Professional Documents

Culture Documents

Broker - Policy Details

Broker - Policy Details

Uploaded by

Venkatesh EESHANCopyright:

Available Formats

You might also like

- Remittance LetterDocument3 pagesRemittance LetterJusta96% (28)

- TC-02 (P)Document17 pagesTC-02 (P)Prabhnoor Kaur100% (4)

- RIBA AgreementDocument60 pagesRIBA AgreementMadhini Prathaban100% (2)

- (Part - B) DM UPDATED 2023Document173 pages(Part - B) DM UPDATED 2023shivaNo ratings yet

- Redwood Pharma Poison Price List 26.08.2023Document18 pagesRedwood Pharma Poison Price List 26.08.2023suhaime tshNo ratings yet

- Analytics Manager Assignment - P&A TeamDocument8 pagesAnalytics Manager Assignment - P&A TeamHHP13579No ratings yet

- Ba50 BH (Zrta) DB BDW UltDocument2 pagesBa50 BH (Zrta) DB BDW Ultdhammika karunasingheNo ratings yet

- Valleyview - T CR Soc: Bulldog Atmxt1664T3-C2Ur Galway Atmxt1667T2-C2UrDocument44 pagesValleyview - T CR Soc: Bulldog Atmxt1664T3-C2Ur Galway Atmxt1667T2-C2Urserrano.flia.co100% (1)

- CRD 400 en 02 Digital ReaderDocument4 pagesCRD 400 en 02 Digital ReaderSDLC100% (1)

- Manheim - Post-Sale Results - Vehicle Listing PDFDocument12 pagesManheim - Post-Sale Results - Vehicle Listing PDFchill mainNo ratings yet

- Gmon WlanDocument20 pagesGmon WlankoncypikeNo ratings yet

- MCS Certificate by Intertek PDFDocument3 pagesMCS Certificate by Intertek PDFtarunNo ratings yet

- DisqualifiedDirectorsBangaloreScanned19092017 2 PDFDocument728 pagesDisqualifiedDirectorsBangaloreScanned19092017 2 PDFniki2512No ratings yet

- Airtel Digital TV DTH FAQsDocument8 pagesAirtel Digital TV DTH FAQsSushubh100% (7)

- Airtel DocumentDocument6 pagesAirtel Documenttanmay100No ratings yet

- CSC 2 0 Digital Seva Connect v1.1Document41 pagesCSC 2 0 Digital Seva Connect v1.1AzImm100% (1)

- School Book Maths Test Percentage - 1 Key PDFDocument2 pagesSchool Book Maths Test Percentage - 1 Key PDFPriya suresh100% (1)

- MB Memory Am4 6L2O VermeerDocument16 pagesMB Memory Am4 6L2O VermeersisonvherNo ratings yet

- Logcat CSC Compare LogDocument2,491 pagesLogcat CSC Compare LogCosmin TironNo ratings yet

- STS Chapter 3Document5 pagesSTS Chapter 3krung krung biNo ratings yet

- Something Happened To Me Yesterday: © Felix Aeppli 01-2017Document76 pagesSomething Happened To Me Yesterday: © Felix Aeppli 01-2017franckf97No ratings yet

- White Mans Burden With Questions - With AnnotatinsDocument4 pagesWhite Mans Burden With Questions - With AnnotatinsSalim AbNo ratings yet

- Oxiinc PDFDocument2 pagesOxiinc PDFChandan kumar singhNo ratings yet

- ROULUNDS RUBBER - Korea - JapanDocument60 pagesROULUNDS RUBBER - Korea - JapanВладимир АнаймановичNo ratings yet

- Logcat Prev CSC LogDocument1,630 pagesLogcat Prev CSC LogRuth GonzálezNo ratings yet

- Tek No Speed Pumps by LowaraDocument20 pagesTek No Speed Pumps by LowaraCatalin Frincu100% (1)

- Medius Technologies - Technical Round WADocument15 pagesMedius Technologies - Technical Round WAJaya BhatiaNo ratings yet

- Asterix The Twelve Tasks Original 2022 English 1Document8 pagesAsterix The Twelve Tasks Original 2022 English 1Giorgio LeoneNo ratings yet

- Scaffeze Plus MSDSDocument6 pagesScaffeze Plus MSDSMaterial Coordinator - WLNo ratings yet

- Penilaian Kls X Kur 13Document8 pagesPenilaian Kls X Kur 13Meiana PrimahatiNo ratings yet

