Professional Documents

Culture Documents

Problems - Bayesian Updating

Problems - Bayesian Updating

Uploaded by

ΩmegaCopyright:

Available Formats

You might also like

- Forensic and Investigative Accounting PDFDocument1,293 pagesForensic and Investigative Accounting PDFShahid Moosa71% (7)

- Universal Pricing FAQ For PartnersDocument12 pagesUniversal Pricing FAQ For PartnersDarren LimNo ratings yet

- Decision Tree AnalyticsDocument5 pagesDecision Tree Analyticshayagreevan v0% (1)

- Decision Tree ExercisesDocument3 pagesDecision Tree ExercisesNafia AzhariyaNo ratings yet

- Ie426 HW5Document2 pagesIe426 HW5fulmanti deviNo ratings yet

- Assignment IndividualDocument4 pagesAssignment IndividualPrakhar SrivastavaNo ratings yet

- Decision Tree ExercisesDocument3 pagesDecision Tree ExercisesSarah Nabilla Yasmin RizaNo ratings yet

- Exercise 1 (Chap 1)Document8 pagesExercise 1 (Chap 1)peikee0% (1)

- 15 ManagementDocument69 pages15 ManagementBelista25% (4)

- First Chicago MethodDocument5 pagesFirst Chicago Methodqu4ntylNo ratings yet

- CBS Casebook 2011-2012Document93 pagesCBS Casebook 2011-2012yahya_c100% (2)

- Cerberus Wireline PDFDocument6 pagesCerberus Wireline PDFLeudys PalmaNo ratings yet

- POLVORON DELIGHT - Business PlanDocument29 pagesPOLVORON DELIGHT - Business PlanChero Dela Cruz100% (5)

- Decision Tree AnalyticsDocument5 pagesDecision Tree Analyticsmehakraj0204No ratings yet

- Questions Decision MakingDocument5 pagesQuestions Decision MakingShubhangi Kesharwani0% (1)

- Topic 1 - Strategic Thinking Sample Problemsv1Document14 pagesTopic 1 - Strategic Thinking Sample Problemsv1Cleo Coleen FortunadoNo ratings yet

- Chapter 05 Questions and ProblemsDocument4 pagesChapter 05 Questions and ProblemshuynhhangocthuNo ratings yet

- Decision Analysis IIDocument6 pagesDecision Analysis IIAinYazidNo ratings yet

- BAI TAP 2-DecisionDocument15 pagesBAI TAP 2-DecisionthoangdungNo ratings yet

- Eco402 Final Term Quiz FileDocument30 pagesEco402 Final Term Quiz FileYounas MujahidNo ratings yet

- ECO402MCQ Midterm PaperDocument28 pagesECO402MCQ Midterm PaperAyesha MughalNo ratings yet

- Cases For StudyDocument2 pagesCases For StudyGaurav SabooNo ratings yet

- Week One Worksheet Assignment-6Document3 pagesWeek One Worksheet Assignment-6Greg KaschuskiNo ratings yet

- Review QNS Msc. Fi - 2 PDFDocument1 pageReview QNS Msc. Fi - 2 PDFPatrick LuandaNo ratings yet

- Eco402 Midterm Solved Mcqs More Than 150 NewDocument22 pagesEco402 Midterm Solved Mcqs More Than 150 NewKinza LaiqatNo ratings yet

- Quantitative MethodsDocument18 pagesQuantitative MethodsNikhil SawantNo ratings yet

- Management Sheet 1 (Decision Making Assignment)Document6 pagesManagement Sheet 1 (Decision Making Assignment)Dalia EhabNo ratings yet

- ECO402 Solved Final Term Quizez MCQsDocument23 pagesECO402 Solved Final Term Quizez MCQsAmmar MalikNo ratings yet

- Decision Tree AnalysisDocument4 pagesDecision Tree AnalysisSachin SinghNo ratings yet

- Intermediate Accounting: Full Disclosure in Financial ReportingDocument89 pagesIntermediate Accounting: Full Disclosure in Financial ReportingJoshua KhanNo ratings yet

- BUS 475 Capstone Final Exam AnswersDocument16 pagesBUS 475 Capstone Final Exam AnswersangleefanslerNo ratings yet

