Professional Documents

Culture Documents

CRS Self-Certification Form For Individual Customers

CRS Self-Certification Form For Individual Customers

Uploaded by

BenCopyright:

Available Formats

You might also like

- Form W-8BEN Rev 920Document2 pagesForm W-8BEN Rev 920alejandroguitierrazxxx100% (3)

- Music MaestroDocument12 pagesMusic Maestrom00sygrlNo ratings yet

- CRS Individual Self Certification Form: InstructionsDocument2 pagesCRS Individual Self Certification Form: InstructionsCyrus FungNo ratings yet

- Jamaica FATCA Individual Self Certification - 2022Document2 pagesJamaica FATCA Individual Self Certification - 2022FandENo ratings yet

- FATCA-CRS Individual Self Certification - TradeZero - Dec 2018Document2 pagesFATCA-CRS Individual Self Certification - TradeZero - Dec 2018Kahchoon ChinNo ratings yet

- NCB Self Certification of ResidencyDocument2 pagesNCB Self Certification of Residencygeeman9787No ratings yet

- 4.fatca Self Declaraton Form Individuals PDFDocument2 pages4.fatca Self Declaraton Form Individuals PDFbala krishnanNo ratings yet

- Fatca Crs Self Certification FormDocument6 pagesFatca Crs Self Certification FormMohammed FaisalNo ratings yet

- Certificate of Payment of Foreign Death Tax: For Paperwork Reduction Act Notice, See The Back of This FormDocument2 pagesCertificate of Payment of Foreign Death Tax: For Paperwork Reduction Act Notice, See The Back of This FormFrancis Wolfgang UrbanNo ratings yet

- Individual Tax Residency Self-Certification FormDocument2 pagesIndividual Tax Residency Self-Certification FormEmadNo ratings yet

- CRS Individual Self-Certification FormDocument6 pagesCRS Individual Self-Certification FormsamNo ratings yet

- Individual Tax Residency Self Certification FormDocument5 pagesIndividual Tax Residency Self Certification FormJennifer LeetNo ratings yet

- Self CertificationDocument6 pagesSelf CertificationGuocheng MaNo ratings yet

- FATCADocument2 pagesFATCAORIENNo ratings yet

- Fatca/Crs Self Certification / Declaration For Individuals: Documents As Mentioned BelowDocument2 pagesFatca/Crs Self Certification / Declaration For Individuals: Documents As Mentioned BelowRaviJhaNo ratings yet

- W-8BEN Form - Frequently Asked QuestionsDocument2 pagesW-8BEN Form - Frequently Asked QuestionsAnkit ChhabraNo ratings yet

- Benfitsform Starbucks BeanstockDocument1 pageBenfitsform Starbucks BeanstockAndrew Christopher CaseNo ratings yet

- CRS Individual Account Self-Cert Form v2015-12 CBI RBI AsiaDocument6 pagesCRS Individual Account Self-Cert Form v2015-12 CBI RBI AsiaJoris RectoNo ratings yet

- Fatca Declaration Active Trade Channel IslandsDocument6 pagesFatca Declaration Active Trade Channel IslandsLosaNo ratings yet

- CRS Self Certification Form IndividualDocument5 pagesCRS Self Certification Form IndividualSalman ArshadNo ratings yet

- Individual Tax Residency Self Certification FormDocument5 pagesIndividual Tax Residency Self Certification FormYaacov KotlickiNo ratings yet

- FATCA-CRS Annexure For Individual Accounts (Including Sole Proprietor) Details Under FATCA and CRSDocument2 pagesFATCA-CRS Annexure For Individual Accounts (Including Sole Proprietor) Details Under FATCA and CRSOws AnishNo ratings yet

- GEK Termination FormDocument2 pagesGEK Termination Formmobla007No ratings yet

- Account Opening Supplementary Form - FATCA and CRS Declaration - 10oct2023Document2 pagesAccount Opening Supplementary Form - FATCA and CRS Declaration - 10oct2023essienegNo ratings yet

- W 8ben TdaDocument1 pageW 8ben TdaAnamaria Suciu100% (1)

- IRS Tax Fraud Reporting F3949aDocument2 pagesIRS Tax Fraud Reporting F3949aTim Bryant100% (2)

- FRM W8DM HRDocument2 pagesFRM W8DM HRmiscribeNo ratings yet

- CRS Self Certification Form For IndividualsDocument6 pagesCRS Self Certification Form For IndividualsSergeyNo ratings yet

