Professional Documents

Culture Documents

13th Sep '11 Asia Market Report

13th Sep '11 Asia Market Report

Uploaded by

LBTodayOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

13th Sep '11 Asia Market Report

13th Sep '11 Asia Market Report

Uploaded by

LBTodayCopyright:

Available Formats

The Electronic Daily from ASIA RESEARCH TEAM

Colombo Stock Market

Daily Review

13th

Tuesday

September 2011

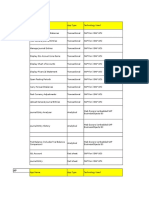

All Share Price Index

Market Statistics

All Share Index

Milanka Index

Treasury Bill Rates (%)

Prime Lending Rate (%)

Deposit Rate (%)

Call Money (%)

Exchange Rates

- 3 mths

- 12 mths

- Avg.

- Wtd. Avg.

- Avg.

- US$

- Euro

- 100

Market Comment

Latest

Previous

7.11

7.25

9.49

6.40

7.11

7.35

9.37

6.35

Sep-13

Sep-12

8.02

110.10

150.49

143.05

8.02

110.10

149.54

142.17

Pre.day

(%)

6,967.6

-0.5

6,270.4

6,271.0

0.0

Banking & Finance

16,579.6

16,652.0

-0.4

Food & Beverage

12,291.1

12,336.0

-0.4

Diversified

nka Price Index

Hotels & Travels

2,269.4

2,270.1

0.0

4,522.5

4,561.8

-0.9

Telecommunication

Money Market Indicators

Today

6,930.0

176.8

181.0

-2.3

Manufacturing

3,676.1

3,708.9

-0.9

Market Capitalisation (LKR bn)

2,485.8

2,499.3

-0.5

(USD bn)

22.6

22.7

-0.5

Market PER (Historical X)

18.9

19.0

-0.5

Market PBV (Historical X)

2.4

2.4

0.0

Market DY (Historical X)

1.5

1.5

0.0

Turnover (LKR mn)

3,073.7

2,303.3

33.4

(USD mn)

27.9

20.9

33.5

297.3

191.8

55.0

98.3

76.4

28.7

438.2

309.3

41.7

Volume (mn shares)

Foreign Purchases (LKR mn)

Foreign Sales (LKR mn)

The All Share Price Index shed 37.6 points to close at 6930.0 points (-0.5%) whilst the Milanka Price Index also fell

marginally 0.6 points to close at 6270.4 points (-0.0%).

The total turnover was LKR3, 074.3 mn (USD27, 922.8 k) vs. 12-months average daily turnover of LKR 2,923.3 mn (USD26,

551.3 k) whilst the volume traded for the day was 297,304k against the 12 months average daily volume of 111,374 k.

Top traded counters were Lanka Milk Foods LKR 590.4mn (USD5, 362.7k, -0.2%), Muller & Phipps LKR276.3mn (USD

2,509.5k, +13.3%), Tess Agro LKR 170.8 mn (USD1, 552.7k, +3.8%), Free Lanka Capital Holdings LKR 134.8mn (USD1,

225.5k, +5.0%) and Ascot Holdings LKR 130.5mn (USD 1,186.4k, -10.0%).

The market continued its negative momentum with both indices closing red. Today the bourse witnessed a retail rally

where the top turnover positions were dominated by retail counters. Lanka Milk Foods became the days top turnover with

a block of 500k shares crossing at 105.00. Tess Agro, Muller & Phipps, and Ascot Holdings were captured to the price band

formula. Both Tess Agro and Muller & Phipps gained 3.9% and 13.33% respectively. Heavy weight John Keells Holdings,

Distilleries Company of Sri Lanka, DFCC Bank and Colombo Dockyard witnessed strategic crossings during the day.

Foreign purchases amounted to LKR98.3 mn (USD 893.5k), whilst foreign sales amounted to LKR438.1mn (USD3, 982.7k).

Market capitalization is at LKR2, 485.8bn. YTD performance is 4.4%

Trade on-line at http://www.cdax.lk

The Electronic Daily from ASIA RESEARCH

Large Cap Focus

Company

Dialog Telekom

John Keells Holdings

SL Telecom

Lanka IOC

Aitken Spence

Hayleys

Hemas Holdings

Richard Pieris

NDB

DFCC Bank

Commercial Bank

HNB

Distilleries

Asian Hotels

Volume

18,200

389,000

12,800

28,400

4,800

600

31,200

553,200

66,300

261,600

13,700

562,700

500

Turnover

(USD000)

1.8

768.4

5.4

4.5

6.4

1.8

11.8

52.7

83.6

327.9

26.3

894.6

-

(LKR mn)

0.2

84.6

0.6

0.5

0.7

0.2

1.3

5.8

9.2

36.1

2.9

98.5

-

High

(LKR)

8.50

219.10

51.00

18.60

140.00

380.10

41.30

10.70

139.00

138.10

210.00

176.60

93.70

Low

(LKR)

8.40

214.90

49.00

18.10

139.00

380.10

41.00

10.30

137.50

138.00

208.10

174.00

91.00

Close

(LKR)

8.40

218.20

49.70

18.20

139.00

380.10

41.00

10.30

138.50

138.00

231.60

210.00

175.00

92.00

Large Trades

Major Price Movements

Company

Sathosa Motors

Regnis (Lanka)

Muller & Phipps

Mercantile Shipping

Abans Financial Services

Pegasus Hotels Of Ceylon

Ascot Holdings

Commercial Development Company

Miramar Beach Hotel

Ceylinco Insurance (Non Voting)

% Total

2.8

0.2

0.3

1.2

0.1

3.2

-

Price

366.80

185.30

3.30

337.00

77.90

69.50

161.50

115.00

280.00

330.00

+/-LKR

86.80

23.60

0.30

22.00

4.80

3.50

-16.80

-10.50

-25.00

-29.00

+/-%

31.00

14.59

10.00

6.98

6.57

5.30

-9.42

-8.37

-8.20

-8.08

CSE Announcements

Company

Muller and Phipps

Tess Agro

Free Lanka Capital Holdings

Seylan Merchant Bank(W : 0015)

Amana Takaful

Blue Diamonds(Non Voting)

Seylan Merchant Bank

Panasian Power

Seylan Merchant Bank(Non Voting)

Raigam Wayamba Salterns

Blue Diamonds

LANKA MILK FOODS

E-CHANNELING

SEYLAN MERCHANT BANK

Volume

74,792,700

31,183,000

31,007,200

20,029,200

19,794,100

18,544,700

13,837,200

11,020,700

9,823,000

9,455,100

5,922,500

5,611,340

3,831,800

3721300

Interim Results

LKR Mn

Sierra Cables

1QFY12

48.9

Trade on-line at http://www.cdax.lk

1QFY11

15.3

Change %

219

September 13, 2011

The Electronic Daily from ASIA RESEARCH

Daily Share Price Movements

COMPANY

HIGH

(LKR)

264.9

LOW

(LKR)

260

CLOSE

(LKR)

261.4

CHANGE

(LKR)

1.4

NO.OF

TRADES

5

VOLUME

ABANS ELECTRICALS PLC

Main

Type

N0000

1700

12M HIGH

(LKR)