- Eco402 Solved Mcqs More Than 150Document40 pagesEco402 Solved Mcqs More Than 150Ammar MalikNo ratings yet

- Cfa Level 1 - Testbank: (64 Questions With Detailed Solutions)Document33 pagesCfa Level 1 - Testbank: (64 Questions With Detailed Solutions)ranjuncajunNo ratings yet

- ACC501 All Solved MCQ MidtermDocument73 pagesACC501 All Solved MCQ MidtermMujtaba AhmadNo ratings yet

- Unit 6 QuizDocument12 pagesUnit 6 QuizMichael JohnsonNo ratings yet

- Capstone Round 3Document43 pagesCapstone Round 3Vatsal Goel100% (1)

- F5 QuestionsDocument10 pagesF5 QuestionsDeanNo ratings yet

- QuestionDocument5 pagesQuestionLevi OrtizNo ratings yet

- Review Session 01 MA Concept Review Section2Document20 pagesReview Session 01 MA Concept Review Section2misalNo ratings yet

- G02Document16 pagesG02Jolly Singhal100% (3)

- Pract 2Document26 pagesPract 2ShalomAnithaNo ratings yet

- Cfa Level 1 - Testbank: (64 Questions With Detailed Solutions)Document33 pagesCfa Level 1 - Testbank: (64 Questions With Detailed Solutions)271703315Ra100% (1)

- Assignment (19.05)Document26 pagesAssignment (19.05)Faisel MohamedNo ratings yet

- University of Tunis Fall 2013 Tunis Business School Decision & Game Theory Tutorial 3Document4 pagesUniversity of Tunis Fall 2013 Tunis Business School Decision & Game Theory Tutorial 3molka ben mahmoudNo ratings yet

- Cat/fia (FFM)Document9 pagesCat/fia (FFM)theizzatirosli100% (1)

- Mancon ActivityDocument3 pagesMancon Activityjane B0% (1)

- Research: Leveraging DesperationDocument10 pagesResearch: Leveraging DesperationMd. Hasan SheikhNo ratings yet

- Quiz - iCPA PDFDocument14 pagesQuiz - iCPA PDFCharlotte Canabang AmmadangNo ratings yet

- Notes CapsimDocument6 pagesNotes CapsimElinorWang0% (1)

- MA2 (100 QS)Document30 pagesMA2 (100 QS)Alina NaeemNo ratings yet

- Foundations in Financial ManagementDocument17 pagesFoundations in Financial ManagementchintengoNo ratings yet

- Test Bank For Financial Management For Decision Makers Second Canadian Edition 2 e 2nd Edition Peter Atrill Paul Hurley DownloadDocument18 pagesTest Bank For Financial Management For Decision Makers Second Canadian Edition 2 e 2nd Edition Peter Atrill Paul Hurley Downloadbriannacochrankaoesqinxw100% (25)

- Jun18l1equ-C03 QaDocument7 pagesJun18l1equ-C03 Qarafav10No ratings yet

- AMB106 Managerial EconomicsbcchghgcDocument10 pagesAMB106 Managerial EconomicsbcchghgcTakangNixonEbotNo ratings yet

- Mas Cup 2019Document8 pagesMas Cup 2019TakuriNo ratings yet

- Microeconomics - ECO402 Final Term QuizDocument28 pagesMicroeconomics - ECO402 Final Term QuizSuleyman KhanNo ratings yet

- Accounting MCQDocument7 pagesAccounting MCQsamuelkishNo ratings yet

- Examination No. - The Public Accountants Examination Council of Malawi 2010 Examinations Foundation Stage Paper 4: Organisational FrameworkDocument11 pagesExamination No. - The Public Accountants Examination Council of Malawi 2010 Examinations Foundation Stage Paper 4: Organisational FrameworkAhmed Raza MirNo ratings yet

- ECO402 MidTerm SolvedPapersAllinOneFileDocument16 pagesECO402 MidTerm SolvedPapersAllinOneFileAlisaad287No ratings yet

- ECO402-MidTerM Solved V.imp Corrected by Suleyman KhanDocument39 pagesECO402-MidTerM Solved V.imp Corrected by Suleyman KhanSuleyman Khan0% (1)

