Professional Documents

Culture Documents

Fukuhmss19acc0183 - Sunday Oche Acc 3214

Fukuhmss19acc0183 - Sunday Oche Acc 3214

Uploaded by

Sunday OcheCopyright:

Available Formats

You might also like

- Negotiable Instrument Law ReviewerDocument22 pagesNegotiable Instrument Law ReviewerChris Javier100% (2)

- Bill of Exchange and ChecksDocument8 pagesBill of Exchange and ChecksSmurf83% (18)

- Unit 4 - Contracts 2-1Document30 pagesUnit 4 - Contracts 2-1sarthak chughNo ratings yet

- Cape Law: Texts and Cases - Contract Law, Tort Law, and Real PropertyFrom EverandCape Law: Texts and Cases - Contract Law, Tort Law, and Real PropertyNo ratings yet

- Negotiable Instruments Reviewer (Agbayani Villanueva Sundiang Aquino)Document88 pagesNegotiable Instruments Reviewer (Agbayani Villanueva Sundiang Aquino)Lee Anne Yabut100% (3)

- Author: Partha Das Sharma, B.Tech (Hons.) in Mining Engineering, E.mail:, Blogs/WebsitesDocument16 pagesAuthor: Partha Das Sharma, B.Tech (Hons.) in Mining Engineering, E.mail:, Blogs/Websitespartha das sharma100% (1)

- 28 Points You Need To Know About SAP WM ImplementationDocument5 pages28 Points You Need To Know About SAP WM ImplementationeddiemedNo ratings yet

- Presumptions. These Are Briefly Stated As Follow:: 1C) Characteristic Features of A Bill of ExchangeDocument14 pagesPresumptions. These Are Briefly Stated As Follow:: 1C) Characteristic Features of A Bill of Exchangebright rainNo ratings yet

- NegotiableDocument8 pagesNegotiableOmega MwakalikamoNo ratings yet

- Class 11 Accountancy Chapter-8 Bill of ExchangeDocument6 pagesClass 11 Accountancy Chapter-8 Bill of ExchangeGoutham GouthamNo ratings yet

- MMS BATCH 2020-22, DIV - B. Name: Shardul Jadhav Roll No - 108Document3 pagesMMS BATCH 2020-22, DIV - B. Name: Shardul Jadhav Roll No - 108Omkar PadaveNo ratings yet

- Financial Accounting NotesDocument23 pagesFinancial Accounting NotesPeter KereriNo ratings yet

- Mercantile Law Notes PDFDocument34 pagesMercantile Law Notes PDFtoktor toktorNo ratings yet

- 320 Accountancy Eng Lesson11Document22 pages320 Accountancy Eng Lesson11Prabhleen KaurNo ratings yet

- 141 - Div C - Legal Aspects of BusinessDocument2 pages141 - Div C - Legal Aspects of BusinessNeel NaikNo ratings yet

- 007 The Law On Negotiable InstrumentsDocument10 pages007 The Law On Negotiable InstrumentsClyde Ian Brett PeñaNo ratings yet

- Negotiable Instrument Act-1881: DR - Itishree MishraDocument23 pagesNegotiable Instrument Act-1881: DR - Itishree MishraAishwarya PriyadarshiniNo ratings yet

- Philippine Law Reviewers: Commercial Law - Negotiable Instruments LawDocument47 pagesPhilippine Law Reviewers: Commercial Law - Negotiable Instruments Lawlebron JamesNo ratings yet

- Law On Nego - Sundiang NotesDocument32 pagesLaw On Nego - Sundiang NotesAbdel Nasser Anni DaudNo ratings yet

- Accounts 2nd Term TheoryDocument10 pagesAccounts 2nd Term Theorylegacy guptaNo ratings yet

- Essential of Bill of ExchangeDocument3 pagesEssential of Bill of ExchangeFaisal NaqviNo ratings yet

- Negotiable Instruments (Sundiang K-Notes) PDFDocument32 pagesNegotiable Instruments (Sundiang K-Notes) PDFKristine FayeNo ratings yet

- Bills of ExchangeDocument22 pagesBills of ExchangeSahil ManchandaNo ratings yet

- P.N Vs B.E Vs ChequeDocument4 pagesP.N Vs B.E Vs ChequeHuzaifa AhmadNo ratings yet

