Professional Documents

Culture Documents

Final Project (APM)

Final Project (APM)

Uploaded by

Arooj FatimaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Final Project (APM)

Final Project (APM)

Uploaded by

Arooj FatimaCopyright:

Available Formats

Chemical Industry of Pakistan

ITTEHAD CHEMICALS LTD

Registered Office / Head Office: 39-Empress Road, Lahore Pakistan.

Tel: +92 42 36306586 - 88

2

Final Project Report

Submitted by:

➢ Rimsha Kanwal 578-FMS/BSAF/F20

➢ Aymen Summiya 594-FMS/BSAF/F20

➢ Arooj Fatima 603-FMS/BSAF/F20

➢ Aimen Sajid 606-FMS/BSAF/F20

➢ Aleena Khursheed 609-FMS/BSAF/F20

Submitted To:

Dr Tahira Awan

Chemical Industry of Pakistan

Intrinsic value 49.7 market value 40.20 recommended to buy

3

TABLE OF CONTENTS

INTRODUCTION TO THE BUSINESS INDUSTRY ...................................................................... 4

Intrinsic value 49.7 market value 40.20 recommended to buy

4

INTRODUCTION TO THE BUSINESS INDUSTRY

Historical background of chemical industry of Pakistan:

▪ The chemical industry in Pakistan traces its roots back to the early years of independence in 1947

when efforts were made to establish domestic manufacturing capabilities.

▪ Significant developments occurred in the 1960s and 1970s with the establishment of major

chemical plants, particularly in the fertilizers and petrochemical sectors.

▪ In the subsequent decades, the industry witnessed growth and diversification, with the emergence

of pharmaceutical, dye, paint, and plastic manufacturing companies.

▪ Over time, the chemical industry in Pakistan has evolved to meet the country's increasing demand

for chemical products and has contributed significantly to the national economy.

Definition & scope:

The chemical industry in Pakistan refers to the sector involved in the production, processing, and

distribution of various chemical products. It encompasses diverse segments such as petrochemicals,

fertilizers, pharmaceuticals, dyes, paints, plastics, and more. The industry plays a vital role in the

country's economy, contributing to GDP growth, employment generation, and export earnings. It serves

multiple sectors, including agriculture, manufacturing, healthcare, textiles, and construction, meeting

both domestic and international demand.

Importance and impact:

The Pakistani chemical industry holds significant importance

as it contributes to the country's economic growth, employment opportunities,

and export earnings. It supports various sectors such as agriculture,

manufacturing, pharmaceuticals, textiles, and construction, providing essential

raw materials and finished products. Additionally, the industry plays a crucial

role in meeting domestic demand, reducing dependency on imports, and fostering self-sufficiency in

chemical production.

OVERVIEW OF THE CURRENT BUSINESS LANDSCAPE

▪ Growing demand for chemical products, driven by increasing population, urbanization, and

industrialization.

▪ Competition among local and international players, with a significant presence of multinational

companies.

Intrinsic value 49.7 market value 40.20 recommended to buy

5

▪ Government initiatives to promote the industry, such as tax incentives, investment

opportunities, and policy reforms.

▪ Rising concern for environmental sustainability, leading to a shift towards eco-friendly and

green chemicals.

▪ Technological advancements and innovation, enabling greater efficiency, productivity, and

quality in chemical production.

▪ Challenges related to energy and raw material costs, inadequate infrastructure, and compliance

with health and safety standards.

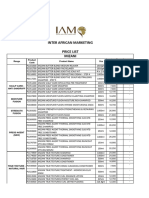

BUSINESS SECTOR: COMPANIES NAME AND LOCATIONS

Certainly! Here are some well-known companies in the chemical industry in Pakistan along with their

locations:

● Engro Corporation Limited - Karachi

● Fauji Fertilizer Company Limited – Rawalpindi

● Pakistan State Oil (PSO) - Karachi

● Pakistan Petroleum Limited (PPL) - Karachi

● ICI Pakistan Limited - Karachi

● Ferozsons Laboratories Limited - Lahore

● Attock Petroleum Limited - Rawalpindi

● Sitara Chemical Industries Limited - Faisalabad

● Descon Chemicals Limited - Lahore

● Ittehad Chemicals Limited - Lahore

● Archroma Pakistan Limited – Karachi

PRODUCTS

Pakistan's chemical industry produces a wide range of products, including basic chemicals,

specialty chemicals, and consumer products. Here are some examples of the products produced by the

chemical industry in Pakistan:

1. Basic chemicals:

o Caustic soda

o Hydrochloric acid

o Sulfuric acid Methanol

o Formaldehyde

2. Specialty chemicals:

Intrinsic value 49.7 market value 40.20 recommended to buy

6

o Dyes and pigments

o Resins

o Adhesives

o Surfactants

o Textile Chemicals

3. Consumer products:

o Soaps and detergents

o Personal care products

o Home care products

o Pesticides and herbicides

o Pharmaceuticals

4. Plastics:

o Polyethylene

o Polypropylene

o PVC

o PET

5. Fertilizers:

o Urea

o DAP (diammonium phosphate)

o NPK (nitrogen, phosphorus, and potassium) fertilizers

These products are used in various industries, including textiles, pharmaceuticals, agriculture,

and construction. The chemical industry is a significant contributor to Pakistan's economy, and the

production of these products is expected to increase in the future as demand for chemical products

continues to grow in the country.

Uses of chemicals:

Chemicals imported and produced in Pakistan are used in various industries in the country. Some

of the major industries that consume chemicals in Pakistan include:

1. Textile industry: Pakistan is one of the largest producers of cotton in the world, and the textile

industry is a significant consumer of chemicals such as dyes, pigments, and finishing agents.

2. Agriculture: The use of fertilizers and agrochemicals is critical to the success of the agricultural

industry in Pakistan that is a major source of food and income.

3. Pharmaceuticals: The pharmaceutical industry in Pakistan requires a range of chemicals for the

production of various drugs.

Intrinsic value 49.7 market value 40.20 recommended to buy

7

4. Construction: The construction industry requires a range of chemicals such as adhesives, sealants,

coatings, and waterproofing agents.

5. Automotive: The automotive industry in Pakistan makes use of chemicals such as lubricants, coolants,

and battery acids.

Chemical buyers:

Various industries buy chemicals in Pakistan, depending on their needs and requirements. Some of

the major industries that buy chemicals in Pakistan include:

▪ Textile industry: The textile industry is one of the leading consumers of chemicals in Pakistan,

and it uses chemicals like dyes, bleaches, and finishing agents.

▪ Pharmaceutical industry: The pharmaceutical industry requires a variety of raw materials and

chemicals to manufacture different drug formulations.

▪ Agriculture: The agriculture sector uses agrochemicals like pesticides and fertilizers.

▪ Paint industry: The paint industry consumes chemicals like pigments, solvents, and resins.

▪ Petrochemical industry: The petrochemical industry uses chemicals like methanol, ammonia,

and ethylene to produce plastics, synthetic fibers, and other materials.

▪ Food industry: The food industry uses chemicals like food additives, preservatives, and

flavorings.

▪ Automotive industry: The automotive industry requires chemicals like lubricants and coolant

for engines and other machine parts.

Quality Control and Analysis:

▪ Analytical Instruments: These include various tools for chemical analysis, such as

spectrophotometers, gas chromatographs, mass spectrometers, or pH meters, to ensure product

quality and compliance with standards.