- 2015 Trends and Predictions Guide for Small Business: Everything you need to know to run a successful business in 2015From Everand2015 Trends and Predictions Guide for Small Business: Everything you need to know to run a successful business in 2015No ratings yet

- The Five Rules for Successful Stock Investing: Morningstar's Guide to Building Wealth and Winning in the MarketFrom EverandThe Five Rules for Successful Stock Investing: Morningstar's Guide to Building Wealth and Winning in the MarketRating: 4 out of 5 stars4/5 (1)

- Actuarial Finance: Derivatives, Quantitative Models and Risk ManagementFrom EverandActuarial Finance: Derivatives, Quantitative Models and Risk ManagementNo ratings yet

- Problems - Decision Analysis v2Document6 pagesProblems - Decision Analysis v2ΩmegaNo ratings yet

- Solutions - Decision Analysis v2Document13 pagesSolutions - Decision Analysis v2ΩmegaNo ratings yet

- Solutions - Bayesian Updating v3Document12 pagesSolutions - Bayesian Updating v3ΩmegaNo ratings yet

- Haida ResturantDocument2 pagesHaida ResturantΩmegaNo ratings yet

- 19 Venkatesh (Sangareddy)Document5 pages19 Venkatesh (Sangareddy)Gabriel DavidNo ratings yet

- Mobile Banking Use: A Comparative Study Between Bangladesh and USDocument12 pagesMobile Banking Use: A Comparative Study Between Bangladesh and USSaqeef RayhanNo ratings yet

- AECOM Handbook 2023 21 30Document10 pagesAECOM Handbook 2023 21 30vividsurveyorNo ratings yet

- Amp ReportDocument7 pagesAmp Reportnouman kaziNo ratings yet

- HI6027 Group Assignment T3 2020 - FINALDocument8 pagesHI6027 Group Assignment T3 2020 - FINALsaleem razaNo ratings yet

- TDS & VDS Percentage With Section or Service Code - BMCDocument7 pagesTDS & VDS Percentage With Section or Service Code - BMCSyedur RahmanNo ratings yet

- Customer Presentation (Fidani Chocolate)Document27 pagesCustomer Presentation (Fidani Chocolate)julailaNo ratings yet

- Art of WarDocument3 pagesArt of WarAbby NavarroNo ratings yet

- Bagan Liga Pelajar PrestasiDocument54 pagesBagan Liga Pelajar PrestasiFour YouNo ratings yet

- Financial RequirementsDocument1 pageFinancial Requirementstil telNo ratings yet

- Jeroen Baggerman Formatted CVDocument2 pagesJeroen Baggerman Formatted CVManoharNo ratings yet

- CASE - China Easterns World Class Dream - Shanghai Based GlobalizationDocument8 pagesCASE - China Easterns World Class Dream - Shanghai Based GlobalizationRafael Osuna100% (1)

- CareerCarve GD WorkshopDocument17 pagesCareerCarve GD WorkshopSai sundarNo ratings yet

- Wallstreetjournaleurope 20160818 The Wall Street Journal EuropeDocument20 pagesWallstreetjournaleurope 20160818 The Wall Street Journal EuropestefanoNo ratings yet

- Analysis of A High-Potential Business: Sqreen: Application Security Management PlatformDocument13 pagesAnalysis of A High-Potential Business: Sqreen: Application Security Management Platformhinaya khanNo ratings yet

- The Global EconomyDocument22 pagesThe Global EconomyElla Mae CantuangcoNo ratings yet

- Accounting Information Systems: The Production CycleDocument13 pagesAccounting Information Systems: The Production CycleHansen Setiawan BunariNo ratings yet

- Revenue Memorandum CircularsDocument90 pagesRevenue Memorandum CircularsJess Esmena100% (1)

- IT AssingmentDocument20 pagesIT AssingmentLeen NisNo ratings yet

- Mp3juices v3.4.1.1 Mp3juicesDocument4 pagesMp3juices v3.4.1.1 Mp3juicesrisaniaqueenNo ratings yet

