagesLegal Aid Application FormHsgceNo ratings yet

- Shelter Island Reporter Classifieds: Nov. 27, 2014Document2 pagesShelter Island Reporter Classifieds: Nov. 27, 2014TimesreviewNo ratings yet

- CCAWV Members Vote NO 2014 Salary HikeDocument4 pagesCCAWV Members Vote NO 2014 Salary HikeKyle LangsleyNo ratings yet

- Wait List Application Oregon HousesDocument7 pagesWait List Application Oregon HousesJacob JohnstonNo ratings yet

- Homework Rocky River OhioDocument4 pagesHomework Rocky River Ohioafmtbioei100% (1)

- SPOFR Volunteer ApplicationDocument9 pagesSPOFR Volunteer ApplicationharshmehtaroyofficalNo ratings yet

- Client Number:: To Contact Us Visit WWW - Workandincome.govt - Nz/contactDocument4 pagesClient Number:: To Contact Us Visit WWW - Workandincome.govt - Nz/contactJason KettleNo ratings yet

- Reflection PaperDocument7 pagesReflection Paperapi-611520408No ratings yet

- 2960-EG - Application For Health InsuranceDocument14 pages2960-EG - Application For Health InsuranceKristopher KrodyNo ratings yet

- Hyosung Americas New Hire FormsDocument15 pagesHyosung Americas New Hire FormsSarfaraz KhanNo ratings yet

- ApplicationDocument2 pagesApplicationapi-247057647No ratings yet

- (A) Applicant (B) Co-ApplicantDocument3 pages(A) Applicant (B) Co-ApplicantYvonne Romine CameronNo ratings yet

- Your U.S. Citizenship Guide: What You Need to Know to Pass Your U.S. Citizenship TestFrom EverandYour U.S. Citizenship Guide: What You Need to Know to Pass Your U.S. Citizenship TestRating: 1 out of 5 stars1/5 (1)

- The Complete Guide to Planning Your Estate in North Carolina: A Step-by-Step Plan to Protect Your Assets, Limit Your Taxes, and Ensure Your Wishes are Fulfilled for North Carolina ResidentsFrom EverandThe Complete Guide to Planning Your Estate in North Carolina: A Step-by-Step Plan to Protect Your Assets, Limit Your Taxes, and Ensure Your Wishes are Fulfilled for North Carolina ResidentsNo ratings yet

- About - Securitization AuditDocument6 pagesAbout - Securitization AuditJohnny LolNo ratings yet

- Agreement To Vacate - 13644 AgateDocument1 pageAgreement To Vacate - 13644 AgateJohnny LolNo ratings yet

- Schott V BAC Home LoansDocument25 pagesSchott V BAC Home LoansJohnny Lol100% (1)

- What Is A Cusip Number and What Does It Mean - ThestreetDocument6 pagesWhat Is A Cusip Number and What Does It Mean - ThestreetJohnny LolNo ratings yet

- Marketables Securities Glossary For Treasurydirect Account Holders - TreasurydirectDocument12 pagesMarketables Securities Glossary For Treasurydirect Account Holders - TreasurydirectJohnny Lol100% (1)

- Cusip Numbers and How To Look Them UpDocument13 pagesCusip Numbers and How To Look Them UpJohnny Lol0% (1)

- Cusip Identification NumberDocument2 pagesCusip Identification NumberJohnny LolNo ratings yet

- People Living at 13644 Agate RD Eagle Point orDocument8 pagesPeople Living at 13644 Agate RD Eagle Point orJohnny LolNo ratings yet

- Cusip Number - Investor - GovDocument1 pageCusip Number - Investor - GovJohnny LolNo ratings yet

- Document 2018-15269Document2 pagesDocument 2018-15269Johnny LolNo ratings yet

- Property Valuation of Agate Road, Eagle Point, OR: 13151, 13371, 13474, 13555, 13555, 13615, 13644, 13777, 13777, 13955 (Tax Assessments)Document6 pagesProperty Valuation of Agate Road, Eagle Point, OR: 13151, 13371, 13474, 13555, 13555, 13615, 13644, 13777, 13777, 13955 (Tax Assessments)Johnny LolNo ratings yet

- Cusip - Isin - Cusip - Lei - Sedol - WKN - Cfi Codes - Database Securities Apply Application RegisterDocument2 pagesCusip - Isin - Cusip - Lei - Sedol - WKN - Cfi Codes - Database Securities Apply Application RegisterJohnny Lol50% (2)

- Document 2017-32203Document1 pageDocument 2017-32203Johnny LolNo ratings yet

- Cusip For A Loan - Isin - Cusip - Lei - Sedol - WKN - Cfi Codes - Database Securities Apply Application RegisterDocument1 pageCusip For A Loan - Isin - Cusip - Lei - Sedol - WKN - Cfi Codes - Database Securities Apply Application RegisterJohnny LolNo ratings yet

- Cusip - Working With Data - Libguides at Vu AmsterdamDocument1 pageCusip - Working With Data - Libguides at Vu AmsterdamJohnny LolNo ratings yet

- Home-Land Fencing - Better Business Bureau® ProfileDocument2 pagesHome-Land Fencing - Better Business Bureau® ProfileJohnny LolNo ratings yet

