Professional Documents

Culture Documents

TAX-101 (Estate Tax)

TAX-101 (Estate Tax)

Uploaded by

Princess ManaloCopyright:

Available Formats

You might also like

- How To Migrate From SAP EWM (Business Suite) To Decentralized EWM Based On SAP S/4HanaDocument30 pagesHow To Migrate From SAP EWM (Business Suite) To Decentralized EWM Based On SAP S/4HanakamalrajNo ratings yet

- Editable Retail Loan Application - ApplicantDocument10 pagesEditable Retail Loan Application - Applicantmadhukar sahayNo ratings yet

- The Nespresso Case: Value Articulation - A Framework For The Strategic Management of Intellectual PropertyDocument6 pagesThe Nespresso Case: Value Articulation - A Framework For The Strategic Management of Intellectual PropertyAna SiqueiraNo ratings yet

- Right To PropertyDocument36 pagesRight To PropertyNilam100% (1)

- Guidelines of Direct Selling LicenseDocument12 pagesGuidelines of Direct Selling LicenseLeon Lu Lih Youn100% (3)

- Chapter 3 - Different Kinds of ObligationDocument18 pagesChapter 3 - Different Kinds of Obligationthatfuturecpa100% (1)

- Cosmeticsandtoiletries201510 DL PDFDocument68 pagesCosmeticsandtoiletries201510 DL PDFtmlNo ratings yet

- Donors To PercentageDocument24 pagesDonors To PercentageFrayladine TabagNo ratings yet

- Estate TaxDocument10 pagesEstate Taxrandomlungs121223No ratings yet

- TAX L002 Individual TaxationDocument18 pagesTAX L002 Individual TaxationYuri CaguioaNo ratings yet

- Excise TaxDocument7 pagesExcise TaxKezNo ratings yet

- Quizzers 12Document13 pagesQuizzers 12Niña Yna Franchesca PantallaNo ratings yet

- Week 3 Income Taxation Individual TaxpayersDocument58 pagesWeek 3 Income Taxation Individual TaxpayersJulienne Untalasco100% (1)

- Photovoltaic (Solar) Installation AgreementDocument6 pagesPhotovoltaic (Solar) Installation AgreementQueNo ratings yet

- Tax Remedies ActDocument8 pagesTax Remedies ActrobNo ratings yet

- For Boi IncentivesDocument7 pagesFor Boi Incentiveskimberly fanoNo ratings yet

- Income Taxation of IndividualsDocument26 pagesIncome Taxation of Individualsarkisha100% (1)

- Codal Reference and Related IssuancesDocument17 pagesCodal Reference and Related IssuancesBernardino PacificAceNo ratings yet

- CPAR Intro To Income Tax and Tax On Individuals (Batch 89) - HandoutDocument29 pagesCPAR Intro To Income Tax and Tax On Individuals (Batch 89) - HandoutMark LapidNo ratings yet

- TAX05-02 Individual Income TaxDocument7 pagesTAX05-02 Individual Income TaxJeth ConchaNo ratings yet

- (Tax) Casino First PreboardDocument5 pages(Tax) Casino First PreboardNor-janisah PundaodayaNo ratings yet

- PRTC 1stpb - 05.22 Sol TaxDocument21 pagesPRTC 1stpb - 05.22 Sol TaxCiatto SpotifyNo ratings yet

- 91-07 Gross IncomeDocument8 pages91-07 Gross IncomeNova PogadoNo ratings yet

- Homecredit Copy Loan AgreementDocument2 pagesHomecredit Copy Loan AgreementMichael Del CarmenNo ratings yet

- Chapter 4 Investments in Debt Securities and Other Long Term InvestmentDocument30 pagesChapter 4 Investments in Debt Securities and Other Long Term InvestmentAngelica Joy ManaoisNo ratings yet

- Rights and Remedies of The Government Under The NIRC: I. Power of The Bir To Obtain Information and Make An AssessmentDocument24 pagesRights and Remedies of The Government Under The NIRC: I. Power of The Bir To Obtain Information and Make An AssessmentPau SaulNo ratings yet

- Income Tax On Individuals and Tax RatesDocument25 pagesIncome Tax On Individuals and Tax RatesmmhNo ratings yet

- TAX HO1002 Individual Taxation StudentDocument12 pagesTAX HO1002 Individual Taxation StudentYuri CaguioaNo ratings yet

- Moral Theory On UtilitarianismDocument6 pagesMoral Theory On UtilitarianismCharles LaspiñasNo ratings yet

- TB ch03 DDDocument26 pagesTB ch03 DDPatricia Jean DigoNo ratings yet

- CODE OF ETHICS For Professional Accountants in TheDocument61 pagesCODE OF ETHICS For Professional Accountants in TheDiana Rose BassigNo ratings yet

- Tax II Digests Y SanchezDocument32 pagesTax II Digests Y SanchezJubsNo ratings yet

- Aud-90 PWDocument17 pagesAud-90 PWElaine Joyce GarciaNo ratings yet

- TAX-902 (Gross Income - Exclusions)Document6 pagesTAX-902 (Gross Income - Exclusions)MABI ESPENIDONo ratings yet

- Itr2 Fy 2020-21 Ay 2021-22Document42 pagesItr2 Fy 2020-21 Ay 2021-22Pradeep GoudaNo ratings yet

- Aescartin/Tlopez/Jpapa: Mobile Telephone GmailDocument7 pagesAescartin/Tlopez/Jpapa: Mobile Telephone GmailReynalyn BarbosaNo ratings yet

- Business Federal Tax UpdateDocument9 pagesBusiness Federal Tax Updatesean dale porlaresNo ratings yet

- Liabilities ReSA Handouts PDFDocument13 pagesLiabilities ReSA Handouts PDFNinaNo ratings yet

- Personal Loan Application Form: Different Needs, One Answer Personal Loans From TVS SOLUTION Loan SystemDocument7 pagesPersonal Loan Application Form: Different Needs, One Answer Personal Loans From TVS SOLUTION Loan Systemjuned shaikhNo ratings yet

- Chapter 5 - Current Asset ManagementDocument15 pagesChapter 5 - Current Asset ManagementReyes JonahNo ratings yet

- TAX 2021 - Theories and Independent ProblemsDocument28 pagesTAX 2021 - Theories and Independent ProblemsMingcheng JeeNo ratings yet

- TAX 702 - Income Tax Rates CorporationsDocument6 pagesTAX 702 - Income Tax Rates CorporationsJuan Miguel UngsodNo ratings yet

- TAX - Income Tax On IndividualsDocument10 pagesTAX - Income Tax On Individualsall about seventeenNo ratings yet

- Double Taxation Agreements 2022Document19 pagesDouble Taxation Agreements 2022rav danoNo ratings yet

- Tax232 - Excise Tax PDFDocument37 pagesTax232 - Excise Tax PDFClaire Ann ParasNo ratings yet

- Management Advisory Services (Mas) MAS01 Introductioin To Management AccountingDocument38 pagesManagement Advisory Services (Mas) MAS01 Introductioin To Management AccountingEagle OrtegaNo ratings yet

- Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocument6 pagesManila Cavite Laguna Cebu Cagayan de Oro DavaoMonica GarciaNo ratings yet

- Module 2 - Income Taxes For Individuals - Lecture NotesDocument52 pagesModule 2 - Income Taxes For Individuals - Lecture NotesRina Bico Advincula100% (1)

- Far Reviewer 1 7Document8 pagesFar Reviewer 1 7Angel Marie MartinezNo ratings yet

- QUIZ Corporate Income Taxation AnswersDocument4 pagesQUIZ Corporate Income Taxation AnswersAang GrandeNo ratings yet

- Name: Section: Date:: Angel SantaDocument5 pagesName: Section: Date:: Angel SantaJoebet DebuyanNo ratings yet

- Capital Gains Tax PDFDocument6 pagesCapital Gains Tax PDFjanus lopezNo ratings yet

- Tax Rate A. For Individuals Earning Purely Compensation Income and Individuals Engaged in Business and Practice of ProfessionDocument8 pagesTax Rate A. For Individuals Earning Purely Compensation Income and Individuals Engaged in Business and Practice of ProfessionInna De LeonNo ratings yet

- CorporationsDocument46 pagesCorporationsDandred AdrianoNo ratings yet

- Capital Gains Tax: Selling Price Basis of Share (Inc. Dividend-On, Net of Tax) Doc. Stamp TaxDocument2 pagesCapital Gains Tax: Selling Price Basis of Share (Inc. Dividend-On, Net of Tax) Doc. Stamp Taxloonie tunesNo ratings yet

- Illustration VATDocument8 pagesIllustration VATLeah Mae NolascoNo ratings yet

- Chapter 6 - Strategy Analysis and ChoiceDocument26 pagesChapter 6 - Strategy Analysis and ChoiceMalaika Khan 009No ratings yet