385

12M LOW

(LKR)

200.1

ABANS FINANCIAL SERVICES

N0000

77.9

72.5

77.9

4.8

ACL CABLES PLC

N0000

78.5

78.5

78.5

0.3

2800

116.2

51

9800

107

73

ACL PLASTICS PLC

N0000

150

150

150

-3

200

200

94

ACME PRINTING & PACKAGING PLC

N0000

26.8

24

24.3

-1.6

106

248400

34.6

16.4

AGALAWATTE PLANTATIONS PLC

N0000

60.7

AITKEN SPENCE

N0000

140

56.1

58.4

-0.2

1100

115

40

139

139

-0.6

18

4800

3500

132

AITKEN SPENCE HOTEL HOLDINGS PLC

N0000

77.1

76

76

-1.5

26

17600

900

68

ALUFAB PLC

N0000

78

71

71.4

0.3

23

4100

192.6

36

AMANA TAKAFUL PLC

N0000

3.1

2.8

2.9

950

19794100

4.5

1.8

APOLLO (LANKA HOSPITALS)

N0000

62

58

58.3

-2.4

225

311300

108.3

29

ASCOT HOLDINGS PLC

N0000

189.8

160.5

161.5

-16.8

621

743400

192

58

ASIA CAPITAL PLC

N0000

96

92

95

-1.6

23

15000

120

40

ASIAN ALLIANCE INSURANCE PLC

N0000

112.6

112.6

112.6

-7.4

100

202

60.5

ASIAN HOTELS & PROPERTIES PLC

N0000

93.7

91

92

500

210

85.2

ASIRI CENTRAL HOSPITALS PLC

N0000

193

190

191

-11.7

14

1900

385

150

ASIRI HOSPITAL HOLDINGS PLC

N0000

10.1

9.9

9.9

-0.1

63

254200

12.4

7.7

ASIRI SURGICAL HOSPITAL PLC

N0000

8.9

8.6

8.7

-0.3

27

43100

11

7.2

BAIRAHA FARMS PLC

N0000

257

252.5

255.4

-4.5

47

26200

525

149.5

BALANGODA PLANTATIONS PLC

N0000

40.4

40

40.2

-0.5

18

8400

77.5

39.6

BIMPUTH LANKA INVESTMENTS

N0000

64.3

64.2

64.3

1100

120

25

BLUE DIAMONDS PLC

N0000

12.3

10.9

11.4

812

5922500

13.1

2.9

BLUE DIAMONDS PLC

X0000

5.6

4.9

-0.1

1018

18544700

6.3

1.5

BOGALA GRAPHITE LANKA PLC

N0000

55.3

51

51

-4.2

1000

100

25

BOGAWANTALAWA TEA ESTATES PLC

N0000

17.9

17.3

17.5

0.1

10

4800

65

16

BROWN & COMPANY PLC

N0000

277

275

275.2

-0.8

17

113100

404.9

170

BROWNS BEACH HOTELS PLC

N0000

18.9

18

18.1

-0.4

46

40100

120

16.1

BUKIT DARAH PLC

N0000

1070

1070

1070

-0.3

12

2500

9000

815

C T LAND

N0000

32

31

31.1

-0.6

19

19300

40

25

C W MACKIE

N0000

98

94

97.9

-0.1

8300

124.9

61

CALTEX LUBRICANTS

N0000

163.2

162

162.1

-1.5

15

16500

183.5

151

CAPITAL DEVELOPMENT AND

INVESTMENT CO PLC

CAPITAL REACH

N0000

440

406

426.9

-9.1

11

1700

777.7

130

N0000

50

49

49

-0.3

15

28100

79

35

CARGILLS CEYLON PLC

N0000

228

220

225

1.6

11

16300

253

117

CARGO BOAT DEVELOPMENT COMPANY

PLC

CARSONS CUMBERBATCH PLC

N0000

130

127

127

-1.5

3400

189.9

100

N0000

600

595

595

-0.7

1800

1230

470

CENTRAL FINANCE COMPANY PLC

N0000

278

274.5

275

-3.4

38

31300

1895

250

CENTRAL INDUSTRIES PLC

N0000

90

90

90

-0.5

100

380

65.3

CEY THEATERS

N0000

189

187

187.9

-1.8

14

10700

249

121

CEYLINCO INSURANCE PLC

N0000

799

749

753

28

1600

950

345.1

CEYLINCO INSURANCE PLC

X0000

350

330

330

-29

300

475

220

CEYLINCO SEYLAN

N0000

15.5

14.9

15

-0.3

196

632400

23.9

10.6

CEYLON & FOREIGN TRADES PLC

N0000

9.6

9.2

9.2

-0.3

50

90600

13.6

CEYLON COLD PLC

N0000

107.5

105.1

106.9

-1.2

18

8400

980

98

CEYLON GLASS

N0000

8.8

8.6

8.6

-0.1

155

555100

12.4

3.2

CEYLON GUARDIAN

N0000

319.9

310

314.1

1.5

15

6300

1499

210

Trade on-line at http://www.cdax.lk

September 13, 2011

The Electronic Daily from ASIA RESEARCH

COMPANY

HIGH

(LKR)

82

LOW

(LKR)

78

CLOSE

(LKR)

81.2

CHANGE

(LKR)

2.5

NO.OF

TRADES

4

VOLUME

CEYLON HOSPITALS PLC

Main

Type

X0000

500

12M HIGH

(LKR)

95

12M LOW

(LKR)

68

CEYLON HOTELS CORPORATION PLC

N0000

32

31

31

22

28100

44.4

21

CEYLON INVESTMENT PLC

N0000

126.1

125.2

126

CEYLON LEATHER PRODUCTS PLC

N0000

88

86.1

87.3

-1.3

14

24700

660

82

-2.3

23

13800

149

50

CEYLON LEATHER PRODUCTS PLC

W0013

13.7

13.2

13.3

-0.3

24

50700

35

9.9

CEYLON LEATHER PRODUCTS PLC

W0014

13.3

13

13.1

-0.4

29

66800

30

10

CEYLON TEA

N0000

CEYLON TOBACCO

N0000

394

7.5

7.8

-0.1

204

568400

8.8

390

390

-3.9

400

399

272

CHILAW FINANCE PLC

N0000

26.9

25

25

-1

27

44300

60

19.8

CIC HOLDINGS PLC

X0000

89

88

88

-0.5

10

10900

144.5

80

CITIZENS DEVELOPMENT BUSINESS

FINANCE

CITIZENS DEVELOPMENT BUSINESS

FINANCE

CITRUS LEISURE

N0000

75.5

74.2

74.9

-0.3

41

413600

165

44.5

X0000

52

49

50

-0.5

45

176300

55

46

CITRUS LEISURE

N0000

79

76.3

76.9

-2.2

68

67200

105

11.7

W0017

37.2

35.5

36.1

-0.3

26

24500

57

12.7

CITRUS LEISURE

W0018

28.5

26.2

27.2

-1.6

39

137500

48.5

12.1

CITRUS LEISURE

W0019

23

21.5

21.9

-0.4

72

506000

33.5

10

CITY HOUSING & REAL ESTATE CO PLC

N0000

24.1

23

23.1

-1.7

62

208000

32

16

COCO LANKA PLC

N0000

71

69

69.5

-2.5

10

3100

95

42.6

COCO LANKA PLC

X0000

58.5

55.6

58

27

14900

70

36.5

COLOMBO FORT INVESTMENTS PLC

N0000

330

330

330

100

710

160

COLOMBO INVESTMENT TRUST PLC

N0000

325.1

325

325

1200

752

171

COLOMBO LAND & DEVELOPMENT CO

PLC

COLONIAL MOTORS PLC

N0000

64.4

62

62.1

-2.1

297

739300

73.4

14.4

N0000

479.5

460

473

-2.3

106

53300

530

85

COMMERCIAL CREDIT PLC

N0000

31.2

30.3

30.4

-1.5

105

326400

45

20

COMMERCIAL DEVELOPMENT CO PLC

N0000

129

115

115

-10.5

31

28600

185

48.1

CONFIFI HOTEL HLDG.

