Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

0 viewsDocument 65

Document 65

Uploaded by

Anil JainRate making refers to the process insurance companies use to determine the premiums they charge. It aims to set fair and adequate premiums while ensuring rates are not excessive or unfairly discriminatory. Key terms in rate making include the pure premium, loading, gross rate, and gross premium. Regulators also establish objectives for rates to be adequate, not excessive, and not unfairly discriminatory. Actuaries determine life insurance premiums based on expected future loss payments discounted to the present and adjusted for expenses and profit to set the gross premium.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- INS21Document110 pagesINS21pav_43675% (12)

- Principles of Insurance Law with Case StudiesFrom EverandPrinciples of Insurance Law with Case StudiesRating: 5 out of 5 stars5/5 (1)

- Chapter 15 International FinanceDocument31 pagesChapter 15 International FinanceSANANDITA DASGUPTA 1723585100% (1)

- INS21 - Revision GuideDocument112 pagesINS21 - Revision GuideManish Mahaseth100% (1)

- General Insurance INS21Document78 pagesGeneral Insurance INS21geoscribblesNo ratings yet

- INS21 Basic NotesDocument61 pagesINS21 Basic Notesashher.aamir1858100% (1)

- INS21 SoftbookDocument111 pagesINS21 SoftbookShrestha Mohanty100% (1)

- The Cherokee Nation of Indians - King 1898Document15 pagesThe Cherokee Nation of Indians - King 1898Kassandra M JournalistNo ratings yet

- Full Pfrs Vs Pfrs For Smes PDFDocument21 pagesFull Pfrs Vs Pfrs For Smes PDFPaula Merriles100% (2)

- Internship Report On District Comptroller of Accounts HaripurDocument75 pagesInternship Report On District Comptroller of Accounts HaripurFaisal AwanNo ratings yet

- The First Lutheran Church Endowment Fund By-LawsDocument7 pagesThe First Lutheran Church Endowment Fund By-LawspostscriptNo ratings yet

- The Rise and Fall of The Montana FreemenDocument30 pagesThe Rise and Fall of The Montana FreemenB Cross Junior100% (1)

- Rate Making: How Insurance Premiums Are SetDocument4 pagesRate Making: How Insurance Premiums Are SetSai Teja NadellaNo ratings yet

- CH 6 Insurance Company Operations PDFDocument22 pagesCH 6 Insurance Company Operations PDFMonika RehmanNo ratings yet

- InsuranceDocument14 pagesInsuranceWanangwa ChiumeNo ratings yet

- Lecture 8 InsuranceDocument8 pagesLecture 8 InsuranceAnna BrasoveanNo ratings yet

- Introduction To Insurance Risk and Insurance Unit 3Document17 pagesIntroduction To Insurance Risk and Insurance Unit 3Harsha MathadNo ratings yet

- Insurance ManagementDocument71 pagesInsurance Managementmesfinabera180No ratings yet

- INS 21 - Chapter 1 - Insurance - What Is ITDocument9 pagesINS 21 - Chapter 1 - Insurance - What Is ITRaghuNo ratings yet

- 96190Document107 pages96190vazeli2004No ratings yet

- Clark 6Document55 pagesClark 6thisisghostactualNo ratings yet

- Insurance PremiumDocument28 pagesInsurance PremiumRaghav100% (1)

- Computation of Premium of Life Insurance PlansDocument9 pagesComputation of Premium of Life Insurance PlansAbhishek Singh PariharNo ratings yet

- Notes 4Document13 pagesNotes 4KRISHVISHESH FILM STUDIOSNo ratings yet

- How Insurance Works PDFDocument24 pagesHow Insurance Works PDFAviNo ratings yet

- U'tingDocument20 pagesU'tingChazzy f ChazzyNo ratings yet

- Vehicle InsuranceDocument31 pagesVehicle Insurancedhanaraj82No ratings yet

- Insurance Premium Rate × Number of Exposure Units PurchasedDocument10 pagesInsurance Premium Rate × Number of Exposure Units Purchasedbeena antuNo ratings yet

- Dbfi303 - Principles and Practices of InsuranceDocument10 pagesDbfi303 - Principles and Practices of Insurancevikash rajNo ratings yet

