Professional Documents

Culture Documents

DEDUCTIONS

DEDUCTIONS

Uploaded by

Angel Jamiana0 ratings0% found this document useful (0 votes)

12 views2 pagesThis document discusses tax deductions in the Philippines. It lists the general requirements for deductions as being ordinary and necessary expenses related to a taxpayer's trade, business or profession that are legal, not contrary to public policy, substantiated, paid within the tax year, and subject to withholding tax if applicable. It then provides examples of common deductible expenses like salaries and wages, travel expenses, and rental payments, along with additional notes about requirements for each.

Original Description:

TAX

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document discusses tax deductions in the Philippines. It lists the general requirements for deductions as being ordinary and necessary expenses related to a taxpayer's trade, business or profession that are legal, not contrary to public policy, substantiated, paid within the tax year, and subject to withholding tax if applicable. It then provides examples of common deductible expenses like salaries and wages, travel expenses, and rental payments, along with additional notes about requirements for each.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

12 views2 pagesDEDUCTIONS

DEDUCTIONS

Uploaded by

Angel JamianaThis document discusses tax deductions in the Philippines. It lists the general requirements for deductions as being ordinary and necessary expenses related to a taxpayer's trade, business or profession that are legal, not contrary to public policy, substantiated, paid within the tax year, and subject to withholding tax if applicable. It then provides examples of common deductible expenses like salaries and wages, travel expenses, and rental payments, along with additional notes about requirements for each.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

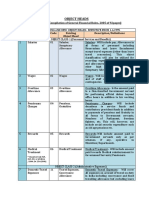

DEDUCTIONS

General requisites

Ordinary and necessary expenses to the trade/business/profession of the taxpayer

Not contrary to law, morals, public order, and public policy

Substantiated

Paid/incurred within the taxable year

Subjected to withholding tax, if applicable

Deduction Nature Notes

Expenses (Ordinary and necessary trade, Salaries, wages, and other forms of 1. All events test

business or professional) compensation 2. Must be actually performed

3. Subjected to withholding tax on

compensation or fringe benefits tax,

whichever applicable (Note: if

included as gross income of

employee, subject to withholding tax)

4. Nondeductible: premiums of

insurance for employee if beneficiary

is employer (treated as exclusion

from gross income upon pay-out)

Travel expenses 1. Includes transportation expenses and

meals and lodging paid by the

employer

2. It also includes laundry and other

incidental expenses that are directly

connected with the trip

3. If granted to employee in the form of

allowances (not subject to

liquidation), deductible as

salaries/allowances (not as travel

expenses)

4. Substantiation: receipts must be

issued to the taxpayer

Rentals and other payments 1. Of property to which the taxpayer

has not taken or is not taking title or

in which he has no equity other than

that of a lessee, user or possessor

2. Includes other payments to the lessor

(taxes and insurance shouldered

You might also like

- Salary-Chp 3Document38 pagesSalary-Chp 3Rozina TabassumNo ratings yet

- IncomeTax Valuation PerquisitesDocument19 pagesIncomeTax Valuation PerquisitesSanjeevNo ratings yet

- Ifrs at A Glance IAS 19 Employee BenefitsDocument5 pagesIfrs at A Glance IAS 19 Employee BenefitsnanaNo ratings yet

- Fringe Benefits Tax and de MinimisDocument6 pagesFringe Benefits Tax and de MinimisL.ShinNo ratings yet

- Forms of Compensation IncomeDocument6 pagesForms of Compensation IncomeMariaHannahKristenRamirezNo ratings yet

- Gros Income and It's CoverageDocument122 pagesGros Income and It's CoverageCenelyn PajarillaNo ratings yet

- Employee Benefits Part 1.1Document5 pagesEmployee Benefits Part 1.1Shanelle SilmaroNo ratings yet

