Professional Documents

Culture Documents

Ombay Dyeing (Full Name: The Bombay Dyeing & Mfg. Co. LTD., Established 1879) Is The

Ombay Dyeing (Full Name: The Bombay Dyeing & Mfg. Co. LTD., Established 1879) Is The

Uploaded by

Himanshu KansalOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ombay Dyeing (Full Name: The Bombay Dyeing & Mfg. Co. LTD., Established 1879) Is The

Ombay Dyeing (Full Name: The Bombay Dyeing & Mfg. Co. LTD., Established 1879) Is The

Uploaded by

Himanshu KansalCopyright:

Available Formats

ombay Dyeing (full name: The Bombay Dyeing & Mfg. Co. Ltd.

, established 1879) is the flagship company of the Wadia

Group, engaged mainly into the business of Textiles. Bombay Dyeing is one of India's largest producers of textiles. [1]

Its current chairman is Nusli Wadia.[2] In March 2011, Jeh Wadia (36), the younger son of Nusli, has been named the

managing director of Wadia Group's flagship, Bombay Dyeing & Manufacturing Company, while the elder son, Ness (38)

has resigned from the post of joint MD of the company.

[3]

Bombay Dyeing was often in the news, apart from other things, for various controversies surrounding its tussle with the

late Dhirubhai Ambani ofReliance Industries Limited and with Calcutta based jutebaron Late Arun Bajoria.[4]

Lackadaisical management has ensured that the company, which was ranked 68 in the Business India Super 100 list in

1997 has steadily lost ground and by 2010 ranked 300 in the ET 500 list.

The company sponsors many events, including Bombay Dyeing Gladrags Mrs. India contest.

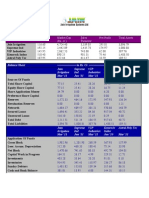

(Rs crore)

Balance sheet

Mar ' 10

Mar ' 09

Mar ' 08

Mar ' 07

Mar ' 06

38.61

38.61

38.61

38.61

38.60

Share application money

11.89

Preference share capital

171.74

130.25

357.30

356.41

342.95

1,611.97

1,499.00

1,024.67

798.49

428.51

163.14

211.88

391.09

253.91

129.86

1,985.46

1,879.74

1,823.56

1,447.42

939.92

Sources of funds

Owner's fund

Equity share capital

Reserves & surplus

Loan funds

Secured loans

Unsecured loans

Total

Uses of funds

Mar ' 10

Mar ' 09

Mar ' 08

Mar ' 07

Mar ' 06

1,183.44

1,159.75

1,060.35

654.58

720.50

201.56

7.66

83.28

Less : accumulated depreciation

231.26

178.72

123.67

512.86

596.20

Net block

952.18

779.47

936.68

134.06

41.02

Capital work-in-progress

208.39

218.85

303.90

735.53

275.07

60.19

60.22

126.72

153.70

168.02

1,091.56

1,167.20

771.19

679.93

574.77

Less : current liabilities & provisions

326.86

347.40

317.72

322.92

124.53

Total net current assets

764.70

819.80

453.47

357.01

450.24

1.40

2.79

67.12

5.57

1,985.46

1,879.74

1,823.56

1,447.42

939.92

Book value of unquoted investments

60.19

60.22

126.72

153.70

138.46

Market value of quoted investments

29.56

75.26

49.64

123.83

201.30

173.87

386.17

386.17

386.15

386.10

386.05

Fixed assets

Gross block

Less : revaluation reserve

Investments

Net current assets

Current assets, loans & advances

Miscellaneous expenses not written

Total

Notes:

Contingent liabilities

Number of equity sharesoutstanding (Lacs)

Buy? Sell? Hold?

