Professional Documents

Culture Documents

M/Chip Functional Architecture For Debit and Credit: Applies To: Summary

M/Chip Functional Architecture For Debit and Credit: Applies To: Summary

Uploaded by

Abiy MulugetaCopyright:

Available Formats

You might also like

- Verifone Vx805 DsiEMVUS Platform Integration Guide SupplementDocument60 pagesVerifone Vx805 DsiEMVUS Platform Integration Guide SupplementHammad ShaukatNo ratings yet

- Ethoca Merchant Data Provision API Integration Guide V 3.0.1 (February 13, 2019)Document13 pagesEthoca Merchant Data Provision API Integration Guide V 3.0.1 (February 13, 2019)NastasVasileNo ratings yet

- Section 1. What's New: This Readme File Contains These SectionsDocument6 pagesSection 1. What's New: This Readme File Contains These SectionsNishant SharmaNo ratings yet

- Swift: Icbpo Irrevocable Conditional Bank Pay Order: TRANSACTION CODEDocument2 pagesSwift: Icbpo Irrevocable Conditional Bank Pay Order: TRANSACTION CODEdavid patrick100% (2)

- SessionDocument8 pagesSessionIngrid Vaughn100% (1)

- EMV Contactless Kernel PR FINALDocument2 pagesEMV Contactless Kernel PR FINALPriyanka PalNo ratings yet

- Payment Card Industry 3-D Secure (PCI 3DS)Document7 pagesPayment Card Industry 3-D Secure (PCI 3DS)Al QUinNo ratings yet

- GP Guidelines For Developing Apps On GP Cards V1.0aDocument65 pagesGP Guidelines For Developing Apps On GP Cards V1.0aCharlieBrown100% (2)

- Terminal Information To Enhance Contactless Application SelectionDocument10 pagesTerminal Information To Enhance Contactless Application SelectionSaradhi MedapureddyNo ratings yet

- MasterCard Regional Pricing BulletinDocument4 pagesMasterCard Regional Pricing Bulletinsoricel23No ratings yet

- Postilion Developer ExternalDocument2 pagesPostilion Developer ExternalMwansa MachaloNo ratings yet

- 80 Byte Population Guide - v15.94Document216 pages80 Byte Population Guide - v15.94HMNo ratings yet

- QRCode-v-1 3Document32 pagesQRCode-v-1 3Mohammed KhalidNo ratings yet

- Collis b2 Emv and Contactless OfferingDocument52 pagesCollis b2 Emv and Contactless OfferingmuratNo ratings yet

- EPC020-08 Book 3 - Data Elements - SCS Volume v7.1Document104 pagesEPC020-08 Book 3 - Data Elements - SCS Volume v7.1Makarand LonkarNo ratings yet

- PCI TSP Requirements v1Document92 pagesPCI TSP Requirements v1Juan Cuba AlarcónNo ratings yet

- Kernel C 4 Specification v2.11Document165 pagesKernel C 4 Specification v2.11Robinson MarquesNo ratings yet

- csfb400 Icsf Apg hcr77d1 PDFDocument1,720 pagescsfb400 Icsf Apg hcr77d1 PDFPalmira PérezNo ratings yet

- Terms and DefinitonsDocument23 pagesTerms and DefinitonsMai Nam ThangNo ratings yet

- Iso 8583 2023Document11 pagesIso 8583 2023Srinivas K100% (1)

- Transaction Processing Rules June 2016Document289 pagesTransaction Processing Rules June 2016Armando ReyNo ratings yet

- Visa Chip Simplifying ImplementationDocument2 pagesVisa Chip Simplifying Implementationjagdish kumarNo ratings yet

- 2.5 Support of Merchant Volume Indicator ValuesDocument10 pages2.5 Support of Merchant Volume Indicator ValuesYasir RoniNo ratings yet

- 200-338 - 0.2 Money Controls CcTalk User ManualDocument226 pages200-338 - 0.2 Money Controls CcTalk User ManualRonald M. Diaz0% (2)

- UPI QuickPass Testing Guide For Acquirers - V201905Document14 pagesUPI QuickPass Testing Guide For Acquirers - V201905yoron liu100% (1)

- ISO 14906-2011 ETC 应用层Document120 pagesISO 14906-2011 ETC 应用层中咨No ratings yet

- Mastercard Switch Rules ManualDocument86 pagesMastercard Switch Rules ManualMatteo TorresNo ratings yet

- Operational Support Client Forum PDFDocument129 pagesOperational Support Client Forum PDFASDFGHTNo ratings yet

- DCI Contact D-PAS Acquirer Host Test Plan v1.2Document89 pagesDCI Contact D-PAS Acquirer Host Test Plan v1.2Roger Cardenas100% (1)

- Biblioteca EMV ContactlessDocument34 pagesBiblioteca EMV ContactlessEder Nunes JúniorNo ratings yet

- Visa USA Interchange Reimbursement FeesDocument26 pagesVisa USA Interchange Reimbursement FeesMark Jasper DabuNo ratings yet

- DOC00310 Verix EVo ACT Programmers GuideDocument348 pagesDOC00310 Verix EVo ACT Programmers GuideFernando75% (4)

- Part II Extended Purchase Specification Based On Contactless Low-Value Payment ApplicationDocument67 pagesPart II Extended Purchase Specification Based On Contactless Low-Value Payment ApplicationMai Nam ThangNo ratings yet

- Contactless Cards WorkingDocument4 pagesContactless Cards WorkingdineshNo ratings yet

- PP MTIP UserGuide Dec2011Document201 pagesPP MTIP UserGuide Dec2011AzzaHassanienNo ratings yet

- PayPass v3 TTAL2-Testing Env Nov2013Document63 pagesPayPass v3 TTAL2-Testing Env Nov2013Phạm Tiến ThànhNo ratings yet

- 7 EMVCo Level3 Framework Implementation Guidelines V 1 1 20190411Document103 pages7 EMVCo Level3 Framework Implementation Guidelines V 1 1 20190411Solomon BuiNo ratings yet

- TIP Entire ManualDocument105 pagesTIP Entire ManualmuratNo ratings yet

- EMV Security Review Emms, M. 2016Document164 pagesEMV Security Review Emms, M. 2016JoDo SayaNo ratings yet

- PayPass - MChip - Acquirer - Imlementation - Requirements - PPMCAIR (V1.0 - July 2008)Document88 pagesPayPass - MChip - Acquirer - Imlementation - Requirements - PPMCAIR (V1.0 - July 2008)berghauptmannNo ratings yet

- Ingenico Driver Installer Release Note ICO-OPE-2012-0820-LTDocument5 pagesIngenico Driver Installer Release Note ICO-OPE-2012-0820-LTtimmyJackson100% (1)

- ATPC Install and Ops Guide 3.10 529056-002 PDFDocument251 pagesATPC Install and Ops Guide 3.10 529056-002 PDFsathish kumarNo ratings yet