▪ Laboratory Equipment: Ittehad Chemical Ltd may use a range of lab equipment like balances,

pipettes, titration devices, and glassware for sample preparation and analysis.

▪ Utilities: Boiler Systems: Boilers are used to generate steam, which is often required for heat

transfer or process operations.

▪ Cooling Systems: Cooling towers or chillers are employed to regulate process temperatures and

maintain optimal conditions.

▪ Storage Tanks: These are used to store raw materials, intermediate products, or finished goods

before packaging or shipment.

IMPORTS & EXPORTS OF CHEMICAL INDUSTRY

Intrinsic value 49.7 market value 40.20 recommended to buy

8

Import:

Pakistan's chemical industry is heavily dependent on imports, as the country is not self-sufficient

in many chemicals. The major imported chemicals include basic chemicals, fertilizers, agrochemicals,

and pharmaceuticals. Pakistan mainly imports these chemicals from the Middle East, Europe, and China.

Pakistan's chemical industry imports a wide range of chemicals from various countries around the

world. Some of the major importing countries for the Pakistani chemical industry include

• China

• Saudi Arabia

• United Arab Emirates

• United States

• Qatar

• Kuwait

These countries are major suppliers of chemicals such as raw materials, intermediates, and finished

products to the Pakistani chemical industry.

Export:

On the other hand, the country is a net exporter of a few chemicals like cement, soda ash, and

caustic soda. The export of chemicals from Pakistan has been on the rise, with exports amounting to

approximately $1.1 billion in 2019. The major markets for chemical exports from Pakistan are

Afghanistan, Sri Lanka, Bangladesh, and the Middle East.

Intrinsic value 49.7 market value 40.20 recommended to buy

9

Pakistan's chemical industry exports a wide range of chemicals to various countries around the world.

Some of the main export destinations include

• United States

• United Arab Emirates

• United Kingdom

• Germany

• Japan

• China

• South Africa

• Brazil

• Saudi Arabia

• Turkey

The exported chemicals include petrochemicals, polymers, agrochemicals, dyes and pigments,

pharmaceuticals, and other specialty chemicals.

Worth of chemical industry:

As of 2021, the chemical industry of Pakistan is worth approximately $4.7 billion USD. It is

considered one of the most significant industries in the country, employing a large number of workers

and contributing significantly to the national economy. The industry is expected to continue growing in

the coming years due to increasing demand for chemicals both domestically and internationally.

Globalization and International Trade:

Globalization has opened up opportunities for the chemical industry in Pakistan to participate in

international trade and expand its market reach. The industry has benefited from increased access to

global markets, allowing Pakistani chemical companies to export their products to other countries.

Intrinsic value 49.7 market value 40.20 recommended to buy

10

International trade has facilitated the import of raw materials, equipment, and technologies

required for the chemical industry in Pakistan. This enables companies to access advanced technologies

and resources from around the world, supporting their growth and competitiveness.

MARKET DYNAMICS

Demand and Supply Forces:

Supply forces in the chemical industry are influenced by factors such as production capacity,

availability of raw materials, technological advancements, and government regulations on production

and import/export. In terms of supply, Pakistan's chemical industry is heavily dependent on imported

raw materials, as the country is not self-sufficient in many chemicals. This creates supply chain

challenges, including transportation costs and lead times, which can impact the availability and cost of

raw materials.

Demand forces in the chemical industry are driven by factors such as economic growth, industrial

activity, consumer demand for chemical products, and emerging markets. The demand for chemicals in

Pakistan has been increasing rapidly due to the growth of various industries, such as textiles,

pharmaceuticals, agriculture, and automotive. However, the country's chemical industry faces challenges

related to the supply of raw materials and the availability of adequate infrastructure and technology.

Demand and supply lead to the price setting.

Price setting:

In Pakistan, prices in the chemical industry are generally set according to the demand and

supply of each particular chemical. When the demand for a particular chemical is high and supply is

low, prices tend to rise, and when demand is low and supply is high, prices tend to fall. The demand

for chemicals is driven by several factors such as the growth of various industries that rely on chemicals,

including textiles, pharmaceuticals, agriculture, and automotive. Additionally, government policies and

decisions can impact the demand for chemicals. On the supply side, key factors that influence pricing

include the availability of raw materials, access to infrastructure and logistics, and regulations and

policies that impact production and distribution. Pricing decisions are also influenced by global market

trends and fluctuations in the supply and demand of chemicals at the international level.

Demand-Supply curve:

Intrinsic value 49.7 market value 40.20 recommended to buy

11

To address these challenges, the chemical industry in Pakistan is focusing on improving local

production capabilities, increasing investment in research and development, and building stronger

partnerships with foreign companies to improve technology transfer and access to raw materials. With

these efforts, the sector aims to meet the growing demand for chemicals in the country and become a

more competitive player in the global market.

INDUSTRY LIFE CYCLE

The chemical industry of Pakistan can be analyzed in terms of the industry life cycle, which

describes the various stages of an industry from its emergence to its decline. Here is an overview of how

the chemical industry in Pakistan has progressed through the different stages of the life cycle:

❖ Startup: The chemical industry in Pakistan emerged in the 1950s and 1960s, with the

establishment of several small-scale chemical plants. These plants produced basic chemicals,

such as caustic soda, sulfuric acid, and chlorine.

❖ Growth: During the 1970s and 1980s, the chemical industry in Pakistan experienced rapid

growth, driven by increased demand for chemicals from various sectors, including agriculture,

textiles, and pharmaceuticals. The industry diversified its product portfolio, and several large-

scale chemical plants were established during this period.

❖ Maturity: In the 1990s and 2000s, the chemical industry in Pakistan entered the maturity stage.

The industry continued to grow, but at a slower rate, and consolidation occurred as smaller

companies were acquired or merged with larger companies. The industry also faced increased

competition from imported chemicals.

❖ Decline: In recent years, the chemical industry in Pakistan has faced several challenges,

including rising energy costs, competition from imports, and government regulations. As a result,

Intrinsic value 49.7 market value 40.20 recommended to buy

12

some smaller chemical plants have closed down, and the industry has experienced a decline in

growth.

Overall, the chemical industry in Pakistan has progressed through the various stages of the industry

life cycle, and it is currently facing challenges as it tries to maintain its competitiveness in a global

market. However, the industry has shown resilience and continues to play a significant role in the

country's economy.

FUTURE GROWTH OPPORTUNITIES OF CHEMICAL INDUSTRY.

The chemical industry is expected to continue experiencing growth opportunities in the future, driven

by various factors such as increasing global population, urbanization, and rising demand for consumer

goods. Here are some of the growth opportunities that the chemical industry can expect in the coming

years:

1. Sustainability and green chemistry: The chemical industry is focusing more on developing

sustainable practices and environmentally friendly products. This includes using renewable resources

and reducing waste and emissions. As consumers become more aware of the impact of their

purchasing decisions on the environment, there will be an increased demand for sustainable and

green products.

2. Digitalization and automation: The chemical industry is embracing digitalization and automation

to optimize production processes and improve efficiency. This includes the use of sensors, machine

learning, and artificial intelligence to monitor and control manufacturing processes, reduce

downtime, and minimize waste.

3. New materials and technologies: The chemical industry is constantly developing new materials and

technologies, such as advanced polymers and composites, that offer improved performance and

Intrinsic value 49.7 market value 40.20 recommended to buy

13

functionality. These materials and technologies are finding applications in a wide range of industries,

from automotive and aerospace to healthcare and electronics.

