Professional Documents

Culture Documents

RBI Working Paper No. 05/2019: Term Premium Spillover From The US To Indian Markets

RBI Working Paper No. 05/2019: Term Premium Spillover From The US To Indian Markets

Uploaded by

Vasu Ram JayanthOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

RBI Working Paper No. 05/2019: Term Premium Spillover From The US To Indian Markets

RBI Working Paper No. 05/2019: Term Premium Spillover From The US To Indian Markets

Uploaded by

Vasu Ram JayanthCopyright:

Available Formats

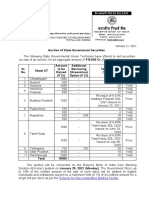

�ेस �काशनी PRESS RELEASE

भारतीय �रज़वर् ब�क

RESERVE BANK OF INDIA

वेबसाइट : www.rbi.org.in/hindi

संचार िवभाग, क� �ीय कायार्लय, एस.बी.एस.मागर्, मुंबई-400001

0

Website : www.rbi.org.in

_____________________________________________________________________________________________________________________

Department of Communication, Central Office, S.B.S.Marg, Mumbai-400001 ई-मेल/email:

फोन/Phone: 022- 22660502 helpdoc@rbi.org.in

December 30, 2019

RBI Working Paper No. 05/2019:

Term Premium Spillover from the US to Indian Markets

The Reserve Bank of India today placed on its website a Working Paper titled

“Term Premium Spillover from the US to Indian Markets” under the Reserve Bank of India

Working Paper Series*. The Paper is authored by Archana Dilip.

The paper estimates and analyses term premium in India and makes an

assessment of interconnectedness and transmission of shocks from the US term structure

of sovereign bond yields to that of India. The term premium is estimated by decomposing

the yield into two components - risk-neutral rate which reflects expectations of future short-

term rates; and term premium which captures the investors’ expectations of future central

bank policy, inflation and growth shocks. The paper identifies inflation volatility and

monetary policy uncertainty as the two important factors influencing term premium in India.

Further, empirical findings indicate that the spillovers between the US treasury yields and

government security yields in India have increased during the sample period from April,

2009 to April, 2019. The paper finds stronger spillover with increased financial integration

and volatile bond markets. The paper concludes that for the long-term yields, the term

premium channel is a stronger transmission channel as compared with the risk-neutral

rates channel.

Ajit Prasad

Press Release: 2019-2020/1542 Director

* The Reserve Bank of India introduced the RBI Working Papers series in March 2011. These papers

present research in progress of the staff members of the Reserve Bank and are disseminated to elicit

comments and further debate. The views expressed in these papers are those of authors and not of the

Reserve Bank of India. Comments and observations may kindly be forwarded to authors. Citation and use of

such papers should take into account its provisional character.

You might also like

- Project On Indian Banking SystemDocument68 pagesProject On Indian Banking SystemBajrang Kaushik71% (86)

- Regional Rural Banks of India: Evolution, Performance and ManagementFrom EverandRegional Rural Banks of India: Evolution, Performance and ManagementNo ratings yet

- IERP1050DP0111Document1 pageIERP1050DP0111kkalashNo ratings yet

- July 2019 Financial Stability Report - June 2019: Press ReleaseDocument1 pageJuly 2019 Financial Stability Report - June 2019: Press ReleaseKanakadurga BNo ratings yet

- Rbi NoticeDocument1 pageRbi NoticeSunil Prasad100% (1)

- PRB81Document1 pagePRB81ashishNo ratings yet

- REleaseW DocumentDocument1 pageREleaseW DocumentAnupam KumarNo ratings yet

- Pilot Survey On Indian Startup Sector - Major FindingsDocument1 pagePilot Survey On Indian Startup Sector - Major FindingsVasu Ram JayanthNo ratings yet

- DICGC Raises To Rs. 5.00 Lakh RCC7BDocument1 pageDICGC Raises To Rs. 5.00 Lakh RCC7BsroyNo ratings yet

- Rbi Releases 'Quarterly Statistics On Deposits and Credit of SCBS: December 2018'Document1 pageRbi Releases 'Quarterly Statistics On Deposits and Credit of SCBS: December 2018'Vivek ThakurNo ratings yet

- State Budgets StudyDocument2 pagesState Budgets Studypls2019No ratings yet

- RBI Releases December 2018 Financial Stability ReportDocument2 pagesRBI Releases December 2018 Financial Stability ReportThermo MadanNo ratings yet