- Substitute Form W-8BEN (Individuals)Document1 pageSubstitute Form W-8BEN (Individuals)hector100% (1)

- Substitute Form W-8BEN (Individuals)Document1 pageSubstitute Form W-8BEN (Individuals)hector100% (1)

- Franklin Templeton Investments: Investor DetailsDocument5 pagesFranklin Templeton Investments: Investor Detailspiper_No ratings yet

- Crs-I Individual Self Cert Form-AustraliaDocument2 pagesCrs-I Individual Self Cert Form-AustraliaminemecryptoNo ratings yet

- New Self Certification FormDocument3 pagesNew Self Certification Formtimstark004No ratings yet

- Irs Form 14039Document2 pagesIrs Form 14039waterfordpoliceNo ratings yet

- CMB Self-Certification Form For Personal Account Holders September 27 2018Document3 pagesCMB Self-Certification Form For Personal Account Holders September 27 2018Elly PérezNo ratings yet

- FATCA RBSC Certification Consent Waiver Form 072015Document4 pagesFATCA RBSC Certification Consent Waiver Form 072015Mary Nespher DelfinNo ratings yet

- FATCA QuestionnaireDocument1 pageFATCA Questionnaireblue606No ratings yet

- Certificate of Foreign Status of Beneficial Owner For United States Tax WithholdingDocument4 pagesCertificate of Foreign Status of Beneficial Owner For United States Tax WithholdingYudia0% (1)

- NM Substitute W9Document2 pagesNM Substitute W9marcelNo ratings yet

- W-8ben For CDN Beachbody Coaches SampleDocument1 pageW-8ben For CDN Beachbody Coaches Sampleapi-295933330No ratings yet

- Fillable W-8BEN 2023Document2 pagesFillable W-8BEN 2023marioNo ratings yet

- CRS - 2022Document13 pagesCRS - 2022johny SahaNo ratings yet

- Foreign Account Tax Compliance Act - 140119Document2 pagesForeign Account Tax Compliance Act - 140119skn bharatNo ratings yet

- Kelley Lynch - Tax Court PetitionDocument57 pagesKelley Lynch - Tax Court PetitionOdzer ChenmaNo ratings yet

- Business Banking Sole Trader Residency FormDocument2 pagesBusiness Banking Sole Trader Residency FormbtcturkdestekinfoNo ratings yet

- 230 Short Sale Packet - BayviewDocument16 pages230 Short Sale Packet - BayviewrapiddocsNo ratings yet

- Extended KYC Annexure IndividualsDocument2 pagesExtended KYC Annexure IndividualsNarendra Reddy BhumaNo ratings yet

- Status Declaration Form For Individuals: DeclarantDocument2 pagesStatus Declaration Form For Individuals: DeclarantDhavalNo ratings yet

- SIGNED-Foreign Account Tax Compliance Act - 140119Document2 pagesSIGNED-Foreign Account Tax Compliance Act - 140119skn bharatNo ratings yet

- CRS-I FormDocument2 pagesCRS-I Formmramzan9820No ratings yet

- I-864 27.10.11Document8 pagesI-864 27.10.11thanhloan2828No ratings yet

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- Innocent Spouse Relief: How You May Not Have To Pay Your Taxes!From EverandInnocent Spouse Relief: How You May Not Have To Pay Your Taxes!No ratings yet

- US Government Economics - Local, State and Federal | How Taxes and Government Spending Work | 4th Grade Children's Government BooksFrom EverandUS Government Economics - Local, State and Federal | How Taxes and Government Spending Work | 4th Grade Children's Government BooksNo ratings yet

- Taverna - Georgina HaydenDocument403 pagesTaverna - Georgina Haydenelena8kartsiouliNo ratings yet

- SCD Define Plant LocationDocument535 pagesSCD Define Plant LocationSantosh YadavNo ratings yet

- Curl Easy PauseDocument2 pagesCurl Easy PauseMarko VujnovicNo ratings yet

- English 102Document4 pagesEnglish 102chiubrit100% (1)

- Drug Discovery Complete NotesDocument5 pagesDrug Discovery Complete NotesSadiqa ForensicNo ratings yet

- MEDICAL DEVICES: Guidance DocumentDocument15 pagesMEDICAL DEVICES: Guidance DocumentPhạm Thu HuyềnNo ratings yet

- 24 Wlic Index PlusDocument12 pages24 Wlic Index PlusSrinivasan KannanNo ratings yet

