Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

2 viewsQuiz Pajak

Quiz Pajak

Uploaded by

Saeful AnwarCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You might also like

- Pajak Matkul.1Document4 pagesPajak Matkul.1razadyesha7No ratings yet

- KELOMPOK 11 (Aspek Keuangan)Document8 pagesKELOMPOK 11 (Aspek Keuangan)Fernanda EraskaNo ratings yet

- PPH Terutang ContohDocument4 pagesPPH Terutang ContohUsadhiNo ratings yet

- Cte WorkshopDocument10 pagesCte WorkshopyukidiwiNo ratings yet

- Perhitungan PPH 21Document2 pagesPerhitungan PPH 21leaNo ratings yet

- PPH 21 Tugas Latihan 08.11.2022Document5 pagesPPH 21 Tugas Latihan 08.11.2022Rizky RwsNo ratings yet

- Dimas Adijaya Nugraha - Tugas Individu B2Document7 pagesDimas Adijaya Nugraha - Tugas Individu B2Sie Keamanan Dimas adijaya nugrahaNo ratings yet

- Latihan Soal Excel BungaDocument3 pagesLatihan Soal Excel BungaRita RustiNo ratings yet

- Perpajakan Excell - Fitri Ruhimah - 081021011Document2 pagesPerpajakan Excell - Fitri Ruhimah - 081021011rhmh fitNo ratings yet

- Praktikum PerpajakanDocument5 pagesPraktikum PerpajakanAdek Siska MarethaNo ratings yet

- MR Liem SalinanDocument6 pagesMR Liem Salinanhaidy jayantiNo ratings yet

- Penyelesaian Soal Aspek Keuangan SKBDocument5 pagesPenyelesaian Soal Aspek Keuangan SKBOlof MeisterNo ratings yet

- Fikri Hidayatullah - 0118101137 - C - Uts - Perpajakan IiDocument2 pagesFikri Hidayatullah - 0118101137 - C - Uts - Perpajakan IiFikri HidayatullahNo ratings yet

- Pricelist DH Mei 15 2024Document4 pagesPricelist DH Mei 15 2024hdahliahomeNo ratings yet

- Tugas IRR FirliansyahDocument2 pagesTugas IRR FirliansyahJon Silas HuangNo ratings yet

- Cafe AngkringanDocument2 pagesCafe AngkringanHarunNo ratings yet

- Evapro FarlyFahreza 008Document13 pagesEvapro FarlyFahreza 008hexsbayNo ratings yet

- Proposal PengelolaanDocument12 pagesProposal PengelolaanmantoNo ratings yet

- Tugas PBP - Andreas FransDocument5 pagesTugas PBP - Andreas FransJon Silas HuangNo ratings yet

- PPH 21 Pegawai Tetap BonussDocument6 pagesPPH 21 Pegawai Tetap BonussERIK SETIYAWANNo ratings yet

- Perhitungan PPH 21 Sebulan Bagi Pegawai TetapDocument117 pagesPerhitungan PPH 21 Sebulan Bagi Pegawai TetapLintang RahmawatiNo ratings yet

- BintanngNF C0C023073 PerpajakanDocument5 pagesBintanngNF C0C023073 PerpajakanBintang Nur FahrizalNo ratings yet

- Contoh Penghitungan Ps 21Document5 pagesContoh Penghitungan Ps 21hiwa sakaNo ratings yet

- Pemotongan Dan Pemungutan Pajak Sesi 6Document3 pagesPemotongan Dan Pemungutan Pajak Sesi 6Rafifah Aprilia IrianiNo ratings yet

- Simulasi KreditDocument3 pagesSimulasi KreditLalahNo ratings yet

- Hitung Angs Fix Mei 2024Document13 pagesHitung Angs Fix Mei 2024Roni Ainur RofiqNo ratings yet

- Perhitungan PPH 21 Sebulan Bagi Pegawai TetapDocument167 pagesPerhitungan PPH 21 Sebulan Bagi Pegawai TetapLintang RahmawatiNo ratings yet

