Professional Documents

Culture Documents

Factsheet - Globe Arbitrage April 2023

Factsheet - Globe Arbitrage April 2023

Uploaded by

Adnan JavedCopyright:

Available Formats

You might also like

- Sell 3rd Edition Ingram Test BankDocument26 pagesSell 3rd Edition Ingram Test BankWendyGouldepia100% (41)

- BBFA2203Document13 pagesBBFA2203Haryanie JNo ratings yet

- JM Financial - Initiating CoverageDocument11 pagesJM Financial - Initiating Coveragerchawdhry123No ratings yet

- Invesco India Caterpillar PortfolioDocument1 pageInvesco India Caterpillar PortfolioAnkurNo ratings yet

- Valuation Report - White Mushrooms HolidayMBDocument14 pagesValuation Report - White Mushrooms HolidayMBDHANAMNo ratings yet

- Latent View Analytics Limited Ipo: All You Need To Know AboutDocument7 pagesLatent View Analytics Limited Ipo: All You Need To Know AboutPeterNo ratings yet

- Sip 06 May 201010Document5 pagesSip 06 May 201010ram_rao28No ratings yet

- Tata Small Cap Fund-Leaflet - Dec'21Document2 pagesTata Small Cap Fund-Leaflet - Dec'21P SinghNo ratings yet

- ATRAM Total Return Peso Bond Fund - KIIDS Dec 2022Document4 pagesATRAM Total Return Peso Bond Fund - KIIDS Dec 2022ParazolaNo ratings yet

- QT Fund Public Version Feb2017v3Document15 pagesQT Fund Public Version Feb2017v3tjjnycNo ratings yet

- TA Asia Absolute Alpha Fund (TAAAAF) - USDDocument7 pagesTA Asia Absolute Alpha Fund (TAAAAF) - USDJason Wei Han LeeNo ratings yet

- Majesco HDFC Sec PDFDocument25 pagesMajesco HDFC Sec PDFJatin SoniNo ratings yet

- PC - IDFC Shriram Merger Event Update - July 2017 20170710181456Document9 pagesPC - IDFC Shriram Merger Event Update - July 2017 20170710181456Mee MeeNo ratings yet

- Research On CAMS by HDFC Securities - Nov 2020Document22 pagesResearch On CAMS by HDFC Securities - Nov 2020Sanjeet SahooNo ratings yet

- Quess CorpDocument22 pagesQuess CorpdcoolsamNo ratings yet

- UTI Asset Management Company: A Turnaround in The Works BUYDocument32 pagesUTI Asset Management Company: A Turnaround in The Works BUYGarvit GoyalNo ratings yet

- For Those Who Play To Win.: Midcap Fund Midcap FundDocument4 pagesFor Those Who Play To Win.: Midcap Fund Midcap FundABCNo ratings yet

- INF179K01CR2 - HDFC Midcap OpportunitiesDocument1 pageINF179K01CR2 - HDFC Midcap OpportunitiesKiran ChilukaNo ratings yet

- Interest Rate PolicyDocument6 pagesInterest Rate PolicyYogeshTiwariNo ratings yet

- MOSL NFAL Model Portfolio Equity ONE PAGERDocument1 pageMOSL NFAL Model Portfolio Equity ONE PAGERg1sreeNo ratings yet

- DSP Small Cap Fund Aug 2023Document7 pagesDSP Small Cap Fund Aug 2023RajNo ratings yet

- Fund Fact Sheet As at 31 July 2021: Investment ObjectiveDocument1 pageFund Fact Sheet As at 31 July 2021: Investment ObjectiveMohd Hafizi Abdul RahmanNo ratings yet

- Key Information Memorandum Cum Application FormDocument44 pagesKey Information Memorandum Cum Application FormChromoNo ratings yet

- 20007Document5 pages20007Archana J RetinueNo ratings yet

- IREDADocument8 pagesIREDAGorilla GondaNo ratings yet

- The Best Stock To Add To Your Portfolio This Month Is Here!: OCTOBER 2020Document9 pagesThe Best Stock To Add To Your Portfolio This Month Is Here!: OCTOBER 2020Vighnesh KurupNo ratings yet