- Basics of Insurance: Click To Edit Master Subtitle StyleDocument29 pagesBasics of Insurance: Click To Edit Master Subtitle StyleeedeepakNo ratings yet

- Assignment RiskDocument6 pagesAssignment Riskdejen mengstieNo ratings yet

- Reading Material - Insurance Business Barter Exchange HFC and Mutual Fund Busines Set IIIDocument75 pagesReading Material - Insurance Business Barter Exchange HFC and Mutual Fund Busines Set IIIdhruv khandelwalNo ratings yet

- Insurance ContractDocument4 pagesInsurance ContractReyza Mikaela AngloNo ratings yet

- Combined Ratio': Tatutory Combined Ratio. The Statutory Combined Ratio (Expressed As A Percentage) Is Calculated inDocument3 pagesCombined Ratio': Tatutory Combined Ratio. The Statutory Combined Ratio (Expressed As A Percentage) Is Calculated inTimothy BrownNo ratings yet

- InsuranceDocument7 pagesInsurancesarvesh.bhartiNo ratings yet

- Categories of InsuranceDocument6 pagesCategories of InsurancewilliamyesNo ratings yet

- Chapter 22 - Insurance Contracts: Pfrs 4Document34 pagesChapter 22 - Insurance Contracts: Pfrs 4Jane Dizon100% (1)

- Research 1Document3 pagesResearch 1Rhythm MukatiNo ratings yet

- DPP dpp90 90dpp029Document26 pagesDPP dpp90 90dpp029aditikhanal.135No ratings yet

- INS - 21 Fundamentals of Insurance Segment A: Fundamentals of Insurance CHAPTER 1: Insurance: What Is It?Document78 pagesINS - 21 Fundamentals of Insurance Segment A: Fundamentals of Insurance CHAPTER 1: Insurance: What Is It?Sparsh GuptaNo ratings yet

- Financial Services: Insurance CompaniesDocument19 pagesFinancial Services: Insurance CompaniesmennaNo ratings yet

- Life InsuranceDocument22 pagesLife Insuranceckchetankhatri967No ratings yet

- Risk Management and Insurance CH - 3Document5 pagesRisk Management and Insurance CH - 3Eliyas ManNo ratings yet

- Actuarial Mathematics II: Notre Dame University - LouaizeDocument54 pagesActuarial Mathematics II: Notre Dame University - LouaizeMarie BtaichNo ratings yet

- The Insurance IndustryDocument9 pagesThe Insurance IndustryUday DharavathNo ratings yet

- 120 Financial Planning Handbook PDPDocument10 pages120 Financial Planning Handbook PDPMoh. Farid Adi PamujiNo ratings yet

- Insurance: An Overview Chapter ThreeDocument15 pagesInsurance: An Overview Chapter ThreeAbel HailuNo ratings yet

- The Private Insurance Industry: Financial Operations of InsurersDocument11 pagesThe Private Insurance Industry: Financial Operations of InsurersSunny SunnyNo ratings yet

- Functions of InsurersDocument19 pagesFunctions of InsurersMd Daud Hossian100% (1)

- Expalain The Following Principles of Insurance The Principle of Insurable InterestDocument4 pagesExpalain The Following Principles of Insurance The Principle of Insurable InterestUzoma FrancisNo ratings yet

- GLOSSARY - Insurance TermsDocument76 pagesGLOSSARY - Insurance TermsTirthajit SinhaNo ratings yet

- Risk Management and InsuranceDocument4 pagesRisk Management and InsuranceKinNo ratings yet

- Insurance Concepts: January 1998Document18 pagesInsurance Concepts: January 1998sunny rockyNo ratings yet

- Risk CH 3Document9 pagesRisk CH 3Tadele BekeleNo ratings yet

- Tl số 1-c7Document16 pagesTl số 1-c7kimkhanh200804No ratings yet

- Rateable Proportion ClauseDocument2 pagesRateable Proportion ClausePrerana ChhapiaNo ratings yet

- Insurance - Rate MakingDocument78 pagesInsurance - Rate Makingthefactorbook100% (1)

