Professional Documents

Culture Documents

Scheme C - Tier I - 0

Scheme C - Tier I - 0

Uploaded by

Kumar AlokOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Scheme C - Tier I - 0

Scheme C - Tier I - 0

Uploaded by

Kumar AlokCopyright:

Available Formats

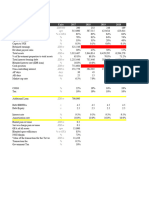

NPS SCHEME - C (Tier-I)

Particulars SBIPF LICPF UTIRSL ICICI PF KOTAK PF HDFC PF BIRLA PF TATA PF MAX LIFE PF AXIS PF

Assets (Rs in crore ) 6,387.52 2,151.10 768.49 3,600.49 560.15 9,395.61 149.39 23.42 38.71 39.89

Scheme Inception Date 15-May-09 23-Jul-13 21-May-09 18-May-09 15-May-09 1-Aug-13 9-May-17 19-Aug-22 12-Sep-22 21-Oct-22

28-Apr-23 36.5287 23.6306 32.3609 36.3474 34.9316 24.0388 16.2128 10.4025 10.4292 10.3995

NAV

52 Week High 36.5308 23.6306 32.3609 36.3474 34.9316 24.0413 16.2128 10.4066 10.4292 10.4044

52 Week Low 33.9633 21.8123 29.9250 33.7589 32.4094 22.3319 15.023 9.9859 9.933 10.0000

3 Months 2.40% 2.57% 2.65% 2.37% 2.37% 2.30% 2.48% 2.55% 2.55% 2.66%

6 Months 4.48% 4.74% 4.79% 4.50% 4.40% 4.31% 4.74% 3.18% NA NA

1 Year 5.57% 5.98% 5.85% 5.57% 5.61% 5.58% 5.88% NA NA NA

2 Years 5.04% 5.04% 4.87% 5.09% 4.96% 5.34% 5.23% NA NA NA

RETURNS

3 Years 7.13% 7.31% 6.82% 7.30% 6.50% 7.49% 7.22% NA NA NA

5 Years 8.37% 8.36% 7.91% 8.29% 7.50% 8.67% 8.41% NA NA NA

7 Years 8.18% 8.06% 7.80% 8.20% 7.63% 8.41% NA NA NA NA

10 Years 8.55% NA 8.36% 8.77% 8.24% NA NA NA NA NA

Since Inception 9.72% 9.20% 8.79% 9.69% 9.37% 9.42% 8.43% 4.02% 4.29% 3.99%

6.45% Icici Senior 8.37% Hudco 6.89% Irfc 2031, Nippon India 8.22 NABARD 7.44% Indian Oil Reliance 8.12% Aditya 7.44% Ntpc 1) Bandhan

Unsecured Bond Unsec Goi 7.70% Sbi 2038, Overnight Fund 2028 (GOI Corp Ltd Industries ,Axis Birla Finance 2033, Overnight Fund -

2028, Serviced 2029 (SR – XXV) 2027 Bank ,Irfc, Hdfc Ltd Series H3 7.725% L&T Direct Plan -

7.15%Bajaj - Direct Plan - Serviced Bond)

6.44% Hdfc Bank Series Vi 2018, 7.11% SIDBI NCD Ltd, Hpcl 2032, Ltd 2028, Growth

8.12% Sec. Nhpc

Finance Limited Growth Option 7.75% SIDBI

2028, Series IV 2026 8.40% Canara 7.97% Hdfc 2) 8.36% NHAI

2031, 6.45% Icici 7.65% PFC 2037 2025

7.65% Axis Bank Ltd. Goi Fully 6.87% Muthoot Bank 2026, 2033, Ltd NCD Mat

2027, Serviced Bonds Bank 2028, 7.80% HDFC 8.55% HDFC Ltd Finance Ltd. 7.82% Lic Hf Uti Overnight 2029