- Cold AisleDocument20 pagesCold Aisleyogesh chandrayanNo ratings yet

- Tsto25vbzctg1fj5nyu1fi0bDocument2 pagesTsto25vbzctg1fj5nyu1fi0bmannish sarawagiNo ratings yet

- Shrimantee Roy - ResumeDocument3 pagesShrimantee Roy - ResumeShrimantee RoyNo ratings yet

- Certificates Revised 18042022Document102 pagesCertificates Revised 18042022sreedev sureshbabuNo ratings yet

- Norms 2077-078 Dhanusadham DCSDocument12 pagesNorms 2077-078 Dhanusadham DCSShivshankar mahatoNo ratings yet

- 6 LiFePO4-Battery-Pack-UU24-100Document6 pages6 LiFePO4-Battery-Pack-UU24-100Anibal GarciaNo ratings yet

- Hansa - 2015.06Document108 pagesHansa - 2015.06Alessandro CastagnaNo ratings yet

- Week 15 PDFDocument23 pagesWeek 15 PDFGerlie V. ArribaNo ratings yet

- Bihar Sharif Smart City ProposalDocument92 pagesBihar Sharif Smart City ProposalDrAshutosh KumarNo ratings yet

- TC200 - Om 2Document192 pagesTC200 - Om 2DmitryNo ratings yet

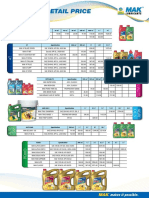

- Maximum Retail Price: 2T Specification 20 40 60 250 500 1 5Document2 pagesMaximum Retail Price: 2T Specification 20 40 60 250 500 1 5Nitansh GuptaNo ratings yet

- Alg 1Document102 pagesAlg 1nilufarkomiljonovna21No ratings yet

- Shotguns, Rifles, Accessories, Ammunition & Equipment: CATALOG 2022Document116 pagesShotguns, Rifles, Accessories, Ammunition & Equipment: CATALOG 2022Alain DNo ratings yet

- SPAN 1001 - Examen FinalDocument6 pagesSPAN 1001 - Examen Finaljaviermd85No ratings yet

- ICICI Direct On AU Small Finance Bank Reverse Arbitrage OpportunityDocument5 pagesICICI Direct On AU Small Finance Bank Reverse Arbitrage OpportunityamsukdNo ratings yet

- IC Event Proposal 9053 - WORDDocument3 pagesIC Event Proposal 9053 - WORDAmandah de SilvaNo ratings yet

- Esp32 Devkit 4Document9 pagesEsp32 Devkit 4Idin FahrudinNo ratings yet

- Customer's Declaration: Assessment of Suitability and Appropriateness For Sale of Third Party ProductsDocument16 pagesCustomer's Declaration: Assessment of Suitability and Appropriateness For Sale of Third Party ProductsPanchu SwainNo ratings yet

- User Manual Universal Remote: Marketed byDocument15 pagesUser Manual Universal Remote: Marketed byDhanu85No ratings yet

- GDSC LPU Info Session - 2023Document54 pagesGDSC LPU Info Session - 2023GDSC LPUNo ratings yet

- 2018 Ambiente Frankfurt ExhibitorsDocument16 pages2018 Ambiente Frankfurt Exhibitorscheng yifangNo ratings yet

- BoI Customer Care Complaint AddressDocument5 pagesBoI Customer Care Complaint AddressvndeshmukhNo ratings yet

- Ola Fleet Technologies Private Limited: AddressDocument1 pageOla Fleet Technologies Private Limited: AddressMukesh PadwalNo ratings yet

- BGS Cca - 1 (D2.2)Document22 pagesBGS Cca - 1 (D2.2)Prathamesh DhamdhereNo ratings yet

- Ups UrduDocument19 pagesUps UrduShah Moeen ud DeenNo ratings yet

- Quotation Number Quotation DateDocument3 pagesQuotation Number Quotation DateArvind PokhariyalNo ratings yet

- DownloadDocument20 pagesDownloadTALHA MONDAL (my.selftalha)No ratings yet

- Driver Full PunjabiDocument180 pagesDriver Full PunjabiKevin BarrientosNo ratings yet

- 653-Article Text-2582-4-10-20210723Document11 pages653-Article Text-2582-4-10-20210723nisa hamzahNo ratings yet

- Santosh Kumar Patna BajajDocument8 pagesSantosh Kumar Patna Bajajbindia.devinewNo ratings yet

