Professional Documents

Culture Documents

AU12 FSA MidTerm Quiz

AU12 FSA MidTerm Quiz

Uploaded by

Han Nguyen GiaCopyright:

Available Formats

You might also like

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)From EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Rating: 5 out of 5 stars5/5 (1)

- Afar QuestionsDocument16 pagesAfar QuestionsJessarene Fauni Depante50% (18)

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Practice Multiple Choice Questions For First Test PDFDocument10 pagesPractice Multiple Choice Questions For First Test PDFBringinthehypeNo ratings yet

- Principles of Financial Accounting PDFDocument5 pagesPrinciples of Financial Accounting PDFJia SNo ratings yet

- Quarter Examination-FABM 1 SY 2018-2019Document4 pagesQuarter Examination-FABM 1 SY 2018-2019Raul Soriano Cabanting100% (2)

- Davis Langdon Africa Handbook Jan 2009Document94 pagesDavis Langdon Africa Handbook Jan 2009Caesar 'Dee' Rethabile SerumulaNo ratings yet

- 1st-mock-cpa-board-exam-far-march-24-2022Document20 pages1st-mock-cpa-board-exam-far-march-24-2022nami zeinNo ratings yet

- 5 Question - FinanceDocument19 pages5 Question - FinanceMuhammad IrfanNo ratings yet

- Module 7 QuestionDocument21 pagesModule 7 QuestionWarren MakNo ratings yet

- Business Finance ExamDocument3 pagesBusiness Finance ExamChristian Joy ReyesNo ratings yet

- Quiz 1 - With Answer PDFDocument12 pagesQuiz 1 - With Answer PDFVerlyn ElfaNo ratings yet

- MCQ in Bca-Accounting & CobolDocument20 pagesMCQ in Bca-Accounting & CobolSagar KansalNo ratings yet

- Amoni Edome Coc Sample Exam-Level LLLDocument13 pagesAmoni Edome Coc Sample Exam-Level LLLAmoni EdomeNo ratings yet

- 201 EXM2 XComp Pract Exam MCDocument11 pages201 EXM2 XComp Pract Exam MCvonns80No ratings yet

- Directions: Read Carefully Each Item. Use A Separate Sheet For Your Answers, Write Only TheDocument3 pagesDirections: Read Carefully Each Item. Use A Separate Sheet For Your Answers, Write Only Thehector mabantaNo ratings yet

- Practice Multiple Choice Questions For First Test PDFDocument10 pagesPractice Multiple Choice Questions For First Test PDFBringinthehypeNo ratings yet

- Corporate Finance Trial Questions 2Document11 pagesCorporate Finance Trial Questions 2Sylvia Nana Ama DurowaaNo ratings yet

- Fabm 2Document7 pagesFabm 2eva hernandez528No ratings yet

- Auditing.: A. B. C. DDocument12 pagesAuditing.: A. B. C. DbiniamNo ratings yet

- Accounting 202 Chapter 15 TestansquestiDocument4 pagesAccounting 202 Chapter 15 TestansquestiSandra ReidNo ratings yet

- Accounting and Finance For ManagementDocument42 pagesAccounting and Finance For Managementsuresh84123No ratings yet

- Chapter 3. Mas-Ambray & BasulDocument7 pagesChapter 3. Mas-Ambray & BasulAmbray LynjoyNo ratings yet

- 2022 Sem 1 ACC10007 Practice MCQs - Topic 4Document6 pages2022 Sem 1 ACC10007 Practice MCQs - Topic 4JordanNo ratings yet

- ACC2010 Sample Final ExamDocument19 pagesACC2010 Sample Final ExamHarjot SinghNo ratings yet

- 2022 Sem 1 ACC10007 Practice MCQs - Topic 3Document7 pages2022 Sem 1 ACC10007 Practice MCQs - Topic 3JordanNo ratings yet