- Unit - Ii - : Income Under The Head Salaries Definition of The Head 'SalariesDocument36 pagesUnit - Ii - : Income Under The Head Salaries Definition of The Head 'SalariesVENKATESWARLUMCOMNo ratings yet

- Ange - Chapter 4 Reviewer TaxationDocument11 pagesAnge - Chapter 4 Reviewer Taxationdevy mar topiaNo ratings yet

- Ange - Chapter 4 Reviewer TaxationDocument11 pagesAnge - Chapter 4 Reviewer Taxationdevy mar topiaNo ratings yet

- 2 Salary - Control Sheet - SirTariqTunio - ARTTDocument1 page2 Salary - Control Sheet - SirTariqTunio - ARTTZari MaviNo ratings yet

- 5E Income Tax Changes AnalysisDocument2 pages5E Income Tax Changes AnalysisSTRATEGIC REGISTRARNo ratings yet

- Gross IncomeDocument5 pagesGross IncomeNavarro Cristine C.No ratings yet

- TX TSNDocument55 pagesTX TSN유니스No ratings yet

- GROSS INCOME - InclusionDocument8 pagesGROSS INCOME - InclusionNessa Mae Leaño JamolinNo ratings yet

- Salary and Its TaxationDocument12 pagesSalary and Its TaxationBasit BandayNo ratings yet

- 1 IAS 19 EMPLOYEE BENEFITS With Suggested Answers As of 11 10Document13 pages1 IAS 19 EMPLOYEE BENEFITS With Suggested Answers As of 11 10Kimberly IgnacioNo ratings yet

- Chapter 11Document2 pagesChapter 11Alyssa BerangberangNo ratings yet

- BA 127 Notes PDFDocument12 pagesBA 127 Notes PDFLorenz De Lemios NalicaNo ratings yet

- Allowances Allowable To Tax PayerDocument13 pagesAllowances Allowable To Tax PayerbabakababaNo ratings yet

- Chapter 4 - ReviewerDocument11 pagesChapter 4 - Reviewerdevy mar topiaNo ratings yet

- CHAPTER 10 - Compensation IncomeDocument3 pagesCHAPTER 10 - Compensation IncomeDeviane CalabriaNo ratings yet

- CHAPTER 11 - IncomeTaxDocument2 pagesCHAPTER 11 - IncomeTaxVicente, Liza Mae C.No ratings yet

- IAS-19 at Glance (BDO)Document4 pagesIAS-19 at Glance (BDO)FaraisNo ratings yet

- Regular Income Taxation Exclusions and Inclusions To Gross IncomeDocument22 pagesRegular Income Taxation Exclusions and Inclusions To Gross IncomeKatrina MaglaquiNo ratings yet

- 04 Regular Income Taxation Exclusions and Inclusions To Gross IncomeDocument22 pages04 Regular Income Taxation Exclusions and Inclusions To Gross IncomeRuth MuldongNo ratings yet

- Deductions From Gross IncomeDocument2 pagesDeductions From Gross Incomericamae saladagaNo ratings yet

- Unit IVDocument23 pagesUnit IVDeepak PantNo ratings yet

- I. Concept Notes IAS19: Employee BenefitsDocument5 pagesI. Concept Notes IAS19: Employee Benefitsem cortezNo ratings yet

- CFAS NotesDocument27 pagesCFAS NotesMikasa AckermanNo ratings yet

- CHAPTER 9 Regular Income TaxDocument8 pagesCHAPTER 9 Regular Income TaxAlyssa BerangberangNo ratings yet

- D. Termination BenefitsDocument2 pagesD. Termination BenefitsHeiza Jane Banal SiguenzaNo ratings yet

- Adobe Scan Dec 09, 2023Document7 pagesAdobe Scan Dec 09, 2023Renalyn Ps MewagNo ratings yet

- Page 1 of 8Document8 pagesPage 1 of 8Aj PotXzs ÜNo ratings yet

- IA3 - Accounting For Employee BenefitsDocument6 pagesIA3 - Accounting For Employee BenefitsHannah Jane Arevalo LafuenteNo ratings yet

