Professional Documents

Culture Documents

Financial Statements With Notes To Fs

Financial Statements With Notes To Fs

Uploaded by

dimpy dCopyright:

Available Formats

You might also like

- #220923 Commercial InvoiceDocument1 page#220923 Commercial InvoiceLuciano GautoNo ratings yet

- Equipment Rental Business ProcessDocument1 pageEquipment Rental Business Processdimpy dNo ratings yet

- Auditing Problems3Document32 pagesAuditing Problems3Kimberly Milante100% (2)

- Financial Accounting 2 BBA 212 Instructions: 1 Answer One (1) Question Only Q. 1Document4 pagesFinancial Accounting 2 BBA 212 Instructions: 1 Answer One (1) Question Only Q. 1Mwilah Joshua ChalobaNo ratings yet

- Contoh Soal Pelaporan KorporatDocument4 pagesContoh Soal Pelaporan Korporatirma cahyani kawi0% (1)

- SBI Life InsuranceDocument73 pagesSBI Life Insuranceiloveyoujaan50% (6)

- Pooja MishraDocument7 pagesPooja MishrasmsmbaNo ratings yet

- Assessment Formal AssessmentDocument8 pagesAssessment Formal Assessmentashish100% (1)

- Output No. 2 - PAS 1 Instruction: Write Your Answers On Long Bond PapersDocument2 pagesOutput No. 2 - PAS 1 Instruction: Write Your Answers On Long Bond Papersnmdl123No ratings yet

- Chapter 3. Exercises Income StatementDocument6 pagesChapter 3. Exercises Income StatementHECTOR ORTEGANo ratings yet

- 2 Exercises On FS 2023-2024 Additional For GformDocument2 pages2 Exercises On FS 2023-2024 Additional For GformAmelia Dela CruzNo ratings yet

- Chapter-1 Homework Basic Concepts Part 1Document4 pagesChapter-1 Homework Basic Concepts Part 1Kenneth Christian WilburNo ratings yet

- Chapter 46 Cash Flow ComprehensiveDocument8 pagesChapter 46 Cash Flow ComprehensiveCheesca Macabanti - 12 Euclid-Digital ModularNo ratings yet

- Ap-Problems - 2015Document20 pagesAp-Problems - 2015jayson100% (1)

- Ias 1 - Questions..Document8 pagesIas 1 - Questions..Timothy KawumaNo ratings yet

- A221 MC 2 - StudentDocument7 pagesA221 MC 2 - StudentNajihah RazakNo ratings yet

- Preparing FSDocument7 pagesPreparing FSJohn AlbateraNo ratings yet

- Equity Method VS Cost MethodDocument14 pagesEquity Method VS Cost MethodMerliza JusayanNo ratings yet

- Exercises On Closing Entries & Reversing EntriesDocument3 pagesExercises On Closing Entries & Reversing EntriesRoy BonitezNo ratings yet

- Assessment MerchandisingDocument2 pagesAssessment MerchandisingPauline BiancaNo ratings yet

- 150.curren and Non Current Assets and Liabilities 2Document3 pages150.curren and Non Current Assets and Liabilities 2Melanie SamsonaNo ratings yet

- SFP and SCF - Practice QuestionsDocument3 pagesSFP and SCF - Practice QuestionsFazelah YakubNo ratings yet

- FinalsDocument7 pagesFinalsMarjorie UrbinoNo ratings yet

- CH 5Document2 pagesCH 5tigger5191No ratings yet

- AFAR Corporate LiquidationDocument4 pagesAFAR Corporate LiquidationAndres, Rebecca PaulaNo ratings yet

- AC3202 WK2 Exercises (22:23A)Document9 pagesAC3202 WK2 Exercises (22:23A)Long LongNo ratings yet

- Presentation of Properly Classified FSDocument9 pagesPresentation of Properly Classified FSpapa1No ratings yet

- Sample Problems Cash Flow AnalysisDocument2 pagesSample Problems Cash Flow AnalysisTeresa AlbertoNo ratings yet