- RBI Releases Financial Literacy Material: Guide Diary 16 PostersDocument1 pageRBI Releases Financial Literacy Material: Guide Diary 16 PostersShrishailamalikarjunNo ratings yet

- Bit CoinDocument1 pageBit CoinVipul S. AgarwalNo ratings yet

- Facility of Exchange of Specified Bank Notes (SBNS) : Press ReleaseDocument2 pagesFacility of Exchange of Specified Bank Notes (SBNS) : Press ReleaseVasu Ram JayanthNo ratings yet

- RBI Bulletin June 2021Document2 pagesRBI Bulletin June 2021Punjab And Sind Bank Legal CellNo ratings yet

- Rbi National Financial Inclusion 1Document1 pageRbi National Financial Inclusion 1unwantedaccountno1No ratings yet

- Vi - 4Document1 pageVi - 4A-Series OfficialNo ratings yet

- SGB40 Issue PriceDocument1 pageSGB40 Issue PriceAkashTripathiNo ratings yet

- RbiDocument2 pagesRbigganageNo ratings yet

- Rbi ActionDocument1 pageRbi Actionsritha_87No ratings yet

- PR1668IBSDocument1 pagePR1668IBSBhupinder PawarNo ratings yet

- Rbi Advisory Mastercard 14july21Document1 pageRbi Advisory Mastercard 14july21Mahtab KhanNo ratings yet

- psl12 PDFDocument2 pagespsl12 PDFsgjatharNo ratings yet

- Governor, RBI Launches ANTARDRIHSTI FINANACIAL INCLUSION DASHBOARDDocument1 pageGovernor, RBI Launches ANTARDRIHSTI FINANACIAL INCLUSION DASHBOARDambarishramanuj8771No ratings yet

- RBI Reference Rate For US $Document1 pageRBI Reference Rate For US $deepu.srivasNo ratings yet

- August 19, 2015: Press ReleaseDocument1 pageAugust 19, 2015: Press ReleaseChandreshSinghNo ratings yet

- January 05, 2018: RBI Introduces Banknote in Mahatma Gandhi (New) SerDocument2 pagesJanuary 05, 2018: RBI Introduces Banknote in Mahatma Gandhi (New) SersatsangiNo ratings yet

- RBI Cautions About Fictitious EmailsDocument2 pagesRBI Cautions About Fictitious EmailsRakesh SharmaNo ratings yet

- Council For Innovative Research: Financial Performance Evaluation of RRB'S in IndiaDocument11 pagesCouncil For Innovative Research: Financial Performance Evaluation of RRB'S in IndiaharshNo ratings yet

- Comparative Study On Financial Performance and Home Loan of Sbi and HDFC K. Pavithra, S. Kirubadevi & S. BrindhaDocument7 pagesComparative Study On Financial Performance and Home Loan of Sbi and HDFC K. Pavithra, S. Kirubadevi & S. BrindhaPooja MauryaNo ratings yet

- ON "Analysis of High Footfall Branches And: A Dissertation ReportDocument39 pagesON "Analysis of High Footfall Branches And: A Dissertation ReportSaroj KhadangaNo ratings yet

- PR5006Document1 pagePR5006TrollTrends inc.No ratings yet

- IEPR32RDG0711Document1 pageIEPR32RDG0711Harsoonu MulyeNo ratings yet

- Unlocking The Lock-A Mirror Image Effect of Sbi Merger in Indian Banking SystemDocument4 pagesUnlocking The Lock-A Mirror Image Effect of Sbi Merger in Indian Banking SystemHemaliNo ratings yet

- IEPR77NP0712Document1 pageIEPR77NP0712kumar_manish2026No ratings yet

- A Study On Financial Performance of State Bank of India: J.Nisha MaryDocument13 pagesA Study On Financial Performance of State Bank of India: J.Nisha Maryprteek kumarNo ratings yet

- Guidelines For Licensing of Payments Banks: Press ReleaseDocument3 pagesGuidelines For Licensing of Payments Banks: Press ReleaseLangpi Dehangi Rural Bank P&DNo ratings yet

- FINANCIAL PERFORMANCE EVALUATION OF RRBs IN INDIADocument11 pagesFINANCIAL PERFORMANCE EVALUATION OF RRBs IN INDIAAarushi PawarNo ratings yet

