Professional Documents

Culture Documents

Acc Notes Ch. 1,2,3

Acc Notes Ch. 1,2,3

Uploaded by

Prajakta JoshiCopyright:

Available Formats

You might also like

- Chapter 5 Answers Key Millan Financial Accounting and Reporting (3rd Edition)Document6 pagesChapter 5 Answers Key Millan Financial Accounting and Reporting (3rd Edition)Terese Pingol100% (1)

- Tutorial Work With SolutionsDocument73 pagesTutorial Work With SolutionsAlison Mokla100% (1)

- Morrison Marketing StrategyDocument38 pagesMorrison Marketing StrategyMuhammad Sajid Saeed100% (21)

- Corporate Financial Distress, Restructuring, and Bankruptcy: Analyze Leveraged Finance, Distressed Debt, and BankruptcyFrom EverandCorporate Financial Distress, Restructuring, and Bankruptcy: Analyze Leveraged Finance, Distressed Debt, and BankruptcyNo ratings yet

- SWOT Analysis For RevlonDocument1 pageSWOT Analysis For Revlonmuhammadamad8930100% (1)

- CRM AuditDocument7 pagesCRM AuditMukesh SinhaNo ratings yet

- Act001 ActivityDocument7 pagesAct001 ActivitygloryfeilagoNo ratings yet

- FABM Q3 M4 (Output No. 4 - Five Major Accounts)Document4 pagesFABM Q3 M4 (Output No. 4 - Five Major Accounts)Sophia MagdaraogNo ratings yet

- 13.1 10.2. Classification of Accounts PDFDocument13 pages13.1 10.2. Classification of Accounts PDFJoi JoiNo ratings yet

- Acctg 1Document3 pagesAcctg 1HoneyzelOmandamPonceNo ratings yet

- Activity 4 Quiz FABMDocument1 pageActivity 4 Quiz FABMJake SabilloNo ratings yet

- Type of AccountsDocument4 pagesType of AccountsIgnacio De LunaNo ratings yet

- Workshop Accounting VocabularyDocument3 pagesWorkshop Accounting VocabularyEstefany ForeroNo ratings yet

- Books of Accounts and Double Entry Sytem BSAIS 1A Group 2Document27 pagesBooks of Accounts and Double Entry Sytem BSAIS 1A Group 2Marydelle De Austria-De GuiaNo ratings yet

- Tally Module 1 Assignment SolutionDocument6 pagesTally Module 1 Assignment Solutioncharu bishtNo ratings yet

- Igcse Accounting TheoryDocument32 pagesIgcse Accounting Theorykuanhuining202104No ratings yet

- Activities Accounting 1 - BSBA MM 1-2 SALAZARDocument7 pagesActivities Accounting 1 - BSBA MM 1-2 SALAZARDarren Ace SalazarNo ratings yet

- Accounting Terms Assingment 1Document2 pagesAccounting Terms Assingment 1nanduapna08No ratings yet

- Chapter 4 - 5 ActivitiesDocument3 pagesChapter 4 - 5 ActivitiesJane Carla BorromeoNo ratings yet

- SHS Basic Accounting Answer KeyDocument4 pagesSHS Basic Accounting Answer KeyKhira Xandria AldabaNo ratings yet

- Job Responsabilities - Ev Conocimiento - Workshop 13Document4 pagesJob Responsabilities - Ev Conocimiento - Workshop 13Karoll DiazNo ratings yet

- AccountingDocument3 pagesAccountingMARA CAMILA ROJAS IZQUIERDONo ratings yet

- LLP Full NotesDocument15 pagesLLP Full NotesJay Desai100% (1)

- Workshop 4 Job Responsabilities - Ev Conocimiento (1)Document4 pagesWorkshop 4 Job Responsabilities - Ev Conocimiento (1)AlejandraNo ratings yet

- Work Book XI-CommerceDocument92 pagesWork Book XI-CommerceTariq IqbalNo ratings yet

- Accounting Concepts: A. Write The Letter of Your Answer Before Each Number or ItemDocument3 pagesAccounting Concepts: A. Write The Letter of Your Answer Before Each Number or ItemDail Xymere YamioNo ratings yet

- Accounting Grade 10 - 12 How To Teach Acc EquationDocument11 pagesAccounting Grade 10 - 12 How To Teach Acc Equationnkambulentokozo55No ratings yet

- Types of Major AccountsDocument6 pagesTypes of Major Accountsks505eNo ratings yet