- Soal IS Dan FS 2Document3 pagesSoal IS Dan FS 2Lala lalaNo ratings yet

- Cash Flow AnalysisDocument4 pagesCash Flow AnalysisMargin Pason RanjoNo ratings yet

- QuestionsDocument12 pagesQuestionsDolliejane MercadoNo ratings yet

- FAR Activity Feb 19 With AnswersDocument16 pagesFAR Activity Feb 19 With AnswersCybill AiraNo ratings yet

- Revision Pack QuestionsDocument12 pagesRevision Pack QuestionsAmmaarah PatelNo ratings yet

- Exercise Chap 5Document9 pagesExercise Chap 5JF FNo ratings yet

- Statement of Comprehensive IncomeDocument4 pagesStatement of Comprehensive Incomebobo tangaNo ratings yet

- AUDIT OF SHAREHOLDERS (Probs)Document4 pagesAUDIT OF SHAREHOLDERS (Probs)wingNo ratings yet

- Soal Cash FlowDocument6 pagesSoal Cash FlowSantiNo ratings yet

- Stock AqDocument19 pagesStock AqLyka RoguelNo ratings yet

- Buscom SeatworkDocument3 pagesBuscom SeatworkTintin AquinoNo ratings yet

- Far01 - The Financial Statements PresentationDocument10 pagesFar01 - The Financial Statements PresentationRNo ratings yet

- Compre Audit Cieloflawless Q PDFDocument3 pagesCompre Audit Cieloflawless Q PDFCarina Mae Valdez ValenciaNo ratings yet

- Westmont PLCDocument5 pagesWestmont PLCmutuamutisya306No ratings yet

- Question Bank Chapter 12Document4 pagesQuestion Bank Chapter 12Giang Thái HươngNo ratings yet

- CFAB - Accounting - QB - Chapter 13Document14 pagesCFAB - Accounting - QB - Chapter 13Huy NguyenNo ratings yet

- CPA 1 - Financial Accounting March 2021Document9 pagesCPA 1 - Financial Accounting March 2021Asaba GloriaNo ratings yet

- 8447809Document11 pages8447809blackghostNo ratings yet

- AFAR-02 Corporate LiquidationDocument2 pagesAFAR-02 Corporate LiquidationRamainne RonquilloNo ratings yet

- Chapter 13 Homework Assignment #2 QuestionsDocument8 pagesChapter 13 Homework Assignment #2 QuestionsCole Doty0% (1)

- Completing The Accounting Cycle - Merchandising YtDocument1 pageCompleting The Accounting Cycle - Merchandising YtGoogle UserNo ratings yet

- Adhila Sandra Devy - LF53 - Cash in FlowsDocument4 pagesAdhila Sandra Devy - LF53 - Cash in FlowsLydia limNo ratings yet

- Fabm Peta 3Document4 pagesFabm Peta 3JEWEL LHIEME ARCILLANo ratings yet

- Ho2 SciDocument2 pagesHo2 SciAbdullah JulkanainNo ratings yet

- Financial Statement ExamDocument2 pagesFinancial Statement ExamTam TamNo ratings yet

- Assignment 4 - Corporate LiquidationDocument5 pagesAssignment 4 - Corporate LiquidationEdmar PuruggananNo ratings yet

- ACC 221 - Intermediate Accounting 3 Exit Competency Exam: Additional InformationDocument2 pagesACC 221 - Intermediate Accounting 3 Exit Competency Exam: Additional InformationRyan PedroNo ratings yet

- Cash ExampleDocument1 pageCash ExampleFRANCIS IAN ALBARACIN IINo ratings yet

- Final Activity 3 QuestionDocument2 pagesFinal Activity 3 QuestionSze ChristienyNo ratings yet

- Quiz - Topic 5Document3 pagesQuiz - Topic 5mariakate LeeNo ratings yet

- Financial ManagementDocument9 pagesFinancial Managementkendrapancho9No ratings yet

