Professional Documents

Culture Documents

Pos Fin Acct Theory

Pos Fin Acct Theory

Uploaded by

Constantine TandayuCopyright:

Available Formats

You might also like

- IStudio Singapore Iphone XS MAx PDFDocument1 pageIStudio Singapore Iphone XS MAx PDFسہیل خان100% (1)

- Requiring Lawyers To Submit Suspicious Transaction Reports PDFDocument13 pagesRequiring Lawyers To Submit Suspicious Transaction Reports PDFGeorge CarmonaNo ratings yet

- Chapter 1Document8 pagesChapter 1Bēkām BūllōōNo ratings yet

- Lecture 1 Introduction To Financial AccountingDocument8 pagesLecture 1 Introduction To Financial AccountingIRUNGU BRENDA MURUGINo ratings yet

- 1.1. AccountingDocument5 pages1.1. AccountingAnwar AdemNo ratings yet

- Equity Theories Past Present and Future Carien Van Mourik 2010Document19 pagesEquity Theories Past Present and Future Carien Van Mourik 2010Firmansyah DjafarNo ratings yet

- International Accounting - SwiftDocument7 pagesInternational Accounting - Swiftzhayang1129No ratings yet

- Conceptual FrameworkDocument8 pagesConceptual FrameworkQuỳnh Anh NguyễnNo ratings yet

- Financial ManagementDocument18 pagesFinancial ManagementAemro TadeleNo ratings yet

- Conceptual Framework of Financial Accounting and ReportingDocument9 pagesConceptual Framework of Financial Accounting and ReportingOyeleye TofunmiNo ratings yet

- 1.8. A Basic Theory of Financial ReportingDocument28 pages1.8. A Basic Theory of Financial ReportingClaudia Urquijo RodríguezNo ratings yet

- The Environment of Financial Accounting and ReportingDocument59 pagesThe Environment of Financial Accounting and ReportingHeisei De LunaNo ratings yet

- Financial Users 1 Running Header: Financial Information UsersDocument6 pagesFinancial Users 1 Running Header: Financial Information UsersShazkie Ata LeuterioNo ratings yet

- Lesson 1 - Accounting and GAAPDocument4 pagesLesson 1 - Accounting and GAAPMazumder SumanNo ratings yet

- Finance For Non-Finance Executives: The Concept of Responsibility CentresDocument31 pagesFinance For Non-Finance Executives: The Concept of Responsibility Centressuresh.srinivasnNo ratings yet

- KB Agt Nina 752 1671184347 681 PDFDocument10 pagesKB Agt Nina 752 1671184347 681 PDFHero PratikNo ratings yet

- CH 1Document17 pagesCH 1Tariku KolchaNo ratings yet

- MMPC 04Document5 pagesMMPC 04iadeemsNo ratings yet

- Actg 431 Week 2Document4 pagesActg 431 Week 2Kimberly ZafraNo ratings yet

- CFR Lecture#1Document14 pagesCFR Lecture#1ZerlishamaarNo ratings yet

- FOA I HandoutDocument88 pagesFOA I HandoutIbsa MohammedNo ratings yet

- AAT Paper 2 FinanceDocument4 pagesAAT Paper 2 FinanceRay LaiNo ratings yet

- C213 Study Guide - SolutionDocument23 pagesC213 Study Guide - Solutiondesouzas.ldsNo ratings yet

- M1 Handout 1the Nature and Scope of Financial AccountingDocument3 pagesM1 Handout 1the Nature and Scope of Financial AccountingAmelia TaylorNo ratings yet

- 1.introduction To Accounting: Topic ListDocument7 pages1.introduction To Accounting: Topic ListHikmət RüstəmovNo ratings yet

- Lecture Notes - 1: Chapter 1: Accounting in BusinessDocument8 pagesLecture Notes - 1: Chapter 1: Accounting in BusinessThomas SamungoleNo ratings yet

- Financial Accounting FrameworkDocument45 pagesFinancial Accounting Frameworkajit_satapathy1988No ratings yet

