Professional Documents

Culture Documents

Practice Question - Cost Information For Pricing and Product Planning

Practice Question - Cost Information For Pricing and Product Planning

Uploaded by

Juan Dela Cruz IIIOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Practice Question - Cost Information For Pricing and Product Planning

Practice Question - Cost Information For Pricing and Product Planning

Uploaded by

Juan Dela Cruz IIICopyright:

Available Formats

CHAPTER

Cost Information for Pricing and

Product Planning

Central Focus and Learning Objectives

This chapter introduces a number of issues relating to pricing and

product mix decisions. After studying this chapter, students should be

able to:

1. Show how a firm chooses its product mix in the short term

2. Explain the way a firm adjusts its prices in the short term depending

on whether capacity is limited.

3. Discuss how a firm determines a long-term benchmark price to guide

its pricing strategy

4. Evaluate the long-term probability of products and market segments

Cost Information for Pricing and Product Planning 1

Chapter overview A number of central issues relating to product mix and pricing

decisions are addressed in Chapter 6. Discussion begins with

definitions of price taking and price setting. A price taker is a firm

that has little or no influence on an industry’s supply and demand

forces and, hence, the prices of its products. Price setters, on the

other hand, usually enjoy a significant market share and can set the

prices of their products.

Four different situations are considered in the chapter based on

whether a decision is short- or long-run in nature and whether the

firm is a price taker or price setter. A number of other important

concepts are introduced, including incremental costs and revenues,

marginal costs and revenues, and opportunity costs. Finally,

markup strategies such as penetration pricing and skimming

pricing are discussed.

Teaching tips • The material in this chapter, together with the readings,

addresses a number of issues for managers of all types.

However, students concentrating in marketing and strategy

should find this chapter of particular interest. You may want to

mention this to increase student involvement. Team teaching a

pricing or product mix case with a marketing colleague can also

be a useful way to introduce students to the interaction between

accounting and marketing issues.

• Emphasize that there is a strong link between product costing

and product mix and pricing decisions. This is a reason why

many organizations now use cross-functional teams, including

both marketing managers and management accountants, to

evaluate product decisions. Marketing managers contribute

market research about which product will sell, and management

accountants provide information about profit impacts based on

analysis of product costs and production constraints. Such

teamwork early on, avoids many possible problems later in the

process and helps speed products to the market.

• Students without any work experience may not realize that

machinery is often the capacity constraint in a manufacturing

organization. Some tend to visualize physical plant sizes as the

capacity constraint.

Recommended 1. Madison Clock (A) and (B) in the Rotch, Allen and Brownlee

cases casebook can be used here.

2. Hanson Manufacturing (HBS case 9-156-004) focuses on

pricing strategy.

3. Destin Brass (HBS 9-191-029; teaching note 5-191-029) deals

with pricing within an activity-based costing framework.

4. Wellesley Paint (in Cases From Management Accounting

Cost Information for Pricing and Product Planning 2

Practice, vol. 14, p. 73) provides an opportunity for analysis of

product lines after a government contract is lost to a

competitor. Quality issues are an important factor in the

analysis.

5. Alma Products (CaseNet, at http://www.swcollege.com/front.html)

is an interesting study in pricing of a consumer product

(chimney-style charcoal starters for barbecues). A variety of

marketing issues arise, making this case highly relevant for use

in a required BBA/MBA management accounting course.

6. AT&T Worldnet (A) and (B) (HBS nos. 9-198-021 and 9-198-

022, respectively) address the issue of pricing access to the

Internet. The context is a situation in which price and volume

are unrelated.

Chapter outline 1. Role of Product Costs in Pricing and Product Mix Decisions

1 Understanding how product costs should be analyzed is very

Learning Objective 1: important for pricing decisions when a firm can set or influence

Show how a firm the prices of its products.

chooses its product 2 Even when prices are set by market forces, product cost

mix in the short term. analysis is very important. The firm has to decide on the product

mix to produce and sell.

3 Whether the firm can influence market prices is also

important. There are two general types of firms: price takers and

price setters.

1 A price taker firm is one that has little or no influence on the

industry supply and demand forces, and, consequently, on the

prices of its products.

2 A price setter firm is one that sets or bids the prices of its

products because it enjoys a significant market share in its industry

segment.

3 Another way to articulate the difference is by noting that

price setters have considerably greater market power than price

takers.

4 Short-Run and Long-Run Pricing Decisions

1 Short-run decisions are usually six months or less, while

long-run decisions are typically longer than a year. These are only

rough guidelines, however, and times will vary by organization

and industry.

2 Many resources committed to activities are more than likely

fixed in the short run, as capacities cannot be easily altered.

