Professional Documents

Culture Documents

Technical Report 14th September 2011

Technical Report 14th September 2011

Uploaded by

Angel BrokingOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Technical Report 14th September 2011

Technical Report 14th September 2011

Uploaded by

Angel BrokingCopyright:

Available Formats

Technical Research | September 14, 2011

Daily Technical Report

Sensex (16467) / Nifty (4941)

Market opened marginally higher and traded with positive bias during the first half but selling pressure intensified during the second half which led indices to close in the negative territory. On the sector front, IT, Teck and Oil & Gas counters were among the major gainers whereas Auto and Healthcare were among the losers. The advance decline ratio was marginally in favor of advancing counters (A=1397 D=1395). (Source www.bseindia.com)

Exhibit 1: Sensex Daily Chart

Formation

No specific pattern is seen on the chart.

Trading strategy:

During yesterdays trading session indices registered a high Of 16766 / 5030 which is almost 50% Fibonacci retracement level of a fall from 5170 to 4911 level. We observed a strong selling pressure around this resistance level which dragged indices to test Mondays low of 16393 / 4911.Going forward, if indices sustain below yesterdays low then they are likely to drift towards 16318 16070 / 4890 4805 levels. On the upside, 16620 16766 / 4985 5030 levels may act as resistance in coming trading session.

Source: Falcon

For Private Circulation Only |

Technical Research | September 14, 2011

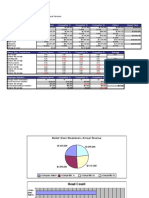

Daily Pivot Levels For Nifty 50 Stocks

SCRIPS SENSEX NIFTY ACC AMBUJACEM AXISBANK BAJAJ-AUTO BHARTIARTL BHEL BPCL CAIRN CIPLA DLF DRREDDY GAIL HCLTECH HDFC HDFCBANK HEROMOTOCO HINDALCO HINDUNILVR ICICIBANK IDFC INFY ITC JINDALSTEL JPASSOCIAT KOTAKBANK LT M&M MARUTI NTPC ONGC PNB POWERGRID RANBAXY RCOM RELCAPITAL RELIANCE RELINFRA RPOWER SAIL SBIN SESAGOA SIEMENS STER SUNPHARMA SUZLON TATAMOTORS TATAPOWER TATASTEEL TCS WIPRO S2 16,145 4,842 1,025 143 1,016 1,547 372 1,664 647 268 277 194 1,423 398 361 632 457 2,169 136 335 820 105 2,162 194 509 60 447 1,595 751 1,043 160 253 916 94 475 78 386 783 434 75 102 1,769 220 817 120 470 38 131 949 442 967 318 S1 16,306 4,891 1,040 144 1,033 1,574 377 1,682 652 278 282 197 1,438 403 370 639 463 2,186 139 338 836 107 2,192 195 520 62 455 1,615 766 1,059 162 255 934 94 482 80 394 796 442 77 104 1,801 223 833 122 476 39 135 964 450 980 324 PIVOT 16,536 4,961 1,049 146 1,056 1,600 384 1,714 657 285 291 200 1,461 411 381 652 469 2,208 143 343 858 109 2,226 197 528 65 462 1,644 781 1,078 164 259 948 95 493 82 404 811 452 78 107 1,850 227 848 126 486 40 142 988 459 1,002 329 R1 16,698 5,010 1,063 147 1,073 1,627 389 1,732 662 295 296 202 1,476 416 390 659 474 2,225 146 346 875 111 2,256 199 539 67 471 1,664 796 1,093 165 262 966 95 500 83 412 824 460 79 110 1,882 231 864 129 492 40 146 1,003 467 1,016 334 R2 16,928 5,080 1,072 149 1,095 1,653 397 1,763 668 301 304 205 1,499 423 401 672 481 2,246 150 351 897 113 2,290 201 547 70 478 1,693 811 1,112 167 265 981 96 510 85 423 839 470 81 113 1,932 234 879 132 502 41 152 1,026 476 1,037 339