- IEPR405RQ0912Document1 pageIEPR405RQ0912kvgsykjaNo ratings yet

- Rbi Press 1Document1 pageRbi Press 1Dhara PatelNo ratings yet

- Role of Reserve Bank in Indian Banking System: Conference PaperDocument11 pagesRole of Reserve Bank in Indian Banking System: Conference PaperVanraj MakwanaNo ratings yet

- RBI Launches The December 2014 Round of Inflation Expectations Survey of HouseholdsDocument1 pageRBI Launches The December 2014 Round of Inflation Expectations Survey of HouseholdsabhilashNo ratings yet

- RBI Press Release - Check Before Depositing Money With Financial Entities - RBI AdvisoryDocument2 pagesRBI Press Release - Check Before Depositing Money With Financial Entities - RBI AdvisoryapjbalamuruganNo ratings yet

- M/s Time Technoplast LTD.: Press ReleaseDocument1 pageM/s Time Technoplast LTD.: Press Releasedeepu.srivasNo ratings yet

- PRD45Document1 pagePRD45KRISHNA KUMAR SINGHNo ratings yet

- IJCRT2302665Document7 pagesIJCRT2302665meetbhagat47No ratings yet

- Non-Performing Assets: A Comparative Study Ofsbi&Icici Bank From 2014-2017Document22 pagesNon-Performing Assets: A Comparative Study Ofsbi&Icici Bank From 2014-2017Alok NayakNo ratings yet

- Press Release:, Reserve Bank of IndiaDocument1 pagePress Release:, Reserve Bank of IndiaDhara PatelNo ratings yet

- Rbi Press Release 21.2Document1 pageRbi Press Release 21.2Laksmi Sundhar SundharNo ratings yet

- Rbi Releases Its Winter PolicyDocument2 pagesRbi Releases Its Winter PolicySwatiRayNo ratings yet

- IB Sept 2014 Low QTDocument68 pagesIB Sept 2014 Low QTkanikaz1No ratings yet

- RBI Monetary Policy 2019Document14 pagesRBI Monetary Policy 2019desikanttNo ratings yet

- Icici Vs SbiDocument16 pagesIcici Vs SbiJay KoliNo ratings yet

- Monthly BeePedia January 2021Document134 pagesMonthly BeePedia January 2021Anish AnishNo ratings yet

- Indusind Bank Internship PresentationDocument19 pagesIndusind Bank Internship Presentationcharu kapoorNo ratings yet

- Subhankar ProjectDocument77 pagesSubhankar ProjectSubhankar mohantyNo ratings yet

- Latest Appointments in Banking Sector - Current Affairs GK 2017Document6 pagesLatest Appointments in Banking Sector - Current Affairs GK 2017bharathiNo ratings yet

- Asia Small and Medium-Sized Enterprise Monitor 2021 Volume IV: How Asia’s Small Businesses Survived A Year into the COVID-19 Pandemic: Survey EvidenceFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2021 Volume IV: How Asia’s Small Businesses Survived A Year into the COVID-19 Pandemic: Survey EvidenceNo ratings yet

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)From EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)No ratings yet

- International Investment Position end-September 2019: �ेस �काशनी PRESS RELEASEDocument3 pagesInternational Investment Position end-September 2019: �ेस �काशनी PRESS RELEASEVasu Ram JayanthNo ratings yet

- Pilot Survey On Indian Startup Sector - Major FindingsDocument1 pagePilot Survey On Indian Startup Sector - Major FindingsVasu Ram JayanthNo ratings yet

- 364-Day Treasury Bills Auction:: General Notification F.No.4 (8) - W&M/2015 Dated May 26, 2016Document1 page364-Day Treasury Bills Auction:: General Notification F.No.4 (8) - W&M/2015 Dated May 26, 2016Vasu Ram JayanthNo ratings yet

- Press ReleaseDocument3 pagesPress ReleaseVasu Ram JayanthNo ratings yet

- Press ReleaseDocument1 pagePress ReleaseVasu Ram JayanthNo ratings yet

- Money Market Operations As On May 29, 2023: Press ReleaseDocument2 pagesMoney Market Operations As On May 29, 2023: Press ReleaseVasu Ram JayanthNo ratings yet

- Facility of Exchange of Specified Bank Notes (SBNS) : Press ReleaseDocument2 pagesFacility of Exchange of Specified Bank Notes (SBNS) : Press ReleaseVasu Ram JayanthNo ratings yet

- Reserve Bank of IndiaDocument3 pagesReserve Bank of IndiaVasu Ram JayanthNo ratings yet

