Professional Documents

Culture Documents

Eskom Fixed Rate Notes - Pricing Supplement Oct 2013

Eskom Fixed Rate Notes - Pricing Supplement Oct 2013

Uploaded by

Willing ZvirevoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Eskom Fixed Rate Notes - Pricing Supplement Oct 2013

Eskom Fixed Rate Notes - Pricing Supplement Oct 2013

Uploaded by

Willing ZvirevoCopyright:

Available Formats

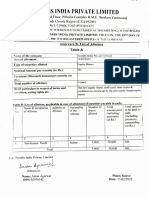

AGR/E/ES42 PRELIMINARY PRICING SUPPLEMENT - 21 Oct 2013

PRICING SUPPLEMENT

ESKOM HOLDINGS SOC LIMITED

(Incorporated in the Republic of South Africa with limited liability under

Registration Number 2002/015527/06)

Listing of ZAR 250,000,000 8.50% Unsecured Fixed Rate Notes due

25 April 2042

Under its ZAR 100,000,000,000 Domestic Multi-Term Note Programme

This document constitutes the Applicable Pricing Supplement relating to the

issue of Notes described herein. Terms used herein shall be deemed to be

defined as such for the purposes of the Terms and Conditions set forth in the

Programme Memorandum dated 04 February 2010. The Notes described in

this Applicable Pricing Supplement contains the final terms of the Notes and

this Applicable Pricing Supplement must be read in conjunction with such

Programme Memorandum. To the extent that there is any conflict or

inconsistency between the contents of this Pricing Supplement and the

Programme Memorandum, the provisions of this Pricing Supplement shall

prevail.

DESCRIPTION OF THE NOTES

1. Issuer Eskom Holdings SOC Limited

2. Guarantor RSA

3. Status of Notes Unsecured

4. Form of Notes Registered Notes

5. Series Number 10

6. Tranche Number 8

7. Aggregate Nominal Amount:

(a) Series ZAR 4,900,000,000.00

(b) Tranche Listed ZAR 250,000,000.00

8. Interest Payment Basis Fixed Rate

Page 2

9. Automatic/Optional Conversion N/A

from, one

Interest/Redemption/Payment

Basis to another

10. Issue Date 24 October 2013

11. Nominal Amount per Note ZAR 1,000,000

12. Specified Denomination ZAR 1,000,000

13. Issue Price 90.13153%

14. Interest Commencement Date 25 April 2013 (first coupon calculated with

accrued interest, which is payable on 25

October 2013

15. Maturity Date 25 April 2042

16. Applicable Business Day Modified Following Business Day

Convention

17. Final Redemption Amount 100% of the Nominal Amount

18. Last Date to Register 17h00 on 14 April and 14 October of each

year.

19. Books Closed Period(s) The Register will be closed from 15 April to

25 April and from 15 October to 25

October (all dates inclusive) in each year

until the Maturity Date.

20. Default Rate N/A

Page 3

Programme Amount

21. Programme Amount as at the ZAR 100,000,000,000

Issue date

22. Aggregate outstanding Nominal ZAR 84,644,287,732

amount of all the Notes issued under

the Programme (including Notes

issued under the Programme

pursuant to the previous Programme

Memorandum as at the Issue date)

FIXED RATE NOTES

23(a) Fixed Rate of Interest 8.50% per cent. per annum payable semi-

annually in arrear

(b) Fixed Interest Payment 25 April and 25 October in each year up to

Date(s) and including the Maturity Date

(c) Fixed Coupon Amount(s)

(d) Initial Broken Amount N/A

(e) Final Broken Amount N/A

(f) Determination Date(s) 25 April and 25 October of each year

(g) Day Count Fraction Actual/365

(h) Any other terms relating to N/A

the particular method of

calculating interest

Page 4

PROVISIONS REGARDING

REDEMPTION/MATURITY

24. Issuer and Guarantor’s Optional No

Redemption:

If yes:

(a) Optional Redemption Date(s) N/A

(b) Optional Redemption N/A

Amount(s) and method, if

any, of calculation of such

amount(s)

(c) Minimum period of notice (if N/A

different from Condition 8.3)

(d) If redeemable in part: N/A

Minimum Redemption N/A

Amount(s)

Higher Redemption N/A

Amount(s)