- AC503 - Finals Reviewer 2Document10 pagesAC503 - Finals Reviewer 2Ashley Levy San PedroNo ratings yet

- Sample Quiz Question 3Document7 pagesSample Quiz Question 3Sonam Dema DorjiNo ratings yet

- RevisedACFNModelExam - 2023Document15 pagesRevisedACFNModelExam - 2023Eyuel SintayehuNo ratings yet

- Multiple Choiche SolutionsDocument11 pagesMultiple Choiche SolutionsGiulia BarthaNo ratings yet

- Accounting 221Document8 pagesAccounting 221Princess ArceNo ratings yet

- Management Accounting QuizzerDocument7 pagesManagement Accounting QuizzerLorielyn Jundarino TimbolNo ratings yet

- 1Document42 pages1Magdy KamelNo ratings yet

- Lebanese Association of Certified Public Accountants - IFRS July Exam 2018Document8 pagesLebanese Association of Certified Public Accountants - IFRS July Exam 2018jad NasserNo ratings yet

- ACCTBA1 - Sample Quiz 1Document3 pagesACCTBA1 - Sample Quiz 1Marie Beth BondestoNo ratings yet

- Accounting 101 FinalsDocument16 pagesAccounting 101 FinalsDanilo Diniay Jr100% (1)

- Finacc 3 Question Set BDocument9 pagesFinacc 3 Question Set BEza Joy ClaveriasNo ratings yet

- CH 3 Working With Financial StatementsDocument36 pagesCH 3 Working With Financial StatementsYehia mohamed Hassen saleh ١٩١٠٣٩٣٦100% (1)

- Par Cor Accounting Cup - Average Round QuestionsDocument6 pagesPar Cor Accounting Cup - Average Round QuestionsShin YaeNo ratings yet

- Fundamentals of Accountancy, Business & Management 1 Second Grading ExaminationDocument6 pagesFundamentals of Accountancy, Business & Management 1 Second Grading ExaminationMc Clent CervantesNo ratings yet

- Appraisal DrillsDocument9 pagesAppraisal DrillsLyca Morandante LamaneroNo ratings yet

- FarDocument15 pagesFarJulius Lester Abiera100% (1)

- A162 Tutorial 4Document6 pagesA162 Tutorial 4Danny SeeNo ratings yet

- Quiz 1 FIN202Document4 pagesQuiz 1 FIN202Ngọc MinhNo ratings yet

- MODEL EXAM (Dessie)Document19 pagesMODEL EXAM (Dessie)tame kibruNo ratings yet

- Inbound 291317058018293855Document5 pagesInbound 291317058018293855Adrienne AvanceñaNo ratings yet

- AFAR Question PDFDocument16 pagesAFAR Question PDFNhel AlvaroNo ratings yet

- Team PRTC Afar-Finpb - 5.21Document16 pagesTeam PRTC Afar-Finpb - 5.21Nanananana100% (2)

- Activity 3 FinMaDocument6 pagesActivity 3 FinMaDiomela BionganNo ratings yet

- Acctg 12 Premid Exam QuestionnaireDocument11 pagesAcctg 12 Premid Exam QuestionnaireJanet AnotdeNo ratings yet

- FIN202 - Quiz Test 1Document4 pagesFIN202 - Quiz Test 1Nguyen Phuong Linh (k17 HCM)No ratings yet

- Soal Preliminary AccountingDocument10 pagesSoal Preliminary AccountingZara WinterNo ratings yet

- Basic MathDocument6 pagesBasic MathWarda MamasalagatNo ratings yet

- NtantDocument6 pagesNtantmahedreNo ratings yet

- Examination Paper: Instruction To CandidatesDocument11 pagesExamination Paper: Instruction To CandidatesNikesh MunankarmiNo ratings yet

- Final Spring 2021 (B)Document6 pagesFinal Spring 2021 (B)rtgxd25zygNo ratings yet

