Professional Documents

Culture Documents

GSTR3B 27ahtpc4965g1zy 062022

GSTR3B 27ahtpc4965g1zy 062022

Uploaded by

MEETCopyright:

Available Formats

You might also like

- Inside Out - Driven by Emotions (Disney Chapter Book (Ebook) ) - NodrmDocument100 pagesInside Out - Driven by Emotions (Disney Chapter Book (Ebook) ) - NodrmLetsNotKidOurselves100% (2)

- An Introduction To TattvasDocument13 pagesAn Introduction To TattvasTemple of the stars83% (6)

- Technical Note Guidance On Corrosion Assessment of Ex EquipmentDocument7 pagesTechnical Note Guidance On Corrosion Assessment of Ex EquipmentParthiban NagarajanNo ratings yet

- GSTR3B 27BCGPS7468K1ZR 072022Document3 pagesGSTR3B 27BCGPS7468K1ZR 072022Aman JaiswalNo ratings yet

- GSTR3B 27BCGPS7468K1ZR 042022Document3 pagesGSTR3B 27BCGPS7468K1ZR 042022Aman JaiswalNo ratings yet

- GSTR3B 19azwpd2404n1zx Aug2022Document2 pagesGSTR3B 19azwpd2404n1zx Aug2022ho.ubiquityNo ratings yet

- GSTR3B 27BCGPS7468K1ZR 062022Document3 pagesGSTR3B 27BCGPS7468K1ZR 062022Aman JaiswalNo ratings yet

- GSTR3B 27BCGPS7468K1ZR 012022Document3 pagesGSTR3B 27BCGPS7468K1ZR 012022Aman JaiswalNo ratings yet

- GSTR3B 20aahcp4985d1zi 012024Document3 pagesGSTR3B 20aahcp4985d1zi 012024sushil.ublNo ratings yet

- GSTR3B 36fjypk4832a1zy 082022Document2 pagesGSTR3B 36fjypk4832a1zy 082022saiakhiltataNo ratings yet

- GSTR3B 03CJQPK1907B2ZL 072023Document2 pagesGSTR3B 03CJQPK1907B2ZL 072023nstradingcompany2023No ratings yet

- GSTR3B 36fjypk4832a1zy 042023Document2 pagesGSTR3B 36fjypk4832a1zy 042023saiakhiltataNo ratings yet

- GSTR3B 29ajbpm5064c1zd 022023Document2 pagesGSTR3B 29ajbpm5064c1zd 022023raghav shettyNo ratings yet

- GSTR3B 19bahph8899e1z2 012022Document3 pagesGSTR3B 19bahph8899e1z2 012022Pawan KanuNo ratings yet

- GSTR3B 33axcps7298d1z7 082022Document2 pagesGSTR3B 33axcps7298d1z7 082022Logesh Waran KmlNo ratings yet

- GSTR3B 19azwpd2404n1zx Dec2022Document2 pagesGSTR3B 19azwpd2404n1zx Dec2022ho.ubiquityNo ratings yet

- GSTR3B 19bahph8899e1z2 052022Document3 pagesGSTR3B 19bahph8899e1z2 052022Pawan KanuNo ratings yet

- 04 July-2022Document3 pages04 July-2022Sunil NNo ratings yet

- GSTR3B 19azwpd2404n1zx Jan2023Document2 pagesGSTR3B 19azwpd2404n1zx Jan2023ho.ubiquityNo ratings yet

- GSTR3B 19bahph8899e1z2 042022Document3 pagesGSTR3B 19bahph8899e1z2 042022Pawan KanuNo ratings yet

- GSTR3B - 08bhupa6318m2zt - 062022 April To June 2022Document3 pagesGSTR3B - 08bhupa6318m2zt - 062022 April To June 2022Rahul SharmaNo ratings yet

- GSTR3B 52022Document2 pagesGSTR3B 52022Logesh Waran KmlNo ratings yet

- GSTR3B 36fjypk4832a1zy 122023Document2 pagesGSTR3B 36fjypk4832a1zy 122023saiakhiltataNo ratings yet

