Professional Documents

Culture Documents

Manage

Manage

Uploaded by

Zoltan SzarvasOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Manage

Manage

Uploaded by

Zoltan SzarvasCopyright:

Available Formats

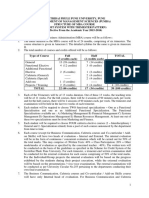

GTI24AN418EN, GTI24AN418EN - TAXATION AND INTERNATIONAL TAXATION

RULES OF ASSESSMENT

A total of 100 points can be earned during the teaching period. Out of these, 90 points can be

obtained by taking midterms during the teaching period. They follow a special schedule and

take place at the Exam Centre. For 3-credit courses 2 midterms for 45 points each are

organised, An additional 10 points can be earned in lectures and seminars. Students may use

the points collected in midterms and other activities to secure their exam eligibility and to

earn an offered grade.

Offered grades can only be obtained above 60 points, and the grade limits are the following:

60-69 satisfactory, 70-84 good, 85-100 excellent.

The exam consists of three parts, it is not possible to step back from each task. Students can

enter twice.

The students have to answer 10 true-false questions for a total of 10 points after the 6th

correct answer gives 2-2 points. They will be given two calculation tasks for 15 points each. 5

points are available for the essay question. The total time is 30 minutes, the test ends

automatically at the end of the time. Answers to questions can only be accepted with

description of the calculation process. The answer to the essay question should contain 10-15

sentences.

The 1st exam consists of the first three lectures and the two seminars. The company tax does

not belong to the subject of this assessment. The video lesson serves as background

information for the essay questions.

Mária Lakatos

You might also like

- Marking SchemeDocument2 pagesMarking SchemeRashmiRavi NaikNo ratings yet

- Assessment MethodsDocument1 pageAssessment MethodsPiotr DąbekNo ratings yet

- Things To Know - Persuasion - ENDocument2 pagesThings To Know - Persuasion - ENlucreciaNo ratings yet

- Syllabus PUMBA PDFDocument17 pagesSyllabus PUMBA PDFVaibhav KharadeNo ratings yet

- 1033se Syl Fall 14Document2 pages1033se Syl Fall 14api-261738292No ratings yet

- M.SC Yoga SyllabusDocument29 pagesM.SC Yoga SyllabusSenthil KumarNo ratings yet

- Revised CBCS CA-StudentsDocument12 pagesRevised CBCS CA-StudentsAbraham96No ratings yet

- Penn State University - University Park MATH 220, Matrices Fall 2013Document6 pagesPenn State University - University Park MATH 220, Matrices Fall 2013Dilnur YuldashevNo ratings yet

- Ma Sociology Twoyear2016-17Document29 pagesMa Sociology Twoyear2016-17vigneshwari jNo ratings yet

- EIE SyllabusDocument122 pagesEIE SyllabusBALAKRISHNANNo ratings yet

- M.A. Economics 2 Year 2018-19Document29 pagesM.A. Economics 2 Year 2018-19arun dhasNo ratings yet

- BSC Science SyllabusDocument106 pagesBSC Science SyllabusNaveen KumarNo ratings yet

- PIT Grade Point SystemDocument7 pagesPIT Grade Point SystemBhupinder SinghNo ratings yet

- MS Regulations MUETDocument8 pagesMS Regulations MUETAli RazaNo ratings yet

- MBA Handbook 2018 19Document154 pagesMBA Handbook 2018 19Akash PriyadarshiNo ratings yet

- MBA (Hospitality Management) 2018-19Document70 pagesMBA (Hospitality Management) 2018-19AbhilashPaulNo ratings yet

- Introductory Mathematics: Course SyllabusDocument5 pagesIntroductory Mathematics: Course SyllabusNika FrolovaNo ratings yet

- Departmental Syllabus For MAT 284, Business Calculus. Spring 2014Document4 pagesDepartmental Syllabus For MAT 284, Business Calculus. Spring 2014Anonymous bZTdTpLNo ratings yet

- Mpharm HandbookDocument130 pagesMpharm HandbookanilNo ratings yet

- Sri Chandrasekharendra Saraswathi Viswa Mahavidyalaya: & Engineering M.E., Computer ScienceDocument58 pagesSri Chandrasekharendra Saraswathi Viswa Mahavidyalaya: & Engineering M.E., Computer ScienceSridhar SriNo ratings yet

- MBA201819FULLTIMEDocument137 pagesMBA201819FULLTIMEAhammed SalamNo ratings yet

- MA 15300 Fall 2015 Syllabus: Math - Purdue.edu/ma153 Loncapa - Purdue.eduDocument4 pagesMA 15300 Fall 2015 Syllabus: Math - Purdue.edu/ma153 Loncapa - Purdue.edugman4dx266No ratings yet

- Iu Masters Policy GuidlinesDocument8 pagesIu Masters Policy GuidlinesOm PrakashNo ratings yet