- Remedies Tax 4 27 - Power and Remedy of AssessmentDocument15 pagesRemedies Tax 4 27 - Power and Remedy of AssessmentEmille LlorenteNo ratings yet

- Tax Exemption GuidelineDocument8 pagesTax Exemption GuidelineonghpNo ratings yet

- Shakey's 2021Document69 pagesShakey's 2021Megan CastilloNo ratings yet

- Part V Disbursement System 04122021Document19 pagesPart V Disbursement System 04122021Mana XD100% (1)

- Administrative Provisions - Estate Tax (Presentation Slides)Document9 pagesAdministrative Provisions - Estate Tax (Presentation Slides)KezNo ratings yet

- Lecture Notes: Advanced Financial Accounting and Reporting G/N/E de Leon AFAR.3014 - NGASDocument11 pagesLecture Notes: Advanced Financial Accounting and Reporting G/N/E de Leon AFAR.3014 - NGASTatianaNo ratings yet

- DPD DogsDocument13 pagesDPD DogsKen HaddadNo ratings yet

- IAS 33 Earnings Per ShareDocument9 pagesIAS 33 Earnings Per ShareangaNo ratings yet

- TAX-201 (Donor's Tax)Document7 pagesTAX-201 (Donor's Tax)Edith DalidaNo ratings yet

- TAX-502 (Excise Tax Rates - Part 2)Document3 pagesTAX-502 (Excise Tax Rates - Part 2)Princess ManaloNo ratings yet

- TAX-401 (Other Percentage Taxes - Part 1)Document5 pagesTAX-401 (Other Percentage Taxes - Part 1)Princess ManaloNo ratings yet

- Lit 2 - Midterm Lesson Part 2Document5 pagesLit 2 - Midterm Lesson Part 2Princess ManaloNo ratings yet

- TAX-303 (Input Taxes)Document7 pagesTAX-303 (Input Taxes)Princess ManaloNo ratings yet

- TAX-301 (VAT-Subject Transactions)Document9 pagesTAX-301 (VAT-Subject Transactions)Princess ManaloNo ratings yet

- Lit 2 - Midterm Lesson Part 1Document4 pagesLit 2 - Midterm Lesson Part 1Princess ManaloNo ratings yet

- Lit 2 - Midterm Lesson Part 5Document20 pagesLit 2 - Midterm Lesson Part 5Princess ManaloNo ratings yet

- Introduction To Accounting: Certificate in Accounting and Finance Stage ExaminationDocument5 pagesIntroduction To Accounting: Certificate in Accounting and Finance Stage ExaminationSYED ANEES ALINo ratings yet

- Learning CAN SLIM Education Resources: Lee TannerDocument43 pagesLearning CAN SLIM Education Resources: Lee Tannerneagucosmin67% (3)

- University Course Fee For Students & AgentsDocument4 pagesUniversity Course Fee For Students & AgentsChandan Kumar BanerjeeNo ratings yet

- Agenda Item 7 App1Document15 pagesAgenda Item 7 App1Sana KhanNo ratings yet

- C.H. Robinson Contract Addendum and Carrier Load Confirmation - #434674433Document4 pagesC.H. Robinson Contract Addendum and Carrier Load Confirmation - #434674433shayan aliNo ratings yet

- Grounds Prescription Ratification Rescissible Contract 4yrsDocument1 pageGrounds Prescription Ratification Rescissible Contract 4yrsDieanne MaeNo ratings yet

- D Ifta Journal 10Document76 pagesD Ifta Journal 10zushiiiNo ratings yet

- Automatización de ProcesosDocument7 pagesAutomatización de ProcesosFernando FlorNo ratings yet

- VRTXDocument27 pagesVRTXJeypee De GeeNo ratings yet

- Terex Wheel Loader Skl844 0100 Radlader Parts CatalogDocument11 pagesTerex Wheel Loader Skl844 0100 Radlader Parts Catalogmrpaulwilliams251290oje100% (68)

- Mba Project On Recruitment Selection PDFDocument100 pagesMba Project On Recruitment Selection PDFsumanNo ratings yet

- United States District Court Central District of California Case No: Cv08-01908 DSF (CTX)Document12 pagesUnited States District Court Central District of California Case No: Cv08-01908 DSF (CTX)twebster321100% (1)

- Mis in ICICI BankDocument14 pagesMis in ICICI BankRavindra Khandelwal100% (1)

- BSBLDR411 Project Portfolio Student.v1.0Document23 pagesBSBLDR411 Project Portfolio Student.v1.0ipal.rhdNo ratings yet

- Knowledge Organisers CIE Geography BWDocument19 pagesKnowledge Organisers CIE Geography BWAntoSeitanNo ratings yet

- Swift Ratw HawkDocument1 pageSwift Ratw HawkMajid ImranNo ratings yet

- GoU Statement Victory Day 2019Document4 pagesGoU Statement Victory Day 2019GCICNo ratings yet

- Summer Dhamaka AprilDocument21 pagesSummer Dhamaka AprilPapia ChandaNo ratings yet

- Archiving Production Orders (PP-SFC)Document13 pagesArchiving Production Orders (PP-SFC)Mayte López AymerichNo ratings yet

- The Large Marketplace Comparison GuideDocument43 pagesThe Large Marketplace Comparison GuidegencmetohuNo ratings yet

- BP Annual Report and Form 20f 2017Document302 pagesBP Annual Report and Form 20f 2017golddust2012No ratings yet

- MODULE - ACC 325 - UNIT1 - ULObDocument4 pagesMODULE - ACC 325 - UNIT1 - ULObJay-ar Castillo Watin Jr.No ratings yet

- SWOTDocument10 pagesSWOTGwendolyn PansoyNo ratings yet

- Paytm Wallet TXN HistoryJan2020 9369204281 PDFDocument2 pagesPaytm Wallet TXN HistoryJan2020 9369204281 PDFSandeep RaiNo ratings yet

TAX-101 (Estate Tax)

TAX-101 (Estate Tax)

Uploaded by

Princess ManaloOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TAX-101 (Estate Tax)

TAX-101 (Estate Tax)

Uploaded by

Princess ManaloCopyright:

Available Formats

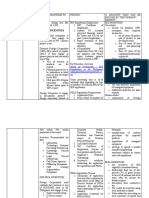

ReSA - THE REVIEW SCHOOL OF ACCOUNTANCY

CPA Review Batch 44 October 2022 CPA Licensure Examination

TAX-101

TAXATION A. TAMAYO E. BUEN G. CAIGA C. LIM K. MANUEL

ESTATE TAX (with COMPARISONS of TRANSFER TAXES)

A. BIR Form No.

Estate Tax Donor’s Tax

Tax Return BIR Form No. 1801 BIR Form No. 1800

B. Effectivity of Transfer

Estate Tax Donor’s Tax

Effectivity of transer Mortis causa Inter vivos

C. Tax rate

Estate Tax Donor’s Tax

Tax rate There shall be levied, assessed, collected The tax for each calendar year shall be

and paid upon the transfer of the net six percent (6%) computed on the

estate of every decedent, whether basis of the total gifts in excess of

resident or nonresident of the Two hundred fifty thousand pesos

Philippines, a tax at the rate of six percent (P250,000) exempt gift made during

(6%) based on the value of such net the calendar year.

estate.”

D. Composition of Gross Estate/Gross Gift

Estate Tax Donor’s Tax

Res/Cit Decedent NRA Decedent Res/Cit Donor NRA Donor

Real properties Wherever situated Situated in the Phils. Wherever situated Situated in the Phils.

Personal properties Wherever situated Situated in the Phils. Wherever situated Situated in the Phils.

Taxable transfers Wherever situated Situated in the Phils. Not applicable Not applicable

E. DEDUCTIONS ALLOWED

Estate Tax Donor’s Tax

Deductions allowed Ordinary deductions Found in the Tax Code Under TRAIN

1, Losses* 1. Gifts made to or for the use of the National

2. Indebtedness (Claims against the estate)* Government or any entity created by any of its

3. Taxes* agencies which is not conducted for profit, or to any

4. Claims against insolvent debtor* political subdivision of the said Government

5. Unpaid mortgage* 2. Gifts in favor of an educational and/or charitable,

6. Vanishing deduction religious, cultural or social welfare corporation,

7. Transfer for public use institution, accredited nongovernment organization,

Special deductions trust or philanthropic organization or research

1. Family home institution or organization.

2. Standarrd deduction Not found in the Tax Code

3. Amount received under RA 4917 1. Encumbrance on the property donated if assumed

Other deduction by done

1. Share in the conjugal property 2. Those specifically provided by donor as a

diminution from the property donated

Note: When decedent is NRA:

Phil. GE x LITE*

World GE

F. Administrative Provisions

Estate Tax Donor’s Tax

1. Notice required Notice of Death Under TRAIN (effective The donor engaged in business shall give a notice

January 1, 2018) – No longer required of donation on every donation worth at least

P50,000 to the RDO which has jurisdiction over his

place of business within 30 days after receipt of the

qualified donee institution’s duly issued Certificate

of Donation, which shall be attached to the said

Notice of Donation, stating that not more than 30%

of the said donations/gifts for the taxable year shall

be used for administration purposes.