3 In the short run, special attention must be paid to the time

period over which capacity is committed, as commitments may

constrain the firm and not allow it to seek more profitable

opportunities.

4 If production is constrained by inadequate capacity, overtime

or the use of subcontractors may be necessary.

5 In the long run, managers have more flexibility in adjusting

Cost Information for Pricing and Product Planning 3

the capacities of activity resources to match demand for resources.

6 To illustrate these issues, ask the students to consider a small

high-tech firm that is considering manufacturing an electronic

component. To do so, it must invest large amounts in plant and

equipment, and commit to substantial amount of related support

activity costs that cannot be easily adjusted.

5 Short-Run Product Mix Decisions

1 Small firms who are price takers can have little influence on

the overall industry supply and demand and, thus, have little

influence also on the prices of its products. Small firms cannot

demand a higher price for their products as customers may go

elsewhere, and if the firm tries to lower prices below industry

prices, large firms might retaliate by engaging in a price war which

would make the small firm and the industry worse off.

2 The simple decision rule for a price-taker firm is to sell as

many of its products as possible as long as their costs are less than

their prices. But two considerations must be kept in mind:

1 What costs are relevant to the short-run product mix

decision? Should all product costs be included or only those that

vary in the short run?

2 Managers may not be able to produce and sell more of those

products whose costs are less than their prices, given capacity

constraints. In other words, how flexible are the capacities of the

firm’s activity resources?

3 Exhibits 6-2 through 6-7 on the HKTex Company provide a

comprehensive example of short-run product mix decisions.

Students often have trouble with fixed costs such as depreciation

on machinery not changing when the product mix changes. The

key to addressing this question is to state that depreciation is a cost

allocation done previously based on the machine’s useful life, and,

in this case, will not change based on a change in the mix.

4 The HKTex example illustrates a key point: the criterion

used to decide which products are the most profitable to produce

and sell at prevailing prices is the contribution margin per unit

of the constrained resource (which was machine-hours in this

example).

5 There are two additional points illustrated by the HKTex

example.

1 First, note that demand forecasting is critical as far as

production goes. If the demand forecast for blouses was, say

20,000, this would result in a change in the entire mix of

production.

2 Second, note that sometimes sales contracts are written with

minimum production numbers for the line of garments, so that the

retail store can say that it carries the full line of clothes. In other

instances, a retailer may wish only to deal with a small number of

manufacturers to avoid the transactions cost involved with a large

number of suppliers.

Cost Information for Pricing and Product Planning 4

6 The Impact of Opportunity Costs

1 A variation in the HKTex problem discussed above is to

consider a situation in which a decision maker chooses one

alternative over another. Thus, an opportunity cost arises.

2 An opportunity cost is the potential benefit sacrificed when,

in selecting one alternative, another alternative is given up.

3 Other examples of opportunity costs include whether to rent

out warehouse space or use it for manufacturing a product,

investing in artwork or mutual funds, purchasing a robot, or hiring

more employees. It should also be noted that opportunity costs are

not recorded on the books of the organization, as no cash outlays

have occurred.

4 The decision rule for deciding between two alternatives in an

opportunity cost situation is to make the decision that minimizes

the opportunity cost. Thus, the product that has the lowest

contribution margin per unit of constrained resource should be

sacrificed.

5 It is essential that students understand that the criterion is

contribution margin per unit of the constrained resource and not

simply contribution margin per unit of product sold.

Learning Objective 2: 2. Short-Run Pricing Decisions

Explain how a firm 1 This section discusses the relationship between costs and

adjusts its prices in prices bid by a supplier for special orders that do not involve long-

the short term term relationships with the customer. Two cases are discussed:

depending on whether when there is available surplus capacity, and when there is no

capacity is limited.

available surplus capacity.

2 Review the Tudor Rose Tools and Dies Company example in

Exhibit 6-8. Note that “full costs” are the sum of all costs (direct

materials, direct labor and support costs) assigned to a product.

1 Available Surplus Capacity

1 When capacity is available, incremental revenues have to be

greater than incremental costs.

2 Incremental costs (or revenues) are the amount by which

costs (or revenues) change if one particular decision is made

instead of another. Incremental costs (revenues) are also referred to

as differential costs (revenues).

3 Incremental cost per unit is the amount by which total

production costs and sales increase when one additional unit of a

product is produced and sold.

2 No Available Surplus Capacity

1 When there is no available capacity, a firm will have to incur

costs to acquire the necessary capacity. This may mean operating

the plant on an overtime basis.

2 Again, the decision rule is that incremental revenues have to

be greater than incremental costs.