- Budget Opex BanceuyDocument51 pagesBudget Opex BanceuyRachmat FirdisNo ratings yet

- Actividad EmpresarialDocument3 pagesActividad Empresarialcarol.alvarado12aguiNo ratings yet

- UTS MNJ FINANSIAL - Hermawan - 172310004Document7 pagesUTS MNJ FINANSIAL - Hermawan - 172310004Dany KusumaNo ratings yet

- Breakdown Target KC Sibolga 2024Document6 pagesBreakdown Target KC Sibolga 2024jamaltinambunan90No ratings yet

- Praktikum PerpajakanDocument105 pagesPraktikum PerpajakanSartika TariganNo ratings yet

- Perhitungan COF Program Bundling Tabungan Dan Deposito Tahun 2024Document14 pagesPerhitungan COF Program Bundling Tabungan Dan Deposito Tahun 2024hanna17002No ratings yet

- PERKIRAAN LABA RUGI DAN ARUS DANA PKMDocument1 pagePERKIRAAN LABA RUGI DAN ARUS DANA PKMRosya Rizky MaulidyaNo ratings yet

- Tugas - Day 2 - HERMAN SYAHPUTRADocument5 pagesTugas - Day 2 - HERMAN SYAHPUTRAJon Silas HuangNo ratings yet

- Kertas Kerja PPH 21 - 222 - Yani Nurpati Pancarani - JanuariDocument5 pagesKertas Kerja PPH 21 - 222 - Yani Nurpati Pancarani - JanuariYani NurpatiNo ratings yet

- Tabel Deposito Lps 6.5% 1 Februari 23Document1 pageTabel Deposito Lps 6.5% 1 Februari 23prita prituNo ratings yet

- Nittyaponno BudgetDocument1 pageNittyaponno Budgetfakhrul.biznessNo ratings yet

- Soal Latihan UPdateDocument6 pagesSoal Latihan UPdateEiznawan MoojoNo ratings yet

- Soal Latihan HBUDocument8 pagesSoal Latihan HBUNurul EkaningrumNo ratings yet

- Harga Rumah Di Palangka Rdjawali EstateDocument3 pagesHarga Rumah Di Palangka Rdjawali EstateSinto WahyuniNo ratings yet

- Pph Badan Yohana Dwika Putri 23302143 6 JuniDocument6 pagesPph Badan Yohana Dwika Putri 23302143 6 JuniYohana Dwika Putri SembiringNo ratings yet

- Simulasi Laba RugiDocument1 pageSimulasi Laba RugiMister LeywonkNo ratings yet

- Realisasi 2014 OkDocument19 pagesRealisasi 2014 OkNur PutriNo ratings yet

- Kategori Ter - PPH 21 2024Document4 pagesKategori Ter - PPH 21 2024Lucky PrasetyoNo ratings yet

- Kertas Kerja Capital BudgetingDocument2 pagesKertas Kerja Capital BudgetingFauzan AhmadNo ratings yet

- Brosur Colt Diesel Euro 4 - NormalDocument3 pagesBrosur Colt Diesel Euro 4 - Normalkaroserimedan88No ratings yet

- RioDocument1 pageRioProtokol Pamera Pameran5No ratings yet

- Hitungan KSO CT SCAN Fixed Income Modal 500 JTDocument1 pageHitungan KSO CT SCAN Fixed Income Modal 500 JTIwankNo ratings yet

- Contoh Excel Perhitungan BPJS 2021Document2 pagesContoh Excel Perhitungan BPJS 2021HeruNo ratings yet

- Hitungan Laba Kotor 2024Document2 pagesHitungan Laba Kotor 2024Seno Ilham MaulanaNo ratings yet

- 02 - Rkas 2019 Contoh RkasDocument26 pages02 - Rkas 2019 Contoh RkasBayu SegaraNo ratings yet

- Skema Kartu KreditDocument30 pagesSkema Kartu KreditJoseph Rubyanto SudrajadNo ratings yet