Technical Research Team

For Private Circulation Only |

Technical Research | September 14, 2011 Technical Report

RESEARCH TEAM

Shardul Kulkarni Sameet Chavan Sacchitanand Uttekar Mehul Kothari Ankur Lakhotia Head - Technicals Technical Analyst Technical Analyst Technical Analyst Technical Analyst

For any Queries, Suggestions and Feedback kindly mail to mehul.kothari@angelbroking.com Research Team: 022-3935 7600 Website: www.angelbroking.com

DISCLAIMER: This document is not for public distribution and has been furnished to you solely for your information and must not be reproduced or redistributed to any other person. Persons into whose possession this document may come are required to observe these restrictions. Opinion expressed is our current opinion as of the date appearing on this material only. While we endeavor to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. Prospective investors and others are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. Our proprietary trading and investment businesses may make investment decisions that are inconsistent with the recommendations expressed herein. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true and are for general guidance only. While every effort is made to ensure the accuracy and completeness of information contained, the company takes no guarantee and assumes no liability for any errors or omissions of the information. No one can use the information as the basis for any claim, demand or cause of action. Recipients of this material should rely on their own investigations and take their own professional advice. Each recipient of this document should make such investigations as it deems necessary to arrive at an independent evaluation of an investment in the securities of companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Price and value of the investments referred to in this material may go up or down. Past performance is not a guide for future performance. Certain transactions - futures, options and other derivatives as well as non-investment grade securities - involve substantial risks and are not suitable for all investors. Reports based on technical analysis centers on studying charts of a stock's price movement and trading volume, as opposed to focusing on a company's fundamentals and as such, may not match with a report on a company's fundamentals. We do not undertake to advise you as to any change of our views expressed in this document. While we would endeavor to update the information herein on a reasonable basis, Angel Broking, its subsidiaries and associated companies, their directors and employees are under no obligation to update or keep the information current. Also there may be regulatory, compliance, or other reasons that may prevent Angel Broking and affiliates from doing so. Prospective investors and others are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. Angel Broking Limited and affiliates, including the analyst who has issued this report, may, on the date of this report, and from time to time, have long or short positions in, and buy or sell the securities of the companies mentioned herein or engage in any other transaction involving such securities and earn brokerage or compensation or act as advisor or have other potential conflict of interest with respect to company/ies mentioned herein or inconsistent with any recommendation and related information and opinions. Angel Broking Limited and affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Sebi Registration No : INB 010996539

For Private Circulation Only |

You might also like

- 3 7BDocument3 pages3 7BFaraz FaisalNo ratings yet

- Dissertation On Debt Securities Market in IndiaDocument103 pagesDissertation On Debt Securities Market in Indiaumesh kumar sahu0% (2)

- Technical Report 24th August 2011Document3 pagesTechnical Report 24th August 2011Angel BrokingNo ratings yet

- Technical Report 17th August 2011Document3 pagesTechnical Report 17th August 2011Angel BrokingNo ratings yet

- Technical Report 6th September 2011Document3 pagesTechnical Report 6th September 2011Angel BrokingNo ratings yet

- Technical Report 15th September 2011Document3 pagesTechnical Report 15th September 2011Angel BrokingNo ratings yet

- Technical Report 9th September 2011Document3 pagesTechnical Report 9th September 2011Angel BrokingNo ratings yet

- Technical Report 4th October 2011Document3 pagesTechnical Report 4th October 2011Angel BrokingNo ratings yet

- Technical Report 27th September 2011Document3 pagesTechnical Report 27th September 2011Angel BrokingNo ratings yet

- Technical Report 18th August 2011Document3 pagesTechnical Report 18th August 2011Angel BrokingNo ratings yet

- Technical Report 7th September 2011Document3 pagesTechnical Report 7th September 2011Angel BrokingNo ratings yet

- Technical Report 25th August 2011Document3 pagesTechnical Report 25th August 2011Angel BrokingNo ratings yet

- Technical Report 19th August 2011Document3 pagesTechnical Report 19th August 2011Angel BrokingNo ratings yet

- Technical Report 30th September 2011Document3 pagesTechnical Report 30th September 2011Angel BrokingNo ratings yet