- Description Account Title SFP Element: Accounts PayableDocument4 pagesDescription Account Title SFP Element: Accounts PayableEnrique BongaisNo ratings yet

- ACCO Module 2Document5 pagesACCO Module 2Lala BoraNo ratings yet

- Quiz 2Document2 pagesQuiz 2Bervette HansNo ratings yet

- Workshop Accounting Vocabulary Class 3Document6 pagesWorkshop Accounting Vocabulary Class 3Oscar NogueraNo ratings yet

- ACCT1101 Wk3 Tutorial 2 SolutionsDocument7 pagesACCT1101 Wk3 Tutorial 2 SolutionskyleNo ratings yet

- Fundamental Notes and Conceptual Problem of Journal Ledger Trial Balance and Cash BookDocument7 pagesFundamental Notes and Conceptual Problem of Journal Ledger Trial Balance and Cash BookShekhar TNo ratings yet

- Workshop Accounting VocabularyDocument4 pagesWorkshop Accounting VocabularyOscar NogueraNo ratings yet

- Basic Concepts, Rules, Double Entries & Formats For Accounting Students (Level# 1)Document36 pagesBasic Concepts, Rules, Double Entries & Formats For Accounting Students (Level# 1)Elee EhmedNo ratings yet

- ACCOUNTING CYCLE STEP 1 TO 4 With IllustrationsDocument6 pagesACCOUNTING CYCLE STEP 1 TO 4 With IllustrationsmallarilecarNo ratings yet

- Chapter 2 The Recording Process SCDocument51 pagesChapter 2 The Recording Process SCYong ZhenNo ratings yet

- FA1 - MM - Pocket NotesDocument25 pagesFA1 - MM - Pocket NotesMirza NoumanNo ratings yet

- Fundamentals of Accountancy Business and ManagementDocument24 pagesFundamentals of Accountancy Business and ManagementAshley Judd Mallonga Beran100% (1)

- Chapter 8Document18 pagesChapter 8Mishu GuptaNo ratings yet

- Fin Accounting 2 EquationDocument25 pagesFin Accounting 2 EquationIqbal Hanif100% (1)

- Unit 3 - Trial BalanceDocument11 pagesUnit 3 - Trial Balancegogo chanNo ratings yet

- Assignment No 2Document4 pagesAssignment No 2Rao khuzaimahNo ratings yet

- Diliman Preparatory School: Basic Education Department-High School SCHOOL YEAR 2019-2020 First Semester Fabm 2Document2 pagesDiliman Preparatory School: Basic Education Department-High School SCHOOL YEAR 2019-2020 First Semester Fabm 2Althea Nicole CanapiNo ratings yet

- Sol. Man. - Chapter 5 - Books of Accounts and Double-Entry SystemDocument7 pagesSol. Man. - Chapter 5 - Books of Accounts and Double-Entry SystemTali0% (1)

- Topic 2 - Accounting & BusinessDocument34 pagesTopic 2 - Accounting & Businessdenixng100% (1)

- Entreprenuership 2nd Sem Quiz QuestionsDocument2 pagesEntreprenuership 2nd Sem Quiz QuestionsHannah LegaspiNo ratings yet

- Profit and Loss P&L Statement StatementDocument3 pagesProfit and Loss P&L Statement StatementShreepathi AdigaNo ratings yet

- Nama Akun AkuntansiDocument4 pagesNama Akun Akuntansitarissa saNo ratings yet

- Key Terms and Chapter Summary 8Document3 pagesKey Terms and Chapter Summary 8Devansh DwivediNo ratings yet

- Kamus Akuntansi: TarissaDocument5 pagesKamus Akuntansi: Tarissatarissa saNo ratings yet

- Basics of Accounting - QBDocument7 pagesBasics of Accounting - QBsujanthqatarNo ratings yet

- ACC406 - Topic 4a - Principle of Double Entry and Books of AccountDocument23 pagesACC406 - Topic 4a - Principle of Double Entry and Books of AccountCarol LeslyNo ratings yet

- Solution 103-Basic Accounting Problem 103 - Recording - Business - TransactionsDocument15 pagesSolution 103-Basic Accounting Problem 103 - Recording - Business - TransactionsmeepxxxNo ratings yet

- International PaymentDocument24 pagesInternational PaymentAgung WidyadnyanaNo ratings yet

