Professional Documents

Culture Documents

Failures of All Institutions For The United States and Other Areas (BKFTTLA641N) FRED St. Louis Fed

Failures of All Institutions For The United States and Other Areas (BKFTTLA641N) FRED St. Louis Fed

Uploaded by

Carlos Eduardo Costa Beber RochaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Failures of All Institutions For The United States and Other Areas (BKFTTLA641N) FRED St. Louis Fed

Failures of All Institutions For The United States and Other Areas (BKFTTLA641N) FRED St. Louis Fed

Uploaded by

Carlos Eduardo Costa Beber RochaCopyright:

Available Formats

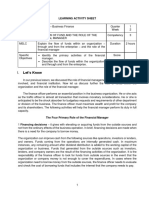

Failures of all Institutions for

the United States and Other Areas

(BKFTTLA641N)

2020: 4 | Number of Institutions | Annual | Updated: Nov 3,

2022

1Y | 5Y | 10Y | Max

FFaaiillu

urres

es of of aallll

IIn

nst

stiittuuttiion

onss ffor

or tth

hee

United

United States States and and Other

Other

AAreas

reas

600

500

400

Number of Institutions

300

2009: 137

200

100

-100

1950 1975 2000

1950 2000

Source: Federal Deposit Insurance Corporation

Share Links

Account Tools

NOTES

Source: Federal Deposit Insurance Corporation

Release: Failures and Assistance Transactions

Units: Number of Institutions, Not Seasonally Adjusted

Frequency: Annual

Transaction Types

Institutions have been resolved through several

different types of transactions. The transaction types

outlined below can be grouped into three general

categories, based upon the method employed to protect

insured depositors and how each transaction affects a

failed/assisted institution's charter. In most assistance

transactions, insured and uninsured depositors are

protected, the failed/assisted institution remains open

and its charter survives the resolution process. In

purchase and assumption transactions, the

failed/assisted institution's insured deposits are

transferred to a successor institution, and its charter is

closed. In most of these transactions, additional

liabilities and assets are also transferred to the

successor institution. In payoff transactions, the deposit

insurer - the FDIC or the former Federal Savings and

Loan Insurance Corporation - pays insured depositors,

the failed/assisted institution's charter is closed, and

there is no successor institution. For a more complete

description of resolution transactions and the FDIC's

receivership activities, see Managing the Crisis: The

FDIC and RTC Experience, a study prepared by the

FDIC's Division of Resolutions and Receiverships. Copies

are available from the FDIC's Public Information Center.

Category 1 Institution's charter survives

A/A Assistance Transactions. These include:

1) transactions where assistance was provided to the

acquirer, who purchased the entire institution. For a few

FSLIC transactions, the acquirer purchased the entire

bridge bank - type entity, but certain other assets were

moved into a liquidating receivership prior to the sale,

and

2) open bank assistance transactions, including those

where assistance was provided under a systemic risk

determination (in such cases any costs that exceed the

amounts estimated under the least cost resolution

requirement would be recovered through a special

assessment on all FDIC-insured institutions).

REP Reprivatization, management takeover with or

without assistance at takeover, followed by a sale with

or without additional assistance.

Category 2 Institution's charter is terminated, insured

deposits plus some assets and other liabilities are

transferred to a successor charter

P&A Purchase and Assumption, where some or all of the

deposits, certain other liabilities and a portion of the

assets (sometimes all of the assets) were sold to an

acquirer. It was not determined if all of the deposits

(PA) or only the insured deposits (PI) were assumed.

PA Purchase and Assumption, where the insured and

uninsured deposits, certain other liabilities and a portion

of the assets were sold to an acquirer.

PI Purchase and Assumption of the insured deposits

only, where the traditional P&A was modified so that

only the insured deposits were assumed by the

acquiring institution.