3 Emphasize that managers often find ways in which they can

Cost Information for Pricing and Product Planning 5

add to capacity, if needed, in the short run. They can use overtime,

paying workers a premium over regular wages, they can choose to

operate a second shift (which also may involve a premium), or they

can decide to subcontract out some or all of the work for some

customer orders.

3 Another key term is relevant costs (and revenues). These are

the costs (and revenues) that differ across alternatives and,

therefore, must be considered in deciding which alternative is the

best. Incremental costs are the relevant costs for the kinds of short-

run decisions discussed above.

Learning Objective 3: 3. Long-Run Pricing Decisions

Discuss how a firm 1 Relevant costs for short-run special order pricing decisions

determines a long- differ from full costs. What is the benefit of having full cost

term benchmark price information?

to guide its pricing 2 Reliance on full costs for pricing can be justified in three

strategy.

types of situations:

1 Government contacts and pricing in regulated industries such

as electric utilities that specify prices as full costs with a markup.

2 Over the long term, managers have greater flexibility in

adjusting the level of commitment for all activity resources. Thus,

full costs are relevant for the long run pricing decision.

3 Because of short-run fluctuations in the demand for products,

firms adjust their prices up and down over a period of time. Over

the long run, their average prices tend to equal the price based on

full costs that may be set in a long-term contract.

3 The amount of markup depends on several factors:

1 If the strength of demand for the product is high, a higher

markup can be used.

2 If demand is elastic, a small increase in price results in a

large decrease in demand. Markups are lower when demand is

elastic.

3 When competition is intense, markups decrease as it is

difficult for firms to sustain prices much higher than their

incremental costs.

4 Markups may be purposefully raised or lowered based on

firm strategy. Two types of strategies are:

1 A skimming price strategy, which involves charging a

higher price initially from customers willing to pay more for the

privilege of possessing a new product.

2 A penetration pricing strategy, which is charging a lower

price initially to win over market share from an established product

of competing firm.

Learning Objective 4: 4. Long-Run Mix Decisions

Evaluate the long- 1 Decisions to add new, or drop existing, products from the

term probability of product portfolio often have long-term implications for the cost

products and market

Cost Information for Pricing and Product Planning 6

segments. structure of the firm.

2 Resources committed for batch-related and product-

sustaining activities cannot be easily changed in the short run, so

changing the mix cannot be done quickly.

3 Another consideration is that, in some cases, customers may

want a firm to maintain a full product line so that they do not have

to go elsewhere for some items. Thus, some unprofitable products

may have to be kept to maintain the entire product line. If this is

too costly, managers might try methods such as reengineering to

lower the cost of some products.

4 Long-run mix decisions have to be aligned carefully with the

firm’s strategy. Strategic cost management links these two areas.

5 One caveat is that dropping products will only help

profitability if managers also eliminate, or redeploy the activity

resources no longer required to support the dropped product.

6 Invite students to consider the following example. If there are

specially trained workers who were employed in the firm only

because of their expertise in producing the product that is dropped,

then dropping the product may mean that they will be let go;this

results in cost savings. If the firm can find another product for

these workers then they can be redeployed; clearly then, cost

savings will result to the extent new workers are not required to be

hired for this other product. Next, invite students to consider the

analysis when instead of specially trained workers, the firm has

some specialized machinery and equipment.

Appendix 6-1 5. The objective of the Appendix is to present an economic

analysis of the pricing decision. Note that a knowledge of basic

differential calculus is needed to work through the analysis.

1 The quantity choice is examined and presented in terms of

equating marginal revenue and marginal cost. Marginal revenues

are the increase in revenues (or costs) for a unit increase in the

quantity produced and sold.

2 Review the graph in Exhibit 6-10.

3 The price choice is examined using differential calculus.

Students will find this material particularly useful if they are also

assigned the pricing experiment described in case 6-51, and are

required to think about reactions and counter-reactions to pricing

decisions by competitors. The pricing experiment in case 6-51 can

be used to increase student understanding and involvement of

pricing in competitive settings. While some students will find the

material in the Appendix useful, this material is not necessary for

them to engage meaningfully in the experiment. Described below

are confidential cost reports distributed by the instructor to the

students before the experiment. The solution to the case is also

provided here instead of in the Solutions Manual.

Cost Information for Pricing and Product Planning 7

A Pricing Experiment

(Rajiv D. Banker and P. Jane Saly)

The objective of this experiment is to introduce students to pricing decisions in a

competitive setting. Its two principal learning objectives are:

1. Expectations about competitors’ pricing decisions must enter a firm’s own pricing

decisions.

2. The type of cost accounting system used (single driver or multiple driver) influences

the equilibrium prices in the industry.