- Accounting For Special Transactions: Unit - 1 Bills of Exhange and Promissory NotesDocument31 pagesAccounting For Special Transactions: Unit - 1 Bills of Exhange and Promissory NotesNakul ChaudharyNo ratings yet

- Banking LawDocument21 pagesBanking LawGhanshyam GaurNo ratings yet

- Chapter 6Document11 pagesChapter 6Gautam KumarNo ratings yet

- 11 Accountancy Notes Ch06 Accounting For Bills of Exchange 02 PDFDocument28 pages11 Accountancy Notes Ch06 Accounting For Bills of Exchange 02 PDFYash GuptaNo ratings yet

- Law On Nego Sundiang NotesDocument33 pagesLaw On Nego Sundiang NotesAudrey100% (1)

- Topic 2 - NegoDocument3 pagesTopic 2 - NegoDANICA FLORESNo ratings yet

- Q.1 Define and Explain Promissory Note and Q.1 Define and Explain Promissory Note and Bill of Exchange. Bill of ExchangeDocument24 pagesQ.1 Define and Explain Promissory Note and Q.1 Define and Explain Promissory Note and Bill of Exchange. Bill of ExchangeernestomalupetNo ratings yet

- Acc 6.1 Boe & PNDocument31 pagesAcc 6.1 Boe & PNJpNo ratings yet

- Accounting For Bills of Exchange: Chapter-7Document30 pagesAccounting For Bills of Exchange: Chapter-7RaghuNo ratings yet

- Promissory Notes-Bills of Exchangeand ChequesDocument17 pagesPromissory Notes-Bills of Exchangeand Chequestheashu022No ratings yet

- Negotiable InstrumentDocument21 pagesNegotiable Instrumentsharmavansh3375No ratings yet

- Negotiable Instrument Law Module: 1 Semester, AY 2020-2021Document5 pagesNegotiable Instrument Law Module: 1 Semester, AY 2020-2021Diomar GusiNo ratings yet

- Cheque Bill of Exchange Promissory NoteDocument2 pagesCheque Bill of Exchange Promissory NoteNeel NaikNo ratings yet

- The Negotiable Instruments Act 1881Document119 pagesThe Negotiable Instruments Act 1881Sunayana GuptaNo ratings yet

- Business Law Question N AnswersDocument24 pagesBusiness Law Question N AnswersMohanarajNo ratings yet

- Negotiable Instrument: Unit 3 Ms - Shruti MinochaDocument50 pagesNegotiable Instrument: Unit 3 Ms - Shruti MinochaAshutosh KumarNo ratings yet

- College Financial-Mgmt-Accounting 9Document4 pagesCollege Financial-Mgmt-Accounting 9Naka MakuNo ratings yet

- Commercial Law - Negotiable Instruments LawDocument9 pagesCommercial Law - Negotiable Instruments LawMunchie MichieNo ratings yet

- Negotiable Instruments Non-Negotiable InstrumentsDocument7 pagesNegotiable Instruments Non-Negotiable InstrumentsCyberR.DomingoNo ratings yet

- Group 5 Final Written Report-Legal FormsDocument34 pagesGroup 5 Final Written Report-Legal FormsFederico Dipay Jr.No ratings yet

- Drawee, He Must Be NAMED ThereinDocument2 pagesDrawee, He Must Be NAMED ThereinGlo GanzonNo ratings yet

- Unit 4 - Negotiable Instrument Act 1881Document17 pagesUnit 4 - Negotiable Instrument Act 1881GAURAV PRAJAPATINo ratings yet

- Negotiable Instruments Reviewer Agbayani Villanueva Sundiang AquinoDocument84 pagesNegotiable Instruments Reviewer Agbayani Villanueva Sundiang AquinoXandae Mempin100% (1)

- Commercial Law Atty. RondezDocument108 pagesCommercial Law Atty. RondezJessyyyyy123No ratings yet

- Negotiable Instruments: - MicaellagarciaDocument4 pagesNegotiable Instruments: - MicaellagarciaMicaella100% (1)

- Business Law ReviewerDocument30 pagesBusiness Law ReviewerBea EchiverriNo ratings yet

