Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

33 viewsImpact of Microfinance Activities On Rural Development

Impact of Microfinance Activities On Rural Development

Uploaded by

anna merlin sunnyMicrofinance activities have a significant impact on rural development in several ways: 1) They provide financial inclusion by giving rural communities access to services like savings accounts and credit. 2) They help reduce poverty by providing small loans that enable income-generating activities. 3) They empower women by targeting them as beneficiaries of small business loans. 4) They improve agricultural productivity by enabling farmers to invest in supplies. 5) They promote social development by building social capital and community. In conclusion, microfinance activities transform lives by furthering inclusion, reducing poverty, empowering women, boosting agriculture, and fostering social progress.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- Solution Manual (Letter Answers Only)Document21 pagesSolution Manual (Letter Answers Only)villanuevacassandrabeatriz1No ratings yet

- Buffet Bid For Media GeneralDocument21 pagesBuffet Bid For Media GeneralDahagam Saumith100% (1)

- Ryan M Scharetg TMobile BillDocument3 pagesRyan M Scharetg TMobile BillJonathan Seagull LivingstonNo ratings yet

- A Study On Impact of Microfinance On Women EmpowermentDocument92 pagesA Study On Impact of Microfinance On Women EmpowermentAbhishek Eraiah100% (4)

- Icro Inance S: 6.M F & SHGDocument10 pagesIcro Inance S: 6.M F & SHGYayati DandekarNo ratings yet

- Final Dsetn 21.4.2017Document83 pagesFinal Dsetn 21.4.2017VEDANT SHINDENo ratings yet

- Research Paper On The Topic Microfinance in AgricultureDocument12 pagesResearch Paper On The Topic Microfinance in AgricultureSukhmander SinghNo ratings yet

- Micro Credit For Sustainable Development: Role of NgosDocument4 pagesMicro Credit For Sustainable Development: Role of NgosSpandana AchantaNo ratings yet

- Propsal of Roll of Microfinance Institution in Economic Empowerment of WomenDocument29 pagesPropsal of Roll of Microfinance Institution in Economic Empowerment of WomenAmare FitaNo ratings yet

- Micro Finance and The Empowerment of WomenDocument10 pagesMicro Finance and The Empowerment of WomenDivya Sunder Raman67% (3)

- Paper T I Yas BiswasDocument12 pagesPaper T I Yas BiswasHaseeb MalikNo ratings yet

- New Syl RD Sem IVDocument4 pagesNew Syl RD Sem IVAbhay JadhavNo ratings yet

- Microfinance and Women EmpowermentDocument6 pagesMicrofinance and Women EmpowermentRasel Talukder100% (1)

- A Study On Microfinance Sector in KarnatakaDocument84 pagesA Study On Microfinance Sector in KarnatakaPrashanth PB100% (3)

- 5117-Article Text-9833-1-10-20210108Document9 pages5117-Article Text-9833-1-10-20210108Md Mazharul Islam SamratNo ratings yet

- Financial Inclusion and Women Empowerment Through Micro FinanceDocument12 pagesFinancial Inclusion and Women Empowerment Through Micro FinanceYogasre ManasviniNo ratings yet

- RamakantDocument41 pagesRamakantArchitNo ratings yet

- 3-Report First CorrectedDocument39 pages3-Report First Corrected9848138725pkNo ratings yet

- Unit 5 Microfinance and DevelopmentDocument10 pagesUnit 5 Microfinance and Developmentjcmxqxz7tcNo ratings yet

- Unitus 2007 Annual ReportDocument23 pagesUnitus 2007 Annual ReportJanith DaveNo ratings yet

- Microfinance in India Scopes and LimitationsDocument41 pagesMicrofinance in India Scopes and Limitationsspy67% (3)

- Microfinance Report in MaharashtraDocument96 pagesMicrofinance Report in MaharashtraJugal Taneja100% (1)

- 07 Chapter 1Document18 pages07 Chapter 1SakshiNo ratings yet

- MICROFINANCEDocument62 pagesMICROFINANCEHarshal SonalNo ratings yet

- Unit 3 Micro FinanceDocument6 pagesUnit 3 Micro FinanceDeveshi JhawarNo ratings yet

