Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

6 viewsFinanace Easy To Remember

Finanace Easy To Remember

Uploaded by

Dean TsolakisThe document discusses the role and processes of financial management. It outlines the strategic role of finance in managing resources efficiently to achieve objectives like profitability, growth, liquidity and solvency. It also describes the interdependence between finance and other business functions like operations, marketing, and human resources. Key influences on financial management include internal and external sources of finance as well as government regulations and global market conditions. The processes of financial management involve planning through tools like budgets to determine financial needs and manage risks.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Multiple Choice Question On IFRS - Caglobal PDFDocument103 pagesMultiple Choice Question On IFRS - Caglobal PDFAngela100% (2)

- COMM 320 Final NotesDocument50 pagesCOMM 320 Final NotesAnonymousNo ratings yet

- Chapter 17 - Financial ManagementDocument7 pagesChapter 17 - Financial ManagementArsalNo ratings yet

- Business Studies - Finance Study NotesDocument29 pagesBusiness Studies - Finance Study NotesSamina Haider50% (2)

- Financial ManagementDocument24 pagesFinancial ManagementJulius Earl MarquezNo ratings yet

- Finance Exam NotesDocument14 pagesFinance Exam NotesAneesha100% (2)

- Financial Management (FM)Document30 pagesFinancial Management (FM)jaskahlon92No ratings yet

- Advance Financial Management 1Document36 pagesAdvance Financial Management 1Indrajeet KoleNo ratings yet

- Financial InstitutionsDocument17 pagesFinancial InstitutionsJean MarkNo ratings yet

- Financial Management CompleteDocument17 pagesFinancial Management Completesphynx labradorNo ratings yet

- FM Reading MaterialDocument12 pagesFM Reading MaterialTaransh ANo ratings yet

- CAIIB-Financial Management-Module B Study of Financial StatementsDocument91 pagesCAIIB-Financial Management-Module B Study of Financial StatementsDeepak RathoreNo ratings yet

- Caiib Fmmodbacs Nov08Document91 pagesCaiib Fmmodbacs Nov08monirba48No ratings yet

- 1.financial ManagementDocument86 pages1.financial ManagementKiran MohanNo ratings yet

- Financial Management Week 1Document36 pagesFinancial Management Week 1kylecantallopezNo ratings yet

- Intro NotesDocument7 pagesIntro NotesLouiseNo ratings yet

- CHP 1 NTRO ADVANCED FINANCIAL MANAGEMENTDocument4 pagesCHP 1 NTRO ADVANCED FINANCIAL MANAGEMENTcuteserese roseNo ratings yet

- Chapter 7 Accounting and Financial ConsiderationsDocument32 pagesChapter 7 Accounting and Financial ConsiderationsErwin MatunanNo ratings yet

- Finance (Pronounced /fɪ Nænts/ or / Faɪnænts/) Is The Science ofDocument50 pagesFinance (Pronounced /fɪ Nænts/ or / Faɪnænts/) Is The Science ofSonal JainNo ratings yet

- Meaning of Financial Management:-: 1. Public FinanceDocument7 pagesMeaning of Financial Management:-: 1. Public FinancekaRan GUptДNo ratings yet

- Working Capital: Concepts of Working Capital Gross Working Capital (GWC)Document37 pagesWorking Capital: Concepts of Working Capital Gross Working Capital (GWC)Manisha SharmaNo ratings yet

- Edexcel A-Level Business Theme 2Document14 pagesEdexcel A-Level Business Theme 2zainab kazieNo ratings yet

- CAIIB-Financial Management-Module B Study of Financial Statements C.S.Balakrishnan Faculty Member SPBT CollegeDocument39 pagesCAIIB-Financial Management-Module B Study of Financial Statements C.S.Balakrishnan Faculty Member SPBT Collegesharadggg8309No ratings yet

- FINANCEDocument45 pagesFINANCEnatz2926No ratings yet

- CH 18 Financial ManagementDocument4 pagesCH 18 Financial Managementt.a.240802No ratings yet

- Unit VDocument9 pagesUnit VJayNo ratings yet

- Working Capital ManagementDocument18 pagesWorking Capital ManagementJesiel Naranjo MaringNo ratings yet

- Chapter 8 Sources of Business Finance - 1.6Document9 pagesChapter 8 Sources of Business Finance - 1.6Divyam PatelNo ratings yet

- Project - Financial Apprasial of ITI LTDDocument67 pagesProject - Financial Apprasial of ITI LTDSATHISHNo ratings yet

- BS Unit 3Document4 pagesBS Unit 3Enea NastriNo ratings yet

- Module-1: Introduction To Finance and Financial ManagementDocument99 pagesModule-1: Introduction To Finance and Financial ManagementAswinNo ratings yet