- 7805 Circuit AnalysisDocument25 pages7805 Circuit Analysisgrb2m2z92No ratings yet

- Broker - Policy DetailsBIKKYDocument1 pageBroker - Policy DetailsBIKKYBrijesh EnterprisesNo ratings yet

- Doc-20230604-Wa0004 230625 211038Document4 pagesDoc-20230604-Wa0004 230625 211038Manu DevangNo ratings yet

- Junior Appellant Script MootDocument11 pagesJunior Appellant Script MootZati ZainalNo ratings yet

- Addendum 2 - The FIDIC Short Form of ContractDocument11 pagesAddendum 2 - The FIDIC Short Form of Contractronald7898No ratings yet

- Rent AggrementDocument2 pagesRent AggrementparimalinNo ratings yet

- Strickland v. ErnstDocument15 pagesStrickland v. Ernstfaye wongNo ratings yet

- Sarsosa Vda de Barsobia Vs Cuenco To Ong Ching Po Vs CADocument4 pagesSarsosa Vda de Barsobia Vs Cuenco To Ong Ching Po Vs CAMariaAyraCelinaBatacanNo ratings yet

- Essential Foundations of Economics 7th Edition Bade Test BankDocument11 pagesEssential Foundations of Economics 7th Edition Bade Test BankMatthewCurryeaqy100% (36)

- 43 MA - Prop Page43Document1 page43 MA - Prop Page43Anonymous syqUJjyNo ratings yet

- Pakistan Internation Airlines Corp. v. OpleDocument2 pagesPakistan Internation Airlines Corp. v. OpleiwamawiNo ratings yet

- Sale of Goods Implied TermsDocument4 pagesSale of Goods Implied TermsOkello MosesNo ratings yet

- DoorDocument4 pagesDoorapi-3807149No ratings yet

- Board Infinity - Terms and Conditions For LearnersDocument5 pagesBoard Infinity - Terms and Conditions For Learnersthrinadh vunnamNo ratings yet

- Shared Space Rental Agreement TemplateDocument3 pagesShared Space Rental Agreement TemplateMaria KryszkiewiczNo ratings yet

- PARTNERSHIP AGREEMENT Located in The State of TennesseeDocument12 pagesPARTNERSHIP AGREEMENT Located in The State of TennesseenowayNo ratings yet

- Uson Vs DiosomitoDocument1 pageUson Vs DiosomitoCJNo ratings yet

- Amendment To ContractDocument5 pagesAmendment To ContractJohn TomlinNo ratings yet

- Transfer of Risk Under Sales of GoodsDocument5 pagesTransfer of Risk Under Sales of GoodsVishal BothraNo ratings yet

- UntitledDocument52 pagesUntitledYEN YEN CHONGNo ratings yet

- PromoterDocument25 pagesPromotergauravNo ratings yet

- B.A.LL.B 2017-22, 8th SemesterDocument3 pagesB.A.LL.B 2017-22, 8th SemesterAnkit KumarNo ratings yet

- Assignment 1Document1 pageAssignment 1Darius KingNo ratings yet

- SPEC PRO ReviewerDocument7 pagesSPEC PRO ReviewerEndless Summer Shakes100% (1)

- CASE 31 - Rizal Commercial Banking Corporation v. CA 2Document1 pageCASE 31 - Rizal Commercial Banking Corporation v. CA 2Aquiline ReedNo ratings yet

- Distinction Between Real Rights and Personal RightsDocument1 pageDistinction Between Real Rights and Personal RightsMzingisi TuswaNo ratings yet

- SKF MB 27 SpecificationDocument3 pagesSKF MB 27 SpecificationMohamed AliNo ratings yet

- ARTICLE 1797: Distribution of Profits and Losses Among PartnersDocument7 pagesARTICLE 1797: Distribution of Profits and Losses Among PartnersBOEN YATORNo ratings yet

- Agrarian Law Case Digest Matrix Set 1Document26 pagesAgrarian Law Case Digest Matrix Set 1Stef Macapagal100% (7)

- Prerequisites of Collective Bargaining: Sahil Pahwa B.B.A.LL.B (Hons.) V SemesterDocument9 pagesPrerequisites of Collective Bargaining: Sahil Pahwa B.B.A.LL.B (Hons.) V Semesterricky2bail_219340830No ratings yet

Broker - Policy Details

Broker - Policy Details

Uploaded by

Venkatesh EESHANOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Broker - Policy Details

Broker - Policy Details

Uploaded by

Venkatesh EESHANCopyright:

Available Formats

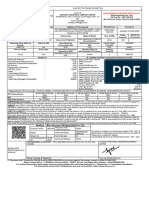

MISC & SPL TYPE OF VECHLES (D) CERT-CUM-POLICY SCHEDULE

Policy No. HERO INSURANCE BROKING INDIA PVT LTD.