- Role of Micro Finance in Rural Development of IndiDocument7 pagesRole of Micro Finance in Rural Development of Indisonujaiswal1267% (6)

- Sakshi Pote Tybbi ProjectDocument93 pagesSakshi Pote Tybbi ProjectAkshataNo ratings yet

- Sage University: TopicDocument25 pagesSage University: TopicJyotika 2003No ratings yet

- An Appraisal of The Performance of Micro Finance Bank in Economic Development of Delta StateDocument29 pagesAn Appraisal of The Performance of Micro Finance Bank in Economic Development of Delta Statealbertosehi1No ratings yet

- Microfinance Services and Women EmpowermentDocument22 pagesMicrofinance Services and Women EmpowermentRonnald WanzusiNo ratings yet

- Micro Finance AssignmentDocument4 pagesMicro Finance AssignmentLimasenla Moa100% (1)

- MicrofinanceDocument65 pagesMicrofinanceRahul AksHNo ratings yet

- Micro Finance and NGO'sDocument50 pagesMicro Finance and NGO'sMunish Dogra100% (1)

- Cashpor ReportDocument91 pagesCashpor ReportAnand Gautam100% (1)

- Role of Banking Sector in Inclusive DevelopmentDocument1 pageRole of Banking Sector in Inclusive DevelopmentmanjinbaruaNo ratings yet

- Anu Rural DevelopmentDocument13 pagesAnu Rural DevelopmentOsinubi Babatunde AdekunleNo ratings yet

- Micro Finance ProposalDocument11 pagesMicro Finance ProposalMarah KalieNo ratings yet

- Women EmpowermentDocument1 pageWomen EmpowermentWaleed MirNo ratings yet

- Assignment ON Micro-FinanceDocument24 pagesAssignment ON Micro-FinancerakeshpataelNo ratings yet

- Submitted To: Submitted By: Ambuj Gupta Sangram Keshari Panigrahi 2k91/BFS/43Document36 pagesSubmitted To: Submitted By: Ambuj Gupta Sangram Keshari Panigrahi 2k91/BFS/43Sangram PanigrahiNo ratings yet

- 04 chapter 1Document30 pages04 chapter 1eshachanga1234No ratings yet

- Impact of Micro-Finances in Rural DevelopmentDocument5 pagesImpact of Micro-Finances in Rural DevelopmentAbsolom JasonNo ratings yet

- Micro-Finance Management & Critical Analysis in IndiaDocument72 pagesMicro-Finance Management & Critical Analysis in IndiaAtul MangaleNo ratings yet

- Microfinace Reading PDFDocument9 pagesMicrofinace Reading PDFCharles GarrettNo ratings yet

- Microfinance in India: A Critique by Rajarshi GhoshDocument9 pagesMicrofinance in India: A Critique by Rajarshi Ghoshpraveen_jha_9No ratings yet

- Microfinance and Rural Banking-NotesDocument93 pagesMicrofinance and Rural Banking-NotesSiddhi MhrZnNo ratings yet

- Microfinance and MicrocreditDocument7 pagesMicrofinance and Microcreditsukriti94No ratings yet

- SynopsisDocument12 pagesSynopsisAnnie MittalNo ratings yet

- Anagha Suresh (20YUCMD012) Project ReportDocument57 pagesAnagha Suresh (20YUCMD012) Project Reportsouvikm056No ratings yet

- Microfinance Regulation in India. Microfinance ManagementDocument5 pagesMicrofinance Regulation in India. Microfinance ManagementRavindra SalviNo ratings yet

- Micro-Finance For Rural Entrepreneurship Development & Rural IndustrializationDocument2 pagesMicro-Finance For Rural Entrepreneurship Development & Rural IndustrializationRashmi Ranjan PanigrahiNo ratings yet

- Anagha Suresh Project ReportDocument56 pagesAnagha Suresh Project Reportsouvikm056No ratings yet

- Impact of Microfinance On Women Entrepreneurship in IndiaDocument12 pagesImpact of Microfinance On Women Entrepreneurship in IndiaSunitaNo ratings yet