(e) Other terms applicable on

Redemption

25. Early Redemption for taxation YES

reasons or on Event of Default(if

required)

If no:

a. Amount Payable or N/A

b. Method of calculation of amount N/A

payable

Page 5

GENERAL

26. Financial Exchange JSE

27 Calculation Agent Issuer

28. Paying Agent Issuer

29 Specified office of the Paying Maxwell Drive, Megawatt Park, Sunninghill,

Agent 2157, South Africa

30. Transfer Agent Issuer

31. Specified office of the Transfer Maxwell Drive, Megawatt Park, Sunninghill,

Agent 2157, South Africa

Tel: (011) 800 5025

Fax: (011) 800 4173

32. Provisions relating to stabilisation N/A

33. Stabilising manager N/A

34. Additional selling restrictions N/A

35. ISIN ZAG000107780

36. Stock Code ES42

37. The notice period required for 14 days prior to the requested date of such

exchanging Uncertificated Notes for exchange

Individual Certificates

38. Method of distribution N/A

39. If syndicated, names of Managers N/A

40. If non-syndicated, name of Dealer Issuer

Page 6

41. Governing law (if the laws of

N/A

South Africa are not applicable)

42. Surrendering of Notes 14 days after the date on which the

Certificate in respect of the Note to be

redeemed has been surrendered to the

Issuer

43. Use of proceeds N/A

44. Pricing Methodology Standard JSE pricing methodology

45. Other provisions N/A

46.CapitalRaisingProcess Open market auction/Reverse enquiry

47. Credit rating outlook

Rating Outlook

Standard & Poor’s

- Foreign currency BBB Negative

- Local currency BBB

Moody's

- Foreign currency Baa3 Negative

- Local currency Baa3

Fitch

- National Long-term (zar) AA+ Stable

- National Short-term (zar) F1+

Page 7

DISCLOSURE REQUIREMENTS IN TERMS OF PARAGRAPH 3(5) OF

Commercial Paper Regulation

48. Paragraph 3(5)(a)

The ultimate borrower is the Issuer.

49. Paragraph 3(5)(b)

The Issuer is a going concern and can in all circumstances be reasonably

expected to meet its commitments under the Notes.

50. Paragraph 3(5)(c)

The auditors of the Issuer are KPMG Inc. and SizweNtsalubaGobodo Inc.

51. Paragraph 3(5)(d)

As at the date of this Supplement:

(i) The Issuer has the following commercial paper in issue in the

domestic market:

a. ZAR 13,089,421,410.47 short dated commercial paper bills

b. ZAR 94,066,234,811 bonds

c. ZAR 2,000,000,000 floating rate notes; and

(ii) to the best of the Issuer’s knowledge and belief, the Issuer estimates

to issue the following during the current financial year, ending 31

March 2014:

a. a further ZAR 2,573,000,000.00 of bonds

b. ZAR 7,436,000,000.00 of commercial paper as and when the

current paper in issue matures.

Page 8

52. Paragraph 3(5)(e)

All information that may reasonably be necessary to enable the lender to

ascertain the nature of the financial and commercial risk of its investment

in the Notes is contained in the Programme Memorandum and the

Applicable Pricing Supplement.

53. Paragraph 3(5)(f)

There has been no material adverse change in the Issuer’s financial

position since the date of its last audited financial statements.

54. Paragraph 3(5)(g)

The Notes issued will be listed on JSE

55. Paragraph 3(5)(h)

The funds to be raised through the issue of the Notes are to be used by

the Issuer for the funding of its business operations within the Eskom

Group.

56. Paragraph 3(5)(i)

The obligations of the Issuer in respect of the Notes are unsecured.

57. Paragraph 3(5)(j)

KPMG Inc. and SizweNtsalubaGobodo Inc, the statutory auditors of the

Issuer, have confirmed that nothing has come to their attention to indicate

that this issue of Notes under the Programme will not comply in all

respects with the relevant provisions of the Commercial Paper

Regulations.

The Issuer’s latest audited financial statements as at 31 March 2013 are

deemed to be incorporated in, and to form part of the Programme

Memorandum and are available free of charge to each person to whom a

copy of the Programme Memorandum has been delivered, upon request

of such person.