- Module 10 Financial StatementsDocument17 pagesModule 10 Financial StatementsChristine CariñoNo ratings yet

- Closing EntriesDocument10 pagesClosing EntriesFranco DexterNo ratings yet

- A1 FS PreparationDocument1 pageA1 FS PreparationJudith DurensNo ratings yet

- Additional InformationDocument6 pagesAdditional InformationBabylyn NavarroNo ratings yet

- The Valuation of Digital Intangibles: Technology, Marketing and InternetFrom EverandThe Valuation of Digital Intangibles: Technology, Marketing and InternetNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Module 1 NotesDocument4 pagesModule 1 Notesdimpy dNo ratings yet

- VAT (Theory & Problem)Document10 pagesVAT (Theory & Problem)dimpy dNo ratings yet

- Estate Tax (Extra Notes)Document8 pagesEstate Tax (Extra Notes)dimpy dNo ratings yet

- Chapter 3 Value Added Tax (VAT)Document34 pagesChapter 3 Value Added Tax (VAT)dimpy dNo ratings yet

- Straight Problems Income Tax Bsa2Document2 pagesStraight Problems Income Tax Bsa2dimpy dNo ratings yet

- Solution To Problem 5Document2 pagesSolution To Problem 5dimpy dNo ratings yet

- LAW 1 ArtDocument1 pageLAW 1 Artdimpy dNo ratings yet

- For Tutoring SessionsDocument30 pagesFor Tutoring Sessionsdimpy dNo ratings yet

- Taxation 1-5Document6 pagesTaxation 1-5dimpy dNo ratings yet

- INTERMEDIATE ACCOUNTING 1 - Cash and Cash Equivalents - Comprehensive Sample ProblemsDocument2 pagesINTERMEDIATE ACCOUNTING 1 - Cash and Cash Equivalents - Comprehensive Sample Problemsdimpy dNo ratings yet

- Estate Tax (Exercises)Document3 pagesEstate Tax (Exercises)dimpy dNo ratings yet

- Liquidation of CompaniesDocument2 pagesLiquidation of CompanieshanumanthaiahgowdaNo ratings yet

- SummaryDocument3 pagesSummaryMaitet CarandangNo ratings yet

- FAR.3207 PPE-RevaluationDocument2 pagesFAR.3207 PPE-RevaluationMira Louise HernandezNo ratings yet

- Managerial AccountingDocument11 pagesManagerial AccountingKalyan MukkamulaNo ratings yet

- Treatment of Dividends in Consolidation - As 21Document3 pagesTreatment of Dividends in Consolidation - As 21Praveen BhargavaNo ratings yet

- Key AnswerDocument2 pagesKey AnswerBSA3Tagum MariletNo ratings yet

- RBI Memorandum On DEAF SchemeDocument2 pagesRBI Memorandum On DEAF SchemeMoneylife FoundationNo ratings yet

- ABMFABM2 - q1 - Mod2 - Statement of Comprehensive Income v2Document50 pagesABMFABM2 - q1 - Mod2 - Statement of Comprehensive Income v230 Odicta, Justine AnneNo ratings yet

- RBL Mitc FinalDocument40 pagesRBL Mitc Finalwebs adwordNo ratings yet

- LMAS - Lapkeu - Des 2020Document88 pagesLMAS - Lapkeu - Des 2020Edo AgusNo ratings yet

- Mock Question of Service Rules Objective QuestionDocument2 pagesMock Question of Service Rules Objective QuestionRavi100% (1)

- Jeevan Umang Comparison New TemplateDocument14 pagesJeevan Umang Comparison New TemplateDarshanNo ratings yet

- PSA ACCOUNTS - MR Desmond AboagyeDocument17 pagesPSA ACCOUNTS - MR Desmond AboagyeGen AbulkhairNo ratings yet

- Bibliography: BooksDocument6 pagesBibliography: BooksramNo ratings yet

- Credit Cards in VietnamDocument15 pagesCredit Cards in Vietnamquinn100% (1)