- Mulugeta Final Proposal CommentedDocument33 pagesMulugeta Final Proposal Commentedpetolaw238No ratings yet

- Impact of Microfinance To Empower Female EntrepreneursDocument6 pagesImpact of Microfinance To Empower Female EntrepreneursInternational Journal of Business Marketing and ManagementNo ratings yet

- Chapter 1Document44 pagesChapter 1suraj BanavalkarNo ratings yet

- Role of Microfinance Institution in Financial InclusionDocument15 pagesRole of Microfinance Institution in Financial Inclusionswati_agarwal67No ratings yet

- Microfinance ResearchDocument17 pagesMicrofinance ResearchKausik KskNo ratings yet

- Micro-Financing and the Economic Health of a NationFrom EverandMicro-Financing and the Economic Health of a NationNo ratings yet

- Alleviating Global Poverty: The Role of Private EnterpriseFrom EverandAlleviating Global Poverty: The Role of Private EnterpriseNo ratings yet

- Ending Poverty: How People, Businesses, Communities and Nations can Create Wealth from Ground - UpwardsFrom EverandEnding Poverty: How People, Businesses, Communities and Nations can Create Wealth from Ground - UpwardsNo ratings yet

- Challenges in The Financial Services Sector in India..Document4 pagesChallenges in The Financial Services Sector in India..anna merlin sunnyNo ratings yet

- Organized Stock Exchange and Its FunctionsDocument6 pagesOrganized Stock Exchange and Its Functionsanna merlin sunnyNo ratings yet

- Recent Trends in The Insurance BusinessDocument4 pagesRecent Trends in The Insurance Businessanna merlin sunnyNo ratings yet

- The Impact of Social Networking On Stock Market A ReviewDocument11 pagesThe Impact of Social Networking On Stock Market A Reviewanna merlin sunnyNo ratings yet

- Labs Group Overview 09 2020Document37 pagesLabs Group Overview 09 2020Jose.SuarezNo ratings yet

- Oman Oil Balance SheetDocument27 pagesOman Oil Balance Sheeta.hasan670100% (1)

- Business Plan TABLE OF CONTENTSDocument3 pagesBusiness Plan TABLE OF CONTENTSOgunfodunrin RemilekunNo ratings yet

- Revolutionizing The Field of AccountancyDocument20 pagesRevolutionizing The Field of AccountancyJessarene Fauni DepanteNo ratings yet

- Financial Accounting Bbaw2103 FinalDocument18 pagesFinancial Accounting Bbaw2103 FinalmelNo ratings yet

- Risk Management For MBA StudentsDocument28 pagesRisk Management For MBA StudentsMuneeb Sada50% (2)

- NC Iii Bookkeeping: Prepared By: Jubailyn V. VillegasDocument48 pagesNC Iii Bookkeeping: Prepared By: Jubailyn V. VillegasFlorinda Gagasa100% (1)

- NovoBanco AnnualReport2021 Non-ESEFDocument462 pagesNovoBanco AnnualReport2021 Non-ESEFkdhanush260No ratings yet

- A Study On Brand Awareness of Financial Products With Special Reference To Agile Capital ServicesDocument71 pagesA Study On Brand Awareness of Financial Products With Special Reference To Agile Capital Servicesjassi nishadNo ratings yet

- CA 9.9 11 Class 2Document1 pageCA 9.9 11 Class 2bimbyboNo ratings yet

- Nego ReviewerDocument86 pagesNego ReviewerNia JulianNo ratings yet

- The Long-Term Performance of Venture Capital Backed IPOs: Comparing The United States and EuropeDocument37 pagesThe Long-Term Performance of Venture Capital Backed IPOs: Comparing The United States and EuropeBelizarNo ratings yet

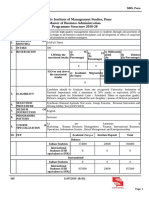

- Symbiosis Institute of Management Studies, Pune Master of Business Administration Programme Structure 2018-20Document15 pagesSymbiosis Institute of Management Studies, Pune Master of Business Administration Programme Structure 2018-20simspuneNo ratings yet