- Finman ReviewerDocument27 pagesFinman Reviewerben yiNo ratings yet

- Financial Management Strategies - NotetakingDocument15 pagesFinancial Management Strategies - NotetakinglouellakayleyNo ratings yet

- Chapter-4 Specialization - Ii FinanceDocument15 pagesChapter-4 Specialization - Ii FinanceRahul ThakurNo ratings yet

- q3 Week1 Business FinanceDocument20 pagesq3 Week1 Business FinanceayaadenipNo ratings yet

- Unit-III Finance FunctionDocument8 pagesUnit-III Finance FunctiondaogafugNo ratings yet

- Notes FMDocument42 pagesNotes FMSneha JayalNo ratings yet

- Agb GayDocument113 pagesAgb Gaymainakroy807No ratings yet

- 9.) Chapter 17 (Financial Management)Document10 pages9.) Chapter 17 (Financial Management)John AustinNo ratings yet

- Financial Management SIR SAIDocument23 pagesFinancial Management SIR SAItekleNo ratings yet

- FM I Chapter 1Document29 pagesFM I Chapter 1ibsaashekaNo ratings yet

- CF NotesDocument5 pagesCF Notes087-Md Arshad Danish KhanNo ratings yet

- Managerial Finance Reviewer (Prelims)Document4 pagesManagerial Finance Reviewer (Prelims)Kendall JennerNo ratings yet

- Financial ManagementDocument5 pagesFinancial ManagementISLAND ROYASNo ratings yet

- Business Finance For Video Module 1Document11 pagesBusiness Finance For Video Module 1Bai NiloNo ratings yet

- Financial Market: 0allocating CapitalDocument5 pagesFinancial Market: 0allocating Capitalharon franciscoNo ratings yet

- PPT2Financial ManagementDocument51 pagesPPT2Financial ManagementAgrim DewanNo ratings yet

- Financial Management: ElementsDocument4 pagesFinancial Management: Elementsharshit mahajanNo ratings yet

- Financial Management - Meaning, Objectives and Functions Meaning of Financial ManagementDocument3 pagesFinancial Management - Meaning, Objectives and Functions Meaning of Financial ManagementGirraj Prasad MinaNo ratings yet

- Financial Management Session 1 2Document12 pagesFinancial Management Session 1 2Khushi HemnaniNo ratings yet

- Financial Management: OverviewDocument13 pagesFinancial Management: OverviewVishal MadlaniNo ratings yet

- The Meaning & Role of Finance Management: Guided By:-Dr. Yogesh A. ChauhanDocument20 pagesThe Meaning & Role of Finance Management: Guided By:-Dr. Yogesh A. ChauhanVenki AdavikolanuNo ratings yet

- Bba 5th First ChapterDocument28 pagesBba 5th First ChapterAnusha carkeyNo ratings yet

- MBA LECTURE-lecture 1Document160 pagesMBA LECTURE-lecture 1takawira chirimeNo ratings yet

- Financial Management 1Document63 pagesFinancial Management 1geachew mihiretuNo ratings yet

- Lesson 1 Business FinanceDocument50 pagesLesson 1 Business FinanceJasmine MendozaNo ratings yet

- HSC Business NotesDocument164 pagesHSC Business Notestiffany100% (1)

- Functions of FinANCEDocument39 pagesFunctions of FinANCEPalak WadhwaNo ratings yet

- EntrepreneurshipDocument3 pagesEntrepreneurshipXty CtyiuNo ratings yet

- Non Bank OperationsDocument78 pagesNon Bank OperationschingNo ratings yet

- The Finace Master: What you Need to Know to Achieve Lasting Financial FreedomFrom EverandThe Finace Master: What you Need to Know to Achieve Lasting Financial FreedomNo ratings yet

- Chapter 4 Audit Evidence: Learning ObjectivesDocument20 pagesChapter 4 Audit Evidence: Learning ObjectivesNik Nur Azmina AzharNo ratings yet

- Audit Planning - Long QuizDocument15 pagesAudit Planning - Long QuizKathleenNo ratings yet

- Deposit Account: DR LM Ndlovu 7 Hi Llhead Dri Ve Mount Edgecombe 4302Document3 pagesDeposit Account: DR LM Ndlovu 7 Hi Llhead Dri Ve Mount Edgecombe 4302Threshing FlowNo ratings yet

- Unit-2 IBDocument42 pagesUnit-2 IBTanya gargNo ratings yet

- Cash Rebate Visa Platinum TN CDocument18 pagesCash Rebate Visa Platinum TN CGiy IngNo ratings yet

- Swift MT940 DocDocument27 pagesSwift MT940 DocGNV Engg ServicesNo ratings yet

- Lecture 1Document15 pagesLecture 1Rahul KhobragadeNo ratings yet

- Banking Mcqs PDF For B.com 3rd SemDocument16 pagesBanking Mcqs PDF For B.com 3rd Semraiyuvraj082No ratings yet