- Risk Management Chapter ThreeDocument8 pagesRisk Management Chapter ThreeDaniel filmonNo ratings yet

- Textbook of Urgent Care Management: Chapter 9, Insurance Requirements for the Urgent Care CenterFrom EverandTextbook of Urgent Care Management: Chapter 9, Insurance Requirements for the Urgent Care CenterNo ratings yet

- 2014: Your Ultimate Guide to Mastering Workers Comp Costs: The MINI-BOOK: Reduce Costs 20% to 50%From Everand2014: Your Ultimate Guide to Mastering Workers Comp Costs: The MINI-BOOK: Reduce Costs 20% to 50%No ratings yet

- Risk Management: How to Use Different Insurance to Your BenefitFrom EverandRisk Management: How to Use Different Insurance to Your BenefitNo ratings yet

- Structured Settlements: A Guide For Prospective SellersFrom EverandStructured Settlements: A Guide For Prospective SellersNo ratings yet

- Final Exam Constitutional Law UkDocument3 pagesFinal Exam Constitutional Law UkZeeshan HaiderNo ratings yet

- Scope of Total IncomeDocument7 pagesScope of Total IncomeSatinderpal KaurNo ratings yet

- Ga State BAR HandbookDocument192 pagesGa State BAR HandbookJohn StarkeyNo ratings yet

- Indg214 PDFDocument8 pagesIndg214 PDFkhalidNo ratings yet

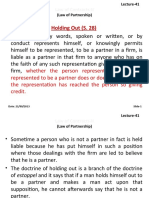

- Holding Out IPA 1932Document9 pagesHolding Out IPA 1932Shubham PhophaliaNo ratings yet

- 2.end of BipolarityDocument8 pages2.end of Bipolaritygunjan sahota100% (2)

- Understanding Cybersecurity Frameworks and Information Security Standards-A Review and Comprehensive OverviewDocument21 pagesUnderstanding Cybersecurity Frameworks and Information Security Standards-A Review and Comprehensive OverviewbaekjungNo ratings yet

- Isp 3550Document10 pagesIsp 3550telusbayviewNo ratings yet

- FNP Module 3Document5 pagesFNP Module 3Jewel Berbano IINo ratings yet

- 2020 KUSA Product Catalog - FinalDocument7 pages2020 KUSA Product Catalog - FinalTapes AndreiNo ratings yet

- Unit 2 - Sbaa7001 Banking Products and ServicesDocument38 pagesUnit 2 - Sbaa7001 Banking Products and ServicesGracyNo ratings yet

- Wallstreetjournal 20170211 The Wall Street JournalDocument52 pagesWallstreetjournal 20170211 The Wall Street JournalstefanoNo ratings yet

- Government of Tamil Nadu: E-ChallanDocument2 pagesGovernment of Tamil Nadu: E-ChallanVenkatesh CheetaNo ratings yet

- Special Penal Laws Reviewer 2Document17 pagesSpecial Penal Laws Reviewer 2Aya BeltranNo ratings yet

- Govt 5th Edition Sidlow Solutions ManualDocument16 pagesGovt 5th Edition Sidlow Solutions ManualJessicaJonesemkgd100% (8)

- Test 1Document105 pagesTest 1PrathibaVenkatNo ratings yet

- Abipid Ong Au Ceg Massè Centre-1Document33 pagesAbipid Ong Au Ceg Massè Centre-1JOWELLE SOTONMABOUNo ratings yet

- Q1 2024 PitchBook Analyst Note Core Insights and Takeaways From Fintech Meetup 2024Document25 pagesQ1 2024 PitchBook Analyst Note Core Insights and Takeaways From Fintech Meetup 2024NointingNo ratings yet

- 086-Thomson vs. CA 298 Scra 280Document8 pages086-Thomson vs. CA 298 Scra 280wewNo ratings yet

- Liam Law vs. Olympic Sawmill Co. ESCRA PDFDocument4 pagesLiam Law vs. Olympic Sawmill Co. ESCRA PDFTasneem C BalindongNo ratings yet

- Chapter 1 - Nature and Scope of NGASDocument26 pagesChapter 1 - Nature and Scope of NGASJapsNo ratings yet