- Sunil Panda Commerce Classes (SPCC) : Daily Practice Problems (DPP) Term 02 Accounts Not For Profit OrganisationDocument4 pagesSunil Panda Commerce Classes (SPCC) : Daily Practice Problems (DPP) Term 02 Accounts Not For Profit OrganisationHigi SNo ratings yet

- Kickback SchemesDocument3 pagesKickback Schemesjoynasr17No ratings yet

- Saintorigins Plantain Cafe BPDocument19 pagesSaintorigins Plantain Cafe BPM.NASIRNo ratings yet

- Basics of Stock MarketDocument13 pagesBasics of Stock MarketRamcharan KadamNo ratings yet

- Benfords Law CAATSDocument28 pagesBenfords Law CAATSHetNo ratings yet

- Market Strcuture of Banking IndustryDocument8 pagesMarket Strcuture of Banking IndustryNatala WillzNo ratings yet

- 10 - Borrowing Costs PS 12edDocument15 pages10 - Borrowing Costs PS 12edbusiness docNo ratings yet

- Professor of Economics: Abdul JalilDocument13 pagesProfessor of Economics: Abdul JalilTanveerNo ratings yet

- Instructions For Form W-8BEN: (Rev. October 2021)Document9 pagesInstructions For Form W-8BEN: (Rev. October 2021)Mario SierraNo ratings yet

- C04-Fundamentals of Business Economics: Sample Exam PaperDocument17 pagesC04-Fundamentals of Business Economics: Sample Exam Paperhkanuradha100% (1)

- Midterm ExaminationDocument11 pagesMidterm ExaminationEdemson NavalesNo ratings yet

- Apr 2023Document1 pageApr 2023saurabhjaNo ratings yet

- Blackrock Smart Beta Guide en Au PDFDocument68 pagesBlackrock Smart Beta Guide en Au PDFdehnailNo ratings yet

- RBI OTS GuidlinesDocument3 pagesRBI OTS Guidliness md nasruNo ratings yet

Impact of Microfinance Activities On Rural Development

Impact of Microfinance Activities On Rural Development

Uploaded by

anna merlin sunny0 ratings0% found this document useful (0 votes)

33 views3 pagesMicrofinance activities have a significant impact on rural development in several ways: 1) They provide financial inclusion by giving rural communities access to services like savings accounts and credit. 2) They help reduce poverty by providing small loans that enable income-generating activities. 3) They empower women by targeting them as beneficiaries of small business loans. 4) They improve agricultural productivity by enabling farmers to invest in supplies. 5) They promote social development by building social capital and community. In conclusion, microfinance activities transform lives by furthering inclusion, reducing poverty, empowering women, boosting agriculture, and fostering social progress.

Original Description:

Original Title

IMPACT OF MICROFINANCE ACTIVITIES ON RURAL DEVELOPMENT

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentMicrofinance activities have a significant impact on rural development in several ways: 1) They provide financial inclusion by giving rural communities access to services like savings accounts and credit. 2) They help reduce poverty by providing small loans that enable income-generating activities. 3) They empower women by targeting them as beneficiaries of small business loans. 4) They improve agricultural productivity by enabling farmers to invest in supplies. 5) They promote social development by building social capital and community. In conclusion, microfinance activities transform lives by furthering inclusion, reducing poverty, empowering women, boosting agriculture, and fostering social progress.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

33 views3 pagesImpact of Microfinance Activities On Rural Development

Impact of Microfinance Activities On Rural Development

Uploaded by

anna merlin sunnyMicrofinance activities have a significant impact on rural development in several ways: 1) They provide financial inclusion by giving rural communities access to services like savings accounts and credit. 2) They help reduce poverty by providing small loans that enable income-generating activities. 3) They empower women by targeting them as beneficiaries of small business loans. 4) They improve agricultural productivity by enabling farmers to invest in supplies. 5) They promote social development by building social capital and community. In conclusion, microfinance activities transform lives by furthering inclusion, reducing poverty, empowering women, boosting agriculture, and fostering social progress.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 3

IMPACT OF

MICROFINANCE

ACTIVITIES ON RURAL

DEVELOPMENT

Anna Merlin Sunny

Microfinance activities have been proven to have a significant impact on rural

development across the world. These activities have helped to promote financial

inclusion, poverty reduction, women empowerment, agricultural productivity,

and social development in rural areas.

