Professional Documents

Culture Documents

Options 1

Options 1

Uploaded by

CharityChan0 ratings0% found this document useful (0 votes)

4 views14 pagesThe document defines call and put options, which give the holder the right but not obligation to buy or sell an asset at a specified price by a specified date. It describes the key characteristics and differences between options and futures contracts. Specifically, it notes that options provide asymmetric risk for buyers and writers, while futures have symmetric risk. It also outlines the maximum gains and losses for buying and writing different option types. The document concludes by describing the traded options market, including standardization, margin requirements, and exercise settlement procedures.

Original Description:

Original Title

Options_1

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document defines call and put options, which give the holder the right but not obligation to buy or sell an asset at a specified price by a specified date. It describes the key characteristics and differences between options and futures contracts. Specifically, it notes that options provide asymmetric risk for buyers and writers, while futures have symmetric risk. It also outlines the maximum gains and losses for buying and writing different option types. The document concludes by describing the traded options market, including standardization, margin requirements, and exercise settlement procedures.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

4 views14 pagesOptions 1

Options 1

Uploaded by

CharityChanThe document defines call and put options, which give the holder the right but not obligation to buy or sell an asset at a specified price by a specified date. It describes the key characteristics and differences between options and futures contracts. Specifically, it notes that options provide asymmetric risk for buyers and writers, while futures have symmetric risk. It also outlines the maximum gains and losses for buying and writing different option types. The document concludes by describing the traded options market, including standardization, margin requirements, and exercise settlement procedures.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 14

Options 1

Introduction: Definitions and Market

Operations

Definitions and Characteristics

• Call option gives buyer of contract (the holder) the

right, but not the obligation to buy specific asset at

specific price (exercise / strike price) on, or prior to,

specific expiry day.

• Put option gives holder right, but not obligation, to sell

asset.

• An option is a contract between two investors

(bilateral contract).

• Buyer of option pays seller (writer) option premium.

• Writer is subordinate to decision of holder. If option

called/exercised by holder, writer is obliged to sell

asset (if option is a call), or buy asset (if option is a

put).

Selling a call versus buying a put

• Selling a call not the same as buying a put.

• Buying a put gives the right to sell the asset, while

selling a call gives someone else the choice of buying

asset from you.

Options versus Futures

risk structure

• Option holder has choice. Writer of option has not.

He/she is subservient to buyer.

• For buyer of option, asymmetric risk structure:

unlimited potential gain, limited potential loss. Vice

versa for writer.

• With futures, symmetric risk structure: potentially large

gains or losses to both buyer and seller.

Options versus Futures

payoff structure

• With both futures and options, gains (or losses) to

buyer = losses (or gains) to writer of contract.

• Buy call: Max loss Option premium

Max gain Unlimited

• Buy put: Max loss Option premium

Max gain Exercise price

• Write call: Max loss Unlimited

Max gain Option premium

• Write put: Max loss Exercise price

Max gain Option premium

• Futures contract to buy

Max loss Futures price

Max gain Unlimited

• Futures contract to sell

Max loss Unlimited

Max gain Futures price

Exercising style of options

• Exercising call options does not increase share

capital of company.

• European option can be exercised only at expiry.

• American option can be exercised at any time until

the expiry date.

• Most options have “American” style of exercising.

Titles have nothing to do with Europe or America.

Traded Options Market

• Negotiated options (customised) available in UK for

centuries.

• Traded options (standardised) since 1978.

• In 1992, London Traded Options Market merged

with London International Financial Futures

Exchange

• Created London International Financial Futures

and Options Exchange (LIFFE), now NYSE

Euronext LIFFE.

• American options traded with maturities of 3, 6, 9

and 12 months (March, June, Sep and Dec). Called

the maturity cycle.

• Traded options available on indices, such as the

FTSE100, and shares of approx. 126 large

companies.

• Each option contract is on 1,000 shares.

• But option price (premium) quoted per share.

(Quote is always per unit of underlying asset –

whatever the asset).

• A series of options are issued by the exchange for

each underlying asset.

• Series = options for specific company (asset) each

expiring on a specific date and has a specific

exercise price.

• For each maturity date a number of options are

issued with exercise price below current spot price

and a roughly equal number with exercise above

current spot price.

• Since option writing entails possibility of unlimited

losses. Option writer must deposit margin

(=collateral/security).

• No margin for buyer of option (limited risk).

• Clearing house/corporation (e.g., ICE Clear Europe

Ltd for Euronext LIFFE derivatives) splits contract

between buyer and seller. It then buys from the seller

and sells to the buyer.