Page 9

Responsibility

The Applicant Issuer certifies that to the best of their knowledge and belief

there are no facts that have been omitted which would make any statement

false or misleading and that all reasonable enquiries to ascertain such facts

have been made as well as that the Placing Document contains all

information required by law and the JSE Listings Requirements. The Applicant

Issuer accepts full responsibility for the accuracy of the information contained

in the Placing Document, Pricing Supplements and the annual financial report,

the amendments to the annual financial report or any supplements from time

to time, except as otherwise stated therein.

Application is hereby made to list this issue of Notes on the 24 October 2013.

SIGNED at Johannesburg on this___________________ day of October 2013

for and on behalf of.

ESKOM HOLDINGS SOC LIMITED

(as Issuer)

______________________ ____________________

BA DAMES Z TSOTSI

CHIEF EXECUTIVE CHAIRMAN

Who warrants his authority hereto Who warrants his authority hereto

You might also like

- FCO ABOGLOBE-Lonca-Trade-28-FEBDocument4 pagesFCO ABOGLOBE-Lonca-Trade-28-FEBabssglobalmarketingNo ratings yet

- CCFE - Mock Test 1 - AnswersDocument7 pagesCCFE - Mock Test 1 - Answersshaunak goswami86% (7)

- Pricing SupplementDocument7 pagesPricing SupplementRajendra AvinashNo ratings yet

- Tipper Truck Bid DocumentDocument93 pagesTipper Truck Bid DocumentDeependraNo ratings yet

- Canara Robeco AMC TeamDocument29 pagesCanara Robeco AMC TeamSarfarazzKhanNo ratings yet

- DVF28 Pricing Supplement 02022023Document7 pagesDVF28 Pricing Supplement 02022023EltonChatambudzaNo ratings yet

- Sub: Announcement - Jaguar Land Rover Automotive PLC, UK Announces Results of Its Tender Offer To Purchase Its Outstanding Series of NoteDocument6 pagesSub: Announcement - Jaguar Land Rover Automotive PLC, UK Announces Results of Its Tender Offer To Purchase Its Outstanding Series of NoteJITHIN KRISHNAN MNo ratings yet

- Alpex Solar 123 Limited - GidDocument40 pagesAlpex Solar 123 Limited - GidxvhotyNo ratings yet

- Board of Investment of Sri LankaDocument48 pagesBoard of Investment of Sri LankaIsuru LakshanNo ratings yet

- DMCIHI - 021 Declaration of Cash Dividends - Final - April 4Document13 pagesDMCIHI - 021 Declaration of Cash Dividends - Final - April 4counsellorsNo ratings yet

- Baseload TorDocument11 pagesBaseload TorFelix Lutero JrNo ratings yet

- Gdfs Oct2022 fr0010952770Document9 pagesGdfs Oct2022 fr0010952770Preticia ChristianNo ratings yet

- Contract Agreement Between Lira Municipal Council and M/S Paradym Investments LTDDocument7 pagesContract Agreement Between Lira Municipal Council and M/S Paradym Investments LTDAllan OcheroNo ratings yet

- Ipdc LLC Gis Ipdc 133Document75 pagesIpdc LLC Gis Ipdc 133Najeeb AnsariNo ratings yet

- Nationa Credit Act FormsDocument114 pagesNationa Credit Act FormsrodystjamesNo ratings yet

- Call Warrants FINAL TERMS Linked To OMX30SDocument62 pagesCall Warrants FINAL TERMS Linked To OMX30SJianhua CaoNo ratings yet

- Case Studies - LCs & Guarantees - Intenssive June 21Document28 pagesCase Studies - LCs & Guarantees - Intenssive June 21Anuradha SaxenaNo ratings yet

- Israel 4th Offshore Bid Round CFBDocument80 pagesIsrael 4th Offshore Bid Round CFBhzoubier75No ratings yet

- Deviation EquityDocument4 pagesDeviation EquityKundariya MayurNo ratings yet

- Debenture Application Form Version 2.0Document5 pagesDebenture Application Form Version 2.0ask1968No ratings yet

