Professional Documents

Culture Documents

Ijarah

Ijarah

Uploaded by

OGETO WESLEYOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ijarah

Ijarah

Uploaded by

OGETO WESLEYCopyright:

Available Formats

University of Nairobi Fundamental of Islamic Finance 2022

UNIVERSITY OF NAIROBI

SCHOOL OF BUSINESS

DEPARTMENT OF FINANCE AND ACCOUNTING

BACHELOR OF SCIENCE IN FINANCE DEGREE PROGRAMME

FUNDAMENTALS OF ISLAMIC FINANCE

DFI 212

Saturday, Nov 2022

DFI 212 IJARA

University of Nairobi Fundamental of Islamic Finance 2022

IJARA

IJARA

Ijarah means ‘to give something on rent’. ajara. To recompense, compensate or to give a

consideration or return In Islamic jurisprudence, it is used for two different situations.

In the first place, it means to employ the services of a person on wages given to him as a

consideration for his hired services.

The second type is relates to the usufructs of assets and properties, and not to the

services of human beings. In this sense it means “to transfer the usufruct of a particular

property to another person in exchange for a rent claimed from him.’

It is a contract for the transfer of ownership of usufruct for compensation. Some scholars

say that, “it is a sale of a known usufruct for a known compensation. Thus, the contract of

lease is a kind of contact of financial exchange.

The difference between ijarah and bay is that ijarah is a sale but only of the usufruct,

whereas a normal bay (sale) contract is a transfer of the corpus. A lease contract may be

carried out immediately or at a future date, whereas a sale contract must be carried out

immediately. Consumables may be the subject matter of a sale but not of a lease.

The key elements in leasing contracts which must fulfill the conditions of its validity are

1. Contracting parties: both lessor and lessee must be of sound mind, attain the age of

maturity and not restricted from dealing with business transaction

2. Object of contract: the asset or equipment must be tangible, owned by the Lessor at

the time of contract, can be delivered to the lessee for usage and remain with the

lessee throughout the lease period

3. Rent : it must be determined and agreed by both parties at the time of the contract,

must be specified in terms of currency and can be collected in advance

4. Term or Period: period of lease must be determined and agreed by both parties at the

time of the contract

5. Offer and acceptance: it must be concluded in a definite and decisive language,

acceptance must be consistent with the offer made and that the offer and acceptance

must be made at the same meeting

In ijarah contract, the financial institution as the Lessor maintains ownership in the leased

asset whilst the lessee owns the rights to use the asset for an agreed period at agreed

rentals. All liabilities and risks pertaining to the leased asset are borne by the Islamic

DFI 212 IJARA

University of Nairobi Fundamental of Islamic Finance 2022

financial institution including obligations to restore any impairment and damage to the

leased asset arising from wear and tear and natural causes which are not due to the

lessee’s misconduct or negligence.

LEASE AS A MODE OF FINANCING

Lease was NOT originally a mode of financing. It is simply a transaction meant to transfer

the usufruct of a property from one person to another for an agreed period against an

agreed consideration. However, certain financial institutions have adopted leasing as a

mode of financing instead of long term lending on the basis of interest. This kind of lease is

generally known as the ‘financial lease’ as distinguished from the ‘operating lease’ and

many basic features of actual leasing transaction have been dispensed with therein.

THE APPLICATION OF IJARAH IN THE BANKING SYSTEM

The common mechanism of ijarah as applicable in Islamic banking contracts is as follows

1. The client identifies and approaches the vendor or supplier of the asset that he or she

needs and collects all the relevant information

2. The client approaches a bank for ijarah of the asset and promises to take the asset on

lease from the bank upon purchase

3. The bank makes payment of price to the vendor

4. The vendor transfers ownership of the asset to the bank

5. The bank leases the asset, transfers possession and specific right of use to the client

6. The client pays ijarah rentals over future (known) time periods(s)

7. The assets reverts to the bank in the operating lease or is transferred to the client in

the financing lease

1. Ijarah Mawsufah fi Al Dhimmah (Forward Lease)

Ijarah Mawsufah fi Al Dhimmah, is a forward lease contract where the lessee will use an asset

or equipment that will only be available in the future. Although the asset is not available at the