IDT Insured Deposit Transfer, where the acquiring

institution served as a paying agent for the insurer,

established accounts on their books for depositors, and

often acquired some assets as well. Includes ABT

(asset-backed transfer, a FSLIC transaction that is very

similar to an IDT).

MGR An institution where FSLIC took over management

and generally provided financial assistance. FSLIC

closed down before the institution was sold.

Category 3 PO Payout, where the insurer paid the

depositors directly and placed the assets in a liquidating

receivership.

Note: Includes transactions where the FDIC established

a Deposit Insurance National Bank to facilitate the

payout process.

For additional notes, see https://www5.fdic.gov/hsob/H

SOBNotes.asp#BF1.

Suggested Citation:

Federal Deposit Insurance Corporation, Failures of all

Institutions for the United States and Other Areas

[BKFTTLA641N], retrieved from FRED, Federal Reserve

Bank of St. Louis;

https://fred.stlouisfed.org/series/BKFTTLA641N, March

31, 2023.

RELATED CONTENT

Related Resources

FRED Blog

Bank failures ...

ALFRED Vintage Series

Failures of all

Institutions for

the United States ...

and Other Areas

Related Categories

Failures and Assistance Transactions Banking

Money, Banking, & Finance

Sources

More Releases from Federal Deposit Insurance Corporation

Releases

More Series from Failures and Assistance Transactions

Tags

Failures Thrifts

Federal Deposit Insurance Corporation Banks

Depository Institutions Annual Nation

Not Seasonally Adjusted

Public Domain: Citation Requested

United States of America

Filter 0

Search FRED

SERVICES

FRED®

ALFRED®

FRASER®

IDEAS

RESEARCH

Eighth District Economy

Working Papers

Events

Publications

TOOLS

FRED Mobile Apps

FRED Add-In for Excel®

Embeddable FRED Widget

Developer/APIs

ABOUT

Careers

Contact

Legal

Privacy Notice & Policy

OUR SITES

St. Louis Fed

Research Division

Education Resources

NEED HELP?

Questions or Comments

FRED Help

SUBSCRIBE TO THE FRED

NEWSLETTER

Email Subscribe

FOLLOW US

Back to Top

Federal Reserve Bank of St. Louis, One Federal Reserve

Bank Plaza, St. Louis, MO 63102

You might also like

- British Gas Bill SampleDocument2 pagesBritish Gas Bill SampleeBay Trackings20% (5)

- Coca-Cola Working-From Sagar - PGPFIN StudentDocument23 pagesCoca-Cola Working-From Sagar - PGPFIN StudentAshutosh TulsyanNo ratings yet

- Day Trading InfoDocument4 pagesDay Trading InfoSomeshwar Gupt100% (1)

- Introduction To Collateralized Debt Obligations: Tavakoli Structured Finance, IncDocument6 pagesIntroduction To Collateralized Debt Obligations: Tavakoli Structured Finance, IncShanza ChNo ratings yet

- Securitization of Financial AssetsDocument14 pagesSecuritization of Financial AssetsHarpott Ghanta100% (2)

- MARKETING PLAN of TUPPERWAREDocument13 pagesMARKETING PLAN of TUPPERWARENIKITA SONINo ratings yet

- MT PDFDocument3 pagesMT PDFSiddhantSinghNo ratings yet

- Financial MarketsDocument4 pagesFinancial MarketsFlorina LuminitaNo ratings yet

- Adoption of IFRS On Audit ReportDocument27 pagesAdoption of IFRS On Audit ReportErmiyasNo ratings yet

- 1st WeekDocument36 pages1st Weeknauraluna.nevetari.sriyono-2021No ratings yet

- Chapter 1 - Introduction To Financial ManagementDocument28 pagesChapter 1 - Introduction To Financial ManagementArminda Villamin100% (1)

- FAQs Regarding Customer Asset Protection in A Broker - Dealer BankruptcyDocument4 pagesFAQs Regarding Customer Asset Protection in A Broker - Dealer BankruptcyRui MaNo ratings yet