- Eagle Point Homes - Listing Report - Rogue Real EstateDocument5 pagesEagle Point Homes - Listing Report - Rogue Real EstateJohnny LolNo ratings yet

- Glossary of Terms - Jackson County - MiDocument88 pagesGlossary of Terms - Jackson County - MiJohnny LolNo ratings yet

- Eric L Lierman - (541) 664-4969 - Eagle Point - Public Records InstantlyDocument8 pagesEric L Lierman - (541) 664-4969 - Eagle Point - Public Records InstantlyJohnny LolNo ratings yet

- Eagle Point Property Records by AddressDocument2 pagesEagle Point Property Records by AddressJohnny LolNo ratings yet

- Agate RD - Eagle Point - or 97524Document24 pagesAgate RD - Eagle Point - or 97524Johnny LolNo ratings yet

- Agate RD - Eagle PT - or 97524 - TruliaDocument64 pagesAgate RD - Eagle PT - or 97524 - TruliaJohnny LolNo ratings yet

- Phony Foreclosure Advocates ExposedDocument3 pagesPhony Foreclosure Advocates ExposedJohnny LolNo ratings yet

- ENotes OriginatorDocument1 pageENotes OriginatorJohnny LolNo ratings yet

- Document 2018-15270Document3 pagesDocument 2018-15270Johnny LolNo ratings yet

- Foreclosure FraudDocument3 pagesForeclosure FraudJohnny LolNo ratings yet

- MersincDocument1 pageMersincJohnny LolNo ratings yet

- 41 DIGEST International Corporate Bank v. Spouses GuecoDocument3 pages41 DIGEST International Corporate Bank v. Spouses GuecoPrincess Aileen EsplanaNo ratings yet

- Public Finance Term Paper TopicsDocument4 pagesPublic Finance Term Paper Topicsafmzubsbdcfffg100% (1)

- Cash Flow Statement ExerciseDocument3 pagesCash Flow Statement ExerciseVikas YadavNo ratings yet

- Metrics in HospitalityDocument10 pagesMetrics in HospitalityPaulo OliveiraNo ratings yet

- Lendsqr WorkDocument6 pagesLendsqr WorkitzsleekmayNo ratings yet

- Project - 8: Finance &risk Analytics - India Credit RiskDocument28 pagesProject - 8: Finance &risk Analytics - India Credit RiskpsyishNo ratings yet

- Introverted Intuitive Thinking Judging: Intjs Can Improve This T-ShirtDocument5 pagesIntroverted Intuitive Thinking Judging: Intjs Can Improve This T-ShirtDeepakNo ratings yet

- 56465bos45796cp4u2 PDFDocument49 pages56465bos45796cp4u2 PDFNarendra VasavanNo ratings yet

- Industrial Visit in Lunar Private (Sivya)Document20 pagesIndustrial Visit in Lunar Private (Sivya)Sivya SolomonNo ratings yet

- Worksheet ch7 ch8 Without AnswersDocument9 pagesWorksheet ch7 ch8 Without Answerssahar201121999No ratings yet

- Julien Day School FeesDocument22 pagesJulien Day School Fees32.Soumik AdakNo ratings yet

- Employee Benefits 2 Employee Benefits 2Document4 pagesEmployee Benefits 2 Employee Benefits 2XNo ratings yet

- Trust Fund DoctrineDocument3 pagesTrust Fund DoctrineClaudine SumalinogNo ratings yet

- Brattleboro Retreat 2018 Form 990 990-T PublicDocument112 pagesBrattleboro Retreat 2018 Form 990 990-T PublicThe Berkshire EagleNo ratings yet

- Obstacles, Predictions and Market DirectionDocument22 pagesObstacles, Predictions and Market DirectionRui AlmeidaNo ratings yet

- Maramag Water District Bukidnon Executive Summary 2020Document6 pagesMaramag Water District Bukidnon Executive Summary 2020cpa126235No ratings yet

- Premises MOU NewDocument2 pagesPremises MOU NewRehanNo ratings yet

- Case 08 16e, Oct 20th, 2023Document4 pagesCase 08 16e, Oct 20th, 2023Itzel OvalleNo ratings yet

- Particulars Amount Amount Particulars Particulars AmountDocument1 pageParticulars Amount Amount Particulars Particulars AmountBetter idontbeNo ratings yet

- Negotiated-Market 045808Document4 pagesNegotiated-Market 045808quinnia.rainiiNo ratings yet

- System Dynamics Approach in Analyzing Impact of deDocument9 pagesSystem Dynamics Approach in Analyzing Impact of deCassia MontiNo ratings yet

- Financial Report For BBA AVIATIONDocument8 pagesFinancial Report For BBA AVIATIONPaul NdegNo ratings yet

- Debt Securities ReviewerDocument30 pagesDebt Securities Reviewerjhie boterNo ratings yet

- SV58410192400 2023 12Document6 pagesSV58410192400 2023 12andreeaNo ratings yet

- IAS 7 - Article For Statement of CashflowsDocument4 pagesIAS 7 - Article For Statement of CashflowsonyeonwuNo ratings yet

- Political Ideology and FDI: Radical ViewDocument11 pagesPolitical Ideology and FDI: Radical ViewInciaNo ratings yet