- Ch.1: Accounting in Action (Cont'd)Document29 pagesCh.1: Accounting in Action (Cont'd)mariam raafatNo ratings yet

- Sample Questions BK 2024Document2 pagesSample Questions BK 2024Neeta PrajapatiNo ratings yet

- Sol. Man. - Chapter 4 - Types of Major AccountsDocument6 pagesSol. Man. - Chapter 4 - Types of Major AccountsAmie Jane MirandaNo ratings yet

- Exercise No. 2 Mba2008b Elements of Accounting ExerciseDocument4 pagesExercise No. 2 Mba2008b Elements of Accounting Exercisemenchong 123No ratings yet

- Commercial Real Estate for Beginner: 1From EverandCommercial Real Estate for Beginner: 1Rating: 5 out of 5 stars5/5 (1)

- Assignment 1 by Muhammad Ehtisham 2172032Document9 pagesAssignment 1 by Muhammad Ehtisham 2172032Muhammad EhtishamNo ratings yet

- Financial Accounting Theory and Analysis Text and Cases 12th Edition Schroeder Test BankDocument25 pagesFinancial Accounting Theory and Analysis Text and Cases 12th Edition Schroeder Test BankCherylHorngjmf100% (42)

- Isp531 ProtonDocument12 pagesIsp531 ProtonSally SallyNo ratings yet

- Chapter 1 Introduction To M&ADocument29 pagesChapter 1 Introduction To M&AK60 Phạm Thị Phương AnhNo ratings yet

- Spoiled Goods Are Goods That Have Been Damaged Through Imperfect Machining or IllustrationDocument3 pagesSpoiled Goods Are Goods That Have Been Damaged Through Imperfect Machining or IllustrationBuff FaloNo ratings yet

- SAP: Building A Leading Technology Brand: Case AnalysisDocument3 pagesSAP: Building A Leading Technology Brand: Case AnalysisSachin SuryavanshiNo ratings yet

- Think Tank Bericht ZusammenfassungDocument21 pagesThink Tank Bericht ZusammenfassungS GuruNo ratings yet

- Assgnmnt 12 BDocument11 pagesAssgnmnt 12 BCharis Adit67% (3)

- 1st Year - Financial Accounting and Reporting 1 PDFDocument14 pages1st Year - Financial Accounting and Reporting 1 PDFIts SaoirseNo ratings yet

- Trade Fairs and ExhibitionsDocument10 pagesTrade Fairs and ExhibitionsdaogafugNo ratings yet

- Scorpio Tankers ProspectusDocument184 pagesScorpio Tankers ProspectusaimranamirNo ratings yet

- Cisco IPF at A GlanceDocument1 pageCisco IPF at A GlanceShantanu PalNo ratings yet

- Accounting For Joint and by ProductsDocument7 pagesAccounting For Joint and by ProductsGian Carlo RamonesNo ratings yet

- RetailDocument4 pagesRetailRakesh Chaudhari0% (1)

- Krown Traders: Amity School of BusinessDocument5 pagesKrown Traders: Amity School of BusinessGautam TandonNo ratings yet

- Hw07 Solution. Corporate FinanceDocument4 pagesHw07 Solution. Corporate FinanceTú Mỹ Ngô100% (1)

- CFA RC Equity Research Report EssentialsDocument3 pagesCFA RC Equity Research Report EssentialsSahil GoyalNo ratings yet

- World Class Manufacturing PDFDocument4 pagesWorld Class Manufacturing PDFRohit Gothwal0% (2)

- How Would Einstein Value Financial Assets? The Asset Pricing Implications of The Great BailoutDocument5 pagesHow Would Einstein Value Financial Assets? The Asset Pricing Implications of The Great BailoutalphathesisNo ratings yet

- Vendor Managed InventoryDocument2 pagesVendor Managed InventoryAdnan NawabNo ratings yet

- Pricing Assignment: Team MembersDocument7 pagesPricing Assignment: Team MembersNeeraj GargNo ratings yet

- Tech Talk - Creating A Social Media StrategyDocument3 pagesTech Talk - Creating A Social Media StrategyAnwesha SahooNo ratings yet

- From MC To IMCDocument8 pagesFrom MC To IMCMagdalena AdrianaNo ratings yet

- Marketing of Compost BinDocument10 pagesMarketing of Compost BinLalitNo ratings yet

- Modern Auditing BoyntonDocument3 pagesModern Auditing BoyntonRirinNo ratings yet