4. Emerging markets: Emerging markets, particularly in Asia and Africa, are experiencing rapid

economic growth and urbanization. This is creating a growing demand for chemicals and materials,

particularly in the construction, automotive, and consumer goods sectors.

5. Healthcare and pharmaceuticals: The chemical industry is playing an increasingly important role

in the healthcare and pharmaceutical sectors, with the development of new drugs, vaccines, and

medical devices. As the global population ages and demand for healthcare services increases, the

chemical industry is expected to see continued growth in this area.

Overall, the chemical industry is likely to experience significant growth opportunities in the coming

years, driven by sustainability, digitalization, new materials and technologies, emerging markets, and

healthcare and pharmaceuticals.

RESEARCH AND DEVELOPMENT

The chemical industry in Pakistan is an important contributor to the national economy, providing

arrange of critical raw materials to various industries, including textiles, agriculture, and personal care

products. In recent years, the industry has been focused on research and development efforts to improve

production efficiency, reduce costs, and develop new chemical products with higher value-added

capabilities.

Intrinsic value 49.7 market value 40.20 recommended to buy

14

One of the key trends in the Pakistani chemical industry is the shift toward sustainable

manufacturing practices. This includes the development of eco-friendly and biodegradable products,

changing production processes to reduce waste and energy consumption, and investing in renewable

energy sources.

The Government of Pakistan has been supportive of the industry’s research and development

efforts through various policy initiatives and funding schemes. The National Research Program for

Universities, the Innovation Challenge Fund, and the Small and Medium-Sized Enterprises Development

Authority are some of the programs that offer financial support to innovative SMEs and research

institutions.

In conclusion, the chemical industry in Pakistan has been active in its efforts to remain

competitive globally through research and development initiatives. These efforts have been supported

by the government, which recognizes the importance of a strong chemical industry to the country’s

economy.

GLOBAL COMPARISON

The chemical industry in Pakistan has been growing steadily over the past few years and has

emerged as a major contributor to the country's economy. However, when compared to other countries,

Pakistan's chemical industry is still relatively small. The chemical industry in Pakistan is a relatively

small industry that is primarily focused on the production of basic chemicals, such as fertilizers, caustic

soda, and sulfuric acid. The industry is dominated by a few large players, including Engro Corporation,

Fauji Fertilizer, and Fatima Group. According to the Pakistan Chemicals and Dyes Merchants

Association, the total annual production of the chemical industry in Pakistan is around 4.5 million tons,

and it contributes around 1.3% to the country's GDP.

Compare GDP Growth Rate with Foreign Countries.

According to data from the World Bank, Pakistan's chemical industry accounted for

approximately 4.4% of the country's GDP in 2020, which is lower than the global average of 5.7%. In

comparison to other countries in the region, such as India and China, Pakistan's chemical industry is

much smaller. India's chemical industry accounted for 7.3% of its GDP in 2020, while China's chemical

industry accounted for 11.6% of its GDP in 2019.

Compare Exports with Foreign Countries.

In terms of exports, Pakistan's chemical industry is also relatively small. According to data from

the Pakistan Bureau of Statistics, chemical and pharmaceutical products accounted for approximately

7.6% of Pakistan's total exports in 2020. In comparison, chemical exports accounted for 15.8% of India's

total exports in 2020 and 12.9% of China's total exports in 2019.

Intrinsic value 49.7 market value 40.20 recommended to buy

15

Despite these challenges, Pakistan's chemical industry has been growing steadily and has shown

potential for further growth. The government has taken several initiatives to promote the chemical

industry, such as providing tax incentives, establishing special economic zones, and promoting research

and development in the sector. These measures, coupled with Pakistan's strategic location and access to

raw materials, could help the country's chemical industry to compete globally in the coming years.

MAJOR VARIANTS

The chemical industry in Pakistan is a diverse sector that encompasses various sub-sectors,

including basic chemicals, specialty chemicals, and agrochemicals. Here are some of the major variants

of the chemical industry in Pakistan.

▪ Fertilizer industry:

One of Pakistan's most important sub-sectors of the chemical industry is the fertilizer industry. It

involves the manufacturing of urea, ammonium phosphate (DAP), single superphosphate (SSP), and

other agricultural fertilizers. Engro Fertilizers, Fauji Fertilizer Company, Fatima Fertilizer Company,

Dawood Hercules Corporation these industries play an important role.

▪ Petrochemical sector:

Pakistan's petrochemical sector manufactures a wide range of goods, including polyethylene,

polypropylene, PVC, and other petrochemicals. The building industry, which accounts for around 70%

of global use, is what drives the need for PVC. PVC is mostly utilized in Pakistan to create pipes, fittings,

cables, profiles, and footwear. Additionally, it is utilized in consumer items, packaging, and medical

devices. These items are utilized in a wide range of industries, including packaging, construction, and

automobile.

▪ Pharmaceutical business

Pakistan's pharmaceutical business manufactures drugs, vaccines, and other healthcare items. The

government actively regulates this business to guarantee that the goods are safe and effective. Abbott

Laboratories Pakistan (ABT), Getz Pharma, GlaxoSmithKline Pakistan (GSK), Searle Pakistan

(SEARL), and Karachi Chemical Industries (KCI Pharma)

▪ Paints and Coatings business

Pakistan's paints and coatings business provides a wide range of goods such as ornamental paints,

industrial coatings, and marine coatings. Sodium carbonate, often known as soda ash, is a chemical

compound used in the production of glass, detergents, paper, textiles, and other goods. Natural resources

like rock salt and limestone are the main sources of its production in Pakistan. These materials are

employed in a variety of applications, including house interiors and heavy-duty industrial equipment.

▪ Textile Industry

Intrinsic value 49.7 market value 40.20 recommended to buy

16

Pakistan's textile industry is one of the country's largest and most significant industries. Textile

production, comprising cotton, silk, and synthetic fibers, as well as dyeing and finishing procedures, are

all part of the business.

▪ Agrochemical business

Pakistan's agrochemical business manufactures a variety of goods, including pesticides, herbicides,

and fungicides. These products are used to protect crops against pests and diseases, as well as to increase

agricultural yields.

▪ Basic chemical industry in Pakistan

The basic chemicals industry in Pakistan involves the manufacture of chemicals such as sulfuric acid,

caustic soda, and chlorine. Textiles, paper, and plastics are among the industries that employ these

compounds.

The chemical industry in Pakistan is diversified and expanding, producing a range of goods for many

industries. Consumers purchase tens of thousands of chemical items each day, according to the Pakistan

Chemical Manufacturers Association (PCMA). Overall, the chemical industry in Pakistan is a significant

contributor to the country's economy, providing employment and contributing to the growth of various

other industries.

PESTLE ANALYSIS:

PESTEL analysis is a framework used to analyze the macro-environmental factors that impact a

particular industry. In this case, let's analyze the chemical industry in Pakistan using PESTEL.

▪ Political Factors:

The chemical industry in Pakistan is governed by government rules and policies. The government

controls the import and export of chemicals, as well as the safety rules and taxation. According to the

import data, Pakistan imports $523.4 million in inorganic chemicals and $2.4 billion in organic

chemicals. The availability of raw resources and the ease of conducting business in the country are also

influenced by government policy. Sometimes political instability gave negative affect to chemical

industry.

▪ Economical Factors:

Pakistan's economic stability has an impact on the expansion of the chemical sector. Inflation,

GDP growth, currency exchange rates, and disposable income all have an influence on chemical demand.