- LT Emerging Business FundDocument2 pagesLT Emerging Business FundSankalp BaliarsinghNo ratings yet

- TMB EASTSPRING Global Core Equity Fund (Tmb-Es-Gcore) : YTD 3 Month 6 Month 1 YearDocument3 pagesTMB EASTSPRING Global Core Equity Fund (Tmb-Es-Gcore) : YTD 3 Month 6 Month 1 Yearaekkasit.seNo ratings yet

- BPI Global Equity Fund of Funds - September 2023 v2Document4 pagesBPI Global Equity Fund of Funds - September 2023 v2Ramon VinzonNo ratings yet

- Exxon Mobil Corporation: Stock Report - December 04, 2020 - NYSE Symbol: XOM - XOM Is in The S&P 500Document9 pagesExxon Mobil Corporation: Stock Report - December 04, 2020 - NYSE Symbol: XOM - XOM Is in The S&P 500garikai masawiNo ratings yet

- Kim - Canara Robeco Equity Tax Saver Fund - Regular Plan - 2021Document25 pagesKim - Canara Robeco Equity Tax Saver Fund - Regular Plan - 2021mayankNo ratings yet

- Multi Commodity Exchange: An AGM To Remember?Document10 pagesMulti Commodity Exchange: An AGM To Remember?parirNo ratings yet

- Jupiter Global Emerging Markets Corporate Bond Factsheet-GB-Retail-LU1551064923-En-GB PDFDocument4 pagesJupiter Global Emerging Markets Corporate Bond Factsheet-GB-Retail-LU1551064923-En-GB PDFeldime06No ratings yet

- ATRAM ASIA EQUITY OPPORTUNITY FEEDER FUND KIIDS - Sept 2021Document4 pagesATRAM ASIA EQUITY OPPORTUNITY FEEDER FUND KIIDS - Sept 2021Ma. Goretti Jica GulaNo ratings yet

- Tata Multicap Fund KIMDocument48 pagesTata Multicap Fund KIMstar-cdNo ratings yet

- Sbi Magnum Midcap Fund Factsheet (January-2021-34-1) PDFDocument1 pageSbi Magnum Midcap Fund Factsheet (January-2021-34-1) PDFavinash sengarNo ratings yet

- Eq - Uitf - Bpi Invest Phdef Jan 2021Document3 pagesEq - Uitf - Bpi Invest Phdef Jan 2021janeneveraNo ratings yet

- Buy Reliance CapitalDocument3 pagesBuy Reliance Capitaldps_virusNo ratings yet

- 7fab25fa-89b8-4495-88e8-da1026945df9Document14 pages7fab25fa-89b8-4495-88e8-da1026945df9MuhasinHaneefaNo ratings yet

- Tata Business Cycle Fund Kim Oct 2023 1Document30 pagesTata Business Cycle Fund Kim Oct 2023 18b2mdnkyjbNo ratings yet

- 5 Stocks For Accelerated Profit Apr2021Document28 pages5 Stocks For Accelerated Profit Apr2021Amrit KocharNo ratings yet

- Tata Capital - July 2023Document4 pagesTata Capital - July 2023Krishna GoyalNo ratings yet

- PMSGDSEP2022Document292 pagesPMSGDSEP2022Rohan ShahNo ratings yet

- HDFC MF 10 Year Challenge - Leaflet (As of January 31, 2019) - Low ResDocument4 pagesHDFC MF 10 Year Challenge - Leaflet (As of January 31, 2019) - Low ResYogesh RathodNo ratings yet

- Asset Allocation Fund (5) : Hybrid Hybrid BalancedDocument2 pagesAsset Allocation Fund (5) : Hybrid Hybrid BalancedHayston DezmenNo ratings yet

- Kotak Standard Multicap Fund: (An Open Ended Multi Cap Scheme)Document2 pagesKotak Standard Multicap Fund: (An Open Ended Multi Cap Scheme)Akshat JainNo ratings yet

