Professional Documents

Culture Documents

N3JZZW1sTDhXRElyNnBUak9DcVJZZz09 Invoice

N3JZZW1sTDhXRElyNnBUak9DcVJZZz09 Invoice

Uploaded by

Jitender NarulaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

N3JZZW1sTDhXRElyNnBUak9DcVJZZz09 Invoice

N3JZZW1sTDhXRElyNnBUak9DcVJZZz09 Invoice

Uploaded by

Jitender NarulaCopyright:

Available Formats

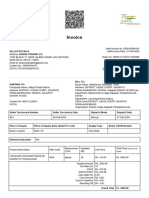

Invoice

GeM Invoice No: GEM-30581455

SELLER DETAILS: GeM Invoice Date: 11-May-2023

Address: Octave Enterprises

H No-269, Ashok Mohalla, Nangloi, New Delhi, West Delhi, Order No: GEMC-511687792286850

DELHI, 110041 Order Date: 08-May-2023

Email Id: octaveenterprises07@gmail.com

Contact No : 09873628996

GSTIN: 07AEMPN1907P1ZZ Click here to download seller invoice

BILL TO:

Buyer Name: Anupama Taneja , BUYER

SHIPPING TO:

Address: Ranjit Nagar-SKV WEST DELHI DELHI 110008

Consignee Name: Kriti Bhalla

Education Department Delhi Directorate of Education

Address: Ranjit Nagar-SKV WEST DELHI

GSTIN: N

DELHI 110008

Department: Education Department Delhi

Office Zone:Office Of Deputy Director Of Education , District

GSTIN: N

West A

Organisation: Directorate of Education

Seller Tax Invoice Number Seller Tax Invoice Date Dispatch Mode Dispatch Date

4296 11-May-2023 Manual 11-May-2023

Place of Supply Place of Supply State (State/UT Code) Supply Type Consignee GSTIN Number

Consignee Location Delhi / 07 Intra-State N

Delivery Instruction NA

Measuremen Supplied Total Price inclusive all

Product Description HSN Code Unit Price

t Unit Qty Taxes

Nataraj Dual sided Plastic Pencil

9609 pieces 235 Rs. 49.98 Rs. 11745.30

Box

Taxable Amount Rs. 9953.64

Tax Rate (%) 18

CGST Rs. 895.83

SGST/UTGST Rs. 895.83

Cess Rate (%) 0.000

Cess Amount Rs. 0.00

Cess in Quantum Rs. 0.00

Rounding Off Rs. 0.00

Grand Total Rs. 11745.30

I /We hereby declare that our firm/company has been specifically excluded from the requirement to comply with GST e-invoicing

provisions vide Notification number 13/2020-Central Tax dated 21 March 2020, as amended up to date. Accordingly, at present,

we are not covered under the ambit of GST e-invoicing provisions. We do hereby declare that once the said provisions are made

applicable to us, we shall issue the duly complied e-Invoice under GST Law.

All GST invoice or document issued by us shall be properly and timely reported under respective returns under GST by us in line

with the notified provisions and the applicable tax collected from Buyer shall be timely and correctly paid to the respective

Government by us.

In case the Input Tax Credit of GST is denied or demand is recovered from Buyer on account of any act/ omission of us in this

regard, we shall be liable in respect of all claims of tax, penalty and/or interest, loss, damages, costs, expenses and liability that

may arise due to such non-compliance. Buyer shall have the right to recover such amount from any payments due to us or from

Performance Security, or any other legal recourse from us.

INK SIGNED SIGNATURES ARE NOT REQUIRED IN SYSTEM GENERATED DOCUMENTS

You might also like

- Bill Sample of CementDocument2 pagesBill Sample of Cementshadanjamia96No ratings yet

- TSs4MDFuOXVOWFNGL3hMYzl2bGQvZz09 InvoiceDocument2 pagesTSs4MDFuOXVOWFNGL3hMYzl2bGQvZz09 InvoiceJitender NarulaNo ratings yet

- NmNEK0JacjBpTStEQm9uN0JwS2ovdz09 InvoiceDocument2 pagesNmNEK0JacjBpTStEQm9uN0JwS2ovdz09 InvoiceJitender NarulaNo ratings yet