- Chapter 4. Basel's Principle For Effective Risk Data Aggregation and Risk ReportingDocument30 pagesChapter 4. Basel's Principle For Effective Risk Data Aggregation and Risk ReportingBelle AnnaNo ratings yet

- Examples-On-Tax On TaxDocument16 pagesExamples-On-Tax On TaxDAO9No ratings yet

- Difference Between Fixed Cost and Variable CostDocument2 pagesDifference Between Fixed Cost and Variable CostGhalib HussainNo ratings yet

- Business Communication - ReportDocument25 pagesBusiness Communication - ReportAhmedNo ratings yet

- Epicor University - Advanced Business Process Management Course PDFDocument54 pagesEpicor University - Advanced Business Process Management Course PDFgvdaniel stpNo ratings yet

Problems - Bayesian Updating

Problems - Bayesian Updating

Uploaded by

ΩmegaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Problems - Bayesian Updating

Problems - Bayesian Updating

Uploaded by

ΩmegaCopyright:

Available Formats

BU275: Practice problems for “Bayesian Updating”

Note: Questions 10 and 11 in the Decision Analysis Practice Problems are also Bayesian updating

problems. Here are a few more:

Q1) Revisit question 4 in the Decision Analysis Practice Problems. Dwight can buy a farmer’s almanac

that will predict whether there will be Heavy Rain or Light Rain this season. In the past, when the

weather was dry, the farmer’s almanac predicted Light Rain 80% of the time and Heavy Rain 20% of the

time. When the weather was moderate, the almanac predicted Light Rain 45% of the time, and Heavy

Rain 55% of the time. When the weather was damp, the almanac predicted Light Rain 30% of the time

and Heavy Rain 70% of the time.

What is the EVSI of the almanac?

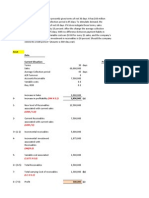

Q2) Morgan Manufacturing must decide whether to manufacture a component of its main product at its

own plant, or purchase the component from a supplier. The resulting profit for the year depends on

demand for the product:

States of Nature

Alternatives: Low Demand (l) Medium Demand (m) High Demand (h)

Manufacture (d1) -$20,000 $40,000 $100,000

Purchase (d2) $10,000 $45,000 $70,000

With no other information, the company believes the probability of low demand is 0.2, of medium

demand is 0.3, and of high demand is 0.5.

A market research firm can write a report with three possible outcomes: Positive, Neutral or Negative.

Based on past reports, when demand for a product was low, the report was Negative 70% of the time

and Neutral 30% of the time. When demand for a product was medium, the report was Negative 25% of

the time, Neutral 60% of the time and Positive 15% of the time. When demand for the product was high,

the report was Positive 75% of the time and Neutral 25% of the time.

What are the marginal probabilities of each of the report outcomes?

What are the posterior probabilities of each of the possible states given the report outcomes?

What is the best decision given each report outcome?

Finally, what is the Efficiency of the report?

Q3) A Machine shop owner is considering buying some new equipment: either a Drill Press, Lathe or

Grinder. The profitability this year depends on whether he gets a new contract from a big customer. He

estimates a 40% chance of getting this contract. The payoffs:

Contract No Contract

Drill Press $ 40,000 $ - 8,000

Lathe $ 20,000 $ 4,000

Grinder $ 12,000 $ 10,000

The shop owner is considering hiring a consultant, who will present a Favourable or Unfavourable report

about the possibility of landing the new contract. Based on previous reports, if the report was

Favourable, there is a 70% chance of getting the contract. If the report was Unfavourable, there is an

80% chance of not getting the contract. The owner expects 50% chance of receiving a Favourable report.

What is the best decision given the possible report outcomes?

What is the Efficiency of the report?