• This leads to buyer (seller) has claim on (obligation

to) the clearing house.

• Few options result in exercise. Can ‘close’ or

‘square’ position by selling options held, or buying

options written.

• If option exercised, clearing house randomly selects

a writer to call from (or ‘match’ with – called

‘matching’).

• Writing call options against shares already held =

writing ‘covered’ call. If option called, deliver shares

at exercise price.

• Writer of ‘naked’ call does not hold the shares. If

called, must buy shares at spot to honour obligation.

You might also like

- Derivatives Notes and Tutorial 2017Document16 pagesDerivatives Notes and Tutorial 2017Chantelle RamsayNo ratings yet

- Tutorial 1: Textbook Question 1Document33 pagesTutorial 1: Textbook Question 1Nurfairuz Diyanah RahzaliNo ratings yet

- Option - DerivativesDocument89 pagesOption - DerivativesProf. Suyog ChachadNo ratings yet

- Lesson 02 Structure of Options MarketsDocument34 pagesLesson 02 Structure of Options MarketsRoman SerondoNo ratings yet

- Presented by:-D.Pradeep Kumar Exe-MBA, IIPM, HydDocument25 pagesPresented by:-D.Pradeep Kumar Exe-MBA, IIPM, Hydpradeep3673No ratings yet

- Options & ModelsDocument48 pagesOptions & ModelsPraveen Kumar SinhaNo ratings yet

- DerivativesDocument3 pagesDerivativesshekharkuNo ratings yet

- DerivativesDocument44 pagesDerivativesKhyati KariaNo ratings yet

- E Book of OptionsDocument29 pagesE Book of OptionsmohitNo ratings yet

- DerivativesDocument29 pagesDerivativessumitbabar0% (1)

- Unit 3 FDDocument28 pagesUnit 3 FDsaurabh thakurNo ratings yet

- Unit 3 FD PDFDocument28 pagesUnit 3 FD PDFraj kumarNo ratings yet

- OptionsDocument49 pagesOptionssacos16074No ratings yet

- Fintech Chapter 12: OptionsDocument25 pagesFintech Chapter 12: OptionsAllen Uhomist AuNo ratings yet

- Fim - 6 Derivative Security MarketsDocument19 pagesFim - 6 Derivative Security MarketsgashukelilNo ratings yet

- Strategic Financial Management KalidassDocument16 pagesStrategic Financial Management KalidassMohamed SaleemNo ratings yet

- Chapter 8 PDFDocument43 pagesChapter 8 PDFCarlosNo ratings yet

- Introduction To Derivatives MarketDocument42 pagesIntroduction To Derivatives Marketpriyank2110No ratings yet

- DerivativesDocument53 pagesDerivativesnikitsharmaNo ratings yet

- Option Strategies: By: Prashant Sharma Vasu KannaDocument39 pagesOption Strategies: By: Prashant Sharma Vasu KannaNihar ShahNo ratings yet

- Option Strategies For Novice TradersDocument27 pagesOption Strategies For Novice Tradersik001No ratings yet

- Chapter 4 Sent DRMDocument41 pagesChapter 4 Sent DRMSarvar PathanNo ratings yet

- Module 4Document8 pagesModule 4Nidhin NalinamNo ratings yet

- Call Options Group 3 Final-1Document21 pagesCall Options Group 3 Final-1smart muteroNo ratings yet

- An Introduction To Derivatives: A Presentation by Derivative ResearchDocument45 pagesAn Introduction To Derivatives: A Presentation by Derivative ResearchUmeshwari RathoreNo ratings yet

- Options WritingDocument44 pagesOptions Writingshankarvs84No ratings yet

- Characteristics of DerivativesDocument17 pagesCharacteristics of DerivativesSwati SinhaNo ratings yet

- 05derivativesmarketarz 100709171035 Phpapp01Document40 pages05derivativesmarketarz 100709171035 Phpapp01leblitzer_0No ratings yet

- Unit 7 - Lecture - DeverivativesDocument66 pagesUnit 7 - Lecture - DeverivativesMichelle LindsayNo ratings yet

- Derivatives InsightsDocument11 pagesDerivatives InsightsalfinprinceNo ratings yet

- O&S Final PDFDocument13 pagesO&S Final PDFrajNo ratings yet

- OptionDocument7 pagesOptionmanoranjanpatraNo ratings yet

- 05.option FaqsDocument15 pages05.option FaqsAMAN KUMAR KHOSLANo ratings yet

- Option: Financial Terms Related To OptionDocument20 pagesOption: Financial Terms Related To OptionGustavoNo ratings yet