The instructor should provide one of the following two confidential cost reports to each

team. All teams in one industry may be provided the cost report based on a single cost

driver system, and all teams in another industry may be provided the cost report based on

a multiple cost driver system.

Single Cost Driver System:

INDUSTRY: FIRM:

Cost Estimates – Private Information

Your accountant has looked at all the costs incurred for your firm and come up with the

following confidential information:

Direct material costs are $8.00 per pair of Lightweight Boots and $20.00 per pair of

Mountaineering Boots.

Direct labor requirements are 0.5 hours per pair of Lightweight Boots and 1 hour per pair of

Mountaineering Boots. Direct labor wage rate (inclusive of benefits) is $8.00 per hour.

Support costs are applied to products at the rate of $14.00 per machine-hour. Each pair of

Lightweight and Mountaineering Boots requires 0.8 machine-hours.

While these are all the costs of producing and selling these products, they are only estimates.

Actual costs will differ somewhat. Remember to keep your costs secret!

Multiple Cost Driver System:

INDUSTRY: FIRM:

Cost Estimates – Private Information

Your accountant has looked at all the costs incurred for your firm and come up with the

following confidential information:

Direct material costs are $8.00 per pair of Lightweight Boots and $20.00 per pair of

Mountaineering Boots.

Direct labor requirements are 0.5 hours per pair of Lightweight Boots and 1 hour per pair of

Mountaineering Boots. Direct labor wage rate (inclusive of benefits) is $8.00 per hour.

There are two cost pools corresponding to two cost drivers (machine-hours and number of

setups). Support costs are applied to products at the rate of $5.00 per machine-hour and $600

per setup. Lightweight Boots are manufactured in batches of 150 pairs; each batch requires a

total of 120 machine-hours. Mountaineering Boots are manufactured in batches of 30 pairs;

each batch requires a total of 24 machine-hours.

While these are all the costs of producing and selling these products, they are only estimates.

Actual costs will differ somewhat. Remember to keep your costs secret!

Solution:

Estimates of the variable costs (n) of the two products depend on whether the team is

provided data from a single cost driver or a multiple cost driver system:

Cost Information for Pricing and Product Planning 8

Single Cost Driver Multiple Cost Driver

LT MT LT MT

Direct Material $ 8.00 $20.00 $8.00 $20.00

Direct Labor 4.00 8.00 4.00 8.00

Support costs - —Machine-hours 11.20 11.20 4.00 4.00

Support costs - —Setup 4.00 20.00

Total variable cost $23.20 $39.20 $20.00 $52.00

You might provide the following mathematical analysis of the case to students after they

have completed the experiment, if you feel they are comfortable with basic differential

calculus.

The contribution, p, from either product is represented by the following expression:

p = (P v)Q

= (P v)(a bP + e(P1 + P2 + P3))

where a, b, and e are the parameters in the appropriate demand function Q = a bP + e(P1

+ P2 + P3). Suppose P = (P1 + P2 + P3)/3 is the average price expected to be set by the

three competing firms. Then,

p = (P v)(a bP + 3aP)

Profit maximization requires:

dp / dP = a 2bP + 3eP + vb =0.

Therefore, the profit maximizing price, P0, given average competitor price, P, is:

P0 = (a + vb + 3eP) / 2b

If, however, we assume that all firms in the industry are identical and P = P0 then the

equilibrium price, P*, can be determined using the following expression:

P* = (a + vb) / (2b – 3e)

The logic underlying this expression is similar to that described in Appendix 6-1.

Contribution to profit at equilibrium prices is determined as:

Contribution = (P* v)Q*

where Q* = a bP* + 3eP* (because there are 3 other identical competing firms) is the

demand quantity at equilibrium prices, and is obtained by inserting the value P* in the

appropriate demand function.

The numerical solutions for equilibrium prices and contribution to profit for the two

products are as follows:

Single Cost Driver Industry

Equilibrium Estimated True

Prices Contribution Contribution

Product LT $ 42 $ 178,656 $ 209,066

Product MT 66 80,453 43,540

Cost Information for Pricing and Product Planning 9

$ 259,109 $ 252,606

Multiple Cost Driver Industry

Equilibrium Estimated True

Prices Contribution Contribution

Product LT $ 40 $ 199,980 $ 199,980

Product MT 75 57,661 57,661

$ 257,641 $ 257,641

You will find that the industry prices converge by the fifth period to price levels close to

(but not necessarily the same as) the equilibrium prices. In the single cost driver case, the

product MT is undercosted and LT is overcosted; their equilibrium prices reflect these

cost distortions. Notice that there is no variance between estimated and true contribution

(and between estimated and actual net income, reported to all teams in each period) for

multiple cost driver firms, but there is a variance of $6,503 ($259,109 – $252,606) for

single cost driver firms.