- Securitization: A Technical GuideDocument60 pagesSecuritization: A Technical GuideGauresh BagayatkarNo ratings yet

- Islamic Financial System Principles and Operations PDF 501 600Document100 pagesIslamic Financial System Principles and Operations PDF 501 600Asdelina R100% (1)

- GD20503 Financial Markets & InstitutionsDocument37 pagesGD20503 Financial Markets & InstitutionsWindyee TanNo ratings yet

- Business Finance-Lesson-2 Financial SystemDocument5 pagesBusiness Finance-Lesson-2 Financial SystemkellybetonioNo ratings yet

- FR Coll GuidelinesDocument23 pagesFR Coll GuidelinesJusta100% (1)

- Islamic Unit TrustDocument31 pagesIslamic Unit TrustHakimi Zulkifili100% (1)

- BUSINESS FINANCE 3rd ReviewerDocument5 pagesBUSINESS FINANCE 3rd ReviewerFelicity BondocNo ratings yet

- CRS Sipc - 20004Document6 pagesCRS Sipc - 20004Ilene KentNo ratings yet

- SecuritizationDocument68 pagesSecuritizationPranav ViraNo ratings yet

- FMI - Chapter 21 Thrift OperationsDocument34 pagesFMI - Chapter 21 Thrift OperationsChew96No ratings yet

- Securitization 130715232722 Phpapp01Document70 pagesSecuritization 130715232722 Phpapp01MRS.NAMRATA KISHNANI BSSSNo ratings yet

- GA ch03 6e Dl8-01-12revDocument21 pagesGA ch03 6e Dl8-01-12revTrần Huyền MyNo ratings yet

- Checklist - Loans and AdvancesDocument11 pagesChecklist - Loans and AdvancesdasharathdhageNo ratings yet

- Mba Assignment 2Document17 pagesMba Assignment 2Joanne LeoNo ratings yet

- Hedge Fund Overview v1Document58 pagesHedge Fund Overview v1Ashish AgrawalNo ratings yet

- Guidancenotedefinitionsfvcsecuritisation 2012 enDocument6 pagesGuidancenotedefinitionsfvcsecuritisation 2012 enYenNo ratings yet

- Securitizacion Primer (Scotia Capital)Document14 pagesSecuritizacion Primer (Scotia Capital)gastonriosNo ratings yet

- Republic of The Philippines Palawan State University College of Business and Accountancy Puerto Princesa CityDocument3 pagesRepublic of The Philippines Palawan State University College of Business and Accountancy Puerto Princesa CitybaneNo ratings yet

- Bofi ReviewerDocument20 pagesBofi ReviewerJared PaulateNo ratings yet

- Research Guide On SecuritizationDocument33 pagesResearch Guide On Securitizationsanaa217No ratings yet

- Securitisation: Vivek Joshi Department of Business Management MAHE MANIPAL Dubai CampusDocument20 pagesSecuritisation: Vivek Joshi Department of Business Management MAHE MANIPAL Dubai CampusbeingshashankNo ratings yet

- 2016 AnswersDocument11 pages2016 AnswersumeshNo ratings yet

- Let's Know: Learning Activity SheetDocument8 pagesLet's Know: Learning Activity SheetWahidah BaraocorNo ratings yet

- Chapter Five: The Financial Statements of Banks and Their Principal CompetitorsDocument58 pagesChapter Five: The Financial Statements of Banks and Their Principal CompetitorsYoussef Youssef Ahmed Abdelmeguid Abdel LatifNo ratings yet

- Money MarketDocument23 pagesMoney MarketMark Andrei CanlasNo ratings yet

- Securitization & Subprime Crisis.: (Type The Document Subtitle)Document13 pagesSecuritization & Subprime Crisis.: (Type The Document Subtitle)bhargavmenamNo ratings yet

- Swift Aboutus Consultationresponse Esma Aug2014Document13 pagesSwift Aboutus Consultationresponse Esma Aug2014RicardoNo ratings yet