You might also like

- Forensic and Investigative Accounting PDFDocument1,293 pagesForensic and Investigative Accounting PDFShahid Moosa71% (7)

- Universal Pricing FAQ For PartnersDocument12 pagesUniversal Pricing FAQ For PartnersDarren LimNo ratings yet

- Decision Tree AnalyticsDocument5 pagesDecision Tree Analyticshayagreevan v0% (1)

- Decision Tree ExercisesDocument3 pagesDecision Tree ExercisesNafia AzhariyaNo ratings yet

- Ie426 HW5Document2 pagesIe426 HW5fulmanti deviNo ratings yet

- Assignment IndividualDocument4 pagesAssignment IndividualPrakhar SrivastavaNo ratings yet

- Decision Tree ExercisesDocument3 pagesDecision Tree ExercisesSarah Nabilla Yasmin RizaNo ratings yet

- Exercise 1 (Chap 1)Document8 pagesExercise 1 (Chap 1)peikee0% (1)

- 15 ManagementDocument69 pages15 ManagementBelista25% (4)

- First Chicago MethodDocument5 pagesFirst Chicago Methodqu4ntylNo ratings yet

- CBS Casebook 2011-2012Document93 pagesCBS Casebook 2011-2012yahya_c100% (2)

- Cerberus Wireline PDFDocument6 pagesCerberus Wireline PDFLeudys PalmaNo ratings yet

- POLVORON DELIGHT - Business PlanDocument29 pagesPOLVORON DELIGHT - Business PlanChero Dela Cruz100% (5)

- Decision Tree AnalyticsDocument5 pagesDecision Tree Analyticsmehakraj0204No ratings yet

- Questions Decision MakingDocument5 pagesQuestions Decision MakingShubhangi Kesharwani0% (1)

- Topic 1 - Strategic Thinking Sample Problemsv1Document14 pagesTopic 1 - Strategic Thinking Sample Problemsv1Cleo Coleen FortunadoNo ratings yet

- Chapter 05 Questions and ProblemsDocument4 pagesChapter 05 Questions and ProblemshuynhhangocthuNo ratings yet

- Decision Analysis IIDocument6 pagesDecision Analysis IIAinYazidNo ratings yet

- BAI TAP 2-DecisionDocument15 pagesBAI TAP 2-DecisionthoangdungNo ratings yet

- Eco402 Final Term Quiz FileDocument30 pagesEco402 Final Term Quiz FileYounas MujahidNo ratings yet

- ECO402MCQ Midterm PaperDocument28 pagesECO402MCQ Midterm PaperAyesha MughalNo ratings yet

- Cases For StudyDocument2 pagesCases For StudyGaurav SabooNo ratings yet

- Week One Worksheet Assignment-6Document3 pagesWeek One Worksheet Assignment-6Greg KaschuskiNo ratings yet

- Review QNS Msc. Fi - 2 PDFDocument1 pageReview QNS Msc. Fi - 2 PDFPatrick LuandaNo ratings yet

- Eco402 Midterm Solved Mcqs More Than 150 NewDocument22 pagesEco402 Midterm Solved Mcqs More Than 150 NewKinza LaiqatNo ratings yet

- Quantitative MethodsDocument18 pagesQuantitative MethodsNikhil SawantNo ratings yet

- Management Sheet 1 (Decision Making Assignment)Document6 pagesManagement Sheet 1 (Decision Making Assignment)Dalia EhabNo ratings yet

- ECO402 Solved Final Term Quizez MCQsDocument23 pagesECO402 Solved Final Term Quizez MCQsAmmar MalikNo ratings yet

- Decision Tree AnalysisDocument4 pagesDecision Tree AnalysisSachin SinghNo ratings yet

- Intermediate Accounting: Full Disclosure in Financial ReportingDocument89 pagesIntermediate Accounting: Full Disclosure in Financial ReportingJoshua KhanNo ratings yet

- BUS 475 Capstone Final Exam AnswersDocument16 pagesBUS 475 Capstone Final Exam AnswersangleefanslerNo ratings yet

- Eco402 Solved Mcqs More Than 150Document40 pagesEco402 Solved Mcqs More Than 150Ammar MalikNo ratings yet

- Cfa Level 1 - Testbank: (64 Questions With Detailed Solutions)Document33 pagesCfa Level 1 - Testbank: (64 Questions With Detailed Solutions)ranjuncajunNo ratings yet

- ACC501 All Solved MCQ MidtermDocument73 pagesACC501 All Solved MCQ MidtermMujtaba AhmadNo ratings yet

- Unit 6 QuizDocument12 pagesUnit 6 QuizMichael JohnsonNo ratings yet

- Capstone Round 3Document43 pagesCapstone Round 3Vatsal Goel100% (1)