- FormcDocument20 pagesFormc420deepakNo ratings yet

- Circular 25.01.2022Document6 pagesCircular 25.01.2022riteshskcoNo ratings yet

- Bid Document PDFDocument126 pagesBid Document PDFbalram tiwariNo ratings yet

- 34292-Bid Document-Supply and Delivery of Drugs Medical Consumables Under and Medical Equipment For Mali Level II HospitalDocument182 pages34292-Bid Document-Supply and Delivery of Drugs Medical Consumables Under and Medical Equipment For Mali Level II HospitalAddisu WassieNo ratings yet

- Oriental Petroleum and Minerals Corporation - SEC 17-Q Quarterly Report 3Q2022 - 14nov2022Document58 pagesOriental Petroleum and Minerals Corporation - SEC 17-Q Quarterly Report 3Q2022 - 14nov2022JadeNo ratings yet

- Bid Evaluation Form December 1997Document39 pagesBid Evaluation Form December 1997mehdi kamaliNo ratings yet

- Tent Bid DocumentDocument29 pagesTent Bid DocumentmountainpeakadvertNo ratings yet

- Updated Operational Circular For Issue and Listing of Commercial Paper - April 13 2022Document120 pagesUpdated Operational Circular For Issue and Listing of Commercial Paper - April 13 2022Vani PattnaikNo ratings yet

- BidingDocument100 pagesBidingPassengerDarkNo ratings yet

- Form No. Chg-1: English Hindi Form LanguageDocument7 pagesForm No. Chg-1: English Hindi Form LanguageKunal ObhraiNo ratings yet

- Supply & Delivery of Remote Graphic Terminal (Display) For Konduwattuwana Water Treatment Plant - AmparaDocument6 pagesSupply & Delivery of Remote Graphic Terminal (Display) For Konduwattuwana Water Treatment Plant - Amparamarketalu1No ratings yet

- Bid Evaluation Form Dec1997Document57 pagesBid Evaluation Form Dec1997technicalvijayNo ratings yet

- 04 - Canara Robeco Equity Tax Saver Fund - April 2023Document77 pages04 - Canara Robeco Equity Tax Saver Fund - April 2023Hari gHOSHNo ratings yet

- SEBI Circular On Private Placement TimelinesDocument6 pagesSEBI Circular On Private Placement TimelinesHarmanpreet SinghNo ratings yet

- Nomura Asset Acceptance Corporation,: To Search For Keyword, Press CTRL-FDocument90 pagesNomura Asset Acceptance Corporation,: To Search For Keyword, Press CTRL-Fagold73No ratings yet

- Corporate Bond GuidelinesDocument12 pagesCorporate Bond GuidelinesnuhubinadamNo ratings yet

- (OC-06) Procurement For The Supply and Delivery of Generic Medicines Subject For Ordering Agreement (1st Quarter 2017)Document90 pages(OC-06) Procurement For The Supply and Delivery of Generic Medicines Subject For Ordering Agreement (1st Quarter 2017)ephraimNo ratings yet

- Invitation To Bid (ITB) SolarrDocument62 pagesInvitation To Bid (ITB) SolarrTrevoh LayHitNo ratings yet

- FRS318 Pricing Supplement 17042023Document7 pagesFRS318 Pricing Supplement 17042023Malcolm M YaduraNo ratings yet

- High Court of Gujarat: Sola, Ahmedabad - 380 060Document30 pagesHigh Court of Gujarat: Sola, Ahmedabad - 380 060Sushma SharmaNo ratings yet

- Final Terms Pricing Supplement 2007 03 15Document5 pagesFinal Terms Pricing Supplement 2007 03 15Mih HrisNo ratings yet

- 06 19 2020 PSE 17-A Annual Report With Attachments PDFDocument324 pages06 19 2020 PSE 17-A Annual Report With Attachments PDFJC ReyesNo ratings yet

- ITT-05.02 - Special ConditionsDocument9 pagesITT-05.02 - Special ConditionszahirNo ratings yet

- Disclosure No. 4705 2022 Amended MWIDE To Sell Sahres in GMR Megawide Cebu Airport Corporation To Aboitiz InfraCapital Inc.Document5 pagesDisclosure No. 4705 2022 Amended MWIDE To Sell Sahres in GMR Megawide Cebu Airport Corporation To Aboitiz InfraCapital Inc.Dolves GumeraNo ratings yet

- Pricing Suppliment-2Document4 pagesPricing Suppliment-2Bilgert UrioNo ratings yet