- Simulasi Laba Rugi Dengan Proyeksi Run Off PelunasanDocument1 pageSimulasi Laba Rugi Dengan Proyeksi Run Off PelunasanMister LeywonkNo ratings yet

- Tarif PSL 31EDocument4 pagesTarif PSL 31EJenniferAnglianiNo ratings yet

- Angsuran AdiraDocument12 pagesAngsuran AdiraHeru MakkaNo ratings yet

- Laporan Realisasi Pelaksanaan: Printed by SiskeudesDocument9 pagesLaporan Realisasi Pelaksanaan: Printed by SiskeudesYayan Ilmuan SipilNo ratings yet

- Template Cashflow JGUDocument5 pagesTemplate Cashflow JGUalicia fajar kiraniNo ratings yet

- Rachmad Toyib - S4E - Tugas Ke-4 - PPICDocument6 pagesRachmad Toyib - S4E - Tugas Ke-4 - PPICRach ToyNo ratings yet

Quiz Pajak

Quiz Pajak

Uploaded by

Saeful Anwar0 ratings0% found this document useful (0 votes)

2 views3 pagesCopyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

2 views3 pagesQuiz Pajak

Quiz Pajak

Uploaded by

Saeful AnwarCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 3

pengurangan

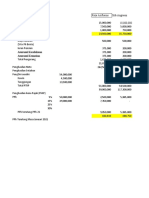

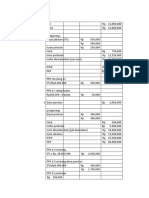

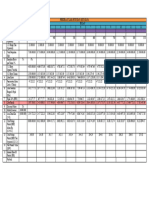

NO nama pegawai gaji tunjangan jumlah (asuransi

premi)

1 ewing yuvisa 26,000,000 8,000,000 34,000,000 1,700,000

2 joko prasetyo 21,000,000 6,000,000 27,000,000 1,350,000

3 andi prakoso 20,000,000 6,000,000 26,000,000 1,300,000

4 henny tri 19,000,000 6,000,000 25,000,000 1,250,000

biaya jabatan penghasilan

iuran pensiun 4% netto setahun x12 ptkp diri WP kawin

5% netto sebulan

1,700,000 1,360,000 29,240,000 Rp 350,880,000 k/2 54,000,000 4,500,000

1,350,000 1,080,000 23,220,000 Rp 278,640,000 k/2 54,000,000 4,500,000

1,300,000 1,040,000 22,360,000 Rp 268,320,000 k/2 54,000,000 4,500,000

1,250,000 1,000,000 21,500,000 Rp 258,000,000 k/2/1 54,000,000 4,500,000

penghasilan kena pph terutang

tanggungan tambahan jumlah pph 21

pajak (5% x pkp)

9,000,000 67,500,000 Rp 283,380,000 14,169,000 1180750

9,000,000 67,500,000 Rp 211,140,000 10,557,000 879750

9,000,000 67,500,000 Rp 200,820,000 10,041,000 836750

9,000,000 54,000,000 121,500,000 Rp 136,500,000 6,825,000 568750

You might also like

- Pajak Matkul.1Document4 pagesPajak Matkul.1razadyesha7No ratings yet

- KELOMPOK 11 (Aspek Keuangan)Document8 pagesKELOMPOK 11 (Aspek Keuangan)Fernanda EraskaNo ratings yet

- PPH Terutang ContohDocument4 pagesPPH Terutang ContohUsadhiNo ratings yet

- Cte WorkshopDocument10 pagesCte WorkshopyukidiwiNo ratings yet

- Perhitungan PPH 21Document2 pagesPerhitungan PPH 21leaNo ratings yet

- PPH 21 Tugas Latihan 08.11.2022Document5 pagesPPH 21 Tugas Latihan 08.11.2022Rizky RwsNo ratings yet

- Dimas Adijaya Nugraha - Tugas Individu B2Document7 pagesDimas Adijaya Nugraha - Tugas Individu B2Sie Keamanan Dimas adijaya nugrahaNo ratings yet