- BPC - ER - A1N0170 - Acleda - Fraud Managent v1.0Document54 pagesBPC - ER - A1N0170 - Acleda - Fraud Managent v1.0jch bpcNo ratings yet

- Cwa14050 42 2005 JanDocument49 pagesCwa14050 42 2005 JanoirrazaNo ratings yet

- QVSDC IRWIN Testing ProcessDocument8 pagesQVSDC IRWIN Testing ProcessLewisMuneneNo ratings yet

- ARQC and ARPCDocument3 pagesARQC and ARPCMayur GowdaNo ratings yet

- As 2805.4.2-2006 Electronic Funds Transfer - Requirements For Interfaces Message Authentication - MechanismsDocument8 pagesAs 2805.4.2-2006 Electronic Funds Transfer - Requirements For Interfaces Message Authentication - MechanismsSAI Global - APACNo ratings yet

- EMV Contactless Book C 8 Kernel 8 Specification v1.1 BookmarksDocument303 pagesEMV Contactless Book C 8 Kernel 8 Specification v1.1 BookmarksRobinson MarquesNo ratings yet

- S7000 OperatorManual 1.3Document48 pagesS7000 OperatorManual 1.3Zagiza TuNo ratings yet

- Fis 8583-2017Document600 pagesFis 8583-2017HipHop MarocNo ratings yet

- EPC342-08 Guidelines On Algorithms and Key ManagementDocument57 pagesEPC342-08 Guidelines On Algorithms and Key ManagementScoobs72No ratings yet

- TEUSERDocument98 pagesTEUSERdsr_ecNo ratings yet

- ANZ EGate Virtual Payment Client Guide Rev 1.2Document74 pagesANZ EGate Virtual Payment Client Guide Rev 1.2Nigel GarciaNo ratings yet

- Card Banking 2Document66 pagesCard Banking 2markos mamadeNo ratings yet

- As 2805.9-2000 Electronic Funds Transfer - Requirements For Interfaces Privacy of CommunicationsDocument7 pagesAs 2805.9-2000 Electronic Funds Transfer - Requirements For Interfaces Privacy of CommunicationsSAI Global - APACNo ratings yet

- MACA ManualDocument597 pagesMACA ManualPrabin ShresthaNo ratings yet

- ArticleforPaymentsSystemsMagazine-13 11 05Document14 pagesArticleforPaymentsSystemsMagazine-13 11 05Syed RazviNo ratings yet

- GlobalPayments Technical SpecificationsDocument66 pagesGlobalPayments Technical SpecificationssanpikNo ratings yet

- ATKEYBLWPDocument9 pagesATKEYBLWPOlusola TalabiNo ratings yet

- 91statistics Annual91Document171 pages91statistics Annual91Abiy MulugetaNo ratings yet

- Efrn 61603Document16 pagesEfrn 61603Abiy MulugetaNo ratings yet

- IE DemandsDocument2 pagesIE DemandsAbiy MulugetaNo ratings yet

- Fundamental Data Mining in Institutional Research WorkshopDocument68 pagesFundamental Data Mining in Institutional Research WorkshopAbiy MulugetaNo ratings yet

- The Application of Data Mining To Support Custemer Relationship Management at Ethiopian AirlinesDocument140 pagesThe Application of Data Mining To Support Custemer Relationship Management at Ethiopian AirlinesAbiy MulugetaNo ratings yet

- Enrollment Prediction - ProjectDocument17 pagesEnrollment Prediction - ProjectAbiy MulugetaNo ratings yet

- Ii - What Is Data Mining?Document4 pagesIi - What Is Data Mining?Abiy MulugetaNo ratings yet

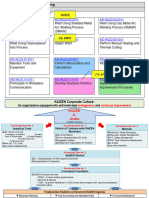

- KAIZEN Road Map & OSDocument2 pagesKAIZEN Road Map & OSAbiy MulugetaNo ratings yet

- Va Enrollment Demand Projection-2001-2010Document62 pagesVa Enrollment Demand Projection-2001-2010Abiy MulugetaNo ratings yet

- Poster FinalDocument1 pagePoster FinalAbiy MulugetaNo ratings yet

- Enrollment StudyDocument33 pagesEnrollment StudyAbiy MulugetaNo ratings yet

- TagarelaDocument11 pagesTagarelaAbiy MulugetaNo ratings yet

- Article 4Document13 pagesArticle 4Abiy MulugetaNo ratings yet

- Paper 28Document6 pagesPaper 28Abiy MulugetaNo ratings yet

- Segmentation of Cells From MicroscopicDocument67 pagesSegmentation of Cells From MicroscopicAbiy MulugetaNo ratings yet

- Vol 101Document124 pagesVol 101Abiy MulugetaNo ratings yet

- SWStutorial ICWE2005Document220 pagesSWStutorial ICWE2005Abiy MulugetaNo ratings yet

- Text Categorization and ClassificationDocument13 pagesText Categorization and ClassificationAbiy MulugetaNo ratings yet

- Python TutorialDocument88 pagesPython TutorialAbiy MulugetaNo ratings yet

- System LinqDocument1,024 pagesSystem LinqAbiy MulugetaNo ratings yet

- Microsoft VisualBasic FileIODocument181 pagesMicrosoft VisualBasic FileIOAbiy MulugetaNo ratings yet

- ED474143Document20 pagesED474143Abiy MulugetaNo ratings yet

- Visa Global Level 3 L3 Testing Guidelines and FAQ Version 1.14 - Build 015 - FINAL - 061523Document8 pagesVisa Global Level 3 L3 Testing Guidelines and FAQ Version 1.14 - Build 015 - FINAL - 061523Abiy MulugetaNo ratings yet

- SPECTRA-SoftPOS ENDocument3 pagesSPECTRA-SoftPOS ENAbiy MulugetaNo ratings yet

- Contactless Mester CardDocument1 pageContactless Mester CardAbiy MulugetaNo ratings yet

- Prediction of Students' Educational Status Using CART Algorithm, Neural Network, and Increase in Prediction Precision Using Combinational ModelDocument5 pagesPrediction of Students' Educational Status Using CART Algorithm, Neural Network, and Increase in Prediction Precision Using Combinational ModelAbiy MulugetaNo ratings yet

- E Book TokenizationDocument8 pagesE Book TokenizationAbiy MulugetaNo ratings yet

- TokenisationDocument2 pagesTokenisationAbiy MulugetaNo ratings yet

- Emvco Keynote The Future of Contactless Payments Slides 001Document21 pagesEmvco Keynote The Future of Contactless Payments Slides 001Abiy MulugetaNo ratings yet

- Visa - Public - Key - Tables - Accessible - Reformatted 15 Sep 23 (1) - ACCESSIBLEDocument9 pagesVisa - Public - Key - Tables - Accessible - Reformatted 15 Sep 23 (1) - ACCESSIBLEAbiy MulugetaNo ratings yet