- Unit 3-BoDocument38 pagesUnit 3-BoRakshitha. A GedamNo ratings yet

- Nego Memo AidDocument49 pagesNego Memo AidGigiRuizTicarNo ratings yet

- LAW 6 ReviewerDocument24 pagesLAW 6 ReviewerNacelleNo ratings yet

- Negotiable Instruments Non-Negotiable InstrumentsDocument31 pagesNegotiable Instruments Non-Negotiable InstrumentspyriadNo ratings yet

- Negotiable Inctruments LawDocument15 pagesNegotiable Inctruments LawAr Di SagamlaNo ratings yet

- Bill of Exchange Vs Promissory Note - Difference and Comparison - The Investors BookDocument18 pagesBill of Exchange Vs Promissory Note - Difference and Comparison - The Investors BookDan Dan Dan Dan100% (1)

- Negotiable Instruments Laws Carlos Hilado Memorial State University Submitted By: Atty. Jul Davi P. SaezDocument26 pagesNegotiable Instruments Laws Carlos Hilado Memorial State University Submitted By: Atty. Jul Davi P. SaezJellie ElmerNo ratings yet

- Negotiable Instruments Negotiable Documents of TitleDocument33 pagesNegotiable Instruments Negotiable Documents of TitleMary Grace Peralta ParagasNo ratings yet

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- A Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsFrom EverandA Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsNo ratings yet

- Revealed From A Top Realtor: The Fastest Way To Sell Properties Like Crazy In Real Estate - Even If You Are A Complete NewbieFrom EverandRevealed From A Top Realtor: The Fastest Way To Sell Properties Like Crazy In Real Estate - Even If You Are A Complete NewbieNo ratings yet

- Fund Raising Letter DniDocument2 pagesFund Raising Letter DniSunday OcheNo ratings yet

- Daily InspirationDocument11 pagesDaily InspirationSunday OcheNo ratings yet

- Unfair CompetitionDocument9 pagesUnfair CompetitionSunday OcheNo ratings yet

- Fukuhmss19acc0183 Oche Acc 3210Document15 pagesFukuhmss19acc0183 Oche Acc 3210Sunday OcheNo ratings yet

- A323 Ea07 VN 00278197 PDFDocument131 pagesA323 Ea07 VN 00278197 PDFhợp trầnNo ratings yet

- JIT Placement Brochure 2019Document28 pagesJIT Placement Brochure 2019elangoprt1No ratings yet

- Experiments MontgomeryDocument111 pagesExperiments MontgomeryJaka Permana SoebagjoNo ratings yet

- Utiliation AssignmentDocument1 pageUtiliation AssignmentOmprakash VermaNo ratings yet

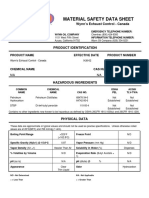

- Msds DTBPDocument6 pagesMsds DTBPYulianto KurniawanNo ratings yet

- Drive List BoxDocument3 pagesDrive List BoxLuis Carlos VillegasNo ratings yet

- Ninja R 2014 945723Document90 pagesNinja R 2014 945723Weldi afriyandaNo ratings yet

- Cookery DLL DPL Sir BobbyDocument3 pagesCookery DLL DPL Sir BobbyIvypadua100% (5)

- AWS Solution Architect SampleDocument3 pagesAWS Solution Architect SamplepandiecNo ratings yet

- Helical Piers Vs Drilled Piers1Document7 pagesHelical Piers Vs Drilled Piers1magicboy12No ratings yet

- Evaporation: Hirizza Junko M. YamamotoDocument3 pagesEvaporation: Hirizza Junko M. YamamotoHirizza Junko YamamotoNo ratings yet

- Tata GroupDocument107 pagesTata Grouprahuljain09No ratings yet

- Catalogo Zaxis 470Document32 pagesCatalogo Zaxis 470Alberto Ferradás0% (1)

- Aakash Deep - ResumeDocument3 pagesAakash Deep - Resumeaakasharora12No ratings yet

- FCV COMBO Manual ABZ Valve W Actuator J032Document28 pagesFCV COMBO Manual ABZ Valve W Actuator J032corasaulNo ratings yet

- Product Information VDROO32-50: Project Name Station NumberDocument6 pagesProduct Information VDROO32-50: Project Name Station NumberFerass EL QASRYNo ratings yet