- YatharthDocument8 pagesYatharthCp918315No ratings yet

- INF090I01569 - Franklin India Smaller Cos FundDocument1 pageINF090I01569 - Franklin India Smaller Cos FundKiran ChilukaNo ratings yet

- Prime PortfolioDocument2 pagesPrime PortfolioBina ShahNo ratings yet

- Eq Uitf Bpi Gefof Nov 2017Document4 pagesEq Uitf Bpi Gefof Nov 2017Jelor GallegoNo ratings yet

- Flip Book - Equity - February 2023Document21 pagesFlip Book - Equity - February 2023hgparekhNo ratings yet

- Royce Special EquityDocument1 pageRoyce Special EquityscottNo ratings yet

- AAM - High 50 Dividend Strategy 2019-3QDocument4 pagesAAM - High 50 Dividend Strategy 2019-3Qag rNo ratings yet

- Market View: For Suggestions, Feedback and QueriesDocument10 pagesMarket View: For Suggestions, Feedback and QueriesJhaveritradeNo ratings yet

- AshokLeyland 82 92Document7 pagesAshokLeyland 82 92ravi kumarNo ratings yet

- SBI Small Cap PDFDocument1 pageSBI Small Cap PDFJasmeet Singh NagpalNo ratings yet

- Inf200k01t28 - Sbi SmallcapDocument1 pageInf200k01t28 - Sbi SmallcapKiran ChilukaNo ratings yet

- FivestarDocument8 pagesFivestarAnkit KumarNo ratings yet

- Kotak Bank Edel 220118Document19 pagesKotak Bank Edel 220118suprabhattNo ratings yet

- Mfu Indiaeq Acc enDocument4 pagesMfu Indiaeq Acc enAlly Bin AssadNo ratings yet

- Financial Management: Reference Book Study Guide ACCA CPA CA CIMA BBA MBA: A Comprehensive GuideFrom EverandFinancial Management: Reference Book Study Guide ACCA CPA CA CIMA BBA MBA: A Comprehensive GuideNo ratings yet

- Discounted Cash Flow Demystified: A Comprehensive Guide to DCF BudgetingFrom EverandDiscounted Cash Flow Demystified: A Comprehensive Guide to DCF BudgetingNo ratings yet

- General Accounting 1 - Indianola Pharmaceutical CompanyDocument7 pagesGeneral Accounting 1 - Indianola Pharmaceutical CompanyRheu ReyesNo ratings yet

- Annual Repot 2021-22Document110 pagesAnnual Repot 2021-22Md. Ibrahim KhalilNo ratings yet

- Financial Accounting and AnalysisDocument7 pagesFinancial Accounting and AnalysisKush BafnaNo ratings yet

- Advanced Accounting 12th Edition Beams Solutions Manual Full Chapter PDFDocument52 pagesAdvanced Accounting 12th Edition Beams Solutions Manual Full Chapter PDFToniPerryyedo100% (11)

- Assistant Commissionerof Incometax, Circle 321, New DelhDocument11 pagesAssistant Commissionerof Incometax, Circle 321, New Delhankita tiwariNo ratings yet

- Home Office Branch Agency AccountingDocument11 pagesHome Office Branch Agency AccountingDarence IndayaNo ratings yet

- Voluntary Liquidation Under The Bvi Business Companies ActDocument7 pagesVoluntary Liquidation Under The Bvi Business Companies ActRenata ParettiNo ratings yet

- 3.2. Case 3Document27 pages3.2. Case 3Vishesh DugarNo ratings yet

- CV 2023062810202090Document3 pagesCV 2023062810202090Kumar SinghNo ratings yet

- CH6-7 Home QuizDocument5 pagesCH6-7 Home QuizAngel MenodiadoNo ratings yet

- Economy 25 - DPPDocument4 pagesEconomy 25 - DPPmikasha977No ratings yet

- EdelweissMF BookSummary TheManualIdeas-29Jan2021Document3 pagesEdelweissMF BookSummary TheManualIdeas-29Jan2021VaishnaviRavipatiNo ratings yet