N0000

222

220

220

-4.8

22

4600

360

175

CONNAISSANCE

N0000

107

105

105.3

-2.7

10

2600

140

80

CONVEVIENCE FOODS LTD.

N0000

339

320

321.7

3.7

400

580

137

DANKOTUWA

N0000

39

37.9

38.3

-0.7

91

90000

98

34

DFCC

N0000

138.1

138

138

-1.1

20

261600

550

125.5

DIALOG

N0000

8.5

8.4

8.4

-0.1

24

18200

13.8

7.8

DIMO

N0000

1444.8

1420

1420

-30

700

1900.1

830

DIPPED PRODUCTS

N0000

125.9

122

122.6

-3.3

21

48000

140

91

DISTILLERIES

N0000

176.6

174

175

-0.1

46

562700

197

155

DOCKYARD

N0000

275

270

270

-0.3

29

126100

315

245

E-CHANNELING

N0000

8.4

7.9

7.9

-0.1

335

3831800

33

EAGLE INSURANCE

N0000

280

280

280

17

16800

335

245.1

EAST WEST

N0000

42

38.5

39.7

-1.4

431

719900

54.5

10

EASTERN MARCHANT

N0000

2325

2250

2298.8

-26.2

500

3850

245

EDEN HOTELS

N0000

45.5

44

44

-1.7

39

24300

71

35

ELEPHANT LITE

N0000

12.4

11.9

12

-0.1

110

709600

14.9

7.6

ELPITIYA PLANTATIONS

N0000

27

26.1

26.5

-0.1

12

6100

55

15

EQUITY

N0000

56

50

50.5

-4.3

18

5100

75

40

EQUITY TWO

N0000

32

30

31.8

0.3

37

36400

40

21.2

EXPOLANKA HOLDINGS

N0000

12.9

12.5

12.5

-0.2

152

601300

16.2

12.3

FIRST CAPITAL HOLDINGS PLC

N0000

19.4

19

19

43

63400

29.3

16.5

FORT LAND AND BUILDING PLC

N0000

65

63.5

63.9

-1

35

54600

580

57.5

Trade on-line at http://www.cdax.lk

September 13, 2011

The Electronic Daily from ASIA RESEARCH

COMPANY

HIGH

(LKR)

30.6

LOW

(LKR)

28.1

CLOSE

(LKR)

28.5

CHANGE

(LKR)

-1.1

NO.OF

TRADES

53

VOLUME

FORTRESS RESORTS

Main

Type

N0000

131200

12M HIGH

(LKR)

35.9

12M LOW

(LKR)

19

FREE LANKA CAPITAL HOLDINGS

N0000

4.5

4.1

0.1

2280

31007200

3.6

GALADARI

N0000

33.6

32.8

33

GESTETNER

N0000

412

351.1

379.5

-0.4

39

22000

46

29.9

0.8

34

7200

520

60

GRAIN ELEVATORS

N0000

115.4

111

112.4

-1.1

149

93000

265

52.7

HAPUGASTENNE

N0000

64

61

63.4

2.3

1100

89.9

48

HAYCARB

N0000

159

159

HAYLEYS

N0000

380.1

380.1

159

5000

219.5

135

380.1

-8.9

600

426

325

HAYLEYS - MGT

N0000

35

33.9

35

1.3

36900

57

28.6

HAYLEYS EXPORTS

N0000

40

40

40

1100

64.9

33

HDFC

N0000

HEMAS HOLDINGS

N0000

1869.9

1800

1800.2

-24.8

29

26400

1900

402

41.3

41

41

18

31200

53.5

40.5

HEMAS POWER

N0000

35

34.1

34.1

-1.2

40

136700

43.9

26.1

HNB

N0000

210

208.1

210

0.5

20

13700

445

120

HNB

X0000

109

108.7

109

17

7600

260

15.6

HNB ASSURANCE

N0000

60.4

60.4

60.4

-0.7

200

92

51

HORANA

N0000

48

47.1

48

0.6

10

6400

96.1

29.3

HOTEL DEVELOPERS

N0000

128.6

128

128.1

-1.4

3100

155

101

HOTEL SERVICES

N0000

22.6

22

22.1

-0.5

23

34500

30

20

HOTEL SIGIRIYA

N0000

75.9

73.5

73.8

-0.4

3100

95

60

HUEJAY

N0000

180

163

169

-9.5

600

293

41.6

HUNAS FALLS

N0000

79

78.6

79

-1

2600

105

75

HUNTERS

N0000

768

740

740

9.8

1200

2300

702

HVA FOODS LIMITED

N0000

75

69.1

71.4

-1.3

485

755700

82.5

12

HYDRO POWER PLC

N0000

14.2

13.5

13.5

-0.5

40

101000

21.8

11.5

INDO MALAY

N0000

1394.9

1394.9

1394.9

100

1720

425

INDUSTRIAL ASPHALTS PLC

N0000

520.5

520

520

-32.3

500

710

189.2

JANASHAKTHI

N0000

16.2

16

16

35

89500

22.1

14

JOHN KEELLS

N0000

90

89.9

89.9

-0.1

600

250

85

JOHN KEELLS HOLD.

N0000

219.1

214.9

218.2

3.6

118

389000

360

183

JOHN KEELLS HOTELS

N0000

17.9

16.2

16.3

-0.1

25

14500

21.8

15.5

KAHAWATTE

N0000

37.9

33.5

33.9

1.5

23

519700

43.1

20.9

KANDY HOTELS

N0000

235

220

221.4

-10.6

2200

365

181.2

KAPILA HEAVY

N0000

48.7

46.6

47

58

36500

684.1

43.5

KEELLS FOOD PRODUCTS

N0000

118.1

118.1

118.1

-3.9

100

175

105.1

KEGALLE

N0000

145.5

145

145.2

0.1

2000

285

140

KELANI CABLES

N0000

99

95.1

97.1

1.9

200

139

79.8

KELANI TYRES

N0000

49

48

48.1

-1

20

14900

129.5

40

KELANI VALLEY

N0000

120.8

119.9

119.9

0.1

1600

210

112

KELSEY DEVELOPMENT

N0000

31.3

29.8

30

-0.4

19

22000

34.5

14.4

KOTAGALA

N0000

103.6

102.1

102.5

-1.5

13

4500

230

75

KSHATHRIYA HOLD.