- Products Standardization in Oil & Gas Sector in IndiaDocument39 pagesProducts Standardization in Oil & Gas Sector in Indiakingking21177No ratings yet

- High Speed Sand Filters Filtres À Sable Rapide Filtros A Silex de Alta Velocidad Filtri A Sabbia Ad Alta Velocitá Sandfilter Filtros de Areia de Alta VelocidadeDocument60 pagesHigh Speed Sand Filters Filtres À Sable Rapide Filtros A Silex de Alta Velocidad Filtri A Sabbia Ad Alta Velocitá Sandfilter Filtros de Areia de Alta VelocidadestewartNo ratings yet

- Chem - Specialties SheetDocument2 pagesChem - Specialties SheetCARMEN LINARESNo ratings yet

- Antenna DesignDocument98 pagesAntenna Designmuhammadabid4uNo ratings yet

- FF0406 01 Current State Vs Future State Slide Template 16x9 1Document6 pagesFF0406 01 Current State Vs Future State Slide Template 16x9 1Lucero GarciaNo ratings yet

- Lunes Martes Miyerkules Huwebes Biyernes: Grade 4 Daily Lesson LogDocument6 pagesLunes Martes Miyerkules Huwebes Biyernes: Grade 4 Daily Lesson LogAlliahNo ratings yet

- Module 3: Cluster Administration BasicsDocument52 pagesModule 3: Cluster Administration BasicsAnonymous fuEkF6dNo ratings yet

- Chandra Sekhar Mishra - 123554Document6 pagesChandra Sekhar Mishra - 123554chandraNo ratings yet

- Eu Requirements For Transformers PDFDocument4 pagesEu Requirements For Transformers PDFpitigoiNo ratings yet

- Wheel Over Position CalculationDocument3 pagesWheel Over Position CalculationSherwin Delfin CincoNo ratings yet

- Engine HistoryDocument10 pagesEngine HistoryFelipe SierraNo ratings yet

- nc60-2006 E2Document588 pagesnc60-2006 E2Sam eagle goodNo ratings yet

Fukuhmss19acc0183 - Sunday Oche Acc 3214

Fukuhmss19acc0183 - Sunday Oche Acc 3214

Uploaded by

Sunday OcheOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fukuhmss19acc0183 - Sunday Oche Acc 3214

Fukuhmss19acc0183 - Sunday Oche Acc 3214

Uploaded by

Sunday OcheCopyright:

Available Formats

FEDERAL UNIVERSITY OF KASHERE, GOMBE STATE.

FACULTY OF MANAGEMENT SCIENCES

ACCOUNTING DEPARTMENT

P.M.B 0182

Course Code: ACC 3214

Course Title: Company Law II

Matric Number: FUKU/HMSS/19/ACC/0183

Names: Onuh Sunday Oche

ASSIGNMENT;

“In a tabular form, write the similarities and differences

between these three negotiable instruments (Promisory

notes, Bill of exchange and Cheque)”

Course Lecturer: DR. UMALE OKOH

Introduction

What Is a Negotiable Instrument?

A negotiable instrument is a signed document that promises a payment to a specified

person or assignee. A transferable, signed document that promises to pay the bearer a sum

of money at a future date or on-demand.

Negotiable instruments are transferable, which allows the recipient to take the funds as cash,

then use them as preferred.

Negotiable instruments are transferable, so the holder can take the funds as cash or

use them for a transaction or other way as they wish. The fund amount listed on the document

includes the specific amount promised, and must be paid in full either on demand or at a

specified time. A negotiable instrument can be transferred from one person to another. Once

the instrument is transferred, the holder gains full legal title to the instrument.

SIMILARITIES BETWEEN CHEQUE, BILL OF EXCHANGE AND

PROMISORY NOTE

S/No Negotiable Instruments Similarities

1. Cheque, Bill of They are Easily transferable

Exchange and Promisory

Note

2. Cheque, Bill of They all are Absolute Title

Exchange and Promisory

Note

3. Cheque, Bill of They are all in written form.

Exchange and Promisory

Note

4. Cheque, Bill of They are all unconditional offer.

Exchange and Promisory

Note

5. Cheque, Bill of They all require a certain time of payment.

Exchange and Promisory

Note

6. Cheque, Bill of The payee must be certain in all three.

Exchange and Promisory

Note

7. Cheque, Bill of All three must be accompany with signature.

Exchange and Promisory

Note

8. Cheque, Bill of All three have right to sue offending parties

Exchange and Promisory when cases arise.