- Introduction To Derivatives Market: Khader ShaikDocument45 pagesIntroduction To Derivatives Market: Khader Shaikms.AhmedNo ratings yet

- 05 Derivatives Market ARZ PDFDocument45 pages05 Derivatives Market ARZ PDFDaviNo ratings yet

- Financial Market-Lecture 9 PDFDocument28 pagesFinancial Market-Lecture 9 PDFJeffNo ratings yet

- Derivative and Risk ManagementDocument35 pagesDerivative and Risk ManagementRajendra LamsalNo ratings yet

- Options StrategiesDocument26 pagesOptions StrategiesPrasad VeesamshettyNo ratings yet

- Basics of Derivatives-1Document30 pagesBasics of Derivatives-1amolekadam70No ratings yet

- Lecture7 Derivatives RevisitedDocument52 pagesLecture7 Derivatives RevisitedLulu KatimaNo ratings yet

- OS 100 ListDocument16 pagesOS 100 ListKUMARPRAVEEN9211No ratings yet

- DerivativeDocument17 pagesDerivativeIsmiyar CahyaniNo ratings yet

- Options Presentation-FinalDocument23 pagesOptions Presentation-FinalPrakriti ThapaNo ratings yet

- Mechanics of Options MarketsDocument36 pagesMechanics of Options MarketsAbhishek AnandNo ratings yet

- 2.6. Derivatives MarketDocument27 pages2.6. Derivatives MarketKetema AsfawNo ratings yet

- Commodity OptionsDocument122 pagesCommodity Optionskunalgupta89No ratings yet

- Foreign Currency Derivatives2Document24 pagesForeign Currency Derivatives2杜易航No ratings yet

- Chapter 7 SummaryDocument12 pagesChapter 7 Summarymark leeNo ratings yet

- Options The Upside Without DownsideDocument69 pagesOptions The Upside Without Downsideasifanis100% (1)

- FD - Unit - III OptionsDocument11 pagesFD - Unit - III OptionspulpsenseNo ratings yet

- Mba III OptionsDocument67 pagesMba III OptionsRitik MishraNo ratings yet

- Introduction To Options: By: Peter Findley and Sreesha Vaman Investment Analysis GroupDocument9 pagesIntroduction To Options: By: Peter Findley and Sreesha Vaman Investment Analysis GroupNeeraj NamanNo ratings yet

- Chapter 4 DerivativesDocument38 pagesChapter 4 DerivativesTamrat KindeNo ratings yet

- Chapter Six Using Options As InvestmentsDocument31 pagesChapter Six Using Options As InvestmentsAltesa AbicheNo ratings yet

- The Only Certainty Is That There Will Be "Uncertainty": Risk ManagementDocument24 pagesThe Only Certainty Is That There Will Be "Uncertainty": Risk ManagementvnevesNo ratings yet

- Chapter 3 Options: Mechanics & Properties of OptionsDocument52 pagesChapter 3 Options: Mechanics & Properties of Optionsvaman kambleNo ratings yet

- Options Trading For Beginners: Tips, Formulas and Strategies For Traders to Make Money with OptionsFrom EverandOptions Trading For Beginners: Tips, Formulas and Strategies For Traders to Make Money with OptionsNo ratings yet

- Options Trading: Invest in Stock Markets and Start Making Profit Using the Ultimate Strategies.From EverandOptions Trading: Invest in Stock Markets and Start Making Profit Using the Ultimate Strategies.No ratings yet

- IntroductionDocument50 pagesIntroductionCharityChanNo ratings yet

- Futures 2 PricingDocument49 pagesFutures 2 PricingCharityChanNo ratings yet

- W8 1Price-StudentwithNotes (PBN)Document31 pagesW8 1Price-StudentwithNotes (PBN)CharityChanNo ratings yet

- W1 Welcome and Course OverviewDocument21 pagesW1 Welcome and Course OverviewCharityChanNo ratings yet

- C18FM W11 1Revision-StudentwithNotes (CD)Document27 pagesC18FM W11 1Revision-StudentwithNotes (CD)CharityChanNo ratings yet

- W7 Product - Value Via Brands & InnovationDocument55 pagesW7 Product - Value Via Brands & InnovationCharityChanNo ratings yet

- H00356301 C18CLDocument5 pagesH00356301 C18CLCharityChanNo ratings yet

- Law Contract Validity TableDocument2 pagesLaw Contract Validity TableCharityChanNo ratings yet

- Commercial Law Course Handbook and NotesDocument8 pagesCommercial Law Course Handbook and NotesCharityChanNo ratings yet