- Usefulness and General Purpose of Financial ReportingDocument5 pagesUsefulness and General Purpose of Financial ReportingHudson CheruiyotNo ratings yet

- Chapter 2-Textbook (Accounting An Introduction)Document34 pagesChapter 2-Textbook (Accounting An Introduction)Jimmy MulokoshiNo ratings yet

- What Is Financial ReportingDocument24 pagesWhat Is Financial ReportingIsha GajeshwarNo ratings yet

- Accounts NotesDocument12 pagesAccounts NotesRishi KumarNo ratings yet

- General AccountingDocument70 pagesGeneral AccountingPenn CollinsNo ratings yet

- Accounting NotesDocument22 pagesAccounting NotesVinay ChawlaNo ratings yet

- Positive Accounting Theory and Agency Costs: A Critical PerspectiveDocument7 pagesPositive Accounting Theory and Agency Costs: A Critical Perspectivejairo cuenuNo ratings yet

- Chapter One Accounting Principles and Professional PracticeDocument22 pagesChapter One Accounting Principles and Professional PracticeHussen Abdulkadir100% (1)

- Accounts NotesDocument12 pagesAccounts NotesRishi KumarNo ratings yet

- Jaibb AccountingDocument13 pagesJaibb AccountingAriful Haque SajibNo ratings yet

- Unit 1Document8 pagesUnit 1FantayNo ratings yet

- The Problem and Its Setting Background of The StudyDocument19 pagesThe Problem and Its Setting Background of The StudyDenise Jane RoqueNo ratings yet

- Financial Accounting 1 Unit 1Document8 pagesFinancial Accounting 1 Unit 1chuchuNo ratings yet

- A. BackgroundDocument6 pagesA. BackgroundBayu Sumber AbadiNo ratings yet

- America Nos CollegeDocument7 pagesAmerica Nos CollegesanjuactionNo ratings yet

- Joey Leong Kah Jie (Tutorial 1)Document3 pagesJoey Leong Kah Jie (Tutorial 1)JOEY LEONG KAH JIENo ratings yet

- Financial Accounting and AnalysisDocument32 pagesFinancial Accounting and AnalysisSafwan HossainNo ratings yet

- 1-5 Ronald Duska, Brenda Shay Duska, Julie Anne Ragatz - Accounting Ethics (2011, Wiley-Blackwell) - Halaman-19-39-Halaman-1-5Document5 pages1-5 Ronald Duska, Brenda Shay Duska, Julie Anne Ragatz - Accounting Ethics (2011, Wiley-Blackwell) - Halaman-19-39-Halaman-1-5rafaeltrikostaNo ratings yet

- Chapter - 5 Review of LiteratureDocument32 pagesChapter - 5 Review of Literatureganesh joshiNo ratings yet

- Literature Review OutlookDocument5 pagesLiterature Review OutlookMegan BlackNo ratings yet

- GFA06 - Financial Analysis and Appraisal of ProjectsDocument48 pagesGFA06 - Financial Analysis and Appraisal of ProjectswossenNo ratings yet

- Principles of Accounting I ModuleDocument107 pagesPrinciples of Accounting I ModuleGirum zewde AsfawNo ratings yet

- Fa&a All Unit (KMBN 103)Document41 pagesFa&a All Unit (KMBN 103)abdheshkumar7897No ratings yet

- Financial Reporting and Regulatory FrameworkDocument14 pagesFinancial Reporting and Regulatory Frameworkvarimember752100% (1)

- W2 Module 3 Conceptual Framework Andtheoretical Structure of Financial Accounting and Reporting Part 1Document5 pagesW2 Module 3 Conceptual Framework Andtheoretical Structure of Financial Accounting and Reporting Part 1leare ruazaNo ratings yet

- Conceptual FrameworkDocument5 pagesConceptual FrameworkMaica PontillasNo ratings yet