- Training Topics: Differentiating InstructionDocument7 pagesTraining Topics: Differentiating InstructionarisuNo ratings yet

- The Future of AI in Medicine: A Perspective From A ChatbotDocument5 pagesThe Future of AI in Medicine: A Perspective From A Chatbotnmabestun1No ratings yet

- Acct2302 E3Document12 pagesAcct2302 E3zeeshan100% (1)

- Developing NGO Partnerships Guidelines PDFDocument31 pagesDeveloping NGO Partnerships Guidelines PDFHarith FadhilaNo ratings yet

- Raccon BookmarkDocument2 pagesRaccon BookmarkLinda YiusNo ratings yet

- Pile Cutting / Hacking (Sub-Structure Work)Document2 pagesPile Cutting / Hacking (Sub-Structure Work)Rahmat HariNo ratings yet

- Lab 8Document5 pagesLab 8Ravin BoodhanNo ratings yet

- FS 2004 A - Rev-7Document78 pagesFS 2004 A - Rev-7Maffone NumerounoNo ratings yet

- Report RUSADocument16 pagesReport RUSApawan kumar100% (1)

- Icn ApiDocument172 pagesIcn ApiNaveen SemwalNo ratings yet

- Family Case Study On The Billones Family 1Document63 pagesFamily Case Study On The Billones Family 1Ivy Mae DecenaNo ratings yet

- Non Dir. O/C Relay ARGUS - 7SR1102: 1. General Data & InformationDocument6 pagesNon Dir. O/C Relay ARGUS - 7SR1102: 1. General Data & InformationAnonymous dH3DIEtzNo ratings yet

- 365 Magic ItemsDocument71 pages365 Magic ItemsJeremy Edwards100% (2)

- Matrix Training Safety PT Acset Indonusa TBKDocument6 pagesMatrix Training Safety PT Acset Indonusa TBKonyo sjariefNo ratings yet

- PD Dac: Concepts of Programming & Operating SystemDocument5 pagesPD Dac: Concepts of Programming & Operating SystemamNo ratings yet

- Maria Katticaran/ M.Arch II/ UCLA SuprastudioDocument19 pagesMaria Katticaran/ M.Arch II/ UCLA SuprastudioMaria KatticaranNo ratings yet

- Alves Doa - Way Intl 102723Document5 pagesAlves Doa - Way Intl 102723michaelgracias700No ratings yet

- Definitive Guide To Security Awareness SuccessDocument19 pagesDefinitive Guide To Security Awareness SuccessRicardo RodríguezNo ratings yet

- Nche211 Exp1Document8 pagesNche211 Exp1Mbali MdlaloseNo ratings yet

- Zebra Rfid LabelDocument4 pagesZebra Rfid LabeldishaNo ratings yet

- Quiz 1Document2 pagesQuiz 1Niño Jay C. GastonesNo ratings yet

- S11 1321 01aDocument20 pagesS11 1321 01aMarsKwokNo ratings yet

CRS Self-Certification Form For Individual Customers

CRS Self-Certification Form For Individual Customers

Uploaded by

BenOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CRS Self-Certification Form For Individual Customers

CRS Self-Certification Form For Individual Customers

Uploaded by

BenCopyright:

Available Formats

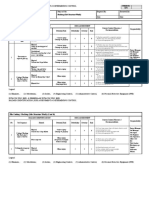

Individual Self-Certification

Instructions for completion

We are required pursuant to the Mutual Legal Assistance (Tax Matters) Act, 2003 and its amendments (namely Mutual Legal Assistance (Tax

Matters) (Amendment) (No. 2) Act, 2015 and any Orders or Guidance made thereunder (implementing legislation), to collect certain

information about each account holder’s tax arrangements. These requirements implement the Common Reporting Standards (CRS). Please

complete the sections below as directed and provide any additional information that is requested. Please note that in certain circumstances

(including if we do not receive a valid self-certification from you) we may be obliged to share information on your account with the BVI

International Tax Authority.

Terms referenced in this Form shall have the same meaning as applicable under the CRS and/or implementing legislation.

If any of the information below about your tax residence changes in the future, please ensure you advise us of these changes promptly. If you

have any questions about how to complete this form, please contact your tax advisor.

Please note that where there are joint account holders each account holder is required to complete a separate self-Certification form.