2. Tax Returns filed 1) In all cases of transfer subject to tax; Any person who makes any transfer by gift (except

2) Where the said estate consists of registered those which are exempt from donor’s tax) shall, for

or registrable property (regardless of the the purpose of donor’s tax, make a return under

value of the gross estate) oath at least in duplicate (triplicate per BIR Form

No. 1800)

3. Persons to file 1) Executor 1) Donor

returns 2) Administrator or 2) Authorized representative

3) Any of the legal heirs

Page 1 of 11 0915-2303213 www.resacpareview.com

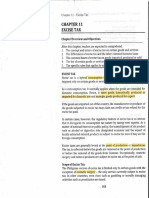

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY

ESTATE TAX (with COMPARISONS of TRANSFER TAXES) TAX-101

4. Information shown 1) The value of the gross estate of the The return shall set forth:

in the returns decedent at the time of his death, or in a. Each gift made during the calendar year which

case of non-resident alien of that part of is to be included in computing net gifts;

his gross estate situated in the Philippines; b. The deductions claimed and allowable;

2) The deductions allowed from the gross c. Any previous net gifts made during the same

estate; calendar year;

3) Such part of such information as may at the d. The name of the donee; and

time be ascertainable and such e. Such other information as may be required by

supplemental data as may be necessary to rules and regulations made pursuant to law.

establish the correct taxes;

5. Time of filing Within one year from decedent’s death The donor’s tax return shall be filed within thirty

returns (30) days after the date the gift is made or

completed.

6. Returns to be supported When the estate tax returns show a gross Not applicable

with statements certified value exceeding P5,000,000

to by a CPA

7. Contents of the 1) Itemized assets of the decedent with their Not applicable

statements certified to corresponding gross value at the time of

by a CPA his death, or in case of non-resident alien,

of that part of his estate situated in the

Philippines;

2) Itemized deductions;

3) The amount of tax due whether paid or still

due and outstanding

8. Filing of certified copy of Within 30 days after the promulgation of such Not applicable

the schedule of partition order

and the order of the court

ordering the same

9. Extension for filing the The Commissioner can, in meritorious cases, No extension

returns extend the filing of returns for a period not

exceeding 30 days.

10. Place of filing of the 1) In case of resident decedent: a. In case of resident donors:

returns a) Accredited agent bank; 1) Authorized agent bank;

b) Revenue District Officer; 2) Revenue District Officer;

c) Collection Officer, or 3) Revenue Collection Officer;

d) Duly authorized Treasurer of the city or 4) Duly authorized Treasurer of the city or

municipality where the decedent was municipality where the donor was domiciled at

domiciled at the time of death. the time of the transfer.

2) In case of non-resident decedent: b. In case of non-resident donors:

a) Revenue District Office where the executor 1) Philippine Embassy or Consulate where he is

or administrator is registered; domiciled at the time of the transfer, or

b) Revenue District Office having jurisdiction 2) Office of the Commissioner (RDO No. 39 –

over the executor or administrator’s legal South Quezon City)

residence (if executor or administrator is

not registered); Note: Returns filed with Philippine Embassy or

c) Office of the Commissioner (RDO No. 39 Consulate shall be paid thereat.

– South Quezon City) (if the estate does

not have an executor or administrator in

the Philippines)

G. Payment of Tax

Estate Tax Donor’s Tax

1. Time of payment At the time the estate tax returns are filed At the time the donor’s tax returns are filed

2. Extension of time of 1) Estate is settled through the courts – not to No extension

payment exceed 5 years

2) Estate is settled extra-judicially – not to

exceed 2 years

3. Requirement of bond if If an extension is granted, the Commissioner or Not applicable

extension is granted his duly authorized representative

may require the executor, or administrator, or

beneficiary, as the case may be, to furnish a

bond in such amount, not exceeding double the

amount of the tax and with such sureties

as the Commissioner deems necessary,

conditioned upon the payment of the said tax in

accordance with the terms of the extension.

4. Extension of payment not When there is negligence, intentional disregard of Not applicable

allowed rules and regulations and fraud on the part of the

taxpayer.

5. Liability for payment 1) The estate tax shall be paid by the executor No specific provision

or administrator before the delivery of the

distributive share in the inheritance to any

heir or beneficiary;

2) Where there are two or more executors or

administrators, all of them are severally

liable for the payment of tax;

Page 2 of 11 0915-2303213 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY

ESTATE TAX (with COMPARISONS of TRANSFER TAXES) TAX-101

3) The executor or administrator of an estate

has the primary obligation to pay the estate

tax but the heir or beneficiary has subsidiary

liability for the payment of that portion of

the estate tax which his distributive share

bears to the value of the total net asset.

6. Payment in installment 1) In case the available cash of the estate is No specific provision

insufficient to pay the total estate tax due,

payment by installment shall be allowed

within two (2) years from statutory date for

its payment without civil penalty and

interest..

2) In case of lapse of two years without the

payment of the entire tax due, the

remaining balance thereof shall be due and

demandable subject to the applicable

penalties and interest reckoned from the

prescribed deadline for filing the return and

payment of the estate tax.

No civil penalties or interest may be imposed

on estates permitted to pay the estate tax

due by installment. Nothing, however,

prevents the Commissioner from executing

enforcement action against the estate after

the due date of the estate tax provided that

all the applicable laws and required

procedures are followed/observed.

7. Modes of payment 1) Payment through Authorized Agent Bank 1) Payment through Authorized Agent Bank (AAB)

(AAB) (a) Over-the-counter cash payment – Maximum

(a) Over-the-counter cash payment – amount per tax payment not to exceed

Maximum amount per tax payment P10,000.00

not to exceed P10,000.00 (b) Bank debit system – taxpayer has bank

(b) Bank debit system – taxpayer has account with AAB

bank account with AAB (c) Checks – indicate “PAY TO THE ORDER OF:

( c) Checks – indicate “PAY TO THE 1) Presenting/collecting bank or the bank

ORDER OF: where the payment is to be coursed and

1) Presenting/collecting bank or the 2) FAO (for account of) Bureau or Internal

bank where the payment is to be Revenue as payee; and

coursed and 3) Under the “ACCOUNT NAME” of the

2) FAO (for account of) Bureau or taxpayer identification number (TIN)

Internal Revenue as payee; and Notes: i. Accommodation checks, second

3) Under the “ACCOUNT NAME” of the endorsed checks, stale checks,

taxpayer identification number postdated checks, unsigned

(TIN) checks and checks with

Notes: i. Accommodation checks, alterations/erasures are not

second endorsed checks, stale acceptable.

checks, postdated checks, ii. Checks to cover one tax type for one

unsigned checks and checks return period only

with alterations/erasures are not 2) Payment through Tax Debit Memo (TDM) (not

acceptable. acceptable as payments for withholding taxes,

ii. Checks to cover one tax type for fringe benefit tax, and for taxes, fees and

one return period only charges collected under special schemes or

2) Payment through Tax Debit Memo (TDM) procedures or programs of the Government or

(not acceptable as payments for BIR)

withholding taxes, fringe benefit tax, and 3) Payment through E-Payment System

for taxes, fees and charges collected under 4) Payment directly to the BIR

special schemes or procedures or programs Payment through creditable withholding taxes

of the Government or BIR)

3) Payment through E-Payment System

4) Payment directly to the BIR

Payment through creditable withholding

taxes

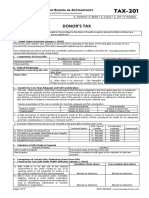

H. Accomplishing Tax Returns

Estate Tax Donor’s Tax

a. BIR Form No. and number BIR Form No. 1801 shall be filed in triplicate BIR Form No. 1800 shall be filed in triplicate (per BIR

of copies (per the BIR form.) Form)

1) A separate return shall be filed by each donor for

each gift (donation) made on different dates during

the year reflecting therein any previous net gifts

made in the same calendar year.

2) Only one return shall be filed for several gifts

(donations) by a donor to the different donees on

the same date.

Page 3 of 11 0915-2303213 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY

ESTATE TAX (with COMPARISONS of TRANSFER TAXES) TAX-101

3) If the gift (donation) involves conjugal/community

property, each spouse shall file separate return

corresponding to his/her share in the

conjugal/community property. This rule shall likewise

apply in the case of co-ownership over the property

being donated

b. Payment and issuance of 1) Upon filing of Estate Tax Return, the estate 1) Upon filing of Donor’s Tax Return, the total amount

Revenue Official Receipt tax due shall be paid to the Authorized payable shall be paid to the Authorized Agent Bank

Agent Bank (AAB) where the return is filed. (AAB) where the return is filed.