- Running Head: Financial AccountingDocument8 pagesRunning Head: Financial AccountingSarabjeet KaurNo ratings yet

- Concept of Accounting:: AdvertisementsDocument13 pagesConcept of Accounting:: AdvertisementsSanthu bm97No ratings yet

- 2nd Resume Alvianty 18102067 AS-BDocument9 pages2nd Resume Alvianty 18102067 AS-BAlviantyNo ratings yet

- Chapter 1-Directed Reading WorksheetDocument9 pagesChapter 1-Directed Reading WorksheetfeyzaNo ratings yet

- Economics Research Paper Sem 4Document9 pagesEconomics Research Paper Sem 4UDAY DESWALNo ratings yet

- Framework of Financial AnalysisDocument7 pagesFramework of Financial AnalysismkhanmajlisNo ratings yet

- Chapter 1: Session 1 Introduction To Financial AccountingDocument161 pagesChapter 1: Session 1 Introduction To Financial AccountingHarshini Akilandan100% (1)

- Accounting For EMBA Prepared by Ahmed SabbirDocument95 pagesAccounting For EMBA Prepared by Ahmed Sabbirsabbir ahmed100% (1)

- Conversion CycleDocument48 pagesConversion CycleConstantine TandayuNo ratings yet

- Introduction To Transaction ProcessingDocument38 pagesIntroduction To Transaction ProcessingConstantine TandayuNo ratings yet

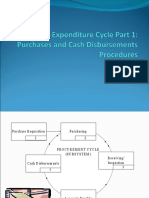

- Expenditure CycleDocument40 pagesExpenditure CycleConstantine TandayuNo ratings yet

- Tandayu IBA PPT CADocument10 pagesTandayu IBA PPT CAConstantine TandayuNo ratings yet

- TOBIAS. Critical Analysis IBATDocument46 pagesTOBIAS. Critical Analysis IBATConstantine TandayuNo ratings yet

- Tandayu AUDITING-SI ActivityDocument4 pagesTandayu AUDITING-SI ActivityConstantine TandayuNo ratings yet

- Tandayu Ass1-Bus - TransferTaxDocument6 pagesTandayu Ass1-Bus - TransferTaxConstantine TandayuNo ratings yet

- LM08 Equity Valuation Concepts and Basic Tools IFT NotesDocument19 pagesLM08 Equity Valuation Concepts and Basic Tools IFT NotesClaptrapjackNo ratings yet

- Complaint: Commissioner@afp - Gov.auDocument40 pagesComplaint: Commissioner@afp - Gov.auGerrit Hendrik Schorel-HlavkaNo ratings yet

- Sunderland App PDFDocument6 pagesSunderland App PDFAsith SavindaNo ratings yet

- IMPERIAL VILLAS Allocation PaperDocument2 pagesIMPERIAL VILLAS Allocation Paperinspirohm777No ratings yet

- VCLA Reading PracticeTestDocument31 pagesVCLA Reading PracticeTestploteusNo ratings yet

- North Korea, Sanity On The BrinkDocument4 pagesNorth Korea, Sanity On The BrinkrazahamdaniNo ratings yet

- Course Title: Intellectual Property (Ip) Law Course Unit: 2 Units Lecturer: Dean Rodel A. Taton, LL.M., DCLDocument11 pagesCourse Title: Intellectual Property (Ip) Law Course Unit: 2 Units Lecturer: Dean Rodel A. Taton, LL.M., DCLMamerto Egargo Jr.No ratings yet

- Capital Markets - EDHEC Risk InstituteDocument386 pagesCapital Markets - EDHEC Risk InstituteRicky Rick100% (1)

- Lesson 1. Rizal LawDocument3 pagesLesson 1. Rizal LawLucius LukeNo ratings yet

- Fee Structure For Session 2023-2024 (Fees Is in Inr)Document1 pageFee Structure For Session 2023-2024 (Fees Is in Inr)Md QualbiNo ratings yet