Pakistan's chemical sector has a substantial impact on the country's economy, accounting for around

4.5% of total exports and approximately 12% of total imports.

▪ Social factors:

Chemical demand is influenced by sociocultural variables such as population demographics,

education levels, and lifestyle trends. No organization can overlook the significance of society and

Intrinsic value 49.7 market value 40.20 recommended to buy

17

culture. The social and production systems in a given region should be in perfect harmony. With this

match, we will be able to gain a lot of goodwill. Pakistan's population is rapidly increasing. For example,

Pakistan's expanding population raises demand for agricultural chemicals. There is a discrepancy

between labor demand and labor supply, which allows businesses to benefit from reduced labor costs.

They must invest a lot of time and money in their training because they are unskilled and novice workers.

▪ Technological factors

Technological improvements in Pakistan's chemical sector can have a substantial influence on

the industry's growth. Technological advancements may increase the efficiency of manufacturing

processes, lower production costs, and enable the development of new goods. Rapid development and

technical advancements have intensified competition. In the Pakistani industry, antiquated machinery is

used.

▪ Environmental factors

Environmental variables such as climate change, pollution, and waste management rules have an

influence on the chemical sector in Pakistan. To reduce environmental effect, the industry must follow

environmental rules. But in many situations, do not follow the environment rules due to cause the air

pollution.

▪ Legal Aspects:

Pakistan's chemical sector is governed by legal and regulatory frameworks such as lab our regulations,

intellectual property protection, and contract law. The legal framework impacts industrial operations and

establishes company liability in the event of a legal issue.

In conclusion; the chemical industry in

Pakistan faces numerous challenges and

opportunities resulting from the PESTEL factors

mentioned above. The industry can leverage

technological advancements to improve efficiency,

comply with environmental regulations, and tap into

the growing demand for chemicals due to population

growth.

However, the industry also faces challenges in

navigating the legal framework, complying with

environmental regulations, and managing economic

instability.

COMPETETION LEVEL

Intrinsic value 49.7 market value 40.20 recommended to buy

18

Porter’s 5 forces model:

The Porter's Five Forces Model may be used to assess the degree of competition in the Pakistan chemical

industry:

▪ Threat of new arrivals

New

▪ Supplier negotiating power arrivals

▪ Buyers’ negotiating power

▪ Substitute danger Buyers

power Five Supplier

power

▪ Competitive rivalry Forces

1) Threat of new arrivals Model

Due to the necessity for large financial investment, Substitute

Competitive Danger

access to raw materials, and tight regulatory compliance, the Rivarly

chemical sector in Pakistan has a high entrance barrier. As a

result, the threat of new entrants is modest.

2) Supplier negotiating power

Supplier bargaining power in the Pakistan chemical sector is modest since most raw materials

are imported, and suppliers may affect costs and quality.

3) Buyers' negotiating power

It is significant since the Pakistan chemical sector is extremely fragmented, and buyers have

numerous choices to select from. Furthermore, because switching costs are minimal, purchasers

frequently have great negotiating leverage.

4) Substitute danger

The threat of replacements is minimal in the Pakistan chemical industry since the industry is vital

to the economy and supplies crucial inputs to many other industries.

5) Competitive rivalry

The Pakistan chemical sector is extremely competitive, with many small and major businesses

competing for market share. To acquire market share, industry competitors compete on price, quality,

and innovation. However, the industry is highly fragmented, with no single company commanding a

sizable proportion.

In summary, the Pakistan chemical industry faces moderate to high competition levels, with a

low threat of new entrants, moderate bargaining power of suppliers, high bargaining power of buyers,

low threat of substitutes, and. highly competitive rivalry.

Intrinsic value 49.7 market value 40.20 recommended to buy

19

ITTEHAD CHEMICAL LTD

Ittehad Chemical Ltd is a leading chemical company based in Pakistan. Established in 1962,

Ittehad Chemical has grown to become one of the country's most prominent manufacturers and suppliers

of a wide range of chemical products. The company is known for its commitment to quality, innovation,

and sustainability in the chemical industry. Ittehad Chemical offers a diverse portfolio of products that

cater to various sectors, including textiles, agriculture, pharmaceuticals, construction, and more. Some

of their key product categories include fertilizers, textile auxiliaries, sulfuric acid, hydrogen peroxide,

and industrial chemicals.

With a focus on customer satisfaction, Ittehad Chemical emphasizes the use of advanced

technologies and best practices to deliver high-quality products that meet international standards. The

company places great importance on research and development, continuously striving to develop

innovative solutions and improve their product offerings. Ittehad Chemical is also dedicated to

sustainability and environmental stewardship. They have implemented eco-friendly manufacturing

processes and adhere to stringent safety and environmental standards to minimize their impact on the

environment.

Overview of Products or Services Offered:

Ittehad Chemical Ltd offers a diverse portfolio of chemical products that cater to the needs of

multiple sectors. Their product range includes [Fertilizers and Crop Nutrition, Industrial Chemicals,

Textile Chemicals, Specialty Chemicals], which are known for their superior quality, reliability, and

effectiveness. They continuously innovate and expand their product line to meet the evolving demands

of their customers.

o Company Vision:

An ‘’ITTEHAD’’ of Pakistan’s best Talent & Technology that serves as a catalyst to deliver

sustainable chemical products to its customers thus optimizing returns for investors.

o Company Mission:

Key ingredients of ICL Mission are:

• Create an environment to attract and retain the best talent

Intrinsic value 49.7 market value 40.20 recommended to buy

20

• Optimize cost and securitize energy through latest technology

• Serving the customers to their satisfaction levels

• Ensuring that we are environment friendly & Zero injury company

• CSR is our forte

o Company core values:

o Integrity: We conduct ourselves in accordance with the highest moral and ethical

standards, and in full compliance with all applicable laws.

o Respect: We treat our employees and all our stakeholders with professionalism, respect

and dignity, creating an environment where people can express their professional

opinions, contribute, innovate and excel.

o Teamwork: We are committed to promoting a culture of teamwork and cooperation

among our employees to enhance their productivity and well-being.

o Accountability: We hold ourselves accountable for our actions to our employees, our

management, our shareholders and to the community that we operate in.

SWOT ANALYSIS.

SWOT analysis is a strategic planning tool that helps organizations identify their strengths,

weaknesses, opportunities, and threats. Here's a SWOT analysis of the chemical industry:

Strengths:

1. Diversified Product Portfolio: Ittehad Chemicals Ltd. offers a wide range of products, including

basic chemicals, specialty chemicals, and consumer products. This diversification helps the

company to reduce the risk of dependence on a single product.

2. Strong Market Position: The company has a strong market position in Pakistan's chemical

industry. It has a significant market share in many of its products.

Intrinsic value 49.7 market value 40.20 recommended to buy

21

3. Experienced Management Team: The management team of Ittehad Chemicals Ltd. is

experienced and knowledgeable. They have a good track record of making sound business

decisions.

4. Efficient Manufacturing Facilities: The company has state-of-the-art manufacturing facilities

that use modern technology and equipment. This enables the company to produce high-quality

products at a lower cost.

Weaknesses:

1. Dependence on Raw Materials: Ittehad Chemicals Ltd. depends on imported raw materials for

the production of many of its products. This dependence on imports exposes the company to

foreign exchange rate risk.

2. Limited Geographic Presence: The company's operations are limited to Pakistan. This limits

its growth potential as it cannot tap into other markets.