- RLD Simplified FDA DRSSDocument18 pagesRLD Simplified FDA DRSSAngel FloresNo ratings yet

- Bulgarian Method 1Document9 pagesBulgarian Method 1TRASH SHUBHAMNo ratings yet

- EN71 Certificate of FangcunDocument5 pagesEN71 Certificate of FangcunIwo Światopełk-Mirski100% (1)

Document 65

Document 65

Uploaded by

Anil Jain0 ratings0% found this document useful (0 votes)

0 views1 pageRate making refers to the process insurance companies use to determine the premiums they charge. It aims to set fair and adequate premiums while ensuring rates are not excessive or unfairly discriminatory. Key terms in rate making include the pure premium, loading, gross rate, and gross premium. Regulators also establish objectives for rates to be adequate, not excessive, and not unfairly discriminatory. Actuaries determine life insurance premiums based on expected future loss payments discounted to the present and adjusted for expenses and profit to set the gross premium.

Original Description:

Project on banking and deposit

Original Title

Document65

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentRate making refers to the process insurance companies use to determine the premiums they charge. It aims to set fair and adequate premiums while ensuring rates are not excessive or unfairly discriminatory. Key terms in rate making include the pure premium, loading, gross rate, and gross premium. Regulators also establish objectives for rates to be adequate, not excessive, and not unfairly discriminatory. Actuaries determine life insurance premiums based on expected future loss payments discounted to the present and adjusted for expenses and profit to set the gross premium.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

0 views1 pageDocument 65

Document 65

Uploaded by

Anil JainRate making refers to the process insurance companies use to determine the premiums they charge. It aims to set fair and adequate premiums while ensuring rates are not excessive or unfairly discriminatory. Key terms in rate making include the pure premium, loading, gross rate, and gross premium. Regulators also establish objectives for rates to be adequate, not excessive, and not unfairly discriminatory. Actuaries determine life insurance premiums based on expected future loss payments discounted to the present and adjusted for expenses and profit to set the gross premium.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

Ans 3 (a)

Rate making, or insurance pricing, is the determination of rates charged by insurance

companies. The benefit of rate making is to ensure insurance companies are setting fair and

adequate premiums given the competitive nature. Rate making, or insurance pricing, is the

determination of rates charged by insurance companies. The benefit of rate making is to

ensure insurance companies are setting fair and adequate premiums given the competitive

nature. or insurance pricing, is the determination of rates charged by insurance companies. The

benefit of rate making is to ensure insurance companies are setting fair and adequate premiums

given the competitive nature.

The following are fundamental terms that are commonly used in rate making. A rate "is the price

per unit of insurance for each exposure unit, which is the unit of measurement used in insurance

pricing". The exposure unit is used to establish insurance premiums by examining parallel

groups

The pure premium "refers to that portion of that rate needed to pay losses and loss-adjustment

expenses". The loading "refers to the amount of the premium necessary to cover other expenses,

particularly sales expenses, and to allow for a profit". The gross rate "is the pure premium and

the loading per exposure unit". Finally, the gross premium is the premium paid by the insured

consisting of the gross rate multiplied by the number of exposure units.

Also,

Rate making has several objectives under regulatory requirements regulated by the states and

business objectives due to the goal of profitability: The goal of insurance regulation is to protect

the public and three regulatory objectives are placed to meet certain standards:

The first regulatory requirement is that rates must be adequate; meaning the rates the

insurers charge should be able to cover expenses.

The second regulatory requirement is that rates must not be excessive; meaning rates

should not be so high that policyholders are paying more than the actual value of their

protection.

The third regulatory objective is the rates must not be unfairly discriminatory;

meaning exposures that are similar with respect to losses and expenses should not be

charged significantly different rates.

Life insurance actuaries determine the probability of death in any given year, and based on this

probability determine the expected value of the loss payment. These expected future payment are

discounted back to the start of the coverage period and summed to determine the net single

premium. The net single premium may be leveled to convert to installment premiums. A loading

for expenses is added to determine the gross premium. With determining life expectancy, age is

the most important factor, other significant factors are sex of the individual and smoking. Thus,

an actuary can reasonably estimate the average age of death for a group of 25-year-old males,

who don't smoke.