- Acc. P 2 2021 RevisionDocument8 pagesAcc. P 2 2021 RevisionSowda AhmedNo ratings yet

- Statement of Financial PositionDocument18 pagesStatement of Financial PositionriaNo ratings yet

- Test Bank Financial Accounting TheoryDocument14 pagesTest Bank Financial Accounting TheoryAnas K. B. AbuiweimerNo ratings yet

- 21-22 QUIZ-1 With SolutionsDocument3 pages21-22 QUIZ-1 With SolutionsShubham BansalNo ratings yet

- FPQP Practice Question Workbook: 1,000 Comprehensive Practice Questions (2024 Edition)From EverandFPQP Practice Question Workbook: 1,000 Comprehensive Practice Questions (2024 Edition)No ratings yet

- DTMF Controlled Robot Without MicrocontrollerDocument4 pagesDTMF Controlled Robot Without MicrocontrollershanofaNo ratings yet

- Motor Baldor Rig-9Document18 pagesMotor Baldor Rig-9Joko SusiloNo ratings yet

- Patient Transfer Policy 3.0Document25 pagesPatient Transfer Policy 3.0Val SolidumNo ratings yet

- CadburyDocument12 pagesCadburymldc20110% (1)

- Poem Alam SekitarDocument1 pagePoem Alam SekitarSITI SYAHIRAH BINTI A MALEKNo ratings yet

- Letters and Emails Sent To Shri I.S.YadavDocument12 pagesLetters and Emails Sent To Shri I.S.YadavArman VijayanNo ratings yet

- Rent Receipt - Tax2winDocument5 pagesRent Receipt - Tax2winAdityaNo ratings yet

- Background Medical CountermeasuresDocument7 pagesBackground Medical Countermeasuresapi-246003035No ratings yet

- Strategic Role of Localization in Multi National EnterprisesDocument23 pagesStrategic Role of Localization in Multi National EnterprisesBryan PetroNo ratings yet

- L2 Structural Steel: CE 332: Structural Design IIDocument6 pagesL2 Structural Steel: CE 332: Structural Design IIAbhay VikramNo ratings yet

- Goldberg v. Jenkins and Law.Document6 pagesGoldberg v. Jenkins and Law.GoldFishNo ratings yet

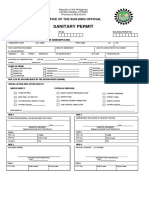

- Sanitary Permit (Front)Document1 pageSanitary Permit (Front)Darwin CustodioNo ratings yet

- Carson Crash LawsuitDocument5 pagesCarson Crash LawsuitABC Action NewsNo ratings yet

- Chemistry Paper 1 - 2018-2003 - QP PDFDocument539 pagesChemistry Paper 1 - 2018-2003 - QP PDFal_helu26No ratings yet

- Unix - Introduction: Prepared by Jadala Vijaya ChandraDocument6 pagesUnix - Introduction: Prepared by Jadala Vijaya ChandraCherukupalli SowjanyaNo ratings yet

- Electrical Discharge MachiningDocument11 pagesElectrical Discharge MachiningRizwan MrnNo ratings yet

- DWF Foundation Grant Guidelines Jan 2022Document4 pagesDWF Foundation Grant Guidelines Jan 2022Saundharaya KhannaNo ratings yet

- Sales - Mamaril Vs Boys Scout PHDocument3 pagesSales - Mamaril Vs Boys Scout PHXing Keet LuNo ratings yet

- Maham Ke Bari GaandDocument13 pagesMaham Ke Bari GaandFaisal GNo ratings yet

- Eddie The Carpet FitterDocument3 pagesEddie The Carpet Fittermaria praveenNo ratings yet

- Walkthrough v1.0.1 CompleteDocument74 pagesWalkthrough v1.0.1 Completemhd.jepri channelNo ratings yet

- Sample Detailed Lesson PlanDocument6 pagesSample Detailed Lesson PlanKarlKarl100% (1)