- Cash Flow Statement Assignment No. 1 SOLDocument1 pageCash Flow Statement Assignment No. 1 SOLMahmoud IbrahimNo ratings yet

- Exam 3 AnsDocument4 pagesExam 3 AnsMahediNo ratings yet

- Ebook Financial Accounting 16Th Edition PDF Full Chapter PDFDocument67 pagesEbook Financial Accounting 16Th Edition PDF Full Chapter PDFjulie.morrill858100% (32)

- Balance SheetDocument3 pagesBalance SheetDina JurķeNo ratings yet

- Financial Statements TemplateDocument17 pagesFinancial Statements Templatevaddana haisocheatNo ratings yet

- Full Download Corporate Financial Accounting 14th Edition Warren Solutions ManualDocument35 pagesFull Download Corporate Financial Accounting 14th Edition Warren Solutions Manualmasonh7dswebb100% (42)

- Practice Exam - 2Document37 pagesPractice Exam - 2Aravind YogeshNo ratings yet

- Shareholder Demand LetterDocument3 pagesShareholder Demand LetterParalegal JGGCNo ratings yet

- Reading Material On EquityDocument82 pagesReading Material On EquityhashNo ratings yet

- BUS 498 ReportDocument16 pagesBUS 498 ReportTazkiyaNo ratings yet

- Goldiam International Annual Report 21-22Document172 pagesGoldiam International Annual Report 21-22Ayush GoelNo ratings yet

- II. Investment EnvironmentDocument45 pagesII. Investment EnvironmentRay MundNo ratings yet

- Adobe Scan 02-Feb-2023Document3 pagesAdobe Scan 02-Feb-2023Lokesh SenNo ratings yet

- Valuasi Ekonomi Penambangan Sumberdaya Belerang Kawah Ijen, Desa Tamansari, Kabupaten Banyuwangi, Provinsi Jawa Timur Latifatul KhoiriyahDocument10 pagesValuasi Ekonomi Penambangan Sumberdaya Belerang Kawah Ijen, Desa Tamansari, Kabupaten Banyuwangi, Provinsi Jawa Timur Latifatul Khoiriyahferdin sitinjakNo ratings yet

- MNCN - Laporan Informasi Dan Fakta Material - 31335204 - Lamp2Document4 pagesMNCN - Laporan Informasi Dan Fakta Material - 31335204 - Lamp2Andri ChandraNo ratings yet

- CF Question Paper t2Document3 pagesCF Question Paper t2KUSHI JAINNo ratings yet

Factsheet - Globe Arbitrage April 2023

Factsheet - Globe Arbitrage April 2023

Uploaded by

Adnan JavedOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Factsheet - Globe Arbitrage April 2023

Factsheet - Globe Arbitrage April 2023

Uploaded by

Adnan JavedCopyright:

Available Formats

Globe Arbitrage Factsheet

Portfolio Management Services | April 2023

Investment Objective Investment Strategy

Globe Arbitrage Strategy aims at investing in low risk Special Situation aims at generating returns by

strategies based on arbitrage opportunities. It also aims at exploiting market inefficiencies and other low risk

investing in various special situations in the market, based opportunities by using various strategies such as Cash

on corporate events and actions, which offer unique Future Arbitrage, Covered Calls/Puts, Pair Trading and

opportunities to earn an additional return without having tries to benefit from event arbitrage involving merger

to take on additional risk. & acquisitions, Open Offers, takeover, de-listing

and other special situations.

The strategy would make use of equity and derivatives to

augment returns in a relatively lower risk manner and to Focus is mainly on those companies transforming their

hedge against abnormal markets movements. capital structure, organization or taking place of an

event as opposed to focus on operations. Special

situations often depend on an event that ranges

between 6 months to 1 year.