Section 1: Account Holder Identification

Account Holder Name Date of Birth (dd/mm/yyyy) Country of Birth

Permanent Residence Address:

Number & Street City/Town

State/Providence/County Post Code Country

Mailing address (if different from above):

Number & Street City/Town

State/Providence/County Post Code Country

Section 2: Declaration of U.S. Citizenship or U.S. Residence for Tax purposes

Please tick either (a) or (b) or (c) and complete as appropriate.

(a) I confirm that I am a U.S. citizen and/or resident in the U.S. for tax purposes (green card holder or resident under the

substantial presence test) and my U.S. federal taxpayer identifying number (U.S. TIN) is as follows:

(b) I confirm that I was born in the U.S. (or a U.S. territory) but am no longer a U.S. citizen as I have voluntarily

surrendered my citizenship as evidenced by the attached documents.

(c) I confirm that I am not a U.S. citizen or resident in the U.S. for tax purposes.

Complete section 3 if you have non-U.S. tax residencies.

Section 3: Declaration of Tax Residency (other than U.S.)

I hereby confirm that I am, for the purposes of that country’s tax system, resident in the following countries (indicate the tax reference

number type and number applicable in each country).

Country/ countries of tax residency Tax reference number type Tax reference number

Please indicate not applicable if the jurisdiction does not issue or you are unable to procure a tax reference number or functional equivalent. If

applicable, please specify the reason/s for non-availability of the tax reference number:

Section 4: Declaration and Undertakings

I declare that the information provided in this form is, to the best of my knowledge and belief, accurate and complete. I undertake to advise

the recipient promptly and provide an updated Self-Certification form within 30 days where any change in circumstances occurs which causes

any of the information contained in this form to be inaccurate or incomplete. Where legally obliged to do so, I hereby consent to the recipient

sharing this information with the relevant tax information authorities.

Signature

Date: (dd/mm/yy)

You might also like

- Form W-8BEN Rev 920Document2 pagesForm W-8BEN Rev 920alejandroguitierrazxxx100% (3)

- Music MaestroDocument12 pagesMusic Maestrom00sygrlNo ratings yet

- CRS Individual Self Certification Form: InstructionsDocument2 pagesCRS Individual Self Certification Form: InstructionsCyrus FungNo ratings yet

- Jamaica FATCA Individual Self Certification - 2022Document2 pagesJamaica FATCA Individual Self Certification - 2022FandENo ratings yet

- FATCA-CRS Individual Self Certification - TradeZero - Dec 2018Document2 pagesFATCA-CRS Individual Self Certification - TradeZero - Dec 2018Kahchoon ChinNo ratings yet

- NCB Self Certification of ResidencyDocument2 pagesNCB Self Certification of Residencygeeman9787No ratings yet

- 4.fatca Self Declaraton Form Individuals PDFDocument2 pages4.fatca Self Declaraton Form Individuals PDFbala krishnanNo ratings yet

- Fatca Crs Self Certification FormDocument6 pagesFatca Crs Self Certification FormMohammed FaisalNo ratings yet

- Certificate of Payment of Foreign Death Tax: For Paperwork Reduction Act Notice, See The Back of This FormDocument2 pagesCertificate of Payment of Foreign Death Tax: For Paperwork Reduction Act Notice, See The Back of This FormFrancis Wolfgang UrbanNo ratings yet

- Individual Tax Residency Self-Certification FormDocument2 pagesIndividual Tax Residency Self-Certification FormEmadNo ratings yet

- CRS Individual Self-Certification FormDocument6 pagesCRS Individual Self-Certification FormsamNo ratings yet

- Individual Tax Residency Self Certification FormDocument5 pagesIndividual Tax Residency Self Certification FormJennifer LeetNo ratings yet

- Self CertificationDocument6 pagesSelf CertificationGuocheng MaNo ratings yet

- FATCADocument2 pagesFATCAORIENNo ratings yet

- Fatca/Crs Self Certification / Declaration For Individuals: Documents As Mentioned BelowDocument2 pagesFatca/Crs Self Certification / Declaration For Individuals: Documents As Mentioned BelowRaviJhaNo ratings yet

- W-8BEN Form - Frequently Asked QuestionsDocument2 pagesW-8BEN Form - Frequently Asked QuestionsAnkit ChhabraNo ratings yet

- Benfitsform Starbucks BeanstockDocument1 pageBenfitsform Starbucks BeanstockAndrew Christopher CaseNo ratings yet

- CRS Individual Account Self-Cert Form v2015-12 CBI RBI AsiaDocument6 pagesCRS Individual Account Self-Cert Form v2015-12 CBI RBI AsiaJoris RectoNo ratings yet