- GSTR3B 33mgkps5309e1z4 012022Document3 pagesGSTR3B 33mgkps5309e1z4 012022Suresh KumarNo ratings yet

- May GSTR3B - 27AAJCB3358E1ZP - 052023Document2 pagesMay GSTR3B - 27AAJCB3358E1ZP - 052023calmincometax36No ratings yet

- D1Z7 122022Document2 pagesD1Z7 122022Logesh Waran KmlNo ratings yet

- 11 GSTR-3B - Feb 21-22Document2 pages11 GSTR-3B - Feb 21-22ArbindraNo ratings yet

- GSTR3B 03lmypk3229a1zy 122022Document2 pagesGSTR3B 03lmypk3229a1zy 122022nstradingcompany2023No ratings yet

- GSTR3B 37adcfs8516j1zp 012018Document2 pagesGSTR3B 37adcfs8516j1zp 012018ravi kiranNo ratings yet

- GSTR3B 36fjypk4832a1zy 032023Document2 pagesGSTR3B 36fjypk4832a1zy 032023saiakhiltataNo ratings yet

- Apr 23Document3 pagesApr 23sbmsalesassociatsNo ratings yet

- GSTR3B 36bmypp9150m1zx 012023Document3 pagesGSTR3B 36bmypp9150m1zx 012023RAJESH DNo ratings yet

- GSTR3B 33auapv1142j1zs 062023Document3 pagesGSTR3B 33auapv1142j1zs 062023crmfinance.tnNo ratings yet

- GSTR3B 36aafcr5625q1zr 022024Document3 pagesGSTR3B 36aafcr5625q1zr 022024Kri ShnaNo ratings yet

- GSTR3B 09aaeci2181f2zn 062022Document2 pagesGSTR3B 09aaeci2181f2zn 062022Pushan SrivastavaNo ratings yet

- GSTR3B 27BCGPS7468K1ZR 082022Document3 pagesGSTR3B 27BCGPS7468K1ZR 082022Aman JaiswalNo ratings yet

- GSTR3B 07aonpj7130d2z2 112022Document3 pagesGSTR3B 07aonpj7130d2z2 112022Rudra JhaNo ratings yet

- GSTR3B 29aaicc9487a1zb 012023Document2 pagesGSTR3B 29aaicc9487a1zb 012023krishswat7912No ratings yet

- GSTR3B 33aeqpy3870g1zy 112023Document3 pagesGSTR3B 33aeqpy3870g1zy 112023Durai kannuNo ratings yet

- GSTR3B 33aeqpy3870g1zy 082023Document3 pagesGSTR3B 33aeqpy3870g1zy 082023Durai kannuNo ratings yet

- GSTR3B 21aywpa7472l1zz 012023Document2 pagesGSTR3B 21aywpa7472l1zz 012023prateek gangwaniNo ratings yet

- GSTR3B 03dacpa5649q1zi 012024Document3 pagesGSTR3B 03dacpa5649q1zi 012024RAHUL kumarNo ratings yet

- Dudi JuneDocument3 pagesDudi JuneSukhchain SinghNo ratings yet

- GSTR3B 23aywpp5389h1zl 122023Document2 pagesGSTR3B 23aywpp5389h1zl 122023riturajasati4205No ratings yet

- GSTR3B 10jespk0829a1zs 042023Document3 pagesGSTR3B 10jespk0829a1zs 042023Pratik RajNo ratings yet

- GSTR3B 24emypa4455b1z3 032023Document3 pagesGSTR3B 24emypa4455b1z3 032023anant1111No ratings yet

- GSTR3B 33aeqpy3870g1zy 062023Document3 pagesGSTR3B 33aeqpy3870g1zy 062023Durai kannuNo ratings yet

- May 23Document3 pagesMay 23sbmsalesassociatsNo ratings yet

- Aug 23Document3 pagesAug 23sbmsalesassociatsNo ratings yet

- 3 GSTR-3B - Jun 21-22Document2 pages3 GSTR-3B - Jun 21-22ArbindraNo ratings yet

- GSTR3B 37BWZPT3110J1ZW 082023Document3 pagesGSTR3B 37BWZPT3110J1ZW 082023satyathirumani5No ratings yet