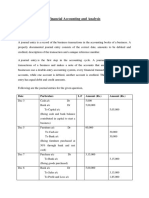

Scheme Details Top Holdings

ACC Ltd Ambuja Cement

Fund Manager: Mr. Parashuram Prasad

HDFC Bank HDFC Ltd

Benchmark: NIFTY 500

NMDC Unichem Lab

Tata Steel Tata Steel Long

Ticket Size: Rs 50 Lacs

JSW Steel JSW Ispat

Asset Allocation (%): Equity: 95 - 100 IDFC Ltd IDFC Bank

Trailing Returns (%)

1Y (CAGR) 2Y (CAGR) 3Y (CAGR) 5Y (CAGR) 10 Y (CAGR) Since Inception

(CAGR)

Strategy Retruns 7.48 19.91 40.07 19.61 16.96 14.07

25.81

Benchmark Returns 2.95 10.98 23.89 9.90 12.61 7.03

18.52

Each PMS account might have different portfolio holdings & returns.

*DISCLAIMER : Returns as ON 30/04/2023

Disclaimer:

The performance related information provided herein is not verified by SEBI. Investments in securities are subject to market risk, please read all documents related to the portfolio carefully. No

assurance or guarantee of the objectives of the portfolio can given or safety of corpus. Investors are requested to read and understand the investment strategy and take into consideration all risk

factors including their financial condition, suitability to risk return profile. It must kept in mind that the aforementioned statements/presentations cannot disclose all the risks and characteristics; top

holdings, market cap allocation are for a model portfolio. Past performance does not guarantee future performance. Neither the company, nor any person connected with it, accepts any liability

arising from the use of this document. This document is not for public distribution and has been furnished to you solely for your information and must not be reproduced or redistributed to any other

person. This document is not to be constructed as an offer to sell or solicitation of an offer to buy any security. While we Endeavour to update on a reasonable basis the information discussed in this

material, its accuracy or completeness cannot be guaranteed.

You might also like

- Sell 3rd Edition Ingram Test BankDocument26 pagesSell 3rd Edition Ingram Test BankWendyGouldepia100% (41)

- BBFA2203Document13 pagesBBFA2203Haryanie JNo ratings yet

- JM Financial - Initiating CoverageDocument11 pagesJM Financial - Initiating Coveragerchawdhry123No ratings yet

- Invesco India Caterpillar PortfolioDocument1 pageInvesco India Caterpillar PortfolioAnkurNo ratings yet

- Valuation Report - White Mushrooms HolidayMBDocument14 pagesValuation Report - White Mushrooms HolidayMBDHANAMNo ratings yet

- Latent View Analytics Limited Ipo: All You Need To Know AboutDocument7 pagesLatent View Analytics Limited Ipo: All You Need To Know AboutPeterNo ratings yet

- Sip 06 May 201010Document5 pagesSip 06 May 201010ram_rao28No ratings yet

- Tata Small Cap Fund-Leaflet - Dec'21Document2 pagesTata Small Cap Fund-Leaflet - Dec'21P SinghNo ratings yet

- ATRAM Total Return Peso Bond Fund - KIIDS Dec 2022Document4 pagesATRAM Total Return Peso Bond Fund - KIIDS Dec 2022ParazolaNo ratings yet

- QT Fund Public Version Feb2017v3Document15 pagesQT Fund Public Version Feb2017v3tjjnycNo ratings yet

- TA Asia Absolute Alpha Fund (TAAAAF) - USDDocument7 pagesTA Asia Absolute Alpha Fund (TAAAAF) - USDJason Wei Han LeeNo ratings yet

- Majesco HDFC Sec PDFDocument25 pagesMajesco HDFC Sec PDFJatin SoniNo ratings yet

- PC - IDFC Shriram Merger Event Update - July 2017 20170710181456Document9 pagesPC - IDFC Shriram Merger Event Update - July 2017 20170710181456Mee MeeNo ratings yet

- Research On CAMS by HDFC Securities - Nov 2020Document22 pagesResearch On CAMS by HDFC Securities - Nov 2020Sanjeet SahooNo ratings yet

- Quess CorpDocument22 pagesQuess CorpdcoolsamNo ratings yet

- UTI Asset Management Company: A Turnaround in The Works BUYDocument32 pagesUTI Asset Management Company: A Turnaround in The Works BUYGarvit GoyalNo ratings yet