HDFC ERGO General Insurance Company Limited. IRDA Registration No.: 649

2316910225254600000

Toll-Free No.: 1800 102 4376

Tel:09390-101202 264, Okhla Ind. Estate, Phase-III, Delhi-110020

www.hdfcergo.com

Insured Business/Profession Address of The Insured Valid From To

S O RAMANNA,18-7,PATHRAPURAM

GRAMAM,VENKATAPURAM

Mr VASAM BALAKRISHNA Self Employed MANDALAM,PALEM G PATHRAPURAM 16-05-2023 03:25:50 Midnight of 15-05-2024

ANDHRA PRADESH Khammam TELANGANA

507133

Vehicle Regn No. Engine No. Frame Trailor Make & Model Year of Mfg Customer Cubic

No. Frame No. GSTIN No. Capacity/HP

T0536341 ESCORTS LTD NA

New E3715829 46KM EURO 42 2023 44

Vehicle IDV Trailor IDV Vehicle Type Non-Electrical Electrical Accessories CNG/LPG/Bi- Total IDV

Accessories IDV IDV Fuel IDV

760000.00 0.00 Tractor-Agriculture 0.00 0.00 0.00 760000.00

Place of Regn. Body Type HP/Lease/Hire- Branch Office of Seating Capacity Premium

Purchase Agreement HP/Lease/Hire-

With Purchase

TS 25 Jayashankar INDUSIND BANK LTD,

--- --- 1 11093.00

Bhupalpally HPA

A. Own Damage Premium Computation (Section 1) in Rs. B. Liability Premium Computation (Section II) in Rs.

Basic Premium On Basic Premium Including Premium for TPPD

Vehicle : 1809.00 Vehicle : 7267.00

Accessories : 0.00 CNG/LPG/Bi-Fuel Kit/Trailor : 0.00

Electronic & Electrical Accessories : 0.00 Add

Bi-Fuel Kit : 0.00 a) Compulsory PA Cover (Owner Driver) : 325.00

Total : 1809.00 Legal Liability

Add Extras: d) Legal Liability Cover (Paid Drivers, Cleaners) : 0.00

Geographical Extension : 0.00 e) Legal Liability Cover (Other then Paid Drivers, Cleaners) : 0.00

For any other extra : Sub-Total Additions : 325.00

Sub Total : 1809.00 Total Liablity Premium (B) : 7592.00

Less Discounts Total Premium (A + B) : 9401.00

For anti-theft devices : 0.00 For any other extra : 0.00

Voluntary Deductibles : 0.00 SGST@ 9% : 846.09

AA Membership : 0.00 CGST@ 9% : 846.09

NCB : 0.00 Gross Premium : 11093.00

Total Deductions : 0.00

Net Own Damage Premium(A) : 1809.00

1.RegistrationNo.:146 || 2.CINNo.:U66030MH2007PLC177117 ||4.GSTIN No.36AABCL5045N1Z9 ||UIN No.-IRDAN125P0005V01200203

CPA (1) Rs. 15 lakhs.

LIMIT OF LIABILITY: Limit of the amount of the Company's liability under the Section II-I(i) in respect of any one accident as per M.V. Act 1988. Limit of the

amount of the Company's liability under Secion II-I(ii) in respect of any one claim or series of claims arising out of one event : Upto Rs

I/We certify that the policy to which the certificate relates as well the certificate of insurance are issued in accordance with the provisions of Chapter X & XI

of M.V. Act 1988

Hero Insurance Broking India Pvt. Ltd.

Premium of Rs. 11093.00 Received Vide

Cash/Cheque No.