- G.R. No. 217138Document2 pagesG.R. No. 217138cercadooharaNo ratings yet

- 879Document48 pages879B. MerkurNo ratings yet

- Paflu vs. Secretary of LaborDocument6 pagesPaflu vs. Secretary of LaborArvhie SantosNo ratings yet

- RESOLUTION NO. 001, SERIES OF 2023 - 5K Office Supplies - SKDocument5 pagesRESOLUTION NO. 001, SERIES OF 2023 - 5K Office Supplies - SKkennethjharid.omisolNo ratings yet

- Financial Accounting (International) : Fundamentals Pilot Paper - Knowledge ModuleDocument19 pagesFinancial Accounting (International) : Fundamentals Pilot Paper - Knowledge ModuleNguyen Thi Phuong ThuyNo ratings yet

- REM OrdnanceMunitionsandMaintenanceTrainingSOWDocument8 pagesREM OrdnanceMunitionsandMaintenanceTrainingSOWMichael AbrahaNo ratings yet

- 148) Reyes Vs TanDocument2 pages148) Reyes Vs TanChaNo ratings yet

- Biography of Abdul Hai HabibiDocument3 pagesBiography of Abdul Hai Habibisanakhan100% (1)

- Tafari St. Aubyn Lewis, A210 109 301 (BIA Jan. 5, 2016)Document6 pagesTafari St. Aubyn Lewis, A210 109 301 (BIA Jan. 5, 2016)Immigrant & Refugee Appellate Center, LLCNo ratings yet

- Barangay Sindalan Vs CADocument10 pagesBarangay Sindalan Vs CAVirnadette LopezNo ratings yet

- Most Popular Newspapers and Magazines in MoldovaDocument2 pagesMost Popular Newspapers and Magazines in MoldovaAdriana AntoniNo ratings yet

- Chapter-1 The French Revolution: France During The Late 18 CenturyDocument33 pagesChapter-1 The French Revolution: France During The Late 18 CenturyNodiaNo ratings yet

- Activity 2 Strategic Management and Business PolicyDocument11 pagesActivity 2 Strategic Management and Business PolicyLymar Von EcapNo ratings yet

- TB ch01 9eDocument12 pagesTB ch01 9eRadizaJisiNo ratings yet

- Plant Assets, Natural Resources, and Intangible Assets: Accounting Principles, Ninth EditionDocument21 pagesPlant Assets, Natural Resources, and Intangible Assets: Accounting Principles, Ninth EditionMehedi HasanNo ratings yet

- Alba I - CommunicationDocument2 pagesAlba I - CommunicationBernard TungbabanNo ratings yet

- Diao Vs MartinezDocument1 pageDiao Vs MartinezPatricia Ann Mae ArmendiNo ratings yet

- Balane SheetDocument33 pagesBalane SheetOswinda GomesNo ratings yet

Pos Fin Acct Theory

Pos Fin Acct Theory

Uploaded by

Constantine TandayuOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pos Fin Acct Theory

Pos Fin Acct Theory

Uploaded by

Constantine TandayuCopyright:

Available Formats

Accounting in market-based economies has two important roles to play.

Firstly, it affords capital

providers (shareholders and creditors) the opportunity to evaluate the return potential of investment

opportunities (the ex-ante or valuation role of accounting information) and secondly, accounting

information allows capital providers to watch the use of their capital once committed (the ex-post or

stewardship position of accounting as an information system) (Anne et al., 2010). This information is

prepared and presented through financial reporting as stipulated by the legislation of the local entity

and that of the international legislation so far it is not in conflict with the local legislation. It is the duty

of the directors to prepare and present at the end of each financial year financial statements of the

entity to the members (shareholders) and any other members such as debenture holders, creditors,

government agencies as well as members of the public who may be entitled to the copy of the said

statement as stipulated by the law. It is universally believed that the primary reality/objective of

financial reporting is the provision of information in in terms of finance about the reporting entity that is

of benefit to both present and potentials investors and creditors to be able to make economic decisions

as providers of capital. The objective refers to financial reporting which encapsulate all the information

contents of published account as a whole and not just financial statement which is a sub set of financial

reporting. Therefore, financial reporting concentrates solely on meeting the information needs of the

groups who are highly interested in financial information. User group in terms of financial information

aims at meeting the needs of those who have claims on the resources of an entity (Noble International

Journal of Economics and Financial Research, 2017).