2) In places where there are no AABs, 2) In places where there are no AABs, payment shall be

payment shall be made directly to the made directly to the Revenue Collection Officer or

Revenue Collection Officer or duly duly authorized City or Municipal Treasurer who shall

authorized City or Municipal Treasurer who issue Revenue Official Receipt (BIR No. 2524).

shall issue Revenue Official Receipt (BIR No. 3) Where the return is filed with an AAB, the lower

2524). portion of the return must be properly machine-

3) Where the return is filed with an AAB, the validated and stamped by AAB to serve as the

lower portion of the return must be properly receipt of payment.

machine-validated and stamped by AAB to 4) The machine validation shall reflect the date of

serve as the receipt of payment. payment, amount paid and transaction code, and

4) The machine validation shall reflect the date the stamp mark shall show the name of the bank,

of payment, amount paid and transaction branch code, teller’s name and teller’s initial.

code, and the stamp mark shall show the 5) The AAB shall also issue an official receipt or bank

name of the bank, branch code, teller’s debit advice or credit document, whichever is

name and teller’s initial. applicable, as additional proof of payment.

5) The AAB shall also issue an official receipt or

bank debit advice or credit document,

whichever is applicable, as additional proof

of payment.

I. GROSS ESTATE OF MARRIED DECEDENTS

Conjugal partnership of gains Absolute community of properties

(CPOG) (ACOP)

Exclusive properties of the decedent Included Included

Common properties Included Included

Exclusive properties of the surviving Not included Not included

spouse

J. COMPOSITION OF THE GROSS ESTATE OF MARRIED DECEDENTS

a. Conjugal Partnership of Gains (Relative Community of Properties) (Married before August 3, 1988)

Exclusive properties Conjugal properties

a. Properties brought into the marriage as either of a. Properties acquired by onerous title during the marriage at the expense of the

the spouse’s own; common fund, whether the acquisition be for the partnership, or for only one of the

spouses;

b. Properties acquired by gratuitous (or lucrative) b. Properties obtained from labor, industry, work or profession of either or both of the

title during the marriage; spouses;

c. Properties acquired by right of c. The fruits, natural, industrial or civil, due or received during the marriage from the

redemption or by exchange with other property common property, as well as the net fruits from the exclusive property of each

belonging to only one of the spouses; spouse;

d. Properties acquired with exclusive money of d. The share of either spouse in the hidden treasure which the law awards to the finder

either spouse. or owner of the property where the treasure is found;

e. Properties acquired through occupation such as fishing and hunting;

f. Livestock existing upon the dissolution of the partnership in excess of the number of

each kind brought to the marriage by either spouse;

g. Properties acquired by chance, such as winnings from gambling and betting.

b. Absolute Community of Properties (Married on or after August 3, 1988)

Exclusive properties Community Properties

a. Properties acquired during the a. All properties owned by spouses at the time of the celebration of

marriage by gratuitous (or lucrative) title by marriage or acquired thereafter.

either spouse, and the fruits as well as the

income thereof, if any, unless it is specifically

provided by the donor, testator or grantor that

they shall form part of the community;

b. Property for personal and exclusive use of either

spouse, however, jewelry shall form part of the

community property;

c. Property acquired before the

marriage by either spouse who has legitimate

descendants by a former marriage, and the

fruits as well as the income, if any, of such

property.

Page 4 of 11 0915-2303213 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY

ESTATE TAX (with COMPARISONS of TRANSFER TAXES) TAX-101

c. Exercise: The decedent was married at the time of death. He was survived by his wife and children. Determine the taxable gross estate

(FMV at the time of death).

EXCL- CONJ- EXCL- COMM-

FMV CPOG CPOG ACOP ACOP

Cash owned by the decedent before the marriage P5,000,000

Real property inherited by the decedent during the marriage 6,000,000

Personal property received by the wife as gift before the marriage 400,000

Property acquired by decedent with cash owned before the marriage 600,000

Personal effects of the decedent purchased with the exclusive money of the wife 500,000

Jewelry purchased with cash of the surviving spouse earned before marriage 1,000,000

Property unidentified when and by whom acquired 1,200,000

Cash representing income received during the marriage from exclusive property 2,000,000

Property acquired before marriage by the decedent who has legitimate

descendants by a former marriage 3,000,000

Total

K. Exercises

The decedent, resident citizen, is a married man with a surviving spouse with the following data dies on January 1, 2021:

Conjugal real and personal properties P 14,000,000

Conjugal family home 9,000,000

Exclusive properties 5,000,000

Conjugal ordinary deductions (including P200,000 funeral

expenses and P100,000 judicial expenses) 2,300,000

Medical expenses 500,000

Using BIR Form 1801 compute the following:

a. Line 34 page 2 (Gross estate)

b. Line 35 page 2 (Ordinary deductions)

c. Line 37D page 2 (Total special deductions

d. Line 40 page 2 (Net taxable estate)

e. Line 18 page 1 (Estate tax due)

L. RULE OF RECIPROCITY (NON RESIDENT ALIEN DECEDENT/DONOR)

1. Properties covered by Intangible personal property situated in the Philippines owned by non-resident alien

reciprocity decedent/donor

2. Basic rules When there is reciprocity – The intangible personal property of non-resident alien situated in the

Philippines are not included in the gross estate.

When there is no reciprocity – The intangible personal property of non-resident alien situated in

the Philippines are included in the gross estate.

3. Properties considered The following shall be considered as situated in the Philippines (among others):

situated in the Philippines b. Franchise which must be exercised in the Philippines;

c. Shares, obligations or bonds issued by any corporation or sociedad anonima organized

and constituted in the Philippines in accordance with its law;

d. Shares, obligations or bonds issued by any foreign corporation 85% of the business of

which is located in the Philippines;

e. Shares, obligations or bonds issued by any foreign corporation if such shares, obligations

or bonds have acquired a business situs in the Philippines;

f. Shares or rights in any partnership, business or industry established in the Philippines.

4. Exercise: A decedent or a donor ahs the following properties. Check the appropriate box if included in the gross estate

Resident NRA-No NRA-With

decedent Reciprocity Reciprocity

House and lot, USA

Condominium unit, Philippines

Furniture and appliances, Philippines,

Car, USA, recently purchased,

Bonds, Philippines

Common shares of stock not traded in the local stock exchange, Philippine Corp.

Preferred shares of stock, foreign corporation, 85% of the business in the Philippines,

Proceeds of life insurance, Philippines (administrator of the estate is irrevocable

beneficiary

M. TAXABLE TRANSFERS

1. Examples of taxable a. Transfer in contemplation of death – motivated by thought of death although death may not be

transfer imminent;

b. Revocable transfer – the enjoyment of the property may be altered, amended, revoked or

terminated by the decedent;

c. Transfer passing under general power of appointment;

d. Transfer with retention or reservation of certain rights;

e. Transfer for insufficient consideration.

2. Motives that preclude a a. To relieve donor from the burden of management;

transfer from the b. To save income or property taxes;

category of one made in c. To settle family litigated and un-litigated disputes;

contemplation of death d. To provide independent income for dependents;

e. To see the children enjoy the property while the donor is alive;

f. To protect the family from hazards of business operations; and

g. To reward services rendered.

Page 5 of 11 0915-2303213 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY

ESTATE TAX (with COMPARISONS of TRANSFER TAXES) TAX-101

Exercise: Determine whether or not the following fall under taxable transfers for estate tax purposes (Y/N)

Taxable transfer? Reason

1) Property transferred, transferor is of advanced age and thought of dying soon

2) Property transferred, transferor wanted to reward services rendered to him

3) Property transferred, transferor has the right to take the property back

4) Property transferred, transferor has the right to take the property back but waived the

right before he died

5) Property transferred under power of appointment which can be exercised in favor of

anybody

6) Property transferred under power of appointment which can be exercised in favor of a

person designated by the transferor of the power of appointment

7) Property transferred, the transferor has the right to the income of the transferred

property while still alive

N. TRANSFER FOR INSUFFICIENT CONSIDERATION

Estate Tax Donor’s Tax

Applicable rule Where property, other than a real property that has Where property, other than a real property that has

been subjected to the final capital gains tax, is been subjected to the final capital gains tax, is

transferred for less than an adequate and full transferred for less than an adequate and full

consideration in money or money’s worth, then the consideration in money or money’s worth, then the

amount by which the fair market value of the amount by which the fair market value of the property

property at the time of the execution of the Contract at the time of the execution of the Contract to Sell or

to Sell or execution of the Deed of Sale which is not execution of the Deed of Sale which is not preceded by

preceded by a Contract to Sell exceeded the value of a Contract to Sell exceeded the value of the agreed or

the agreed or actual consideration or selling price actual consideration or selling price shall be deemed a

shall be included in computing the amount of gross gift, and shall be included in computing the amount of

estate. gifts made during the calendar year.