- Commercial Law AssignmentDocument12 pagesCommercial Law AssignmentCharityChanNo ratings yet

- How To Write A Legal EssayDocument3 pagesHow To Write A Legal EssayCharityChanNo ratings yet

- Quiz No. 4 Chapter 4 Financial MarketsDocument5 pagesQuiz No. 4 Chapter 4 Financial MarketsBoy fernandezNo ratings yet

- TBCH 12Document35 pagesTBCH 12Tornike JashiNo ratings yet

- Jan 31, 2022Document2 pagesJan 31, 2022kramergeorgec397No ratings yet

- Joy and Jolly Day Care CentreDocument20 pagesJoy and Jolly Day Care CentreSsemakula FrankNo ratings yet

- 8 Steps For Analysing A Balance Sheet PDFDocument2 pages8 Steps For Analysing A Balance Sheet PDFJaggarwal SaabNo ratings yet

- APC 403 PFRS For SMEsDocument10 pagesAPC 403 PFRS For SMEsHazel Seguerra BicadaNo ratings yet

- Greyerz - The Terrifying Truth About What Is ComingDocument21 pagesGreyerz - The Terrifying Truth About What Is ComingKarine ReisNo ratings yet

- IMF Papers - CBDC Role in Promoting Financial InclusionDocument37 pagesIMF Papers - CBDC Role in Promoting Financial InclusionRitesh ChandraNo ratings yet

- Exampundit - In: Insurance Awareness Expected Questions - Part 1Document3 pagesExampundit - In: Insurance Awareness Expected Questions - Part 1ANNENo ratings yet

- Sunshine ContractDocument13 pagesSunshine Contractnick wilkinsonNo ratings yet

- Capital Alert 6/13/2008Document1 pageCapital Alert 6/13/2008Russell KlusasNo ratings yet

- Incomes Which Do Not Form Part of Total Income: After Studying This Chapter, You Would Be Able ToDocument40 pagesIncomes Which Do Not Form Part of Total Income: After Studying This Chapter, You Would Be Able ToYash SharmaNo ratings yet

- Performanace of Tax Saving Sehemes in Mutual FundsDocument13 pagesPerformanace of Tax Saving Sehemes in Mutual FundsRajkamalChichaNo ratings yet

- How To Use EA Scouts Gold V9.5.5Document7 pagesHow To Use EA Scouts Gold V9.5.5Sulistriono TyoNo ratings yet

- Organisational Study On Hailey Buria Tea Estates LTDDocument68 pagesOrganisational Study On Hailey Buria Tea Estates LTDanees elyasNo ratings yet

- Contract CostingDocument60 pagesContract Costinganon_67206536267% (6)

- FIN202Document6 pagesFIN202Dang Ngoc Van (K17 DN)No ratings yet

- BPI Trade FAQsDocument19 pagesBPI Trade FAQslenard5No ratings yet

- Chapter 6 Bond ValuationDocument41 pagesChapter 6 Bond ValuationMustafa EyüboğluNo ratings yet

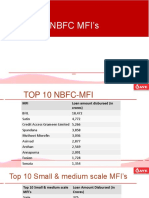

- NBFC Mfi AnalysisDocument10 pagesNBFC Mfi AnalysisNeeraj KumarNo ratings yet

- Financial Inclusion: Reaching The UnreachedDocument11 pagesFinancial Inclusion: Reaching The Unreacheddigish_shahNo ratings yet

- Exercise 12-8 Intangible AssetsDocument2 pagesExercise 12-8 Intangible AssetsJay LazaroNo ratings yet

- Econet Data Bundles On Airtime Uat ScriptDocument16 pagesEconet Data Bundles On Airtime Uat ScriptSarah ManiwaNo ratings yet

- BIR Ruling DST On Loan and Security DocsDocument8 pagesBIR Ruling DST On Loan and Security Docsbishopblue0622No ratings yet

- (TAN410) Quiz 3. Review Chapter 4 + Chapter 5 - questions-đã chuyển đổiDocument11 pages(TAN410) Quiz 3. Review Chapter 4 + Chapter 5 - questions-đã chuyển đổiK59 Nguyen Hang NgaNo ratings yet

- Difference Between Fundamental and Technical AnalysisDocument6 pagesDifference Between Fundamental and Technical Analysistungeena waseemNo ratings yet

- CAF Syllabus 2023Document39 pagesCAF Syllabus 2023Kaali CANo ratings yet

- Automart BusinessDocument14 pagesAutomart BusinessRam LamaNo ratings yet