- Master Mind 2012 Page 36-38Document76 pagesMaster Mind 2012 Page 36-38Nikitas KouimanisNo ratings yet

- HBLDocument28 pagesHBLMalik Farasat AliNo ratings yet

- Questionnaire: Current A/c Saving A/cDocument2 pagesQuestionnaire: Current A/c Saving A/clucadNo ratings yet

- Account Statement 260122 250422Document23 pagesAccount Statement 260122 250422Shashi HublimathNo ratings yet

- Renovo FinancialDocument11 pagesRenovo FinancialRenovo Financial, LLCNo ratings yet

- G.R. No. L-62943Document10 pagesG.R. No. L-62943Rene ValentosNo ratings yet

- Fair Value Measurement Edited GDDocument37 pagesFair Value Measurement Edited GDyonas alemuNo ratings yet

- AgingbyGeneralLedgerAccount - Receivables Aging by General Ledger Account ReportDocument2 pagesAgingbyGeneralLedgerAccount - Receivables Aging by General Ledger Account ReportsureshNo ratings yet

- QUIZ AccountingDocument5 pagesQUIZ AccountingEzy Tri TANo ratings yet

- Weekly Post-Class Online Quiz #4Document8 pagesWeekly Post-Class Online Quiz #4Nghi AnNo ratings yet

- Solution To Example 1:: Property, Plant and Equipment - Part 3 - Solutions To ExamplesDocument11 pagesSolution To Example 1:: Property, Plant and Equipment - Part 3 - Solutions To ExamplesLayNo ratings yet

Financial Statements With Notes To Fs

Financial Statements With Notes To Fs

Uploaded by

dimpy dOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Statements With Notes To Fs

Financial Statements With Notes To Fs

Uploaded by

dimpy dCopyright:

Available Formats

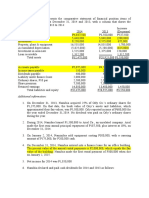

ACCOUNTING 102

Financial Statements

The following account balances are taken from the ledger of Djukovic Corporation as of December 31, 2011:

Ordinary share capital 31,000,000 Share premium 2,150,000

Merchandise inventory, Jan. 1 7,329,000 Merchandise inventory, Dec. 31 8,245,00

Security services

140,000

Investment in ABC ordinary shares 946,000 Accrued expenses 286,000

Investment income 106,000 Investment in equity securities 1,887,000

Land 9,480,000 Building 22,770,000

Purchases 65,336,000 Purchase discount 1,084,000

Commission expense 145,000 Unrealized gain – OCI 18,000

Sales salaries 1,200,000 Office salaries 2,400,000

Gain on foreign currency 39,000 Interest expense 633,000

BSP treasury bills 540,000 Prepaid building insurance 42,000

Creditors’ accounts with debit balances 29,000 Franchise 3,500,000

Store equipment 870,000 Accum. depr. – Building 2,548,000

Investment in affiliate 2,800,000

Advances to affiliates 600,000 Bonds payable 5,000,000

Accum. depr. – Store equipment 154,000 Sales discount 886,000

Freight in 1,258,000 Mortgage payable 4,800,000

Dividend revenue 45,000 Depreciation – Building 320,000

Depreciation – Office equipment 48,000 Leasehold 540,000

Office equipment 684,000

Bank overdraft 32,000 Cash in closed bank 276,000

Investment in DEF bonds 2,950,000 Accounts receivable 10,658,000

Notes payable 845,000 Interest income 53,000

Store equipment repairs 19,000 Insurance expense – Building 48,000

Accum. depr. - Office equipment 132,000

Appropriated for contingencies 400,000 Share dividends payable 1,200,000

Accounts payable 8,336,000 Treasury shares , 6,000 shares, at cost 720,000

Time deposit 2,200,000 Sales returns & allowances 626,000

Purchase returns 884,000 Commission income 387,000

Legal expenses 156,000 Freight out 226,000

VAT payable 234,000 SSS contributions 204,000

Philhealth contributions 48,000 Light, telephone & water 359,000

Auditing fees 240,000 Pag-ibig contributions 72,000

Change fund 10,000 Cash surrender value of life insurance 346,000

Withholding taxes payable 84,000 Unused supplies 38,000

Loss on accident 177,000 SSS, PH & Pag-ibig payable 83,000

Estimated warranties liability 805,000 Unearned income 56,000

Miscellaneous selling expenses 62,000

Miscellaneous office expenses 37,000 Depreciation – Store equipment 39,000

Sales 81,841,000 Land held for speculation 2,500,000

Idle land 1,200,000 Cash in banks ?

Retained earnings 8,765,000 Dividends paid during the year 1,000,000

Share premium-Treasury shares 50,000 Appropriated for sinking fund 1,000,000

Share premium-Share dividends 240,000

Additional information:

1. The entity adopted significant accounting policies which are in accordance with the Philippine Financial

Reporting Standards and the rules and regulations of the Securities and Exchange Commission. These

accounting policies have been applied on a consistent basis.

2. The ordinary shares consist of 500,000 shares authorized with a par value of 100 per share. During the year,

32,000 shares were issued at 112 per share.

3. The straight line method of depreciation is used for all property and equipment items based on their estimated

lives. The building is occupied 60% by the sales office and 40% by the administrative office.

4. Merchandise inventory is valued using the first-in, first-out method of costing, periodic basis

5. The BSP treasury bills were acquired on November 30, 2011 and will mature on January 15, 2012.

6. The investment in affiliate consists of 25,000 ordinary shares of Roland Garros Corporation representing a

25% interest in the total authorized capital of the corporation.

7. The investment in ABC ordinary shares and in DEF bonds are held for trading purposes. Their fair values at

year-end are 972,000 and 2,980,000, respectively.

8. The investment in equity securities are not held for trading. Its fair value at year-end is 1,852,000.

9. The time deposit of 2,200,000 is a 4.5% 60-day time deposit opened at BDO on December 7, 2011.

10. The mortgage payable is a 3-year 18% loan obtained from Banco de Oro on August 1, 2011. It is payable in

three equal annual installments plus interest beginning August 1, 2012. It is secured by a mortgage on the

company’s land and building.

11. Retained earnings was appropriated for sinking fund during the year, 500,000.

12. Payroll contributions are to be allocated to selling and administrative expenses in the ratio of salaries.

REQUIRED

Prepare a statement of comprehensive income, a statement of financial position and a statement of changes in

equity based on Philippine Financial Reporting Standards including any notes to financial statements.

You might also like

- #220923 Commercial InvoiceDocument1 page#220923 Commercial InvoiceLuciano GautoNo ratings yet

- Equipment Rental Business ProcessDocument1 pageEquipment Rental Business Processdimpy dNo ratings yet

- Auditing Problems3Document32 pagesAuditing Problems3Kimberly Milante100% (2)

- Financial Accounting 2 BBA 212 Instructions: 1 Answer One (1) Question Only Q. 1Document4 pagesFinancial Accounting 2 BBA 212 Instructions: 1 Answer One (1) Question Only Q. 1Mwilah Joshua ChalobaNo ratings yet

- Contoh Soal Pelaporan KorporatDocument4 pagesContoh Soal Pelaporan Korporatirma cahyani kawi0% (1)

- SBI Life InsuranceDocument73 pagesSBI Life Insuranceiloveyoujaan50% (6)

- Pooja MishraDocument7 pagesPooja MishrasmsmbaNo ratings yet

- Assessment Formal AssessmentDocument8 pagesAssessment Formal Assessmentashish100% (1)

- Output No. 2 - PAS 1 Instruction: Write Your Answers On Long Bond PapersDocument2 pagesOutput No. 2 - PAS 1 Instruction: Write Your Answers On Long Bond Papersnmdl123No ratings yet

- Chapter 3. Exercises Income StatementDocument6 pagesChapter 3. Exercises Income StatementHECTOR ORTEGANo ratings yet