- Financial TheoryDocument173 pagesFinancial TheoryDaniele NaddeoNo ratings yet

- CH2@Financial InstitutionsDocument10 pagesCH2@Financial Institutionstamiratg24No ratings yet

- Question Bank Test 1 With AnswersDocument9 pagesQuestion Bank Test 1 With AnswersUlugbek BayboboevNo ratings yet

- 2 4securitizationDocument28 pages2 4securitizationSwathi SriNo ratings yet

- Debt Securitisation by Saket RathiDocument6 pagesDebt Securitisation by Saket RathisaketrathiNo ratings yet

- Equities ExplainedDocument19 pagesEquities ExplainedRavi ChandraNo ratings yet

- Master in Business Finance: Praloy Majumder Icai Mumbai May 2010Document38 pagesMaster in Business Finance: Praloy Majumder Icai Mumbai May 2010praloy66No ratings yet

- Oil and Gas Asset Backed SecuritizationsDocument9 pagesOil and Gas Asset Backed SecuritizationsCDNo ratings yet

- Guide To Syndicated Leveraged FinanceDocument11 pagesGuide To Syndicated Leveraged FinanceMrigank Agarwal100% (1)

- 2.5 CC Trade ReceivablesDocument36 pages2.5 CC Trade ReceivablesDaefnate KhanNo ratings yet

- Financialservices 333Document34 pagesFinancialservices 333Mengsong NguonNo ratings yet

- Transferring Funds From Lenders To Borrowers: By: Myla Jenn L. ConstantinoDocument15 pagesTransferring Funds From Lenders To Borrowers: By: Myla Jenn L. ConstantinoIvy RosalesNo ratings yet

- Introduction ... . 3: PagesDocument29 pagesIntroduction ... . 3: PagesVithia AngamuthuNo ratings yet

- Franklin Custodian Funds: Statement of Additional InformationDocument72 pagesFranklin Custodian Funds: Statement of Additional InformationorangecountyNo ratings yet

- Securitization: After Reading This Chapter, You Will Be Conversant WithDocument9 pagesSecuritization: After Reading This Chapter, You Will Be Conversant WithHariNo ratings yet

- Financial Management Presentation Part I - Summer Class 2017Document44 pagesFinancial Management Presentation Part I - Summer Class 2017Juan Sebastian Leyton ZabaletaNo ratings yet

- Lecture in Finance 105 0n Investment Laws, Rules, and RegulationsDocument30 pagesLecture in Finance 105 0n Investment Laws, Rules, and RegulationsJoy ZeeNo ratings yet

- Ia. Financial Markets: ObjectivesDocument4 pagesIa. Financial Markets: ObjectivesCosulschi NicolaeNo ratings yet

- Asset Securitization in Asia: Ian H. GiddyDocument30 pagesAsset Securitization in Asia: Ian H. Giddy111No ratings yet

- Presentation 171004142621Document43 pagesPresentation 171004142621narayanthakur87No ratings yet

- BUSINESS FINANCE Chapter 1Document16 pagesBUSINESS FINANCE Chapter 1Melvin J. ReyesNo ratings yet

- Extreme Value Hedging: How Activist Hedge Fund Managers Are Taking on the WorldFrom EverandExtreme Value Hedging: How Activist Hedge Fund Managers Are Taking on the WorldRating: 2.5 out of 5 stars2.5/5 (1)

- Trust Funds: Hometown Investments and Mutual Funds for BeginnersFrom EverandTrust Funds: Hometown Investments and Mutual Funds for BeginnersNo ratings yet

- Iso Astm 52901-16Document7 pagesIso Astm 52901-16Dmitry_ucpNo ratings yet

- UPDATE 111120 SoreDocument103 pagesUPDATE 111120 Soremelissadevina29No ratings yet