In this case, the true firm profits are lower when all firms in the industry use a single cost

driver system than when they all use a multiple cost driver system ($252,606 versus

$257,641). This illustrates that even in a competitive setting, more accurate cost

information may make you better off. However, this is not always true. It is possible that,

for certain values of the cost and demand parameters, the equilibrium prices in a single

cost driver industry result in higher profits than in a multiple cost driver industry. See

Rajiv D. Banker and Gordon Potter, “Economic Evaluation of Single Cost Driver

Systems,” Journal of Management Accounting Research, Fall 1993, pp. 1532.

Chapter quiz

1. A price taker firm is one that:

a. has little or no influence on the industry supply and demand forces, and

consequently on the prices of its products.

b. sets the prices of its products.

c. accepts whatever price its customers offer.

d. announces its prices in a brochure mailed annually to its customers.

2. Small firms in industries such as automobile parts manufacturing, steel, and generic

chemicals usually:

a. are price setters.

b. can influence prices.

c. are price makers.

d. are price takers.

3. When production is limited by a scarce resource, a firm maximizes its profits if it

selects products in the rank order of their;

a. unit contribution margins.

Cost Information for Pricing and Product Planning 10

b. contribution margins per unit of the scarce resource.

c. total sales.

d. gross margins per unit of the scarce resource.

4. If there is unused capacity available in the short run, then the minimum acceptable

price for a special order should cover:

a. both variable and fixed costs.

b. both variable and fixed costs plus a regular markup.

c. variable costs.

d. fixed costs.

5. All of the following statements are correct EXCEPT:

a. the short run price needs to cover only the costs that vary in the short run.

b. the short-run price needs to cover both variable and fixed costs.

c. the long-run price needs to cover both fixed and variable costs.

d. incremental costs are relevant costs in the short run.

6. Under which one of the following circumstances, can full cost pricing not be justified

economically?

a. when contracts are developed with governmental agencies

b. when product prices are regulated

c. when a firm enters into a short-term contractual relationship with a customer to

supply a product

d. when a firm enters into a long-term contractual relationship with a customer to

supply a product

7. When a firm uses a low markup for a new product, it may be using a:

a. full-cost pricing strategy.

b. opportunity pricing strategy.

c. skimming pricing strategy.

d. penetration pricing strategy.

8. If the demand for a product is more price elastic, then:

a. an increase in its price is more likely to result in an increase in profit.

b. an increase in its price is more likely to result in a decrease in profit.

c. an increase in its price is more likely to result in a decrease in the quantity sold.

d. an increase in its price is less likely to result in a decrease in the quantity sold.

9. The decision to drop a major product line that is produced in large batches will likely

affect which of the following types of costs?

a. unit-related costs only

b. unit-related and batch-related costs only

c. batch-related costs only

d. unit-related, batch-related, and product-sustaining costs

10. Of the strategies below for reducing the cost of a product, which will likely be the

least effective?

a. Provide quantity discounts for customers to increase their order sizes.

b. Reengineer the product.

Cost Information for Pricing and Product Planning 11

c. Decrease the functionality of the product.

d. Differentiate products further so that prices can be raised and costs brought more

in line with prices.

Cost Information for Pricing and Product Planning 12

Solutions to chapter quiz

1. a

2. d

3. b

4. c

5. b

6. c

7. d

8. c

9. d

10. c

Cost Information for Pricing and Product Planning 13

You might also like

- Full Download Solution Manual For Operations Management 13th Edition PDF Full ChapterDocument6 pagesFull Download Solution Manual For Operations Management 13th Edition PDF Full Chapterdewdrop.threat.7ia4yn100% (20)

- Discussion QA 9to17Document56 pagesDiscussion QA 9to17April Reynolds100% (16)

- Operations Management 12th Edition Stevenson Solutions ManualDocument17 pagesOperations Management 12th Edition Stevenson Solutions ManualMichelleJenkinseirts100% (40)

- Pricing Strategy Review in Telecom SectorDocument40 pagesPricing Strategy Review in Telecom SectorSonam GuptaNo ratings yet

- 3.4.a-The Contribution of Technology To Competitive AdvantagDocument26 pages3.4.a-The Contribution of Technology To Competitive Advantagjjamppong09No ratings yet

- Consulting Interview Case Preparation: Frameworks and Practice CasesFrom EverandConsulting Interview Case Preparation: Frameworks and Practice CasesNo ratings yet

- Mvno Startup ProjectionDocument9 pagesMvno Startup ProjectionMichael KingNo ratings yet