Hence at last but not the least, Rate making, or insurance pricing, is the determination of rates

charged by insurance companies. The benefit of rate making is to ensure insurance companies

are setting fair and adequate premiums given the competitive nature.

You might also like

- INS21Document110 pagesINS21pav_43675% (12)

- Principles of Insurance Law with Case StudiesFrom EverandPrinciples of Insurance Law with Case StudiesRating: 5 out of 5 stars5/5 (1)

- Chapter 15 International FinanceDocument31 pagesChapter 15 International FinanceSANANDITA DASGUPTA 1723585100% (1)

- INS21 - Revision GuideDocument112 pagesINS21 - Revision GuideManish Mahaseth100% (1)

- General Insurance INS21Document78 pagesGeneral Insurance INS21geoscribblesNo ratings yet

- INS21 Basic NotesDocument61 pagesINS21 Basic Notesashher.aamir1858100% (1)

- INS21 SoftbookDocument111 pagesINS21 SoftbookShrestha Mohanty100% (1)

- The Cherokee Nation of Indians - King 1898Document15 pagesThe Cherokee Nation of Indians - King 1898Kassandra M JournalistNo ratings yet

- Full Pfrs Vs Pfrs For Smes PDFDocument21 pagesFull Pfrs Vs Pfrs For Smes PDFPaula Merriles100% (2)

- Internship Report On District Comptroller of Accounts HaripurDocument75 pagesInternship Report On District Comptroller of Accounts HaripurFaisal AwanNo ratings yet

- The First Lutheran Church Endowment Fund By-LawsDocument7 pagesThe First Lutheran Church Endowment Fund By-LawspostscriptNo ratings yet

- The Rise and Fall of The Montana FreemenDocument30 pagesThe Rise and Fall of The Montana FreemenB Cross Junior100% (1)

- Rate Making: How Insurance Premiums Are SetDocument4 pagesRate Making: How Insurance Premiums Are SetSai Teja NadellaNo ratings yet

- CH 6 Insurance Company Operations PDFDocument22 pagesCH 6 Insurance Company Operations PDFMonika RehmanNo ratings yet

- InsuranceDocument14 pagesInsuranceWanangwa ChiumeNo ratings yet

- Lecture 8 InsuranceDocument8 pagesLecture 8 InsuranceAnna BrasoveanNo ratings yet

- Introduction To Insurance Risk and Insurance Unit 3Document17 pagesIntroduction To Insurance Risk and Insurance Unit 3Harsha MathadNo ratings yet

- Insurance ManagementDocument71 pagesInsurance Managementmesfinabera180No ratings yet

- INS 21 - Chapter 1 - Insurance - What Is ITDocument9 pagesINS 21 - Chapter 1 - Insurance - What Is ITRaghuNo ratings yet

- 96190Document107 pages96190vazeli2004No ratings yet

- Clark 6Document55 pagesClark 6thisisghostactualNo ratings yet

- Insurance PremiumDocument28 pagesInsurance PremiumRaghav100% (1)

- Computation of Premium of Life Insurance PlansDocument9 pagesComputation of Premium of Life Insurance PlansAbhishek Singh PariharNo ratings yet

- Notes 4Document13 pagesNotes 4KRISHVISHESH FILM STUDIOSNo ratings yet

- How Insurance Works PDFDocument24 pagesHow Insurance Works PDFAviNo ratings yet

- U'tingDocument20 pagesU'tingChazzy f ChazzyNo ratings yet

- Vehicle InsuranceDocument31 pagesVehicle Insurancedhanaraj82No ratings yet

- Insurance Premium Rate × Number of Exposure Units PurchasedDocument10 pagesInsurance Premium Rate × Number of Exposure Units Purchasedbeena antuNo ratings yet

- Dbfi303 - Principles and Practices of InsuranceDocument10 pagesDbfi303 - Principles and Practices of Insurancevikash rajNo ratings yet

- Basics of Insurance: Click To Edit Master Subtitle StyleDocument29 pagesBasics of Insurance: Click To Edit Master Subtitle StyleeedeepakNo ratings yet