N0000

18.6

18.1

18.2

-0.2

33

25700

33

11

KURUWITA TEXTILES

N0000

28.6

28.5

28.5

-0.8

1500

44

22.2

LAKE HOUSE PRIN.

N0000

175.1

165.1

172.5

-2.5

15

7200

225

81

LAMBRETTA

N0000

49

47.4

48.1

-1.1

4300

80

23

LANKA ALUMINIUM

N0000

55.1

54.1

54.4

-4.7

42

15300

104

34.5

LANKA ASHOK LEYLAND PLC

N0000

3800

3505

3655

55

400

7490

1000

LANKA CEMENT

N0000

24.4

22.8

24.4

0.9

22

253900

33.5

17.5

Trade on-line at http://www.cdax.lk

September 13, 2011

The Electronic Daily from ASIA RESEARCH

COMPANY

HIGH

(LKR)

105

LOW

(LKR)

105

CLOSE

(LKR)

105

CHANGE

(LKR)

-5.1

NO.OF

TRADES

2

VOLUME

LANKA CERAMIC PLC

Main

Type

N0000

500

12M HIGH

(LKR)

165

12M LOW

(LKR)

75

LANKA IOC

N0000

18.6

18.1

18.2

-0.3

21

28400

21.5

15.9

LANKA MILK FOODS

N0000

116.1

110

110.4

LANKA ORIX FINANCE COMPANY

N0000

11.1

10.9

10.9

0.2

114

5611340

154.9

95

-0.1

87

491800

22.5

8.6

LANKA TILES

N0000

103

102

103

-1

23000

145

87.5

LANKA VENTURES

N0000

46

44

44.3

-1.3

23

23900

60

26.5

LANKA WALLTILES

N0000

110

110

110

LANKEM CEYLON

N0000

361

351

356.9

1100

187

92

1.3

14

2700

590

180

LANKEM DEV.

N0000

20.2

19

19.2

-0.7

49

65500

92.5

15.7

LAUGFS GAS

N0000

42.9

41.5

42.2

0.3

120

523700

60

23

LAUGFS GAS

X0000

29

LB FINANCE

N0000

170

28

28.2

-0.4

121

119900

45.3

14.9

168.5

168.6

-1.4

1400

340

131.1

LIGHT HOUSE HOTEL

N0000

53.8

53.7

53.7

-0.2

1000

79.5

49.5

LION BREWERY

N0000

204

202

202

1.5

2300

260

114.5

LOLC

N0000

99.4

MADULSIMA

N0000

20.1

99

99

-0.3

41

106600

1600

90

20.1

20.1

-0.2

1700

37

14.5

MAHAWELI REACH

N0000

39.5

37

37.6

-0.2

139

120900

44.6

28

MALWATTE VALLEY

N0000

7.6

6.9

-0.3

116

229400

127

5.9

MALWATTE VALLEY

MARAWILA HOLIDAY

X0000

6.5

6.5

-0.4

13

156300

99.9

5.6

N0000

12.5

12

12

-0.4

93

285100

18.3

9.1

MASKELIYA

N0000

26

24

24.2

-0.5

12

20500

35

21.1

MERC. SHIPPINGS

N0000

337

337

337

22

100

511

170

MERCHANT BANK

N0000

39

38.7

38.8

-0.1

21

22000

59.7

35.9

METROPOLITAN

N0000

32.5

30.2

30.2

-2.3

1200

62.5

24

MIRAMAR

N0000

280

280

280

-25

400

565

72

MULLERS

N0000

4.3

3.1

3.3

0.3

3957

74792700

4.3

1.5

MULTI FINANCE

N0000

57.6

51.2

53.3

-2.4

183

110000

77.5

25

NAMUNUKULA

N0000

93

93

93

-0.4

700

159.9

90

NATION LANKA

N0000

20.5

19.9

20

-0.9

223

738200

32.7

NATIONS TRUST

N0000

65

63.9

63.9

-0.4

29

29900

114.7

57

NAWALOKA

N0000

4.1

49

369100

10

3.5

NDB

N0000

139

137.5

138.5

-0.5

26

66300

415

132

NESTLE

N0000

924.9

900

913.4

-6.6

16

4500

1000

615

NUWARA ELIYA

N0000

1500

1500

1500

-49

100

2039.9

702

ODEL LIMITED

N0000

38.4

37.3

37.9

0.1

122

712200

52.4

28

ON'ALLY

N0000

78

75.3

75.4

-0.4

21

5600

156.6

55.1

ORIENT GARMENTS

N0000

34.7

30.1

32.3

-0.7

170

273500

48.3

21.5

OVERSEAS REALTY

N0000

15.1

14.9

14.9

-0.2

92

432400

19.4

13.6

PAN ASIA

N0000

28

27.2

27.8

0.3

173

775400

76.5

22.8

PANASIAN POWER

N0000

5.6

5.1

-0.3

633

11020700

8.8

3.5

PARQUET

N0000

25.3

25.3

25.3

6500

35.5

20

PC HOUSE PLC

N0000

18.9

18

18

-0.7

545

2282300

32.2

8.6

PEGASUS

N0000

69.5

69.5

69.5

3.5

2400

85

57

PELWATTE

N0000

34.3

33

33.6

84

147400

50

24.4

PEOPLE'S MERCHANT

N0000

21

20.3

20.4

-0.6

98

331600

42

20.1

PRINT CARE PLC

N0000

41.9

39.6

39.9

-0.1

12

6900

350

33

PROPERTY DEVELOP.

N0000

73.1

68.5

72.4

-1

13

14500

80

42

RADIANT GEMS

N0000

139

125

131.4

5.9

394

355300

139

25.3

Trade on-line at http://www.cdax.lk

September 13, 2011

The Electronic Daily from ASIA RESEARCH

COMPANY

HIGH

(LKR)

5.3

LOW

(LKR)

4.9

CLOSE

(LKR)

5

CHANGE

(LKR)

0.1

NO.OF

TRADES

501

VOLUME

RAIGAM SALTIERNS

Main

Type

N0000

9455100

12M HIGH

(LKR)

5.4

12M LOW

(LKR)

3.7

REGNIS

N0000

199

161

185.3

23.6

160

101300

268.9

112

RENUKA AGRI

N0000

6.6

6.7

RENUKA CITY HOT.