One of the most significant impacts of microfinance activities is financial

inclusion. Microfinance institutions provide access to financial services such as

savings accounts, credit, and insurance to rural communities who were

previously excluded from the formal financial system. This inclusion helps to

build the financial capacity of individuals and communities, enabling them to

save, borrow and invest in income-generating activities.

Microfinance activities also help to reduce poverty levels in rural areas. Small

loans provided by microfinance institutions enable rural communities to start

small businesses or invest in agriculture. This leads to increased income and

employment opportunities, thereby reducing poverty levels in rural areas.

Women empowerment is another significant impact of microfinance activities.

Microfinance institutions target women as the primary beneficiaries, providing

them with small loans which they use to start small businesses. This leads to

increased income and improved socio-economic status, thereby empowering

women and improving the overall development of rural communities.

Microfinance activities also lead to improved agricultural productivity. Farmers

are provided with access to credit, enabling them to invest in agricultural inputs

such as seeds, fertilizers, and machinery. This leads to increased agricultural

productivity and improved food security in rural areas. Finally, microfinance

activities have a positive impact on social development. By providing access to

credit and other financial services, microfinance institutions help in building

social capital, promoting community development, and improving the overall

quality of life in rural areas.

In conclusion, microfinance activities have a significant impact on rural

development by promoting financial inclusion, poverty reduction, women

empowerment, agricultural productivity, and social development. These

activities have the potential to transform rural communities across the world and

improve the lives of millions of people.

Microfinance activities have a significant impact on rural development in

several ways:

1. Financial Inclusion: Microfinance activities provide access to financial

services to the rural population who were previously excluded from the formal

financial system. This inclusion helps in building the financial capacity of

individuals and communities, enabling them to save, borrow and invest in

income-generating activities.

2. Poverty Reduction: Microfinance activities provide small loans to rural

communities, which they can use to start small businesses or invest in

agriculture. This leads to increased income and employment opportunities,

thereby reducing poverty levels in rural areas.

3. Women Empowerment: Microfinance activities target women as the primary

beneficiaries. Women are provided with small loans, which they use to start

small businesses, leading to increased income and improved socio-economic

status. This empowerment of women has a positive impact on the overall

development of rural communities.

4. Improved Agricultural Productivity: Microfinance activities provide farmers

with access to credit, enabling them to invest in agricultural inputs such as

seeds, fertilizers, and machinery. This leads to increased agricultural

productivity and improved food security in rural areas.

5. Social Development: Microfinance activities also have a positive impact on

social development. By providing access to credit and other financial services,

microfinance institutions help in building social capital, promoting community

development, and improving the overall quality of life in rural areas.

In conclusion, microfinance activities have a significant impact on rural

development by promoting financial inclusion, poverty reduction, women

empowerment, agricultural productivity, and social development.

You might also like

- Solution Manual (Letter Answers Only)Document21 pagesSolution Manual (Letter Answers Only)villanuevacassandrabeatriz1No ratings yet

- Buffet Bid For Media GeneralDocument21 pagesBuffet Bid For Media GeneralDahagam Saumith100% (1)

- Ryan M Scharetg TMobile BillDocument3 pagesRyan M Scharetg TMobile BillJonathan Seagull LivingstonNo ratings yet

- A Study On Impact of Microfinance On Women EmpowermentDocument92 pagesA Study On Impact of Microfinance On Women EmpowermentAbhishek Eraiah100% (4)

- Icro Inance S: 6.M F & SHGDocument10 pagesIcro Inance S: 6.M F & SHGYayati DandekarNo ratings yet

- Final Dsetn 21.4.2017Document83 pagesFinal Dsetn 21.4.2017VEDANT SHINDENo ratings yet

- Research Paper On The Topic Microfinance in AgricultureDocument12 pagesResearch Paper On The Topic Microfinance in AgricultureSukhmander SinghNo ratings yet