- Sectoral Deployment of Bank Credit - April 2023: Statements I and IIDocument1 pageSectoral Deployment of Bank Credit - April 2023: Statements I and IIVasu Ram JayanthNo ratings yet

- Andhra Pradesh 2033 Andhra Pradesh 2035 Haryana 2029 Haryana 2033Document6 pagesAndhra Pradesh 2033 Andhra Pradesh 2035 Haryana 2029 Haryana 2033Vasu Ram JayanthNo ratings yet

- General Notification F.No.4 (2) - W&M/2018 Dated March 27, 2018 Amendment Notification No.F.4 (2) - W&M/2018 Dated April 05, 2018Document2 pagesGeneral Notification F.No.4 (2) - W&M/2018 Dated March 27, 2018 Amendment Notification No.F.4 (2) - W&M/2018 Dated April 05, 2018Vasu Ram JayanthNo ratings yet

- Press ReleaseDocument1 pagePress ReleaseVasu Ram JayanthNo ratings yet

- संचार िवभाग, क��ीय कायार्लय, एस.बी.एस.मागर्, मुंबई 400001 फोन/Phone 022-22660502 वेबसाइट ई-मेल emailDocument1 pageसंचार िवभाग, क��ीय कायार्लय, एस.बी.एस.मागर्, मुंबई 400001 फोन/Phone 022-22660502 वेबसाइट ई-मेल emailVasu Ram JayanthNo ratings yet

- Money Market Operations As On July 16, 2021Document2 pagesMoney Market Operations As On July 16, 2021Vasu Ram JayanthNo ratings yet

- VVVHHFFDocument2 pagesVVVHHFFVasu Ram JayanthNo ratings yet

- Reserve Bank of IndiaDocument2 pagesReserve Bank of IndiaVasu Ram JayanthNo ratings yet

- Master Circular - Scheme of Penalties For Bank Branches Based On Performance in Rendering Customer Service To The Members of PublicDocument4 pagesMaster Circular - Scheme of Penalties For Bank Branches Based On Performance in Rendering Customer Service To The Members of PublicVasu Ram JayanthNo ratings yet

- भारतीय �रज़व� ब�क - - - - - - - - - - - - - - - - - - - - - - - RESERVE BANK OF INDIA - - - - - - - - - - - - - - - - - - - - - - - - -Document1 pageभारतीय �रज़व� ब�क - - - - - - - - - - - - - - - - - - - - - - - RESERVE BANK OF INDIA - - - - - - - - - - - - - - - - - - - - - - - - -Vasu Ram JayanthNo ratings yet

- Ajit Prasad Press Release: 2020-2021/987 DirectorDocument1 pageAjit Prasad Press Release: 2020-2021/987 DirectorVasu Ram JayanthNo ratings yet

- Amount in Rupees Crore, Rate in Per CentDocument2 pagesAmount in Rupees Crore, Rate in Per CentVasu Ram JayanthNo ratings yet

- (Amount in Rupees Crore, Rate in Per cent) : �ेस �काशनी PRESS RELEASEDocument2 pages(Amount in Rupees Crore, Rate in Per cent) : �ेस �काशनी PRESS RELEASEVasu Ram JayanthNo ratings yet

- Master Direction - Operational Guidelines For Primary DealersDocument70 pagesMaster Direction - Operational Guidelines For Primary DealersVasu Ram JayanthNo ratings yet

- Your Vi Bill: Mr. Guntupalli Vasuram JayanthDocument4 pagesYour Vi Bill: Mr. Guntupalli Vasuram JayanthVasu Ram JayanthNo ratings yet

- RBI/DCBR/2015-16/23 Master Direction DCBR - Dir.No.1/13.01.000/2015-16Document19 pagesRBI/DCBR/2015-16/23 Master Direction DCBR - Dir.No.1/13.01.000/2015-16Vasu Ram JayanthNo ratings yet

- Lesson 1 - Trading Tactics 1Document1 pageLesson 1 - Trading Tactics 1KOF.ETIENNE KOUMANo ratings yet

- International Culture: MCQ of IbeDocument63 pagesInternational Culture: MCQ of IbePreet GalaniNo ratings yet

- Ref No: APSEZL/SECT/2022-23/82 December 23, 2022: BSE Limited National Stock Exchange of India LimitedDocument2 pagesRef No: APSEZL/SECT/2022-23/82 December 23, 2022: BSE Limited National Stock Exchange of India Limitedvirupakshudu kodiyalaNo ratings yet