N0000

360.1

360

360.1

229

2447700

8.5

4.1

-3.8

1100

450

275.5

RENUKA HOLDINGS

N0000

62.9

61.6

61.9

-1.3

16

36900

87.2

49.9

RENUKA HOLDINGS

X0000

39.8

39.1

39.1

-0.7

13

5600

60.6

32

RICH PIERIS EXP

N0000

30.9

RICHARD PIERIS

N0000

10.7

30.1

30.3

-0.7

18

15100

57.8

25

10.3

10.3

-0.2

156

553200

185

9.8

RIVERINA HOTELS PLC

N0000

113

105.6

105.9

-7.1

700

165

85.5

ROYAL CERAMICS

N0000

147.2

147

147.1

-0.8

15

9500

336

136

ROYAL PALM HOTEL

N0000

SAMPATH

N0000

69.1

69.1

69.1

0.1

100

100

58

238.9

236.5

238

0.2

40

46900

550

215

SATHOSA MOTORS

N0000

379.9

280

366.8

86.8

144

30700

380

165

SELINSING

N0000

1125

1125

1125

25

100

1475

260

SERENDIB HOTELS

N0000

32.5

30

30.4

-0.1

39

42400

185

21.1

SERENDIB HOTELS

X0000

22.9

21

21.4

-0.6

33

451500

140

14

SEYLAN BANK

N0000

64.4

63

64

0.9

22

112100

125

59.5

SEYLAN BANK

X0000

35.8

34

34.2

-0.8

57

182700

64.9

28

SEYLAN MERC.LEASING

N0000

47.5

45.9

46.4

-0.5

29

14600

350

37

SEYLAN MERC.LEASING

W0020

21.1

20.7

20.7

-0.5

5900

50

20

SEYLAN MERCHANT BANK

N0000

2.6

2.6

484

13837200

3.6

SEYLAN MERCHANT BANK

W0015

1.4

1.3

1.4

0.1

197

20029200

2.4

0.3

SEYLAN MERCHANT BANK

W0016

0.5

0.4

0.4

67

3721300

0.9

0.2

SEYLAN MERCHANT BANK

X0000

0.9

0.8

0.8

203

9823000

2.5

0.6

SHALIMAR

N0000

885.1

885.1

885.1

200

1230

660.2

SHAW WALLACE

N0000

330

330

330

500

365

202

SIERRA CABLES

N0000

5.3

4.9

0.1

362

3006400

6.4

SIGIRIYA VILLAGE

N0000

101

100

100.2

-2.8

500

149.9

88

SINGALANKA

N0000

315

310

311.7

-6.3

800

4090

165

SINGER FINANCE

N0000

37

34

34.3

-0.8

170

170000

55.7

25.5

SINGER IND.

N0000

245

223.2

226.2

-11.8

46

8700

455

103.6

SINGER SRI LANKA

N0000

126.5

122

124.2

0.8

41

21100

248

92.1

SINHAPUTHRA FINANCE

N0000

119

119

119

-1

100

154

68

SOFTLOGIC HOLDINGS

N0000

23.5

23

23.1

-0.3

127

252500

28

16.2

SRI LANKA TELECOM

N0000

51

49

49.7

-1.6

25

12800

64.5

40.1

STAFFORD

N0000

59.1

56

56.2

-2.6

26

13900

76.8

38

SUNSHINE TRAVELS

N0000

38.4

38.4

38.4

0.9

300

60

37

SWARNAMAHAL FINANCE

N0000

86.9

83.2

84.8

0.4

78

118500

135.3

35

TAJ LANKA

N0000

53.2

50.1

50.3

-0.5

23

10500

89

40

TALAWAKELLE

N0000

34

34

34

0.8

100

55

30

TEA SMALLHOLDERS

N0000

83.9

80

82.3

-2.2

600

300

78

TESS AGRO

N0000

5.7

4.8

5.3

0.1

1415

31183000

5.7

2.2

TEXTURED JERSEY

N0000

14.9

14.5

14.6

-0.3

149

503600

15.7

13.5

THE AUTODROME PLC

N0000

853.1

853.1

853.1

0.9

100

1550

400

THE FINANCE

N0000

43.5

38.5

40.1

-2

140

176700

80

26

THE FINANCE

X0000

16.7

15

15.3

440

2084700

20

10

THREE ACRE

N0000

112

105

106.5

-2.9

101

32000

242

35

TOKYO CEMENT

N0000

52

52

52

11

5700

71

38

Trade on-line at http://www.cdax.lk

September 13, 2011

The Electronic Daily from ASIA RESEARCH

COMPANY

HIGH

(LKR)

39.5

LOW

(LKR)

39.2

CLOSE

(LKR)

39.2

CHANGE

(LKR)

-0.3

NO.OF

TRADES

6

VOLUME

TOKYO CEMENT

Main

Type

X0000

9200

12M HIGH

(LKR)

55

12M LOW

(LKR)

29

TOUCHWOOD

N0000

24

23.4

23.6

-0.2

97

162600

46.5

20.6

UDAPUSSELLAWA

N0000

37.3

37

37

UNION ASSURANCE

N0000

115

115

115

-0.7

1300

63

32

-4.4

200

299

87

UNION BANK PLC

N0000

23.9

23.5

23.6

86

75500

45

21

UNITED MOTORS

N0000

175

165

169.5

-5

111

76200

270

99

VALLIBEL FINANCE

N0000

VALLIBEL ONE LIMITED

N0000

46

44

44.2

-1.8

63

52400

129.9

37

29.5

28.1

28.2

-0.8

369

644900

38.5

27.8

VALLIBEL POWER ERATHNA

N0000

9.4

9.3

9.4

26

466800

14.5

7.8

VIDULANKA

N0000

9.7

9.3

0.3

156

519600

11

5.8

WALK & GREIG

WALK & GREIG

N0000

68

64.2

65.1

-2.5

170

170100

120.2

55.1

W0002

32.9

31.6

31.7

-1.6

115

213400

65

23

WALK & GREIG

W0003

30

29.4

30

-0.6

19

36400

62

22.6

WALK & GREIG

W0006

28.7

27.6

27.6

-1.4

79

71400

61.5

21

WATAPOTA

N0000

172

165

168.9

1.7

62

20400

10012.5

125

WATAWALA

N0000

19.5

19.2

19.3

20

15400

322

18

YORK ARCADE

N0000

30.3

30

30.1

-0.4

42

24500

47.9

22.3

Trade on-line at http://www.cdax.lk

September 13, 2011

The Electronic Daily from ASIA RESEARCH

Research

Senior Analyst

Amali Perera

(94-11)5320256

amali@asiacapital.lk

Corporates

Economy

Minoli Mallwaarachchi

Nirmala Samarawickrama

Dilan Wijekoon

Thilina Ukwatta

Shan Silva

(94-11)5320259

(94-11)5320253

(94-11)5320253

(94-11)5320253

(94-11)5320251

Dhanusha Pathirana

Travis Gomez

(94-11)5320254

(94-11)5320000

Statistician

Nuwan Pradeep

(94-11)5320257

Sales

Institutional Sales

Sabri Marikar

Niroshan Wijayakoon

Niyaz Aboobucker

Anura Hedigallage

Chelaka Hapugoda

Chaminda Mahanama

Hiran Bibile

(94-11) 5320224

(94-11) 5320208

(94-11) 5320213

(94-11) 5320211

(94-11) 5320240

(94-11) 5320223

(94-11) 5320238

Retail Sales

077 3-576868

0777-713645

0777-727352

0777 -713663

0777 -256740

0777 -556582

0777 -352032

sabri@asiacapital.lk

niroshan@asiacapital.lk

niyaz@asiacapital.lk

anura@asiacapital.lk

chelaka@asiacapital.lk

mahanama@asiacapital.lk

hiran@asiacapital.lk

Shiyam Subaulla

Gagani Jayawardhana

Priyantha Hingurage

Neluka Rodrigo

Subeeth Perera

(011)- 5320218

(011)- 5320236

(011)- 5320217

(011)- 5320214

(011)- 5320227

0773-502016

0714-084953

0773-502015

0777-366280

0714-042683

shiyam@asiacapital.lk

gagani@asiacapital.lk

priyantha@asiacapital.lk

neluka@asiacapital.lk

subeeth@asiacapital.lk

Branches

CSE Floor

CSE,01-04, World Trade Centre, Colombo 1.