- Warren SM Ch.09 FinalDocument23 pagesWarren SM Ch.09 FinalAA BB MMNo ratings yet

- The OSI Model and The TCP/IP Protocol SuiteDocument39 pagesThe OSI Model and The TCP/IP Protocol SuiteS JNo ratings yet

- Audit of Cash and Cash EquivalentsDocument3 pagesAudit of Cash and Cash EquivalentsJesebel AmbalesNo ratings yet

- Pashchimanchal Vidyut Vitran Nigam Ltd. - PAYMENTDocument1 pagePashchimanchal Vidyut Vitran Nigam Ltd. - PAYMENTAkriti DhimanNo ratings yet

- Chapter 1Document50 pagesChapter 1Gabriela MariaNo ratings yet

- Computer Accounting With Quickbooks Online A Cloud Based Approach 1st Edition Yacht Solutions ManualDocument10 pagesComputer Accounting With Quickbooks Online A Cloud Based Approach 1st Edition Yacht Solutions Manualjubasticky.vlvus2100% (27)

- Emerging PaymentsDocument24 pagesEmerging PaymentsHương MaiNo ratings yet

- Accounting EquationsDocument6 pagesAccounting EquationsSuraj KumarNo ratings yet

- Road To NC3 - 1Document1 pageRoad To NC3 - 1Mabelle Dabu Facturanan100% (2)

- 6 XFL 1621587920041Document79 pages6 XFL 1621587920041Gajendra AudichyaNo ratings yet

- Stock Associate ResumeDocument7 pagesStock Associate Resumerqaeibifg100% (2)

- Provider ICdetectionDocument22 pagesProvider ICdetectionMario CordinaNo ratings yet

- Adult Expansion Comparison Chart - FINALDocument1 pageAdult Expansion Comparison Chart - FINALMcKenzie StaufferNo ratings yet

- Why Migrate To p25 Digital LMR White Paper GlobalDocument8 pagesWhy Migrate To p25 Digital LMR White Paper Global北梦No ratings yet

- Fee Acknowledgement - Academic Session:2022-23: Form No.:22651356Document1 pageFee Acknowledgement - Academic Session:2022-23: Form No.:22651356haleyNo ratings yet

- FIN512 Chapter 8 - Life InsuranceDocument25 pagesFIN512 Chapter 8 - Life InsuranceAmandaNo ratings yet

- BGP WeaknessDocument21 pagesBGP WeaknessYaw NyameNo ratings yet

- Blackbook ProjectDocument19 pagesBlackbook ProjectDhruv Rocksta100% (1)

- Attachment 1577791792Document3 pagesAttachment 1577791792fahad chaudhryNo ratings yet

- Insurance PremiumDocument2 pagesInsurance PremiumRhows BuergoNo ratings yet

- VANET Security Research and Development EcosystemDocument11 pagesVANET Security Research and Development EcosystemDr.Irshad Ahmed SumraNo ratings yet

Finanace Easy To Remember

Finanace Easy To Remember

Uploaded by

Dean Tsolakis0 ratings0% found this document useful (0 votes)

6 views12 pagesThe document discusses the role and processes of financial management. It outlines the strategic role of finance in managing resources efficiently to achieve objectives like profitability, growth, liquidity and solvency. It also describes the interdependence between finance and other business functions like operations, marketing, and human resources. Key influences on financial management include internal and external sources of finance as well as government regulations and global market conditions. The processes of financial management involve planning through tools like budgets to determine financial needs and manage risks.

Original Description:

Original Title

Finanace Easy to Remember

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses the role and processes of financial management. It outlines the strategic role of finance in managing resources efficiently to achieve objectives like profitability, growth, liquidity and solvency. It also describes the interdependence between finance and other business functions like operations, marketing, and human resources. Key influences on financial management include internal and external sources of finance as well as government regulations and global market conditions. The processes of financial management involve planning through tools like budgets to determine financial needs and manage risks.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

6 views12 pagesFinanace Easy To Remember

Finanace Easy To Remember

Uploaded by

Dean TsolakisThe document discusses the role and processes of financial management. It outlines the strategic role of finance in managing resources efficiently to achieve objectives like profitability, growth, liquidity and solvency. It also describes the interdependence between finance and other business functions like operations, marketing, and human resources. Key influences on financial management include internal and external sources of finance as well as government regulations and global market conditions. The processes of financial management involve planning through tools like budgets to determine financial needs and manage risks.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 12

FINANCE

role of financial management

• strategic role of financial management

The strategic role of finance is to manage the financial resources (debt/equity) both

efficiently and effectively in order to achieve the triple bottom line.