time of the contract, the Lessor must describe in detail and must deliver at an agreed date in

the future

The key elements in forward sale contract which must fulfill the conditions of its validity are

a) The rental payable may be fixed or varied according to an agreed benchmark for a

specified period and shall be determined at the time of the contract

DFI 212 IJARA

University of Nairobi Fundamental of Islamic Finance 2022

b) The rental can be paid in advance but the amount received by the Lessor shall be

earned only upon effective delivery of the usufruct of the leased asset to the lessee

c) The rental amount received by Lessor shall be refunded to the lessee if the asset

cannot be effectively delivered to the lessee for the agreed period.

d) Upon the completion of the leased asset under a forward lease and prior to enjoyment

of the usufruct, the lessee may purchase the leased asset and the forward rentals

amount may be treated as part of the selling price.

2. Ijarah Muntahiya Bil- Tamlik

It refers to a lease contract with the transfer of the legal title of the leased to the lessee at

the conclusion of the lease arrangement. The transfer can be in the form of a sale or a gift

of the asset to the lessee.

3. Ijarah Thumma Al- Bay’

It is a form of ijarah where the sale contract is executed at the lease period to effectively

transfer the asset ownership from the competition of the Islamic financial institution

(Lessor/seller) to the customer (lessee/buyer)

It comprises of two separate contracts that are executed in sequence i.e. ijarah (leasing)

and Bay’ (sale)

Through the lease period, the lessee pays a total sum of monthly rentals comprising of an

actual cost of the asset paid by the Islamic financial institutions (lessor) after deducting any

down payment paid by the lessee and the lessor’s profit margin

At the end of the lease period or upon early settlement, the Islamic financial institution

(seller) transfers the title of the asset to the customer (buyer) for a token sum by executing

a sale contract.

Silent Shari’a Issues in Ijarah Contract

1. Combination of Contracts

Muslim jurists ruled that it is not permissible to tie up one transaction with another so as to

make the former a pre-condition for the other. However, they allow the combination of

more than one contract in one transaction without imposing one contract as a condition in

the other, provided that it does not go against the restriction of the Shari’a that prohibits it

on exceptional basis. Therefore, the Lessor may enter into a unilateral undertaking to sell

the leased asset to the lessee at the end of the lease period. This undertaking shall be

binding on the Lessor only.

DFI 212 IJARA

University of Nairobi Fundamental of Islamic Finance 2022

2. Linked Rentals in Long-term Lease with Interest Rate Benchmark

Muslim jurists agree that the Lessor in a long-term may either stipulate a condition may

also tie the rent amount with other well-defined benchmarks such as linking the increment

or decrease in rent to the rate of government taxes or the inflation rate. They, however,

disagree on tying the rental with an interest rate benchmark like LIBOR.

DFI 212 IJARA

You might also like

- Controlling Sex and Decency in Advertising Around The WorldDocument12 pagesControlling Sex and Decency in Advertising Around The WorldShwetha ShekharNo ratings yet

- Ibf Case StudyDocument17 pagesIbf Case StudyAyesha HamidNo ratings yet

- Center of Islamic Finance: COMSATS Institute of Information Technology Lahore CampusDocument20 pagesCenter of Islamic Finance: COMSATS Institute of Information Technology Lahore CampusAbdul RaufNo ratings yet

- Ijarah LeasingDocument3 pagesIjarah LeasingHuda Reem MansharamaniNo ratings yet

- Ijara-Based Financing: Definition of Ijara (Leasing)Document13 pagesIjara-Based Financing: Definition of Ijara (Leasing)Nura HaikuNo ratings yet

- Unit 15 Leasing and Hire Purchase: ObjectivesDocument15 pagesUnit 15 Leasing and Hire Purchase: ObjectivesJaniceNo ratings yet

- Diff. in Leasing and IjarahDocument4 pagesDiff. in Leasing and Ijarahhasan_siddiqui_15No ratings yet

- Unit 15 Leasing and Hire Purchase: ObjectivesDocument15 pagesUnit 15 Leasing and Hire Purchase: Objectivesmaniraj21No ratings yet