- Economics of Strategy FDocument41 pagesEconomics of Strategy FChristy NyenesNo ratings yet

- Managerial Economics 1st SemDocument39 pagesManagerial Economics 1st SemAmrutha GowdaNo ratings yet

- Discussion ch09Document3 pagesDiscussion ch09Umar HarizNo ratings yet

- Product Pricing and Time Horizon: Unit 2 SectionDocument6 pagesProduct Pricing and Time Horizon: Unit 2 SectionBabamu Kalmoni JaatoNo ratings yet

- Operations Management 13th Edition Stevenson Solutions ManualDocument25 pagesOperations Management 13th Edition Stevenson Solutions ManualChristopherDixonjrdt100% (43)

- Pricing Decisions - Nov. 2017Document10 pagesPricing Decisions - Nov. 2017vicent laurianNo ratings yet

- Bus. Level Stg.-Porter Generic StrategiesDocument7 pagesBus. Level Stg.-Porter Generic StrategiesJitender KaushalNo ratings yet

- Segmentation 1Document10 pagesSegmentation 1Govish Kumar MenonNo ratings yet

- Full Download Operations Management 13th Edition Stevenson Solutions ManualDocument35 pagesFull Download Operations Management 13th Edition Stevenson Solutions Manualgayoyigachy100% (23)

- Dwnload Full Operations Management 13th Edition Stevenson Solutions Manual PDFDocument35 pagesDwnload Full Operations Management 13th Edition Stevenson Solutions Manual PDFjackiesanchez70z3ci100% (14)

- Chapter 6 Performance Objectives of Operations ManagementDocument17 pagesChapter 6 Performance Objectives of Operations ManagementJimmy Ong Ah Huat100% (2)

- Costing Theory ImpDocument57 pagesCosting Theory ImpHilary GaureaNo ratings yet

- Appendix 20-32 ReviewerDocument5 pagesAppendix 20-32 ReviewerjajajajaNo ratings yet

- Industry AnalysisDocument13 pagesIndustry AnalysisKasiira HatimuNo ratings yet

- BDHR - Bab 12Document40 pagesBDHR - Bab 12NataliaNo ratings yet

- Operations and Supply Chain Management The Core 4th Edition Jacobs Chase Solution ManualDocument26 pagesOperations and Supply Chain Management The Core 4th Edition Jacobs Chase Solution Manualkaren100% (28)

- Solution Manual For Operations and Supply Chain Management The Core 4Th Edition Jacobs Chase 1259549720 9781259549724 Full Chapter PDFDocument36 pagesSolution Manual For Operations and Supply Chain Management The Core 4Th Edition Jacobs Chase 1259549720 9781259549724 Full Chapter PDFjoyce.willoughby377100% (17)

- Cost Leadership Porter Generic StrategiesDocument7 pagesCost Leadership Porter Generic StrategiesRamar MurugasenNo ratings yet

- Filled Notes For Chapter 2Document4 pagesFilled Notes For Chapter 2frtisNo ratings yet

- Focused ManufacturingDocument10 pagesFocused Manufacturingniroshan24No ratings yet

- Module 5 - SBADocument6 pagesModule 5 - SBAPatricia ReyesNo ratings yet

- Full Download Operations Management 12th Edition Stevenson Solutions ManualDocument35 pagesFull Download Operations Management 12th Edition Stevenson Solutions Manualgayoyigachy100% (42)

- Dwnload Full Operations Management 12th Edition Stevenson Solutions Manual PDFDocument35 pagesDwnload Full Operations Management 12th Edition Stevenson Solutions Manual PDFjackiesanchez70z3ci100% (11)

- Industrial Market SegmentationDocument8 pagesIndustrial Market SegmentationnisargoNo ratings yet

- Chapter 8 - Competitive AdvantageDocument10 pagesChapter 8 - Competitive AdvantageSteffany RoqueNo ratings yet

- Target Costing: Kenneth Crow DRM AssociatesDocument6 pagesTarget Costing: Kenneth Crow DRM AssociatesAhmed RazaNo ratings yet

- Porter's Framework of Competitive Strategies (Generic Strategies)Document14 pagesPorter's Framework of Competitive Strategies (Generic Strategies)Adil Bin Khalid100% (1)

- Strategies For Market Share PDFDocument8 pagesStrategies For Market Share PDFMarcus PurcellNo ratings yet

- FOM Chapters 3 and 4Document29 pagesFOM Chapters 3 and 4maylinalorraine23estoyaNo ratings yet

- Cos Price ProjectDocument15 pagesCos Price ProjectHisham HusseiniNo ratings yet