- Guitar Ensembles Steve Marsh: A Benslow Music CourseDocument4 pagesGuitar Ensembles Steve Marsh: A Benslow Music Courseapi-210427398No ratings yet

- Standard Chartered Online Banking - ZWDocument2 pagesStandard Chartered Online Banking - ZWrussell makosaNo ratings yet

- Difference Between Pay Order and Demand DraftDocument3 pagesDifference Between Pay Order and Demand DraftAman DegraNo ratings yet

- India and BankingDocument3 pagesIndia and BankingJanu PriyaNo ratings yet

- Modeling Customers Intention To Use E-Wallet in ADocument5 pagesModeling Customers Intention To Use E-Wallet in AFaten bakloutiNo ratings yet

- 201908Document1 page201908HarryNo ratings yet

- TRM N61 V JC OMTKD7Document8 pagesTRM N61 V JC OMTKD7Mukesh Kumar DubeyNo ratings yet

- ADocument3 pagesApradeepNo ratings yet

- List of Conditions Effective From 01-04-2017Document13 pagesList of Conditions Effective From 01-04-2017omidreza tabrizianNo ratings yet

- JAIIB Principles of Banking Module C NewDocument16 pagesJAIIB Principles of Banking Module C News1508198767% (3)

- Bruno - Gomes Statement 2021 07Document4 pagesBruno - Gomes Statement 2021 07B gNo ratings yet

- Calculate EMV Cryptogram ARQC-ARPC For ISO8583 PaymentsDocument6 pagesCalculate EMV Cryptogram ARQC-ARPC For ISO8583 Paymentssajad salehiNo ratings yet

- Ach Code CardDocument2 pagesAch Code CardSankaetPathakNo ratings yet

- PH 9 HK 2 y 3 GGu 4 ZWLNDocument6 pagesPH 9 HK 2 y 3 GGu 4 ZWLNRanjit BeheraNo ratings yet

- Plastic Money Full ProjectDocument54 pagesPlastic Money Full ProjectNevil Surani76% (169)

- COMIN Egypt Launch Strategy-VFDocument45 pagesCOMIN Egypt Launch Strategy-VFSallam BakeerNo ratings yet

- Information On Payment Services Corporate 13.1.2018Document19 pagesInformation On Payment Services Corporate 13.1.2018Riciu IonutNo ratings yet

- Formato Recepcion UsdDocument1 pageFormato Recepcion UsdRicardo Villalón WNo ratings yet

- 279 Villas: Jalan Baik - Baik Nakula BaratDocument4 pages279 Villas: Jalan Baik - Baik Nakula BaratmarkNo ratings yet

- State Bank Collect Reprint Remittance Form Payment HistoryDocument1 pageState Bank Collect Reprint Remittance Form Payment HistoryBinayakSwainNo ratings yet

- Soal Siklus 2Document5 pagesSoal Siklus 2Darmadi0% (1)

- MrcInvoices November2022 272286Document1 pageMrcInvoices November2022 272286Saad AzmatNo ratings yet

- Chartered Accountant 2 0Document3 pagesChartered Accountant 2 0RkNo ratings yet

- 3-D Secure Vendor List v1 10-30-20181Document4 pages3-D Secure Vendor List v1 10-30-20181Mohamed LahlouNo ratings yet

- BOM Statement xxxxxxxx4898 20190401 20191009 20191009022924 PDFDocument14 pagesBOM Statement xxxxxxxx4898 20190401 20191009 20191009022924 PDFtrupti jadhavNo ratings yet

- Upi ProjectDocument26 pagesUpi Projectradheshyamsharma9953No ratings yet

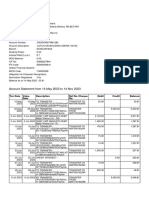

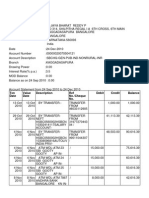

- TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument4 pagesTXN Date Value Date Description Ref No./Cheque No. Debit Credit Balanceswetha_muthumulaNo ratings yet

- 7588 Ca 3891 C 0Document56 pages7588 Ca 3891 C 0luuuNo ratings yet

M/Chip Functional Architecture For Debit and Credit: Applies To: Summary

M/Chip Functional Architecture For Debit and Credit: Applies To: Summary

Uploaded by

Abiy MulugetaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

M/Chip Functional Architecture For Debit and Credit: Applies To: Summary

M/Chip Functional Architecture For Debit and Credit: Applies To: Summary

Uploaded by

Abiy MulugetaCopyright:

Available Formats

M/Chip Functional Architecture for Debit

and Credit

Christian Delporte, Vice President, Chip Centre of Excellence, New Products Engineering

Suggested routing: Authorization, Chargeback, Chip Technology, Clearing, Mail List, Principal,

Programming, Risk Management, Security, and Settlement Contacts

Applies to: ; Issuers ; Acquirers

Summary: Effective January 2005, MasterCard will update the M/Chip

Functional Architecture for Debit and Credit document.

To help members to prepare their systems, this article lists

significant changes that the document will include.

Action

Indicator: I Informational only (no action required)

Effective Date: MasterCard will publish an updated version of the M/Chip

Functional Architecture in January 2005.

Effective January 2005, MasterCard will introduce new features. To help

members to prepare their systems, this article lists significant changes that

the document will include.

Effective Date Change

Immediately MasterCard has made changes to type approval testing to

correct interoperability issues. The new tests already apply to

new implementations. The new version of the M/Chip

Functional Architecture for Debit and Credit document will

contain details about the changes.

1 January 2005 The new version of the M/Chip Functional Architecture for

Debit and Credit document will be available. Type approval

test tools will be available to test all of the new options in the

document.

1 July 2005 MasterCard will conduct all new type approvals against the new

functional architecture only. New terminals and cards must

support all the new requirements as of this date.

44 Europe Edition Operations Bulletin No. 7, 1 July 2004

MasterCard International Incorporated

Background

The M/Chip Functional Architecture for Debit and Credit manual is the

main document explaining how members should implement credit and

debit programs using EMV1 smart cards. As part of the normal

development cycle, MasterCard provides updated versions that contain

corrections, clarifications, and additions to the previous versions.

Effect on members

The changes described in this article are divided into four categories,

depending on their impact on members.

1) Changes to existing requirements—Changes that are a result of either:

− a) A policy change, or

− b) A clarification made because members have not correctly

In some cases, implemented the requirements in the past. Members that have

MasterCard has already

implemented the requirements correctly will not be affected.

tested the new

requirements in type

approval. Therefore, 2) New options—Changes and additions made to implement completely

MasterCard has already new features. These options will be available in Type Approval testing

tested new

implementations to

beginning in January 2005.

conform to these

requirements. 3) New requirements—Additional features that members must implement.