- 2 Exercises On FS 2023-2024 Additional For GformDocument2 pages2 Exercises On FS 2023-2024 Additional For GformAmelia Dela CruzNo ratings yet

- Chapter-1 Homework Basic Concepts Part 1Document4 pagesChapter-1 Homework Basic Concepts Part 1Kenneth Christian WilburNo ratings yet

- Chapter 46 Cash Flow ComprehensiveDocument8 pagesChapter 46 Cash Flow ComprehensiveCheesca Macabanti - 12 Euclid-Digital ModularNo ratings yet

- Ap-Problems - 2015Document20 pagesAp-Problems - 2015jayson100% (1)

- Ias 1 - Questions..Document8 pagesIas 1 - Questions..Timothy KawumaNo ratings yet

- A221 MC 2 - StudentDocument7 pagesA221 MC 2 - StudentNajihah RazakNo ratings yet

- Preparing FSDocument7 pagesPreparing FSJohn AlbateraNo ratings yet

- Equity Method VS Cost MethodDocument14 pagesEquity Method VS Cost MethodMerliza JusayanNo ratings yet

- Exercises On Closing Entries & Reversing EntriesDocument3 pagesExercises On Closing Entries & Reversing EntriesRoy BonitezNo ratings yet

- Assessment MerchandisingDocument2 pagesAssessment MerchandisingPauline BiancaNo ratings yet

- 150.curren and Non Current Assets and Liabilities 2Document3 pages150.curren and Non Current Assets and Liabilities 2Melanie SamsonaNo ratings yet

- SFP and SCF - Practice QuestionsDocument3 pagesSFP and SCF - Practice QuestionsFazelah YakubNo ratings yet

- FinalsDocument7 pagesFinalsMarjorie UrbinoNo ratings yet

- CH 5Document2 pagesCH 5tigger5191No ratings yet

- AFAR Corporate LiquidationDocument4 pagesAFAR Corporate LiquidationAndres, Rebecca PaulaNo ratings yet

- AC3202 WK2 Exercises (22:23A)Document9 pagesAC3202 WK2 Exercises (22:23A)Long LongNo ratings yet

- Presentation of Properly Classified FSDocument9 pagesPresentation of Properly Classified FSpapa1No ratings yet

- Sample Problems Cash Flow AnalysisDocument2 pagesSample Problems Cash Flow AnalysisTeresa AlbertoNo ratings yet

- Soal IS Dan FS 2Document3 pagesSoal IS Dan FS 2Lala lalaNo ratings yet

- Cash Flow AnalysisDocument4 pagesCash Flow AnalysisMargin Pason RanjoNo ratings yet

- QuestionsDocument12 pagesQuestionsDolliejane MercadoNo ratings yet

- FAR Activity Feb 19 With AnswersDocument16 pagesFAR Activity Feb 19 With AnswersCybill AiraNo ratings yet

- Revision Pack QuestionsDocument12 pagesRevision Pack QuestionsAmmaarah PatelNo ratings yet

- Exercise Chap 5Document9 pagesExercise Chap 5JF FNo ratings yet

- Statement of Comprehensive IncomeDocument4 pagesStatement of Comprehensive Incomebobo tangaNo ratings yet

- AUDIT OF SHAREHOLDERS (Probs)Document4 pagesAUDIT OF SHAREHOLDERS (Probs)wingNo ratings yet

- Soal Cash FlowDocument6 pagesSoal Cash FlowSantiNo ratings yet

- Stock AqDocument19 pagesStock AqLyka RoguelNo ratings yet

- Buscom SeatworkDocument3 pagesBuscom SeatworkTintin AquinoNo ratings yet

- Far01 - The Financial Statements PresentationDocument10 pagesFar01 - The Financial Statements PresentationRNo ratings yet

- Compre Audit Cieloflawless Q PDFDocument3 pagesCompre Audit Cieloflawless Q PDFCarina Mae Valdez ValenciaNo ratings yet