- Micro Credit For Sustainable Development: Role of NgosDocument4 pagesMicro Credit For Sustainable Development: Role of NgosSpandana AchantaNo ratings yet

- Propsal of Roll of Microfinance Institution in Economic Empowerment of WomenDocument29 pagesPropsal of Roll of Microfinance Institution in Economic Empowerment of WomenAmare FitaNo ratings yet

- Micro Finance and The Empowerment of WomenDocument10 pagesMicro Finance and The Empowerment of WomenDivya Sunder Raman67% (3)

- Paper T I Yas BiswasDocument12 pagesPaper T I Yas BiswasHaseeb MalikNo ratings yet

- New Syl RD Sem IVDocument4 pagesNew Syl RD Sem IVAbhay JadhavNo ratings yet

- Microfinance and Women EmpowermentDocument6 pagesMicrofinance and Women EmpowermentRasel Talukder100% (1)

- A Study On Microfinance Sector in KarnatakaDocument84 pagesA Study On Microfinance Sector in KarnatakaPrashanth PB100% (3)

- 5117-Article Text-9833-1-10-20210108Document9 pages5117-Article Text-9833-1-10-20210108Md Mazharul Islam SamratNo ratings yet

- Financial Inclusion and Women Empowerment Through Micro FinanceDocument12 pagesFinancial Inclusion and Women Empowerment Through Micro FinanceYogasre ManasviniNo ratings yet

- RamakantDocument41 pagesRamakantArchitNo ratings yet

- 3-Report First CorrectedDocument39 pages3-Report First Corrected9848138725pkNo ratings yet

- Unit 5 Microfinance and DevelopmentDocument10 pagesUnit 5 Microfinance and Developmentjcmxqxz7tcNo ratings yet

- Unitus 2007 Annual ReportDocument23 pagesUnitus 2007 Annual ReportJanith DaveNo ratings yet

- Microfinance in India Scopes and LimitationsDocument41 pagesMicrofinance in India Scopes and Limitationsspy67% (3)

- Microfinance Report in MaharashtraDocument96 pagesMicrofinance Report in MaharashtraJugal Taneja100% (1)

- 07 Chapter 1Document18 pages07 Chapter 1SakshiNo ratings yet

- MICROFINANCEDocument62 pagesMICROFINANCEHarshal SonalNo ratings yet

- Unit 3 Micro FinanceDocument6 pagesUnit 3 Micro FinanceDeveshi JhawarNo ratings yet

- Role of Micro Finance in Rural Development of IndiDocument7 pagesRole of Micro Finance in Rural Development of Indisonujaiswal1267% (6)

- Sakshi Pote Tybbi ProjectDocument93 pagesSakshi Pote Tybbi ProjectAkshataNo ratings yet

- Sage University: TopicDocument25 pagesSage University: TopicJyotika 2003No ratings yet

- An Appraisal of The Performance of Micro Finance Bank in Economic Development of Delta StateDocument29 pagesAn Appraisal of The Performance of Micro Finance Bank in Economic Development of Delta Statealbertosehi1No ratings yet

- Microfinance Services and Women EmpowermentDocument22 pagesMicrofinance Services and Women EmpowermentRonnald WanzusiNo ratings yet

- Micro Finance AssignmentDocument4 pagesMicro Finance AssignmentLimasenla Moa100% (1)

- MicrofinanceDocument65 pagesMicrofinanceRahul AksHNo ratings yet

- Micro Finance and NGO'sDocument50 pagesMicro Finance and NGO'sMunish Dogra100% (1)

- Cashpor ReportDocument91 pagesCashpor ReportAnand Gautam100% (1)

- Role of Banking Sector in Inclusive DevelopmentDocument1 pageRole of Banking Sector in Inclusive DevelopmentmanjinbaruaNo ratings yet

- Anu Rural DevelopmentDocument13 pagesAnu Rural DevelopmentOsinubi Babatunde AdekunleNo ratings yet

- Micro Finance ProposalDocument11 pagesMicro Finance ProposalMarah KalieNo ratings yet

- Women EmpowermentDocument1 pageWomen EmpowermentWaleed MirNo ratings yet

- Assignment ON Micro-FinanceDocument24 pagesAssignment ON Micro-FinancerakeshpataelNo ratings yet