Kiribathgoda

Level 2-6,Udeshi City Shopping complex, No 94,Makola Rd,Kiribathgoda

Kurunegala

Union Assurance Building, No.6,1st Floor, Rajapilla Rd, Kurunagala.

Matara

Galle

E.H.Cooray Building, Mezzanine Floor, No:24, Anagarika Darmapala Mw,

Matara

Peoples Leasing Building, 2nd Floor, No.118,Matara Road, Galle

Negombo

Asia Asset Finance, 171/1, Station Road, Negombo.

Thushara Adhikari

M G Suranjana

Danushka Boteju

Suranga Harshana

Asanka Samarakoon

Gayan Nishsanka

Bandula Lansakkara

Sumeda Jayawardena

Lalinda Liyanapathirana

Ruchira Hasantha

Ushan Sachith

Uthpala Karunatilake

(011)-5735122

(011)-5763539

(011)-5634803

(011)-5734773

(037)-5628844

(037)-5642717

(037)-5643580

(041)-5677525

(041)-5677526

(091)-5629998

(091)-5676767

(031)-5676881

0773-688202

0773-954994

0716-270527

0783-452500

0773-690749

0777-105356

0773-925852

0773-687027

0778-628798

0773-687027

0778-628798

0773-691685

adhikari@asiacapital.lk

0772-544044

gayan@asiacapital.lk

Service Centers

Gayan Perera

(031)-5676880

Kandy

k3-L1,Level 01,kcc, No 5 ,Dalda Veediya, Kandy.

Hambantota

Hambanthota Chamber of Commerce, Thangalle Road, Hambantota.

(081)-5628500

(081)-5625577

(047)-5679240

(047)-5679241

Ampara

2nd Floor, T.K.S. Building, D.S. Senanayake Street, Ampara.

Jaffna

11-8, First Floor, Stanley Road, Jaffna

Wennappuwa

Asia Asset Finance, No.176, Negombo Road, Katuneriya.

Moratuwa

Asia Asset Finance, No.18, New De Zoysa Rd, Moratuwa.

Panadura

Asian Alliance Building, 293, Galle Road, Panadura

Nilupul Hettiarachchi

Radhika Hettiarachchi

Gayan Sanjeewa

Anusha Muthumali

Shermin Ranasinghe

Ravi De Mel

Madushanka Rathnayaka

Gratian Nirmalan

S.Puviraj

Sajith Iroshan

Sandun Athulathmudali

Hashan Lalantha

Charith Perera

Ranganath Wijetunga

Asanka Chaminda

0773-691816

0777-810694

0715-536309

0772-351716

0772-378352

(063)-5679071 0772-681995

(063)-5679070 0779-036577

(021)-5671800 0777-567933

(021)-5671801 0775-096969

(032)- 5673881 0773-740208

(032)- 5673882 0772-533331

(011)-5238662

(011)-5238663

(038)-5670400 0715-120723

(038)-5670407 0713-559552

boteju@asiacapital.lk

harshana@asiacapital.lk

asanka@asiacapital.lk

nishshanka@asiacapital.lk

sumeda@asiacapital.lk

rishan@asiacapital.lk

ruchira@asiacapital.lk

ushan@asiacapital.lk

uthpala@asiacapital.lk

nilupul@asiacapital.lk

radhika@asiacapital.lk

sanjeewa@asiacapital.lk

muthu@asiacapital.lk

shermin@asiacapital.lk

ravide@asiacapital.lk

shanka@asiacapital.lk

nirmal@asiacapital.lk

puviraj@asiacapital.lk

sajith@asiacapital.lk

sranga@asiacapital.lk

lalantha@asiacapital.lk

charithn@asiacapital.lk

ranganath@asiacapital.lk

chaminda@asiacapital.lk

The report has been prepared by Asia Wealth (Private) Limited. The information and opinions contained herein has been compiled or arrived at based upon information obtained from sources believed to be reliable and in good faith. Such information has not

been independently verified and no guaranty, representation or warranty, express or implied is made as to its accuracy, completeness or correctness, reliability or suitability. All such information and opinions are subject to change without notice. This document

is for information purposes only, descriptions of any company or companies or their securities mentioned herein are not intended to be complete and this document is not, and should not be construed as, an offer, or solicitation of an offer, to buy or sell any

securities or other financial instruments. In no event will Asia Securities be liable for any loss or damage including without limitation, indirect or consequential loss or damage, or any loss or damage whatsoever arising out of, or in connection with the use of this

report and any reliance you place on such information is therefore strictly at your own risk.

Asia Securities may, to the extent permissible by applicable law or regulation, use the above material, conclusions, research or analysis in which they are based before the material is disseminated to their customers. Not all customers will receive the material at

the same time. Asia Securities, their respective directors, officers, representatives, employees, related persons and/or Asia Securities, may have a long or short position in any of the securities or other financial instruments mentioned or issuers described herein at

any time and may make a purchase and/or sale, or offer to make a purchase and/or sale of any such securities or other financial instruments from time to time in the open market or otherwise, in each case either as principal or agent. Asia Securities may make

markets in securities or other financial instruments described in this publication, in securities of issuers described herein or in securities underlying or related to such securities. Asia Securities may have recently underwritten the securities of an issuer mentioned

herein. The information contained in this report is for general information purposes only. This report and its content is copyright of Asia Securities and all rights reserved. This report- in whole or in part- may not, except with the express written permission of

Asia Securities be reproduced or distributed or commercially exploited in any material form by any means whether graphic, electronic, mechanical or any means. Nor may you transmit it or store it in any other website or other form of electronic retrieval

system. Any unauthorised use of this report will result in immediate proceedings.

Trade on-line at http://www.cdax.lk

September 13, 2011

You might also like

- 32 Ways To Stop Foreclosure 21 BQFNLJDocument213 pages32 Ways To Stop Foreclosure 21 BQFNLJcarl100% (2)

- Short-Selling with the O'Neil Disciples: Turn to the Dark Side of TradingFrom EverandShort-Selling with the O'Neil Disciples: Turn to the Dark Side of TradingNo ratings yet

- Mint Banking Conclave Calling DBDocument276 pagesMint Banking Conclave Calling DBVikram44% (9)

- Asia Market Report 21st Sep '11Document8 pagesAsia Market Report 21st Sep '11LBTodayNo ratings yet

- Asia Market Report 14th Sep '11Document9 pagesAsia Market Report 14th Sep '11LBTodayNo ratings yet

- Aily Review: Market Statistics All Share Price IndexDocument10 pagesAily Review: Market Statistics All Share Price IndexRandora LkNo ratings yet

- Indices Reversed Backed by The Recent Down Trended Counters..Document6 pagesIndices Reversed Backed by The Recent Down Trended Counters..Randora LkNo ratings yet

- Daily Trade Journal - 11.06.2013Document7 pagesDaily Trade Journal - 11.06.2013Randora LkNo ratings yet