- Is The Higher BetweenDocument4 pagesIs The Higher Betweenleshz zynNo ratings yet

- 77taxability of Retirement Benefits 231122 092942Document9 pages77taxability of Retirement Benefits 231122 092942jasontamang565No ratings yet

- SN Employee BenefitsDocument6 pagesSN Employee BenefitsKiana FernandezNo ratings yet

- Object Head List PDFDocument6 pagesObject Head List PDFLal ZahawmaNo ratings yet

- W6-Module Concept of Income-Part 1Document14 pagesW6-Module Concept of Income-Part 1Danica VetuzNo ratings yet

- 2 Index For Withholding TaxDocument16 pages2 Index For Withholding TaxabbelleNo ratings yet

- Special Article - Employment IncomeDocument6 pagesSpecial Article - Employment IncomeYi Tong LiewNo ratings yet

- Chapter 11Document16 pagesChapter 11Rein ConcepcionNo ratings yet

- Gross Income From BusinessDocument13 pagesGross Income From BusinessAllan SantosNo ratings yet

- Summary of IAS 19_ Employee BenefitsDocument8 pagesSummary of IAS 19_ Employee BenefitsMohammad KashirNo ratings yet

- FS2122-INCOMETAX-02: BSA 1202 Atty. F. R. SorianoDocument11 pagesFS2122-INCOMETAX-02: BSA 1202 Atty. F. R. SorianoKatring O.No ratings yet

- Ast TX 901 Fringe Benefits Tax (Batch 22)Document6 pagesAst TX 901 Fringe Benefits Tax (Batch 22)Shining LightNo ratings yet

- Fringe BenefitsDocument16 pagesFringe BenefitsVenz LacreNo ratings yet

- FAR23 Employee Benefits - With AnsDocument13 pagesFAR23 Employee Benefits - With AnsAJ Cresmundo100% (1)

- Income Tax Inclusion From Gross IncomeDocument5 pagesIncome Tax Inclusion From Gross IncomeHeinie Joy PauleNo ratings yet

- Income Tax Inclusion From Gross IncomeDocument5 pagesIncome Tax Inclusion From Gross IncomeSharmaine Clemencio0No ratings yet

- Ia2 Employee BenefitsDocument5 pagesIa2 Employee BenefitsnishioyukihimeNo ratings yet

- Tax Reviewer (Mfp-2)Document13 pagesTax Reviewer (Mfp-2)Mikaela Pamatmat100% (1)

- MasterSheet04 IFB SirTariqTunio FinalDocument2 pagesMasterSheet04 IFB SirTariqTunio FinalKamran MehboobNo ratings yet

- TAX.2811 Deductions From Gross IncomeDocument10 pagesTAX.2811 Deductions From Gross IncomeMary Ann Del PradoNo ratings yet

- Income From HPDocument17 pagesIncome From HPaKSHAT sHARMANo ratings yet

- Module 3 Fringe Benefits Tax and de Minimis BenefitsDocument15 pagesModule 3 Fringe Benefits Tax and de Minimis BenefitsJericho PapioNo ratings yet

- Title Ii Wages Preliminary Matters ARTICLE 97. Definitions. - As Used in This TitleDocument12 pagesTitle Ii Wages Preliminary Matters ARTICLE 97. Definitions. - As Used in This Titlemitsudayo_No ratings yet

- Notes On Employee BenefitsDocument26 pagesNotes On Employee BenefitsSarannyaRajendraNo ratings yet

- EmailsDocument31 pagesEmailsretihot169No ratings yet

- TAX Mock September 2023Document64 pagesTAX Mock September 2023Saqib IqbalNo ratings yet

- Nonparmtric 3Document37 pagesNonparmtric 3Dawit MarkosNo ratings yet

- (Affilited To Savitribai Phule University Pune) : SNBP Law CollegeDocument15 pages(Affilited To Savitribai Phule University Pune) : SNBP Law CollegeLata Yadav maindadNo ratings yet