- GSTR3B 09aaeci2181f2zn 052022Document2 pagesGSTR3B 09aaeci2181f2zn 052022Pushan SrivastavaNo ratings yet

- GSTR3B 27BCGPS7468K1ZR 092022Document3 pagesGSTR3B 27BCGPS7468K1ZR 092022Aman JaiswalNo ratings yet

- GSTR3B 10CKPPK6612R1ZP 082022Document3 pagesGSTR3B 10CKPPK6612R1ZP 082022Saurav KumarNo ratings yet

- GSTR3B 27aecpn4152q1z2 092023Document3 pagesGSTR3B 27aecpn4152q1z2 092023dhatusanvardhanaurvastuvinimayNo ratings yet

- GSTR3B 09adppu6529c1z2 032024Document3 pagesGSTR3B 09adppu6529c1z2 032024teamlifeeduNo ratings yet

- GSTR3B 33aivpc1432h1zi 062023Document3 pagesGSTR3B 33aivpc1432h1zi 062023crmfinance.tnNo ratings yet

- GSTR3B 03dacpa5649q1zi 032024Document3 pagesGSTR3B 03dacpa5649q1zi 032024RAHUL kumarNo ratings yet

- MH GSTR3B Nov'22Document3 pagesMH GSTR3B Nov'22crmfinance.tnNo ratings yet

- GSTR3B 21aachs0767c1zm 032023Document3 pagesGSTR3B 21aachs0767c1zm 032023Subrat Kumar RanaNo ratings yet

- MH GSTR3B Dec'22Document3 pagesMH GSTR3B Dec'22crmfinance.tnNo ratings yet

- GSTR3B 03alnpk4728k1zv 052021Document2 pagesGSTR3B 03alnpk4728k1zv 052021Harish VermaNo ratings yet

- 3 Methods For Crack Depth Measurement in ConcreteDocument4 pages3 Methods For Crack Depth Measurement in ConcreteEvello MercanoNo ratings yet

- Task 1 - PCK8Document8 pagesTask 1 - PCK8Andrea SantosNo ratings yet

- Origami Symbols: (Fold The Paper Towards You)Document6 pagesOrigami Symbols: (Fold The Paper Towards You)Ian De La CruzNo ratings yet

- Flow of Fluids QuizDocument2 pagesFlow of Fluids QuizJhon Oliver De JoseNo ratings yet

- Geologia 2Document194 pagesGeologia 2agvega69109No ratings yet

- Dominos Swot & 4 PsDocument10 pagesDominos Swot & 4 PsPrithvi BarodiaNo ratings yet

- 33 05 13 Manholes and Structures 10Document4 pages33 05 13 Manholes and Structures 10salamNo ratings yet

- Jemal Yahyaa Software Project Managemant Case Study PrintDocument30 pagesJemal Yahyaa Software Project Managemant Case Study Printjemal yahyaaNo ratings yet

- Yoga For Modern Age - 1Document181 pagesYoga For Modern Age - 1GayathriNo ratings yet

- File ListDocument5 pagesFile ListanetaNo ratings yet

- Shady Othman Nour El Deen: Doha, QatarDocument3 pagesShady Othman Nour El Deen: Doha, QatarHatem HusseinNo ratings yet

- Executing / Implementing Agency: Financial Management Assessment Questionnaire Topic ResponseDocument6 pagesExecuting / Implementing Agency: Financial Management Assessment Questionnaire Topic ResponseBelle CartagenaNo ratings yet

- Ni Based Superalloy: Casting Technology, Metallurgy, Development, Properties and ApplicationsDocument46 pagesNi Based Superalloy: Casting Technology, Metallurgy, Development, Properties and ApplicationsffazlaliNo ratings yet

- R105Document1 pageR105Francisco Javier López BarrancoNo ratings yet

- Clinical and Diagnostic Imaging Findings in Police Working Dogs Referred For Hip OsteoarthritisDocument11 pagesClinical and Diagnostic Imaging Findings in Police Working Dogs Referred For Hip OsteoarthritisEquilibrium EduardoNo ratings yet