- Assignment RiskDocument6 pagesAssignment Riskdejen mengstieNo ratings yet

- Reading Material - Insurance Business Barter Exchange HFC and Mutual Fund Busines Set IIIDocument75 pagesReading Material - Insurance Business Barter Exchange HFC and Mutual Fund Busines Set IIIdhruv khandelwalNo ratings yet

- Insurance ContractDocument4 pagesInsurance ContractReyza Mikaela AngloNo ratings yet

- Combined Ratio': Tatutory Combined Ratio. The Statutory Combined Ratio (Expressed As A Percentage) Is Calculated inDocument3 pagesCombined Ratio': Tatutory Combined Ratio. The Statutory Combined Ratio (Expressed As A Percentage) Is Calculated inTimothy BrownNo ratings yet

- InsuranceDocument7 pagesInsurancesarvesh.bhartiNo ratings yet

- Categories of InsuranceDocument6 pagesCategories of InsurancewilliamyesNo ratings yet

- Chapter 22 - Insurance Contracts: Pfrs 4Document34 pagesChapter 22 - Insurance Contracts: Pfrs 4Jane Dizon100% (1)

- Research 1Document3 pagesResearch 1Rhythm MukatiNo ratings yet

- DPP dpp90 90dpp029Document26 pagesDPP dpp90 90dpp029aditikhanal.135No ratings yet

- INS - 21 Fundamentals of Insurance Segment A: Fundamentals of Insurance CHAPTER 1: Insurance: What Is It?Document78 pagesINS - 21 Fundamentals of Insurance Segment A: Fundamentals of Insurance CHAPTER 1: Insurance: What Is It?Sparsh GuptaNo ratings yet

- Financial Services: Insurance CompaniesDocument19 pagesFinancial Services: Insurance CompaniesmennaNo ratings yet

- Life InsuranceDocument22 pagesLife Insuranceckchetankhatri967No ratings yet

- Risk Management and Insurance CH - 3Document5 pagesRisk Management and Insurance CH - 3Eliyas ManNo ratings yet

- Actuarial Mathematics II: Notre Dame University - LouaizeDocument54 pagesActuarial Mathematics II: Notre Dame University - LouaizeMarie BtaichNo ratings yet

- The Insurance IndustryDocument9 pagesThe Insurance IndustryUday DharavathNo ratings yet

- 120 Financial Planning Handbook PDPDocument10 pages120 Financial Planning Handbook PDPMoh. Farid Adi PamujiNo ratings yet

- Insurance: An Overview Chapter ThreeDocument15 pagesInsurance: An Overview Chapter ThreeAbel HailuNo ratings yet

- The Private Insurance Industry: Financial Operations of InsurersDocument11 pagesThe Private Insurance Industry: Financial Operations of InsurersSunny SunnyNo ratings yet

- Functions of InsurersDocument19 pagesFunctions of InsurersMd Daud Hossian100% (1)

- Expalain The Following Principles of Insurance The Principle of Insurable InterestDocument4 pagesExpalain The Following Principles of Insurance The Principle of Insurable InterestUzoma FrancisNo ratings yet

- GLOSSARY - Insurance TermsDocument76 pagesGLOSSARY - Insurance TermsTirthajit SinhaNo ratings yet

- Risk Management and InsuranceDocument4 pagesRisk Management and InsuranceKinNo ratings yet

- Insurance Concepts: January 1998Document18 pagesInsurance Concepts: January 1998sunny rockyNo ratings yet

- Risk CH 3Document9 pagesRisk CH 3Tadele BekeleNo ratings yet

- Tl số 1-c7Document16 pagesTl số 1-c7kimkhanh200804No ratings yet

- Rateable Proportion ClauseDocument2 pagesRateable Proportion ClausePrerana ChhapiaNo ratings yet

- Insurance - Rate MakingDocument78 pagesInsurance - Rate Makingthefactorbook100% (1)

- Risk Management Chapter ThreeDocument8 pagesRisk Management Chapter ThreeDaniel filmonNo ratings yet

- Textbook of Urgent Care Management: Chapter 9, Insurance Requirements for the Urgent Care CenterFrom EverandTextbook of Urgent Care Management: Chapter 9, Insurance Requirements for the Urgent Care CenterNo ratings yet