Get the Latest Stock Tips

Market Astrology

Stock market predictions by Satish Gupta

P AND L A/C

Mar ' 10

Mar ' 09

Mar ' 08

Mar ' 07

Mar ' 06

1,661.38

1,344.00

934.54

496.22

1,016.63

Material consumed

824.85

811.19

630.80

294.58

688.88

Manufacturing expenses

358.07

272.29

267.45

130.67

157.05

Personnel expenses

49.72

51.38

35.13

38.47

53.35

Selling expenses

74.56

87.37

23.40

22.04

23.13

Adminstrative expenses

73.95

59.85

60.49

41.73

37.54

-148.60

-100.86

1,381.15

1,282.08

868.67

426.63

959.95

280.23

61.92

65.87

69.59

56.68

23.75

25.84

26.59

19.41

15.23

Adjusted PBDIT

303.98

87.76

92.46

89.00

71.91

Financial expenses

200.70

184.95

73.40

31.83

16.73

59.54

55.73

35.42

17.46

16.90

43.74

-152.92

-16.36

39.71

38.28

3.77

1.02

1.33

4.48

-2.12

Adjusted PAT

39.97

-153.94

-17.69

35.23

40.40

Non recurring items

-21.55

-40.68

25.30

0.70

20.85

Income

Operating income

Expenses

Expenses capitalised

Cost of sales

Operating profit

Other recurring income

Depreciation

Other write offs

Adjusted PBT

Tax charges

Mar ' 10

Mar ' 09

Mar ' 08

Mar ' 07

Mar ' 06

0.09

Reported net profit

18.42

-194.62

7.61

35.93

61.34

Earnigs before appropriation

34.76

-6.03

202.01

35.93

199.05

9.66

3.86

13.52

19.31

19.30

1.60

0.66

2.30

3.28

2.71

23.50

-10.55

186.19

13.34

177.04

Other non cash adjustments

Equity dividend

Preference dividend

Dividend tax

Retained earnings

http://money.rediff.com/companies/bombay-dyeing-and-manufacturing-company-ltd/16010003/profitand-loss

You might also like

- Initiation of Coverage-Scancom PLC. (MTNGH) Spins Its WH PDFDocument30 pagesInitiation of Coverage-Scancom PLC. (MTNGH) Spins Its WH PDFQuofi SeliNo ratings yet

- Merton Truck CompanyDocument16 pagesMerton Truck CompanyAmeeno Pradeep PaulNo ratings yet

- Campbell and Bailyn's Boston OfficeDocument12 pagesCampbell and Bailyn's Boston OfficeBorne KillereNo ratings yet

- Case 3 - Azim Hasham Premjis Value-Based LeadershipDocument18 pagesCase 3 - Azim Hasham Premjis Value-Based LeadershipSachinRavindranNo ratings yet

- Essar SteelDocument15 pagesEssar SteelKhushiyal M. KatreNo ratings yet

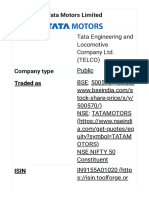

- Tata Motors LTD: Registered AddressDocument5 pagesTata Motors LTD: Registered AddressSivaraj PadmanabanNo ratings yet

- Blue Star Ltd.Document69 pagesBlue Star Ltd.AB JaatNo ratings yet

- 100 IntroductionDocument6 pages100 IntroductionMohit WaniNo ratings yet

- Company - Jain Irrigation System LTDDocument31 pagesCompany - Jain Irrigation System LTDNoor_DawoodaniNo ratings yet

- General Information: WWW - Bata.inDocument3 pagesGeneral Information: WWW - Bata.inViny GokhruNo ratings yet

- Bima PDFDocument2 pagesBima PDFIshidaUryuuNo ratings yet

- Muhammad Rizwan MC090408006 Finance: Master in Business Administration (MBA)Document55 pagesMuhammad Rizwan MC090408006 Finance: Master in Business Administration (MBA)Faizan Tufail MalikNo ratings yet

- 12 Grasim Manish SainiDocument20 pages12 Grasim Manish Sainisunilgenius@gmail.comNo ratings yet

- FM Report On Ultratech Cement (Sem 2)Document22 pagesFM Report On Ultratech Cement (Sem 2)mital208No ratings yet

- FINAL RCF Annual Report 2010 111Document108 pagesFINAL RCF Annual Report 2010 111Ankit ChudawalaNo ratings yet

- BramDocument2 pagesBramIshidaUryuuNo ratings yet

- Ar 31mar09Document1 pageAr 31mar09Nikhil RanaNo ratings yet

- Company Analysis Report (Raymond)Document33 pagesCompany Analysis Report (Raymond)balaji bysani100% (2)

- Industry Founded Founder Headquarters Area Served Key People Products RevenueDocument2 pagesIndustry Founded Founder Headquarters Area Served Key People Products RevenuemojahedNo ratings yet

- An Analytical Study: Bombay House, 24, Homi Mody Street, Fort, Mumbai-400 001Document65 pagesAn Analytical Study: Bombay House, 24, Homi Mody Street, Fort, Mumbai-400 001Shyam AgrawalNo ratings yet

- Tata Motors - WikipediaDocument4 pagesTata Motors - Wikipedianishantpandeya2004No ratings yet

- BUY BUY BUY BUY: Balmer Lawrie & Co. LTDDocument12 pagesBUY BUY BUY BUY: Balmer Lawrie & Co. LTDKothapatnam Suresh BabuNo ratings yet