3. Dependence on Few Customers: Ittehad Chemicals Ltd. has a few customers who account for

a significant portion of its revenue. This makes the company vulnerable to the loss of a major

customer.

Opportunities:

1. Expansion into New Markets: Ittehad Chemicals Ltd. can explore opportunities to expand into

new markets, such as the Middle East and Africa. This would enable the company to diversify

its customer base and reduce its dependence on Pakistan's market.

2. Investment in Research and Development: The company can invest in research and

development to develop new products that can meet the needs of its customers.

3. Increasing Demand for Chemical Products: The demand for chemical products is increasing

in Pakistan and other developing countries. This presents an opportunity for Ittehad Chemicals

Ltd. to increase its production capacity and capture a larger market share.

Threats:

1. Intense Competition: Ittehad Chemicals Ltd. faces intense competition from both local and

international companies. This puts pressure on the company to maintain its market share.

2. Volatility in Raw Material Prices: The prices of raw materials are subject to volatility due to

global market conditions. This can impact the company's profitability and margins.

3. Changes in Government Regulations: The company is subject to government regulations, and

changes in regulations can impact its operations and profitability.

Intrinsic value 49.7 market value 40.20 recommended to buy

22

VALUATION

Date Ittehad KSE prices Return Ittehad Return KSE

04-01-23 36 41,580.85 - -

03-01-23 32.03 40,000.83 -0.110277778 -0.0379987

02-01-23 34 40,510.37 0.061504839 0.01273824

01-01-23 31 40,673.06 -0.088235294 0.00401601

12-01-22 27.5 40,420.45 -0.112903226 -0.0062107

11-01-22 27.4 42,348.63 -0.003636364 0.04770308

10-01-22 29 41,264.66 0.058394161 -0.0255963

09-01-22 28.55 41,128.67 -0.015517241 -0.0032956

08-01-22 32.31 42,351.15 0.131698774 0.0297233

07-01-22 29.7 40,150.36 -0.080779944 -0.0519653

06-01-22 29.87 41,540.83 0.005723906 0.03463157

05-01-22 30.55 43,078.14 0.022765316 0.0370072

04-01-22 28.37 45,249.41 -0.071358429 0.05040306

03-01-22 27.5 44,928.83 -0.030666197 -0.0070847

02-01-22 28.15 44,461.01 0.023636364 -0.0104125

01-01-22 30.4 45,374.68 0.079928952 0.02054992

12-01-21 25.93 44,596.07 -0.147039474 -0.0171596

11-01-21 23.67 45,072.38 -0.087157732 0.01068054

10-01-21 25.37 46,218.93 0.07182087 0.02543797

09-01-21 25.44 44,899.60 0.002759164 -0.0285452

08-01-21 31.51 47,419.74 0.238600629 0.05612834

07-01-21 30.7 47,055.29 -0.025706125 -0.0076856

06-01-21 32.23 47,356.02 0.049837134 0.00639099

05-01-21 33.51 47,896.34 0.039714552 0.01140974

04-01-21 27.1 44,262.35 -0.191286183 -0.075872

03-01-21 29.19 44,587.85 0.077121771 0.00735388

02-01-21 34.95 45,865.02 0.197327852 0.0286439

01-01-21 30.83 46,385.54 -0.11788269 0.01134895

12-01-20 27.11 43,755.38 -0.120661693 -0.0567022

11-01-20 25.33 41,068.82 -0.065658429 -0.0613995

10-01-20 29.31 39,888.00 0.157125938 -0.0287522

09-01-20 23.37 40,571.48 -0.202661208 0.01713498

08-01-20 25.56 41,110.93 0.093709884 0.01329629

07-01-20 26.5 39,258.44 0.036776213 -0.0450608

06-01-20 22.32 34,421.92 -0.157735849 -0.1231969

05-01-20 23.72 33,931.23 0.062724014 -0.0142552

Monthly Average Return -1% -1%

Monthly Variance 1% 0%

Monthly Standard Deviation 11% 4%

Annual Return -7% -6%

Annual Variance 14% 2%

Annual Standard Deviation 37% 13%

Coefficient of Variation (Annual) 5.29 6.29

Covariance Ri and Rm 0.00193945

Intrinsic value 49.7 market value 40.20 recommended to buy

23

∑𝑅 ̅ 𝒊)𝟐

∑(𝐑𝐢−𝑹

𝑅̅ i = = -0.07 = -7% 𝜎 i2 = = 0.14 = 14%

𝑛 𝑛

𝜎i = √0.14 = ± 0.37 = ±37%

∑𝑅 ̅ 𝒊)𝟐

∑(𝐑𝐢−𝑹

𝑅̅m = = -0.06 = -6% 𝜎m2 = = 0.02 = 2%

𝑛 𝑛

𝜎m = √0.02 = ± 0.13 = ±13%

• Relative risk of Ittehad Chemicals ltd.

𝜎 0.37

Coefficient of variation = R = −0.07 = 5.29

• Systematic risk of Ittehad Chemicals ltd.

Co.variance Ri ,Rm ∑(𝐑𝐢−𝐑𝐢).(𝐑𝐦−𝐑𝐦) 0.001939

βi = = = = 0.09695

𝜎𝑚2 𝜎𝑚2 0.02

• Unsystematic Risk of Ittehad Chemicals ltd.:

𝜎i2 = βi2 𝜎m2 + 𝜎e2

𝜎e2 = 𝜎i2 - βi2 𝜎m2

𝜎e2 = 0.13 – (0.09695)2 (0.02)

𝜎e = √0.1298 = ±0.3602 = ±36.02%

• Downside risk of Ittehad Chemicals ltd.:

Date Return Ittehad

03-01-23 -0.110277778

01-01-23 -0.088235294

12-01-22 -0.112903226

11-01-22 -0.003636364

09-01-22 -0.015517241

07-01-22 -0.080779944

04-01-22 -0.071358429

03-01-22 -0.030666197

12-01-21 -0.147039474

11-01-21 -0.087157732

07-01-21 -0.025706125

04-01-21 -0.191286183

Intrinsic value 49.7 market value 40.20 recommended to buy

24

01-01-21 -0.11788269

12-01-20 -0.120661693

11-01-20 -0.065658429

09-01-20 -0.202661208

06-01-20 -0.157735849

Monthly Variance 0.003410297

Annual Variance 0.04092357

Annual Standard Deviation 0.202295749

̅ 𝒊)𝟐

∑(𝐑𝐢−𝑹

𝜎 i2 = = 0.0409 = 4.09%

𝑛

𝜎i = √0.0409 = ± 0.2022 = ±20.22%

1 year Portfolio with OGDCL

Here, we have made our portfolio with another stock that is OGDCL. We have invested 55% in Ittehad

and 45% in OGDCL. We have calculated return on portfolio and risk of portfolio as follows.