• objectives of financial management

- profitability, growth, efficiency, liquidity, solvency

- Profitability: the ability of a firm to generate profit (the difference between

revenue and expenses

- Growth: the ability of the business to increase its size in the longer term.

- Efficiency: is the ability of the firm to use its resources effectively in ensuring

financial stability and profitability of the business.

- Liquidity: the ability of a firm to pay its short-term debt obligations as they fall

due i.e., overdrafts, accounts payables, inventory purchases, wages and

commercial bills.

- Solvency: the ability of a company to meet its long-term financial obligations

(MUDL)

- short-term and long-term

• interdependence with other key business functions

The marketing, operations and human resources departments rely on financial

managers to allocate them adequate funds.

Ops

- requires funds to purchase inputs and carry out their transformation processes

- relies on operations to produce the products

Marketing

- requires funds to undertake the various forms of promotion

- relies on marketing to promote the products

HR

- requires funds in order to pay for staff

- relies on HR to manage staff

*Each of these functions helps the business generate sales and therefore provide

income to the finance department.

influences on financial management

• internal sources of finance – retained profits

The most common source of internal finance is retained earnings or profits in which

all profits are not distributed but are kept in the business as a cheap and accessible

source of finance for future activities. Most businesses keep some of their profit in

the form of retained earnings. In Aus. businesses, approx. 50% of profits on average

are retained to be reinvested.

• external sources of finance

- debt – short-term borrowing (overdraft, commercial bills, factoring), long-term

borrowing (mortgage, debentures, unsecured notes, leasing)

short term (COF)

* Commercial bill: money borrowed from other firms looking to earn interest in

excess funds not being used – typically over $100,000

* Overdraft: overdraw an account to a specific limited, paying interest only

when account in deficit

* Factoring: the sale of accounts receivable for a discounted price

long term (MUDL)

* Mortgage: loan for property purchases (underlying asset held as security)

* Unsecured note: a loan that is not secured by the issuer’s asset

* Debenture: a long term (3-5 yr.) security yielding a fixed rate of interest,

issued by a company and secured against assets.

* Lease: borrowing, contractual agreement to pay lessor over long term for the

use of an asset.

- equity – ordinary shares (new issues, rights issues, placements, share purchase

plans), private equity

* new shares (the public)

* rights issue (existing shareholders)

* placement (sophisticated investors i.e., banks)

* share purchase plans (employees)

• financial institutions – banks, investment banks, finance companies, superannuation

funds, life insurance companies, unit trusts and the Australian Securities Exchange

- Banks: retail banks (i.e., commonwealth, NAB) takes deposits from account

holders, borrows money from int. money mkt. and lends money to indiv. & busi.

- Investment banks: merchant banks (i.e., Macquarie Bank, Citibank) provide

financial services to the business sector. Provide debt sourcing services for large

loans, create debentures, advise merges/acquisitions etc.

- Financial companies: finance companies act as higher risk bankers

* Don’t accept deposits

* Borrow money at low rates

* Lend on higher rates of interest

* This interest rate margin generates profits

- Superannuation funds: Aus. Workers have forced investment accounts that earn

returns over decades to fun retirement.

* Invest in the debt of business (debenture)

* Shares (equity) of public firms to gain returns for remembers

- Life insurance companies: providing risk protection to indiv. in case of death or

serious injury.

* Not many people claim, therefore they create a large pool of funds to invest

into equity and debt markets (debentures and shares of large businesses)

- Unit trusts: an investment vehicle through which member can contribute funds

to purchase assets to gain a return.

- ASX: share market operator for the trading of securities

* Primary market: new shares

* Secondary: sale and purchase of pre-owned shares.

• influence of government – Australian Securities and Investments Commission,

company taxation

- Australian securities and investments commission (ASIC)

* Enforces and administers the corporation’s acts and protects consumers in

areas of investment, life and general insurance, superannuation and banking.

* Ensures all companies adhere to the law, collects info about companies à

makes available to public.

* Impact on profitability; compliance costs (expense) which increase as

regulation around an industry increases

- Company tax – tax paid on net profit

* Was 30% but decreasing slowly in 2021-22 aiming for 25%

* Impact on profitability; expenses

• global market influences – economic outlook, availability of funds, interest rates

- economic outlook – forecast of expected eco. Conditions worldwide – impacts on

decisions made by businesses and individuals.

* Positives: businesses willingness to take risks and pursue growth, consumers

increase D 4 g/s (businesses require funds to meet this D), finance is easier to

obtain (decrease risk due to increase D)

* Negatives: consumer demand slows, finance is harder to obtain (and more

expensive due to uncertainty)

- Availability of funds – willingness of investors to lend money…is linked to global

outlook, though it can be also influenced by domestic economy/resources

* Investors (banks, financial institutions, other companies, high net worth indiv,

govt) willingness to take risks and invest money dependant on current and

future market conditions.

