Professional Documents

Culture Documents

Bank Reconciliation Manual

Bank Reconciliation Manual

Uploaded by

kryzz Choice Mart KCMOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bank Reconciliation Manual

Bank Reconciliation Manual

Uploaded by

kryzz Choice Mart KCMCopyright:

Available Formats

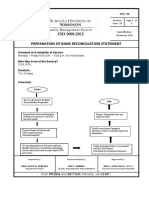

Title: Client: Consultant: Version: Date:

QB Procedure: Bank Reconciliation Baguio Group of Companies SPCG Inc. Draft April 5, 2023

.

BANK RECONCILATION

Follow the steps carefully!

GO TO HOME AND CLICK THE RECONCILE ICON

Screen 1, select or enter…

• Bank Account

• Bank Statement’s Date

• Bank Statement’s Ending Bal.

• Service Charge, if any, and account

• Interest, if any, and account.

• Locate Inconsistencies, if needed.

Press Continue to go to next screen.

Screen 2,

• Under Columns to Display button,

select the items that you want to display.

• Show transactions on or before statement ending date.

From the bank statement, check off….

• checks that cleared the bank (LEFT)

• deposits that cleared the bank (RIGHT)

If you click modify – it will return to screen 1.

COMPARE BANK (PASSBOOK/SUMMARY) TO THE RECORDS IN QB BANK RECONCILIATION

When reconciling the bank statement in QuickBooks, compare the data carefully to ensure accuracy.

And properly reconciled. After Comparing you may click the Reconcile Now

The Reconcile Now button should be selected ONLY when the accountant

Check the Data in QB if confirmed that the amount is existing in the Bank Passbook/Summary already verified the reconciliation. QuickBooks gives you a warning and

• checks that cleared the bank (LEFT) choices when your bank statement and QuickBooks bank account are not

• deposits that cleared the bank (RIGHT)

reconciled.

After checking off cleared transactions in the QB Bank Reconcile screen, the QB total deposits. When the bank statement balance and the QuickBooks checking register are

plus, other credits and the total Checks plus other bank charges should match the Total Deposits and reconciled, a detailed bank reconciliation report should be printed and attached

Checks on the bank statement. to the bank statement.

Note: it is not advisable to undo reconciliations, make sure to click the reconciliation

only if there is zero difference, do not proceed if there are still differences.

Approved and Accepted by:

1

Title: Client: Consultant: Version: Date:

QB Procedure: Bank Reconciliation Baguio Group of Companies SPCG Inc. Draft

UNDO RECONCILIATION

If you cannot locate discrepancies when reconciling an account, you can undo your last reconciliation and start again.

The Undo Reconciliation reverts to the previous beginning balance and the previous bank reconciliation (depending on how many times the accountant clicked the reconcile button), charges, interest, and

balance adjustments.

Note: it is not advisable to undo reconciliations, make sure to click the reconciliation only if there is zero difference, do not proceed if there are still differences.

Also, if reconciled make sure to close the QB, to prevent the discrepancies on transactions (on or before the cut-off date)

Select Undo last Reconciliation button on the Locate Discrepancies screen.

If you want to change the date of your opening balance, you'll need to undo your previous reconciliation.

When you redo the reconciliation, you'll be able to enter the correct date.

1. Make sure you back up your data before you begin.

2. Go to the Banking menu and then click Reconcile.

3. In the Begin Reconciliation window, click Locate Discrepancies.

4. Click Discrepancy Report or Previous Reports to view the list of discrepancies or the previous reconciliation report, if necessary.

5. Click Undo Last Reconciliation.

6. Click Restart Reconciliation to repeat the reconciliation process from the beginning. For assistance, contact your consultant.