- Westmont PLCDocument5 pagesWestmont PLCmutuamutisya306No ratings yet

- Question Bank Chapter 12Document4 pagesQuestion Bank Chapter 12Giang Thái HươngNo ratings yet

- CFAB - Accounting - QB - Chapter 13Document14 pagesCFAB - Accounting - QB - Chapter 13Huy NguyenNo ratings yet

- CPA 1 - Financial Accounting March 2021Document9 pagesCPA 1 - Financial Accounting March 2021Asaba GloriaNo ratings yet

- 8447809Document11 pages8447809blackghostNo ratings yet

- AFAR-02 Corporate LiquidationDocument2 pagesAFAR-02 Corporate LiquidationRamainne RonquilloNo ratings yet

- Chapter 13 Homework Assignment #2 QuestionsDocument8 pagesChapter 13 Homework Assignment #2 QuestionsCole Doty0% (1)

- Completing The Accounting Cycle - Merchandising YtDocument1 pageCompleting The Accounting Cycle - Merchandising YtGoogle UserNo ratings yet

- Adhila Sandra Devy - LF53 - Cash in FlowsDocument4 pagesAdhila Sandra Devy - LF53 - Cash in FlowsLydia limNo ratings yet

- Fabm Peta 3Document4 pagesFabm Peta 3JEWEL LHIEME ARCILLANo ratings yet

- Ho2 SciDocument2 pagesHo2 SciAbdullah JulkanainNo ratings yet

- Financial Statement ExamDocument2 pagesFinancial Statement ExamTam TamNo ratings yet

- Assignment 4 - Corporate LiquidationDocument5 pagesAssignment 4 - Corporate LiquidationEdmar PuruggananNo ratings yet

- ACC 221 - Intermediate Accounting 3 Exit Competency Exam: Additional InformationDocument2 pagesACC 221 - Intermediate Accounting 3 Exit Competency Exam: Additional InformationRyan PedroNo ratings yet

- Cash ExampleDocument1 pageCash ExampleFRANCIS IAN ALBARACIN IINo ratings yet

- Final Activity 3 QuestionDocument2 pagesFinal Activity 3 QuestionSze ChristienyNo ratings yet

- Quiz - Topic 5Document3 pagesQuiz - Topic 5mariakate LeeNo ratings yet

- Financial ManagementDocument9 pagesFinancial Managementkendrapancho9No ratings yet

- Module 10 Financial StatementsDocument17 pagesModule 10 Financial StatementsChristine CariñoNo ratings yet

- Closing EntriesDocument10 pagesClosing EntriesFranco DexterNo ratings yet

- A1 FS PreparationDocument1 pageA1 FS PreparationJudith DurensNo ratings yet

- Additional InformationDocument6 pagesAdditional InformationBabylyn NavarroNo ratings yet

- The Valuation of Digital Intangibles: Technology, Marketing and InternetFrom EverandThe Valuation of Digital Intangibles: Technology, Marketing and InternetNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Module 1 NotesDocument4 pagesModule 1 Notesdimpy dNo ratings yet

- VAT (Theory & Problem)Document10 pagesVAT (Theory & Problem)dimpy dNo ratings yet

- Estate Tax (Extra Notes)Document8 pagesEstate Tax (Extra Notes)dimpy dNo ratings yet

- Chapter 3 Value Added Tax (VAT)Document34 pagesChapter 3 Value Added Tax (VAT)dimpy dNo ratings yet

- Straight Problems Income Tax Bsa2Document2 pagesStraight Problems Income Tax Bsa2dimpy dNo ratings yet

- Solution To Problem 5Document2 pagesSolution To Problem 5dimpy dNo ratings yet

- LAW 1 ArtDocument1 pageLAW 1 Artdimpy dNo ratings yet

- For Tutoring SessionsDocument30 pagesFor Tutoring Sessionsdimpy dNo ratings yet