- Daily Trade Journal - 28.01.2014Document6 pagesDaily Trade Journal - 28.01.2014Randora LkNo ratings yet

- Daily Trade Journal - 08.07.2013Document6 pagesDaily Trade Journal - 08.07.2013Randora LkNo ratings yet

- 26th February 2014Document7 pages26th February 2014Randora LkNo ratings yet

- Daily Trade Journal - 04.10.2013Document6 pagesDaily Trade Journal - 04.10.2013Randora LkNo ratings yet

- Upward Climb in ASPI Amidst Crossings Adding 54% To TurnoverDocument6 pagesUpward Climb in ASPI Amidst Crossings Adding 54% To TurnoverRandora LkNo ratings yet

- Daily Trade Journal - 06.05.2013Document6 pagesDaily Trade Journal - 06.05.2013ishara-gamage-1523No ratings yet

- Bluechips Stepped Center Stage Amidst Rallying of IndicesDocument6 pagesBluechips Stepped Center Stage Amidst Rallying of IndicesRandora LkNo ratings yet

- Daily Trade Journal - 29.04.2013Document8 pagesDaily Trade Journal - 29.04.2013Randora LkNo ratings yet

- Daily Trade Journal - 15.10.2013Document6 pagesDaily Trade Journal - 15.10.2013Randora LkNo ratings yet

- Wednesday, July 24, 2013: Heavyweights Spearheaded Turnover Amidst Sluggish Indices..Document6 pagesWednesday, July 24, 2013: Heavyweights Spearheaded Turnover Amidst Sluggish Indices..Randora LkNo ratings yet

- Daily Trade Journal - 09.09.2013Document6 pagesDaily Trade Journal - 09.09.2013Randora LkNo ratings yet

- Daily Trade Journal - 08.08.2013Document6 pagesDaily Trade Journal - 08.08.2013Randora LkNo ratings yet

- ASPI Ends Flat S&P SL20 Falls With Liquid Big Caps : Thursday, February 13, 2014Document6 pagesASPI Ends Flat S&P SL20 Falls With Liquid Big Caps : Thursday, February 13, 2014Randora LkNo ratings yet

- Daily Trade Journal - 12.07.2013Document6 pagesDaily Trade Journal - 12.07.2013Randora LkNo ratings yet

- Daily Trade Journal - 05.11.2013Document6 pagesDaily Trade Journal - 05.11.2013Randora LkNo ratings yet

- Daily Trade Journal - 11.02.2014Document6 pagesDaily Trade Journal - 11.02.2014Randora LkNo ratings yet

- Daily Trade Journal - 13.06.2013Document7 pagesDaily Trade Journal - 13.06.2013Randora LkNo ratings yet

- Index Spikes Around An Important Technical Level at 5,900..Document6 pagesIndex Spikes Around An Important Technical Level at 5,900..Randora LkNo ratings yet

- Daily Trade Journal - 13.09.2013Document6 pagesDaily Trade Journal - 13.09.2013Randora LkNo ratings yet

- Daily Trade Journal - 09.07.2013Document6 pagesDaily Trade Journal - 09.07.2013Randora LkNo ratings yet

- Daily Trade Journal - 22.08.2013Document6 pagesDaily Trade Journal - 22.08.2013Randora LkNo ratings yet

- Daily Trade Journal - 17.09.2013Document6 pagesDaily Trade Journal - 17.09.2013ishara-gamage-1523No ratings yet

- Daily Trade Journal - 05.03.2014Document6 pagesDaily Trade Journal - 05.03.2014Randora LkNo ratings yet

- Daily Trade Journal - 18.09.2013Document6 pagesDaily Trade Journal - 18.09.2013Randora LkNo ratings yet

- Daily Trade Journal - 11.07.2013Document7 pagesDaily Trade Journal - 11.07.2013Randora LkNo ratings yet

- Daily 21 02 11Document3 pagesDaily 21 02 11Ramachandra Tumkur KarnikNo ratings yet

- Daily Trade Journal - 03.12.2013Document6 pagesDaily Trade Journal - 03.12.2013Randora LkNo ratings yet

- Bluechips Underscored Activity Turnover at A One-Week LowDocument6 pagesBluechips Underscored Activity Turnover at A One-Week LowRandora LkNo ratings yet

- Daily Trade Journal - 05.03Document7 pagesDaily Trade Journal - 05.03ran2013No ratings yet

- Index Dipped Amidst Profit Taking : Tuesday, April 30, 2013Document7 pagesIndex Dipped Amidst Profit Taking : Tuesday, April 30, 2013Randora LkNo ratings yet

- Dull Outlook Continues Crossings Dominate Turnover... : Monday, November 18, 2013Document6 pagesDull Outlook Continues Crossings Dominate Turnover... : Monday, November 18, 2013Randora LkNo ratings yet

- Daily Trade Journal - 13.05.2013Document6 pagesDaily Trade Journal - 13.05.2013Randora LkNo ratings yet

- Crossings Carry The Turnover To A 2-Week High Led by BFI SectorDocument7 pagesCrossings Carry The Turnover To A 2-Week High Led by BFI SectorRandora LkNo ratings yet

- Daily Trade Journal - 10.01Document13 pagesDaily Trade Journal - 10.01ran2013No ratings yet

- Correction Phase Sets in With Indices Extending A Steep DowntrendDocument7 pagesCorrection Phase Sets in With Indices Extending A Steep DowntrendRandora LkNo ratings yet

- Daily Trade Journal - 14.11.2013Document6 pagesDaily Trade Journal - 14.11.2013Randora LkNo ratings yet

- Daily Trade Journal - 04.03Document7 pagesDaily Trade Journal - 04.03ran2013No ratings yet

- Daily Trade Journal - 12.06.2013Document7 pagesDaily Trade Journal - 12.06.2013Randora LkNo ratings yet

- Indices Ended in Opposites JKH Added 73% To The Daily TurnoverDocument6 pagesIndices Ended in Opposites JKH Added 73% To The Daily Turnoverishara-gamage-1523No ratings yet

- Daily Trade Journal - 26.12.2013Document6 pagesDaily Trade Journal - 26.12.2013Randora LkNo ratings yet

- Daily Trade Journal - 27.05.2013Document6 pagesDaily Trade Journal - 27.05.2013Randora LkNo ratings yet

- Daily Trade Journal - 21.01Document12 pagesDaily Trade Journal - 21.01ran2013No ratings yet

- Daily Trade Journal - 30.09.2013Document6 pagesDaily Trade Journal - 30.09.2013Randora LkNo ratings yet

- Daily Trade Journal - 27.03.2014Document6 pagesDaily Trade Journal - 27.03.2014Randora LkNo ratings yet

- Index Reversed But On A Slow Note : Wednesday, July 10, 2013Document7 pagesIndex Reversed But On A Slow Note : Wednesday, July 10, 2013Randora LkNo ratings yet

- Soft 07Document6 pagesSoft 07ishara-gamage-1523No ratings yet

- Daily Trade Journal - 03.09.2013Document6 pagesDaily Trade Journal - 03.09.2013Randora LkNo ratings yet

- Daily Trade Journal - 12.02.2014Document6 pagesDaily Trade Journal - 12.02.2014Randora LkNo ratings yet