- Business Environment Ch.3Document13 pagesBusiness Environment Ch.3hahahaha wahahahhaNo ratings yet

- An Overview of Croatian Autochthonous Varieties of Sweet CherryDocument7 pagesAn Overview of Croatian Autochthonous Varieties of Sweet CherryJasna HasanbegovićNo ratings yet

- MESFETDocument2 pagesMESFETKarthik KichuNo ratings yet

- Europe & ThailandDocument1 pageEurope & ThailandTipitaka TripitakaNo ratings yet

- Britain Food and DrinksDocument15 pagesBritain Food and DrinksAnny NamelessNo ratings yet

- Demonic Corruption RulesetDocument4 pagesDemonic Corruption RulesetJeffrey BeaumontNo ratings yet

- Bermundo Task 3 Iii-20Document2 pagesBermundo Task 3 Iii-20Jakeson Ranit BermundoNo ratings yet

- Electromagnetic Interference (EMI) in Power SuppliesDocument41 pagesElectromagnetic Interference (EMI) in Power SuppliesAmarnath M DamodaranNo ratings yet

- Epoxy Curing Agents and Modifiers: Ancamide® 260A Curing AgentDocument1 pageEpoxy Curing Agents and Modifiers: Ancamide® 260A Curing AgentNissim Hazar CasanovaNo ratings yet

- DSC Polyma E 1013Document24 pagesDSC Polyma E 1013sanipoulouNo ratings yet

- SSI-5000 Service ManualDocument107 pagesSSI-5000 Service ManualNikolay Penev100% (2)

- SP6 MB Tutorial 01Document20 pagesSP6 MB Tutorial 01Nikola PetrakNo ratings yet

GSTR3B 27ahtpc4965g1zy 062022

GSTR3B 27ahtpc4965g1zy 062022

Uploaded by

MEETOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

GSTR3B 27ahtpc4965g1zy 062022

GSTR3B 27ahtpc4965g1zy 062022

Uploaded by

MEETCopyright:

Available Formats

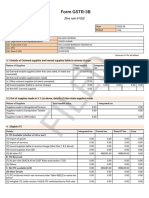

Form GSTR-3B

[See rule 61(5)]

Year 2022-23

Period June

1. GSTIN 27AHTPC4965G1ZY

2(a). Legal name of the registered person AJAY KUMAR JAIKISHAN CHOUHAN

2(b). Trade name, if any SUN-SHINE SERVICES

2(c). ARN AC270622858770T

2(d). Date of ARN 19/08/2022

(Amount in ₹ for all tables)

3.1 Details of Outward supplies and inward supplies liable to reverse charge

Nature of Supplies Total taxable Integrated Central State/UT Cess

exempted)

(b) Outward taxable supplies (zero rated)

(c ) Other outward supplies (nil rated, exempted)

(d) Inward supplies (liable to reverse charge)

(e) Non-GST outward supplies

ED

(a) Outward taxable supplies (other than zero rated, nil rated and

value

3.2 Out of supplies made in 3.1 (a) above, details of inter-state supplies made

5000.00

0.00

0.00

0.00

0.00

tax

-

0.00

0.00

0.00

tax

450.00

-

-

-

0.00

tax

450.00

-

-

-

0.00

0.00

0.00

-

0.00

-

FIL

Nature of Supplies Total taxable value Integrated tax

Supplies made to Unregistered Persons 0.00 0.00

Supplies made to Composition Taxable 0.00 0.00

Persons

Supplies made to UIN holders 0.00 0.00

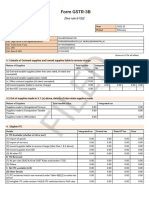

4. Eligible ITC

Details Integrated tax Central tax State/UT tax Cess

A. ITC Available (whether in full or part)

(1) Import of goods 0.00 0.00 0.00 0.00

(2) Import of services 0.00 0.00 0.00 0.00

(3) Inward supplies liable to reverse charge (other than 1 & 2 above) 0.00 0.00 0.00 0.00