- Taxation 1-5Document6 pagesTaxation 1-5dimpy dNo ratings yet

- INTERMEDIATE ACCOUNTING 1 - Cash and Cash Equivalents - Comprehensive Sample ProblemsDocument2 pagesINTERMEDIATE ACCOUNTING 1 - Cash and Cash Equivalents - Comprehensive Sample Problemsdimpy dNo ratings yet

- Estate Tax (Exercises)Document3 pagesEstate Tax (Exercises)dimpy dNo ratings yet

- Liquidation of CompaniesDocument2 pagesLiquidation of CompanieshanumanthaiahgowdaNo ratings yet

- SummaryDocument3 pagesSummaryMaitet CarandangNo ratings yet

- FAR.3207 PPE-RevaluationDocument2 pagesFAR.3207 PPE-RevaluationMira Louise HernandezNo ratings yet

- Managerial AccountingDocument11 pagesManagerial AccountingKalyan MukkamulaNo ratings yet

- Treatment of Dividends in Consolidation - As 21Document3 pagesTreatment of Dividends in Consolidation - As 21Praveen BhargavaNo ratings yet

- Key AnswerDocument2 pagesKey AnswerBSA3Tagum MariletNo ratings yet

- RBI Memorandum On DEAF SchemeDocument2 pagesRBI Memorandum On DEAF SchemeMoneylife FoundationNo ratings yet

- ABMFABM2 - q1 - Mod2 - Statement of Comprehensive Income v2Document50 pagesABMFABM2 - q1 - Mod2 - Statement of Comprehensive Income v230 Odicta, Justine AnneNo ratings yet

- RBL Mitc FinalDocument40 pagesRBL Mitc Finalwebs adwordNo ratings yet

- LMAS - Lapkeu - Des 2020Document88 pagesLMAS - Lapkeu - Des 2020Edo AgusNo ratings yet

- Mock Question of Service Rules Objective QuestionDocument2 pagesMock Question of Service Rules Objective QuestionRavi100% (1)

- Jeevan Umang Comparison New TemplateDocument14 pagesJeevan Umang Comparison New TemplateDarshanNo ratings yet

- PSA ACCOUNTS - MR Desmond AboagyeDocument17 pagesPSA ACCOUNTS - MR Desmond AboagyeGen AbulkhairNo ratings yet

- Bibliography: BooksDocument6 pagesBibliography: BooksramNo ratings yet

- Credit Cards in VietnamDocument15 pagesCredit Cards in Vietnamquinn100% (1)

- Master Mind 2012 Page 36-38Document76 pagesMaster Mind 2012 Page 36-38Nikitas KouimanisNo ratings yet

- HBLDocument28 pagesHBLMalik Farasat AliNo ratings yet

- Questionnaire: Current A/c Saving A/cDocument2 pagesQuestionnaire: Current A/c Saving A/clucadNo ratings yet

- Account Statement 260122 250422Document23 pagesAccount Statement 260122 250422Shashi HublimathNo ratings yet

- Renovo FinancialDocument11 pagesRenovo FinancialRenovo Financial, LLCNo ratings yet

- G.R. No. L-62943Document10 pagesG.R. No. L-62943Rene ValentosNo ratings yet

- Fair Value Measurement Edited GDDocument37 pagesFair Value Measurement Edited GDyonas alemuNo ratings yet

- AgingbyGeneralLedgerAccount - Receivables Aging by General Ledger Account ReportDocument2 pagesAgingbyGeneralLedgerAccount - Receivables Aging by General Ledger Account ReportsureshNo ratings yet

- QUIZ AccountingDocument5 pagesQUIZ AccountingEzy Tri TANo ratings yet

- Weekly Post-Class Online Quiz #4Document8 pagesWeekly Post-Class Online Quiz #4Nghi AnNo ratings yet

- Solution To Example 1:: Property, Plant and Equipment - Part 3 - Solutions To ExamplesDocument11 pagesSolution To Example 1:: Property, Plant and Equipment - Part 3 - Solutions To ExamplesLayNo ratings yet