- For Those Who Play To Win.: Midcap Fund Midcap FundDocument4 pagesFor Those Who Play To Win.: Midcap Fund Midcap FundABCNo ratings yet

- INF179K01CR2 - HDFC Midcap OpportunitiesDocument1 pageINF179K01CR2 - HDFC Midcap OpportunitiesKiran ChilukaNo ratings yet

- Interest Rate PolicyDocument6 pagesInterest Rate PolicyYogeshTiwariNo ratings yet

- MOSL NFAL Model Portfolio Equity ONE PAGERDocument1 pageMOSL NFAL Model Portfolio Equity ONE PAGERg1sreeNo ratings yet

- DSP Small Cap Fund Aug 2023Document7 pagesDSP Small Cap Fund Aug 2023RajNo ratings yet

- Fund Fact Sheet As at 31 July 2021: Investment ObjectiveDocument1 pageFund Fact Sheet As at 31 July 2021: Investment ObjectiveMohd Hafizi Abdul RahmanNo ratings yet

- Key Information Memorandum Cum Application FormDocument44 pagesKey Information Memorandum Cum Application FormChromoNo ratings yet

- 20007Document5 pages20007Archana J RetinueNo ratings yet

- IREDADocument8 pagesIREDAGorilla GondaNo ratings yet

- The Best Stock To Add To Your Portfolio This Month Is Here!: OCTOBER 2020Document9 pagesThe Best Stock To Add To Your Portfolio This Month Is Here!: OCTOBER 2020Vighnesh KurupNo ratings yet

- LT Emerging Business FundDocument2 pagesLT Emerging Business FundSankalp BaliarsinghNo ratings yet

- TMB EASTSPRING Global Core Equity Fund (Tmb-Es-Gcore) : YTD 3 Month 6 Month 1 YearDocument3 pagesTMB EASTSPRING Global Core Equity Fund (Tmb-Es-Gcore) : YTD 3 Month 6 Month 1 Yearaekkasit.seNo ratings yet

- BPI Global Equity Fund of Funds - September 2023 v2Document4 pagesBPI Global Equity Fund of Funds - September 2023 v2Ramon VinzonNo ratings yet

- Exxon Mobil Corporation: Stock Report - December 04, 2020 - NYSE Symbol: XOM - XOM Is in The S&P 500Document9 pagesExxon Mobil Corporation: Stock Report - December 04, 2020 - NYSE Symbol: XOM - XOM Is in The S&P 500garikai masawiNo ratings yet

- Kim - Canara Robeco Equity Tax Saver Fund - Regular Plan - 2021Document25 pagesKim - Canara Robeco Equity Tax Saver Fund - Regular Plan - 2021mayankNo ratings yet

- Multi Commodity Exchange: An AGM To Remember?Document10 pagesMulti Commodity Exchange: An AGM To Remember?parirNo ratings yet

- Jupiter Global Emerging Markets Corporate Bond Factsheet-GB-Retail-LU1551064923-En-GB PDFDocument4 pagesJupiter Global Emerging Markets Corporate Bond Factsheet-GB-Retail-LU1551064923-En-GB PDFeldime06No ratings yet

- ATRAM ASIA EQUITY OPPORTUNITY FEEDER FUND KIIDS - Sept 2021Document4 pagesATRAM ASIA EQUITY OPPORTUNITY FEEDER FUND KIIDS - Sept 2021Ma. Goretti Jica GulaNo ratings yet

- Tata Multicap Fund KIMDocument48 pagesTata Multicap Fund KIMstar-cdNo ratings yet

- Sbi Magnum Midcap Fund Factsheet (January-2021-34-1) PDFDocument1 pageSbi Magnum Midcap Fund Factsheet (January-2021-34-1) PDFavinash sengarNo ratings yet

- Eq - Uitf - Bpi Invest Phdef Jan 2021Document3 pagesEq - Uitf - Bpi Invest Phdef Jan 2021janeneveraNo ratings yet