- Generally Accepted Accounting Principles and Accounting StandardsDocument32 pagesGenerally Accepted Accounting Principles and Accounting StandardsDileepkumar K DiliNo ratings yet

- Writing A Business Plan: Bruce R. Barringer R. Duane IrelandDocument21 pagesWriting A Business Plan: Bruce R. Barringer R. Duane IrelandMuhammadAli AbidNo ratings yet

Acc Notes Ch. 1,2,3

Acc Notes Ch. 1,2,3

Uploaded by

Prajakta JoshiOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Acc Notes Ch. 1,2,3

Acc Notes Ch. 1,2,3

Uploaded by

Prajakta JoshiCopyright:

Available Formats

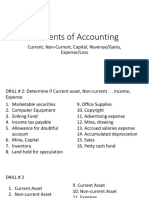

Classification of assets and liabilities – Answer

Classify the following accounts – in the correct group

Example = Cash on hand = A = CA

(Refer Keywords = A, L, OE, NCA, CA, NCL, CL )

OE = owners’ equity = capital

NCA /CA /

Account A / L /OE

NCL / CL

1. Land* A NCA

2. Office fax machine, office computers, office

A NCA

equipment

3. Freehold premises, Premises A NCA

4. Factory building, office building, building A NCA

5. Fitting and fixtures, showcase and shelves,

A NCA

furniture

6. Equipment, machinery, Plant and Machinery A NCA

7. Motor vehicle, Delivery van A NCA

8. Trademarks, Brand name Patents Copy right

A NCA

Goodwill

9. Bank fixed deposit / investments A NCA

10. Loan to Employee A CA

11. Trade Debtors, trade receivable, Money owed

from customers, customers Dr. Bal, customer

A CA

X, Debtors = (all these are generally for

goods)

12. Stock / inventory / goods / stock of goods /

(commodity or product in which we are A CA

dealing)

13. Stock of Office stationery A CA

14. Cash on hand, cash register, cash, cash

A CA

balance

15. Bank, cash at bank, Bank (Dr.), bank balance A CA

16. Other receivables , Prepaid / paid in advance

A CA

Ch. 11

17. Capital, Owners’ Equity, Equity, owner’s

contributions, net worth, Investment from the

OE / C

owner, Money put into the business by the

owner

18. Mortgage on land and building L NCL

19. Loan from the finance company , Loan from

Mr. John (4 yr), Loan - $1000 , Loan - $10,

L NCL

Loan from KBZ bank (3 yrs.), Bank Loan, Loan

from ABC bank (13 m)

20. Loan from XYZ Bank (6 m) L CL

21. Bank overdraft, Bank(Cr.) (Ch. 4) L CL

22. Trade creditors, trade payables, Money owed

to the supplier, supplier Y, creditors = (all L CL

these are generally for goods)

23. Other payables ,Outstanding / accrued Ch. 11 L CL

Classification of income and Expenses – Answer

Account Expenses Income

1. bank charges, interest on loan from bank *

2. Advertising, packaging, staff salaries, wages *

3. Stationary, postage stamps, *

4. travelling expenses, Transport, insurance *

5. Power, water, fuel, electricity *

6. repairs and maintenance, Repairs to building *

7. interest of fixed deposits *

8. gain from sale of motor van *

9. sales or revenue *

10. Carriage inward, Carriage, carriage outward *

11. Discount received *

12. Discount allowed *

13. rent received *

14. Rent paid / payable *

15. interest received *

16. Interest paid *

17. commission received *

18. Commission paid *

Double entry rules

1. Asset Increase debit Asset decrease credit

2. Liability increase credit Liability decrease debit

3. Capital increase credit Capital decrease debit

4. Expenses always debit

5. Income always credit

Steps

1. Select 2 accounts involved

2. Decide type of each account (Asset, Liability, Capital, Expenses, Income)

3. Effect of Transaction (increase or decrease)

4. Action in account (debit or credit)

Inventory / stock / goods = Asset

Instead of goods account = we use purchases /sales / purchases returns /sales

returns account= depending on transaction.