These requirements are mandatory and will be tested in type approval

from July 2005.

4) Clarifications and recommendations—Expanded definitions where there

have been misinterpretations or questions in the past. Clarifications

require no action. There will be no impact on members that have already

implemented the requirements correctly.

Member benefit

The purpose of the new version of the document is to make MasterCard

requirements clearer and easier to implement. The benefits to members

are:

• Clearer explanations and better guidelines so that implementation will

be easier and less expensive

• Better definitions, leading to fewer interoperability problems

• Documentation support

1

In 1996, Europay (now MasterCard Europe sprl), MasterCard, and Visa (EMV)

developed standards for integrated circuit cards (ICCs), terminals, and applications.

EMVCo, LLC, established in 1999, is the organization that oversees and maintains the

EMV specifications.

Europe Edition Operations Bulletin No. 7, 1 July 2004

MasterCard International Incorporated 45

Summary of changes

The following sections summarize the changes that MasterCard will make

The use of a single quote

to the M/Chip Functional Architecture for Debit and Credit document.

(‘) before a number

indicates that the number 1a) Changes with immediate effect due to policy changes

is in hexadecimal format.

Following are changes to existing rules that may have an impact on

existing cards and terminals. Members should check the following points

carefully to determine the impact on their operations.

New CVM condition codes from EMV

EMVCo has defined new Card Verification Method (CVM) condition codes

to replace the existing “if cash or cashback” codes. The announcement is

in EMVCo Bulletin 16.

The new CVM codes are:

• ‘01’—Unattended cash

• ‘02’—Not unattended cash, and not manual cash, and not purchase

with cash back

• ‘04’—Manual cash

• ‘05’—Purchase with cash back

The intention is that, in the future, issuers will be able to use these codes

to implement different card behavior for ATM withdrawals compared to

other kinds of cash transactions.

The new version of the functional architecture will incorporate the new

EMV codes and explain their impact on cards and terminals. Existing

terminals will continue to work correctly with cards that use the new

codes.

New Maestro CVM policy

In February 2004, the Debit Advisory Board decided that hybrid Maestro

cards must support both offline and online personal identification numbers

(PINs).

1b) Changes with immediate effect due to requirements

clarification

The following clarifications are effective immediately.

Use of the fallback indicator

Some acquirers using magnetic stripe-only technology have misunderstood

the use of the fallback indicator. The new version of the document will

clarify the Standard that only chip-approved acquirers may use the fallback

indicator. Acquirers that do not accept MasterCard chip cards

internationally must not use the fallback indicator.

46 Europe Edition Operations Bulletin No. 7, 1 July 2004

MasterCard International Incorporated

For more information about the fallback indicator, refer to Europe Edition

Operations Bulletin No. 6, June 2003.

Implications of an empty Candidate List

The updated document will clarify that MasterCard considers an empty

A “Candidate List” is the

Candidate List (i.e. a situation where there is no common application

list of possible supported by both the chip and the terminal) a failure of chip technology,

applications which can be and fallback to magnetic stripe is applicable.

used to make a payment.

It is a list of the

applications that are The MasterCard Terminal Integration Process already ensures that terminals

present on both the card comply with this requirement.

and the terminal.

Printing transaction information

In the January 2003 version of the functional architecture, to help resolve

any future acceptance problems, MasterCard required new terminals to

support printing or to display the details of the terminal application’s

parameters, and the details of the last transaction performed.

MasterCard will begin enforcing this requirement immediately.

The displayed data must include:

• Application Identifier (AID) or the file name of the application used

• Card primary account number (PAN)

• Card PAN sequence number

• Integrated Circuit Card (ICC) System-Related Data (Data Element [DE]

55) produced by the transaction

• Terminal and issuer action codes (TACs and IACs)

Inconsistency of Track 2 data

MasterCard has clarified the Standards concerning Track 2 data and Track 2

Equivalent data.

A MasterCard EMV application must contain a data element (tag ’57) called

Track 2 Equivalent data. This data element should contain the same PAN

and application expiry date as that present in the chip data Application

PAN (tag ‘5A) and the Application Expiration Date (tag ‘5724). If the

values of these data elements are not the same, the terminal must terminate

the chip transaction. The terminal may process the transaction as a

fallback to magnetic stripe.

This Standard protects acquirers from possible liability if they use the

wrong PAN to clear the transaction or to check the Warning Bulletin.

The Terminal Integration Process ensures that terminals comply with this

requirement.

Europe Edition Operations Bulletin No. 7, 1 July 2004

MasterCard International Incorporated 47

Fallback on CATs

Cardholder-activated terminals (CATs) with separate readers now will

accept the first technology that the cardholder tries to use, and will not

prompt to use chip if the technology is magnetic stripe. It is too confusing

to prompt the cardholder to continue their transaction using the magnetic

stripe if the chip does not work, especially if the cardholder is not familiar

with the language of the terminal.

DE 23 in authorization and clearing messages

MasterCard clarified requirements for including Card Sequence Number

(DE 23). If Point of Service Data Code (DE 22) has the value ‘05x and the

Application PAN Sequence Number (tag ‘5F34) is present on the chip, then

DE 23 must be present and contain the Application PAN Sequence Number

in both the authorization and clearing messages.

A migration period will help satisfy this long term requirement. During the

migration period, DE 23 may be forbidden on some networks, if DE 55 is

not present.

The MasterCard Card Type Approval process already checks that the

Application PAN Sequence Number (tag ‘5F34) is present on the chip.

Default value of authorization response code

The default value of the authorization response code is value 58 if a

terminal does not receive the exact value of the issuer response code for

online-declined transactions.

The Terminal Integration Process ensures that terminals comply with this

requirement.

Settings for Stand-In

Issuers using Stand-In services for their smart cards should be aware of

certain limitations of these services that may increase authorization risk.

MasterCard will provide more detailed guidance for issuers using Stand-In

services, and new recommendations for the setting of the Issuer Action

Codes (IACs).

The Card Type Approval ensures that cards comply with this requirement.

AID support at ATMs

The Cirrus Worldwide Operating Rules define the ATM rules for cards

bearing the Cirrus, MasterCard, and Maestro logos. Most ATMs accept

all three brands. ATM vendors that want to complete Type Approval only

once must undergo chip certification while supporting all the chip AIDs

corresponding to the card products that are accepted on their ATMs.

48 Europe Edition Operations Bulletin No. 7, 1 July 2004

MasterCard International Incorporated

Hybrid terminal definition

MasterCard will clarify in the updated document the definition of hybrid

terminals to express the fact that they must be type-approved to accept

MasterCard smart cards. If the hybrid terminals are not type-approved,

MasterCard considers the terminals to be magnetic stripe-only.

2) New options

Following are new options in the functional architecture.

CVC1

Issuers should use a different value of the CVC 1 on the chip and on the

magnetic stripe. Issuers may determine the method of calculating the chip

CVC 1.