- Submitted To: Submitted By: Ambuj Gupta Sangram Keshari Panigrahi 2k91/BFS/43Document36 pagesSubmitted To: Submitted By: Ambuj Gupta Sangram Keshari Panigrahi 2k91/BFS/43Sangram PanigrahiNo ratings yet

- 04 chapter 1Document30 pages04 chapter 1eshachanga1234No ratings yet

- Impact of Micro-Finances in Rural DevelopmentDocument5 pagesImpact of Micro-Finances in Rural DevelopmentAbsolom JasonNo ratings yet

- Micro-Finance Management & Critical Analysis in IndiaDocument72 pagesMicro-Finance Management & Critical Analysis in IndiaAtul MangaleNo ratings yet

- Microfinace Reading PDFDocument9 pagesMicrofinace Reading PDFCharles GarrettNo ratings yet

- Microfinance in India: A Critique by Rajarshi GhoshDocument9 pagesMicrofinance in India: A Critique by Rajarshi Ghoshpraveen_jha_9No ratings yet

- Microfinance and Rural Banking-NotesDocument93 pagesMicrofinance and Rural Banking-NotesSiddhi MhrZnNo ratings yet

- Microfinance and MicrocreditDocument7 pagesMicrofinance and Microcreditsukriti94No ratings yet

- SynopsisDocument12 pagesSynopsisAnnie MittalNo ratings yet

- Anagha Suresh (20YUCMD012) Project ReportDocument57 pagesAnagha Suresh (20YUCMD012) Project Reportsouvikm056No ratings yet

- Microfinance Regulation in India. Microfinance ManagementDocument5 pagesMicrofinance Regulation in India. Microfinance ManagementRavindra SalviNo ratings yet

- Micro-Finance For Rural Entrepreneurship Development & Rural IndustrializationDocument2 pagesMicro-Finance For Rural Entrepreneurship Development & Rural IndustrializationRashmi Ranjan PanigrahiNo ratings yet

- Anagha Suresh Project ReportDocument56 pagesAnagha Suresh Project Reportsouvikm056No ratings yet

- Impact of Microfinance On Women Entrepreneurship in IndiaDocument12 pagesImpact of Microfinance On Women Entrepreneurship in IndiaSunitaNo ratings yet

- Mulugeta Final Proposal CommentedDocument33 pagesMulugeta Final Proposal Commentedpetolaw238No ratings yet

- Impact of Microfinance To Empower Female EntrepreneursDocument6 pagesImpact of Microfinance To Empower Female EntrepreneursInternational Journal of Business Marketing and ManagementNo ratings yet

- Chapter 1Document44 pagesChapter 1suraj BanavalkarNo ratings yet

- Role of Microfinance Institution in Financial InclusionDocument15 pagesRole of Microfinance Institution in Financial Inclusionswati_agarwal67No ratings yet

- Microfinance ResearchDocument17 pagesMicrofinance ResearchKausik KskNo ratings yet

- Micro-Financing and the Economic Health of a NationFrom EverandMicro-Financing and the Economic Health of a NationNo ratings yet

- Alleviating Global Poverty: The Role of Private EnterpriseFrom EverandAlleviating Global Poverty: The Role of Private EnterpriseNo ratings yet

- Ending Poverty: How People, Businesses, Communities and Nations can Create Wealth from Ground - UpwardsFrom EverandEnding Poverty: How People, Businesses, Communities and Nations can Create Wealth from Ground - UpwardsNo ratings yet

- Challenges in The Financial Services Sector in India..Document4 pagesChallenges in The Financial Services Sector in India..anna merlin sunnyNo ratings yet

- Organized Stock Exchange and Its FunctionsDocument6 pagesOrganized Stock Exchange and Its Functionsanna merlin sunnyNo ratings yet

- Recent Trends in The Insurance BusinessDocument4 pagesRecent Trends in The Insurance Businessanna merlin sunnyNo ratings yet

- The Impact of Social Networking On Stock Market A ReviewDocument11 pagesThe Impact of Social Networking On Stock Market A Reviewanna merlin sunnyNo ratings yet