Hints - for trial balance

Accounts generally with Accounts generally with

debit balances credit balances

Drawings Capital

Purchases Revenue / sales

Sales returns Purchases returns

Assets Liabilities

Expenses Income

You might also like

- Chapter 5 Answers Key Millan Financial Accounting and Reporting (3rd Edition)Document6 pagesChapter 5 Answers Key Millan Financial Accounting and Reporting (3rd Edition)Terese Pingol100% (1)

- Tutorial Work With SolutionsDocument73 pagesTutorial Work With SolutionsAlison Mokla100% (1)

- Morrison Marketing StrategyDocument38 pagesMorrison Marketing StrategyMuhammad Sajid Saeed100% (21)

- Corporate Financial Distress, Restructuring, and Bankruptcy: Analyze Leveraged Finance, Distressed Debt, and BankruptcyFrom EverandCorporate Financial Distress, Restructuring, and Bankruptcy: Analyze Leveraged Finance, Distressed Debt, and BankruptcyNo ratings yet

- SWOT Analysis For RevlonDocument1 pageSWOT Analysis For Revlonmuhammadamad8930100% (1)

- CRM AuditDocument7 pagesCRM AuditMukesh SinhaNo ratings yet

- Act001 ActivityDocument7 pagesAct001 ActivitygloryfeilagoNo ratings yet

- FABM Q3 M4 (Output No. 4 - Five Major Accounts)Document4 pagesFABM Q3 M4 (Output No. 4 - Five Major Accounts)Sophia MagdaraogNo ratings yet

- 13.1 10.2. Classification of Accounts PDFDocument13 pages13.1 10.2. Classification of Accounts PDFJoi JoiNo ratings yet

- Acctg 1Document3 pagesAcctg 1HoneyzelOmandamPonceNo ratings yet

- Activity 4 Quiz FABMDocument1 pageActivity 4 Quiz FABMJake SabilloNo ratings yet

- Type of AccountsDocument4 pagesType of AccountsIgnacio De LunaNo ratings yet

- Workshop Accounting VocabularyDocument3 pagesWorkshop Accounting VocabularyEstefany ForeroNo ratings yet

- Books of Accounts and Double Entry Sytem BSAIS 1A Group 2Document27 pagesBooks of Accounts and Double Entry Sytem BSAIS 1A Group 2Marydelle De Austria-De GuiaNo ratings yet

- Tally Module 1 Assignment SolutionDocument6 pagesTally Module 1 Assignment Solutioncharu bishtNo ratings yet

- Igcse Accounting TheoryDocument32 pagesIgcse Accounting Theorykuanhuining202104No ratings yet

- Activities Accounting 1 - BSBA MM 1-2 SALAZARDocument7 pagesActivities Accounting 1 - BSBA MM 1-2 SALAZARDarren Ace SalazarNo ratings yet

- Accounting Terms Assingment 1Document2 pagesAccounting Terms Assingment 1nanduapna08No ratings yet

- Chapter 4 - 5 ActivitiesDocument3 pagesChapter 4 - 5 ActivitiesJane Carla BorromeoNo ratings yet

- SHS Basic Accounting Answer KeyDocument4 pagesSHS Basic Accounting Answer KeyKhira Xandria AldabaNo ratings yet

- Job Responsabilities - Ev Conocimiento - Workshop 13Document4 pagesJob Responsabilities - Ev Conocimiento - Workshop 13Karoll DiazNo ratings yet

- AccountingDocument3 pagesAccountingMARA CAMILA ROJAS IZQUIERDONo ratings yet

- LLP Full NotesDocument15 pagesLLP Full NotesJay Desai100% (1)

- Workshop 4 Job Responsabilities - Ev Conocimiento (1)Document4 pagesWorkshop 4 Job Responsabilities - Ev Conocimiento (1)AlejandraNo ratings yet

- Work Book XI-CommerceDocument92 pagesWork Book XI-CommerceTariq IqbalNo ratings yet

- Accounting Concepts: A. Write The Letter of Your Answer Before Each Number or ItemDocument3 pagesAccounting Concepts: A. Write The Letter of Your Answer Before Each Number or ItemDail Xymere YamioNo ratings yet

- Accounting Grade 10 - 12 How To Teach Acc EquationDocument11 pagesAccounting Grade 10 - 12 How To Teach Acc Equationnkambulentokozo55No ratings yet

- Types of Major AccountsDocument6 pagesTypes of Major Accountsks505eNo ratings yet

- Description Account Title SFP Element: Accounts PayableDocument4 pagesDescription Account Title SFP Element: Accounts PayableEnrique BongaisNo ratings yet

- ACCO Module 2Document5 pagesACCO Module 2Lala BoraNo ratings yet

- Quiz 2Document2 pagesQuiz 2Bervette HansNo ratings yet

- Workshop Accounting Vocabulary Class 3Document6 pagesWorkshop Accounting Vocabulary Class 3Oscar NogueraNo ratings yet