Technology selection and fallback

Following are revisions and clarifications about technology selection and

fallback:

• Acquirers may now apply for a waiver to support fallback on online-

capable CATs in the Europe region.

• Fallback requirements for manual cash advance terminals are the same

as for point-of-sale (POS) terminals.

• Fallback is now possible for offline-only terminals, using voice

authorization.

• A terminal that detects a chip technology failure after having requested

a decline (by asking the card for an Application Authentication

Cryptogram [AAC]) may decline the transaction without fallback.

• A terminal that detects a chip technology failure after the card replied

with a request for online authorization (by responding with an

Authorization ReQuest Cryptogram [ARQC]) may terminate the smart

card transaction without falling back to magnetic stripe.

Definitions of CAT levels

Members often program CATs to behave differently depending on

circumstances. For example, an unattended petrol pump may act as a CAT

Level 1 terminal if a cardholder inserts a Maestro card (which has a zero

floor limit and online PIN as the CVM). However, the same petrol pump

may act as a CAT Level 2 terminal (with a zero floor limit, limited amount,

and no CVM) when a cardholder uses a MasterCard card.

Similarly, online capable CATs with “No CVM” may act as a CAT 2 terminal

if the transaction is sent for online approval, or as a CAT 3 terminal if the

transaction is approved offline.

Europe Edition Operations Bulletin No. 7, 1 July 2004

MasterCard International Incorporated 49

A number of existing terminals are a mix of CAT 1, CAT 2, or CAT 3. This

does not pose any problem as long as the authorization and clearing

messages carry the appropriate CAT level identification.

In the new version of the document, the terms for CAT levels will refer to

transactions, not to the terminals that process the transactions. This revision

simplifies the definition of terminals, which may be online or offline, and

may or may not support PINs.

The following table explains the definitions of CAT transactions.

CVM Online Authorization Offline Approval

PIN CAT Level 1 CAT Level 1

Other than PIN CAT Level 2 CAT Level 3

Terminal Risk Management

MasterCard does not require online-only terminals to support terminal risk

management.

RSA2 key requirements

Key index 03 is now due to expire in 2009 (not in 2008).

MasterCard has accepted the new EMV recommendations for keys with

indices of:

• 05 (length 1,408 bits, expiry 2014)

• 06 (length 1,984 bits, expiry 2016)

All new and existing keys use exponent 3.

CAM requirements

Full grade, online-capable CAT terminals do not need to support an offline

Card Authentication Method (CAM).

Hybrid cards may support Dynamic Data Authentication (DDA) only.

CVM policy

MasterCard will revise the section detailing allowable CVMs to reflect the

revised Standards. These changes include the following:

• MasterCard allows online PIN instead of signature for MasterCard card

transactions at a POS.

2

Rivest, Shamir, and Adleman

50 Europe Edition Operations Bulletin No. 7, 1 July 2004

MasterCard International Incorporated

• Maestro now accepts hybrid terminals that use offline PIN only.

• For transactions using a signature as the CVM, MasterCard allows either

“Apply next CVM” (‘1E03) or “Fail CVM processing” (‘5E03).

MasterCard Electronic

M/Chip Functional Architecture for Debit and Credit will define the

Standards for using chip technology to support MasterCard Electronic

cards.

The MasterCard AID identifies MasterCard Electronic chip transactions.

The AID eases the migration from MasterCard card acceptance to

MasterCard Electronic acceptance. Once a merchant has signed up for

MasterCard Electronic, it may acquire MasterCard Electronic transactions

without changing its chip terminal.

The issuer must program their MasterCard Electronic chip applications to

be online only. A cardholder cannot use a MasterCard Electronic card

without a CVM on a CAT terminal.

Issuers will indicate in the card settings whether they allow the use of

MasterCard Electronic cards at ATMs.

Quasi-cash disbursements

The functional architecture will define the chip impact on “quasi-cash”

transactions. These transactions involve instruments that are convertible to

cash directly, but are not legal tender in the country where they are issued.

Examples include traveler’s cheques, foreign currency, money orders, and

gambling chips.

Payment of gratuities

Currently, when cardholders use MasterCard payment cards, it is normal

for the cardholder be able to add a gratuity or tip to the total amount of

the card transaction. The functional architecture will explain the Standards

and guidelines for these types of payments, particularly when a PIN is used

as CVM.

Chip support for QPS

The Quick Payment Service (QPS) is a program for merchants in the

United States that need very fast checkouts, whereby acquirers may

approve transactions without a signed receipt or an online authorization.

Europe Edition Operations Bulletin No. 7, 1 July 2004

MasterCard International Incorporated 51

In practice, the terminal is set up with a QPS floor limit, which may be

different from the normal terminal floor limit. Acquirers may approve

transactions below the QPS floor limit with no CVM and without online

authorization. Acquirers can obtain this approval by varying the terminal

capabilities, so that below the QPS floor limit the terminal will support

either “No CVM” or “No CVM and offline PIN”.

The document is available Smart card use does not affect chargeback rights or other Standards for

electronically in the QPS. For full details, refer to the Quick Payment Service Program Guide.

Member Publications

product on MasterCard

OnLine. Issuer country code as part of the signed static application

data

When cards have a domestic and an international application on the chip,

MasterCard recommends that members include the issuer country code as

part of the signed static application data (SSAD), ensuring that its value

cannot be changed. This helps prevent possible fraud opportunities.

Balance inquiry on ATM

MasterCard has clarified the requirements for ATMs supporting balance

inquiry transactions for smart cards. The functional architecture will

provide guidance on how to implement the function.

3) New requirement

Following is a new requirement in the functional architecture.

Processing domestic transactions

Processing foreign cards with a service code of ‘6XX (domestic use) is the

same as for cards with a service code of ‘2XX.

52 Europe Edition Operations Bulletin No. 7, 1 July 2004

MasterCard International Incorporated

4) Clarifications and recommendations

Following are clarifications about existing options and recommended best

practices.

Applying brand-specific fallback rules

The fallback decision should occur at the acquirer host. If the chip

technology fails, the terminal will send the transaction data and the

magnetic stripe track-2 data to the acquirer host system. The acquirer will

then use the acquirer BIN tables to identify the card brand. The host

system then may decide if the transaction continues in fallback mode, or if

the transaction is declined because fallback is not allowed in the specific

program rules.

This process will allow acquirers the flexibility to adapt to new fallback

requirements that MasterCard may introduce in the future.

Cash disbursements

MasterCard has clarified the rules relating to cash withdrawals as they

relate to chip cards.

Fallback Rules for Domestic Cards

The M/Chip Functional Architecture for Debit and Credit document will

state that acquirers that process domestic transactions as international

transactions must follow the same fallback requirements for their domestic

cards (service code = ‘6XX) as for international cards (service code = ‘2XX).