7.65% Irfc 2033, Series I, 7.65% Axis Bank 2032 2029 Series 20A Option 2032, Fund - Direct 3) 7.59% NHPC

7.97% Hdfc Ltd 7.49% Sec 2027 Axis Liquid 7.62% NABARD II Tranche I 2025 Npcl 09.18% Plan Growth, Ltd NCD Mat

National Hihway Fund - Direct 23I-R1 2028

2033 7.15% SIDBI NCD Seriesxxviii 7.62% Nabard 2027

Top 5 Holdings Authority Of India

Plan - Growth 7.38% NHPC Ltd Series I 2025 Tranche E 2029, 2028 4) 7.35% NTPC

2029,

Option STRRP Y1 2029 7.32% 8.10% M&Mfsl Ltd NCD Mat

8.24% Sec Power

8.12% ABFL Cholamandalam 2026 2026

Grid Corporation

2032 Invt & Fin Co. Ltd. 5) 8.05% India

Bonds -Series-I

Series 621 Option Infradebt Ltd

2029,

7.48% Sec Indian II NCD 2026 NCD Mat 2028

Railway Finance

Corporation

PORTFOLIO

Bonds

Weigtage of top 5

10.77 13.20 17.25 11.64 14.63 14.95 20.27 26.71 34.72 31.01

Holdings,%

Other Credit Finance, Other Credit Other credit Other Credit 1)Other credit Oil & Gas, Bank Activities of Banking Other Credit

Granting,Other Power Granting, granting gran ng granting & Finance, specialized Power Granting,

Monetary Generation & Monetary Activities of Other 2)Other Infra Finance institutions Infra / Power Activities of

Intermediation specialized

Distribution, Intermediation Monetary monetary granting Finance Specialized

Services institutions

Banks Of Commercial Intermediation intermediation credit for Institutions

N.E.C.,Monetary granting credit

Intermediation Of

Banks, Saving for house

serv services n.e.c. house ,Other Granting Credit

Commercial Banks purchases Activities of 3)Monetary credit for House

Top 3 Sectors Banks, Saving Activities Of Monetary splzed inst intermediation granting Purchases,

Banks Specialized intermediation of granting of commercial Management

Institutions commercial banks, saving of Mutual

Granting Credit banks, saving banks. postal Funds,

For House banks, postal savings bank

Purchases savings. and discount

houses

* Scheme Returns for more than 01 year are annualised

SCHEME BENCHMARK RETURN

3 month 2.41%

6 month 4.75%

1 year 6.06%

2 years 5.42%

3 years 8.25%

5 years 8.97%

7 Years 8.49%

10 Years 8.85%

You might also like

- SBI Account Transfer FormatDocument1 pageSBI Account Transfer FormatSethuHari65% (20)

- Comprovante - Swift dj3ktRfY8cGDFYZSi PDFDocument1 pageComprovante - Swift dj3ktRfY8cGDFYZSi PDFPyero Talone100% (1)

- 2021 Mckinsey Global Payments ReportDocument40 pages2021 Mckinsey Global Payments ReportChandulalNo ratings yet

- Merchant BankingDocument94 pagesMerchant BankingCliffton Kinny100% (7)

- Scheme C - Tier IDocument1 pageScheme C - Tier INitesh TirkeyNo ratings yet

- Nps Scheme - C (Tier-I)Document1 pageNps Scheme - C (Tier-I)Kolluri VenkataraoNo ratings yet

- SCHEME - C (Tier-II) - 0Document1 pageSCHEME - C (Tier-II) - 0krishnaNo ratings yet

- SCHEME - G (Tier-I) - 0Document1 pageSCHEME - G (Tier-I) - 0krishnaNo ratings yet

- Nps Scheme - G (Tier-I) : 7.22% NA NA NADocument1 pageNps Scheme - G (Tier-I) : 7.22% NA NA NAKolluri VenkataraoNo ratings yet