- ACCT1101 Wk3 Tutorial 2 SolutionsDocument7 pagesACCT1101 Wk3 Tutorial 2 SolutionskyleNo ratings yet

- Fundamental Notes and Conceptual Problem of Journal Ledger Trial Balance and Cash BookDocument7 pagesFundamental Notes and Conceptual Problem of Journal Ledger Trial Balance and Cash BookShekhar TNo ratings yet

- Workshop Accounting VocabularyDocument4 pagesWorkshop Accounting VocabularyOscar NogueraNo ratings yet

- Basic Concepts, Rules, Double Entries & Formats For Accounting Students (Level# 1)Document36 pagesBasic Concepts, Rules, Double Entries & Formats For Accounting Students (Level# 1)Elee EhmedNo ratings yet

- ACCOUNTING CYCLE STEP 1 TO 4 With IllustrationsDocument6 pagesACCOUNTING CYCLE STEP 1 TO 4 With IllustrationsmallarilecarNo ratings yet

- Chapter 2 The Recording Process SCDocument51 pagesChapter 2 The Recording Process SCYong ZhenNo ratings yet

- FA1 - MM - Pocket NotesDocument25 pagesFA1 - MM - Pocket NotesMirza NoumanNo ratings yet

- Fundamentals of Accountancy Business and ManagementDocument24 pagesFundamentals of Accountancy Business and ManagementAshley Judd Mallonga Beran100% (1)

- Chapter 8Document18 pagesChapter 8Mishu GuptaNo ratings yet

- Fin Accounting 2 EquationDocument25 pagesFin Accounting 2 EquationIqbal Hanif100% (1)

- Unit 3 - Trial BalanceDocument11 pagesUnit 3 - Trial Balancegogo chanNo ratings yet

- Assignment No 2Document4 pagesAssignment No 2Rao khuzaimahNo ratings yet

- Diliman Preparatory School: Basic Education Department-High School SCHOOL YEAR 2019-2020 First Semester Fabm 2Document2 pagesDiliman Preparatory School: Basic Education Department-High School SCHOOL YEAR 2019-2020 First Semester Fabm 2Althea Nicole CanapiNo ratings yet

- Sol. Man. - Chapter 5 - Books of Accounts and Double-Entry SystemDocument7 pagesSol. Man. - Chapter 5 - Books of Accounts and Double-Entry SystemTali0% (1)

- Topic 2 - Accounting & BusinessDocument34 pagesTopic 2 - Accounting & Businessdenixng100% (1)

- Entreprenuership 2nd Sem Quiz QuestionsDocument2 pagesEntreprenuership 2nd Sem Quiz QuestionsHannah LegaspiNo ratings yet

- Profit and Loss P&L Statement StatementDocument3 pagesProfit and Loss P&L Statement StatementShreepathi AdigaNo ratings yet

- Nama Akun AkuntansiDocument4 pagesNama Akun Akuntansitarissa saNo ratings yet

- Key Terms and Chapter Summary 8Document3 pagesKey Terms and Chapter Summary 8Devansh DwivediNo ratings yet

- Kamus Akuntansi: TarissaDocument5 pagesKamus Akuntansi: Tarissatarissa saNo ratings yet

- Basics of Accounting - QBDocument7 pagesBasics of Accounting - QBsujanthqatarNo ratings yet

- ACC406 - Topic 4a - Principle of Double Entry and Books of AccountDocument23 pagesACC406 - Topic 4a - Principle of Double Entry and Books of AccountCarol LeslyNo ratings yet

- Solution 103-Basic Accounting Problem 103 - Recording - Business - TransactionsDocument15 pagesSolution 103-Basic Accounting Problem 103 - Recording - Business - TransactionsmeepxxxNo ratings yet

- International PaymentDocument24 pagesInternational PaymentAgung WidyadnyanaNo ratings yet

- Ch.1: Accounting in Action (Cont'd)Document29 pagesCh.1: Accounting in Action (Cont'd)mariam raafatNo ratings yet

- Sample Questions BK 2024Document2 pagesSample Questions BK 2024Neeta PrajapatiNo ratings yet

- Sol. Man. - Chapter 4 - Types of Major AccountsDocument6 pagesSol. Man. - Chapter 4 - Types of Major AccountsAmie Jane MirandaNo ratings yet