Approved and Accepted by: Process Owner: Process Performer: Approved by:

2

You might also like

- Balance Sheet Account Reconciliation SOP Apr'22Document15 pagesBalance Sheet Account Reconciliation SOP Apr'22AndyTanNo ratings yet

- FABM2 Q2 Module WS 1Document14 pagesFABM2 Q2 Module WS 1Mitch Dumlao73% (11)

- Balance Sheet ReconciliationsDocument6 pagesBalance Sheet ReconciliationsvidushigargeNo ratings yet

- Leasing & Rents Conventional Pre-Close ProceduresDocument10 pagesLeasing & Rents Conventional Pre-Close ProceduresLisa GoldmanNo ratings yet

- Bank Reconciliation StatementDocument19 pagesBank Reconciliation StatementJaneth Bootan ProtacioNo ratings yet

- Bank Reconciliation Using QuickbooksDocument3 pagesBank Reconciliation Using Quickbookskibakikangoye99No ratings yet

- Bank Reconciliation: AccountingtoolsDocument1 pageBank Reconciliation: AccountingtoolsQuenie De la CruzNo ratings yet

- Bank Reconciliation Statement: Fundamentals of ABM 2Document7 pagesBank Reconciliation Statement: Fundamentals of ABM 2Zymon Andrew MaquintoNo ratings yet

- Excerpt of Bookkeeping Review ChecklistDocument2 pagesExcerpt of Bookkeeping Review ChecklisthumphreyiNo ratings yet

- Troubleshooting Out of Balance Bank Reconciliation: Errors Causing Your Bank Statement Not To BalanceDocument2 pagesTroubleshooting Out of Balance Bank Reconciliation: Errors Causing Your Bank Statement Not To BalanceKrishna Kishore CNo ratings yet

- Introduction To Bank Reconciliation Statement: ReconcileDocument2 pagesIntroduction To Bank Reconciliation Statement: ReconcileJayesh RasalNo ratings yet

- Bank Reconciliation Theory & ProblemsDocument9 pagesBank Reconciliation Theory & ProblemsSalvador DapatNo ratings yet

- 5.A Statutory Audit of Bank Chapter 5 ConclusionDocument4 pages5.A Statutory Audit of Bank Chapter 5 Conclusionhivamol906No ratings yet

- Bank ReconciliationDocument23 pagesBank ReconciliationAlyson Jane ConstantinoNo ratings yet

- Acc_Gr_12_Week_7_Recons_ENG_cheques_out_2021_(1)Document9 pagesAcc_Gr_12_Week_7_Recons_ENG_cheques_out_2021_(1)siqiniseko2106No ratings yet

- Bank Reconciliation Statement PDFDocument4 pagesBank Reconciliation Statement PDFNasar IqbalNo ratings yet

- Bank Reconciliation Quick TipsDocument4 pagesBank Reconciliation Quick Tipswaheed ahmedNo ratings yet

- Chapter 2.bank ReconDocument26 pagesChapter 2.bank ReconLykie Mae ParedesNo ratings yet

- Trial Balance and Rectification of Errors: Accountancy 180Document46 pagesTrial Balance and Rectification of Errors: Accountancy 180kofirNo ratings yet

- 2nd QTR Week 8 Fabm 2 Bank ReconDocument9 pages2nd QTR Week 8 Fabm 2 Bank ReconHannah Grace ManagasNo ratings yet

- Reconciliation ChecklistDocument6 pagesReconciliation ChecklistRikky SoNo ratings yet

- Fabm2 q2 Module 3 Bank ReconDocument13 pagesFabm2 q2 Module 3 Bank ReconLady Hara100% (2)

- ACC 06 PROCESS MANUAL Bank ReconDocument7 pagesACC 06 PROCESS MANUAL Bank ReconMaricrisNo ratings yet

- Apresentação Confirming - NestleDocument11 pagesApresentação Confirming - NestleFernanda Fagundes100% (1)

- Core Text Module 2 Session 3Document5 pagesCore Text Module 2 Session 3apple_doctoleroNo ratings yet

- F.A.B.M PortfolioDocument28 pagesF.A.B.M PortfolioLjoy Vlog SurvivedNo ratings yet

- C2 Bank ReconciliationDocument22 pagesC2 Bank ReconciliationKenzel lawasNo ratings yet

- Chapter # 4: Bank Reconciliation StatementDocument20 pagesChapter # 4: Bank Reconciliation Statementsadia abidNo ratings yet

- Fabm2 Q2 M3 - 4Document9 pagesFabm2 Q2 M3 - 4Zeus MalicdemNo ratings yet

- Trial BalanceDocument4 pagesTrial BalanceMapalo KamonaNo ratings yet

- Personal Schedule of Fees: Effective February 19, 2021Document21 pagesPersonal Schedule of Fees: Effective February 19, 2021miaaconicNo ratings yet