The policy is subject to a compulsory excess of Rs. 2000/-

& Depreciation is applicable as per policy terms &

Dated Nominee Name RAMANA conditions* (Please turn overleaf for details)

Drawn on Nominee Age 60 Consolidated Stamp Duty Paid

Endorsements: IMT - 21,36,5

Acknowledgement Dt 16-05- Nominee Relation Father

2023

FOR RENEWALS CONTACT: MALLISHWARI BANKA Ph.No- 09390- On behalf of HDFC ERGO General Insurance Company

101202 Limited.

16-May-2023

Date & Signature of

proposer

Dealer's Stamp & Signature Duly Constituted Attorney

Regd. & Head Office : Regd. & Head Office : 1st Floor,HDFC House, 165 - 166 Backbay Reclamation,H. T. Parekh Marg, Churchgate, Mumbai - 400 020

Order Certificate Number– CSD/105/2021/2914 Date 03-08-2021

For further information about motor insurance policy please also visit http://irda.gov.in >> Grievances >> Policyholder Handbooks

AVOIDANCE OF CERTAIN TERMS AND RIGHT TO RECOVERY

Nothing in this Policy or and endorsement hereon shall affect the right of any person indemnified by this policy or any other person to recover an amount

under or by virtue of the Provisions of the Motor Vehicles Act.

But the Insured shall repay to the Company all sums paid by the Company which Company would not have been liable to pay but for the said provisions..

IMPORTANT:--IN THE EVENT OF TRANSFER OF OWNERSHIP, INSURANCE IS NOT AUTOMATICALLY TRANSFERRED IN THE NAME OF TRANSFEREE UNLESS

APPLICATION IS MADE WITHIN FOURTEEN DAYS THERE OF SEEKING TRANSFER OF INSURANCE .

LIMITATIONS AS TO USE: The Policy covers use of the vehicle for any purpose other than: a) Hire Or Reward b) Carriage of goods (other than samples or

personal luggage) c) Organized Racing d) Pace Making e) Speed Testing f) Reliability Trials g) Any purpose in connection with Motor Trade.

IMPORTANT NOTICE: The insured is not indemified if the vehicle is used or driven otherwise than in accordance with this Schedule. Any payment made by

the company by reason of wider terms appearing in the Certificate in order to comply with the Motor Vehicle Act, 1988 is recoverable from the insured. See

the clause headed 'AVOIDANCE OF CERTAIN TERMS AND RIGHTS OF RECOVERY'

DRIVER: Any person including insured: Provided that a person driving holds an effective driving licence at the time of the accident and is not disqualified from

Holding or obtaining such a licence.Provided also that the person holding an effective Learner's Licence may also drive the vehicle and that such a person

satisfies the requirements of Rule 3 of the Central Motor Vehicle Rules, 1989.

SCHEDULE OF DEPRECIATION FOR ARRIVING AT IDV

AGE OF THE VEHICLE RATE OF DEPRECIATION FOR FIXING IDV

Not Exceeding 6 months 5%

Exceeding 6 months but not exceeding 1 year 15%

Exceeding 1 year but not exceeding 2 years 20%

Exceeding 2 year but not exceeding 3 years 30%

Exceeding 3 year but not exceeding 4 years 40%

Exceeding 4 year but not exceeding 5 years 50%

Depreciation of Parts for Partial Loss Claims

a. Rate of depreciation for all rubber/nylon/plastic parts, tyres and tubes, batteries and air bags 50%

b. Rate of depreciation for all fibre glass components 30%

c. Rate of depreciation for all parts made of glass NIL

d. Rate of depreciation for all other parts including wooden parts is to be as per the following schedule:

AGE OF THE VEHICLE RATE DEPRECIATION

Not exceeding 6 months NIL

Exceeding 6 months but not exceeding 1 year 5%

Exceeding 1 year but not exceeding 2 years 10%

Exceeding 2 year but not exceeding 3 years 15%

Exceeding 3 year but not exceeding 4 years 25%

Exceeding 4 year but not exceeding 5 years 35%

Exceeding 5 year but not exceeding 10 years 40%

Exceeding 10 years 50%

e. Rate of Depreciation for Painting:- In the case of painting, the depreciation rate of 50% shall be applied only on the

material cost of total painting charges. In case of a consolidated bill for painting charges, the material component shall be

considered as 25% of the total painting charges for the purpose of applying the depreciation.

* No renewal discount.

DO'S FOR THE INSURED

1. In the event of accident to the vehicle, please Inform in writing to the authorised dealer &/ or Insurance Company's office immediately.

2. Please complete and sign the claim form.

3. Documents like claim form, original driving licence, original registration certificates, copy of policy, police report (In case of the theft/third party loss) and

Satisfaction Voucher be submitted to the authorised Dealer.

4. If the vehicle is to be repaired at a workshop other than authorized workshop, please intimate to the nearest office of HDFC ERGO General Insurance

Company Limited. along with copy of policy for appointment of surveyor to assess the loss.