Note

DIFFERENCES BETWEEN CHEQUE, BILL OF EXCHANGE AND

PROMISORY NOTE

S/No Basic of Cheque Bill of exchange Promisory

Difference Note

1. Nature of A cheque A bill of A promisory

order/undertaking contains an order exchange contain note contains

to pay money. an unconditional an

order to pay unconditional

money. undertaking to

pay money.

2. Number of There are three There are three There are only

parties parties in a parties in bill of two parties in

cheque (drawer, exchange the promisory

drawee and (drawer, drawee note (the

payee). and payee). maker and the

payee).

3. Identity of the The drawer and In bill of In a promisory

parties the drawee can excahnge, both note, the

be one and same the drawer and maker himself

person. the drawee can cannot be both

be one and same the promisor

person. and the

promisee.

4. Acceptance A cheque must be A time bill must No acceptance

accepted by the be accepted by is necessary in

payee. the drawee. the case of

promisory note

as it is made

by the debtor

himself.

5. Notice of When a cheque is On dishonor of a No notice of

Dishonor dishonored, a bill, notice of dishonor is

notice is given to dishonor must be necessary in

the drawee which given to the the case of

in turn relates it drawer and other promisory

to the drawer. endorsers. note.

6. Crossing A cheque can be A bill of A promisory

crossed. exchange can not note can not

be crossed. be crossed.

7. Payableness A cheque is Bill of excahnge A promisory

always payable can be payable in note, note on

on demand a later date. the other hand

is payable

either on

demand or

after a

specified

period.

8. Bearer A cheque is A bill of A promisory

payable to order exchange is note can not

or bearer necessarily be made

payable to payable to a

bearer. bearer.

REFERENCES

McClure, M., Level, A.V., Cranston, C.L., Oehlerts, B. & Culbertson, M. (2014).

Data curation: a study of financial instruments in international practices and needs: Libraries

and the Academy, 14(2), p. 139-164.

McLennan, C.J., Moyle, B.D. & Weiler, B.V. (2013). The role of negotiable

instruments in relation postgraduate research: An analysis of doctoral dissertations completed

between 2000 – 2010. Journal of Applied Economics and Business Research, 3(4), p. 181-

191.

You might also like

- Negotiable Instrument Law ReviewerDocument22 pagesNegotiable Instrument Law ReviewerChris Javier100% (2)

- Bill of Exchange and ChecksDocument8 pagesBill of Exchange and ChecksSmurf83% (18)

- Unit 4 - Contracts 2-1Document30 pagesUnit 4 - Contracts 2-1sarthak chughNo ratings yet

- Cape Law: Texts and Cases - Contract Law, Tort Law, and Real PropertyFrom EverandCape Law: Texts and Cases - Contract Law, Tort Law, and Real PropertyNo ratings yet

- Negotiable Instruments Reviewer (Agbayani Villanueva Sundiang Aquino)Document88 pagesNegotiable Instruments Reviewer (Agbayani Villanueva Sundiang Aquino)Lee Anne Yabut100% (3)

- Author: Partha Das Sharma, B.Tech (Hons.) in Mining Engineering, E.mail:, Blogs/WebsitesDocument16 pagesAuthor: Partha Das Sharma, B.Tech (Hons.) in Mining Engineering, E.mail:, Blogs/Websitespartha das sharma100% (1)

- 28 Points You Need To Know About SAP WM ImplementationDocument5 pages28 Points You Need To Know About SAP WM ImplementationeddiemedNo ratings yet

- Presumptions. These Are Briefly Stated As Follow:: 1C) Characteristic Features of A Bill of ExchangeDocument14 pagesPresumptions. These Are Briefly Stated As Follow:: 1C) Characteristic Features of A Bill of Exchangebright rainNo ratings yet

- NegotiableDocument8 pagesNegotiableOmega MwakalikamoNo ratings yet

- Class 11 Accountancy Chapter-8 Bill of ExchangeDocument6 pagesClass 11 Accountancy Chapter-8 Bill of ExchangeGoutham GouthamNo ratings yet