- Exercise No. 2 Mba2008b Elements of Accounting ExerciseDocument4 pagesExercise No. 2 Mba2008b Elements of Accounting Exercisemenchong 123No ratings yet

- Commercial Real Estate for Beginner: 1From EverandCommercial Real Estate for Beginner: 1Rating: 5 out of 5 stars5/5 (1)

- Assignment 1 by Muhammad Ehtisham 2172032Document9 pagesAssignment 1 by Muhammad Ehtisham 2172032Muhammad EhtishamNo ratings yet

- Financial Accounting Theory and Analysis Text and Cases 12th Edition Schroeder Test BankDocument25 pagesFinancial Accounting Theory and Analysis Text and Cases 12th Edition Schroeder Test BankCherylHorngjmf100% (42)

- Isp531 ProtonDocument12 pagesIsp531 ProtonSally SallyNo ratings yet

- Chapter 1 Introduction To M&ADocument29 pagesChapter 1 Introduction To M&AK60 Phạm Thị Phương AnhNo ratings yet

- Spoiled Goods Are Goods That Have Been Damaged Through Imperfect Machining or IllustrationDocument3 pagesSpoiled Goods Are Goods That Have Been Damaged Through Imperfect Machining or IllustrationBuff FaloNo ratings yet

- SAP: Building A Leading Technology Brand: Case AnalysisDocument3 pagesSAP: Building A Leading Technology Brand: Case AnalysisSachin SuryavanshiNo ratings yet

- Think Tank Bericht ZusammenfassungDocument21 pagesThink Tank Bericht ZusammenfassungS GuruNo ratings yet

- Assgnmnt 12 BDocument11 pagesAssgnmnt 12 BCharis Adit67% (3)

- 1st Year - Financial Accounting and Reporting 1 PDFDocument14 pages1st Year - Financial Accounting and Reporting 1 PDFIts SaoirseNo ratings yet

- Trade Fairs and ExhibitionsDocument10 pagesTrade Fairs and ExhibitionsdaogafugNo ratings yet

- Scorpio Tankers ProspectusDocument184 pagesScorpio Tankers ProspectusaimranamirNo ratings yet

- Cisco IPF at A GlanceDocument1 pageCisco IPF at A GlanceShantanu PalNo ratings yet

- Accounting For Joint and by ProductsDocument7 pagesAccounting For Joint and by ProductsGian Carlo RamonesNo ratings yet

- RetailDocument4 pagesRetailRakesh Chaudhari0% (1)

- Krown Traders: Amity School of BusinessDocument5 pagesKrown Traders: Amity School of BusinessGautam TandonNo ratings yet

- Hw07 Solution. Corporate FinanceDocument4 pagesHw07 Solution. Corporate FinanceTú Mỹ Ngô100% (1)

- CFA RC Equity Research Report EssentialsDocument3 pagesCFA RC Equity Research Report EssentialsSahil GoyalNo ratings yet

- World Class Manufacturing PDFDocument4 pagesWorld Class Manufacturing PDFRohit Gothwal0% (2)

- How Would Einstein Value Financial Assets? The Asset Pricing Implications of The Great BailoutDocument5 pagesHow Would Einstein Value Financial Assets? The Asset Pricing Implications of The Great BailoutalphathesisNo ratings yet

- Vendor Managed InventoryDocument2 pagesVendor Managed InventoryAdnan NawabNo ratings yet

- Pricing Assignment: Team MembersDocument7 pagesPricing Assignment: Team MembersNeeraj GargNo ratings yet

- Tech Talk - Creating A Social Media StrategyDocument3 pagesTech Talk - Creating A Social Media StrategyAnwesha SahooNo ratings yet

- From MC To IMCDocument8 pagesFrom MC To IMCMagdalena AdrianaNo ratings yet

- Marketing of Compost BinDocument10 pagesMarketing of Compost BinLalitNo ratings yet

- Modern Auditing BoyntonDocument3 pagesModern Auditing BoyntonRirinNo ratings yet

- Generally Accepted Accounting Principles and Accounting StandardsDocument32 pagesGenerally Accepted Accounting Principles and Accounting StandardsDileepkumar K DiliNo ratings yet

- Writing A Business Plan: Bruce R. Barringer R. Duane IrelandDocument21 pagesWriting A Business Plan: Bruce R. Barringer R. Duane IrelandMuhammadAli AbidNo ratings yet