Positive accounting emerged with the accounting studies that generated in late 1960s. This concept was

organized as a school of thought by Ross Watts and Jerold Zimmerman. Positive Accounting Theory

attempts to make great forecasts of genuine occasions and make an interpretation of them to

accounting transactions. While normative theories will, in general, suggest what ought to be done,

Positive Theories attempt to clarify and foresee activities, for example, which accounting transactions

firms will pick how firms will respond to recently proposed accounting standards. Its general aim is to

comprehend and foresee the decision of accounting policies crosswise over varying firms. It perceives

that financial outcome exist. Under this theory, three hypotheses have been brought into light, First

Keeping all other things constant, managers of firms with reward plans are bound to pick accounting

procedures that shift reported income from future periods to the present time frame. Second, keeping

all other things constant, the bigger a company's debt/equity ratio, the more probable the company's

manager is to choose accounting procedure that shifts reported earnings from future periods to the

present time frame. Last, keeping all other things constant, the larger the firm, the almost certain the

manager is to pick accounting procedures that defer reported earnings from current to future periods,

(Jagriti Srivastava Pankaj Kumar Baag, 2020).

You might also like

- IStudio Singapore Iphone XS MAx PDFDocument1 pageIStudio Singapore Iphone XS MAx PDFسہیل خان100% (1)

- Requiring Lawyers To Submit Suspicious Transaction Reports PDFDocument13 pagesRequiring Lawyers To Submit Suspicious Transaction Reports PDFGeorge CarmonaNo ratings yet

- Chapter 1Document8 pagesChapter 1Bēkām BūllōōNo ratings yet

- Lecture 1 Introduction To Financial AccountingDocument8 pagesLecture 1 Introduction To Financial AccountingIRUNGU BRENDA MURUGINo ratings yet

- 1.1. AccountingDocument5 pages1.1. AccountingAnwar AdemNo ratings yet

- Equity Theories Past Present and Future Carien Van Mourik 2010Document19 pagesEquity Theories Past Present and Future Carien Van Mourik 2010Firmansyah DjafarNo ratings yet

- International Accounting - SwiftDocument7 pagesInternational Accounting - Swiftzhayang1129No ratings yet

- Conceptual FrameworkDocument8 pagesConceptual FrameworkQuỳnh Anh NguyễnNo ratings yet

- Financial ManagementDocument18 pagesFinancial ManagementAemro TadeleNo ratings yet

- Conceptual Framework of Financial Accounting and ReportingDocument9 pagesConceptual Framework of Financial Accounting and ReportingOyeleye TofunmiNo ratings yet

- 1.8. A Basic Theory of Financial ReportingDocument28 pages1.8. A Basic Theory of Financial ReportingClaudia Urquijo RodríguezNo ratings yet

- The Environment of Financial Accounting and ReportingDocument59 pagesThe Environment of Financial Accounting and ReportingHeisei De LunaNo ratings yet

- Financial Users 1 Running Header: Financial Information UsersDocument6 pagesFinancial Users 1 Running Header: Financial Information UsersShazkie Ata LeuterioNo ratings yet

- Lesson 1 - Accounting and GAAPDocument4 pagesLesson 1 - Accounting and GAAPMazumder SumanNo ratings yet

- Finance For Non-Finance Executives: The Concept of Responsibility CentresDocument31 pagesFinance For Non-Finance Executives: The Concept of Responsibility Centressuresh.srinivasnNo ratings yet

- KB Agt Nina 752 1671184347 681 PDFDocument10 pagesKB Agt Nina 752 1671184347 681 PDFHero PratikNo ratings yet