- Technical Report 13th September 2011Document3 pagesTechnical Report 13th September 2011Angel BrokingNo ratings yet

- Technical Report 26th August 2011Document3 pagesTechnical Report 26th August 2011Angel BrokingNo ratings yet

- Technical Report 8th September 2011Document3 pagesTechnical Report 8th September 2011Angel BrokingNo ratings yet

- Technical Report 20th September 2011Document3 pagesTechnical Report 20th September 2011Angel BrokingNo ratings yet

- Technical Report 2nd September 2011Document3 pagesTechnical Report 2nd September 2011Angel BrokingNo ratings yet

- Technical Report 23rd September 2011Document3 pagesTechnical Report 23rd September 2011Angel BrokingNo ratings yet

- Technical Report 5th October 2011Document3 pagesTechnical Report 5th October 2011Angel BrokingNo ratings yet

- Technical Report 23rd August 2011Document3 pagesTechnical Report 23rd August 2011Angel BrokingNo ratings yet

- Technical Report 21st September 2011Document3 pagesTechnical Report 21st September 2011Angel BrokingNo ratings yet

- Technical Report 11th August 2011Document3 pagesTechnical Report 11th August 2011Angel BrokingNo ratings yet

- Technical Report 16th September 2011Document3 pagesTechnical Report 16th September 2011Angel BrokingNo ratings yet

- Technical Report 3 RD August 2011Document3 pagesTechnical Report 3 RD August 2011Angel BrokingNo ratings yet

- Technical Report 29th August 2011Document3 pagesTechnical Report 29th August 2011Angel BrokingNo ratings yet

- Technical Report 3rd October 2011Document3 pagesTechnical Report 3rd October 2011Angel BrokingNo ratings yet

- Technical Report 2nd August 2011Document3 pagesTechnical Report 2nd August 2011Angel BrokingNo ratings yet

- Technical Report 31st January 2012Document5 pagesTechnical Report 31st January 2012Angel BrokingNo ratings yet

- Technical Report 17th January 2012Document5 pagesTechnical Report 17th January 2012Angel BrokingNo ratings yet

- Technical Report 26th September 2011Document3 pagesTechnical Report 26th September 2011Angel BrokingNo ratings yet

- Technical Report 28th September 2011Document3 pagesTechnical Report 28th September 2011Angel BrokingNo ratings yet

- Technical Report 25th November 2011Document5 pagesTechnical Report 25th November 2011Angel BrokingNo ratings yet

- Technical Report 13th January 2012Document5 pagesTechnical Report 13th January 2012Angel BrokingNo ratings yet

- Technical Report 12th January 2012Document5 pagesTechnical Report 12th January 2012Angel BrokingNo ratings yet

- Technical Report 11th January 2012Document5 pagesTechnical Report 11th January 2012Angel BrokingNo ratings yet

- Technical Report 22nd August 2011Document3 pagesTechnical Report 22nd August 2011Angel BrokingNo ratings yet

- Technical Report 27th December 2011Document5 pagesTechnical Report 27th December 2011Angel BrokingNo ratings yet

- Technical Report 2nd December 2011Document5 pagesTechnical Report 2nd December 2011Angel BrokingNo ratings yet

- Technical Report 3rd November 2011Document5 pagesTechnical Report 3rd November 2011Angel BrokingNo ratings yet

- Technical Report 2nd January 2012Document5 pagesTechnical Report 2nd January 2012Angel BrokingNo ratings yet

- Technical Report 23rd November 2011Document5 pagesTechnical Report 23rd November 2011Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (16222) / NIFTY (4921)Document4 pagesDaily Technical Report: Sensex (16222) / NIFTY (4921)Angel BrokingNo ratings yet

- Technical Report 9th January 2012Document5 pagesTechnical Report 9th January 2012Angel BrokingNo ratings yet

- Technical Report 8th December 2011Document5 pagesTechnical Report 8th December 2011Angel BrokingNo ratings yet

- Technical Report 29th December 2011Document5 pagesTechnical Report 29th December 2011Angel BrokingNo ratings yet

- Technical Report 26th December 2011Document5 pagesTechnical Report 26th December 2011Angel BrokingNo ratings yet