- Hire Purchase Under ShirkatulDocument33 pagesHire Purchase Under ShirkatulShad LeeNo ratings yet

- IjamanDocument20 pagesIjamanIqbal Hussain DadiNo ratings yet

- Introduction To Ijarah: Release DateDocument21 pagesIntroduction To Ijarah: Release Datewafa shumailNo ratings yet

- Lease: Section 105Document14 pagesLease: Section 105Deepak PanwarNo ratings yet

- AlijarahDocument6 pagesAlijarahMastura AmitNo ratings yet

- Ijarah Fund: This Way May Be Justified On The Analogy of Simsâr (Broker) For Whom The Fee Based On Percentage Is AllowedDocument9 pagesIjarah Fund: This Way May Be Justified On The Analogy of Simsâr (Broker) For Whom The Fee Based On Percentage Is AllowedumairNo ratings yet

- 1 - IjarahDocument31 pages1 - IjarahAlishba KaiserNo ratings yet

- The Parameters of Forward IjarahDocument43 pagesThe Parameters of Forward IjarahRamah Le BelNo ratings yet

- Meezan Bank ReportDocument19 pagesMeezan Bank ReportkashifislamicNo ratings yet

- Notes 4Document12 pagesNotes 4Kurukshetra Milk PlantNo ratings yet

- The Concept of Ijarah: Center of Islamic FinanceDocument21 pagesThe Concept of Ijarah: Center of Islamic FinanceSam KhanNo ratings yet

- Group 6 PresentationDocument9 pagesGroup 6 Presentationcbuba1999No ratings yet

- Leasing (Ijara) FacilityDocument24 pagesLeasing (Ijara) FacilityAbdiel BanjaryNo ratings yet

- Lease Based Contracts Contract of Ijārah (Leasing) : Basic RulesDocument7 pagesLease Based Contracts Contract of Ijārah (Leasing) : Basic RulesAbdi HiirNo ratings yet

- Unit 4Document29 pagesUnit 4123kasaragod123No ratings yet

- Enforcement of Security Interests in Banking TransactionsDocument20 pagesEnforcement of Security Interests in Banking TransactionsAbhjeet Kumar Sinha100% (2)

- AccountDocument1 pageAccountMusfirah KarajahNo ratings yet

- A SalamDocument3 pagesA Salamali_zain_7No ratings yet

- Ijarah: DR - Muhammad Sohail Shari'ah Compliance DepartmentDocument15 pagesIjarah: DR - Muhammad Sohail Shari'ah Compliance DepartmentMUHAMMAD TALATNo ratings yet

- Chapter 5 Ijarah 16012022 061036pmDocument12 pagesChapter 5 Ijarah 16012022 061036pmYusra Rehman KhanNo ratings yet

- Islamic Leasing DocumentDocument19 pagesIslamic Leasing DocumentJasonKestNo ratings yet

- AS-19-LeasesDocument23 pagesAS-19-LeasesKrishna Jha0% (2)

- Final Special Topics Lesson 1 2Document36 pagesFinal Special Topics Lesson 1 2nomer christian verderaNo ratings yet

- Leases (TOPA)Document14 pagesLeases (TOPA)KarthikNo ratings yet

- Sesi 7 - IjarahDocument32 pagesSesi 7 - IjarahLinda Tri LestariNo ratings yet

- Basic Concepts of Islamic FinanceDocument5 pagesBasic Concepts of Islamic FinanceSaifullahMakenNo ratings yet

- Ijarah FinancingDocument50 pagesIjarah FinancingDeliaFitrianaHidayatNo ratings yet

- Mbfs Unit IVDocument16 pagesMbfs Unit IVPriyanka PanigrahiNo ratings yet

- Chapter IvDocument15 pagesChapter IvIndhuja MNo ratings yet

- Al Ijarah TashghiliyahDocument5 pagesAl Ijarah TashghiliyahPolkapolka DotNo ratings yet

- IjarahDocument2 pagesIjarahSK LashariNo ratings yet

- UIB 2612 Gan Yu LinDocument5 pagesUIB 2612 Gan Yu LinGAN YU LINNo ratings yet

- Comments On The CMP Documents For Islamic Housing (SHFC) Maharlika J. AlontoDocument6 pagesComments On The CMP Documents For Islamic Housing (SHFC) Maharlika J. AlontohezeNo ratings yet