- SmlFT3VYRHpYZzRnV010am9veC9IZz09 InvoiceDocument2 pagesSmlFT3VYRHpYZzRnV010am9veC9IZz09 InvoiceJitender NarulaNo ratings yet

- NDkySFNWeWUyYTVQbU9KSC85akVaUT09 InvoiceDocument2 pagesNDkySFNWeWUyYTVQbU9KSC85akVaUT09 InvoiceInclusive Education BranchNo ratings yet

- bkhWNWhJTzlTK0R4QkJwbmFvV1phZz09 InvoiceDocument2 pagesbkhWNWhJTzlTK0R4QkJwbmFvV1phZz09 InvoiceInclusive Education BranchNo ratings yet

- RzhHNnk0V3QzeXNZbzBQUU9HMEM5UT09 InvoiceDocument2 pagesRzhHNnk0V3QzeXNZbzBQUU9HMEM5UT09 InvoiceInclusive Education BranchNo ratings yet

- dkNQenFEN3Jsb2R1b3EzQmRERVMzUT09 InvoiceDocument2 pagesdkNQenFEN3Jsb2R1b3EzQmRERVMzUT09 InvoiceAkash ChoudharyNo ratings yet

- MnVyK1hpRDdlQXF6R25YbmwwSElXZz09 InvoiceDocument2 pagesMnVyK1hpRDdlQXF6R25YbmwwSElXZz09 InvoiceInclusive Education BranchNo ratings yet

- Invoice: Seller Details: Private LimitedDocument2 pagesInvoice: Seller Details: Private LimitedHusain KanchwalaNo ratings yet

- NXZGWUpKQzhGaHIzS0NEbFlUT0ZsUT09 InvoiceDocument2 pagesNXZGWUpKQzhGaHIzS0NEbFlUT0ZsUT09 InvoiceInclusive Education BranchNo ratings yet

- Zk1HeFpuMjMwanpiTjg3TnNPb2w5UT09 InvoiceDocument2 pagesZk1HeFpuMjMwanpiTjg3TnNPb2w5UT09 Invoicerajrathwa85No ratings yet

- UmMwWHVzMFEwc3paWkRSWkVjS0o3Zz09 InvoiceDocument2 pagesUmMwWHVzMFEwc3paWkRSWkVjS0o3Zz09 InvoiceNSTI AKKINo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)GhhhNo ratings yet

- DocumentDocument2 pagesDocumentHarish BisthNo ratings yet

- DFpTQkJ2RS9Bak4rRWFHRFZyelJ2dz09 InvoiceDocument2 pagesDFpTQkJ2RS9Bak4rRWFHRFZyelJ2dz09 Invoiceomkar daveNo ratings yet

- L0JJYm1iUlAzNDUvRE1tektJQnlqZz09 InvoiceDocument2 pagesL0JJYm1iUlAzNDUvRE1tektJQnlqZz09 Invoicemankari.kamal.18022963No ratings yet

- Canon Printer InvoiceDocument2 pagesCanon Printer InvoiceTYCS35 SIDDHESH PENDURKARNo ratings yet

- GEMC-511687720852142 Invoice PDFDocument2 pagesGEMC-511687720852142 Invoice PDFrip111176No ratings yet

- Invoice: Click Here To Download Seller InvoiceDocument2 pagesInvoice: Click Here To Download Seller InvoicearyandjNo ratings yet

- Target Face 150 (PSH)Document2 pagesTarget Face 150 (PSH)sarthakgan29No ratings yet

- Invoice n-1Document1 pageInvoice n-1TEZ BUZZNo ratings yet

- AThvdnVjYkI3ZGRGQzVyeFRvTThIUT09 InvoiceDocument2 pagesAThvdnVjYkI3ZGRGQzVyeFRvTThIUT09 InvoiceRobin singhNo ratings yet

- MSF R.K.P Sec-13 - Aug'23Document2 pagesMSF R.K.P Sec-13 - Aug'23vineet.tpsNo ratings yet

- Bill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDocument2 pagesBill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountShiv RajNo ratings yet

- Item Invoice DownloadDocument3 pagesItem Invoice DownloadAmandeep SinghNo ratings yet