- Samples Solution Manual Designing and Managing The Supply Chain 3rd Edition by David Simchi Levi SLM1060Document11 pagesSamples Solution Manual Designing and Managing The Supply Chain 3rd Edition by David Simchi Levi SLM1060mathimurugan n0% (1)

- Experience Curve PricingDocument3 pagesExperience Curve PricingpoojaNo ratings yet

- Operations ManagementDocument3 pagesOperations ManagementAshishAg91No ratings yet

- PricingDocument7 pagesPricingleenasainiNo ratings yet

- MGT411 Business StrategyDocument4 pagesMGT411 Business Strategyprashant jain100% (1)

- Industrial Market Segmentation-AdditionalDocument6 pagesIndustrial Market Segmentation-Additionalking hoboNo ratings yet

- Porter Generic StrategiesDocument3 pagesPorter Generic StrategiesbravehorseNo ratings yet

- Module in Product and Pricing StrategiesDocument27 pagesModule in Product and Pricing Strategiessenoramichell100% (1)

- FMCG PPTs UNIT 3Document87 pagesFMCG PPTs UNIT 3Ayushi ShahNo ratings yet

- Task No. 4Document4 pagesTask No. 4VenNo ratings yet

- SBAN11B MODULE 5 Porters Generic Market AnalysisDocument3 pagesSBAN11B MODULE 5 Porters Generic Market AnalysisFrancis Ryan PorquezNo ratings yet

- Strategic Management - Open Book Test-Question 07Document4 pagesStrategic Management - Open Book Test-Question 07pavithraNo ratings yet

- Solution Manual For Operations Management 13th EditionDocument36 pagesSolution Manual For Operations Management 13th Editiongowdie.mornward.b50a100% (52)

- Product Line PricingDocument25 pagesProduct Line PricingNimmy M JamesNo ratings yet

- FinalAssignmentDocument5 pagesFinalAssignmentAB BANo ratings yet

- Operations Management: Individual Assignment (20%)Document7 pagesOperations Management: Individual Assignment (20%)AddiNo ratings yet

- Industrial Market SegmentationDocument5 pagesIndustrial Market SegmentationKhudadad NabizadaNo ratings yet

- The Strategic Planning ProcessDocument25 pagesThe Strategic Planning ProcessraaazsNo ratings yet

- MGT411-Business Strategy Assignment: DATE 15-12-2019Document7 pagesMGT411-Business Strategy Assignment: DATE 15-12-2019santosh vighneshwar hegdeNo ratings yet

- Unit 6 Product Portfolio: ObjectivesDocument19 pagesUnit 6 Product Portfolio: ObjectivesAdil Bin KhalidNo ratings yet

- StuDY-GUIDe FiveDocument11 pagesStuDY-GUIDe Fiveambitchous19No ratings yet

- CHAPTER 3-Purchasing MMDocument25 pagesCHAPTER 3-Purchasing MMhailegebreselassie24No ratings yet

- Solution Manual For Economics of Strategy 6th Edition by Besanko Dranove Schaefer Shanley ISBN 111827363X 9781118273630Document36 pagesSolution Manual For Economics of Strategy 6th Edition by Besanko Dranove Schaefer Shanley ISBN 111827363X 9781118273630jacobdaviswckfzotpma100% (27)

- Practice Questions Process CostingDocument68 pagesPractice Questions Process CostingJuan Dela Cruz IIINo ratings yet

- Practice Question Job Order CostingDocument67 pagesPractice Question Job Order CostingJuan Dela Cruz IIINo ratings yet

- Practice Questions and Concepts of The Balanced ScorecardDocument8 pagesPractice Questions and Concepts of The Balanced ScorecardJuan Dela Cruz IIINo ratings yet

- Decision MakingDocument1 pageDecision MakingJuan Dela Cruz IIINo ratings yet

- IAS19 Changes: "New Volatility and Extra Complexity"Document1 pageIAS19 Changes: "New Volatility and Extra Complexity"Juan Dela Cruz IIINo ratings yet

- Chapter 5 Scheduling & Tracking Edited 03042014Document40 pagesChapter 5 Scheduling & Tracking Edited 03042014Shafiq KadirNo ratings yet

- Job Order Costing Quiz AnswerDocument7 pagesJob Order Costing Quiz AnswerElaine Joyce GarciaNo ratings yet

- CAT 2003 Question Paper (Leaked) by CrackuDocument71 pagesCAT 2003 Question Paper (Leaked) by Crackuenzogaming475No ratings yet

- Chapter3 Za PrijevodDocument30 pagesChapter3 Za PrijevodKerim MuharembegovicNo ratings yet