* Positives: high levels of business and consumer confidence à less risk in

lending $$$, more likely to lend money (more availability), more likely to

invest in equity (increase availability) and cos to borrow money is lower (IR)

* Negatives: low confidence levels à perceived risk in lending $$, less likely to

lend money (decrease availability), less likely to invest in equity (shares)

(decrease availability), cost to borrow money is higher (IR)

- Interest rates – the cost of borrowing $$ is linked to the availability of funds and

the eco outlook.

* Rates set by RBA

* Positive economic outlook: high levels of business and consumer confidence

à less risk in lending money à cost to borrow $$ is lower (IR)

* Negative economic outlook: low confidence levels à perceived risk in

lending money à cost to borrow $$ is higher

processes of financial management

• planning and implementing – financial needs, budgets, record systems, financial

risks, financial controls

* Financial needs – inflows>outflows, more money coming in than out

> Financial information includes balance sheets, income statements,

cash flow statements, sales/price forecasts, budgets, bank

statements, weekly reports, break-even analysis

> Determined by – size of business, current phase of the business cycle,

future plans for growth and development, capacity to source finance

(debt and/or equity), management skills for assessing financial needs

and planning

> Business plan may be used when seeking finance or support for a

project from a bank or investors, these institutions must ensure that

financial commitment will result in success – types of info in business

plan depends on audience (employees, owners, lenders, investors) –

needed to show that a business can generate acceptable return on

investment sought

* Budgets

> Provide information in quantitative terms about requirements to

achieve a particular purpose

> Budgets show – cash required for planned outlays for a particular

period, cost of capital expenditure and associated expenses against

earning capacity, estimated use and cost of raw materials or

inventory, number and cost of labour hours required for production

> Reflect strategic planning about resource use and provide info about

goals and are used in strategic, tactical, and operational planning

> Enable constant monitoring of objectives and provide a basis for

administrative control, sales effort, planning, price setting, stock

control, expenses, and production cost

> Used in both planning and control – control measure, planned

performance can be measured against actual performance and

corrective action taken as needed

> Budgeting must consider – review of past figures and trends,

gathered estimates, potential market/market share, trend, seasonal

fluctuation, proposed expansion or discontinuation of projects,

proposals to alter price/quality, current orders, plant capacity,

considerations from external environment (financial trends,

availability of materials and labour)

* Record systems

> Mechanism employed by business to ensure that data is recorded

and info provided by record systems is accurate, reliable, efficient,

and accessible

> ASIC – poor record keeping is major cause of business failure

> Minimising errors in recording process and maintaining accurate

financial statements important – double entry system of accounting is

an important control aspect (record all items twice, entries seen to

balance, and checks to find errors can be carried out quickly)

> ATO legal requirement to keep certain records for min. of 5 years

> Financial statements – revenue statement, balance sheet, cash-flow

statement

* Financial risks

o Risk to a business of being unable to cover its financial obligations

(debts incurred through borrowing) – if this occurs bankruptcy will

result

o In assessing financial risk, consider – amount of business’s

borrowings, borrowings are due to be repaid, interest rates, required

level of current assets needed to finance operations

o If business financed from borrowings – higher risk – greater

expectation of profits/dividends

o To minimise risk, business consider amount of profit to be generated

– must cover debt and justify risk – also consider liquidity of assets,

short-term debt it must have liquid assets so debt including interest

and repayment of principal on loans are covered

* Financial controls

> Most common cause of financial loss/problems – theft, fraud, damage

or loss of assets, errors in record system

> Theft/fraud – unnecessary over purchase of stock for personal use,

conflict of interest, misuse of expense accounts, false invoices theft of

inventory/assets, or credit card fraud

> Financial controls – policies and procedures that ensure that the

plans of a business will be achieved in the most efficient way

> Policy/procedure must be followed by both management and

employees – control important in assets such as accounts receivable,

inventory, and cash

> Common policies that promote control – clear authorisation and

responsibility for tasks in the business, separation of duties, rotation

of duties, control of cash, protection of assets, control of credit

procedures (follow up overdue accounts and customer credit checks)

- debt and equity financing – advantages and disadvantages of each

- matching the terms and source of finance to business purpose

• monitoring and controlling – cash flow statement, income statement, balance sheet

* Cash flow statement

> indicates movement of cash receipts and cash payments resulting

from transactions over a period of time

> Users of the statement – creditors, lenders, owners, shareholders,

potential shareholders

> Better predictor of status that profitability, whether a firm can –

§ Generate favourable cash flow ratio

§ Pay financial commitments when they fall due

§ Have sufficient funds for growth/change

§ Obtain external finance

§ Pay drawings to owners or dividends

> Activities of businesses are divided into 3 categories –

§ Operating activities = cash in/outflows relating to main

business activity. Y from sales plus dividends and I received.