- Scheme NPS Lite September 2019Document1 pageScheme NPS Lite September 2019Kuntal DasNo ratings yet

- SchemeTaxSaver TierIIDocument1 pageSchemeTaxSaver TierIIAnjali DahiyaNo ratings yet

- Nps Scheme - Central Government: 7.57% Gsec 2033, 6.67% Gsec 2050, 6.67% Gsec 2035, 6.10% Gsec 2031, 7.16% Gsec 2050Document1 pageNps Scheme - Central Government: 7.57% Gsec 2033, 6.67% Gsec 2050, 6.67% Gsec 2035, 6.10% Gsec 2031, 7.16% Gsec 2050Kolluri VenkataraoNo ratings yet

- Scheme CG July 2020-MinDocument1 pageScheme CG July 2020-MinSandipan MukherjeeNo ratings yet

- Nps Scheme - G (Tier-I) : Scheme Returns For More Than 01 Year Are AnnualisedDocument1 pageNps Scheme - G (Tier-I) : Scheme Returns For More Than 01 Year Are AnnualisedsatishNo ratings yet

- Scheme G 1 September 2019Document1 pageScheme G 1 September 2019deesingNo ratings yet

- Scheme NPS Lite December - 2020-MinDocument1 pageScheme NPS Lite December - 2020-MinRahulNo ratings yet

- Scheme NPS Lite May 2019Document1 pageScheme NPS Lite May 2019Ayanendu SanyalNo ratings yet

- Nps Scheme - Central GovernmentDocument1 pageNps Scheme - Central GovernmentArya MalikNo ratings yet

- Nps Scheme - A (Tier-I)Document1 pageNps Scheme - A (Tier-I)glorymatrixNo ratings yet

- State Government Scheme - 0Document1 pageState Government Scheme - 0Vishwajeet DasNo ratings yet

- Scheme A - 6Document1 pageScheme A - 6SRIKANTA ROUTNo ratings yet

- ICICI Prudential MF Head Start 15012024Document6 pagesICICI Prudential MF Head Start 15012024LAKHAN TRIVEDINo ratings yet

- Scheme A 1 July 2021Document1 pageScheme A 1 July 2021amar srinivasNo ratings yet

- Scheme A - 9Document1 pageScheme A - 94296tNo ratings yet

- Central Payout Structure Schemes of IndiaDocument1 pageCentral Payout Structure Schemes of Indiakanna275No ratings yet

- SCHEME - A (Tier-I) - 0Document1 pageSCHEME - A (Tier-I) - 0krishnaNo ratings yet

- Nps Scheme - A (Tier-I)Document1 pageNps Scheme - A (Tier-I)Kolluri VenkataraoNo ratings yet

- ICICI Prudential MFDocument2 pagesICICI Prudential MFDOLLY KHAPRENo ratings yet

- Performance Summary of The FundDocument1 pagePerformance Summary of The FundSudheer KumarNo ratings yet

- Rate Chart - 19.10.22Document1 pageRate Chart - 19.10.22rime.samimahmudkhanNo ratings yet

- Building ModelDocument4 pagesBuilding Modelqxcars1No ratings yet

- Profit Rates November 2021Document4 pagesProfit Rates November 2021Abubakar112No ratings yet

- Nps Scheme - E (Tier-I)Document1 pageNps Scheme - E (Tier-I)SRIKANTA ROUTNo ratings yet

- Contact Hour 17 Valuation (Contd.) 08/10/2017: BITS PilaniDocument17 pagesContact Hour 17 Valuation (Contd.) 08/10/2017: BITS PilaniNarendran NareshNo ratings yet

- Nps Scheme - E (Tier-I)Document1 pageNps Scheme - E (Tier-I)Kolluri VenkataraoNo ratings yet

- 08 - 12 - 2022 Florida Department of Health Covid19 - Data - LatestDocument10 pages08 - 12 - 2022 Florida Department of Health Covid19 - Data - LatestWTXL ABC27No ratings yet