A sale, exchange, or other transfer of property made in

the ordinary course of business (a transaction which

is a bona fide, at arm’s length, and free from any

donative intent), will be considered as made for an

adequate and full consideration in money or money’s

worth.”

Exercise: Determine what value shall be included in the gross estate

FMV, time of Consideration FMV, time of Amount included in the

transfer received death/donation gross estate/gross gift

Case 1 P1,000,000 P 800,000 P1,200,000

2 P1,500,000 P 900,000 P1,000,000

3 P2,000,000 None P1,500,000

4 P2,500,000 P3,000,000 P3,500,000

5 P2,200,000 P1,500,000 P1,200,000

O. OTHER ITEMS (INTANGIBLE PERSONAL PROPERTY)

1. Proceeds of life insurance Generally taxable, except when:

a. A third person is irrevocably designated as beneficiary;

b. The proceeds/benefits come from SSS or GSIS;

c. The proceeds come from group insurance.

Assumption when designation When the designation of the beneficiary is not stated or is not clear, the Insurance Code assumes

is not stated revocable designation.

2. Claims against insolvent a. The full amount of the claims is included in the gross estate.

persons b. The uncollectible amount of the claims is deducted from the gross estate.

3. Amount received by heirs a. R.A. No. 4917 is entitled ‘An Act Providing That Retirement Benefits of Employees of Private Firms

under R.A. No. 4917 Shall Not be Subject to Attachment, Levy, Execution, or Any Tax Whatsoever’.

b. The amount received by heirs from decedent’s employer as a consequence of the death of the

decedent-employee is included in the gross estate of the decedent.

c. The amount above is also allowed as deduction from gross estate.

4. Exercise

a. Determine whether or not the following proceeds of life insurance shall be included in the gross estate (Y/N)

Included? Reason

1) Proceeds from life insurance, third person is irrevocably designated as beneficiary

2) Proceeds from life insurance, third person is revocably designated as beneficiary

3) Proceeds of life insurance, the beneficiary’s designation is not clear

4) Proceeds of life insurance, administrator of the estate is irrevocably designated as beneficiary

5) Proceeds of life insurance, executor of the estate is revocably designated as beneficiary

6) Benefits received from SSS, third person is irrevocably designated as beneficiary

7) Benefits from GSIS, third person is revocably designated as beneficiary

Page 6 of 11 0915-2303213 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY

ESTATE TAX (with COMPARISONS of TRANSFER TAXES) TAX-101

P. EXEMPTIONS/EXCLUSIONS

1. Exemptions of certain a. The merger of usufruct in the owner of the naked title;

acquisitions and b. The transmission or delivery of the inheritance or legacy by the fiduciary heir or legatee to the

transmissions fideicommissary;

c. The transmission from the first heir, legatee or donee in favor of another beneficiary in accordance

with the desire of the predecessor; and

d. All bequest, devises, legacies or transfers to social welfare, cultural and charitable institutions, no part

of the net income of which inures to the benefit of any individual: Provided, however, that not more

than 30% of the said bequest, devises, legacies or transfers shall be used by such institutions for

administration purposes.

2. Exclusions from gross a. Amount received as war damages;

estate/gross gift under b. Amount received from US Veterans Administration;

special laws c. Benefits from GSIS and SSS.

Q. DETERMINATION OF THE VALUE OF THE ESTATE/GIFT

Estate Tax Donor’s Tax

1. Usufruct In accordance with the latest Basic Standard Mortality Table, to be No specific provision

approved by the Secretary of Finance, upon the recommendation

of the Insurance Commissioner.

2. Properties a. Generally – Fair market value at the time of a. Generally - Fair market value at the time

decedent’s death; of the gift

b. Real property – Higher between fair market value, BIR (zonal b. Real property - Provisions in estate tax

value) and fair market value, Provincial and City assessor shall apply to the valuation of said real

(assessed value); property

c. Personal properties – Recently purchased – Purchase price

d. Personal property tot recently purchased – Pawn value x 3

d. Securities (shares of stock)

1) Traded in the local stock exchange – Mean between the

highest and lowest quotations on valuation date or on a

date nearest the valuation date;

2) Not traded in the local stock exchange

a) Common (ordinary) shares – Book value on valuation

date or on a date nearest the valuation date;

b) Preferred (preference) shares – Par value

3. Exercise: Determine the value to be included in the gross estate/gross gift

a. Real property, zonal value, time of death/donation, P1,500,000; value per tax declaration, time of death/donaton,

P1,200,000

b. Real property, zonal value, 6 months before death/donation, P1,500,000; assessed value, time of death/donation,

P1,200,000

c. Personal property, recently purchased, FMV, time of death/donation, P700,000; purchase price, P800,000

d. Personal property, recently purchased, purchase price, P800,000

e. Personal property, not recently purchased, pawn value, P80,000

f. 10,000 shares of stock, traded in the local stock exchange, par value, P20/share; mean between highest and lowest

quotation, P15/share

g. 5,000 common shares, not traded in the local stock exchange, FMV, time of death P2/share; par value, P5/share

h. 5,000 common shares, not traded in the local stock exchange, par value, P5/share; book value, P4/share

i. 10,000 preferred shares, not traded in the local stock exchange par value, P10/share; book value, P15/share

R. Deductions Amplified (Estate Tax)

ORDINARY DEDUCTIONS

a. Losses

Requisites for a) Incurred during the settlement of the estate; Actual amount of loss

deduction and b) Arising from fires, storms, shipwreck, or other casualties, or from

amount deductible robbery, theft or embezzlement;

c) Not compensated for by insurance or

otherwise;

d) Not claimed as deduction for income tax

purposes in an income tax return;

e) Incurred not later than the last day for the

payment of the estate tax.

b. Indebtedness (Claims against the estate)

Requisites for a) The liability represents a personal obligation of the deceased Debts or demands of pecuniary nature which

deduction and existing at the time of his death; could have been enforced against the

amount deductible b) The liability was contracted in good faith and for adequate and deceased in his lifetime and could have been

full consideration in money or money’s worth; reduced to simple money terms

c) The claim must be a debt or claim which is valid in law and

enforceable in court;

d) The indebtedness must not have been condoned by the

creditor or the action to collect from the decedent must not

have prescribed.

e) At the time the indebtedness was incurred the debt instrument

was duly notarized; and

f) If the loan was contracted within three (3) years before the

death of the decedent, the administrator or executor shall

submit a statement showing the disposition of the proceeds of

the loan

Page 7 of 11 0915-2303213 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY

ESTATE TAX (with COMPARISONS of TRANSFER TAXES) TAX-101

c. Unpaid taxes

Requisites for The tax must have accrued before the death of the decedent Unpaid taxes that accrued before the

deduction and decedent’s death but not including:

amount deductible a) any income tax upon income

received after the death of

the decedent, or

b) property taxes not accrued

before his death,

c) or any estate tax.

d. Claims against insolvent persons

Requisites for a) Value of claims is included in the gross estate; Claims that are not collectible

deduction and b) The incapacity of the debtors to pay their

amount deductible obligation is proven.

e. Unpaid mortgage

Requisites for a) The fair market value of the mortgaged property without Amount of unpaid mortgage

deduction and deducting the mortgage indebtedness has been initially

amount deductible included as part of the gross estate;

b) The mortgage indebtedness was contracted in good faith and

for an adequate and full consideration.

f. Computation of Deductible Losses, Indebtedness, Taxes, Claims Against Insolvent and Unpaid Mortgage (LITE) For

Non-Resident Alien Decedent

Formula Philippine gross income

Total gross income x LITE = Deductible LITE

g. Transfer for Public Use

Requisite for deductibility Amount deductible Deducted from

The transfer must be testamentary in character or by Amount of all bequest, legacies, devises, or Exclusive property

way of donation mortis causa executed by the transfers to or for the use of the Government

decedent before his death of the Philippines, or any political subdivision

for exclusively public purpose

h. Property Previously Taxed (Vanishing Deduction) (For Estate Tax)

Rates (based on time gap)

Requisites for deduction Format of computation

a. The date of death of the present 100% - if not more than 1 Value to take P xxx

decedent must not exceed 5 years from the date year Less: Mortgage paid by present

of death of the prior decedent or date of donation. decedent xxx

b. The property can be identified as the one received 80% - if more than 1 year but Initial basis xxx

from prior decedent, or from the donor, or the not more than 2 years Less: Proportional deduction

property acquired in exchanged for the original (Initial basis/Gross estate

property so received. 60% - if more than 2 years x Deductions) xxx

c. The property must have formed part of the prior but not more than 3 years Final basis xxx

decedent’s gross estate situated in the Philippines Rate xxx

or been included in the total amount of the gifts of 40% -if more than 3 years but Vanishing deduction xxx

the donor made within 5 years prior to the present not more than 4 years Notes:

decedent’s death. 1) Under conjugal partnership of gains

d. The estate tax must have been finally determined 20% - if more than 4 years vanishing is a deduction from exclusive

and paid by the prior decedent or the donor’s tax but not more than 5 years property.