Outflows consist of payments to suppliers, employees, and

general operating expenses

§ Investing activities = cash in/outflows relating to purchase and

sale of NCA and I, used to generate Y for business

§ Financing activities = cash in/outflows relating to borrowing

activities of the business. Inflows relate to equity or debt,

outflows relate to repayment, dividends, or cash drawings (of

owner)

> Usually prepared from income statement and balance sheet. ONLY

CASH TRANSACTIONS

* Income statement (statement of financial performance)

> summary of the Y earned, and the expenses paid over a period of time

> Statement shows:

§ Operating Y earned from the main function of the business,

i.e., sales of inventories, services, and non-operating revenue

earned from other operations such as interest, etc.

§ Operating expenses i.e., purchase of inventories, payment for

services and other expenses incurred in the main operation of

the business

§ GP = SALES REVENUE – COGS

§ NP = COGS – EXPENSES

* Balance sheet (statement of financial position)

> Represents business’s assets and liabilities at a particular point in time

and represents the net worth (equity) of the business

> Shows level of C/NC Liabilities/assets

§ Asset – items of value. Current can be turned to cash within 12

months, non-current greater than 12 months

§ Liabilities – claims against assets, representing what is owed

by the business

§ Owners’ equity – funds contributed by the owner, represents

net worth of business

> Analysis indicates – assets to repay debts, assets being utilised to

maximise profits, owners making good return on investments

> Accounting equation – relationship between assets, liabilities, and

owners’ equity

§ Assets = Liabilities + Owners’ Equity

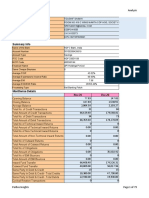

• financial ratios

- liquidity – current ratio (current assets ÷ current liabilities)

o a ratio showing the dollar amount of current assets to every $1 of current

liabilities

o balance sheet

o compare to - accounting convention 2:1

o should a business have greater than 2:1, it may not be using its cash

effectively in terms of growth. Highly liquid

o should a business have less than 2:1, it may find it difficult to meet its

short-term financial commitments as they fall due. May not have enough

cash on hand

- gearing – debt to equity ratio (total liabilities ÷ total equity)

o a ratio showing the dollar amount of debt to every $1 of owner’s equity

o balance sheet

o compare to – 1:1

o greater than 1:1, it may find it difficult to repay its long-term debts as

they fall due and therefore be required to sell off assets. Highly geared

o Less than 1:1, it should not have any difficulties in repaying its long-term

debts are they fall due and may take the opportunity to take on more

debt to grow the business. Adequately geared

- profitability – gross profit ratio (gross profit ÷ sales); net profit ratio (net profit ÷

sales); return on equity ratio (net profit ÷ total equity)

* Gross profit ratio – income statement

o showing the dollar amount of GP earned on every $1 of sales

o level of mark up a firm has on its financial output; the difference between

COGS and revenue; how much profit is generated from good sold.

o the higher the ratio the better à shows efficiency of COGS

o lower results indicate narrow profit margins

o ↑ GP = COGS ↓ or sales ↑

o ↓ GP = COGS ↑ or sales ↓

* Net profit ratio – income statement

o Showing the dollar amount of NP earned on every $1 of sales

o Shows how profitable a firm is after COGS and all other expenses have

been deducted from revenue

o Shows overall performance of business

o The higher numbers are better for a firm

o Lower results indicate firm is struggling to cover all expenses

o ↑ NP = expenses ↓ or GP ↑

o ↓ NP = expenses ↑ or GP ↓

o Budgeted figures = “predicted” figures

* Return owner’s equity ratio – income statement (NP) and balance sheet (OE)

o Show the dollar amount of NP earned on every $1 of owners invest. funds

o Shows effectiveness of business to generate a profit using money

invested by owners *sales management, COGS “ “, op exp “ “

o The higher the ratio the better à hopefully ↑ overtime

o Favourable results may encourage additional investment

o Higher # better for owners

o If return compares favourable à owners may consider expansion or

diversification of the business

o If return is unfavourable à owners would consider alternative options,

including selling off the business

- efficiency – expense ratio (total expenses ÷ sales), accounts receivable turnover

ratio (sales ÷ accounts receivable)

* expense ratio – income statement

o a ratio showing the amount of expenses to every $1 of sales or %

o track costs i.e., wages

o higher expense ratios may be the result of poor management

* account receivables ratio – income statement and balance sheet

o STEP TWO = 365 DAYS / X (FOUND IN STEP 1)

o The number of days it takes to collect accounts receivables

o < 30 days = efficient

o 40 or more days = less efficient

o ↑ efficiency = ↑ profits and financial stability

- comparative ratio analysis – over different time periods, against standards, with

similar businesses

• limitations of financial reports – normalised earnings, capitalising expenses, valuing

assets, timing issues, debt repayments, notes to the financial statements

* normalised earnings; adjusted to take into account changes in the eco. Cycle or

remove one off or unusual items that will affect profitability – done to give more

accurate depiction of the true earnings of a company. i.e., floods, or bushfires

* capitalised expenses: where business records an expense as an asset on the

balance sheet rather than an expense of the income statement – underrates

expenses and overstates profits as well as the assets of the business i.e. research

and development, development expenditure, delivery truck as to buy petrol.