- Nps Scheme - C (Tier-I) : Scheme Returns For More Than 01 Year Are AnnualisedDocument1 pageNps Scheme - C (Tier-I) : Scheme Returns For More Than 01 Year Are AnnualisedshrikanhaiyyaNo ratings yet

- Vajiram Ravi Installment From HDFC BANK Cards KYCDocument4 pagesVajiram Ravi Installment From HDFC BANK Cards KYCSatyam MakwanaNo ratings yet

- ACC DCF ValuationDocument7 pagesACC DCF ValuationJitesh ThakurNo ratings yet

- Corfin Study Case - Data Book and Working Paper - GalihAbimataDocument10 pagesCorfin Study Case - Data Book and Working Paper - GalihAbimataDImas AntonioNo ratings yet

- ICICI Prudential MF Head Start - 08062022Document2 pagesICICI Prudential MF Head Start - 08062022Chucha LullNo ratings yet

- TARIF Website PDFDocument1 pageTARIF Website PDFArsenal HolicNo ratings yet

- Property Valuation Analysis: Building I Want 160Document21 pagesProperty Valuation Analysis: Building I Want 160yhcdyhdNo ratings yet

- Financial Projections Template 08Document26 pagesFinancial Projections Template 08Clyde SakuradaNo ratings yet

- HDFC Life InsuranceDocument83 pagesHDFC Life InsuranceSanket AndhareNo ratings yet

- Year 2017 2018 2019 2020 2021 D/E 57.1 53.6 56.2 76.5 95.6 Times Inter 10.2 12.9 13.8 3Document4 pagesYear 2017 2018 2019 2020 2021 D/E 57.1 53.6 56.2 76.5 95.6 Times Inter 10.2 12.9 13.8 3Muhammad AnnasNo ratings yet

- ICICI Prudential MF Head Start - 03082022Document2 pagesICICI Prudential MF Head Start - 03082022shailendra kumarNo ratings yet

- Q1 Target Vs Ach FY 24-25 - TFPPLDocument8 pagesQ1 Target Vs Ach FY 24-25 - TFPPLMukul BansalNo ratings yet

- FD Shareable - PartnerDocument10 pagesFD Shareable - PartnerkhareanamiNo ratings yet

- Effective Annualized Rate of Return - Resident-NRO TD 1-09-2023Document1 pageEffective Annualized Rate of Return - Resident-NRO TD 1-09-2023Arun sharmaNo ratings yet

- SCHEME - E (Tier-I) - 0Document1 pageSCHEME - E (Tier-I) - 0krishnaNo ratings yet

- Meezan Bank Car Ijarah Rental Caculation: Booking PeriodDocument1 pageMeezan Bank Car Ijarah Rental Caculation: Booking PeriodMuhammad UsmanNo ratings yet

- ICICI Prudential MF Head Start - 07062022Document2 pagesICICI Prudential MF Head Start - 07062022Chucha LullNo ratings yet

- Views On Markets and SectorsDocument19 pagesViews On Markets and SectorskundansudNo ratings yet

- Fund Performance Individual JuneDocument4 pagesFund Performance Individual JuneSai Deepak NNo ratings yet

- 2 Wheelers in A Sweet Spot - Flag Bearer of The Recovery in Automotive SegmentDocument23 pages2 Wheelers in A Sweet Spot - Flag Bearer of The Recovery in Automotive SegmentayushNo ratings yet

- Tapasije Mishra ReportDocument42 pagesTapasije Mishra ReportTapasije MishraNo ratings yet

- Transaksi Energi 2020 11Document25 pagesTransaksi Energi 2020 11Ahmad SutaNo ratings yet

- Website ChangesDocument5 pagesWebsite ChangesTamil MasalaNo ratings yet

- Update Harga: Real-Time: QualityDocument44 pagesUpdate Harga: Real-Time: QualityNul AsashiNo ratings yet