- Brkipm-2011 - Multicast MplsDocument106 pagesBrkipm-2011 - Multicast MplsmatarakiNo ratings yet

- COST ACCOUNTING JOB-ORDER COSTING ProbleDocument2 pagesCOST ACCOUNTING JOB-ORDER COSTING ProbleEleonora MarinettiNo ratings yet

- PRC Case Completion Form For Midwifery ExamsDocument2 pagesPRC Case Completion Form For Midwifery ExamsNoel84% (31)

- (Download PDF) Handbook of Radar Signal Analysis Advances in Applied Mathematics 1St Edition Bassem R Mahafza Editor Ebook Online Full ChapterDocument53 pages(Download PDF) Handbook of Radar Signal Analysis Advances in Applied Mathematics 1St Edition Bassem R Mahafza Editor Ebook Online Full Chapterradjalvuyo30100% (7)

- Amazon Cognito PrinciplesDocument3 pagesAmazon Cognito PrinciplesHaider HadiNo ratings yet

- BPTP Tera Boq - Split AcDocument36 pagesBPTP Tera Boq - Split AckarunvandnaNo ratings yet

- Strategic Issues in Strategic ManagementDocument23 pagesStrategic Issues in Strategic Managementzakirno19248No ratings yet

AU12 FSA MidTerm Quiz

AU12 FSA MidTerm Quiz

Uploaded by

Han Nguyen GiaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AU12 FSA MidTerm Quiz

AU12 FSA MidTerm Quiz

Uploaded by

Han Nguyen GiaCopyright:

Available Formats

Andrews University Financial Statement Analysis Mid-Term

AU12-2023

Name:…………………………………………….

Code:……………………………………………..

TRUE-FALSE

1. A common-size balance sheet is useful to the analyst because it facilitates

the structural analysis of the firm. True

2. The statement of stockholders’ equity is an important link between the

True

balance sheet and the income statement.

False

3. Gross profit is the difference between sales and all operating expenses.

4. The objectives of a financial statement analysis will vary depending on the

perspective of the financial statement user. True

5. Three ratios that help the financial analyst assess short-term solvency are

True

the current ratio, the quick ratio and the cash flow liquidity ratio.

MULTIPLE CHOICE

6. Which financial statement presents the results of operations? C

a. Balance sheet.

b. Statement of financial position.

c. Income statement.

d. Statement of cash flows.

7. Which financial statement shows the assets, liabilities and stockholders’ D

equity of the firm on a particular date?

a. Statement of stockholders’ equity.

b. Statement of cash flows.

c. Earnings statement.

d. Balance sheet.

8. Which financial statement provides information about operating, financing

and investing activities? B

a. Statement of financial position.

b. Statement of cash flows.

c. Statement of stockholders’ equity.

d. Income statement.

Nguyen Tan Binh Page |1

Andrews University Financial Statement Analysis Mid-Term

AU12-2023

9. What basic financial statements can be found in a corporate annual report? A

a. Balance sheet, income statement, statement of shareholders' equity, and

statement of cash flows.

b. Balance sheet, auditor's report and income statement.

c. Earnings statement and statement of retained earnings.

d. Statement of cash flows and five-year summary of key financial data.

10. The balancing equation is expressed as: D

a. Assets + Liabilities = Equity.

b. Revenues – Expenses = Net Income.

c. Sales – Costs = Net Profit.

d. Assets = Liabilities + Equity.

11. Which of the following accounts would be classified as current assets on

the balance sheet? A

a. Cash and cash equivalents, accounts receivable, inventory.

b. Marketable securities, accounts payable, property, plant and

equipment.

c. Prepaid expenses, goodwill, long-term investments.

d. Property, plant and equipment, inventory, goodwill.

12. Which method of inventory assumes the last units purchased will remain in

A

ending inventory on the balance sheet?

a. FIFO.

b. LIFO.

c. Average cost.

d. LIFO and FIFO.