- 2014: Your Ultimate Guide to Mastering Workers Comp Costs: The MINI-BOOK: Reduce Costs 20% to 50%From Everand2014: Your Ultimate Guide to Mastering Workers Comp Costs: The MINI-BOOK: Reduce Costs 20% to 50%No ratings yet

- Risk Management: How to Use Different Insurance to Your BenefitFrom EverandRisk Management: How to Use Different Insurance to Your BenefitNo ratings yet

- Structured Settlements: A Guide For Prospective SellersFrom EverandStructured Settlements: A Guide For Prospective SellersNo ratings yet

- Final Exam Constitutional Law UkDocument3 pagesFinal Exam Constitutional Law UkZeeshan HaiderNo ratings yet

- Scope of Total IncomeDocument7 pagesScope of Total IncomeSatinderpal KaurNo ratings yet

- Ga State BAR HandbookDocument192 pagesGa State BAR HandbookJohn StarkeyNo ratings yet

- Indg214 PDFDocument8 pagesIndg214 PDFkhalidNo ratings yet

- Holding Out IPA 1932Document9 pagesHolding Out IPA 1932Shubham PhophaliaNo ratings yet

- 2.end of BipolarityDocument8 pages2.end of Bipolaritygunjan sahota100% (2)

- Understanding Cybersecurity Frameworks and Information Security Standards-A Review and Comprehensive OverviewDocument21 pagesUnderstanding Cybersecurity Frameworks and Information Security Standards-A Review and Comprehensive OverviewbaekjungNo ratings yet

- Isp 3550Document10 pagesIsp 3550telusbayviewNo ratings yet

- FNP Module 3Document5 pagesFNP Module 3Jewel Berbano IINo ratings yet

- 2020 KUSA Product Catalog - FinalDocument7 pages2020 KUSA Product Catalog - FinalTapes AndreiNo ratings yet

- Unit 2 - Sbaa7001 Banking Products and ServicesDocument38 pagesUnit 2 - Sbaa7001 Banking Products and ServicesGracyNo ratings yet

- Wallstreetjournal 20170211 The Wall Street JournalDocument52 pagesWallstreetjournal 20170211 The Wall Street JournalstefanoNo ratings yet

- Government of Tamil Nadu: E-ChallanDocument2 pagesGovernment of Tamil Nadu: E-ChallanVenkatesh CheetaNo ratings yet

- Special Penal Laws Reviewer 2Document17 pagesSpecial Penal Laws Reviewer 2Aya BeltranNo ratings yet

- Govt 5th Edition Sidlow Solutions ManualDocument16 pagesGovt 5th Edition Sidlow Solutions ManualJessicaJonesemkgd100% (8)

- Test 1Document105 pagesTest 1PrathibaVenkatNo ratings yet

- Abipid Ong Au Ceg Massè Centre-1Document33 pagesAbipid Ong Au Ceg Massè Centre-1JOWELLE SOTONMABOUNo ratings yet

- Q1 2024 PitchBook Analyst Note Core Insights and Takeaways From Fintech Meetup 2024Document25 pagesQ1 2024 PitchBook Analyst Note Core Insights and Takeaways From Fintech Meetup 2024NointingNo ratings yet

- 086-Thomson vs. CA 298 Scra 280Document8 pages086-Thomson vs. CA 298 Scra 280wewNo ratings yet

- Liam Law vs. Olympic Sawmill Co. ESCRA PDFDocument4 pagesLiam Law vs. Olympic Sawmill Co. ESCRA PDFTasneem C BalindongNo ratings yet

- Chapter 1 - Nature and Scope of NGASDocument26 pagesChapter 1 - Nature and Scope of NGASJapsNo ratings yet

- RLD Simplified FDA DRSSDocument18 pagesRLD Simplified FDA DRSSAngel FloresNo ratings yet

- Bulgarian Method 1Document9 pagesBulgarian Method 1TRASH SHUBHAMNo ratings yet

- EN71 Certificate of FangcunDocument5 pagesEN71 Certificate of FangcunIwo Światopełk-Mirski100% (1)