- Latihan Soal Excel BungaDocument3 pagesLatihan Soal Excel BungaRita RustiNo ratings yet

- Perpajakan Excell - Fitri Ruhimah - 081021011Document2 pagesPerpajakan Excell - Fitri Ruhimah - 081021011rhmh fitNo ratings yet

- Praktikum PerpajakanDocument5 pagesPraktikum PerpajakanAdek Siska MarethaNo ratings yet

- MR Liem SalinanDocument6 pagesMR Liem Salinanhaidy jayantiNo ratings yet

- Penyelesaian Soal Aspek Keuangan SKBDocument5 pagesPenyelesaian Soal Aspek Keuangan SKBOlof MeisterNo ratings yet

- Fikri Hidayatullah - 0118101137 - C - Uts - Perpajakan IiDocument2 pagesFikri Hidayatullah - 0118101137 - C - Uts - Perpajakan IiFikri HidayatullahNo ratings yet

- Pricelist DH Mei 15 2024Document4 pagesPricelist DH Mei 15 2024hdahliahomeNo ratings yet

- Tugas IRR FirliansyahDocument2 pagesTugas IRR FirliansyahJon Silas HuangNo ratings yet

- Cafe AngkringanDocument2 pagesCafe AngkringanHarunNo ratings yet

- Evapro FarlyFahreza 008Document13 pagesEvapro FarlyFahreza 008hexsbayNo ratings yet

- Proposal PengelolaanDocument12 pagesProposal PengelolaanmantoNo ratings yet

- Tugas PBP - Andreas FransDocument5 pagesTugas PBP - Andreas FransJon Silas HuangNo ratings yet

- PPH 21 Pegawai Tetap BonussDocument6 pagesPPH 21 Pegawai Tetap BonussERIK SETIYAWANNo ratings yet

- Perhitungan PPH 21 Sebulan Bagi Pegawai TetapDocument117 pagesPerhitungan PPH 21 Sebulan Bagi Pegawai TetapLintang RahmawatiNo ratings yet

- BintanngNF C0C023073 PerpajakanDocument5 pagesBintanngNF C0C023073 PerpajakanBintang Nur FahrizalNo ratings yet

- Contoh Penghitungan Ps 21Document5 pagesContoh Penghitungan Ps 21hiwa sakaNo ratings yet

- Pemotongan Dan Pemungutan Pajak Sesi 6Document3 pagesPemotongan Dan Pemungutan Pajak Sesi 6Rafifah Aprilia IrianiNo ratings yet

- Simulasi KreditDocument3 pagesSimulasi KreditLalahNo ratings yet

- Hitung Angs Fix Mei 2024Document13 pagesHitung Angs Fix Mei 2024Roni Ainur RofiqNo ratings yet

- Perhitungan PPH 21 Sebulan Bagi Pegawai TetapDocument167 pagesPerhitungan PPH 21 Sebulan Bagi Pegawai TetapLintang RahmawatiNo ratings yet

- Budget Opex BanceuyDocument51 pagesBudget Opex BanceuyRachmat FirdisNo ratings yet

- Actividad EmpresarialDocument3 pagesActividad Empresarialcarol.alvarado12aguiNo ratings yet

- UTS MNJ FINANSIAL - Hermawan - 172310004Document7 pagesUTS MNJ FINANSIAL - Hermawan - 172310004Dany KusumaNo ratings yet

- Breakdown Target KC Sibolga 2024Document6 pagesBreakdown Target KC Sibolga 2024jamaltinambunan90No ratings yet

- Praktikum PerpajakanDocument105 pagesPraktikum PerpajakanSartika TariganNo ratings yet

- Perhitungan COF Program Bundling Tabungan Dan Deposito Tahun 2024Document14 pagesPerhitungan COF Program Bundling Tabungan Dan Deposito Tahun 2024hanna17002No ratings yet