(4) Inward supplies from ISD 0.00 0.00 0.00 0.00

(5) All other ITC 0.00 0.00 0.00 0.00

B. ITC Reversed

(1) As per rules 42 & 43 of CGST Rules 0.00 0.00 0.00 0.00

(2) Others 0.00 0.00 0.00 0.00

C. Net ITC available (A-B) 0.00 0.00 0.00 0.00

D. Ineligible ITC 0.00 0.00 0.00 0.00

(1) As per section 17(5) 0.00 0.00 0.00 0.00

(2) Others 0.00 0.00 0.00 0.00

5 Values of exempt, nil-rated and non-GST inward supplies

Nature of Supplies Inter- State supplies Intra- State supplies

From a supplier under composition scheme, Exempt, Nil rated supply 0.00 0.00

Non GST supply 0.00 0.00

5.1 Interest and Late fee for previous tax period

Details Integrated tax Central tax State/UT tax Cess

System computed 69.26 82.62 82.62 -

Interest

Interest Paid 69.26 82.62 82.62 0.00

Late fee - 1000.00 1000.00 -

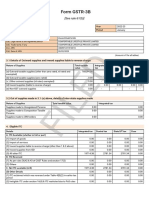

6.1 Payment of tax

Description Total tax Tax paid through ITC Tax paid in Interest paid in Late fee paid in

tax

Central tax

State/UT tax

Cess

payable

(A) Other than reverse charge

Integrated

(B) Reverse charge

Integrated

0.00

450.00

450.00

0.00

0.00

Integrated

tax

-

0.00

0.00

0.00

ED

Central

tax

-

-

-

0.00

0.00

State/UT

tax

-

0.00

0.00

Cess

-

-

0.00

-

cash

0.00

450.00

450.00

0.00

0.00

cash

-

69.00

83.00

83.00

0.00

cash

-

1000.00

1000.00

FIL

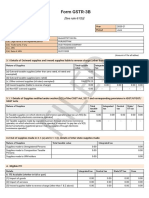

tax

Central tax 0.00 - - - - 0.00 - -

State/UT tax 0.00 - - - - 0.00 - -

Cess 0.00 - - - - 0.00 - -

Breakup of tax liability declared (for interest computation)

Period Integrated tax Central tax State/UT tax Cess

June 2022 0.00 450.00 450.00 0.00

Verification:

I hereby solemnly affirm and declare that the information given herein above is true and correct to the best of my knowledge and belief and

nothing has been concealed there from.

Date: 19/08/2022 Name of Authorized Signatory

AJAY JAIKISHAN CHOUHAN

Designation /Status

PROPRIETORSHIP

You might also like

- Inside Out - Driven by Emotions (Disney Chapter Book (Ebook) ) - NodrmDocument100 pagesInside Out - Driven by Emotions (Disney Chapter Book (Ebook) ) - NodrmLetsNotKidOurselves100% (2)

- An Introduction To TattvasDocument13 pagesAn Introduction To TattvasTemple of the stars83% (6)

- Technical Note Guidance On Corrosion Assessment of Ex EquipmentDocument7 pagesTechnical Note Guidance On Corrosion Assessment of Ex EquipmentParthiban NagarajanNo ratings yet

- GSTR3B 27BCGPS7468K1ZR 072022Document3 pagesGSTR3B 27BCGPS7468K1ZR 072022Aman JaiswalNo ratings yet

- GSTR3B 27BCGPS7468K1ZR 042022Document3 pagesGSTR3B 27BCGPS7468K1ZR 042022Aman JaiswalNo ratings yet

- GSTR3B 19azwpd2404n1zx Aug2022Document2 pagesGSTR3B 19azwpd2404n1zx Aug2022ho.ubiquityNo ratings yet

- GSTR3B 27BCGPS7468K1ZR 062022Document3 pagesGSTR3B 27BCGPS7468K1ZR 062022Aman JaiswalNo ratings yet

- GSTR3B 27BCGPS7468K1ZR 012022Document3 pagesGSTR3B 27BCGPS7468K1ZR 012022Aman JaiswalNo ratings yet