- F5 QuestionsDocument10 pagesF5 QuestionsDeanNo ratings yet

- QuestionDocument5 pagesQuestionLevi OrtizNo ratings yet

- Review Session 01 MA Concept Review Section2Document20 pagesReview Session 01 MA Concept Review Section2misalNo ratings yet

- G02Document16 pagesG02Jolly Singhal100% (3)

- Pract 2Document26 pagesPract 2ShalomAnithaNo ratings yet

- Cfa Level 1 - Testbank: (64 Questions With Detailed Solutions)Document33 pagesCfa Level 1 - Testbank: (64 Questions With Detailed Solutions)271703315Ra100% (1)

- Assignment (19.05)Document26 pagesAssignment (19.05)Faisel MohamedNo ratings yet

- University of Tunis Fall 2013 Tunis Business School Decision & Game Theory Tutorial 3Document4 pagesUniversity of Tunis Fall 2013 Tunis Business School Decision & Game Theory Tutorial 3molka ben mahmoudNo ratings yet

- Cat/fia (FFM)Document9 pagesCat/fia (FFM)theizzatirosli100% (1)

- Mancon ActivityDocument3 pagesMancon Activityjane B0% (1)

- Research: Leveraging DesperationDocument10 pagesResearch: Leveraging DesperationMd. Hasan SheikhNo ratings yet

- Quiz - iCPA PDFDocument14 pagesQuiz - iCPA PDFCharlotte Canabang AmmadangNo ratings yet

- Notes CapsimDocument6 pagesNotes CapsimElinorWang0% (1)

- MA2 (100 QS)Document30 pagesMA2 (100 QS)Alina NaeemNo ratings yet

- Foundations in Financial ManagementDocument17 pagesFoundations in Financial ManagementchintengoNo ratings yet

- Test Bank For Financial Management For Decision Makers Second Canadian Edition 2 e 2nd Edition Peter Atrill Paul Hurley DownloadDocument18 pagesTest Bank For Financial Management For Decision Makers Second Canadian Edition 2 e 2nd Edition Peter Atrill Paul Hurley Downloadbriannacochrankaoesqinxw100% (25)

- Jun18l1equ-C03 QaDocument7 pagesJun18l1equ-C03 Qarafav10No ratings yet

- AMB106 Managerial EconomicsbcchghgcDocument10 pagesAMB106 Managerial EconomicsbcchghgcTakangNixonEbotNo ratings yet

- Mas Cup 2019Document8 pagesMas Cup 2019TakuriNo ratings yet

- Microeconomics - ECO402 Final Term QuizDocument28 pagesMicroeconomics - ECO402 Final Term QuizSuleyman KhanNo ratings yet

- Accounting MCQDocument7 pagesAccounting MCQsamuelkishNo ratings yet

- Examination No. - The Public Accountants Examination Council of Malawi 2010 Examinations Foundation Stage Paper 4: Organisational FrameworkDocument11 pagesExamination No. - The Public Accountants Examination Council of Malawi 2010 Examinations Foundation Stage Paper 4: Organisational FrameworkAhmed Raza MirNo ratings yet

- ECO402 MidTerm SolvedPapersAllinOneFileDocument16 pagesECO402 MidTerm SolvedPapersAllinOneFileAlisaad287No ratings yet

- ECO402-MidTerM Solved V.imp Corrected by Suleyman KhanDocument39 pagesECO402-MidTerM Solved V.imp Corrected by Suleyman KhanSuleyman Khan0% (1)

- 2015 Trends and Predictions Guide for Small Business: Everything you need to know to run a successful business in 2015From Everand2015 Trends and Predictions Guide for Small Business: Everything you need to know to run a successful business in 2015No ratings yet

- The Five Rules for Successful Stock Investing: Morningstar's Guide to Building Wealth and Winning in the MarketFrom EverandThe Five Rules for Successful Stock Investing: Morningstar's Guide to Building Wealth and Winning in the MarketRating: 4 out of 5 stars4/5 (1)

- Actuarial Finance: Derivatives, Quantitative Models and Risk ManagementFrom EverandActuarial Finance: Derivatives, Quantitative Models and Risk ManagementNo ratings yet