* Valuing assets; process of estimating the value of assets when recording them

on a balance sheet i.e., goodwill (reputation), house (dep/appreciation of value)

* Timing issues: the matching principle à expenses incurred by a business must

be recorded on income statement for the accounting period which the revenue is

earned. i.e. real estate agent sold property June, received 2% commission but

employer did not pay them till July. This expense SHOULD be recorded in June

* Debt repayments: gearing ratio used to determine whether businesses are at

risk of meeting long term financial commitment. A business that is highly geared

may be alarming for some stakeholders. Cane be limited because don’t always

have capacity onto disclose specific info

* Notes to financial statement: any changes must be noted at end of financial

reports

• ethical issues related to financial reports

Audited accounts

* All private and public companies are required to have their accounts audited

(checked)

* Auditing is a process designed to establish the truth and fairness of the

financial reports

* Conducted by independent accountants who check samples, chosen at

random, to ensure the overall accounts are accurate

Inappropriate cut

* Profits need to be matched with the costs and revenues that generated that

profit.

* If done dishonestly or incompetently and the cut-off period is inappropriate,

the reports will give a false impression.

Misuse of Funds

* The misuse of funds refers to a range of dishonest and illegal practices.

* Systems and procedures should be put in place to prevent fraud.

financial management strategies

• cash flow management

- cash flow statements

- distribution of payments, discounts for early payment, factoring

o discounts for early payments – offer debtors opportunity to receive a

discount if they pay their account early increasing cash, liquidity and

decreasing cost to consumer.

o Factoring – sell accounts receivables to factoring businesses at discounted

price hence original current assets total is now actually worth less.

• working capital management

- control of current assets – cash, receivables, inventories

o ↑ CA by –

§ Selling NC assets and lease them back

§ Distribute its ongoing payments to retain cash

§ Manage inventory to ensure not waste and protect inventory to

reduce/eliminate theft

§ ↑ cash by taking on debt

§ ↓ spending on capital equipment or infrastructure to retain cash

- control of current liabilities – payables, loans, overdrafts

o accounts payables by – paying early is a discount is offered by creditor or

wait till end of payment period to pay off debt (hold onto cash for as long

as possible.

o Loans – monitor costs of establishment, IR, ongoing fees

o Overdraft by – monitoring est. costs, fees, IR and withdrawal limit

- strategies – leasing, sale and lease back

o sell and lease non-current assets

• profitability management

- cost controls – fixed and variable, cost centres, expense minimisation

o fixed and variable, expense minimisation - reducing costs

o fixed costs remain same irrespective of business activity i.e., salaries and

rent

o variable costs change proportionally to busines activity i.e., wages,

utilities usage

o cost centres – creation of separate cost accounts for divisions/units i.e.,

breaking costs by dep. And tracking over time

- revenue controls – marketing objectives

elements of 4ps to ensure firm minimises revenue and profits pricing policies

o too high – fewer sales (at higher margins)

o too low – higher sales (at narrow margin without covering firm expenses)

o reviewing sales (product) mix

o changing the products/services

o diversitising: new lines

o maximising profits: remove products

• global financial management

- exchange rates

* as countries have their own currency, they use for domestic purposes it is this

dom. currency that business seeking M must use to pay for their purposes

* therefore, in all global transactions it is necessary to convert the currency to the

domestic currency to enact payment

* the foreign exchange market (forex) is the ratio of one currency to another

* effects of currency fluctuations:

* an appreciating A$ - makes Aus. X $ ↑ à ↓ sales ↓ profits

* a depreciating A$ - makes Aus. X cheaper à ↑ sales ↑ profits

- interest rates

* as a business expands overseas or domestically it will normally need to raise

finance from domestic or international lends

o whilst o/s IR may be lower than in Aus, a business needs to take into

account fluctuations in ER when assessing whether to loan money from

an international lenders as repayments need to be made in a foreign

currency. The ER fluctuations may negate the IR savings.

- methods of international payment – payment in advance, letter of credit, clean

payment, bill of exchange

* to reduce risk associated w/ payment for goods/shipping goods across the globe,

there are 4 different forms of payments

* methods of trust payments.

o payment in advance – exporter receives payment first then sends the

goods. This is what happens when you shop online. No risk for exporters

but higher risk for importers

o clean payment – exporter ships goods directly to the importer first, then

the importer payers. Risk for exporter not receiving payment, no risk for

importer

* methods of payment third party

o letter of credit – bank to bank commitment – bank acts as a middleman.