- Fatca Declaration Active Trade Channel IslandsDocument6 pagesFatca Declaration Active Trade Channel IslandsLosaNo ratings yet

- CRS Self Certification Form IndividualDocument5 pagesCRS Self Certification Form IndividualSalman ArshadNo ratings yet

- Individual Tax Residency Self Certification FormDocument5 pagesIndividual Tax Residency Self Certification FormYaacov KotlickiNo ratings yet

- FATCA-CRS Annexure For Individual Accounts (Including Sole Proprietor) Details Under FATCA and CRSDocument2 pagesFATCA-CRS Annexure For Individual Accounts (Including Sole Proprietor) Details Under FATCA and CRSOws AnishNo ratings yet

- GEK Termination FormDocument2 pagesGEK Termination Formmobla007No ratings yet

- Account Opening Supplementary Form - FATCA and CRS Declaration - 10oct2023Document2 pagesAccount Opening Supplementary Form - FATCA and CRS Declaration - 10oct2023essienegNo ratings yet

- W 8ben TdaDocument1 pageW 8ben TdaAnamaria Suciu100% (1)

- IRS Tax Fraud Reporting F3949aDocument2 pagesIRS Tax Fraud Reporting F3949aTim Bryant100% (2)

- FRM W8DM HRDocument2 pagesFRM W8DM HRmiscribeNo ratings yet

- CRS Self Certification Form For IndividualsDocument6 pagesCRS Self Certification Form For IndividualsSergeyNo ratings yet

- Substitute Form W-8BEN (Individuals)Document1 pageSubstitute Form W-8BEN (Individuals)hector100% (1)

- Substitute Form W-8BEN (Individuals)Document1 pageSubstitute Form W-8BEN (Individuals)hector100% (1)

- Franklin Templeton Investments: Investor DetailsDocument5 pagesFranklin Templeton Investments: Investor Detailspiper_No ratings yet

- Crs-I Individual Self Cert Form-AustraliaDocument2 pagesCrs-I Individual Self Cert Form-AustraliaminemecryptoNo ratings yet

- New Self Certification FormDocument3 pagesNew Self Certification Formtimstark004No ratings yet

- Irs Form 14039Document2 pagesIrs Form 14039waterfordpoliceNo ratings yet

- CMB Self-Certification Form For Personal Account Holders September 27 2018Document3 pagesCMB Self-Certification Form For Personal Account Holders September 27 2018Elly PérezNo ratings yet

- FATCA RBSC Certification Consent Waiver Form 072015Document4 pagesFATCA RBSC Certification Consent Waiver Form 072015Mary Nespher DelfinNo ratings yet

- FATCA QuestionnaireDocument1 pageFATCA Questionnaireblue606No ratings yet

- Certificate of Foreign Status of Beneficial Owner For United States Tax WithholdingDocument4 pagesCertificate of Foreign Status of Beneficial Owner For United States Tax WithholdingYudia0% (1)

- NM Substitute W9Document2 pagesNM Substitute W9marcelNo ratings yet

- W-8ben For CDN Beachbody Coaches SampleDocument1 pageW-8ben For CDN Beachbody Coaches Sampleapi-295933330No ratings yet

- Fillable W-8BEN 2023Document2 pagesFillable W-8BEN 2023marioNo ratings yet

- CRS - 2022Document13 pagesCRS - 2022johny SahaNo ratings yet

- Foreign Account Tax Compliance Act - 140119Document2 pagesForeign Account Tax Compliance Act - 140119skn bharatNo ratings yet

- Kelley Lynch - Tax Court PetitionDocument57 pagesKelley Lynch - Tax Court PetitionOdzer ChenmaNo ratings yet

- Business Banking Sole Trader Residency FormDocument2 pagesBusiness Banking Sole Trader Residency FormbtcturkdestekinfoNo ratings yet

- 230 Short Sale Packet - BayviewDocument16 pages230 Short Sale Packet - BayviewrapiddocsNo ratings yet

- Extended KYC Annexure IndividualsDocument2 pagesExtended KYC Annexure IndividualsNarendra Reddy BhumaNo ratings yet

- Status Declaration Form For Individuals: DeclarantDocument2 pagesStatus Declaration Form For Individuals: DeclarantDhavalNo ratings yet

- SIGNED-Foreign Account Tax Compliance Act - 140119Document2 pagesSIGNED-Foreign Account Tax Compliance Act - 140119skn bharatNo ratings yet