DONT'S FOR THE INSURED

1. In case of Third Party Loss/ extensive Damage to own vehicle inform the police for obtaining proper F.I.R. and do not admit any liability or enter in to any

compromise without written consent of the Insurance Company.

2. Do not proceed with the repairs or replacement job unless approved by the Insurer/authorized surveyor.

You might also like

- Remittance LetterDocument3 pagesRemittance LetterJusta96% (28)

- TC-02 (P)Document17 pagesTC-02 (P)Prabhnoor Kaur100% (4)

- RIBA AgreementDocument60 pagesRIBA AgreementMadhini Prathaban100% (2)

- (Part - B) DM UPDATED 2023Document173 pages(Part - B) DM UPDATED 2023shivaNo ratings yet

- Redwood Pharma Poison Price List 26.08.2023Document18 pagesRedwood Pharma Poison Price List 26.08.2023suhaime tshNo ratings yet

- Analytics Manager Assignment - P&A TeamDocument8 pagesAnalytics Manager Assignment - P&A TeamHHP13579No ratings yet

- Ba50 BH (Zrta) DB BDW UltDocument2 pagesBa50 BH (Zrta) DB BDW Ultdhammika karunasingheNo ratings yet

- Valleyview - T CR Soc: Bulldog Atmxt1664T3-C2Ur Galway Atmxt1667T2-C2UrDocument44 pagesValleyview - T CR Soc: Bulldog Atmxt1664T3-C2Ur Galway Atmxt1667T2-C2Urserrano.flia.co100% (1)

- CRD 400 en 02 Digital ReaderDocument4 pagesCRD 400 en 02 Digital ReaderSDLC100% (1)

- Manheim - Post-Sale Results - Vehicle Listing PDFDocument12 pagesManheim - Post-Sale Results - Vehicle Listing PDFchill mainNo ratings yet

- Gmon WlanDocument20 pagesGmon WlankoncypikeNo ratings yet

- MCS Certificate by Intertek PDFDocument3 pagesMCS Certificate by Intertek PDFtarunNo ratings yet

- DisqualifiedDirectorsBangaloreScanned19092017 2 PDFDocument728 pagesDisqualifiedDirectorsBangaloreScanned19092017 2 PDFniki2512No ratings yet

- Airtel Digital TV DTH FAQsDocument8 pagesAirtel Digital TV DTH FAQsSushubh100% (7)

- Airtel DocumentDocument6 pagesAirtel Documenttanmay100No ratings yet

- CSC 2 0 Digital Seva Connect v1.1Document41 pagesCSC 2 0 Digital Seva Connect v1.1AzImm100% (1)

- School Book Maths Test Percentage - 1 Key PDFDocument2 pagesSchool Book Maths Test Percentage - 1 Key PDFPriya suresh100% (1)

- MB Memory Am4 6L2O VermeerDocument16 pagesMB Memory Am4 6L2O VermeersisonvherNo ratings yet

- Logcat CSC Compare LogDocument2,491 pagesLogcat CSC Compare LogCosmin TironNo ratings yet

- STS Chapter 3Document5 pagesSTS Chapter 3krung krung biNo ratings yet

- Something Happened To Me Yesterday: © Felix Aeppli 01-2017Document76 pagesSomething Happened To Me Yesterday: © Felix Aeppli 01-2017franckf97No ratings yet

- White Mans Burden With Questions - With AnnotatinsDocument4 pagesWhite Mans Burden With Questions - With AnnotatinsSalim AbNo ratings yet

- Oxiinc PDFDocument2 pagesOxiinc PDFChandan kumar singhNo ratings yet

- ROULUNDS RUBBER - Korea - JapanDocument60 pagesROULUNDS RUBBER - Korea - JapanВладимир АнаймановичNo ratings yet

- Logcat Prev CSC LogDocument1,630 pagesLogcat Prev CSC LogRuth GonzálezNo ratings yet

- Tek No Speed Pumps by LowaraDocument20 pagesTek No Speed Pumps by LowaraCatalin Frincu100% (1)

- Medius Technologies - Technical Round WADocument15 pagesMedius Technologies - Technical Round WAJaya BhatiaNo ratings yet

- Asterix The Twelve Tasks Original 2022 English 1Document8 pagesAsterix The Twelve Tasks Original 2022 English 1Giorgio LeoneNo ratings yet