must have been paid by the donor 2) Under absolute community of property, vanishing

e. No vanishing deduction was allowed in determining deduction may be deducted from exclusive

the value of the net estate of the prior decedent property or community property.

i. Exercise on vanishing deduction

a. Decedent was a citizen of the Philippines who was single at the time of death. Compute the vanishing deduction based on the

following information that were made available:

Properties inherited two-and-a-half years before death:

Located outside the Philippines P3,000,000

Located in the Philippines

FMV, when inherited 6,500,000

FMV, time of death 7,000,000

Unpaid mortgage on the property when inherited 1,500,000

Unpaid mortgage on the property at the time of death 1,000,000

Property acquired through own labor 2,000,000

Expenses, losses, indebtedness, taxes, etc. (excluding the unpaid mortgage of P1,000,000) 800,000

Transfer for public use 970,000

Medical expenses 800,000

Page 8 of 11 0915-2303213 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY

ESTATE TAX (with COMPARISONS of TRANSFER TAXES) TAX-101

j. Exercise of deductions allowed to non-resident alien decedent

1. Mr. Poh Ma Naw, a single and a non-resident alien, died of a heart attack in 2021, leaving the following properties in favor of his

heirs:

Gross estate within the Philippines P 30,000,000

Gross estate outside of the Philippines 20,000,000

Funeral expense 500,000

Judicial and administrative expenses 2,000,000

Claims against the estate 5,000,000

Loss due to theft 1,000,000

Medical expenses 500,000

His gross estate includes family home valued at 8,000,000

Compute the following using BIR Form No. 1801:

a. Line 34 page 2 (Gross estate)

b. Line 35 page 2 (Ordinary deductions)

c. Line 37D page 2 (Total special deductions

d. Line 40 page 2 (Net taxable estate)

e. Line 18 page 1 (Estate tax due)

SPECIAL DEDUCTIONS

1. Family Home - The family home, constituted jointly by the husband and the wife or by an unmarried head of the family, is the

dwelling house where they and their family reside and the land on which it is situated.

Conditions for the allowance of family home deduction Amount deductible

1) The family home must be the actual residential home of the 1) Exclusive property Full value included in the

decedent and his family at the time of his death, as certified by the gross estate

Barangay Captain of the locality the family home is situated; 2) Conjugal/community One-half (1/2) of the value

2) The total value of the family home must be included as part of the property included in the gross estate

gross estate of the decedent; and 3) Partly exclusive Exclusive part (full value)

3) Allowable deduction must be in an amount equivalent to the property, partly Conjugal/community part

current fair market value of the family home as declared or included conjugal/community (1/2 x value)

in the gross estate, or to the extent of the decedent’s interest property

(whether conjugal/community or exclusive property), whichever is Note: In all three (3) cases, the maximum amount of

lower, but not exceeding P10,000,000 (old deduction was family home deduction is P10,000,000.

P1,000,000.)

4) Exercise: For year 2021, determine the amount to be included in the GE, decedent’s interest and the FH deduction

Gross estate Decedent’s interest Family home deduction

Case 1 – Family home is conjugal property,

P13,000,000

2 - Family home is conjugal property,

P25,000,000

3 – Family home is exclusive property,

P12,000,000

4 - Family home is exclusive property,

P8,000,000

5 - Family home is partly common, partly

exclusive

Exclusive lot – P5,000,000

Conjugal house – P8,000,000

2. Standard Deduction Under TRAIN (effective January 1, 2018)

Resident/citizen decedent Non-resident alien decedent

Amount deductible P5,000,000 P500,000

3. Amount Received by Heirs Under R.A. No. 4917

Requisite for deduction Amount deductible

The amount of the separation benefit is included as part of the Any amount received by the heirs from decedent’s employer as a

gross estate of the decedent consequence of the death of the employee-decedent

4. Charges Against Exclusive or Conjugal/Communal Property Under the Family Code

a. Support of spouses, their common children and legitimate children of either spouse CONJ/COMM

b. All debts and obligations contracted during the marriage by the designated administrator-spouse for the

benefit of the conjugal partnership of gain or community, or by both spouses, or by one spouse with the

consent of the other CONJ/COMM

c. Debts and obligations contracted by either spouse without the consent of the other to the extent that the

family may have been benefited CONJ/COMM

d. All taxes, liens, charges and expenses, including major and minor repairs, upon the conjugal/community

property CONJ/COMM

e. All taxes and expenses for mere preservation made during the marriage upon the separate property of either

spouse used by the family CONJ/COMM

f. Expenses to enable either spouse to commence or complete a professional or vocational course, or other

activity for self-improvement CONJ/COMM

g. Ante nuptial debts of either spouse insofar as they have redounded to the benefit of

the family CONJ/COMM

Page 9 of 11 0915-2303213 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY

ESTATE TAX (with COMPARISONS of TRANSFER TAXES) TAX-101

h. Value of what is donated or promised by both spouses in favor of their legitimate children for the exclusive

purpose of commencing or completing a professional or vocational course or other activity for self-

improvement CONJ/COMM

i. Expenses of litigation between the spouses unless the suit is found to be groundless CONJ/COMM

j. Ante-nuptial debts of either spouse that did not redound to the benefit of the family EXCLUSIVE

k. Support of illegitimate children of either spouse EXCLUSIVE

l. Liabilities incurred by either spouse by reason of crime or quasi-delict EXCLUSIVE

m. Loss during the marriage in any game of chance, betting, Sweepstakes, or any other kind of gambling whether

permitted or prohibited by law EXCLUSIVE

OTHER DEDUCTIONS

1. Share of the Surviving Spouse

Gross conjugal/community properties P xxx

Less: Conjugal/community deductions xxx

Net conjugal/community properties (NCP) P xxx

Share of surviving spouse (1/2 x NCP) P xxx

S. Tax Credit for Estate/Donor’s Tax Paid to a Foreign Country

Estate Tax Donor’s Tax

1. Entitled to tax credit Resident or citizen decedents Resident or citizen donor

2. Deducted from estate tax due The estate tax imposed in the Tax Code The donor’’s tax imposed in the Tax Code

shall be credited with the amounts of any shall be credited with the amounts of any

estate tax imposed by the authority of a donor’s tax imposed by the authority of a

foreign country. foreign country.

3. Limitations on credit

a. Only one foreign country Limit: Net estate, foreign/Entire net estate Limit: Net gift, foreign/Entire net gift x

x Philippine estate tax or Philippine donor’s tax or

Actual foreign estate tax, Actual foreign estate tax,

whichever is lower whichever is lower

b. Two or more foreign Limit (a) – Per foreign country : Net estate, Limit (a) – Per foreign country : Net estate,

countries are involved per foreign country/Entire net per foreign country/Entire net

estate x Philippine estate tax estate x Philippine estate tax

due or due or

Limit (b) – By total: Net estate (all foreign Limit (b) – By total: Net estate (all foreign

countries)/Entire net estate x countries)/Entire net estate x

Phil. estate tax due Phil. estate tax due

whichever is lower whichever is lower

4. Exercises:

a. Estate Tax: The estate of a decedent who dies January 1, 2018 has the following data (standard deduction already taken into

account):

Net estate, Philippines P1,200,000

Net estate, Country A (after P10,000 estate tax paid) 190,000

Net estate, Country B (before P14,000 estate tax paid) 200,000

Net estate, Country C (100,000)

Compute the estate tax payable if : 1) resident alien 2) non-resident alien

Exercise: Decedent died January 1, 2021. Determine whether or not notice of death, estate tax return or statement certified by

a CPA need to be filed (Y/N)

Notice of Estate tax Statement

death return certified by CPA

Case 1 – Gross estate is P16,000,000; Deductions, P11,000,000

2 – Gross estate is P4,000,000; Deductions, P6,000,000

3 – Gross estate is P2,000,000, Deductions, P600,000 (NRA decedent)

4– Gross estate is P15,00,000 comprising of car, land and shares of stock;

Deductions, P10,000,000

5 – Gross estate is P5,000,000; Deductions are P1,200,000 (NRA decedent)

7 – Gross estate is P5,500,000; Deductions are P1,000,000 (NRA decedent)

T. Acts Requiring Certification from the Commissioner that the Estate Tax Has been Paid Under TRAIN (effective January

1. 2018)

Acts requiring 1. Delivery of distributive shares to the heirs;

certification 2. Registration in the Registry of Deeds of transfer of inherited real property or real rights;