HPR

Date Ittehad HPY ogdcl

OGDCL Ri Rog HPR Ittehad HPY Ittehad ogdcl

04-01-23 36 85.97 - - - - - -

03-01-23 32.03 82.75 -0.1102 -0.03745 0.88972 -0.1102 0.96 -0.04

02-01-23 34 82 0.0615 -0.00906 1.06150 0.06150 0.99 0.01

01-01-23 31 87.94 -0.0882 0.07243 0.91176 -0.08823 1.07 0.07

12-01-22 27.5 79.66 -0.1129 -0.09416 0.88709 -0.1129 0.91 -0.09

11-01-22 27.4 72.3 -0.0036 -0.09239 0.9963 -0.0036 0.91 -0.09

10-01-22 29 69.97 0.0583 -0.03223 1.0583 0.0583 0.97 -0.03

09-01-22 28.55 75.72 -0.0155 0.08217 0.98448 -0.0155 1.08 0.08

08-01-22 32.31 82.75 0.1316 0.09284 1.1316 0.1316 1.09 0.09

07-01-22 29.7 80.42 -0.0807 -0.02816 0.91926 -0.08077 0.97 -0.03

06-01-22 29.87 78.9 0.0057 -0.0189 1.0057 0.0057 0.98 -0.02

05-01-22 30.55 80.67 0.0227 0.02243 1.02276 0.0227 1.02 0.02

Monthly Average

Return -1% 0%

Monthly Variance 1% 0%

Monthly Standard

Deviation 8% 6%

Annual Return -14% -5%

Annual Variance 8% 5%

Annual Standard

Deviation 27% 22%

CoVariance 0.00

∑ 𝐻𝑃𝑌

𝑅̅ i = -0.14 𝑅̅ o = -0.05 A.M= G.M= (𝜋 𝐻𝑃𝑅)1/n -1

𝑛

𝜎i2 = 0.08 𝜎o2 = 0.05 A.M =

−0.1312 G.M = (0.8627)1/11 -1

11

𝜎o = ±0.22 G.Mittehad= -0.0133 = -

𝜎i = ±0.27 A.Mittehad = -0.01199 = -

1.33%

1.19%

G.Mogdcl = 0.577%

A.M = 0%

Intrinsic value 49.7 market value 40.20 recommended to buy

25

If we have invested 45% in OGDCL then,

wi = 1 – 0.45 = 0.55 wo = 0.45

• Portfolio Risk:

̅ 𝒊).𝐑𝐨−𝑹

∑(𝐑𝐢−𝑹 ̅ 𝒐)

Rp = wiRi + woRo 𝜎1,2= 𝑛

Rp = (0.55*-0.14) + (0.45*-0.05) 0.0

𝜎1,2= 6

Rp = -0.0995 = -10%

𝜎1,2=0.0

• Portfolio Return:

𝜎p2 = wi2 𝜎i2 + wo2 𝜎o2+ 2w1w2𝜎1,2

𝜎p2 = (0.55)2(0.08) + (0.45)2(0.05) + 2(0.55)(0.45)(0.0)

𝜎p2 = 0.0242 + 0.01012 + 0

𝜎p = √0.03432

𝜎p = ±0.1852 = ±18.52%

Efficient Portfolio Frontier:

W1 W2 Return Risk

0% 100% 0.05 0.223607

10% 90% 0.059 0.203224 Efficient Portfolio Frontier

20% 80% 0.068 0.187617 0.16

30% 70% 0.077 0.178045 0.14

40% 60% 0.086 0.175499 0.12

50% 50% 0.095 0.180278 0.1

55% 45% 0.0995 0.18527 0.08

60% 40% 0.104 0.191833 0.06

70% 30% 0.113 0.04

0.209045

80% 20% 0.122 0.02

0.230651

0

90% 10% 0.131 0.255539 0 0.05 0.1 0.15 0.2 0.25 0.3

100% 0% 0.14 0.282843

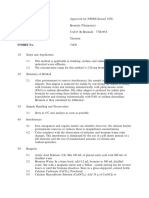

Intrinsic value of share:

Dividend based models (constant growth)

∑𝒈 𝟎.𝟗𝟑𝟓𝟔𝟔𝟒

Average growth = = = 0.15599

𝒏 𝟔

𝐃𝐨(𝟏+𝐠) 𝟏(𝟏+𝟎.𝟏𝟓𝟓𝟗𝟗)

Po = =

𝐊𝐞 − 𝐠 𝟎.𝟕−𝟎.𝟏𝟓𝟓𝟗𝟗

Ke = Rf + (Rm-Rf).b

Po = 1.8135

Ke =0.1558 + (-0.06-0.1558) * 0.09695

Ke = 0.135 = 13.5%

Intrinsic value 49.7 market value 40.20 recommended to buy

26

Ratio Analysis:

2022 2021 2020

Gross Profit Margin 13.17 16.95 13.34

Net Profit Margin 2.64 5.9 0.69

ROE 11.4 20.01 1.99

Price Earnings Ratio 7.2 4.91 36.6

Debt to Equity 0.51 0.51 0.6

Current Ratio 0.99 1.05 1.18

Quick Ratio 0.53 0.64 0.74

Interest Coverage ratio 3.01 4.85 1.03

Debtor Turnover 10.28 11.25 13.05

Inventory turnover 5.11 5.91 6.95

Dividend Payout 24.12 30.45 139.31

Bonus Shares 18.06 _ _

Dividend per share 1 2 1

Earnings per share 4.15 6.57 0.72

Financial Highlights:

Income Statement:

2022 2021 2020

Sales 15,681,372 11,123,793 8,856,601

Gross profit 2,064,777 1,885,509 1,181,643

operating profit 992,781 1,093,005 496,032

EBT 764,049 980,110 77,727

profit/loss 414,539 656,767 60,800

Balance Sheet:

2022 2021 2020

Current Assets 5,706,353 3,804,882 2,968,161

noncurrent/fixed assets 7,158,708 6,504,901 6,172,395

Total Assets 12,865,061 10,309,783 9,140,556

Current liabilities 5,774,596 3,638,600 2,507,780

Long term liabilities 1,909,447 1,796,789 2,578,972

Shareholder's Equity 5,181,018 4,874,394 4,053,804

Intrinsic value 49.7 market value 40.20 recommended to buy

27

Total Liabilities and equity 12,865,061 10,309,783 9,140,556

Share Capital 1,000,000 847,000 847,000

Horizontal and Vertical Analysis:

❖ Income Statement:

Vertical Analysis

Sales 100 100 100

CGS -86.83293146 -83.04976549 -86.65805313

Gross Profit 13.16706854 16.95023451 13.34194687

Selling and distributive expense -5.139225063 -5.182593743 -5.657260613

General and administrative expense -1.563307088 -1.803188894 -2.351985824

Other operating expenses -0.516523682 -0.968293818 -0.684935451

Other income 0.382944809 0.829672037 0.952938944

Operating Profit 6.330957521 9.825830092 5.600703927

Financial Charges -2.104292915 -2.026242308 -5.421718784

Fair value gain on investment 0.645670545 1.01134568 0.69863145

Profit before taxation 4.87233515 8.810933465 0.877616594

Taxation -2.228822835 -2.906769301 -0.191122983

Net Profit 2.643512315 5.904164164 0.686493611

Horizontal Analysis

Sales 177.0585804 125.5988951 100

CGS 177.4158894 120.3691799 100

Gross Profit 174.7378015 159.5667219 100

Selling and distributive expense 160.84532 115.0606437 100

General and administrative expense 117.6864805 96.29247357 100

Other operating expenses 133.5234578 177.5592628 100

Other income 71.15216 109.3521173 100

Operating Profit 200.1445471 220.3496952 100

Financial Charges 68.72047982 46.93968928 100

Fair value gain on investment 163.6363636 181.8181818 100

Profit before taxation 982.9904666 1260.964658 100

Taxation 2064.807704 1910.220358 100

Net Profit 681.8075658 1080.208882 100

Intrinsic value 49.7 market value 40.20 recommended to buy

28

❖ Balance Sheet:

Vertical Analysis

2022 2021 2020

ASSETS

NON-CURRENT ASSETS 55.64457098 63.09445116 67.52756616

CURRENT ASSETS 44.35542902 36.90554884 32.47243384

TOTAL ASSETS 100 100 100

EQUITY AND LIABILITIES 40.27200493 47.27930743 44.3496435

SHARE CAPITAL AND RESERVES 14.84211385 17.42800018 28.21460751

NON-CURRENT LIABILITIES 44.88588123 35.29269239 27.43574899

CURRENT LIABILITIES 44.88588123 35.29269239 27.43574899

TOTAL EQUITY AND LIABILITIES 100 100 100

Horizontal Analysis

2022 2021 2020

ASSETS

NON-CURRENT ASSETS 115.9794213 128.1898792 100

CURRENT ASSETS 192.2521386 128 100

TOTAL ASSETS 140.747029 113 100

EQUITY AND LIABILITIES

SHARE CAPITAL AND RESERVES 127.8063271 120 100

NON-CURRENT LIABILITIES 74.03907448 70 100

CURRENT LIABILITIES 230.2672483 145 100

TOTAL EQUITY AND LIABILITIES 140.747029 113 100

Intrinsic value 49.7 market value 40.20 recommended to buy

You might also like

- Besan Mill ProjectDocument14 pagesBesan Mill Projectshreyans01100% (1)

- Avid Organics VRD Eia1 PDFDocument133 pagesAvid Organics VRD Eia1 PDFmehul10941No ratings yet

- Project Report On Whipping CreamDocument5 pagesProject Report On Whipping CreamEIRI Board of Consultants and PublishersNo ratings yet

- Coursebook Answers Chapter 25 Asal ChemistryDocument4 pagesCoursebook Answers Chapter 25 Asal ChemistryAditiNo ratings yet

- POR 2015-16 FinalDocument242 pagesPOR 2015-16 FinalKhalida MuddasserNo ratings yet

- Cetp 28-11-2016Document616 pagesCetp 28-11-2016neeraj sharmaNo ratings yet

- Guideline For Establishment of Lube Plant and Application FormDocument11 pagesGuideline For Establishment of Lube Plant and Application FormEmmanuel OguaforNo ratings yet

- SA Calcium StearateDocument35 pagesSA Calcium StearateAPJ HollywoodsistersNo ratings yet

- 4 AAC BLOCKS Other Sample Project Report Laxmi Tpe2jwDocument28 pages4 AAC BLOCKS Other Sample Project Report Laxmi Tpe2jwDhruVikas & AssociatesNo ratings yet

- Kof Part B 1.1 - KP New KPDocument44 pagesKof Part B 1.1 - KP New KPkp vineetNo ratings yet

- Safety Hiblack 30LDocument3 pagesSafety Hiblack 30Lalfa twoNo ratings yet

- Profile On AnilineDocument16 pagesProfile On AnilineGovindanayagi PattabiramanNo ratings yet

- Brief History Nimir ChemicalsDocument3 pagesBrief History Nimir ChemicalsammmmmiNo ratings yet

- Ittehad Chemicals Limited SWOT AnalysisDocument4 pagesIttehad Chemicals Limited SWOT AnalysisIdealeyes100% (1)

- PDF Project 260Document149 pagesPDF Project 260ukamaluddinmba100% (1)

- Engineers India - EIRI HiTech Magazine - May 2018Document17 pagesEngineers India - EIRI HiTech Magazine - May 2018Sunesh SharmaNo ratings yet

- Economics of ABS Production ProcessesDocument4 pagesEconomics of ABS Production ProcessesfdfNo ratings yet

- Cornstarch ProjectDocument44 pagesCornstarch ProjectpadhaiNo ratings yet

- Employees Federation of PakistanDocument36 pagesEmployees Federation of PakistanBusiness PartnerzNo ratings yet

- List of Permitted Food AdditivesDocument25 pagesList of Permitted Food AdditivesKarla Marie Miras CastroNo ratings yet

- Final ReportDocument40 pagesFinal ReportAmol RastogiNo ratings yet

- Caustic Soda Feasibility StudyDocument75 pagesCaustic Soda Feasibility StudyMarcos Gonzalez50% (2)

- Aluminium Extrusion Industry in IndiaDocument3 pagesAluminium Extrusion Industry in Indiakalan45No ratings yet

- Kairos Company ProfileDocument2 pagesKairos Company Profileapi-326437421No ratings yet

- Final Cpec ReportDocument8 pagesFinal Cpec ReportMuhammad FaizanNo ratings yet

- BASF 4A Molecular Sieve DatasheetDocument2 pagesBASF 4A Molecular Sieve DatasheetseyedAli TabatabaeeNo ratings yet

- Professional ProjectDocument84 pagesProfessional ProjectumairNo ratings yet

- India Glycols Limited: An Industrial Training Report ofDocument48 pagesIndia Glycols Limited: An Industrial Training Report ofVishwaraj0% (1)

- Effect of Refining of Crude Rice Bran Oil On The Retention of Oryzanol in The Refined OilDocument5 pagesEffect of Refining of Crude Rice Bran Oil On The Retention of Oryzanol in The Refined Oilmuhammad alaik nailal HudaNo ratings yet

- Report On CpecDocument22 pagesReport On CpecHamza ShabbirNo ratings yet

- Starch Sources Processing in IndiaDocument76 pagesStarch Sources Processing in Indias_vral87No ratings yet

- General Tyre Annual Report June 30 2020 1Document112 pagesGeneral Tyre Annual Report June 30 2020 1M.TalhaNo ratings yet

- Fatima FertilizerDocument18 pagesFatima FertilizersyeddanishrasoolNo ratings yet

- Preços Cloro - Soda CáusticaDocument27 pagesPreços Cloro - Soda CáusticaLuiz Guilherme Carvalho PaivaNo ratings yet

- Pakarab Fertilizers Limited ReportDocument84 pagesPakarab Fertilizers Limited ReportImranQureshiNo ratings yet

- Healthgenic Chemicals Private Limited: In-Plant Training atDocument58 pagesHealthgenic Chemicals Private Limited: In-Plant Training atxabeha5945No ratings yet

- 8th PPT of Microbiology of Indigenous Milk Products Desiccated Milk Based Products 1Document29 pages8th PPT of Microbiology of Indigenous Milk Products Desiccated Milk Based Products 1Rohit PandeyNo ratings yet

- Petroleum Exploration & Production POLICY 2011: Government of Pakistan Ministry of Petroleum & Natural ResourcesDocument54 pagesPetroleum Exploration & Production POLICY 2011: Government of Pakistan Ministry of Petroleum & Natural ResourcesShaista IshaqNo ratings yet

- Soyaben ProjectDocument66 pagesSoyaben ProjectAmeshe Moges100% (1)

- Curriculum Vitae Leonardo Concezzi: (Private and Confidential)Document7 pagesCurriculum Vitae Leonardo Concezzi: (Private and Confidential)samaanNo ratings yet

- Biodiesel Business PlanDocument6 pagesBiodiesel Business Planarihant jainNo ratings yet

- Vikas Eco PDFDocument60 pagesVikas Eco PDFAbhi PatNo ratings yet

- Strategy Formulation For IOCL For 2012Document14 pagesStrategy Formulation For IOCL For 2012mannu.abhimanyu3098100% (1)