- Analysis ReportDocument10 pagesAnalysis ReportMohit RawatNo ratings yet

- UntitledDocument6 pagesUntitledKunal NakumNo ratings yet

- Assessment of The Global and Indian Pharmaceuticals Industry - CRISILDocument120 pagesAssessment of The Global and Indian Pharmaceuticals Industry - CRISILblackjack_21No ratings yet

- To the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioFrom EverandTo the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioNo ratings yet

- UNIT 1 BankingDocument119 pagesUNIT 1 BankingfaizNo ratings yet

- CC Chap 5Document9 pagesCC Chap 520100131No ratings yet

- Final ProjectDocument77 pagesFinal ProjectbccmehtaNo ratings yet

- Kebusaph Memo TemplateDocument107 pagesKebusaph Memo TemplateOLUMAYOWA OMOTOSONo ratings yet

- Voucher Safe Open Source Voucher Payment ProjectDocument3 pagesVoucher Safe Open Source Voucher Payment ProjectCarl MullanNo ratings yet

- Monetary Policy & Central Banking Finmgt2 Course Syllabus: 1st Semester SY 2012 - 2013Document9 pagesMonetary Policy & Central Banking Finmgt2 Course Syllabus: 1st Semester SY 2012 - 2013Renz Hector Bonifacio100% (1)

- Oct. 4 2021 HOPEful Beginnings LoanDocument9 pagesOct. 4 2021 HOPEful Beginnings LoanJoe BowenNo ratings yet

- Monometallism BimetallismDocument22 pagesMonometallism BimetallismMissVirginia1105No ratings yet

- KVGB LedDocument42 pagesKVGB LedRajashekhar PujariNo ratings yet

- Cashier TraningDocument30 pagesCashier TraningnehaNo ratings yet

- KMA Sacco Loan Application FormDocument4 pagesKMA Sacco Loan Application FormDr. philemon mwongeraNo ratings yet

- GraphDocument5 pagesGraphSri WinNo ratings yet

- Money Laundering ActDocument4 pagesMoney Laundering ActpadminiNo ratings yet

- Internet Dec22Document1 pageInternet Dec22Hari HaranNo ratings yet

- IBPS SO Marketing Mains Current Affairs CapsuleDocument41 pagesIBPS SO Marketing Mains Current Affairs CapsuleAP ABHILASHNo ratings yet

- 2008 MFI BenchmarksDocument47 pages2008 MFI BenchmarksVũ TrangNo ratings yet

- 15 Appendix 2Document11 pages15 Appendix 2Pratibha GodiyalNo ratings yet

- Chapter 3Document4 pagesChapter 3Jimmy LojaNo ratings yet

- RD SharmaDocument11 pagesRD SharmaRavi kantNo ratings yet

- Preparation of T-Ledger Accounts Lesson ActivityDocument4 pagesPreparation of T-Ledger Accounts Lesson ActivityJanice BaltorNo ratings yet

- Commercial Application ProjectDocument12 pagesCommercial Application ProjectMridul MoolchandaniNo ratings yet

- Kwekwe Polytechnic: Engineering DivisionDocument3 pagesKwekwe Polytechnic: Engineering DivisionSimbarashe MakanyireNo ratings yet

- Process NoteDocument1 pageProcess NoteIreneNo ratings yet

- CBM 122Document3 pagesCBM 122Jahara Obedencio CalaycaNo ratings yet

- Sbiepay Sbiepay: Neft Challan (No RTGS) Neft Challan (No RTGS)Document1 pageSbiepay Sbiepay: Neft Challan (No RTGS) Neft Challan (No RTGS)Ajaysinh VaghelaNo ratings yet

- Zoho Books Exercise#1Document3 pagesZoho Books Exercise#1Mr. JalilNo ratings yet