3. Payments of debt by decedent’s debtor to the heirs, legatees, executor or administrator of the creditor-

decedent;

4. Transfer of inherited shares, rights or bonds;

5. Withdrawal from decedent’s bank deposit (allowed subject to final withholding tax of 6%, withdrawal slip

shall contain a statement that all joint depositors are still living at the time of withdrawal by any one of the

joint depositors and such statement shall be under oath by the said depositor)

Page 10 of 11 0915-2303213 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY

ESTATE TAX (with COMPARISONS of TRANSFER TAXES) TAX-101

Additional Cases

Estate Tax

1. The resident decedent is a married man with a surviving spouse with the following data died on January 15, 2021:

Conjugal real properties P 6,000,000

Conjugal family house 1,000,000

Exclusive family lot 400,000

Other exclusive properties 4,500,000

Conjugal ordinary deductions (including P200,000 funeral expenses and

P300,000 judicial expenses) 1,500,000

Exclusive ordinary deductions 500,000

Medical expenses 600,000

Compute the following using BIR Form No. 1801:

a. Line 34 page 2 (Gross estate)

b. Line 35 page 2 (Ordinary deductions)

c. Line 37D page 2 (Total special deductions

d. Line 40 page 2 (Net taxable estate)

e. Line 18 page 1 (Estate tax due)

2. The citizen decedent is unmarried head of the family with the following data died on March 1, 2021:

Real and personal properties (including P1,500,000 bank deposit, P500,000 of which was withdrawn

and subjected to 6% withholding tax) P 14,000,000

Family home 9,000,000

Ordinary deductions (including P100,000 funeral expenses and P200,000 judicial expenses) 2,000,000

Medical expenses 300,000

Compute the following using BIR Form No. 1801:

a. Line 34 page 2 (Gross estate)

b. Line 35 page 2 (Ordinary deductions)

c. Line 37D page 2 (Total special deductions)

d. Line 40 page 2 (Net taxable estate)

e. Line 18 page 1 (Estate tax due)

Estate Tax: A non-resident alien decedent, single, died on January 1, 2018 left the following properties:

Car, Manila (inherited 4 years before he died, FMV, date of inheritance was P1,700,000) P1.500,000

Car, USA 2.600,000

Shares of stock, USA 900,000

Shares of stock, Manila 800,000

House and lot, USA 4,800,000

Bank deposit, PNB-Manila 1,000,000

Other tangible personal properties, Manila 500,000

The administrator claimed the following deductions:

Actual funeral expenses P40,000

Judicial expenses 30,000

Loss of certain tangible personal properties 25,000

Claims against the estate 20,000

Unpaid taxes, accrued before death 15,000

Claims against insolvent person 10,000

Transfer for public use 10,000

Medical expenses 50,000

Compute the following using BIR Form No. 1801:

a. Line 34 page 2 (Gross estate)

b. Line 35 page 2 (Ordinary deductions)

c. Line 37D page 2 (Total special deductions

d. Line 40 page 2 (Net taxable estate)

e. Line 18 page 1 (Estate tax due)

END

“Never underestimate your ability to achieve your goal. You are made to succeed.” - Tamthewise

Page 11 of 11 0915-2303213 www.resacpareview.com

You might also like

- How To Migrate From SAP EWM (Business Suite) To Decentralized EWM Based On SAP S/4HanaDocument30 pagesHow To Migrate From SAP EWM (Business Suite) To Decentralized EWM Based On SAP S/4HanakamalrajNo ratings yet

- Editable Retail Loan Application - ApplicantDocument10 pagesEditable Retail Loan Application - Applicantmadhukar sahayNo ratings yet

- The Nespresso Case: Value Articulation - A Framework For The Strategic Management of Intellectual PropertyDocument6 pagesThe Nespresso Case: Value Articulation - A Framework For The Strategic Management of Intellectual PropertyAna SiqueiraNo ratings yet

- Right To PropertyDocument36 pagesRight To PropertyNilam100% (1)

- Guidelines of Direct Selling LicenseDocument12 pagesGuidelines of Direct Selling LicenseLeon Lu Lih Youn100% (3)

- Chapter 3 - Different Kinds of ObligationDocument18 pagesChapter 3 - Different Kinds of Obligationthatfuturecpa100% (1)

- Cosmeticsandtoiletries201510 DL PDFDocument68 pagesCosmeticsandtoiletries201510 DL PDFtmlNo ratings yet

- Donors To PercentageDocument24 pagesDonors To PercentageFrayladine TabagNo ratings yet

- Estate TaxDocument10 pagesEstate Taxrandomlungs121223No ratings yet

- TAX L002 Individual TaxationDocument18 pagesTAX L002 Individual TaxationYuri CaguioaNo ratings yet

- Excise TaxDocument7 pagesExcise TaxKezNo ratings yet

- Quizzers 12Document13 pagesQuizzers 12Niña Yna Franchesca PantallaNo ratings yet

- Week 3 Income Taxation Individual TaxpayersDocument58 pagesWeek 3 Income Taxation Individual TaxpayersJulienne Untalasco100% (1)

- Photovoltaic (Solar) Installation AgreementDocument6 pagesPhotovoltaic (Solar) Installation AgreementQueNo ratings yet

- Tax Remedies ActDocument8 pagesTax Remedies ActrobNo ratings yet

- For Boi IncentivesDocument7 pagesFor Boi Incentiveskimberly fanoNo ratings yet

- Income Taxation of IndividualsDocument26 pagesIncome Taxation of Individualsarkisha100% (1)

- Codal Reference and Related IssuancesDocument17 pagesCodal Reference and Related IssuancesBernardino PacificAceNo ratings yet

- CPAR Intro To Income Tax and Tax On Individuals (Batch 89) - HandoutDocument29 pagesCPAR Intro To Income Tax and Tax On Individuals (Batch 89) - HandoutMark LapidNo ratings yet

- TAX05-02 Individual Income TaxDocument7 pagesTAX05-02 Individual Income TaxJeth ConchaNo ratings yet

- (Tax) Casino First PreboardDocument5 pages(Tax) Casino First PreboardNor-janisah PundaodayaNo ratings yet

- PRTC 1stpb - 05.22 Sol TaxDocument21 pagesPRTC 1stpb - 05.22 Sol TaxCiatto SpotifyNo ratings yet

- 91-07 Gross IncomeDocument8 pages91-07 Gross IncomeNova PogadoNo ratings yet

- Homecredit Copy Loan AgreementDocument2 pagesHomecredit Copy Loan AgreementMichael Del CarmenNo ratings yet

- Chapter 4 Investments in Debt Securities and Other Long Term InvestmentDocument30 pagesChapter 4 Investments in Debt Securities and Other Long Term InvestmentAngelica Joy ManaoisNo ratings yet

- Rights and Remedies of The Government Under The NIRC: I. Power of The Bir To Obtain Information and Make An AssessmentDocument24 pagesRights and Remedies of The Government Under The NIRC: I. Power of The Bir To Obtain Information and Make An AssessmentPau SaulNo ratings yet

- Income Tax On Individuals and Tax RatesDocument25 pagesIncome Tax On Individuals and Tax RatesmmhNo ratings yet

- TAX HO1002 Individual Taxation StudentDocument12 pagesTAX HO1002 Individual Taxation StudentYuri CaguioaNo ratings yet

- Moral Theory On UtilitarianismDocument6 pagesMoral Theory On UtilitarianismCharles LaspiñasNo ratings yet

- TB ch03 DDDocument26 pagesTB ch03 DDPatricia Jean DigoNo ratings yet

- CODE OF ETHICS For Professional Accountants in TheDocument61 pagesCODE OF ETHICS For Professional Accountants in TheDiana Rose BassigNo ratings yet

- Tax II Digests Y SanchezDocument32 pagesTax II Digests Y SanchezJubsNo ratings yet

- Aud-90 PWDocument17 pagesAud-90 PWElaine Joyce GarciaNo ratings yet

- TAX-902 (Gross Income - Exclusions)Document6 pagesTAX-902 (Gross Income - Exclusions)MABI ESPENIDONo ratings yet

- Itr2 Fy 2020-21 Ay 2021-22Document42 pagesItr2 Fy 2020-21 Ay 2021-22Pradeep GoudaNo ratings yet

- Aescartin/Tlopez/Jpapa: Mobile Telephone GmailDocument7 pagesAescartin/Tlopez/Jpapa: Mobile Telephone GmailReynalyn BarbosaNo ratings yet

- Business Federal Tax UpdateDocument9 pagesBusiness Federal Tax Updatesean dale porlaresNo ratings yet

- Liabilities ReSA Handouts PDFDocument13 pagesLiabilities ReSA Handouts PDFNinaNo ratings yet

- Personal Loan Application Form: Different Needs, One Answer Personal Loans From TVS SOLUTION Loan SystemDocument7 pagesPersonal Loan Application Form: Different Needs, One Answer Personal Loans From TVS SOLUTION Loan Systemjuned shaikhNo ratings yet