- CH 1Document17 pagesCH 1Tariku KolchaNo ratings yet

- MMPC 04Document5 pagesMMPC 04iadeemsNo ratings yet

- Actg 431 Week 2Document4 pagesActg 431 Week 2Kimberly ZafraNo ratings yet

- CFR Lecture#1Document14 pagesCFR Lecture#1ZerlishamaarNo ratings yet

- FOA I HandoutDocument88 pagesFOA I HandoutIbsa MohammedNo ratings yet

- AAT Paper 2 FinanceDocument4 pagesAAT Paper 2 FinanceRay LaiNo ratings yet

- C213 Study Guide - SolutionDocument23 pagesC213 Study Guide - Solutiondesouzas.ldsNo ratings yet

- M1 Handout 1the Nature and Scope of Financial AccountingDocument3 pagesM1 Handout 1the Nature and Scope of Financial AccountingAmelia TaylorNo ratings yet

- 1.introduction To Accounting: Topic ListDocument7 pages1.introduction To Accounting: Topic ListHikmət RüstəmovNo ratings yet

- Lecture Notes - 1: Chapter 1: Accounting in BusinessDocument8 pagesLecture Notes - 1: Chapter 1: Accounting in BusinessThomas SamungoleNo ratings yet

- Financial Accounting FrameworkDocument45 pagesFinancial Accounting Frameworkajit_satapathy1988No ratings yet

- Usefulness and General Purpose of Financial ReportingDocument5 pagesUsefulness and General Purpose of Financial ReportingHudson CheruiyotNo ratings yet

- Chapter 2-Textbook (Accounting An Introduction)Document34 pagesChapter 2-Textbook (Accounting An Introduction)Jimmy MulokoshiNo ratings yet

- What Is Financial ReportingDocument24 pagesWhat Is Financial ReportingIsha GajeshwarNo ratings yet

- Accounts NotesDocument12 pagesAccounts NotesRishi KumarNo ratings yet

- General AccountingDocument70 pagesGeneral AccountingPenn CollinsNo ratings yet

- Accounting NotesDocument22 pagesAccounting NotesVinay ChawlaNo ratings yet

- Positive Accounting Theory and Agency Costs: A Critical PerspectiveDocument7 pagesPositive Accounting Theory and Agency Costs: A Critical Perspectivejairo cuenuNo ratings yet

- Chapter One Accounting Principles and Professional PracticeDocument22 pagesChapter One Accounting Principles and Professional PracticeHussen Abdulkadir100% (1)

- Accounts NotesDocument12 pagesAccounts NotesRishi KumarNo ratings yet

- Jaibb AccountingDocument13 pagesJaibb AccountingAriful Haque SajibNo ratings yet

- Unit 1Document8 pagesUnit 1FantayNo ratings yet

- The Problem and Its Setting Background of The StudyDocument19 pagesThe Problem and Its Setting Background of The StudyDenise Jane RoqueNo ratings yet

- Financial Accounting 1 Unit 1Document8 pagesFinancial Accounting 1 Unit 1chuchuNo ratings yet

- A. BackgroundDocument6 pagesA. BackgroundBayu Sumber AbadiNo ratings yet

- America Nos CollegeDocument7 pagesAmerica Nos CollegesanjuactionNo ratings yet

- Joey Leong Kah Jie (Tutorial 1)Document3 pagesJoey Leong Kah Jie (Tutorial 1)JOEY LEONG KAH JIENo ratings yet

- Financial Accounting and AnalysisDocument32 pagesFinancial Accounting and AnalysisSafwan HossainNo ratings yet

- 1-5 Ronald Duska, Brenda Shay Duska, Julie Anne Ragatz - Accounting Ethics (2011, Wiley-Blackwell) - Halaman-19-39-Halaman-1-5Document5 pages1-5 Ronald Duska, Brenda Shay Duska, Julie Anne Ragatz - Accounting Ethics (2011, Wiley-Blackwell) - Halaman-19-39-Halaman-1-5rafaeltrikostaNo ratings yet