- GSTR3B 20aahcp4985d1zi 012024Document3 pagesGSTR3B 20aahcp4985d1zi 012024sushil.ublNo ratings yet

- GSTR3B 36fjypk4832a1zy 082022Document2 pagesGSTR3B 36fjypk4832a1zy 082022saiakhiltataNo ratings yet

- GSTR3B 03CJQPK1907B2ZL 072023Document2 pagesGSTR3B 03CJQPK1907B2ZL 072023nstradingcompany2023No ratings yet

- GSTR3B 36fjypk4832a1zy 042023Document2 pagesGSTR3B 36fjypk4832a1zy 042023saiakhiltataNo ratings yet

- GSTR3B 29ajbpm5064c1zd 022023Document2 pagesGSTR3B 29ajbpm5064c1zd 022023raghav shettyNo ratings yet

- GSTR3B 19bahph8899e1z2 012022Document3 pagesGSTR3B 19bahph8899e1z2 012022Pawan KanuNo ratings yet

- GSTR3B 33axcps7298d1z7 082022Document2 pagesGSTR3B 33axcps7298d1z7 082022Logesh Waran KmlNo ratings yet

- GSTR3B 19azwpd2404n1zx Dec2022Document2 pagesGSTR3B 19azwpd2404n1zx Dec2022ho.ubiquityNo ratings yet

- GSTR3B 19bahph8899e1z2 052022Document3 pagesGSTR3B 19bahph8899e1z2 052022Pawan KanuNo ratings yet

- 04 July-2022Document3 pages04 July-2022Sunil NNo ratings yet

- GSTR3B 19azwpd2404n1zx Jan2023Document2 pagesGSTR3B 19azwpd2404n1zx Jan2023ho.ubiquityNo ratings yet

- GSTR3B 19bahph8899e1z2 042022Document3 pagesGSTR3B 19bahph8899e1z2 042022Pawan KanuNo ratings yet

- GSTR3B - 08bhupa6318m2zt - 062022 April To June 2022Document3 pagesGSTR3B - 08bhupa6318m2zt - 062022 April To June 2022Rahul SharmaNo ratings yet

- GSTR3B 52022Document2 pagesGSTR3B 52022Logesh Waran KmlNo ratings yet

- GSTR3B 36fjypk4832a1zy 122023Document2 pagesGSTR3B 36fjypk4832a1zy 122023saiakhiltataNo ratings yet

- GSTR3B 33mgkps5309e1z4 012022Document3 pagesGSTR3B 33mgkps5309e1z4 012022Suresh KumarNo ratings yet

- May GSTR3B - 27AAJCB3358E1ZP - 052023Document2 pagesMay GSTR3B - 27AAJCB3358E1ZP - 052023calmincometax36No ratings yet

- D1Z7 122022Document2 pagesD1Z7 122022Logesh Waran KmlNo ratings yet

- 11 GSTR-3B - Feb 21-22Document2 pages11 GSTR-3B - Feb 21-22ArbindraNo ratings yet

- GSTR3B 03lmypk3229a1zy 122022Document2 pagesGSTR3B 03lmypk3229a1zy 122022nstradingcompany2023No ratings yet

- GSTR3B 37adcfs8516j1zp 012018Document2 pagesGSTR3B 37adcfs8516j1zp 012018ravi kiranNo ratings yet

- GSTR3B 36fjypk4832a1zy 032023Document2 pagesGSTR3B 36fjypk4832a1zy 032023saiakhiltataNo ratings yet

- Apr 23Document3 pagesApr 23sbmsalesassociatsNo ratings yet

- GSTR3B 36bmypp9150m1zx 012023Document3 pagesGSTR3B 36bmypp9150m1zx 012023RAJESH DNo ratings yet

- GSTR3B 33auapv1142j1zs 062023Document3 pagesGSTR3B 33auapv1142j1zs 062023crmfinance.tnNo ratings yet

- GSTR3B 36aafcr5625q1zr 022024Document3 pagesGSTR3B 36aafcr5625q1zr 022024Kri ShnaNo ratings yet

- GSTR3B 09aaeci2181f2zn 062022Document2 pagesGSTR3B 09aaeci2181f2zn 062022Pushan SrivastavaNo ratings yet