- Technical Report 1st February 2012Document5 pagesTechnical Report 1st February 2012Angel BrokingNo ratings yet

- Technical Report 19th March 2012Document5 pagesTechnical Report 19th March 2012Angel BrokingNo ratings yet

- Technical Report 23rd December 2011Document5 pagesTechnical Report 23rd December 2011Angel BrokingNo ratings yet

- Technical Report 22nd September 2011Document3 pagesTechnical Report 22nd September 2011Angel BrokingNo ratings yet

- Technical Report 25th April 2012Document5 pagesTechnical Report 25th April 2012Angel BrokingNo ratings yet

- Technical Report 26th April 2012Document5 pagesTechnical Report 26th April 2012Angel BrokingNo ratings yet

- Technical Report 19th September 2011Document3 pagesTechnical Report 19th September 2011Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (15948) / NIFTY (4836)Document4 pagesDaily Technical Report: Sensex (15948) / NIFTY (4836)Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (15965) / NIFTY (4842)Document4 pagesDaily Technical Report: Sensex (15965) / NIFTY (4842)Angel BrokingNo ratings yet

- Technical Report 14th October 2011Document5 pagesTechnical Report 14th October 2011Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (16462) / NIFTY (4935)Document5 pagesDaily Technical Report: Sensex (16462) / NIFTY (4935)Angel BrokingNo ratings yet

- Technical Report 11th November 2011Document5 pagesTechnical Report 11th November 2011Angel BrokingNo ratings yet

- Technical Report 30th November 2011Document5 pagesTechnical Report 30th November 2011Angel BrokingNo ratings yet

- The Power of Charts: Using Technical Analysis to Predict Stock Price MovementsFrom EverandThe Power of Charts: Using Technical Analysis to Predict Stock Price MovementsNo ratings yet

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocument4 pagesRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNo ratings yet

- International Commodities Evening Update September 16 2013Document3 pagesInternational Commodities Evening Update September 16 2013Angel BrokingNo ratings yet

- WPIInflation August2013Document5 pagesWPIInflation August2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 14 2013Document2 pagesDaily Agri Tech Report September 14 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 16 2013Document6 pagesDaily Metals and Energy Report September 16 2013Angel BrokingNo ratings yet

- Oilseeds and Edible Oil UpdateDocument9 pagesOilseeds and Edible Oil UpdateAngel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 13Document2 pagesMetal and Energy Tech Report Sept 13Angel BrokingNo ratings yet

- Daily Agri Report September 16 2013Document9 pagesDaily Agri Report September 16 2013Angel BrokingNo ratings yet

- Currency Daily Report September 16 2013Document4 pagesCurrency Daily Report September 16 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 16 2013Document2 pagesDaily Agri Tech Report September 16 2013Angel BrokingNo ratings yet

- Currency Daily Report September 13 2013Document4 pagesCurrency Daily Report September 13 2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Document4 pagesDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 12Document2 pagesMetal and Energy Tech Report Sept 12Angel BrokingNo ratings yet

- Derivatives Report 8th JanDocument3 pagesDerivatives Report 8th JanAngel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocument6 pagesTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument12 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocument1 pagePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5913)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5913)Angel Broking100% (1)

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocument4 pagesJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNo ratings yet

- Daily Agri Report September 12 2013Document9 pagesDaily Agri Report September 12 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 12 2013Document6 pagesDaily Metals and Energy Report September 12 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 12 2013Document2 pagesDaily Agri Tech Report September 12 2013Angel BrokingNo ratings yet

- Currency Daily Report September 12 2013Document4 pagesCurrency Daily Report September 12 2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5897)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5897)Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- BSG Decisions & Reports3Document9 pagesBSG Decisions & Reports3Deyvis GabrielNo ratings yet

- Explanation of Quasimodo Pattern, Over and UnderDocument2 pagesExplanation of Quasimodo Pattern, Over and Undermhudzz100% (2)

- Mega Walk-In Drive For Financial Analyst: Job DescriptionDocument3 pagesMega Walk-In Drive For Financial Analyst: Job DescriptionRaj JoshiNo ratings yet