- Chapter - 5 Review of LiteratureDocument32 pagesChapter - 5 Review of Literatureganesh joshiNo ratings yet

- Literature Review OutlookDocument5 pagesLiterature Review OutlookMegan BlackNo ratings yet

- GFA06 - Financial Analysis and Appraisal of ProjectsDocument48 pagesGFA06 - Financial Analysis and Appraisal of ProjectswossenNo ratings yet

- Principles of Accounting I ModuleDocument107 pagesPrinciples of Accounting I ModuleGirum zewde AsfawNo ratings yet

- Fa&a All Unit (KMBN 103)Document41 pagesFa&a All Unit (KMBN 103)abdheshkumar7897No ratings yet

- Financial Reporting and Regulatory FrameworkDocument14 pagesFinancial Reporting and Regulatory Frameworkvarimember752100% (1)

- W2 Module 3 Conceptual Framework Andtheoretical Structure of Financial Accounting and Reporting Part 1Document5 pagesW2 Module 3 Conceptual Framework Andtheoretical Structure of Financial Accounting and Reporting Part 1leare ruazaNo ratings yet

- Conceptual FrameworkDocument5 pagesConceptual FrameworkMaica PontillasNo ratings yet

- Running Head: Financial AccountingDocument8 pagesRunning Head: Financial AccountingSarabjeet KaurNo ratings yet

- Concept of Accounting:: AdvertisementsDocument13 pagesConcept of Accounting:: AdvertisementsSanthu bm97No ratings yet

- 2nd Resume Alvianty 18102067 AS-BDocument9 pages2nd Resume Alvianty 18102067 AS-BAlviantyNo ratings yet

- Chapter 1-Directed Reading WorksheetDocument9 pagesChapter 1-Directed Reading WorksheetfeyzaNo ratings yet

- Economics Research Paper Sem 4Document9 pagesEconomics Research Paper Sem 4UDAY DESWALNo ratings yet

- Framework of Financial AnalysisDocument7 pagesFramework of Financial AnalysismkhanmajlisNo ratings yet

- Chapter 1: Session 1 Introduction To Financial AccountingDocument161 pagesChapter 1: Session 1 Introduction To Financial AccountingHarshini Akilandan100% (1)

- Accounting For EMBA Prepared by Ahmed SabbirDocument95 pagesAccounting For EMBA Prepared by Ahmed Sabbirsabbir ahmed100% (1)

- Conversion CycleDocument48 pagesConversion CycleConstantine TandayuNo ratings yet

- Introduction To Transaction ProcessingDocument38 pagesIntroduction To Transaction ProcessingConstantine TandayuNo ratings yet

- Expenditure CycleDocument40 pagesExpenditure CycleConstantine TandayuNo ratings yet

- Tandayu IBA PPT CADocument10 pagesTandayu IBA PPT CAConstantine TandayuNo ratings yet

- TOBIAS. Critical Analysis IBATDocument46 pagesTOBIAS. Critical Analysis IBATConstantine TandayuNo ratings yet

- Tandayu AUDITING-SI ActivityDocument4 pagesTandayu AUDITING-SI ActivityConstantine TandayuNo ratings yet

- Tandayu Ass1-Bus - TransferTaxDocument6 pagesTandayu Ass1-Bus - TransferTaxConstantine TandayuNo ratings yet

- LM08 Equity Valuation Concepts and Basic Tools IFT NotesDocument19 pagesLM08 Equity Valuation Concepts and Basic Tools IFT NotesClaptrapjackNo ratings yet

- Complaint: Commissioner@afp - Gov.auDocument40 pagesComplaint: Commissioner@afp - Gov.auGerrit Hendrik Schorel-HlavkaNo ratings yet

- Sunderland App PDFDocument6 pagesSunderland App PDFAsith SavindaNo ratings yet

- IMPERIAL VILLAS Allocation PaperDocument2 pagesIMPERIAL VILLAS Allocation Paperinspirohm777No ratings yet