- Investment Scrips Corporate ProfileDocument11 pagesInvestment Scrips Corporate Profileshankarm500No ratings yet

- Mock Test 02 BST Sunil PandaDocument3 pagesMock Test 02 BST Sunil PandaHarsh MishraNo ratings yet

- Investment Analysis of Tata Motors (Nano) : Submitted To: Submitted byDocument6 pagesInvestment Analysis of Tata Motors (Nano) : Submitted To: Submitted bynikhil6710349No ratings yet

- Ratio Analysis of Textile IndustryDocument16 pagesRatio Analysis of Textile IndustryTanmayVanmali100% (1)

- MarutiSuzuki Financial AnalysisDocument20 pagesMarutiSuzuki Financial AnalysisSushant TanejaNo ratings yet

- 1.1 Company Profile: 1.1.1 Head Office, Branches and CollaborationsDocument14 pages1.1 Company Profile: 1.1.1 Head Office, Branches and CollaborationsPritam ShawNo ratings yet

- List of Companies Sap NewDocument30 pagesList of Companies Sap NewDasi Rakesh KumarNo ratings yet

- Metropolitan Resource Holdings - 2008-09Document60 pagesMetropolitan Resource Holdings - 2008-09Madhuka RanmaleeNo ratings yet

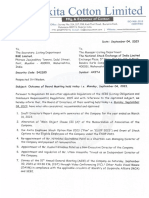

- Axita Cotton Limited: No. 324, 357, 358, Kadi Thol Road, Borisana Kadi, Certified Mahesana-3827I5. Gujarat. IndiaDocument7 pagesAxita Cotton Limited: No. 324, 357, 358, Kadi Thol Road, Borisana Kadi, Certified Mahesana-3827I5. Gujarat. Indianaresh kayadNo ratings yet

- Fin382 Company AnalysisDocument16 pagesFin382 Company AnalysiszaryNo ratings yet

- Tata Motors Limited - India, December 2020Document65 pagesTata Motors Limited - India, December 2020acc walaNo ratings yet

- Telephony India Mumbai Airtel Vodafone BSNL: C Is A WirelessDocument29 pagesTelephony India Mumbai Airtel Vodafone BSNL: C Is A Wirelessnikkyjain99No ratings yet

- Bata India PVT Ltd.Document18 pagesBata India PVT Ltd.harsha_uNo ratings yet

- Financial Statements: Nine Months Ended 31 March, 2009Document22 pagesFinancial Statements: Nine Months Ended 31 March, 2009Muhammad BakhshNo ratings yet

- Intimation Anchor Letter-NSE and BSE - ExecutedDocument2 pagesIntimation Anchor Letter-NSE and BSE - Executedhappycoollife7No ratings yet

- BST MockDocument3 pagesBST Mocksasta jiNo ratings yet

- Company Analysis Report On (Hindustan Oil Exploration Company LTD)Document33 pagesCompany Analysis Report On (Hindustan Oil Exploration Company LTD)balaji bysaniNo ratings yet

- DPPL Shareholding Pattern As On 31.07.2018Document1 pageDPPL Shareholding Pattern As On 31.07.2018xyzNo ratings yet

- Balance Sheet of Asian PaintsDocument4 pagesBalance Sheet of Asian PaintsSumedh KakdeNo ratings yet

- 178 Research Report Sel Manufacturing Company LTDDocument8 pages178 Research Report Sel Manufacturing Company LTDPasupathy VkNo ratings yet

- Introduction About The Grasim IndustryDocument15 pagesIntroduction About The Grasim Industryabhishek makasareNo ratings yet

- Bajaj Auto LTD Ifs AssignmentDocument16 pagesBajaj Auto LTD Ifs AssignmentKalash KhushalaniNo ratings yet

- Introduction:-: Mission & VisionDocument10 pagesIntroduction:-: Mission & Visionzalaks100% (5)

- Balance Sheet of Bharti AirtelDocument7 pagesBalance Sheet of Bharti Airteltiku_048No ratings yet

- Corporate Governance of Tata SteelDocument27 pagesCorporate Governance of Tata Steelneevan55980% (5)

- Financial Performance of BataDocument26 pagesFinancial Performance of Bataparas ke ideasNo ratings yet

- FCFE Analysis of TATA SteelDocument8 pagesFCFE Analysis of TATA SteelJobin Jose KadavilNo ratings yet

- Sang AmDocument3 pagesSang Amvicky_tiwari1023No ratings yet

- Equity Research Report On Tata MotorsDocument26 pagesEquity Research Report On Tata MotorsRijul SaxenaNo ratings yet