Emergency card replacement

MasterCard has clarified that the Emergency Card Replacement service will

only deliver a replacement magnetic stripe card, even if the original card

was issued with a chip.

Pre-authorizations, referrals, refunds, and voice

authorization

The functional architecture now provides more guidance to acquirers as to

how they should implement these functions in the chip environment.

Amount Other field

Members use the Amount Other field when there is a disbursement as part

of a purchase transaction. MasterCard has:

• Clarified the Standards governing cash disbursement transactions

• Explained how members can use the Amount Other field to support

this function

Europe Edition Operations Bulletin No. 7, 1 July 2004

MasterCard International Incorporated 53

Script terminology

The current use of the terms “critical” and “non-critical” scripts is not

consistent with EMV use. Therefore, MasterCard replaced the term “critical

scripts” with “scripts template 1,” and the term “non-critical scripts” with

“scripts template 2.”

Use of DE 22 in clearing messages

MasterCard will explain the meaning and use of the different subfields in

DE 22 in the functional architecture.

Chip to magnetic stripe conversion service

As a service to issuers during their migration, MasterCard has developed a

service that converts chip authorization requests to magnetic stripe

requests. This service allows issuers to begin issuing smart cards without

upgrading their authorization systems.

Data in clearing records

With the revised document, Integrated Product Messages (IPM) clearing

records may contain Issuer Authentication Data (Private Data Subelement

[PDS] 91) within DE 55.

M/Chip documentation

The M/Chip Functional Architecture for Debit and Credit manual will

explain more clearly the structure and contents of the documents

supporting the range of M/Chip products:

• M/Chip Lite 2.1

• M/Chip Select 2.0

• M/Chip 4 Lite

• M/Chip 4 Select

CDA support

MasterCard expanded the possible responses to the “Generate AC”

command to include the responses generated while performing a

Combined Dynamic Data Authentication-Application Cryptogram

Generation (CDA) transaction.

Variable CVM capabilities

MasterCard allows terminal and additional terminal capabilities to vary

according to the card application that the cardholder uses for a payment.

This means that terminals may support CVM capabilities that MasterCard

does not allow (e.g. domestic debit product support), but the terminal

must not provide these options when processing a MasterCard card.

54 Europe Edition Operations Bulletin No. 7, 1 July 2004

MasterCard International Incorporated

CVM substitution

MasterCard will clarify the M/Chip Functional Architecture for Debit and

Credit manual to explain when MasterCard allows CVM substitution (e.g.

the use of a signature when the card PIN did not work).

Application PAN and application expiry date

MasterCard clarified that the PAN and the expiry date, which are printed

on the ticket, used in Primary Account Number (DE 2) and Date,

Expiration (DE 14) in the authorization and clearing messages, must be the

Application PAN (tag ‘5A) and the Application Expiration Date (tag ‘5724).

Online only cards

MasterCard has clarified the card settings that must be used to ensure that a

card always goes online for authorizations.

Acquirer authorization below international floor limit

MasterCard has clarified the requirements for acquirers that authorize

below floor limit transactions offline.

For more information

For additional details about the M/Chip Functional Architecture for Debit

and Credit document or its impact on members, please contact:

Chip Help Desk

E-mail: chip_help@mastercard.com

Europe Edition Operations Bulletin No. 7, 1 July 2004

MasterCard International Incorporated 55

You might also like

- Verifone Vx805 DsiEMVUS Platform Integration Guide SupplementDocument60 pagesVerifone Vx805 DsiEMVUS Platform Integration Guide SupplementHammad ShaukatNo ratings yet

- Ethoca Merchant Data Provision API Integration Guide V 3.0.1 (February 13, 2019)Document13 pagesEthoca Merchant Data Provision API Integration Guide V 3.0.1 (February 13, 2019)NastasVasileNo ratings yet

- Section 1. What's New: This Readme File Contains These SectionsDocument6 pagesSection 1. What's New: This Readme File Contains These SectionsNishant SharmaNo ratings yet

- Swift: Icbpo Irrevocable Conditional Bank Pay Order: TRANSACTION CODEDocument2 pagesSwift: Icbpo Irrevocable Conditional Bank Pay Order: TRANSACTION CODEdavid patrick100% (2)

- SessionDocument8 pagesSessionIngrid Vaughn100% (1)

- EMV Contactless Kernel PR FINALDocument2 pagesEMV Contactless Kernel PR FINALPriyanka PalNo ratings yet

- Payment Card Industry 3-D Secure (PCI 3DS)Document7 pagesPayment Card Industry 3-D Secure (PCI 3DS)Al QUinNo ratings yet

- GP Guidelines For Developing Apps On GP Cards V1.0aDocument65 pagesGP Guidelines For Developing Apps On GP Cards V1.0aCharlieBrown100% (2)

- Terminal Information To Enhance Contactless Application SelectionDocument10 pagesTerminal Information To Enhance Contactless Application SelectionSaradhi MedapureddyNo ratings yet

- MasterCard Regional Pricing BulletinDocument4 pagesMasterCard Regional Pricing Bulletinsoricel23No ratings yet

- Postilion Developer ExternalDocument2 pagesPostilion Developer ExternalMwansa MachaloNo ratings yet

- 80 Byte Population Guide - v15.94Document216 pages80 Byte Population Guide - v15.94HMNo ratings yet

- QRCode-v-1 3Document32 pagesQRCode-v-1 3Mohammed KhalidNo ratings yet

- Collis b2 Emv and Contactless OfferingDocument52 pagesCollis b2 Emv and Contactless OfferingmuratNo ratings yet

- EPC020-08 Book 3 - Data Elements - SCS Volume v7.1Document104 pagesEPC020-08 Book 3 - Data Elements - SCS Volume v7.1Makarand LonkarNo ratings yet

- PCI TSP Requirements v1Document92 pagesPCI TSP Requirements v1Juan Cuba AlarcónNo ratings yet

- Kernel C 4 Specification v2.11Document165 pagesKernel C 4 Specification v2.11Robinson MarquesNo ratings yet

- csfb400 Icsf Apg hcr77d1 PDFDocument1,720 pagescsfb400 Icsf Apg hcr77d1 PDFPalmira PérezNo ratings yet

- Terms and DefinitonsDocument23 pagesTerms and DefinitonsMai Nam ThangNo ratings yet

- Iso 8583 2023Document11 pagesIso 8583 2023Srinivas K100% (1)

- Transaction Processing Rules June 2016Document289 pagesTransaction Processing Rules June 2016Armando ReyNo ratings yet

- Visa Chip Simplifying ImplementationDocument2 pagesVisa Chip Simplifying Implementationjagdish kumarNo ratings yet

- 2.5 Support of Merchant Volume Indicator ValuesDocument10 pages2.5 Support of Merchant Volume Indicator ValuesYasir RoniNo ratings yet