- Businesses Errors: Preparation of Bank Reconciliation StatementDocument5 pagesBusinesses Errors: Preparation of Bank Reconciliation StatementPREX WEXNo ratings yet

- Las1 Q2 BankreconDocument12 pagesLas1 Q2 BankreconCharlyn CastroNo ratings yet

- CBS FaqDocument138 pagesCBS FaqKallol DasNo ratings yet

- Accountancy Notes PDF Class 11 Chapter 5Document4 pagesAccountancy Notes PDF Class 11 Chapter 5Rishi ShibdatNo ratings yet

- Reading Material BRSDocument12 pagesReading Material BRSDrake100% (1)

- 1.0 Bank Statement Preparation: ProcedureDocument3 pages1.0 Bank Statement Preparation: ProcedureJoseNo ratings yet

- Accounting Grade 11 Relab Activities - Learner's GuideDocument161 pagesAccounting Grade 11 Relab Activities - Learner's Guidethatoramoupi54No ratings yet

- Bank Reconciliation Statement: Names of Sub-UnitsDocument6 pagesBank Reconciliation Statement: Names of Sub-UnitsHermann Schmidt EbengaNo ratings yet

- What Is A Bank Reconciliation StatementDocument4 pagesWhat Is A Bank Reconciliation StatementHsin Wua ChiNo ratings yet

- Bank ReconciliationDocument5 pagesBank ReconciliationaizaNo ratings yet

- Bank Reconciliation: Ninia C. Pauig-Lumauan, MBA, CPA Lyceum of AparriDocument60 pagesBank Reconciliation: Ninia C. Pauig-Lumauan, MBA, CPA Lyceum of AparriTessang OnongenNo ratings yet

- Bank Rec Report V 10Document4 pagesBank Rec Report V 10HILLARY KIRUINo ratings yet

- QB Using Bank FeedsDocument6 pagesQB Using Bank Feedsvanosoy19No ratings yet

- Copy of Hasarkrishan SinghDocument11 pagesCopy of Hasarkrishan SinghHarkrishan SinghNo ratings yet

- Fia Fa1 Bank ReconciliationsDocument22 pagesFia Fa1 Bank ReconciliationsAlepha TemboNo ratings yet

- Bank Reconciliation StatementDocument6 pagesBank Reconciliation StatementamnatariqshahNo ratings yet

- ACC117 - Chapter 7 - Bank Reconciliation StatementDocument24 pagesACC117 - Chapter 7 - Bank Reconciliation StatementIrah NazirahNo ratings yet

- Bank Reconciliation StatementDocument5 pagesBank Reconciliation StatementMuhammad JunaidNo ratings yet

- Basic Reconciliation StatementDocument25 pagesBasic Reconciliation StatementSophia Nicole100% (1)

- Bank Reconciliation 1Document32 pagesBank Reconciliation 1MussaNo ratings yet

- Bookkeeping To Trial Balance 9Document17 pagesBookkeeping To Trial Balance 9elelwaniNo ratings yet

- Accounting Lesson 1 Bank Reconciliation NotesDocument9 pagesAccounting Lesson 1 Bank Reconciliation NotesKabelo SefaliNo ratings yet

- Bank ReconciliationDocument6 pagesBank ReconciliationDenishNo ratings yet

- How ToDocument8 pagesHow TobookbooksNo ratings yet

- Financial Accounting Handout 2Document49 pagesFinancial Accounting Handout 2Rhoda Mbabazi ByogaNo ratings yet

- Verification of AdvancesDocument12 pagesVerification of AdvancesAvinash SinyalNo ratings yet

- Bank Reconciliation StatementDocument14 pagesBank Reconciliation StatementBharathi RajuNo ratings yet

- Project Report RANJNADocument25 pagesProject Report RANJNACûtë Vijay RandhawaNo ratings yet

- Credit Repair: The Ultimate Guide System On How To Remove Negative Items From Your Report And Improve Your Score With An Easy Plan; The Secrets To Rapid Restore And Fast ResultsFrom EverandCredit Repair: The Ultimate Guide System On How To Remove Negative Items From Your Report And Improve Your Score With An Easy Plan; The Secrets To Rapid Restore And Fast ResultsRating: 1 out of 5 stars1/5 (2)