- Chapter 5 - Current Asset ManagementDocument15 pagesChapter 5 - Current Asset ManagementReyes JonahNo ratings yet

- TAX 2021 - Theories and Independent ProblemsDocument28 pagesTAX 2021 - Theories and Independent ProblemsMingcheng JeeNo ratings yet

- TAX 702 - Income Tax Rates CorporationsDocument6 pagesTAX 702 - Income Tax Rates CorporationsJuan Miguel UngsodNo ratings yet

- TAX - Income Tax On IndividualsDocument10 pagesTAX - Income Tax On Individualsall about seventeenNo ratings yet

- Double Taxation Agreements 2022Document19 pagesDouble Taxation Agreements 2022rav danoNo ratings yet

- Tax232 - Excise Tax PDFDocument37 pagesTax232 - Excise Tax PDFClaire Ann ParasNo ratings yet

- Management Advisory Services (Mas) MAS01 Introductioin To Management AccountingDocument38 pagesManagement Advisory Services (Mas) MAS01 Introductioin To Management AccountingEagle OrtegaNo ratings yet

- Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocument6 pagesManila Cavite Laguna Cebu Cagayan de Oro DavaoMonica GarciaNo ratings yet

- Module 2 - Income Taxes For Individuals - Lecture NotesDocument52 pagesModule 2 - Income Taxes For Individuals - Lecture NotesRina Bico Advincula100% (1)

- Far Reviewer 1 7Document8 pagesFar Reviewer 1 7Angel Marie MartinezNo ratings yet

- QUIZ Corporate Income Taxation AnswersDocument4 pagesQUIZ Corporate Income Taxation AnswersAang GrandeNo ratings yet

- Name: Section: Date:: Angel SantaDocument5 pagesName: Section: Date:: Angel SantaJoebet DebuyanNo ratings yet

- Capital Gains Tax PDFDocument6 pagesCapital Gains Tax PDFjanus lopezNo ratings yet

- Tax Rate A. For Individuals Earning Purely Compensation Income and Individuals Engaged in Business and Practice of ProfessionDocument8 pagesTax Rate A. For Individuals Earning Purely Compensation Income and Individuals Engaged in Business and Practice of ProfessionInna De LeonNo ratings yet

- CorporationsDocument46 pagesCorporationsDandred AdrianoNo ratings yet

- Capital Gains Tax: Selling Price Basis of Share (Inc. Dividend-On, Net of Tax) Doc. Stamp TaxDocument2 pagesCapital Gains Tax: Selling Price Basis of Share (Inc. Dividend-On, Net of Tax) Doc. Stamp Taxloonie tunesNo ratings yet

- Illustration VATDocument8 pagesIllustration VATLeah Mae NolascoNo ratings yet

- Chapter 6 - Strategy Analysis and ChoiceDocument26 pagesChapter 6 - Strategy Analysis and ChoiceMalaika Khan 009No ratings yet

- Remedies Tax 4 27 - Power and Remedy of AssessmentDocument15 pagesRemedies Tax 4 27 - Power and Remedy of AssessmentEmille LlorenteNo ratings yet

- Tax Exemption GuidelineDocument8 pagesTax Exemption GuidelineonghpNo ratings yet

- Shakey's 2021Document69 pagesShakey's 2021Megan CastilloNo ratings yet

- Part V Disbursement System 04122021Document19 pagesPart V Disbursement System 04122021Mana XD100% (1)

- Administrative Provisions - Estate Tax (Presentation Slides)Document9 pagesAdministrative Provisions - Estate Tax (Presentation Slides)KezNo ratings yet

- Lecture Notes: Advanced Financial Accounting and Reporting G/N/E de Leon AFAR.3014 - NGASDocument11 pagesLecture Notes: Advanced Financial Accounting and Reporting G/N/E de Leon AFAR.3014 - NGASTatianaNo ratings yet

- DPD DogsDocument13 pagesDPD DogsKen HaddadNo ratings yet

- IAS 33 Earnings Per ShareDocument9 pagesIAS 33 Earnings Per ShareangaNo ratings yet

- TAX-201 (Donor's Tax)Document7 pagesTAX-201 (Donor's Tax)Edith DalidaNo ratings yet

- TAX-502 (Excise Tax Rates - Part 2)Document3 pagesTAX-502 (Excise Tax Rates - Part 2)Princess ManaloNo ratings yet

- TAX-401 (Other Percentage Taxes - Part 1)Document5 pagesTAX-401 (Other Percentage Taxes - Part 1)Princess ManaloNo ratings yet

- Lit 2 - Midterm Lesson Part 2Document5 pagesLit 2 - Midterm Lesson Part 2Princess ManaloNo ratings yet

- TAX-303 (Input Taxes)Document7 pagesTAX-303 (Input Taxes)Princess ManaloNo ratings yet

- TAX-301 (VAT-Subject Transactions)Document9 pagesTAX-301 (VAT-Subject Transactions)Princess ManaloNo ratings yet

- Lit 2 - Midterm Lesson Part 1Document4 pagesLit 2 - Midterm Lesson Part 1Princess ManaloNo ratings yet

- Lit 2 - Midterm Lesson Part 5Document20 pagesLit 2 - Midterm Lesson Part 5Princess ManaloNo ratings yet

- Introduction To Accounting: Certificate in Accounting and Finance Stage ExaminationDocument5 pagesIntroduction To Accounting: Certificate in Accounting and Finance Stage ExaminationSYED ANEES ALINo ratings yet

- Learning CAN SLIM Education Resources: Lee TannerDocument43 pagesLearning CAN SLIM Education Resources: Lee Tannerneagucosmin67% (3)

- University Course Fee For Students & AgentsDocument4 pagesUniversity Course Fee For Students & AgentsChandan Kumar BanerjeeNo ratings yet

- Agenda Item 7 App1Document15 pagesAgenda Item 7 App1Sana KhanNo ratings yet

- C.H. Robinson Contract Addendum and Carrier Load Confirmation - #434674433Document4 pagesC.H. Robinson Contract Addendum and Carrier Load Confirmation - #434674433shayan aliNo ratings yet

- Grounds Prescription Ratification Rescissible Contract 4yrsDocument1 pageGrounds Prescription Ratification Rescissible Contract 4yrsDieanne MaeNo ratings yet

- D Ifta Journal 10Document76 pagesD Ifta Journal 10zushiiiNo ratings yet

- Automatización de ProcesosDocument7 pagesAutomatización de ProcesosFernando FlorNo ratings yet

- VRTXDocument27 pagesVRTXJeypee De GeeNo ratings yet

- Terex Wheel Loader Skl844 0100 Radlader Parts CatalogDocument11 pagesTerex Wheel Loader Skl844 0100 Radlader Parts Catalogmrpaulwilliams251290oje100% (68)

- Mba Project On Recruitment Selection PDFDocument100 pagesMba Project On Recruitment Selection PDFsumanNo ratings yet

- United States District Court Central District of California Case No: Cv08-01908 DSF (CTX)Document12 pagesUnited States District Court Central District of California Case No: Cv08-01908 DSF (CTX)twebster321100% (1)

- Mis in ICICI BankDocument14 pagesMis in ICICI BankRavindra Khandelwal100% (1)

- BSBLDR411 Project Portfolio Student.v1.0Document23 pagesBSBLDR411 Project Portfolio Student.v1.0ipal.rhdNo ratings yet

- Knowledge Organisers CIE Geography BWDocument19 pagesKnowledge Organisers CIE Geography BWAntoSeitanNo ratings yet

- Swift Ratw HawkDocument1 pageSwift Ratw HawkMajid ImranNo ratings yet

- GoU Statement Victory Day 2019Document4 pagesGoU Statement Victory Day 2019GCICNo ratings yet

- Summer Dhamaka AprilDocument21 pagesSummer Dhamaka AprilPapia ChandaNo ratings yet

- Archiving Production Orders (PP-SFC)Document13 pagesArchiving Production Orders (PP-SFC)Mayte López AymerichNo ratings yet

- The Large Marketplace Comparison GuideDocument43 pagesThe Large Marketplace Comparison GuidegencmetohuNo ratings yet

- BP Annual Report and Form 20f 2017Document302 pagesBP Annual Report and Form 20f 2017golddust2012No ratings yet

- MODULE - ACC 325 - UNIT1 - ULObDocument4 pagesMODULE - ACC 325 - UNIT1 - ULObJay-ar Castillo Watin Jr.No ratings yet

- SWOTDocument10 pagesSWOTGwendolyn PansoyNo ratings yet

- Paytm Wallet TXN HistoryJan2020 9369204281 PDFDocument2 pagesPaytm Wallet TXN HistoryJan2020 9369204281 PDFSandeep RaiNo ratings yet