- Book BillDocument1 pageBook Billag9322596No ratings yet

- Vvneq1m5ymzryny1nuj2swrlwef0dz09 InvoiceDocument2 pagesVvneq1m5ymzryny1nuj2swrlwef0dz09 InvoiceTYCS35 SIDDHESH PENDURKARNo ratings yet

- Gem InvoiceDocument2 pagesGem InvoicenimaygabaNo ratings yet

- aGlWTUxqUGZwSHUxN0hodHduM3AvUT09 InvoiceDocument2 pagesaGlWTUxqUGZwSHUxN0hodHduM3AvUT09 InvoiceSandeep KumarNo ratings yet

- Item Invoice DownloadDocument3 pagesItem Invoice DownloadA. SinghaniaNo ratings yet

- Item Invoice DownloadDocument3 pagesItem Invoice DownloadA. SinghaniaNo ratings yet

- Item Invoice DownloadDocument3 pagesItem Invoice DownloadA. SinghaniaNo ratings yet

- Invoice - Sandisk Memory CardDocument1 pageInvoice - Sandisk Memory CardPrashant KumarNo ratings yet

- Spanish ConversationDocument1 pageSpanish Conversationdarakhshan1980No ratings yet

- TldEdURCaElod0FGVE12NldQL2l6Zz09 InvoiceDocument2 pagesTldEdURCaElod0FGVE12NldQL2l6Zz09 InvoicePratyush kumar NayakNo ratings yet

- InvoiceDocument1 pageInvoiceVimal VajpeyiNo ratings yet

- PASTDocument2 pagesPASTpatel harshadNo ratings yet

- InvoiceDocument1 pageInvoiceRAKESH STÅRKNo ratings yet

- Azure InvoiceDocument1 pageAzure InvoiceAnkit SambhareNo ratings yet

- Del5 2923583Document1 pageDel5 2923583smriti.sinha323No ratings yet

- UVdqZ0Y4UkFWd1J6STdzaWpmbkk1QT09 InvoiceDocument2 pagesUVdqZ0Y4UkFWd1J6STdzaWpmbkk1QT09 Invoicenagasesha ReddyNo ratings yet

- State: DelhiDocument1 pageState: DelhinavjyotifurnitureNo ratings yet

- PDF DocumentDocument2 pagesPDF DocumentTisha SodeNo ratings yet

- Tax InvoiceDocument3 pagesTax Invoicerenukaguguloth90No ratings yet

- Moto G5+Document1 pageMoto G5+Rajat DheemanNo ratings yet

- InvoiceDocument1 pageInvoicejaatpiyuushNo ratings yet

- InvoiceDocument1 pageInvoiceManish KumarNo ratings yet

- InvoiceDocument1 pageInvoicevipinjadaun06augNo ratings yet

- InvoiceDocument1 pageInvoicedonorvicky749No ratings yet

- Sterling MonitorDocument1 pageSterling MonitorSwagBeast SKJJNo ratings yet

- Faulty Adopters InvoiceDocument1 pageFaulty Adopters InvoicesumitsharmaNo ratings yet

- InvoiceDocument2 pagesInvoiceMukesh ChoudharyNo ratings yet

- Tax InvoiceDocument3 pagesTax Invoicerkmohit9792No ratings yet

- ASSAMBILLDocument2 pagesASSAMBILLmahavirtrading0201No ratings yet

- Invoice BookDocument1 pageInvoice BookAnkit ParasharNo ratings yet

- serviceCustomerInvoice 2297 2023 10 25 serviceCustomerInvoice-b95cadc9-2297-6cf15573 1c80 4597 bf22 336ccecfeacbs36DU3l0fb-5039332339Document1 pageserviceCustomerInvoice 2297 2023 10 25 serviceCustomerInvoice-b95cadc9-2297-6cf15573 1c80 4597 bf22 336ccecfeacbs36DU3l0fb-5039332339saksham kapoorNo ratings yet

- Nikhil RaiDocument11 pagesNikhil RaiShekharNo ratings yet

- ZjcybEtEa0N1SVRxVGV5aXpwb2R0UT09 Invoice-3Document2 pagesZjcybEtEa0N1SVRxVGV5aXpwb2R0UT09 Invoice-3nagasesha ReddyNo ratings yet