- Term GautamDocument49 pagesTerm GautamshauryapartyNo ratings yet

- Relevant Contracts TaxDocument11 pagesRelevant Contracts TaxTe KruNo ratings yet

- Final Project - AZIZDocument73 pagesFinal Project - AZIZsmart boyNo ratings yet

- Business Statistics Midterm Exam: Fall 2019: BUS41000Document16 pagesBusiness Statistics Midterm Exam: Fall 2019: BUS41000vinayak mishraNo ratings yet

- Agrarian Law and Social Legislation by Paulino Ungos 2014 1 1Document390 pagesAgrarian Law and Social Legislation by Paulino Ungos 2014 1 1Christian TajarrosNo ratings yet

- HDFC Thunder Bird Insurance 2021-22Document3 pagesHDFC Thunder Bird Insurance 2021-22ShivaNo ratings yet

- Comparison Tata Aig Medicare Vs Niva BupaDocument1 pageComparison Tata Aig Medicare Vs Niva BupaTikekar ShubhamNo ratings yet

- Chapter 15 - HRM CycleDocument7 pagesChapter 15 - HRM CycleArdyana RachmayantiNo ratings yet

- Business Office Administration ProceduresDocument45 pagesBusiness Office Administration ProceduresIslandNo ratings yet

- Scratch Paper (Business Plan)Document17 pagesScratch Paper (Business Plan)The Brain Dump PHNo ratings yet

- Scrip Code Scrip NameDocument5 pagesScrip Code Scrip NamenitmemberNo ratings yet

- 10 Best Practices For Increasing Hospital ProfitabilityDocument8 pages10 Best Practices For Increasing Hospital ProfitabilitySarita BhattaraiNo ratings yet

- AnnuitiesDocument17 pagesAnnuitiesRuzherry Angeli AzcuetaNo ratings yet

- Group 1Document50 pagesGroup 1agparcoNo ratings yet

- Electronic Transferto: F TheDocument2 pagesElectronic Transferto: F TheCheah Hon KeongNo ratings yet

- Gujarat Technological UnversityDocument2 pagesGujarat Technological UnversityKrutika Goyal100% (1)

- Medical Office ProceduresDocument3 pagesMedical Office ProceduresariiyaNo ratings yet

- Government Money: PaymentDocument17 pagesGovernment Money: PaymentrickmortyNo ratings yet

- FY 21-22 - MFIN India Microfinance ReviewDocument92 pagesFY 21-22 - MFIN India Microfinance Reviewletihi9143No ratings yet

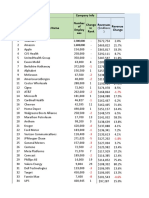

- Fortune List 2022Document52 pagesFortune List 2022JonNo ratings yet

- Microlink Institute of Science and Technology, Inc.: 1-Jul-19 15-Jul-19Document18 pagesMicrolink Institute of Science and Technology, Inc.: 1-Jul-19 15-Jul-19Dudz MatienzoNo ratings yet

- ID 193120001 Final Assignment.Document64 pagesID 193120001 Final Assignment.CSE 1033Naymur RahmanNo ratings yet

- Fact-Finding Form - GLDocument12 pagesFact-Finding Form - GLChellay MNo ratings yet

- 02 - Estate TaxesDocument27 pages02 - Estate TaxesShiela MeiNo ratings yet

- Transportify Service Agreement - FACILITIES MANAGERS INC. - March 2024Document8 pagesTransportify Service Agreement - FACILITIES MANAGERS INC. - March 2024alfred jamNo ratings yet

- Midterm Quiz 01 - Adjusting Entries From Accrual To Provision For Uncollectible AccountsDocument3 pagesMidterm Quiz 01 - Adjusting Entries From Accrual To Provision For Uncollectible AccountsGarp Barroca100% (1)