- Aily Review: Market Statistics All Share Price IndexDocument9 pagesAily Review: Market Statistics All Share Price IndexRandora LkNo ratings yet

- Daily Trade Journal - 18.06.2013Document7 pagesDaily Trade Journal - 18.06.2013Randora LkNo ratings yet

- Daily Trade Journal - 05.07.2013Document6 pagesDaily Trade Journal - 05.07.2013Randora LkNo ratings yet

- Daily Trade Journal - 24.12.2013Document6 pagesDaily Trade Journal - 24.12.2013Randora LkNo ratings yet

- ASPI Slips JKH Deals Boost Turnover : Friday, March 28, 2014Document6 pagesASPI Slips JKH Deals Boost Turnover : Friday, March 28, 2014Randora LkNo ratings yet

- JKSB WEEKLY 31-12-2015mDocument2 pagesJKSB WEEKLY 31-12-2015mDhananjaya HathurusingheNo ratings yet

- Capital Alliance PLC The Biggest Where Size MattersDocument31 pagesCapital Alliance PLC The Biggest Where Size MattersLBTodayNo ratings yet

- Brs-Ipo Document Peoples Leasing Company LimitedDocument13 pagesBrs-Ipo Document Peoples Leasing Company LimitedLBTodayNo ratings yet

- NDB Daily Market Update 27.10.11Document1 pageNDB Daily Market Update 27.10.11LBTodayNo ratings yet

- Price List 1Document4 pagesPrice List 1LBTodayNo ratings yet

- Peoples Leasing Co. IPODocument18 pagesPeoples Leasing Co. IPOLBTodayNo ratings yet

- CSE 16-2011 - Dialog Axiata PLC - Q3 2011 Financial StatementsDocument13 pagesCSE 16-2011 - Dialog Axiata PLC - Q3 2011 Financial StatementsLBTodayNo ratings yet

- Focus: Colombo Stock ExchangeDocument24 pagesFocus: Colombo Stock ExchangeLBTodayNo ratings yet

- Liquor EnglishDocument2 pagesLiquor EnglishLBTodayNo ratings yet

- DNH Market Watch Daily 27.10.2011Document1 pageDNH Market Watch Daily 27.10.2011LBTodayNo ratings yet

- DNH Sri Lanka Weekly 17-21 October 2011Document11 pagesDNH Sri Lanka Weekly 17-21 October 2011LBTodayNo ratings yet

- Central Bank of Sri Lanka: Selected Weekly Economic IndicatorsDocument12 pagesCentral Bank of Sri Lanka: Selected Weekly Economic IndicatorsLBTodayNo ratings yet

- DNH Market Watch Daily 20.10Document1 pageDNH Market Watch Daily 20.10LBTodayNo ratings yet

- Price List 1Document5 pagesPrice List 1LBTodayNo ratings yet

- Central Bank of Sri Lanka: Selected Weekly Economic IndicatorsDocument12 pagesCentral Bank of Sri Lanka: Selected Weekly Economic IndicatorsLBTodayNo ratings yet

- Finanial Analysis of HDFC BankDocument15 pagesFinanial Analysis of HDFC BankShweta SinghNo ratings yet

- Letter IT Informants Rewards Scheme 1 5 18Document21 pagesLetter IT Informants Rewards Scheme 1 5 18Manish SrivastavaNo ratings yet

- Ref - Construction P2P RoadshowDocument83 pagesRef - Construction P2P RoadshowGAhr CeredonNo ratings yet

- Car Depreciation Rate and IDV Calculator - MintWiseDocument3 pagesCar Depreciation Rate and IDV Calculator - MintWiseRakyNo ratings yet

- Kerala Agricultural Income Tax Act 1991Document97 pagesKerala Agricultural Income Tax Act 1991Anjali Krishna SNo ratings yet

- 3M Residential Water Quality SolutionsDocument20 pages3M Residential Water Quality SolutionskuraimundNo ratings yet

- Statistical Abstract 2015 PDFDocument639 pagesStatistical Abstract 2015 PDFnbprNo ratings yet

- HC 4.3: Financial Services Venture Capital: Module - 3Document15 pagesHC 4.3: Financial Services Venture Capital: Module - 3AishuNo ratings yet

- Variable Universal Life Insurance: Is It Worth It?: James H. Hunt, F.S.A. February 2003Document22 pagesVariable Universal Life Insurance: Is It Worth It?: James H. Hunt, F.S.A. February 2003Niren PatelNo ratings yet

- Recommended FIORI AppsDocument55 pagesRecommended FIORI AppsRehan Khan0% (1)

- Financial Analysis Final Report General TyresDocument36 pagesFinancial Analysis Final Report General TyresBurhan AhmadNo ratings yet

- Ross Corporate 13e PPT CH10 AccessibleDocument26 pagesRoss Corporate 13e PPT CH10 Accessible22003099No ratings yet

- West Tambaram House Rent, Sale, Flat Rent, Sale, Lease, Land SaleDocument2 pagesWest Tambaram House Rent, Sale, Flat Rent, Sale, Lease, Land SaleBaaBuuJeeNo ratings yet

- Chapter 1. Introduction (300 Words) : MassaDocument5 pagesChapter 1. Introduction (300 Words) : MassaAbhinav P KrishnaNo ratings yet

- Universiti Utara Malaysia Bwff2043 Advanced Financial Management (Group A) SECOND SEMESTER SESSION 2019/2020 (A192)Document10 pagesUniversiti Utara Malaysia Bwff2043 Advanced Financial Management (Group A) SECOND SEMESTER SESSION 2019/2020 (A192)Hirosha VejianNo ratings yet

- Pro-Forma Sale & Purchase: Purchaser (S) ParticularsDocument1 pagePro-Forma Sale & Purchase: Purchaser (S) ParticularsFazrul ZaimNo ratings yet

- Presentation BNP Paribas TrustDocument47 pagesPresentation BNP Paribas Trustmypi100% (1)

- 10000000301Document92 pages10000000301Chapter 11 DocketsNo ratings yet

- Stronghold Insurance Vs Pamana Case DigestDocument7 pagesStronghold Insurance Vs Pamana Case DigestHazelGarciaNo ratings yet

- Eagle Eyes ReportDocument3 pagesEagle Eyes ReportSaketh DahagamNo ratings yet

- 210 - F - ZuariDocument72 pages210 - F - ZuariPeacock Live ProjectsNo ratings yet

- P7 ShareDocument16 pagesP7 Sharerafialazmi2004No ratings yet

- Lewis-Palmer Board 7-15-99Document6 pagesLewis-Palmer Board 7-15-99Anonymous kprzCiZNo ratings yet

- MA 2.1-Financial StatementDocument57 pagesMA 2.1-Financial Statementvini2710100% (1)

- 002 - Bidder QuestionnaireDocument6 pages002 - Bidder QuestionnaireSon DDarrellNo ratings yet

- 56 - PLUE329 - Mergers and AcquisitionsDocument9 pages56 - PLUE329 - Mergers and AcquisitionslyvuongthaoNo ratings yet

- AA153501 1427378053 BookDocument193 pagesAA153501 1427378053 BooklentinieNo ratings yet