Use the following information to answer questions 13 through 14:

ABC Company purchases five products for sale in the order and at the costs

shown:

Unit Cost per Unit

1 $10

2 $12

3 $15

4 $18

5 $13

13. Assume ABC sells two items and uses the FIFO method of inventory

valuation. What amount would appear in ending inventory on the balance

sheet? B

Nguyen Tan Binh Page |2

Andrews University Financial Statement Analysis Mid-Term

AU12-2023

a. $22

b. $46

c. $45

d. $31

14. Assume ABC sells two items and uses the LIFO method of inventory

valuation. What amount would appear for cost of goods sold on the income

statement? D

a. $37

b. $41

c. $22

d. $31

15. Which equation represents an income statement? C

a. Assets = liabilities + stockholders’ equity.

b. Cash in – cash out = net income.

c. Revenues - expenses = net income.

d. Beginning retained earnings + revenues – expenses = ending retained

earnings.

16. How is a common-size income statement prepared? B

a. Each income statement item is expressed as a percentage of total assets.

b. Each income statement item is expressed as a percentage of net sales.

c. Each income statement item is expressed as a percentage of net

income.

d. Each income statement item is expressed as a percentage of cash flow.

17. How is earnings per common share EPS calculated? C

a. Operating profit divided by the average number of common stock

shares outstanding.

b. Net profit divided by the average number of common and preferred

stock shares outstanding.

c. Operating profit divided by the average number of repurchased

common stock shares.

d. Net profit divided by the average number of common stock shares

outstanding.

Use the following information for Jett Co. to answer questions 18.

2023 2022

Sales 1,000 1,000

COGS 800 700

Operating expenses 100 200

Income tax rate 20% 20%

Nguyen Tan Binh Page |3

Andrews University Financial Statement Analysis Mid-Term

AU12-2023

18. Jett Co.'s gross profit, operating profit and net profit margins for 2023 are:

a. 50.0%, 32.0%, 22.0% respectively. B

b. 20.0%, 10.0%, 8.0%, respectively.

c. 30.0%, 10.0%, 10.0%, respectively.

d. 21.0%, 18.0%, 12.0%, respectively.

19. Identify the following as operating (O), investing (I), or financing (F)

activities:

a. Proceeds from borrowing F

b. Purchases of property, plant and equipment I

c. Cash from sale of a business segment I

d. Interest payments to lenders F

e. Cash from sales of goods and services O

f. Payment of dividends F

g. Payments for purchase of inventory O

h. Payments for taxes O

i. Repurchase of a firm’s own shares F

j. Cash collections from loans to others I

20. Which group of people would be the most concerned about the operating

areas that have contributed to the success of the firm and which have not? B

a. Customers.

b. Management.

c. Auditors.

d. Creditors.

-THE END-

Nguyen Tan Binh Page |4

You might also like

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)From EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Rating: 5 out of 5 stars5/5 (1)

- Afar QuestionsDocument16 pagesAfar QuestionsJessarene Fauni Depante50% (18)

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Practice Multiple Choice Questions For First Test PDFDocument10 pagesPractice Multiple Choice Questions For First Test PDFBringinthehypeNo ratings yet

- Principles of Financial Accounting PDFDocument5 pagesPrinciples of Financial Accounting PDFJia SNo ratings yet

- Quarter Examination-FABM 1 SY 2018-2019Document4 pagesQuarter Examination-FABM 1 SY 2018-2019Raul Soriano Cabanting100% (2)

- Davis Langdon Africa Handbook Jan 2009Document94 pagesDavis Langdon Africa Handbook Jan 2009Caesar 'Dee' Rethabile SerumulaNo ratings yet

- 1st-mock-cpa-board-exam-far-march-24-2022Document20 pages1st-mock-cpa-board-exam-far-march-24-2022nami zeinNo ratings yet