- PERKIRAAN LABA RUGI DAN ARUS DANA PKMDocument1 pagePERKIRAAN LABA RUGI DAN ARUS DANA PKMRosya Rizky MaulidyaNo ratings yet

- Tugas - Day 2 - HERMAN SYAHPUTRADocument5 pagesTugas - Day 2 - HERMAN SYAHPUTRAJon Silas HuangNo ratings yet

- Kertas Kerja PPH 21 - 222 - Yani Nurpati Pancarani - JanuariDocument5 pagesKertas Kerja PPH 21 - 222 - Yani Nurpati Pancarani - JanuariYani NurpatiNo ratings yet

- Tabel Deposito Lps 6.5% 1 Februari 23Document1 pageTabel Deposito Lps 6.5% 1 Februari 23prita prituNo ratings yet

- Nittyaponno BudgetDocument1 pageNittyaponno Budgetfakhrul.biznessNo ratings yet

- Soal Latihan UPdateDocument6 pagesSoal Latihan UPdateEiznawan MoojoNo ratings yet

- Soal Latihan HBUDocument8 pagesSoal Latihan HBUNurul EkaningrumNo ratings yet

- Harga Rumah Di Palangka Rdjawali EstateDocument3 pagesHarga Rumah Di Palangka Rdjawali EstateSinto WahyuniNo ratings yet

- Pph Badan Yohana Dwika Putri 23302143 6 JuniDocument6 pagesPph Badan Yohana Dwika Putri 23302143 6 JuniYohana Dwika Putri SembiringNo ratings yet

- Simulasi Laba RugiDocument1 pageSimulasi Laba RugiMister LeywonkNo ratings yet

- Realisasi 2014 OkDocument19 pagesRealisasi 2014 OkNur PutriNo ratings yet

- Kategori Ter - PPH 21 2024Document4 pagesKategori Ter - PPH 21 2024Lucky PrasetyoNo ratings yet

- Kertas Kerja Capital BudgetingDocument2 pagesKertas Kerja Capital BudgetingFauzan AhmadNo ratings yet

- Brosur Colt Diesel Euro 4 - NormalDocument3 pagesBrosur Colt Diesel Euro 4 - Normalkaroserimedan88No ratings yet

- RioDocument1 pageRioProtokol Pamera Pameran5No ratings yet

- Hitungan KSO CT SCAN Fixed Income Modal 500 JTDocument1 pageHitungan KSO CT SCAN Fixed Income Modal 500 JTIwankNo ratings yet

- Contoh Excel Perhitungan BPJS 2021Document2 pagesContoh Excel Perhitungan BPJS 2021HeruNo ratings yet

- Hitungan Laba Kotor 2024Document2 pagesHitungan Laba Kotor 2024Seno Ilham MaulanaNo ratings yet

- 02 - Rkas 2019 Contoh RkasDocument26 pages02 - Rkas 2019 Contoh RkasBayu SegaraNo ratings yet

- Skema Kartu KreditDocument30 pagesSkema Kartu KreditJoseph Rubyanto SudrajadNo ratings yet

- Simulasi Laba Rugi Dengan Proyeksi Run Off PelunasanDocument1 pageSimulasi Laba Rugi Dengan Proyeksi Run Off PelunasanMister LeywonkNo ratings yet

- Tarif PSL 31EDocument4 pagesTarif PSL 31EJenniferAnglianiNo ratings yet

- Angsuran AdiraDocument12 pagesAngsuran AdiraHeru MakkaNo ratings yet

- Laporan Realisasi Pelaksanaan: Printed by SiskeudesDocument9 pagesLaporan Realisasi Pelaksanaan: Printed by SiskeudesYayan Ilmuan SipilNo ratings yet

- Template Cashflow JGUDocument5 pagesTemplate Cashflow JGUalicia fajar kiraniNo ratings yet

- Rachmad Toyib - S4E - Tugas Ke-4 - PPICDocument6 pagesRachmad Toyib - S4E - Tugas Ke-4 - PPICRach ToyNo ratings yet