- Buy Reliance CapitalDocument3 pagesBuy Reliance Capitaldps_virusNo ratings yet

- 7fab25fa-89b8-4495-88e8-da1026945df9Document14 pages7fab25fa-89b8-4495-88e8-da1026945df9MuhasinHaneefaNo ratings yet

- Tata Business Cycle Fund Kim Oct 2023 1Document30 pagesTata Business Cycle Fund Kim Oct 2023 18b2mdnkyjbNo ratings yet

- 5 Stocks For Accelerated Profit Apr2021Document28 pages5 Stocks For Accelerated Profit Apr2021Amrit KocharNo ratings yet

- Tata Capital - July 2023Document4 pagesTata Capital - July 2023Krishna GoyalNo ratings yet

- PMSGDSEP2022Document292 pagesPMSGDSEP2022Rohan ShahNo ratings yet

- HDFC MF 10 Year Challenge - Leaflet (As of January 31, 2019) - Low ResDocument4 pagesHDFC MF 10 Year Challenge - Leaflet (As of January 31, 2019) - Low ResYogesh RathodNo ratings yet

- Asset Allocation Fund (5) : Hybrid Hybrid BalancedDocument2 pagesAsset Allocation Fund (5) : Hybrid Hybrid BalancedHayston DezmenNo ratings yet

- Kotak Standard Multicap Fund: (An Open Ended Multi Cap Scheme)Document2 pagesKotak Standard Multicap Fund: (An Open Ended Multi Cap Scheme)Akshat JainNo ratings yet

- YatharthDocument8 pagesYatharthCp918315No ratings yet

- INF090I01569 - Franklin India Smaller Cos FundDocument1 pageINF090I01569 - Franklin India Smaller Cos FundKiran ChilukaNo ratings yet

- Prime PortfolioDocument2 pagesPrime PortfolioBina ShahNo ratings yet

- Eq Uitf Bpi Gefof Nov 2017Document4 pagesEq Uitf Bpi Gefof Nov 2017Jelor GallegoNo ratings yet

- Flip Book - Equity - February 2023Document21 pagesFlip Book - Equity - February 2023hgparekhNo ratings yet

- Royce Special EquityDocument1 pageRoyce Special EquityscottNo ratings yet

- AAM - High 50 Dividend Strategy 2019-3QDocument4 pagesAAM - High 50 Dividend Strategy 2019-3Qag rNo ratings yet

- Market View: For Suggestions, Feedback and QueriesDocument10 pagesMarket View: For Suggestions, Feedback and QueriesJhaveritradeNo ratings yet

- AshokLeyland 82 92Document7 pagesAshokLeyland 82 92ravi kumarNo ratings yet

- SBI Small Cap PDFDocument1 pageSBI Small Cap PDFJasmeet Singh NagpalNo ratings yet

- Inf200k01t28 - Sbi SmallcapDocument1 pageInf200k01t28 - Sbi SmallcapKiran ChilukaNo ratings yet

- FivestarDocument8 pagesFivestarAnkit KumarNo ratings yet

- Kotak Bank Edel 220118Document19 pagesKotak Bank Edel 220118suprabhattNo ratings yet

- Mfu Indiaeq Acc enDocument4 pagesMfu Indiaeq Acc enAlly Bin AssadNo ratings yet

- Financial Management: Reference Book Study Guide ACCA CPA CA CIMA BBA MBA: A Comprehensive GuideFrom EverandFinancial Management: Reference Book Study Guide ACCA CPA CA CIMA BBA MBA: A Comprehensive GuideNo ratings yet

- Discounted Cash Flow Demystified: A Comprehensive Guide to DCF BudgetingFrom EverandDiscounted Cash Flow Demystified: A Comprehensive Guide to DCF BudgetingNo ratings yet

- General Accounting 1 - Indianola Pharmaceutical CompanyDocument7 pagesGeneral Accounting 1 - Indianola Pharmaceutical CompanyRheu ReyesNo ratings yet

- Annual Repot 2021-22Document110 pagesAnnual Repot 2021-22Md. Ibrahim KhalilNo ratings yet