- Menka Jha - LinkedInDocument9 pagesMenka Jha - LinkedInVVB MULTI VENTURE FINANCENo ratings yet

- SEVENTH. That The Authorized Capital Stock of The Corporation Is ONE BILLION PESOSDocument2 pagesSEVENTH. That The Authorized Capital Stock of The Corporation Is ONE BILLION PESOSReysel Adeza MuliNo ratings yet

- ME Module 5Document12 pagesME Module 5Pratham J TudoorNo ratings yet

- Fixed Income Part IV SSEIDocument1 pageFixed Income Part IV SSEIpare121No ratings yet

- McqsDocument12 pagesMcqsMuhammad AwaisNo ratings yet

- Main Syllabus w22 Svsu Mba 604-ADocument7 pagesMain Syllabus w22 Svsu Mba 604-AFalguni ShomeNo ratings yet

- Options, Futures, and Other Derivatives, 5th Edition © 2002 by John C. HullDocument30 pagesOptions, Futures, and Other Derivatives, 5th Edition © 2002 by John C. HullHarry PasseyNo ratings yet

- RMC No 57 - Annexes A CDocument5 pagesRMC No 57 - Annexes A CVicky Tamo-oNo ratings yet

- Competitive Market Benchmark Analysis For Financial ServicesDocument2 pagesCompetitive Market Benchmark Analysis For Financial Servicesapi-3809857No ratings yet

- Partnership OperationsDocument3 pagesPartnership OperationsAra AlcantaraNo ratings yet

- CISI Workbook Editions Chart - November 2019Document4 pagesCISI Workbook Editions Chart - November 2019RockybuddyNilNo ratings yet

- Lorenzo Bergomi - Smile DynamicsDocument14 pagesLorenzo Bergomi - Smile DynamicsPranay PankajNo ratings yet

- Japanese Candlestick Charts: - Maximum Information From Minimum DataDocument29 pagesJapanese Candlestick Charts: - Maximum Information From Minimum DataPanneer Selvam EaswaranNo ratings yet

- HFI Global Briefing - November 2010Document12 pagesHFI Global Briefing - November 2010Absolute ReturnNo ratings yet

- Sahand CVDocument1 pageSahand CVSahand LaliNo ratings yet

- 4 - Derivative Concept SummaryDocument39 pages4 - Derivative Concept SummaryDeepika JhaNo ratings yet

- 02 Financial Statements AnalysisDocument44 pages02 Financial Statements AnalysisalecksgodinezNo ratings yet

- Internship Report On Awareness About Stock Markets of India: Submitted By: Vaibhav Arora (MBA-2019) Roll No: 19020259Document38 pagesInternship Report On Awareness About Stock Markets of India: Submitted By: Vaibhav Arora (MBA-2019) Roll No: 19020259Vaibhav AroraNo ratings yet

- How Securities Are TradedDocument15 pagesHow Securities Are TradedRazafinandrasanaNo ratings yet

- ITC Presentation2.1Document10 pagesITC Presentation2.1Rohit singhNo ratings yet

- Profit Test Modelling in Life Assurance Using Spreadsheets Part TwoDocument48 pagesProfit Test Modelling in Life Assurance Using Spreadsheets Part Twoulfa dianitaNo ratings yet

- The Relative Pricing of High-Yield Debt: The Case of RJR Nabisco Holdings Capital CorporationDocument24 pagesThe Relative Pricing of High-Yield Debt: The Case of RJR Nabisco Holdings Capital CorporationAhsen Ali Siddiqui100% (1)

- BRPD 18 ICAAP Reporting Circular Dec 21 2014 BRPD 18 eDocument2 pagesBRPD 18 ICAAP Reporting Circular Dec 21 2014 BRPD 18 etusher1984No ratings yet

- Assignment 2 - CommerzbankDocument6 pagesAssignment 2 - CommerzbankSushownikaTrehanNo ratings yet

- M&B HK Ch7 20Document2 pagesM&B HK Ch7 20K60 Phạm Thị Phương AnhNo ratings yet