- 200-338 - 0.2 Money Controls CcTalk User ManualDocument226 pages200-338 - 0.2 Money Controls CcTalk User ManualRonald M. Diaz0% (2)

- UPI QuickPass Testing Guide For Acquirers - V201905Document14 pagesUPI QuickPass Testing Guide For Acquirers - V201905yoron liu100% (1)

- ISO 14906-2011 ETC 应用层Document120 pagesISO 14906-2011 ETC 应用层中咨No ratings yet

- Mastercard Switch Rules ManualDocument86 pagesMastercard Switch Rules ManualMatteo TorresNo ratings yet

- Operational Support Client Forum PDFDocument129 pagesOperational Support Client Forum PDFASDFGHTNo ratings yet

- DCI Contact D-PAS Acquirer Host Test Plan v1.2Document89 pagesDCI Contact D-PAS Acquirer Host Test Plan v1.2Roger Cardenas100% (1)

- Biblioteca EMV ContactlessDocument34 pagesBiblioteca EMV ContactlessEder Nunes JúniorNo ratings yet

- Visa USA Interchange Reimbursement FeesDocument26 pagesVisa USA Interchange Reimbursement FeesMark Jasper DabuNo ratings yet

- DOC00310 Verix EVo ACT Programmers GuideDocument348 pagesDOC00310 Verix EVo ACT Programmers GuideFernando75% (4)

- Part II Extended Purchase Specification Based On Contactless Low-Value Payment ApplicationDocument67 pagesPart II Extended Purchase Specification Based On Contactless Low-Value Payment ApplicationMai Nam ThangNo ratings yet

- Contactless Cards WorkingDocument4 pagesContactless Cards WorkingdineshNo ratings yet

- PP MTIP UserGuide Dec2011Document201 pagesPP MTIP UserGuide Dec2011AzzaHassanienNo ratings yet

- PayPass v3 TTAL2-Testing Env Nov2013Document63 pagesPayPass v3 TTAL2-Testing Env Nov2013Phạm Tiến ThànhNo ratings yet

- 7 EMVCo Level3 Framework Implementation Guidelines V 1 1 20190411Document103 pages7 EMVCo Level3 Framework Implementation Guidelines V 1 1 20190411Solomon BuiNo ratings yet

- TIP Entire ManualDocument105 pagesTIP Entire ManualmuratNo ratings yet

- EMV Security Review Emms, M. 2016Document164 pagesEMV Security Review Emms, M. 2016JoDo SayaNo ratings yet

- PayPass - MChip - Acquirer - Imlementation - Requirements - PPMCAIR (V1.0 - July 2008)Document88 pagesPayPass - MChip - Acquirer - Imlementation - Requirements - PPMCAIR (V1.0 - July 2008)berghauptmannNo ratings yet

- Ingenico Driver Installer Release Note ICO-OPE-2012-0820-LTDocument5 pagesIngenico Driver Installer Release Note ICO-OPE-2012-0820-LTtimmyJackson100% (1)

- ATPC Install and Ops Guide 3.10 529056-002 PDFDocument251 pagesATPC Install and Ops Guide 3.10 529056-002 PDFsathish kumarNo ratings yet

- BPC - ER - A1N0170 - Acleda - Fraud Managent v1.0Document54 pagesBPC - ER - A1N0170 - Acleda - Fraud Managent v1.0jch bpcNo ratings yet

- Cwa14050 42 2005 JanDocument49 pagesCwa14050 42 2005 JanoirrazaNo ratings yet

- QVSDC IRWIN Testing ProcessDocument8 pagesQVSDC IRWIN Testing ProcessLewisMuneneNo ratings yet

- ARQC and ARPCDocument3 pagesARQC and ARPCMayur GowdaNo ratings yet

- As 2805.4.2-2006 Electronic Funds Transfer - Requirements For Interfaces Message Authentication - MechanismsDocument8 pagesAs 2805.4.2-2006 Electronic Funds Transfer - Requirements For Interfaces Message Authentication - MechanismsSAI Global - APACNo ratings yet

- EMV Contactless Book C 8 Kernel 8 Specification v1.1 BookmarksDocument303 pagesEMV Contactless Book C 8 Kernel 8 Specification v1.1 BookmarksRobinson MarquesNo ratings yet

- S7000 OperatorManual 1.3Document48 pagesS7000 OperatorManual 1.3Zagiza TuNo ratings yet

- Fis 8583-2017Document600 pagesFis 8583-2017HipHop MarocNo ratings yet

- EPC342-08 Guidelines On Algorithms and Key ManagementDocument57 pagesEPC342-08 Guidelines On Algorithms and Key ManagementScoobs72No ratings yet

- TEUSERDocument98 pagesTEUSERdsr_ecNo ratings yet

- ANZ EGate Virtual Payment Client Guide Rev 1.2Document74 pagesANZ EGate Virtual Payment Client Guide Rev 1.2Nigel GarciaNo ratings yet

- Card Banking 2Document66 pagesCard Banking 2markos mamadeNo ratings yet

- As 2805.9-2000 Electronic Funds Transfer - Requirements For Interfaces Privacy of CommunicationsDocument7 pagesAs 2805.9-2000 Electronic Funds Transfer - Requirements For Interfaces Privacy of CommunicationsSAI Global - APACNo ratings yet

- MACA ManualDocument597 pagesMACA ManualPrabin ShresthaNo ratings yet

- ArticleforPaymentsSystemsMagazine-13 11 05Document14 pagesArticleforPaymentsSystemsMagazine-13 11 05Syed RazviNo ratings yet

- GlobalPayments Technical SpecificationsDocument66 pagesGlobalPayments Technical SpecificationssanpikNo ratings yet

- ATKEYBLWPDocument9 pagesATKEYBLWPOlusola TalabiNo ratings yet

- 91statistics Annual91Document171 pages91statistics Annual91Abiy MulugetaNo ratings yet

- Efrn 61603Document16 pagesEfrn 61603Abiy MulugetaNo ratings yet

- IE DemandsDocument2 pagesIE DemandsAbiy MulugetaNo ratings yet

- Fundamental Data Mining in Institutional Research WorkshopDocument68 pagesFundamental Data Mining in Institutional Research WorkshopAbiy MulugetaNo ratings yet

- The Application of Data Mining To Support Custemer Relationship Management at Ethiopian AirlinesDocument140 pagesThe Application of Data Mining To Support Custemer Relationship Management at Ethiopian AirlinesAbiy MulugetaNo ratings yet

- Enrollment Prediction - ProjectDocument17 pagesEnrollment Prediction - ProjectAbiy MulugetaNo ratings yet

- Ii - What Is Data Mining?Document4 pagesIi - What Is Data Mining?Abiy MulugetaNo ratings yet

- KAIZEN Road Map & OSDocument2 pagesKAIZEN Road Map & OSAbiy MulugetaNo ratings yet