- GSTR3B 27BCGPS7468K1ZR 082022Document3 pagesGSTR3B 27BCGPS7468K1ZR 082022Aman JaiswalNo ratings yet

- GSTR3B 07aonpj7130d2z2 112022Document3 pagesGSTR3B 07aonpj7130d2z2 112022Rudra JhaNo ratings yet

- GSTR3B 29aaicc9487a1zb 012023Document2 pagesGSTR3B 29aaicc9487a1zb 012023krishswat7912No ratings yet

- GSTR3B 33aeqpy3870g1zy 112023Document3 pagesGSTR3B 33aeqpy3870g1zy 112023Durai kannuNo ratings yet

- GSTR3B 33aeqpy3870g1zy 082023Document3 pagesGSTR3B 33aeqpy3870g1zy 082023Durai kannuNo ratings yet

- GSTR3B 21aywpa7472l1zz 012023Document2 pagesGSTR3B 21aywpa7472l1zz 012023prateek gangwaniNo ratings yet

- GSTR3B 03dacpa5649q1zi 012024Document3 pagesGSTR3B 03dacpa5649q1zi 012024RAHUL kumarNo ratings yet

- Dudi JuneDocument3 pagesDudi JuneSukhchain SinghNo ratings yet

- GSTR3B 23aywpp5389h1zl 122023Document2 pagesGSTR3B 23aywpp5389h1zl 122023riturajasati4205No ratings yet

- GSTR3B 10jespk0829a1zs 042023Document3 pagesGSTR3B 10jespk0829a1zs 042023Pratik RajNo ratings yet

- GSTR3B 24emypa4455b1z3 032023Document3 pagesGSTR3B 24emypa4455b1z3 032023anant1111No ratings yet

- GSTR3B 33aeqpy3870g1zy 062023Document3 pagesGSTR3B 33aeqpy3870g1zy 062023Durai kannuNo ratings yet

- May 23Document3 pagesMay 23sbmsalesassociatsNo ratings yet

- Aug 23Document3 pagesAug 23sbmsalesassociatsNo ratings yet

- 3 GSTR-3B - Jun 21-22Document2 pages3 GSTR-3B - Jun 21-22ArbindraNo ratings yet

- GSTR3B 37BWZPT3110J1ZW 082023Document3 pagesGSTR3B 37BWZPT3110J1ZW 082023satyathirumani5No ratings yet

- GSTR3B 09aaeci2181f2zn 052022Document2 pagesGSTR3B 09aaeci2181f2zn 052022Pushan SrivastavaNo ratings yet

- GSTR3B 27BCGPS7468K1ZR 092022Document3 pagesGSTR3B 27BCGPS7468K1ZR 092022Aman JaiswalNo ratings yet

- GSTR3B 10CKPPK6612R1ZP 082022Document3 pagesGSTR3B 10CKPPK6612R1ZP 082022Saurav KumarNo ratings yet

- GSTR3B 27aecpn4152q1z2 092023Document3 pagesGSTR3B 27aecpn4152q1z2 092023dhatusanvardhanaurvastuvinimayNo ratings yet

- GSTR3B 09adppu6529c1z2 032024Document3 pagesGSTR3B 09adppu6529c1z2 032024teamlifeeduNo ratings yet

- GSTR3B 33aivpc1432h1zi 062023Document3 pagesGSTR3B 33aivpc1432h1zi 062023crmfinance.tnNo ratings yet

- GSTR3B 03dacpa5649q1zi 032024Document3 pagesGSTR3B 03dacpa5649q1zi 032024RAHUL kumarNo ratings yet

- MH GSTR3B Nov'22Document3 pagesMH GSTR3B Nov'22crmfinance.tnNo ratings yet

- GSTR3B 21aachs0767c1zm 032023Document3 pagesGSTR3B 21aachs0767c1zm 032023Subrat Kumar RanaNo ratings yet

- MH GSTR3B Dec'22Document3 pagesMH GSTR3B Dec'22crmfinance.tnNo ratings yet

- GSTR3B 03alnpk4728k1zv 052021Document2 pagesGSTR3B 03alnpk4728k1zv 052021Harish VermaNo ratings yet