- 5 Question - FinanceDocument19 pages5 Question - FinanceMuhammad IrfanNo ratings yet

- Module 7 QuestionDocument21 pagesModule 7 QuestionWarren MakNo ratings yet

- Business Finance ExamDocument3 pagesBusiness Finance ExamChristian Joy ReyesNo ratings yet

- Quiz 1 - With Answer PDFDocument12 pagesQuiz 1 - With Answer PDFVerlyn ElfaNo ratings yet

- MCQ in Bca-Accounting & CobolDocument20 pagesMCQ in Bca-Accounting & CobolSagar KansalNo ratings yet

- Amoni Edome Coc Sample Exam-Level LLLDocument13 pagesAmoni Edome Coc Sample Exam-Level LLLAmoni EdomeNo ratings yet

- 201 EXM2 XComp Pract Exam MCDocument11 pages201 EXM2 XComp Pract Exam MCvonns80No ratings yet

- Directions: Read Carefully Each Item. Use A Separate Sheet For Your Answers, Write Only TheDocument3 pagesDirections: Read Carefully Each Item. Use A Separate Sheet For Your Answers, Write Only Thehector mabantaNo ratings yet

- Practice Multiple Choice Questions For First Test PDFDocument10 pagesPractice Multiple Choice Questions For First Test PDFBringinthehypeNo ratings yet

- Corporate Finance Trial Questions 2Document11 pagesCorporate Finance Trial Questions 2Sylvia Nana Ama DurowaaNo ratings yet

- Fabm 2Document7 pagesFabm 2eva hernandez528No ratings yet

- Auditing.: A. B. C. DDocument12 pagesAuditing.: A. B. C. DbiniamNo ratings yet

- Accounting 202 Chapter 15 TestansquestiDocument4 pagesAccounting 202 Chapter 15 TestansquestiSandra ReidNo ratings yet

- Accounting and Finance For ManagementDocument42 pagesAccounting and Finance For Managementsuresh84123No ratings yet

- Chapter 3. Mas-Ambray & BasulDocument7 pagesChapter 3. Mas-Ambray & BasulAmbray LynjoyNo ratings yet

- 2022 Sem 1 ACC10007 Practice MCQs - Topic 4Document6 pages2022 Sem 1 ACC10007 Practice MCQs - Topic 4JordanNo ratings yet

- ACC2010 Sample Final ExamDocument19 pagesACC2010 Sample Final ExamHarjot SinghNo ratings yet

- 2022 Sem 1 ACC10007 Practice MCQs - Topic 3Document7 pages2022 Sem 1 ACC10007 Practice MCQs - Topic 3JordanNo ratings yet

- AC503 - Finals Reviewer 2Document10 pagesAC503 - Finals Reviewer 2Ashley Levy San PedroNo ratings yet

- Sample Quiz Question 3Document7 pagesSample Quiz Question 3Sonam Dema DorjiNo ratings yet

- RevisedACFNModelExam - 2023Document15 pagesRevisedACFNModelExam - 2023Eyuel SintayehuNo ratings yet

- Multiple Choiche SolutionsDocument11 pagesMultiple Choiche SolutionsGiulia BarthaNo ratings yet

- Accounting 221Document8 pagesAccounting 221Princess ArceNo ratings yet

- Management Accounting QuizzerDocument7 pagesManagement Accounting QuizzerLorielyn Jundarino TimbolNo ratings yet

- 1Document42 pages1Magdy KamelNo ratings yet

- Lebanese Association of Certified Public Accountants - IFRS July Exam 2018Document8 pagesLebanese Association of Certified Public Accountants - IFRS July Exam 2018jad NasserNo ratings yet

- ACCTBA1 - Sample Quiz 1Document3 pagesACCTBA1 - Sample Quiz 1Marie Beth BondestoNo ratings yet