- Far Eastern University SEC Form 17 A PSE Form 17-1-13september2022Document366 pagesFar Eastern University SEC Form 17 A PSE Form 17-1-13september2022Cristine Grace AcuyanNo ratings yet

- Avionics Parts For MI-17 Helicopter IIDocument114 pagesAvionics Parts For MI-17 Helicopter IIAshraf FadelNo ratings yet

- Supply and Delivery of Tools and Testing Equipment For Hydropower PlantsDocument126 pagesSupply and Delivery of Tools and Testing Equipment For Hydropower PlantsBinod Kumar BhagatNo ratings yet

- SMC Trading and Settlement Operating Guidelines v4Document3 pagesSMC Trading and Settlement Operating Guidelines v4rarayancalbetNo ratings yet

- FDC LimitedDocument48 pagesFDC LimitedPrakash MishraNo ratings yet

- 16Th April: Letter of CreditDocument4 pages16Th April: Letter of CreditSandeep AppajiNo ratings yet

- 2nd Tranche of EDC ASEAN Green Bonds - May 13'24Document1 page2nd Tranche of EDC ASEAN Green Bonds - May 13'24Joshua ArmeaNo ratings yet

- Pao Bill FormDocument11 pagesPao Bill Formకొల్లి రాఘవేణిNo ratings yet

- Procurement of School Bags With School Kits Fy 202Document38 pagesProcurement of School Bags With School Kits Fy 202Pharmastar Int'l Trading Corp.No ratings yet

- LC Swift - SanitizedDocument4 pagesLC Swift - SanitizedavinashNo ratings yet

- Revenue Recovery Certificate Ver 1 2Document11 pagesRevenue Recovery Certificate Ver 1 2SAMPATS LAW FIRM VINOD SAMPATNo ratings yet

- Risk Management and Inter-Bank DealingsDocument94 pagesRisk Management and Inter-Bank Dealingsmd1586No ratings yet

- Equitable PCI Banking Corp. vs. RCBCDocument24 pagesEquitable PCI Banking Corp. vs. RCBCFranchette Kaye LimNo ratings yet

- Implementation of the ASEAN+3 Multi-Currency Bond Issuance Framework: ASEAN+3 Bond Market Forum Sub-Forum 1 Phase 3 ReportFrom EverandImplementation of the ASEAN+3 Multi-Currency Bond Issuance Framework: ASEAN+3 Bond Market Forum Sub-Forum 1 Phase 3 ReportNo ratings yet

- 2425 Securities (Incorporationg 2013 Amendments)Document53 pages2425 Securities (Incorporationg 2013 Amendments)Willing ZvirevoNo ratings yet

- Mozambique Admin A3PC 12-04-2007Document1 pageMozambique Admin A3PC 12-04-2007Willing ZvirevoNo ratings yet

- Equalisation On Investment FundsDocument10 pagesEqualisation On Investment FundsWilling ZvirevoNo ratings yet

- GaiaIC Infrastructure Fund Roadshow-PresentationDocument45 pagesGaiaIC Infrastructure Fund Roadshow-PresentationWilling ZvirevoNo ratings yet

- Kenya Bond DocumentationDocument9 pagesKenya Bond DocumentationWilling ZvirevoNo ratings yet

- Bank Group Trust Fund Policy 2021Document28 pagesBank Group Trust Fund Policy 2021Willing ZvirevoNo ratings yet

- Ghana - The Ghana Infrastructure Investment Fund - Project Summary NoteDocument2 pagesGhana - The Ghana Infrastructure Investment Fund - Project Summary NoteWilling ZvirevoNo ratings yet

- Kenya Infrastructure Bond Terms IFB1-2018-20 Dated 19.11.2018Document2 pagesKenya Infrastructure Bond Terms IFB1-2018-20 Dated 19.11.2018Willing ZvirevoNo ratings yet

- Kenya Retail Bond Prospectus March 2017Document3 pagesKenya Retail Bond Prospectus March 2017Willing ZvirevoNo ratings yet

- Eskom Domestic Multi-Term Programme MemorandumDocument77 pagesEskom Domestic Multi-Term Programme MemorandumWilling ZvirevoNo ratings yet

- Kenya Deed of Covenant - NotesDocument7 pagesKenya Deed of Covenant - NotesWilling ZvirevoNo ratings yet