- Melendrez vs. Atty. DecenaDocument2 pagesMelendrez vs. Atty. DecenaCaleb Josh PacanaNo ratings yet

- Chapter 5: E-Commerce Payment SystemsDocument8 pagesChapter 5: E-Commerce Payment SystemsAgmasie TsegaNo ratings yet

- The 9 Core Elements of A Quality Management SystemDocument8 pagesThe 9 Core Elements of A Quality Management SystemThe Engineers EDGE, CoimbatoreNo ratings yet

- University of Zurich, Dept. of Economics Prof. Dr. Mathias Hoffmann Exam For Spring 2015 LectureDocument4 pagesUniversity of Zurich, Dept. of Economics Prof. Dr. Mathias Hoffmann Exam For Spring 2015 LectureMatthias LeuthardNo ratings yet

- Medc Ledc Settlement EssayDocument2 pagesMedc Ledc Settlement Essayapi-221981095No ratings yet

- Annual Report: Bangladesh BankDocument350 pagesAnnual Report: Bangladesh BankPeal AhmedNo ratings yet

- Accounting Error QNSDocument3 pagesAccounting Error QNSGerald MagaitaNo ratings yet

- Large Shops Over Small Stores EssayDocument3 pagesLarge Shops Over Small Stores EssayMindificent Education KitNo ratings yet

- Customer Relationship Management: Charan Kumar Reddy Ekta Parwal Divyansh Danish DeepjyotiDocument22 pagesCustomer Relationship Management: Charan Kumar Reddy Ekta Parwal Divyansh Danish DeepjyotiUzma HussainNo ratings yet

- Investments 10Th Edition Bodie Solutions Manual Full Chapter PDFDocument36 pagesInvestments 10Th Edition Bodie Solutions Manual Full Chapter PDFWilliamCartersafg100% (12)

- Role of Commercial Bank in The Economic Development of INDIADocument5 pagesRole of Commercial Bank in The Economic Development of INDIAVaibhavRanjankarNo ratings yet

- The Citizen's Portal - Seven Seas TechnologiesDocument11 pagesThe Citizen's Portal - Seven Seas TechnologiesICT AUTHORITYNo ratings yet

- FinMan 4 Group 2 - 20240220 - 222159 - 0000Document44 pagesFinMan 4 Group 2 - 20240220 - 222159 - 0000SILVESTRE, NelsonNo ratings yet

- Tutorial BankruptcyDocument2 pagesTutorial BankruptcyNur NabihahNo ratings yet

- Supplier Assessment Report-Shenzhen Mingqun Electronic Co., Ltd.Document22 pagesSupplier Assessment Report-Shenzhen Mingqun Electronic Co., Ltd.scirrocco1704No ratings yet

- 03 EditedDocument4 pages03 EditedPhước Nguyễn VănNo ratings yet

- Agile 2Document7 pagesAgile 2Nagaraj RNo ratings yet

- Annual Report 2018 PDFDocument114 pagesAnnual Report 2018 PDFSalman RahmanNo ratings yet

- Weekly Report 2021-06-07Document1 pageWeekly Report 2021-06-07latomNo ratings yet

- GSIS Sues IBM, Subsidiary For P100 MillionDocument14 pagesGSIS Sues IBM, Subsidiary For P100 MillionEvaine LeBlancNo ratings yet

- Final Admission Circular-On Campus - 19.07.23Document4 pagesFinal Admission Circular-On Campus - 19.07.23zaher shuvoNo ratings yet

- C13-CIRQUE-DU-SOLEIL - Case StudyDocument2 pagesC13-CIRQUE-DU-SOLEIL - Case StudyesperoflorenceNo ratings yet

- Social Media Marketing FinalDocument10 pagesSocial Media Marketing FinalHira ParachaNo ratings yet

- RENTAL AGREEMENT of Madhu Kiran & AnithaDocument4 pagesRENTAL AGREEMENT of Madhu Kiran & AnithabpbanuNo ratings yet