- Accounting 101 FinalsDocument16 pagesAccounting 101 FinalsDanilo Diniay Jr100% (1)

- Finacc 3 Question Set BDocument9 pagesFinacc 3 Question Set BEza Joy ClaveriasNo ratings yet

- CH 3 Working With Financial StatementsDocument36 pagesCH 3 Working With Financial StatementsYehia mohamed Hassen saleh ١٩١٠٣٩٣٦100% (1)

- Par Cor Accounting Cup - Average Round QuestionsDocument6 pagesPar Cor Accounting Cup - Average Round QuestionsShin YaeNo ratings yet

- Fundamentals of Accountancy, Business & Management 1 Second Grading ExaminationDocument6 pagesFundamentals of Accountancy, Business & Management 1 Second Grading ExaminationMc Clent CervantesNo ratings yet

- Appraisal DrillsDocument9 pagesAppraisal DrillsLyca Morandante LamaneroNo ratings yet

- FarDocument15 pagesFarJulius Lester Abiera100% (1)

- A162 Tutorial 4Document6 pagesA162 Tutorial 4Danny SeeNo ratings yet

- Quiz 1 FIN202Document4 pagesQuiz 1 FIN202Ngọc MinhNo ratings yet

- MODEL EXAM (Dessie)Document19 pagesMODEL EXAM (Dessie)tame kibruNo ratings yet

- Inbound 291317058018293855Document5 pagesInbound 291317058018293855Adrienne AvanceñaNo ratings yet

- AFAR Question PDFDocument16 pagesAFAR Question PDFNhel AlvaroNo ratings yet

- Team PRTC Afar-Finpb - 5.21Document16 pagesTeam PRTC Afar-Finpb - 5.21Nanananana100% (2)

- Activity 3 FinMaDocument6 pagesActivity 3 FinMaDiomela BionganNo ratings yet

- Acctg 12 Premid Exam QuestionnaireDocument11 pagesAcctg 12 Premid Exam QuestionnaireJanet AnotdeNo ratings yet

- FIN202 - Quiz Test 1Document4 pagesFIN202 - Quiz Test 1Nguyen Phuong Linh (k17 HCM)No ratings yet

- Soal Preliminary AccountingDocument10 pagesSoal Preliminary AccountingZara WinterNo ratings yet

- Basic MathDocument6 pagesBasic MathWarda MamasalagatNo ratings yet

- NtantDocument6 pagesNtantmahedreNo ratings yet

- Examination Paper: Instruction To CandidatesDocument11 pagesExamination Paper: Instruction To CandidatesNikesh MunankarmiNo ratings yet

- Final Spring 2021 (B)Document6 pagesFinal Spring 2021 (B)rtgxd25zygNo ratings yet

- Acc. P 2 2021 RevisionDocument8 pagesAcc. P 2 2021 RevisionSowda AhmedNo ratings yet

- Statement of Financial PositionDocument18 pagesStatement of Financial PositionriaNo ratings yet

- Test Bank Financial Accounting TheoryDocument14 pagesTest Bank Financial Accounting TheoryAnas K. B. AbuiweimerNo ratings yet

- 21-22 QUIZ-1 With SolutionsDocument3 pages21-22 QUIZ-1 With SolutionsShubham BansalNo ratings yet

- FPQP Practice Question Workbook: 1,000 Comprehensive Practice Questions (2024 Edition)From EverandFPQP Practice Question Workbook: 1,000 Comprehensive Practice Questions (2024 Edition)No ratings yet

- DTMF Controlled Robot Without MicrocontrollerDocument4 pagesDTMF Controlled Robot Without MicrocontrollershanofaNo ratings yet

- Motor Baldor Rig-9Document18 pagesMotor Baldor Rig-9Joko SusiloNo ratings yet

- Patient Transfer Policy 3.0Document25 pagesPatient Transfer Policy 3.0Val SolidumNo ratings yet