- Labs Group Overview 09 2020Document37 pagesLabs Group Overview 09 2020Jose.SuarezNo ratings yet

- Oman Oil Balance SheetDocument27 pagesOman Oil Balance Sheeta.hasan670100% (1)

- Business Plan TABLE OF CONTENTSDocument3 pagesBusiness Plan TABLE OF CONTENTSOgunfodunrin RemilekunNo ratings yet

- Revolutionizing The Field of AccountancyDocument20 pagesRevolutionizing The Field of AccountancyJessarene Fauni DepanteNo ratings yet

- Financial Accounting Bbaw2103 FinalDocument18 pagesFinancial Accounting Bbaw2103 FinalmelNo ratings yet

- Risk Management For MBA StudentsDocument28 pagesRisk Management For MBA StudentsMuneeb Sada50% (2)

- NC Iii Bookkeeping: Prepared By: Jubailyn V. VillegasDocument48 pagesNC Iii Bookkeeping: Prepared By: Jubailyn V. VillegasFlorinda Gagasa100% (1)

- NovoBanco AnnualReport2021 Non-ESEFDocument462 pagesNovoBanco AnnualReport2021 Non-ESEFkdhanush260No ratings yet

- A Study On Brand Awareness of Financial Products With Special Reference To Agile Capital ServicesDocument71 pagesA Study On Brand Awareness of Financial Products With Special Reference To Agile Capital Servicesjassi nishadNo ratings yet

- CA 9.9 11 Class 2Document1 pageCA 9.9 11 Class 2bimbyboNo ratings yet

- Nego ReviewerDocument86 pagesNego ReviewerNia JulianNo ratings yet

- The Long-Term Performance of Venture Capital Backed IPOs: Comparing The United States and EuropeDocument37 pagesThe Long-Term Performance of Venture Capital Backed IPOs: Comparing The United States and EuropeBelizarNo ratings yet

- Symbiosis Institute of Management Studies, Pune Master of Business Administration Programme Structure 2018-20Document15 pagesSymbiosis Institute of Management Studies, Pune Master of Business Administration Programme Structure 2018-20simspuneNo ratings yet

- Sunil Panda Commerce Classes (SPCC) : Daily Practice Problems (DPP) Term 02 Accounts Not For Profit OrganisationDocument4 pagesSunil Panda Commerce Classes (SPCC) : Daily Practice Problems (DPP) Term 02 Accounts Not For Profit OrganisationHigi SNo ratings yet

- Kickback SchemesDocument3 pagesKickback Schemesjoynasr17No ratings yet

- Saintorigins Plantain Cafe BPDocument19 pagesSaintorigins Plantain Cafe BPM.NASIRNo ratings yet

- Basics of Stock MarketDocument13 pagesBasics of Stock MarketRamcharan KadamNo ratings yet

- Benfords Law CAATSDocument28 pagesBenfords Law CAATSHetNo ratings yet

- Market Strcuture of Banking IndustryDocument8 pagesMarket Strcuture of Banking IndustryNatala WillzNo ratings yet

- 10 - Borrowing Costs PS 12edDocument15 pages10 - Borrowing Costs PS 12edbusiness docNo ratings yet

- Professor of Economics: Abdul JalilDocument13 pagesProfessor of Economics: Abdul JalilTanveerNo ratings yet

- Instructions For Form W-8BEN: (Rev. October 2021)Document9 pagesInstructions For Form W-8BEN: (Rev. October 2021)Mario SierraNo ratings yet

- C04-Fundamentals of Business Economics: Sample Exam PaperDocument17 pagesC04-Fundamentals of Business Economics: Sample Exam Paperhkanuradha100% (1)

- Midterm ExaminationDocument11 pagesMidterm ExaminationEdemson NavalesNo ratings yet

- Apr 2023Document1 pageApr 2023saurabhjaNo ratings yet

- Blackrock Smart Beta Guide en Au PDFDocument68 pagesBlackrock Smart Beta Guide en Au PDFdehnailNo ratings yet

- RBI OTS GuidlinesDocument3 pagesRBI OTS Guidliness md nasruNo ratings yet