- Credit Trans - NotesDocument18 pagesCredit Trans - NotesCath VillarinNo ratings yet

- Chp4. Application of Islamic Lease FinancingDocument35 pagesChp4. Application of Islamic Lease FinancingUsaama AbdilaahiNo ratings yet

- Uqud in Islamic Financial TransactionsDocument40 pagesUqud in Islamic Financial Transactionsmohamed saidNo ratings yet

- IjaraDocument15 pagesIjarakamranp1No ratings yet

- IjarahDocument26 pagesIjarahMohsen SirajNo ratings yet

- 2 RahnuDocument12 pages2 RahnuAhmadUmairIlyasNo ratings yet

- Notes 5Document13 pagesNotes 5Kurukshetra Milk PlantNo ratings yet

- IJARAHDocument17 pagesIJARAHFariaFaryNo ratings yet

- The Financial LeasingDocument19 pagesThe Financial Leasingahmed alnahalNo ratings yet

- Ijarah (Islamic Leasing)Document26 pagesIjarah (Islamic Leasing)hina ranaNo ratings yet

- Department of Law Bahria University Islamabad: Similar Contracts With Sales of GoodsDocument15 pagesDepartment of Law Bahria University Islamabad: Similar Contracts With Sales of GoodsFareeha RajaNo ratings yet

- Handouts For Credit TransactionsDocument15 pagesHandouts For Credit TransactionsIrene Sheeran100% (1)

- Leases (Pas 17) PDFDocument4 pagesLeases (Pas 17) PDFRon GumapacNo ratings yet

- Anuj Patel, 183, LeaseDocument23 pagesAnuj Patel, 183, LeaseAnuj PatelNo ratings yet

- Benefitting From LoanDocument35 pagesBenefitting From LoanSharifah Faizah As SeggafNo ratings yet

- Credit Transactions by Pineda PDFDocument12 pagesCredit Transactions by Pineda PDFNyl John Caesar GenobiagonNo ratings yet

- Group2 Lease FinancingDocument24 pagesGroup2 Lease FinancingMohit Motwani100% (1)

- Securitized Real Estate and 1031 ExchangesFrom EverandSecuritized Real Estate and 1031 ExchangesNo ratings yet

- Real Estate Terminology: Property Management, Financing, Construction, Agents and Brokers TermsFrom EverandReal Estate Terminology: Property Management, Financing, Construction, Agents and Brokers TermsNo ratings yet

- IstisnaaDocument5 pagesIstisnaaOGETO WESLEYNo ratings yet

- MurabahaDocument11 pagesMurabahaOGETO WESLEYNo ratings yet

- TawarruqDocument5 pagesTawarruqOGETO WESLEYNo ratings yet

- MushaarakaDocument10 pagesMushaarakaOGETO WESLEYNo ratings yet

- Financial InstitutionsDocument9 pagesFinancial InstitutionsOGETO WESLEYNo ratings yet

- Provisions Relating To Pre-Mature Retirement in The Fundamental Rules and CCS (Pension) Rules, 1972Document10 pagesProvisions Relating To Pre-Mature Retirement in The Fundamental Rules and CCS (Pension) Rules, 1972anilNo ratings yet

- Balatbat Vs CA, GR NO. 109410Document2 pagesBalatbat Vs CA, GR NO. 109410Ryan AgcaoiliNo ratings yet

- In Re - Sabio V GordonDocument2 pagesIn Re - Sabio V GordonCarlota Nicolas VillaromanNo ratings yet

- NYC Man Arrested For Hacking SUNY Geneseo Student's Snapchat AccountDocument3 pagesNYC Man Arrested For Hacking SUNY Geneseo Student's Snapchat AccountNews 8 WROCNo ratings yet

- DIGEST - Republic v. SerenoDocument15 pagesDIGEST - Republic v. SerenoPrincess Agpaoa100% (1)

- PL and 3rd Paty Reply To Answer To Second ComplDocument2 pagesPL and 3rd Paty Reply To Answer To Second Complmdubard1No ratings yet