- MMS BATCH 2020-22, DIV - B. Name: Shardul Jadhav Roll No - 108Document3 pagesMMS BATCH 2020-22, DIV - B. Name: Shardul Jadhav Roll No - 108Omkar PadaveNo ratings yet

- Financial Accounting NotesDocument23 pagesFinancial Accounting NotesPeter KereriNo ratings yet

- Mercantile Law Notes PDFDocument34 pagesMercantile Law Notes PDFtoktor toktorNo ratings yet

- 320 Accountancy Eng Lesson11Document22 pages320 Accountancy Eng Lesson11Prabhleen KaurNo ratings yet

- 141 - Div C - Legal Aspects of BusinessDocument2 pages141 - Div C - Legal Aspects of BusinessNeel NaikNo ratings yet

- 007 The Law On Negotiable InstrumentsDocument10 pages007 The Law On Negotiable InstrumentsClyde Ian Brett PeñaNo ratings yet

- Negotiable Instrument Act-1881: DR - Itishree MishraDocument23 pagesNegotiable Instrument Act-1881: DR - Itishree MishraAishwarya PriyadarshiniNo ratings yet

- Philippine Law Reviewers: Commercial Law - Negotiable Instruments LawDocument47 pagesPhilippine Law Reviewers: Commercial Law - Negotiable Instruments Lawlebron JamesNo ratings yet

- Law On Nego - Sundiang NotesDocument32 pagesLaw On Nego - Sundiang NotesAbdel Nasser Anni DaudNo ratings yet

- Accounts 2nd Term TheoryDocument10 pagesAccounts 2nd Term Theorylegacy guptaNo ratings yet

- Essential of Bill of ExchangeDocument3 pagesEssential of Bill of ExchangeFaisal NaqviNo ratings yet

- Negotiable Instruments (Sundiang K-Notes) PDFDocument32 pagesNegotiable Instruments (Sundiang K-Notes) PDFKristine FayeNo ratings yet

- Bills of ExchangeDocument22 pagesBills of ExchangeSahil ManchandaNo ratings yet

- P.N Vs B.E Vs ChequeDocument4 pagesP.N Vs B.E Vs ChequeHuzaifa AhmadNo ratings yet

- Accounting For Special Transactions: Unit - 1 Bills of Exhange and Promissory NotesDocument31 pagesAccounting For Special Transactions: Unit - 1 Bills of Exhange and Promissory NotesNakul ChaudharyNo ratings yet

- Banking LawDocument21 pagesBanking LawGhanshyam GaurNo ratings yet

- Chapter 6Document11 pagesChapter 6Gautam KumarNo ratings yet

- 11 Accountancy Notes Ch06 Accounting For Bills of Exchange 02 PDFDocument28 pages11 Accountancy Notes Ch06 Accounting For Bills of Exchange 02 PDFYash GuptaNo ratings yet

- Law On Nego Sundiang NotesDocument33 pagesLaw On Nego Sundiang NotesAudrey100% (1)

- Topic 2 - NegoDocument3 pagesTopic 2 - NegoDANICA FLORESNo ratings yet

- Q.1 Define and Explain Promissory Note and Q.1 Define and Explain Promissory Note and Bill of Exchange. Bill of ExchangeDocument24 pagesQ.1 Define and Explain Promissory Note and Q.1 Define and Explain Promissory Note and Bill of Exchange. Bill of ExchangeernestomalupetNo ratings yet

- Acc 6.1 Boe & PNDocument31 pagesAcc 6.1 Boe & PNJpNo ratings yet

- Accounting For Bills of Exchange: Chapter-7Document30 pagesAccounting For Bills of Exchange: Chapter-7RaghuNo ratings yet

- Promissory Notes-Bills of Exchangeand ChequesDocument17 pagesPromissory Notes-Bills of Exchangeand Chequestheashu022No ratings yet

- Negotiable InstrumentDocument21 pagesNegotiable Instrumentsharmavansh3375No ratings yet

- Negotiable Instrument Law Module: 1 Semester, AY 2020-2021Document5 pagesNegotiable Instrument Law Module: 1 Semester, AY 2020-2021Diomar GusiNo ratings yet