- Problems - Decision Analysis v2Document6 pagesProblems - Decision Analysis v2ΩmegaNo ratings yet

- Solutions - Decision Analysis v2Document13 pagesSolutions - Decision Analysis v2ΩmegaNo ratings yet

- Solutions - Bayesian Updating v3Document12 pagesSolutions - Bayesian Updating v3ΩmegaNo ratings yet

- Haida ResturantDocument2 pagesHaida ResturantΩmegaNo ratings yet

- 19 Venkatesh (Sangareddy)Document5 pages19 Venkatesh (Sangareddy)Gabriel DavidNo ratings yet

- Mobile Banking Use: A Comparative Study Between Bangladesh and USDocument12 pagesMobile Banking Use: A Comparative Study Between Bangladesh and USSaqeef RayhanNo ratings yet

- AECOM Handbook 2023 21 30Document10 pagesAECOM Handbook 2023 21 30vividsurveyorNo ratings yet

- Amp ReportDocument7 pagesAmp Reportnouman kaziNo ratings yet

- HI6027 Group Assignment T3 2020 - FINALDocument8 pagesHI6027 Group Assignment T3 2020 - FINALsaleem razaNo ratings yet

- TDS & VDS Percentage With Section or Service Code - BMCDocument7 pagesTDS & VDS Percentage With Section or Service Code - BMCSyedur RahmanNo ratings yet

- Customer Presentation (Fidani Chocolate)Document27 pagesCustomer Presentation (Fidani Chocolate)julailaNo ratings yet

- Art of WarDocument3 pagesArt of WarAbby NavarroNo ratings yet

- Bagan Liga Pelajar PrestasiDocument54 pagesBagan Liga Pelajar PrestasiFour YouNo ratings yet

- Financial RequirementsDocument1 pageFinancial Requirementstil telNo ratings yet

- Jeroen Baggerman Formatted CVDocument2 pagesJeroen Baggerman Formatted CVManoharNo ratings yet

- CASE - China Easterns World Class Dream - Shanghai Based GlobalizationDocument8 pagesCASE - China Easterns World Class Dream - Shanghai Based GlobalizationRafael Osuna100% (1)

- CareerCarve GD WorkshopDocument17 pagesCareerCarve GD WorkshopSai sundarNo ratings yet

- Wallstreetjournaleurope 20160818 The Wall Street Journal EuropeDocument20 pagesWallstreetjournaleurope 20160818 The Wall Street Journal EuropestefanoNo ratings yet

- Analysis of A High-Potential Business: Sqreen: Application Security Management PlatformDocument13 pagesAnalysis of A High-Potential Business: Sqreen: Application Security Management Platformhinaya khanNo ratings yet

- The Global EconomyDocument22 pagesThe Global EconomyElla Mae CantuangcoNo ratings yet

- Accounting Information Systems: The Production CycleDocument13 pagesAccounting Information Systems: The Production CycleHansen Setiawan BunariNo ratings yet

- Revenue Memorandum CircularsDocument90 pagesRevenue Memorandum CircularsJess Esmena100% (1)

- IT AssingmentDocument20 pagesIT AssingmentLeen NisNo ratings yet

- Mp3juices v3.4.1.1 Mp3juicesDocument4 pagesMp3juices v3.4.1.1 Mp3juicesrisaniaqueenNo ratings yet

- Chapter 4. Basel's Principle For Effective Risk Data Aggregation and Risk ReportingDocument30 pagesChapter 4. Basel's Principle For Effective Risk Data Aggregation and Risk ReportingBelle AnnaNo ratings yet

- Examples-On-Tax On TaxDocument16 pagesExamples-On-Tax On TaxDAO9No ratings yet

- Difference Between Fixed Cost and Variable CostDocument2 pagesDifference Between Fixed Cost and Variable CostGhalib HussainNo ratings yet

- Business Communication - ReportDocument25 pagesBusiness Communication - ReportAhmedNo ratings yet

- Epicor University - Advanced Business Process Management Course PDFDocument54 pagesEpicor University - Advanced Business Process Management Course PDFgvdaniel stpNo ratings yet