- CasesDocument21 pagesCasesKatrina Vianca DecapiaNo ratings yet

- AILA and AIC Release Survey Findings On DHS's Exercise of Prosecutorial Discretion in Immigration CourtDocument25 pagesAILA and AIC Release Survey Findings On DHS's Exercise of Prosecutorial Discretion in Immigration CourtUmesh HeendeniyaNo ratings yet

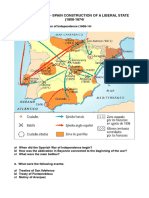

- Questionnaire Spain - Construction of A Liberal StateDocument3 pagesQuestionnaire Spain - Construction of A Liberal StateSAUL SILVANo ratings yet

- Toledo Vs CA (Jurisdiction)Document26 pagesToledo Vs CA (Jurisdiction)noorlaw100% (1)

- Caterino v. Barry, 1st Cir. (1993)Document37 pagesCaterino v. Barry, 1st Cir. (1993)Scribd Government DocsNo ratings yet

- ContractDocument6 pagesContractpankajNo ratings yet

- CLJ ExamDocument53 pagesCLJ ExamJeselyn Malaluan100% (1)

- Affidavit Mou Tutor Check SAISADDocument11 pagesAffidavit Mou Tutor Check SAISADJaiprakash SharmaNo ratings yet

- Amnesty International Power of WordsDocument2 pagesAmnesty International Power of WordsAngel Angeleri-priftis.100% (1)

- Vasanth and Co: Rating AdvisoryDocument8 pagesVasanth and Co: Rating Advisory18UCOM049 CLSURYANo ratings yet

- United States Court of Appeals, Third CircuitDocument16 pagesUnited States Court of Appeals, Third CircuitScribd Government DocsNo ratings yet

- Land Titles - 10 - MHH - PrintDocument6 pagesLand Titles - 10 - MHH - PrintLeo TumNo ratings yet

- Appointment Letter - DraftDocument5 pagesAppointment Letter - DraftKarishma ParekhNo ratings yet

- Google Terms of Service en-GB GBDocument16 pagesGoogle Terms of Service en-GB GBDon GaarganNo ratings yet

- Perez vs. Pumar, 2 Phil. 682 (EDWARD) VICENTE PEREZ, Plaintiff-Appellee, EUGENIO POMAR, Agent of The Compañia General de Tabacos, DefendantDocument22 pagesPerez vs. Pumar, 2 Phil. 682 (EDWARD) VICENTE PEREZ, Plaintiff-Appellee, EUGENIO POMAR, Agent of The Compañia General de Tabacos, DefendantJames Evan I. ObnamiaNo ratings yet

- Santiago V COMELEC DigestDocument4 pagesSantiago V COMELEC DigestWenzl BatestilNo ratings yet

- Verified Motion For Reconsideration: NLRC LAC NO. 07-002695-19 RAB CASE NO. RAB IV 7-01352-18-CDocument8 pagesVerified Motion For Reconsideration: NLRC LAC NO. 07-002695-19 RAB CASE NO. RAB IV 7-01352-18-CPau JoyosaNo ratings yet

- Muyonjo Amanda Elizabeth 2018Document77 pagesMuyonjo Amanda Elizabeth 2018abongilePandula16 YvonneNo ratings yet

- Affidavit of ConfessionDocument2 pagesAffidavit of ConfessionClimz AetherNo ratings yet

- Tax 1 PrimerDocument113 pagesTax 1 PrimerPatrice De CastroNo ratings yet

- Sales Questions GroupDocument8 pagesSales Questions GroupJymldy Encln100% (1)

- The Public Premises (Eviction of Unauthorised Occupants) Act, 1971 A N - 40 1971Document11 pagesThe Public Premises (Eviction of Unauthorised Occupants) Act, 1971 A N - 40 1971Chandra SekaranNo ratings yet

- S C J P S: Telefax No.: (074) 442-3071 E-Mail Address: Ub@ubaguio - Edu Website: WWW - Ubaguio.eduDocument4 pagesS C J P S: Telefax No.: (074) 442-3071 E-Mail Address: Ub@ubaguio - Edu Website: WWW - Ubaguio.eduUniversal CollabNo ratings yet