- CadburyDocument12 pagesCadburymldc20110% (1)

- Poem Alam SekitarDocument1 pagePoem Alam SekitarSITI SYAHIRAH BINTI A MALEKNo ratings yet

- Letters and Emails Sent To Shri I.S.YadavDocument12 pagesLetters and Emails Sent To Shri I.S.YadavArman VijayanNo ratings yet

- Rent Receipt - Tax2winDocument5 pagesRent Receipt - Tax2winAdityaNo ratings yet

- Background Medical CountermeasuresDocument7 pagesBackground Medical Countermeasuresapi-246003035No ratings yet

- Strategic Role of Localization in Multi National EnterprisesDocument23 pagesStrategic Role of Localization in Multi National EnterprisesBryan PetroNo ratings yet

- L2 Structural Steel: CE 332: Structural Design IIDocument6 pagesL2 Structural Steel: CE 332: Structural Design IIAbhay VikramNo ratings yet

- Goldberg v. Jenkins and Law.Document6 pagesGoldberg v. Jenkins and Law.GoldFishNo ratings yet

- Sanitary Permit (Front)Document1 pageSanitary Permit (Front)Darwin CustodioNo ratings yet

- Carson Crash LawsuitDocument5 pagesCarson Crash LawsuitABC Action NewsNo ratings yet

- Chemistry Paper 1 - 2018-2003 - QP PDFDocument539 pagesChemistry Paper 1 - 2018-2003 - QP PDFal_helu26No ratings yet

- Unix - Introduction: Prepared by Jadala Vijaya ChandraDocument6 pagesUnix - Introduction: Prepared by Jadala Vijaya ChandraCherukupalli SowjanyaNo ratings yet

- Electrical Discharge MachiningDocument11 pagesElectrical Discharge MachiningRizwan MrnNo ratings yet

- DWF Foundation Grant Guidelines Jan 2022Document4 pagesDWF Foundation Grant Guidelines Jan 2022Saundharaya KhannaNo ratings yet

- Sales - Mamaril Vs Boys Scout PHDocument3 pagesSales - Mamaril Vs Boys Scout PHXing Keet LuNo ratings yet

- Maham Ke Bari GaandDocument13 pagesMaham Ke Bari GaandFaisal GNo ratings yet

- Eddie The Carpet FitterDocument3 pagesEddie The Carpet Fittermaria praveenNo ratings yet

- Walkthrough v1.0.1 CompleteDocument74 pagesWalkthrough v1.0.1 Completemhd.jepri channelNo ratings yet

- Sample Detailed Lesson PlanDocument6 pagesSample Detailed Lesson PlanKarlKarl100% (1)

- Brkipm-2011 - Multicast MplsDocument106 pagesBrkipm-2011 - Multicast MplsmatarakiNo ratings yet

- COST ACCOUNTING JOB-ORDER COSTING ProbleDocument2 pagesCOST ACCOUNTING JOB-ORDER COSTING ProbleEleonora MarinettiNo ratings yet

- PRC Case Completion Form For Midwifery ExamsDocument2 pagesPRC Case Completion Form For Midwifery ExamsNoel84% (31)

- (Download PDF) Handbook of Radar Signal Analysis Advances in Applied Mathematics 1St Edition Bassem R Mahafza Editor Ebook Online Full ChapterDocument53 pages(Download PDF) Handbook of Radar Signal Analysis Advances in Applied Mathematics 1St Edition Bassem R Mahafza Editor Ebook Online Full Chapterradjalvuyo30100% (7)

- Amazon Cognito PrinciplesDocument3 pagesAmazon Cognito PrinciplesHaider HadiNo ratings yet

- BPTP Tera Boq - Split AcDocument36 pagesBPTP Tera Boq - Split AckarunvandnaNo ratings yet

- Strategic Issues in Strategic ManagementDocument23 pagesStrategic Issues in Strategic Managementzakirno19248No ratings yet