- 3 Methods For Crack Depth Measurement in ConcreteDocument4 pages3 Methods For Crack Depth Measurement in ConcreteEvello MercanoNo ratings yet

- Task 1 - PCK8Document8 pagesTask 1 - PCK8Andrea SantosNo ratings yet

- Origami Symbols: (Fold The Paper Towards You)Document6 pagesOrigami Symbols: (Fold The Paper Towards You)Ian De La CruzNo ratings yet

- Flow of Fluids QuizDocument2 pagesFlow of Fluids QuizJhon Oliver De JoseNo ratings yet

- Geologia 2Document194 pagesGeologia 2agvega69109No ratings yet

- Dominos Swot & 4 PsDocument10 pagesDominos Swot & 4 PsPrithvi BarodiaNo ratings yet

- 33 05 13 Manholes and Structures 10Document4 pages33 05 13 Manholes and Structures 10salamNo ratings yet

- Jemal Yahyaa Software Project Managemant Case Study PrintDocument30 pagesJemal Yahyaa Software Project Managemant Case Study Printjemal yahyaaNo ratings yet

- Yoga For Modern Age - 1Document181 pagesYoga For Modern Age - 1GayathriNo ratings yet

- File ListDocument5 pagesFile ListanetaNo ratings yet

- Shady Othman Nour El Deen: Doha, QatarDocument3 pagesShady Othman Nour El Deen: Doha, QatarHatem HusseinNo ratings yet

- Executing / Implementing Agency: Financial Management Assessment Questionnaire Topic ResponseDocument6 pagesExecuting / Implementing Agency: Financial Management Assessment Questionnaire Topic ResponseBelle CartagenaNo ratings yet

- Ni Based Superalloy: Casting Technology, Metallurgy, Development, Properties and ApplicationsDocument46 pagesNi Based Superalloy: Casting Technology, Metallurgy, Development, Properties and ApplicationsffazlaliNo ratings yet

- R105Document1 pageR105Francisco Javier López BarrancoNo ratings yet

- Clinical and Diagnostic Imaging Findings in Police Working Dogs Referred For Hip OsteoarthritisDocument11 pagesClinical and Diagnostic Imaging Findings in Police Working Dogs Referred For Hip OsteoarthritisEquilibrium EduardoNo ratings yet

- Business Environment Ch.3Document13 pagesBusiness Environment Ch.3hahahaha wahahahhaNo ratings yet

- An Overview of Croatian Autochthonous Varieties of Sweet CherryDocument7 pagesAn Overview of Croatian Autochthonous Varieties of Sweet CherryJasna HasanbegovićNo ratings yet

- MESFETDocument2 pagesMESFETKarthik KichuNo ratings yet

- Europe & ThailandDocument1 pageEurope & ThailandTipitaka TripitakaNo ratings yet

- Britain Food and DrinksDocument15 pagesBritain Food and DrinksAnny NamelessNo ratings yet

- Demonic Corruption RulesetDocument4 pagesDemonic Corruption RulesetJeffrey BeaumontNo ratings yet

- Bermundo Task 3 Iii-20Document2 pagesBermundo Task 3 Iii-20Jakeson Ranit BermundoNo ratings yet

- Electromagnetic Interference (EMI) in Power SuppliesDocument41 pagesElectromagnetic Interference (EMI) in Power SuppliesAmarnath M DamodaranNo ratings yet

- Epoxy Curing Agents and Modifiers: Ancamide® 260A Curing AgentDocument1 pageEpoxy Curing Agents and Modifiers: Ancamide® 260A Curing AgentNissim Hazar CasanovaNo ratings yet

- DSC Polyma E 1013Document24 pagesDSC Polyma E 1013sanipoulouNo ratings yet

- SSI-5000 Service ManualDocument107 pagesSSI-5000 Service ManualNikolay Penev100% (2)

- SP6 MB Tutorial 01Document20 pagesSP6 MB Tutorial 01Nikola PetrakNo ratings yet