- Cheque Bill of Exchange Promissory NoteDocument2 pagesCheque Bill of Exchange Promissory NoteNeel NaikNo ratings yet

- The Negotiable Instruments Act 1881Document119 pagesThe Negotiable Instruments Act 1881Sunayana GuptaNo ratings yet

- Business Law Question N AnswersDocument24 pagesBusiness Law Question N AnswersMohanarajNo ratings yet

- Negotiable Instrument: Unit 3 Ms - Shruti MinochaDocument50 pagesNegotiable Instrument: Unit 3 Ms - Shruti MinochaAshutosh KumarNo ratings yet

- College Financial-Mgmt-Accounting 9Document4 pagesCollege Financial-Mgmt-Accounting 9Naka MakuNo ratings yet

- Commercial Law - Negotiable Instruments LawDocument9 pagesCommercial Law - Negotiable Instruments LawMunchie MichieNo ratings yet

- Negotiable Instruments Non-Negotiable InstrumentsDocument7 pagesNegotiable Instruments Non-Negotiable InstrumentsCyberR.DomingoNo ratings yet

- Group 5 Final Written Report-Legal FormsDocument34 pagesGroup 5 Final Written Report-Legal FormsFederico Dipay Jr.No ratings yet

- Drawee, He Must Be NAMED ThereinDocument2 pagesDrawee, He Must Be NAMED ThereinGlo GanzonNo ratings yet

- Unit 4 - Negotiable Instrument Act 1881Document17 pagesUnit 4 - Negotiable Instrument Act 1881GAURAV PRAJAPATINo ratings yet

- Negotiable Instruments Reviewer Agbayani Villanueva Sundiang AquinoDocument84 pagesNegotiable Instruments Reviewer Agbayani Villanueva Sundiang AquinoXandae Mempin100% (1)

- Commercial Law Atty. RondezDocument108 pagesCommercial Law Atty. RondezJessyyyyy123No ratings yet

- Negotiable Instruments: - MicaellagarciaDocument4 pagesNegotiable Instruments: - MicaellagarciaMicaella100% (1)

- Business Law ReviewerDocument30 pagesBusiness Law ReviewerBea EchiverriNo ratings yet

- Unit 3-BoDocument38 pagesUnit 3-BoRakshitha. A GedamNo ratings yet

- Nego Memo AidDocument49 pagesNego Memo AidGigiRuizTicarNo ratings yet

- LAW 6 ReviewerDocument24 pagesLAW 6 ReviewerNacelleNo ratings yet

- Negotiable Instruments Non-Negotiable InstrumentsDocument31 pagesNegotiable Instruments Non-Negotiable InstrumentspyriadNo ratings yet

- Negotiable Inctruments LawDocument15 pagesNegotiable Inctruments LawAr Di SagamlaNo ratings yet

- Bill of Exchange Vs Promissory Note - Difference and Comparison - The Investors BookDocument18 pagesBill of Exchange Vs Promissory Note - Difference and Comparison - The Investors BookDan Dan Dan Dan100% (1)

- Negotiable Instruments Laws Carlos Hilado Memorial State University Submitted By: Atty. Jul Davi P. SaezDocument26 pagesNegotiable Instruments Laws Carlos Hilado Memorial State University Submitted By: Atty. Jul Davi P. SaezJellie ElmerNo ratings yet

- Negotiable Instruments Negotiable Documents of TitleDocument33 pagesNegotiable Instruments Negotiable Documents of TitleMary Grace Peralta ParagasNo ratings yet

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- A Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsFrom EverandA Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsNo ratings yet

- Revealed From A Top Realtor: The Fastest Way To Sell Properties Like Crazy In Real Estate - Even If You Are A Complete NewbieFrom EverandRevealed From A Top Realtor: The Fastest Way To Sell Properties Like Crazy In Real Estate - Even If You Are A Complete NewbieNo ratings yet

- Fund Raising Letter DniDocument2 pagesFund Raising Letter DniSunday OcheNo ratings yet

- Daily InspirationDocument11 pagesDaily InspirationSunday OcheNo ratings yet

- Unfair CompetitionDocument9 pagesUnfair CompetitionSunday OcheNo ratings yet

- Fukuhmss19acc0183 Oche Acc 3210Document15 pagesFukuhmss19acc0183 Oche Acc 3210Sunday OcheNo ratings yet