- Rules For B. Pharm. Examinations (Semester System)Document4 pagesRules For B. Pharm. Examinations (Semester System)Shahid KhanNo ratings yet

- Maria - Aronne@montgomerycollege - Edu: (Preferred Means of Communication - Please, Include Your NameDocument4 pagesMaria - Aronne@montgomerycollege - Edu: (Preferred Means of Communication - Please, Include Your NameLuis GuardadoNo ratings yet

- Aptitide TestDocument6 pagesAptitide TestAnonymous CmxkmL08No ratings yet

- MCA Science SylabDocument33 pagesMCA Science Sylabrameshsahoo11No ratings yet

- M.Ed. 2-YearsDocument114 pagesM.Ed. 2-YearsMohanTnlNo ratings yet

- CHEM 1310 SyllabusDocument6 pagesCHEM 1310 SyllabusJuan JoséNo ratings yet

- Rules and Regulations - July 24,2018 PDFDocument4 pagesRules and Regulations - July 24,2018 PDFKhandaker Amir EntezamNo ratings yet

- Rules and Regulations - Updated As On February 1, 2023Document5 pagesRules and Regulations - Updated As On February 1, 2023neoNo ratings yet

- MS RegulationsDocument11 pagesMS RegulationsSyed Muhammad JahangeerNo ratings yet

- Guidelines For Internal AssessmentDocument6 pagesGuidelines For Internal AssessmentRathin BanerjeeNo ratings yet

- Syllabus Affiliated ArtsScience B.Com .-General-2021-22Document89 pagesSyllabus Affiliated ArtsScience B.Com .-General-2021-22HariniNo ratings yet

- Accountancy Quizbowl GuidelinesDocument4 pagesAccountancy Quizbowl GuidelinesMaria Kem EumagueNo ratings yet

- Iit Exam Rules PDFDocument5 pagesIit Exam Rules PDFAditya RawatNo ratings yet

- Grading System BioDocument2 pagesGrading System Bioapi-328359262No ratings yet

- r19 Mba RegulationsDocument15 pagesr19 Mba RegulationsRajasekharKosuruNo ratings yet

- SCSVMV University Ece SyllabusDocument71 pagesSCSVMV University Ece SyllabusNaveen NDNo ratings yet

- MCA Science 2013-14 - CollegeDocument35 pagesMCA Science 2013-14 - CollegeTushar ChaudhariNo ratings yet

- Assessment Procedure BMT HNDocument4 pagesAssessment Procedure BMT HNIrina BrumaNo ratings yet

- Georgia Institute of Technology Ivan Allen College of Liberal Arts School of EconomicsDocument3 pagesGeorgia Institute of Technology Ivan Allen College of Liberal Arts School of EconomicsKhoaNo ratings yet

- FDGT Syllabus 2010Document38 pagesFDGT Syllabus 2010swatagodaNo ratings yet

- BE ECE Regular SyllabusDocument71 pagesBE ECE Regular SyllabusGanesh RamNo ratings yet

- BBA SyllabusDocument51 pagesBBA SyllabusShuvo SahaNo ratings yet

- MTH 182 - Common, SP16Document10 pagesMTH 182 - Common, SP16Hazim HazimNo ratings yet

- Syllabus 25112021Document19 pagesSyllabus 25112021Kiccha sudeepNo ratings yet

- Grading Policy-Ap Calculus BCDocument2 pagesGrading Policy-Ap Calculus BCapi-319065418No ratings yet

- Exams: How Cbse'S Will WorkDocument8 pagesExams: How Cbse'S Will WorkroohintazNo ratings yet

- Board Results India.20130224.061043Document2 pagesBoard Results India.20130224.061043doll1brainNo ratings yet

- Credits at MUSTDocument3 pagesCredits at MUSTChimegErdenebatNo ratings yet

- SyllabusDocument3 pagesSyllabusapi-259508181No ratings yet

- Acc204 Syllabus - ReidenbachDocument9 pagesAcc204 Syllabus - ReidenbachMatthew ReidenbachNo ratings yet

- Info MATH1013Document4 pagesInfo MATH1013Dimitris KatsourinisNo ratings yet

- Studies in English - Rules and Regulations in The Foreign Languages CentreDocument3 pagesStudies in English - Rules and Regulations in The Foreign Languages CentreMelody MurNo ratings yet

- Irr Non Academic Quiz Bee IrrDocument3 pagesIrr Non Academic Quiz Bee IrrErica DizonNo ratings yet

- MATD 1534 Planning 2024Document9 pagesMATD 1534 Planning 2024faiyazzbrentNo ratings yet

- Program MathematicsDocument1 pageProgram MathematicsDhameer AlrakhamiNo ratings yet

- ACCT 4341 SyllabusDocument4 pagesACCT 4341 SyllabusTammy TranNo ratings yet

- Science: For NTSE, olympiads & competitive examsFrom EverandScience: For NTSE, olympiads & competitive examsRating: 5 out of 5 stars5/5 (3)