- Financial Accounting and AnalysisDocument7 pagesFinancial Accounting and AnalysisKush BafnaNo ratings yet

- Advanced Accounting 12th Edition Beams Solutions Manual Full Chapter PDFDocument52 pagesAdvanced Accounting 12th Edition Beams Solutions Manual Full Chapter PDFToniPerryyedo100% (11)

- Assistant Commissionerof Incometax, Circle 321, New DelhDocument11 pagesAssistant Commissionerof Incometax, Circle 321, New Delhankita tiwariNo ratings yet

- Home Office Branch Agency AccountingDocument11 pagesHome Office Branch Agency AccountingDarence IndayaNo ratings yet

- Voluntary Liquidation Under The Bvi Business Companies ActDocument7 pagesVoluntary Liquidation Under The Bvi Business Companies ActRenata ParettiNo ratings yet

- 3.2. Case 3Document27 pages3.2. Case 3Vishesh DugarNo ratings yet

- CV 2023062810202090Document3 pagesCV 2023062810202090Kumar SinghNo ratings yet

- CH6-7 Home QuizDocument5 pagesCH6-7 Home QuizAngel MenodiadoNo ratings yet

- Economy 25 - DPPDocument4 pagesEconomy 25 - DPPmikasha977No ratings yet

- EdelweissMF BookSummary TheManualIdeas-29Jan2021Document3 pagesEdelweissMF BookSummary TheManualIdeas-29Jan2021VaishnaviRavipatiNo ratings yet

- Cash Flow Statement Assignment No. 1 SOLDocument1 pageCash Flow Statement Assignment No. 1 SOLMahmoud IbrahimNo ratings yet

- Exam 3 AnsDocument4 pagesExam 3 AnsMahediNo ratings yet

- Ebook Financial Accounting 16Th Edition PDF Full Chapter PDFDocument67 pagesEbook Financial Accounting 16Th Edition PDF Full Chapter PDFjulie.morrill858100% (32)

- Balance SheetDocument3 pagesBalance SheetDina JurķeNo ratings yet

- Financial Statements TemplateDocument17 pagesFinancial Statements Templatevaddana haisocheatNo ratings yet

- Full Download Corporate Financial Accounting 14th Edition Warren Solutions ManualDocument35 pagesFull Download Corporate Financial Accounting 14th Edition Warren Solutions Manualmasonh7dswebb100% (42)

- Practice Exam - 2Document37 pagesPractice Exam - 2Aravind YogeshNo ratings yet

- Shareholder Demand LetterDocument3 pagesShareholder Demand LetterParalegal JGGCNo ratings yet

- Reading Material On EquityDocument82 pagesReading Material On EquityhashNo ratings yet

- BUS 498 ReportDocument16 pagesBUS 498 ReportTazkiyaNo ratings yet

- Goldiam International Annual Report 21-22Document172 pagesGoldiam International Annual Report 21-22Ayush GoelNo ratings yet

- II. Investment EnvironmentDocument45 pagesII. Investment EnvironmentRay MundNo ratings yet

- Adobe Scan 02-Feb-2023Document3 pagesAdobe Scan 02-Feb-2023Lokesh SenNo ratings yet

- Valuasi Ekonomi Penambangan Sumberdaya Belerang Kawah Ijen, Desa Tamansari, Kabupaten Banyuwangi, Provinsi Jawa Timur Latifatul KhoiriyahDocument10 pagesValuasi Ekonomi Penambangan Sumberdaya Belerang Kawah Ijen, Desa Tamansari, Kabupaten Banyuwangi, Provinsi Jawa Timur Latifatul Khoiriyahferdin sitinjakNo ratings yet

- MNCN - Laporan Informasi Dan Fakta Material - 31335204 - Lamp2Document4 pagesMNCN - Laporan Informasi Dan Fakta Material - 31335204 - Lamp2Andri ChandraNo ratings yet

- CF Question Paper t2Document3 pagesCF Question Paper t2KUSHI JAINNo ratings yet