- Paint Industry AnalysisDocument25 pagesPaint Industry AnalysisRAJASHEKAR REDDY SNo ratings yet

- Chemical Interesterification of Palm, Palm KernelDocument8 pagesChemical Interesterification of Palm, Palm KernelAfsoon QNetNo ratings yet

- MEPC.2-Circ.26 - Provisional Categorization of Liquid Substances in Accordance WithMarpol Annex II and The... (Secretariat)Document87 pagesMEPC.2-Circ.26 - Provisional Categorization of Liquid Substances in Accordance WithMarpol Annex II and The... (Secretariat)DeepakNo ratings yet

- Synopsis Project JocilDocument16 pagesSynopsis Project JocilbhatiaharryjassiNo ratings yet

- Battery Swapping For E2Ws in IndiaDocument25 pagesBattery Swapping For E2Ws in IndiaRahul DeshpandeNo ratings yet

- A Study On Cash Management With Reference To Alloysys Extrusion (P) LTD (2018-2022)Document88 pagesA Study On Cash Management With Reference To Alloysys Extrusion (P) LTD (2018-2022)anamika ANo ratings yet

- BPD Used Oil RefineryDocument5 pagesBPD Used Oil Refineryrpr013279No ratings yet

- Total PricesDocument4 pagesTotal PricesZahid Gill0% (1)

- World Fuel Services Corporate Brochure 2016Document28 pagesWorld Fuel Services Corporate Brochure 2016narutorazNo ratings yet

- PakarabDocument10 pagesPakarabWaheedAhmedNo ratings yet

- Sector Brief Chemicals Industry in PakistanDocument2 pagesSector Brief Chemicals Industry in PakistanregallydivineNo ratings yet

- Companies ListDocument3 pagesCompanies ListTanmay Agnani0% (1)

- Introduction To Chemical IndustryDocument19 pagesIntroduction To Chemical Industrysukhmani100% (1)

- Petrochemicals: Samata Deep Raj Deeksha.N.S Krishna Gowri DasariDocument14 pagesPetrochemicals: Samata Deep Raj Deeksha.N.S Krishna Gowri DasariKrishna Gowri Dasari100% (1)

- 1) Unit-1 Classification of Indian Chemical IndustryDocument26 pages1) Unit-1 Classification of Indian Chemical IndustrySruthi ChallapalliNo ratings yet

- Chemical Industry in PakistanDocument3 pagesChemical Industry in PakistanSundas ImranNo ratings yet

- PCMA Mag December 2019 FinalDocument60 pagesPCMA Mag December 2019 FinalAMMARULLAH KHANNo ratings yet

- Process Design Feasibility Study Lecture Notesv2Document55 pagesProcess Design Feasibility Study Lecture Notesv2Zaki WasitNo ratings yet

- Department of Automobile Engineering At8091 - Manufacturing of Automotive ComponentsDocument11 pagesDepartment of Automobile Engineering At8091 - Manufacturing of Automotive ComponentsERKATHIRNo ratings yet

- New - Mizani Price List October 2023Document2 pagesNew - Mizani Price List October 2023oluwasegundeborah151No ratings yet

- Unllna) : - PopiiDocument25 pagesUnllna) : - PopiiWaren LlorenNo ratings yet

- Kinetics Worksheet AnswersDocument7 pagesKinetics Worksheet AnswerslinaNo ratings yet

- Classification, Construction & Manufacture of Heat ExchangerDocument56 pagesClassification, Construction & Manufacture of Heat ExchangerMochammad ReshaNo ratings yet

- Medical Abbreviations: Prepared By: Prof. Lizamae C. Ong, RPH, FscoDocument3 pagesMedical Abbreviations: Prepared By: Prof. Lizamae C. Ong, RPH, FscoNashreen QtqtNo ratings yet

- All About HydrocolloidsDocument28 pagesAll About HydrocolloidsBambang NurhadiNo ratings yet

- Genesis 2020 PDFDocument154 pagesGenesis 2020 PDFDilon FernandoNo ratings yet

- Titation and Limiting ReagentDocument27 pagesTitation and Limiting Reagentngah lidwine100% (1)

- Bromide (Titrimetric) 320 - 1Document5 pagesBromide (Titrimetric) 320 - 1maría joséNo ratings yet

- Mechanical Material PropertiesDocument10 pagesMechanical Material PropertiesDong HungNo ratings yet

- TM and Repair of Centrifugal PumpsDocument29 pagesTM and Repair of Centrifugal PumpsPotter A. VijayNo ratings yet

- Fowler's Solution - WikipediaDocument1 pageFowler's Solution - WikipediamrkuroiNo ratings yet

- 63:M:J:20Document9 pages63:M:J:202025svyasNo ratings yet

- Week 6 EnzymessDocument49 pagesWeek 6 EnzymessRechell Mae DaclesNo ratings yet

- + ( ) ( ) Handerson Hasselbalch EquationDocument2 pages+ ( ) ( ) Handerson Hasselbalch Equation123123No ratings yet

- Flood Assessment MethodsDocument219 pagesFlood Assessment MethodsCvetkoNo ratings yet

- CAPE Chemistry 2017 U2 P032Document8 pagesCAPE Chemistry 2017 U2 P032Kyle YearwoodNo ratings yet

- Department of Chemical Technology Chulalongkorn University 2306 334 App Math Chem Eng II September 20, 2021 Classwork VDocument6 pagesDepartment of Chemical Technology Chulalongkorn University 2306 334 App Math Chem Eng II September 20, 2021 Classwork VPacharapol NokphoNo ratings yet

- Extraction of Alkaloids: Pharmacognosy LabDocument1 pageExtraction of Alkaloids: Pharmacognosy Labnicee willaineNo ratings yet

- Get To Know Potassium Nitrate in Tomato Nutrient ManagementDocument4 pagesGet To Know Potassium Nitrate in Tomato Nutrient ManagementRómulo Del ValleNo ratings yet

- Chemical Hazards: Guide For Risk Assessment in Small and Medium EnterprisesDocument18 pagesChemical Hazards: Guide For Risk Assessment in Small and Medium EnterprisescbeylefeldNo ratings yet

- Steel Wire, Hard-Drawn For Prestressed Concrete PipeDocument5 pagesSteel Wire, Hard-Drawn For Prestressed Concrete PipeDarwin DarmawanNo ratings yet

- Modular TiO2-Squaraine Dyes/Electrolyte Interface For Dye-Sensitized Solar Cells With Cobalt ElectrolyteDocument16 pagesModular TiO2-Squaraine Dyes/Electrolyte Interface For Dye-Sensitized Solar Cells With Cobalt Electrolytebishtrajesh60No ratings yet

- Aircell CatalogueDocument8 pagesAircell CatalogueAftab Beig100% (1)

- Bio Mutations Show 2019Document21 pagesBio Mutations Show 2019Ashish SethyNo ratings yet

- Proteins As Drugs: Analysis, Formulation and Delivery: A. IntroductionDocument2 pagesProteins As Drugs: Analysis, Formulation and Delivery: A. IntroductionAMOL RASTOGI 19BCM0012No ratings yet

- Seminar II Recent Advances in Electrochemiluminescence By: Yegezu M. July, 2022 Addis AbabaDocument35 pagesSeminar II Recent Advances in Electrochemiluminescence By: Yegezu M. July, 2022 Addis AbabaYegezu MebratuNo ratings yet

- Unit-3 MHD Part-1Document12 pagesUnit-3 MHD Part-1amit621988No ratings yet