- Scaffeze Plus MSDSDocument6 pagesScaffeze Plus MSDSMaterial Coordinator - WLNo ratings yet

- Penilaian Kls X Kur 13Document8 pagesPenilaian Kls X Kur 13Meiana PrimahatiNo ratings yet

- Cold AisleDocument20 pagesCold Aisleyogesh chandrayanNo ratings yet

- Tsto25vbzctg1fj5nyu1fi0bDocument2 pagesTsto25vbzctg1fj5nyu1fi0bmannish sarawagiNo ratings yet

- Shrimantee Roy - ResumeDocument3 pagesShrimantee Roy - ResumeShrimantee RoyNo ratings yet

- Certificates Revised 18042022Document102 pagesCertificates Revised 18042022sreedev sureshbabuNo ratings yet

- Norms 2077-078 Dhanusadham DCSDocument12 pagesNorms 2077-078 Dhanusadham DCSShivshankar mahatoNo ratings yet

- 6 LiFePO4-Battery-Pack-UU24-100Document6 pages6 LiFePO4-Battery-Pack-UU24-100Anibal GarciaNo ratings yet

- Hansa - 2015.06Document108 pagesHansa - 2015.06Alessandro CastagnaNo ratings yet

- Week 15 PDFDocument23 pagesWeek 15 PDFGerlie V. ArribaNo ratings yet

- Bihar Sharif Smart City ProposalDocument92 pagesBihar Sharif Smart City ProposalDrAshutosh KumarNo ratings yet

- TC200 - Om 2Document192 pagesTC200 - Om 2DmitryNo ratings yet

- Maximum Retail Price: 2T Specification 20 40 60 250 500 1 5Document2 pagesMaximum Retail Price: 2T Specification 20 40 60 250 500 1 5Nitansh GuptaNo ratings yet

- Alg 1Document102 pagesAlg 1nilufarkomiljonovna21No ratings yet

- Shotguns, Rifles, Accessories, Ammunition & Equipment: CATALOG 2022Document116 pagesShotguns, Rifles, Accessories, Ammunition & Equipment: CATALOG 2022Alain DNo ratings yet

- SPAN 1001 - Examen FinalDocument6 pagesSPAN 1001 - Examen Finaljaviermd85No ratings yet

- ICICI Direct On AU Small Finance Bank Reverse Arbitrage OpportunityDocument5 pagesICICI Direct On AU Small Finance Bank Reverse Arbitrage OpportunityamsukdNo ratings yet

- IC Event Proposal 9053 - WORDDocument3 pagesIC Event Proposal 9053 - WORDAmandah de SilvaNo ratings yet

- Esp32 Devkit 4Document9 pagesEsp32 Devkit 4Idin FahrudinNo ratings yet

- Customer's Declaration: Assessment of Suitability and Appropriateness For Sale of Third Party ProductsDocument16 pagesCustomer's Declaration: Assessment of Suitability and Appropriateness For Sale of Third Party ProductsPanchu SwainNo ratings yet

- User Manual Universal Remote: Marketed byDocument15 pagesUser Manual Universal Remote: Marketed byDhanu85No ratings yet

- GDSC LPU Info Session - 2023Document54 pagesGDSC LPU Info Session - 2023GDSC LPUNo ratings yet

- 2018 Ambiente Frankfurt ExhibitorsDocument16 pages2018 Ambiente Frankfurt Exhibitorscheng yifangNo ratings yet

- BoI Customer Care Complaint AddressDocument5 pagesBoI Customer Care Complaint AddressvndeshmukhNo ratings yet

- Ola Fleet Technologies Private Limited: AddressDocument1 pageOla Fleet Technologies Private Limited: AddressMukesh PadwalNo ratings yet

- BGS Cca - 1 (D2.2)Document22 pagesBGS Cca - 1 (D2.2)Prathamesh DhamdhereNo ratings yet

- Ups UrduDocument19 pagesUps UrduShah Moeen ud DeenNo ratings yet

- Quotation Number Quotation DateDocument3 pagesQuotation Number Quotation DateArvind PokhariyalNo ratings yet

- DownloadDocument20 pagesDownloadTALHA MONDAL (my.selftalha)No ratings yet

- Driver Full PunjabiDocument180 pagesDriver Full PunjabiKevin BarrientosNo ratings yet

- 653-Article Text-2582-4-10-20210723Document11 pages653-Article Text-2582-4-10-20210723nisa hamzahNo ratings yet