- Ifrs 8: Operating SegmentsDocument15 pagesIfrs 8: Operating SegmentsMohammad BaratNo ratings yet

- Reconciliation SOPDocument2 pagesReconciliation SOPsheetal.kamthewadNo ratings yet

- C7A Cash & Cash EquivalentsDocument6 pagesC7A Cash & Cash EquivalentsSteeeeeeeephNo ratings yet

- Ifrs Edition: Prepared by Coby Harmon University of California, Santa Barbara Westmont CollegeDocument33 pagesIfrs Edition: Prepared by Coby Harmon University of California, Santa Barbara Westmont CollegeAhmed El KhateebNo ratings yet

- Work in Process, Beginning:: Required: Prepare A Production Report For The Department Using The Weighted-Average MethodDocument6 pagesWork in Process, Beginning:: Required: Prepare A Production Report For The Department Using The Weighted-Average MethodJhunorlando DisonoNo ratings yet

- Senior Accountant in Charlotte NC Resume Karen GeorgeDocument2 pagesSenior Accountant in Charlotte NC Resume Karen GeorgeKarenGeorge1No ratings yet

- JUDITH IPCRF & KRA FinalDocument12 pagesJUDITH IPCRF & KRA FinalMary Joy ClarNo ratings yet

- CH 07Document81 pagesCH 07Ismadth2918388No ratings yet

- CM 040 Validation ScriptsDocument67 pagesCM 040 Validation Scriptsavesh ansariNo ratings yet

- Finance Manual DdcaDocument74 pagesFinance Manual DdcaArjuunChhokarNo ratings yet

- SAP Business One 9.2 TB1100 - 97 - InstructorGuideDocument33 pagesSAP Business One 9.2 TB1100 - 97 - InstructorGuideycoutyNo ratings yet

- Resume I Chanchal Jain (3) - 1Document2 pagesResume I Chanchal Jain (3) - 1GauravGupta11No ratings yet

- Job Description Senior AccountantDocument3 pagesJob Description Senior AccountantMami HarariNo ratings yet

- Audit Report SampleDocument27 pagesAudit Report SampleshanifNo ratings yet

- Field Report GenuineDocument15 pagesField Report GenuineSabrina HusseinNo ratings yet

- What Is Intercompany ReconciliationDocument7 pagesWhat Is Intercompany ReconciliationChakravarthy AkellaNo ratings yet

- Dygnonise of FusionDocument17 pagesDygnonise of Fusionyramesh77No ratings yet

- Kashika Aggarwal: GENPACT - Process DeveloperDocument1 pageKashika Aggarwal: GENPACT - Process DeveloperBigBoysChoice ShowNo ratings yet

- Chapter Reconciliation 4Document17 pagesChapter Reconciliation 4bhagyashripande321No ratings yet

- Fabm2 - Q2 - M5Document13 pagesFabm2 - Q2 - M5Christopher AbundoNo ratings yet

- Cash Management Test Script Oracle 12Document5 pagesCash Management Test Script Oracle 12suresh mysNo ratings yet

- Surendra Kumar MahatoDocument3 pagesSurendra Kumar MahatoThe Cultural CommitteeNo ratings yet

- Bank ReconciliationDocument60 pagesBank ReconciliationLourdes EyoNo ratings yet

- Fabm2 - June 17, 2021 Asynchronous Activity: Thanks, Happy Working. 3Document7 pagesFabm2 - June 17, 2021 Asynchronous Activity: Thanks, Happy Working. 3Khaira PeraltaNo ratings yet

- Chapter 16Document28 pagesChapter 16Kevin HenricoNo ratings yet

- CV - 2Document3 pagesCV - 2Luba GusevaNo ratings yet

- Bank ReconciliationDocument20 pagesBank ReconciliationJalieca Lumbria GadongNo ratings yet

- City of Cincinnati Park Board AuditReport and Attachments 7-26-16Document21 pagesCity of Cincinnati Park Board AuditReport and Attachments 7-26-16James PilcherNo ratings yet

- Pranali Audumbar SutarDocument32 pagesPranali Audumbar SutarSukhvinder SinghNo ratings yet