- TataDocument3 pagesTataShameem BanuNo ratings yet

- Ratio Analysis Tata MotorsDocument8 pagesRatio Analysis Tata Motorssadafkhan21No ratings yet

- Company Analysis Report On M/s Vimal Oil & Foods LTDDocument32 pagesCompany Analysis Report On M/s Vimal Oil & Foods LTDbalaji bysani100% (1)

- Reliance Communications: Public BSE TelecommunicationsDocument19 pagesReliance Communications: Public BSE TelecommunicationsAnchal JulkaNo ratings yet

- Cartelization in Indian Cement Industry 1 .pptx-1Document15 pagesCartelization in Indian Cement Industry 1 .pptx-1mananNo ratings yet

- Sangam India FundDocument49 pagesSangam India FundP.B VeeraraghavuluNo ratings yet

- Investing BasicsDocument5 pagesInvesting Basicsapi-3749578No ratings yet

- Chapter 1 PA IDocument71 pagesChapter 1 PA Ibeshahashenafe20No ratings yet

- Rise and Fall of Air IndiaDocument44 pagesRise and Fall of Air IndianARAYANNo ratings yet

- FAR 2841 - Equity-summary-DIYDocument4 pagesFAR 2841 - Equity-summary-DIYEira Shane100% (1)

- Mics ProjectDocument7 pagesMics Projectpallavbajaj88No ratings yet

- Logistics MamagementDocument69 pagesLogistics MamagementFadekemi AdelabuNo ratings yet

- SME ReportDocument16 pagesSME ReportNur Aqilah JailaniNo ratings yet

- 1 InvoiceDocument1 page1 InvoiceMohit GargNo ratings yet

- Ambac Industries, Inc. (Formerly American Bosch Arma Corporation) v. Commissioner of Internal Revenue, 487 F.2d 463, 2d Cir. (1973)Document7 pagesAmbac Industries, Inc. (Formerly American Bosch Arma Corporation) v. Commissioner of Internal Revenue, 487 F.2d 463, 2d Cir. (1973)Scribd Government DocsNo ratings yet

- Predicting The Risk of Corporate FailureDocument330 pagesPredicting The Risk of Corporate FailureAngus SadpetNo ratings yet

- Test On Quantitative AptitudeDocument2 pagesTest On Quantitative AptitudeDebabrata DasNo ratings yet

- Taste MeDocument157 pagesTaste MeNoname-14No ratings yet

- Decision Making and Relevant Costing TestDocument61 pagesDecision Making and Relevant Costing TestSUBMERIN100% (1)

- Batliboi Complete AR 2016 - 11072016182402Document140 pagesBatliboi Complete AR 2016 - 11072016182402Raj SinghNo ratings yet

- Adjustments To Financial Statements - Students - ACCA Global - ACCA GlobalDocument4 pagesAdjustments To Financial Statements - Students - ACCA Global - ACCA Globalacca_kaplan100% (1)

- Financial Management Model Question PaperDocument2 pagesFinancial Management Model Question PaperdvraoNo ratings yet

- Lloyd Best ArticleDocument48 pagesLloyd Best ArticleShafel CruickshankNo ratings yet

- China Trust Application Form (L)Document2 pagesChina Trust Application Form (L)bimbot100% (2)

- Magnit ValuationDocument50 pagesMagnit ValuationNikolay MalakhovNo ratings yet

- 1517380650cost 2018 June Part A PDFDocument229 pages1517380650cost 2018 June Part A PDFangelNo ratings yet

- Chapter 9 - Authorizing and Making PaymentsDocument26 pagesChapter 9 - Authorizing and Making Paymentsshemida100% (2)

- Cash Advances For TravelDocument10 pagesCash Advances For TravelLhorene Hope DueñasNo ratings yet

- Chapter 1-GL ConfigurationDocument140 pagesChapter 1-GL ConfigurationashokNo ratings yet

- P.7 - Cost AccumulationDocument8 pagesP.7 - Cost AccumulationSaeed RahamanNo ratings yet

- Problem A - Adjusting EntriesDocument4 pagesProblem A - Adjusting EntriesMischa Bianca BesmonteNo ratings yet

- InventoriesDocument7 pagesInventoriesShey INFTNo ratings yet

- Annual Report PT. WIKADocument635 pagesAnnual Report PT. WIKASilvani Margaretha SimangunsongNo ratings yet

- Management Advisory Services - FinalDocument8 pagesManagement Advisory Services - FinalFrancis MateosNo ratings yet