- 13gbrvol2no3 Submission 52Document7 pages13gbrvol2no3 Submission 52xapovNo ratings yet

- RA.040 Corsair BUSINESS DATA STRUCTURES V 1.4Document32 pagesRA.040 Corsair BUSINESS DATA STRUCTURES V 1.4Suman GangapatnamNo ratings yet

- Entrepreneurship - NursingDocument11 pagesEntrepreneurship - NursingAbraham Leslie PetirNo ratings yet

- Value Management (Analysis) 31.10.21Document28 pagesValue Management (Analysis) 31.10.21muzaire solomonNo ratings yet

- Review About Kpi & Okr, Change Management, and Mece Principles Management Trainee 2023Document3 pagesReview About Kpi & Okr, Change Management, and Mece Principles Management Trainee 2023Owing 28No ratings yet

- Growth Through Mergers and Acquisitions - How It Wont Be A Losers GameDocument9 pagesGrowth Through Mergers and Acquisitions - How It Wont Be A Losers GameNurussyifa SafiraNo ratings yet

- P.O.M Midterm Revision: Lecturer: N.N.Tung Prepared & Presented by TA Nguyen Dang Tu OanhDocument54 pagesP.O.M Midterm Revision: Lecturer: N.N.Tung Prepared & Presented by TA Nguyen Dang Tu OanhTú TrươngNo ratings yet

- Activity Analysis, Cost Behavior, and Cost Estimation: Answers To Review QuestionsDocument84 pagesActivity Analysis, Cost Behavior, and Cost Estimation: Answers To Review QuestionsMuhammad MishbahurrizqiNo ratings yet

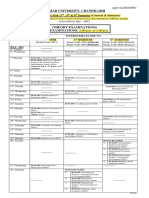

- Panjab University, Chandigarh: Examination (Offline Mode) To Be Held in July - 2022Document2 pagesPanjab University, Chandigarh: Examination (Offline Mode) To Be Held in July - 2022Sumit SharmaNo ratings yet

- 5-Page Resume Template - USDocument5 pages5-Page Resume Template - USPlayerOne ComputerShopNo ratings yet

- Competing With Dual Business Models - A Contingency ApproachDocument17 pagesCompeting With Dual Business Models - A Contingency ApproachCaio PeretNo ratings yet

- Industrial Management and Engineering Economy: Individual ASSIGNMENT 1 (15% Marks)Document9 pagesIndustrial Management and Engineering Economy: Individual ASSIGNMENT 1 (15% Marks)Esmael ShiferuNo ratings yet

- Supply Chain Risk ManagementDocument61 pagesSupply Chain Risk ManagementTabz Hussain100% (2)

- Statement of Changes in Equity ReviewerDocument3 pagesStatement of Changes in Equity ReviewerSean Arvy SamsonNo ratings yet

- CS Long AnswersDocument16 pagesCS Long Answersrattan billawariaNo ratings yet

- SAP User Guide - Single ReportDocument28 pagesSAP User Guide - Single ReportJoão ArmandoNo ratings yet

- 02 Audit of Mining Entities PDFDocument12 pages02 Audit of Mining Entities PDFelaine piliNo ratings yet

- BCOM (Hons) - Sem - II-IV-VI-08-03-2022Document2 pagesBCOM (Hons) - Sem - II-IV-VI-08-03-2022anshul yadavNo ratings yet

- Employee & Line Manager Information: MIDAS Safety Performance Management FORMDocument4 pagesEmployee & Line Manager Information: MIDAS Safety Performance Management FORMallyNo ratings yet

- Case 7B FRC M. Gerry Naufal 29123123Document7 pagesCase 7B FRC M. Gerry Naufal 29123123m.gerryNo ratings yet

- Original For Recipient Duplicate For Transporter Triplicate For SupplierDocument1 pageOriginal For Recipient Duplicate For Transporter Triplicate For SupplierKarthik TNo ratings yet

- Microsoft Certified: Dynamics 365 Fundamentals (ERP) - Skills MeasuredDocument4 pagesMicrosoft Certified: Dynamics 365 Fundamentals (ERP) - Skills MeasuredAdmire ZaembaNo ratings yet

- Home-Based Business: Market Analysis and SWOTDocument6 pagesHome-Based Business: Market Analysis and SWOTpeterpunxNo ratings yet

- 2020-10-08-Confidential - Prasmul-Eli New Business ModelDocument12 pages2020-10-08-Confidential - Prasmul-Eli New Business ModelPT Eleonora Sukses AbadiNo ratings yet

- KA2 - Elicitation & CollaborationDocument1 pageKA2 - Elicitation & CollaborationSaurabh MehtaNo ratings yet