- Jawaharlal Nehru University MA Economics Past Year Papers: Source Updated: August 20, 2021Document178 pagesJawaharlal Nehru University MA Economics Past Year Papers: Source Updated: August 20, 2021Shourya MarwahaNo ratings yet

- Economics AssignmentDocument6 pagesEconomics Assignmenturoosa vayaniNo ratings yet

- Stock & Commodities 2010 - 01Document100 pagesStock & Commodities 2010 - 01John Green100% (1)

- Sheep Shearing: WWW - Umext.maine - Edu/events/wool08/school - HTM WWW - Ansci.cornell - Edu/sheep/calendar/shearingschool - HTMLDocument2 pagesSheep Shearing: WWW - Umext.maine - Edu/events/wool08/school - HTM WWW - Ansci.cornell - Edu/sheep/calendar/shearingschool - HTMLgeo_gabe_galan5473No ratings yet

- Assesment 2 Microeconomics 2014 PDFDocument328 pagesAssesment 2 Microeconomics 2014 PDFEin LuckyNo ratings yet

- Top Chart Traders - Insider Tips - Best High Performance Indicators PDFDocument133 pagesTop Chart Traders - Insider Tips - Best High Performance Indicators PDFlior199No ratings yet

- Lesson 02Document37 pagesLesson 02Ishan RavinduNo ratings yet

- Economics II Sheet 1Document6 pagesEconomics II Sheet 1Anushka KallaNo ratings yet

- GEN 005 Lesson 1 To 6Document2 pagesGEN 005 Lesson 1 To 61204892920% (1)

- The 32nd Edition of The Famous Enugu International Trade Fair Is Here With Us As We Have Come Through Another Full CircleDocument12 pagesThe 32nd Edition of The Famous Enugu International Trade Fair Is Here With Us As We Have Come Through Another Full CircleYouth for Agriculture Abuja-Nigeria AbujaNo ratings yet

- Aniruddha Nath 1110 Economic Survey IWEDocument3 pagesAniruddha Nath 1110 Economic Survey IWEAniruddha NathNo ratings yet

- AEE ElectricalDocument5 pagesAEE ElectricalGauravKumarNo ratings yet

- Module 2 DissDocument6 pagesModule 2 Disskimberson alacyang100% (1)

- 2021 Social Science Standards Integrated With Ethnic StudiesDocument29 pages2021 Social Science Standards Integrated With Ethnic StudiesThePoliticalHatNo ratings yet

- Matrix 320 - 9MM - HP - STDDocument1 pageMatrix 320 - 9MM - HP - STDkuponator123No ratings yet

- Shipping Agents - Freight ForwardersDocument48 pagesShipping Agents - Freight ForwardersKunwar Saigal100% (1)

- Govt Sr. Sec School Dilod Hathi, Atru Baran: Income Tax Calculation (Ga-55) 2022-23Document5 pagesGovt Sr. Sec School Dilod Hathi, Atru Baran: Income Tax Calculation (Ga-55) 2022-23Nitesh YNo ratings yet

- Travel & Tourism: Economic Impact 2017 EgyptDocument24 pagesTravel & Tourism: Economic Impact 2017 EgyptHassan MohamedNo ratings yet

- 2023 02 enDocument84 pages2023 02 enSumit DasNo ratings yet

- Financial Asset at Fair Value Problem 21-1 (IFRS) : Solution 21-1 Answer CDocument15 pagesFinancial Asset at Fair Value Problem 21-1 (IFRS) : Solution 21-1 Answer CEngel QuimsonNo ratings yet

- Raydium LitepaperDocument5 pagesRaydium Litepaperapid5851No ratings yet

- Unit 13Document22 pagesUnit 13Pavan Kumar MRNo ratings yet

- FBO InvoiceDocument2 pagesFBO InvoiceThe smocking tyresNo ratings yet

- Brahmastra Schedule Batch-2Document12 pagesBrahmastra Schedule Batch-2anshuman kumarNo ratings yet

- Capital Structure of Commercial BankDocument8 pagesCapital Structure of Commercial Bankyashaswisharma68No ratings yet

- Semester-1 Bi-102 - EconomicsDocument3 pagesSemester-1 Bi-102 - EconomicsYaniNo ratings yet

- Detroit: Then and Now: Reading ComprehensionDocument1 pageDetroit: Then and Now: Reading ComprehensionChristina MoldoveanuNo ratings yet