- VCLA Reading PracticeTestDocument31 pagesVCLA Reading PracticeTestploteusNo ratings yet

- North Korea, Sanity On The BrinkDocument4 pagesNorth Korea, Sanity On The BrinkrazahamdaniNo ratings yet

- Course Title: Intellectual Property (Ip) Law Course Unit: 2 Units Lecturer: Dean Rodel A. Taton, LL.M., DCLDocument11 pagesCourse Title: Intellectual Property (Ip) Law Course Unit: 2 Units Lecturer: Dean Rodel A. Taton, LL.M., DCLMamerto Egargo Jr.No ratings yet

- Capital Markets - EDHEC Risk InstituteDocument386 pagesCapital Markets - EDHEC Risk InstituteRicky Rick100% (1)

- Lesson 1. Rizal LawDocument3 pagesLesson 1. Rizal LawLucius LukeNo ratings yet

- Fee Structure For Session 2023-2024 (Fees Is in Inr)Document1 pageFee Structure For Session 2023-2024 (Fees Is in Inr)Md QualbiNo ratings yet

- G.R. No. 217138Document2 pagesG.R. No. 217138cercadooharaNo ratings yet

- 879Document48 pages879B. MerkurNo ratings yet

- Paflu vs. Secretary of LaborDocument6 pagesPaflu vs. Secretary of LaborArvhie SantosNo ratings yet

- RESOLUTION NO. 001, SERIES OF 2023 - 5K Office Supplies - SKDocument5 pagesRESOLUTION NO. 001, SERIES OF 2023 - 5K Office Supplies - SKkennethjharid.omisolNo ratings yet

- Financial Accounting (International) : Fundamentals Pilot Paper - Knowledge ModuleDocument19 pagesFinancial Accounting (International) : Fundamentals Pilot Paper - Knowledge ModuleNguyen Thi Phuong ThuyNo ratings yet

- REM OrdnanceMunitionsandMaintenanceTrainingSOWDocument8 pagesREM OrdnanceMunitionsandMaintenanceTrainingSOWMichael AbrahaNo ratings yet

- 148) Reyes Vs TanDocument2 pages148) Reyes Vs TanChaNo ratings yet

- Biography of Abdul Hai HabibiDocument3 pagesBiography of Abdul Hai Habibisanakhan100% (1)

- Tafari St. Aubyn Lewis, A210 109 301 (BIA Jan. 5, 2016)Document6 pagesTafari St. Aubyn Lewis, A210 109 301 (BIA Jan. 5, 2016)Immigrant & Refugee Appellate Center, LLCNo ratings yet

- Barangay Sindalan Vs CADocument10 pagesBarangay Sindalan Vs CAVirnadette LopezNo ratings yet

- Most Popular Newspapers and Magazines in MoldovaDocument2 pagesMost Popular Newspapers and Magazines in MoldovaAdriana AntoniNo ratings yet

- Chapter-1 The French Revolution: France During The Late 18 CenturyDocument33 pagesChapter-1 The French Revolution: France During The Late 18 CenturyNodiaNo ratings yet

- Activity 2 Strategic Management and Business PolicyDocument11 pagesActivity 2 Strategic Management and Business PolicyLymar Von EcapNo ratings yet

- TB ch01 9eDocument12 pagesTB ch01 9eRadizaJisiNo ratings yet

- Plant Assets, Natural Resources, and Intangible Assets: Accounting Principles, Ninth EditionDocument21 pagesPlant Assets, Natural Resources, and Intangible Assets: Accounting Principles, Ninth EditionMehedi HasanNo ratings yet

- Alba I - CommunicationDocument2 pagesAlba I - CommunicationBernard TungbabanNo ratings yet

- Diao Vs MartinezDocument1 pageDiao Vs MartinezPatricia Ann Mae ArmendiNo ratings yet

- Balane SheetDocument33 pagesBalane SheetOswinda GomesNo ratings yet