- Va Enrollment Demand Projection-2001-2010Document62 pagesVa Enrollment Demand Projection-2001-2010Abiy MulugetaNo ratings yet

- Poster FinalDocument1 pagePoster FinalAbiy MulugetaNo ratings yet

- Enrollment StudyDocument33 pagesEnrollment StudyAbiy MulugetaNo ratings yet

- TagarelaDocument11 pagesTagarelaAbiy MulugetaNo ratings yet

- Article 4Document13 pagesArticle 4Abiy MulugetaNo ratings yet

- Paper 28Document6 pagesPaper 28Abiy MulugetaNo ratings yet

- Segmentation of Cells From MicroscopicDocument67 pagesSegmentation of Cells From MicroscopicAbiy MulugetaNo ratings yet

- Vol 101Document124 pagesVol 101Abiy MulugetaNo ratings yet

- SWStutorial ICWE2005Document220 pagesSWStutorial ICWE2005Abiy MulugetaNo ratings yet

- Text Categorization and ClassificationDocument13 pagesText Categorization and ClassificationAbiy MulugetaNo ratings yet

- Python TutorialDocument88 pagesPython TutorialAbiy MulugetaNo ratings yet

- System LinqDocument1,024 pagesSystem LinqAbiy MulugetaNo ratings yet

- Microsoft VisualBasic FileIODocument181 pagesMicrosoft VisualBasic FileIOAbiy MulugetaNo ratings yet

- ED474143Document20 pagesED474143Abiy MulugetaNo ratings yet

- Visa Global Level 3 L3 Testing Guidelines and FAQ Version 1.14 - Build 015 - FINAL - 061523Document8 pagesVisa Global Level 3 L3 Testing Guidelines and FAQ Version 1.14 - Build 015 - FINAL - 061523Abiy MulugetaNo ratings yet

- SPECTRA-SoftPOS ENDocument3 pagesSPECTRA-SoftPOS ENAbiy MulugetaNo ratings yet

- Contactless Mester CardDocument1 pageContactless Mester CardAbiy MulugetaNo ratings yet

- Prediction of Students' Educational Status Using CART Algorithm, Neural Network, and Increase in Prediction Precision Using Combinational ModelDocument5 pagesPrediction of Students' Educational Status Using CART Algorithm, Neural Network, and Increase in Prediction Precision Using Combinational ModelAbiy MulugetaNo ratings yet

- E Book TokenizationDocument8 pagesE Book TokenizationAbiy MulugetaNo ratings yet

- TokenisationDocument2 pagesTokenisationAbiy MulugetaNo ratings yet

- Emvco Keynote The Future of Contactless Payments Slides 001Document21 pagesEmvco Keynote The Future of Contactless Payments Slides 001Abiy MulugetaNo ratings yet

- Visa - Public - Key - Tables - Accessible - Reformatted 15 Sep 23 (1) - ACCESSIBLEDocument9 pagesVisa - Public - Key - Tables - Accessible - Reformatted 15 Sep 23 (1) - ACCESSIBLEAbiy MulugetaNo ratings yet

- Guitar Ensembles Steve Marsh: A Benslow Music CourseDocument4 pagesGuitar Ensembles Steve Marsh: A Benslow Music Courseapi-210427398No ratings yet

- Standard Chartered Online Banking - ZWDocument2 pagesStandard Chartered Online Banking - ZWrussell makosaNo ratings yet

- Difference Between Pay Order and Demand DraftDocument3 pagesDifference Between Pay Order and Demand DraftAman DegraNo ratings yet

- India and BankingDocument3 pagesIndia and BankingJanu PriyaNo ratings yet

- Modeling Customers Intention To Use E-Wallet in ADocument5 pagesModeling Customers Intention To Use E-Wallet in AFaten bakloutiNo ratings yet

- 201908Document1 page201908HarryNo ratings yet

- TRM N61 V JC OMTKD7Document8 pagesTRM N61 V JC OMTKD7Mukesh Kumar DubeyNo ratings yet

- ADocument3 pagesApradeepNo ratings yet

- List of Conditions Effective From 01-04-2017Document13 pagesList of Conditions Effective From 01-04-2017omidreza tabrizianNo ratings yet

- JAIIB Principles of Banking Module C NewDocument16 pagesJAIIB Principles of Banking Module C News1508198767% (3)

- Bruno - Gomes Statement 2021 07Document4 pagesBruno - Gomes Statement 2021 07B gNo ratings yet

- Calculate EMV Cryptogram ARQC-ARPC For ISO8583 PaymentsDocument6 pagesCalculate EMV Cryptogram ARQC-ARPC For ISO8583 Paymentssajad salehiNo ratings yet

- Ach Code CardDocument2 pagesAch Code CardSankaetPathakNo ratings yet

- PH 9 HK 2 y 3 GGu 4 ZWLNDocument6 pagesPH 9 HK 2 y 3 GGu 4 ZWLNRanjit BeheraNo ratings yet

- Plastic Money Full ProjectDocument54 pagesPlastic Money Full ProjectNevil Surani76% (169)

- COMIN Egypt Launch Strategy-VFDocument45 pagesCOMIN Egypt Launch Strategy-VFSallam BakeerNo ratings yet

- Information On Payment Services Corporate 13.1.2018Document19 pagesInformation On Payment Services Corporate 13.1.2018Riciu IonutNo ratings yet

- Formato Recepcion UsdDocument1 pageFormato Recepcion UsdRicardo Villalón WNo ratings yet

- 279 Villas: Jalan Baik - Baik Nakula BaratDocument4 pages279 Villas: Jalan Baik - Baik Nakula BaratmarkNo ratings yet

- State Bank Collect Reprint Remittance Form Payment HistoryDocument1 pageState Bank Collect Reprint Remittance Form Payment HistoryBinayakSwainNo ratings yet

- Soal Siklus 2Document5 pagesSoal Siklus 2Darmadi0% (1)

- MrcInvoices November2022 272286Document1 pageMrcInvoices November2022 272286Saad AzmatNo ratings yet

- Chartered Accountant 2 0Document3 pagesChartered Accountant 2 0RkNo ratings yet

- 3-D Secure Vendor List v1 10-30-20181Document4 pages3-D Secure Vendor List v1 10-30-20181Mohamed LahlouNo ratings yet

- BOM Statement xxxxxxxx4898 20190401 20191009 20191009022924 PDFDocument14 pagesBOM Statement xxxxxxxx4898 20190401 20191009 20191009022924 PDFtrupti jadhavNo ratings yet

- Upi ProjectDocument26 pagesUpi Projectradheshyamsharma9953No ratings yet

- TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument4 pagesTXN Date Value Date Description Ref No./Cheque No. Debit Credit Balanceswetha_muthumulaNo ratings yet

- 7588 Ca 3891 C 0Document56 pages7588 Ca 3891 C 0luuuNo ratings yet