- A323 Ea07 VN 00278197 PDFDocument131 pagesA323 Ea07 VN 00278197 PDFhợp trầnNo ratings yet

- JIT Placement Brochure 2019Document28 pagesJIT Placement Brochure 2019elangoprt1No ratings yet

- Experiments MontgomeryDocument111 pagesExperiments MontgomeryJaka Permana SoebagjoNo ratings yet

- Utiliation AssignmentDocument1 pageUtiliation AssignmentOmprakash VermaNo ratings yet

- Msds DTBPDocument6 pagesMsds DTBPYulianto KurniawanNo ratings yet

- Drive List BoxDocument3 pagesDrive List BoxLuis Carlos VillegasNo ratings yet

- Ninja R 2014 945723Document90 pagesNinja R 2014 945723Weldi afriyandaNo ratings yet

- Cookery DLL DPL Sir BobbyDocument3 pagesCookery DLL DPL Sir BobbyIvypadua100% (5)

- AWS Solution Architect SampleDocument3 pagesAWS Solution Architect SamplepandiecNo ratings yet

- Helical Piers Vs Drilled Piers1Document7 pagesHelical Piers Vs Drilled Piers1magicboy12No ratings yet

- Evaporation: Hirizza Junko M. YamamotoDocument3 pagesEvaporation: Hirizza Junko M. YamamotoHirizza Junko YamamotoNo ratings yet

- Tata GroupDocument107 pagesTata Grouprahuljain09No ratings yet

- Catalogo Zaxis 470Document32 pagesCatalogo Zaxis 470Alberto Ferradás0% (1)

- Aakash Deep - ResumeDocument3 pagesAakash Deep - Resumeaakasharora12No ratings yet

- FCV COMBO Manual ABZ Valve W Actuator J032Document28 pagesFCV COMBO Manual ABZ Valve W Actuator J032corasaulNo ratings yet

- Product Information VDROO32-50: Project Name Station NumberDocument6 pagesProduct Information VDROO32-50: Project Name Station NumberFerass EL QASRYNo ratings yet

- Products Standardization in Oil & Gas Sector in IndiaDocument39 pagesProducts Standardization in Oil & Gas Sector in Indiakingking21177No ratings yet

- High Speed Sand Filters Filtres À Sable Rapide Filtros A Silex de Alta Velocidad Filtri A Sabbia Ad Alta Velocitá Sandfilter Filtros de Areia de Alta VelocidadeDocument60 pagesHigh Speed Sand Filters Filtres À Sable Rapide Filtros A Silex de Alta Velocidad Filtri A Sabbia Ad Alta Velocitá Sandfilter Filtros de Areia de Alta VelocidadestewartNo ratings yet

- Chem - Specialties SheetDocument2 pagesChem - Specialties SheetCARMEN LINARESNo ratings yet

- Antenna DesignDocument98 pagesAntenna Designmuhammadabid4uNo ratings yet

- FF0406 01 Current State Vs Future State Slide Template 16x9 1Document6 pagesFF0406 01 Current State Vs Future State Slide Template 16x9 1Lucero GarciaNo ratings yet

- Lunes Martes Miyerkules Huwebes Biyernes: Grade 4 Daily Lesson LogDocument6 pagesLunes Martes Miyerkules Huwebes Biyernes: Grade 4 Daily Lesson LogAlliahNo ratings yet

- Module 3: Cluster Administration BasicsDocument52 pagesModule 3: Cluster Administration BasicsAnonymous fuEkF6dNo ratings yet

- Chandra Sekhar Mishra - 123554Document6 pagesChandra Sekhar Mishra - 123554chandraNo ratings yet

- Eu Requirements For Transformers PDFDocument4 pagesEu Requirements For Transformers PDFpitigoiNo ratings yet

- Wheel Over Position CalculationDocument3 pagesWheel Over Position CalculationSherwin Delfin CincoNo ratings yet

- Engine HistoryDocument10 pagesEngine HistoryFelipe SierraNo ratings yet

- nc60-2006 E2Document588 pagesnc60-2006 E2Sam eagle goodNo ratings yet