- Eskom Credit and Inflation Linked Note - 2011Document26 pagesEskom Credit and Inflation Linked Note - 2011Willing ZvirevoNo ratings yet

- Eskom Fixed Rate Notes - Pricing Supplement June 2015Document7 pagesEskom Fixed Rate Notes - Pricing Supplement June 2015Willing ZvirevoNo ratings yet

- Private Equity JargonDocument14 pagesPrivate Equity JargonWilling ZvirevoNo ratings yet

- Org - Management Module 4Document9 pagesOrg - Management Module 4Ploppy PoopNo ratings yet

- WAVE SénégalDocument29 pagesWAVE Sénégalghizlane mhilisNo ratings yet

- Job Batch CostingDocument21 pagesJob Batch CostingsamiNo ratings yet

- NTB Annual Report 2022 PDFDocument256 pagesNTB Annual Report 2022 PDFhashii 1794100% (1)

- Borras&ang&yepez Acccob2 Reflection1Document11 pagesBorras&ang&yepez Acccob2 Reflection1Josh Gabriel BorrasNo ratings yet

- Epp With Entrep Theory ReportDocument6 pagesEpp With Entrep Theory ReportAngel Florence V. VillareNo ratings yet

- ICICI Prudential Equity & Debt FundDocument3 pagesICICI Prudential Equity & Debt FundSabyasachi ChatterjeeNo ratings yet

- Take Home Exercise No 6 - Source of Profits (2023S)Document3 pagesTake Home Exercise No 6 - Source of Profits (2023S)何健珩No ratings yet

- Topic03 - Capital AllocationDocument49 pagesTopic03 - Capital Allocationmatthiaskoerner19No ratings yet

- Ch04-Discussion Questions and AnswersDocument4 pagesCh04-Discussion Questions and Answerseeman kNo ratings yet

- Terms ConditionsDocument3 pagesTerms ConditionsArdenNo ratings yet

- DCF - Reverse DCFDocument4 pagesDCF - Reverse DCFDeep BorsadiyaNo ratings yet

- Bollinger BandsDocument10 pagesBollinger Bandsarvindk.online6095No ratings yet

- BS Delhi English 13-12-2023Document30 pagesBS Delhi English 13-12-2023PKMKBNo ratings yet

- 307 Marketing (1) Tution 3Document8 pages307 Marketing (1) Tution 3Manash TiwariNo ratings yet

- IFM - CorrectedDocument119 pagesIFM - CorrectedTarun TaterNo ratings yet

- Geojit InsightsOct 23Document52 pagesGeojit InsightsOct 23raja_s_patilNo ratings yet

- IG 3rd Party Logistics 3PL and Ecommerce enDocument1 pageIG 3rd Party Logistics 3PL and Ecommerce enJoaquim AmericoNo ratings yet

- Tectabs Private: IndiaDocument1 pageTectabs Private: IndiaTanya sheetalNo ratings yet

- Financial Management Theory and Practice Brigham 13th Edition Test BankDocument44 pagesFinancial Management Theory and Practice Brigham 13th Edition Test Bankletitiaestheru3hnxz100% (24)

- 1 - Dasar-Dasar KewirausahaanDocument11 pages1 - Dasar-Dasar KewirausahaanmeirnaNo ratings yet

- Dentons HPRP Financial Sector Development and Reinforcement LawDocument4 pagesDentons HPRP Financial Sector Development and Reinforcement LawMuhammad KarimNo ratings yet

- Fe OpenAPIs-V2022.5Document33 pagesFe OpenAPIs-V2022.5Lucas AlmeidaNo ratings yet

- Jenn Accounting - 2024 - Autumn - MaterialDocument46 pagesJenn Accounting - 2024 - Autumn - Material9vrzdg24pzNo ratings yet

- Exhausted Selling ModelDocument1 pageExhausted Selling ModelJoel FrankNo ratings yet

- Valuation - NVIDIADocument27 pagesValuation - NVIDIALegends MomentsNo ratings yet

- V28 C02 031sherDocument9 pagesV28 C02 031sherZen TraderNo ratings yet

- Product Specification GuideDocument7 pagesProduct Specification Guidecrstngnt1991No ratings yet

- Tacn FNDocument61 pagesTacn FNhungt7619No ratings yet