- CRS-I FormDocument2 pagesCRS-I Formmramzan9820No ratings yet

- I-864 27.10.11Document8 pagesI-864 27.10.11thanhloan2828No ratings yet

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- Innocent Spouse Relief: How You May Not Have To Pay Your Taxes!From EverandInnocent Spouse Relief: How You May Not Have To Pay Your Taxes!No ratings yet

- US Government Economics - Local, State and Federal | How Taxes and Government Spending Work | 4th Grade Children's Government BooksFrom EverandUS Government Economics - Local, State and Federal | How Taxes and Government Spending Work | 4th Grade Children's Government BooksNo ratings yet

- Taverna - Georgina HaydenDocument403 pagesTaverna - Georgina Haydenelena8kartsiouliNo ratings yet

- SCD Define Plant LocationDocument535 pagesSCD Define Plant LocationSantosh YadavNo ratings yet

- Curl Easy PauseDocument2 pagesCurl Easy PauseMarko VujnovicNo ratings yet

- English 102Document4 pagesEnglish 102chiubrit100% (1)

- Drug Discovery Complete NotesDocument5 pagesDrug Discovery Complete NotesSadiqa ForensicNo ratings yet

- MEDICAL DEVICES: Guidance DocumentDocument15 pagesMEDICAL DEVICES: Guidance DocumentPhạm Thu HuyềnNo ratings yet

- 24 Wlic Index PlusDocument12 pages24 Wlic Index PlusSrinivasan KannanNo ratings yet

- Training Topics: Differentiating InstructionDocument7 pagesTraining Topics: Differentiating InstructionarisuNo ratings yet

- The Future of AI in Medicine: A Perspective From A ChatbotDocument5 pagesThe Future of AI in Medicine: A Perspective From A Chatbotnmabestun1No ratings yet

- Acct2302 E3Document12 pagesAcct2302 E3zeeshan100% (1)

- Developing NGO Partnerships Guidelines PDFDocument31 pagesDeveloping NGO Partnerships Guidelines PDFHarith FadhilaNo ratings yet

- Raccon BookmarkDocument2 pagesRaccon BookmarkLinda YiusNo ratings yet

- Pile Cutting / Hacking (Sub-Structure Work)Document2 pagesPile Cutting / Hacking (Sub-Structure Work)Rahmat HariNo ratings yet

- Lab 8Document5 pagesLab 8Ravin BoodhanNo ratings yet

- FS 2004 A - Rev-7Document78 pagesFS 2004 A - Rev-7Maffone NumerounoNo ratings yet

- Report RUSADocument16 pagesReport RUSApawan kumar100% (1)

- Icn ApiDocument172 pagesIcn ApiNaveen SemwalNo ratings yet

- Family Case Study On The Billones Family 1Document63 pagesFamily Case Study On The Billones Family 1Ivy Mae DecenaNo ratings yet

- Non Dir. O/C Relay ARGUS - 7SR1102: 1. General Data & InformationDocument6 pagesNon Dir. O/C Relay ARGUS - 7SR1102: 1. General Data & InformationAnonymous dH3DIEtzNo ratings yet

- 365 Magic ItemsDocument71 pages365 Magic ItemsJeremy Edwards100% (2)

- Matrix Training Safety PT Acset Indonusa TBKDocument6 pagesMatrix Training Safety PT Acset Indonusa TBKonyo sjariefNo ratings yet

- PD Dac: Concepts of Programming & Operating SystemDocument5 pagesPD Dac: Concepts of Programming & Operating SystemamNo ratings yet

- Maria Katticaran/ M.Arch II/ UCLA SuprastudioDocument19 pagesMaria Katticaran/ M.Arch II/ UCLA SuprastudioMaria KatticaranNo ratings yet

- Alves Doa - Way Intl 102723Document5 pagesAlves Doa - Way Intl 102723michaelgracias700No ratings yet

- Definitive Guide To Security Awareness SuccessDocument19 pagesDefinitive Guide To Security Awareness SuccessRicardo RodríguezNo ratings yet

- Nche211 Exp1Document8 pagesNche211 Exp1Mbali MdlaloseNo ratings yet

- Zebra Rfid LabelDocument4 pagesZebra Rfid LabeldishaNo ratings yet

- Quiz 1Document2 pagesQuiz 1Niño Jay C. GastonesNo ratings yet

- S11 1321 01aDocument20 pagesS11 1321 01aMarsKwokNo ratings yet