- Santosh Kumar Patna BajajDocument8 pagesSantosh Kumar Patna Bajajbindia.devinewNo ratings yet

- 7805 Circuit AnalysisDocument25 pages7805 Circuit Analysisgrb2m2z92No ratings yet

- Broker - Policy DetailsBIKKYDocument1 pageBroker - Policy DetailsBIKKYBrijesh EnterprisesNo ratings yet

- Doc-20230604-Wa0004 230625 211038Document4 pagesDoc-20230604-Wa0004 230625 211038Manu DevangNo ratings yet

- Junior Appellant Script MootDocument11 pagesJunior Appellant Script MootZati ZainalNo ratings yet

- Addendum 2 - The FIDIC Short Form of ContractDocument11 pagesAddendum 2 - The FIDIC Short Form of Contractronald7898No ratings yet

- Rent AggrementDocument2 pagesRent AggrementparimalinNo ratings yet

- Strickland v. ErnstDocument15 pagesStrickland v. Ernstfaye wongNo ratings yet

- Sarsosa Vda de Barsobia Vs Cuenco To Ong Ching Po Vs CADocument4 pagesSarsosa Vda de Barsobia Vs Cuenco To Ong Ching Po Vs CAMariaAyraCelinaBatacanNo ratings yet

- Essential Foundations of Economics 7th Edition Bade Test BankDocument11 pagesEssential Foundations of Economics 7th Edition Bade Test BankMatthewCurryeaqy100% (36)

- 43 MA - Prop Page43Document1 page43 MA - Prop Page43Anonymous syqUJjyNo ratings yet

- Pakistan Internation Airlines Corp. v. OpleDocument2 pagesPakistan Internation Airlines Corp. v. OpleiwamawiNo ratings yet

- Sale of Goods Implied TermsDocument4 pagesSale of Goods Implied TermsOkello MosesNo ratings yet

- DoorDocument4 pagesDoorapi-3807149No ratings yet

- Board Infinity - Terms and Conditions For LearnersDocument5 pagesBoard Infinity - Terms and Conditions For Learnersthrinadh vunnamNo ratings yet

- Shared Space Rental Agreement TemplateDocument3 pagesShared Space Rental Agreement TemplateMaria KryszkiewiczNo ratings yet

- PARTNERSHIP AGREEMENT Located in The State of TennesseeDocument12 pagesPARTNERSHIP AGREEMENT Located in The State of TennesseenowayNo ratings yet

- Uson Vs DiosomitoDocument1 pageUson Vs DiosomitoCJNo ratings yet

- Amendment To ContractDocument5 pagesAmendment To ContractJohn TomlinNo ratings yet

- Transfer of Risk Under Sales of GoodsDocument5 pagesTransfer of Risk Under Sales of GoodsVishal BothraNo ratings yet

- UntitledDocument52 pagesUntitledYEN YEN CHONGNo ratings yet

- PromoterDocument25 pagesPromotergauravNo ratings yet

- B.A.LL.B 2017-22, 8th SemesterDocument3 pagesB.A.LL.B 2017-22, 8th SemesterAnkit KumarNo ratings yet

- Assignment 1Document1 pageAssignment 1Darius KingNo ratings yet

- SPEC PRO ReviewerDocument7 pagesSPEC PRO ReviewerEndless Summer Shakes100% (1)

- CASE 31 - Rizal Commercial Banking Corporation v. CA 2Document1 pageCASE 31 - Rizal Commercial Banking Corporation v. CA 2Aquiline ReedNo ratings yet

- Distinction Between Real Rights and Personal RightsDocument1 pageDistinction Between Real Rights and Personal RightsMzingisi TuswaNo ratings yet

- SKF MB 27 SpecificationDocument3 pagesSKF MB 27 SpecificationMohamed AliNo ratings yet

- ARTICLE 1797: Distribution of Profits and Losses Among PartnersDocument7 pagesARTICLE 1797: Distribution of Profits and Losses Among PartnersBOEN YATORNo ratings yet

- Agrarian Law Case Digest Matrix Set 1Document26 pagesAgrarian Law Case Digest Matrix Set 1Stef Macapagal100% (7)

- Prerequisites of Collective Bargaining: Sahil Pahwa B.B.A.LL.B (Hons.) V SemesterDocument9 pagesPrerequisites of Collective Bargaining: Sahil Pahwa B.B.A.LL.B (Hons.) V Semesterricky2bail_219340830No ratings yet