Bank has buyers funds and issues a letter of credit (which guarantees

payment) which will be sent to the exporter once they provide proof of

shipment. Essentially bank holds onto the money until tracking info is

provided for the goods. Risk for exported not receiving payment is low

but delayed. Risk for importer low risk no receiving good but bank fees

o bill of exchange – exporter sends goods and a letter requesting payment

however, the exporter legal ownership over the goods until payment has

been made. Risk for exporter equal risk for importer equal.

- Hedging

* A way of protecting oneself against financial loss or other adverse

circumstances i.e., safeguard, protect or shield

* Derivative contracts can be used to hedge financial exposure. Hedging refers

to the practise of reducing or fully eliminating the risk associated with

holding an unstable assets

* Natural hedging: establish offer shore subsidies (establish company in

another country so all transactions undertaken in their dom. currency.

Arrange for M

* Hedge-process which minimise risk associated with international trade

(exchange rates, interest rates)

* A hedge can be thought as a type of insurance. A premium is paid to protect

a company from negative outcome

* Normally done using complex financial instruments known as derivatives

- Derivative

* Financial instruments used to reduce exporting risk.

1. Forward Exchange Contract

* Contract to exchange one currency for another at an agreed rate at an agreed

time

* Usually 30, 90 or 180 days

2. Options Contract

* Gives the buyer the right to buy or sell currency at future time

* No obligation

* Buyer - option holder

3. Swap Contract

* Contract to swap currencies on the spot with an agreement to reserve the

transaction in the future

* Allow domestic and foreign companies to take advantage of their good credit

rating at home

You might also like

- Multiple Choice Question On IFRS - Caglobal PDFDocument103 pagesMultiple Choice Question On IFRS - Caglobal PDFAngela100% (2)

- COMM 320 Final NotesDocument50 pagesCOMM 320 Final NotesAnonymousNo ratings yet

- Chapter 17 - Financial ManagementDocument7 pagesChapter 17 - Financial ManagementArsalNo ratings yet

- Business Studies - Finance Study NotesDocument29 pagesBusiness Studies - Finance Study NotesSamina Haider50% (2)

- Financial ManagementDocument24 pagesFinancial ManagementJulius Earl MarquezNo ratings yet

- Finance Exam NotesDocument14 pagesFinance Exam NotesAneesha100% (2)

- Financial Management (FM)Document30 pagesFinancial Management (FM)jaskahlon92No ratings yet

- Advance Financial Management 1Document36 pagesAdvance Financial Management 1Indrajeet KoleNo ratings yet

- Financial InstitutionsDocument17 pagesFinancial InstitutionsJean MarkNo ratings yet

- Financial Management CompleteDocument17 pagesFinancial Management Completesphynx labradorNo ratings yet

- FM Reading MaterialDocument12 pagesFM Reading MaterialTaransh ANo ratings yet

- CAIIB-Financial Management-Module B Study of Financial StatementsDocument91 pagesCAIIB-Financial Management-Module B Study of Financial StatementsDeepak RathoreNo ratings yet

- Caiib Fmmodbacs Nov08Document91 pagesCaiib Fmmodbacs Nov08monirba48No ratings yet

- 1.financial ManagementDocument86 pages1.financial ManagementKiran MohanNo ratings yet

- Financial Management Week 1Document36 pagesFinancial Management Week 1kylecantallopezNo ratings yet

- Intro NotesDocument7 pagesIntro NotesLouiseNo ratings yet

- CHP 1 NTRO ADVANCED FINANCIAL MANAGEMENTDocument4 pagesCHP 1 NTRO ADVANCED FINANCIAL MANAGEMENTcuteserese roseNo ratings yet

- Chapter 7 Accounting and Financial ConsiderationsDocument32 pagesChapter 7 Accounting and Financial ConsiderationsErwin MatunanNo ratings yet

- Finance (Pronounced /fɪ Nænts/ or / Faɪnænts/) Is The Science ofDocument50 pagesFinance (Pronounced /fɪ Nænts/ or / Faɪnænts/) Is The Science ofSonal JainNo ratings yet

- Meaning of Financial Management:-: 1. Public FinanceDocument7 pagesMeaning of Financial Management:-: 1. Public FinancekaRan GUptДNo ratings yet

- Working Capital: Concepts of Working Capital Gross Working Capital (GWC)Document37 pagesWorking Capital: Concepts of Working Capital Gross Working Capital (GWC)Manisha SharmaNo ratings yet

- Edexcel A-Level Business Theme 2Document14 pagesEdexcel A-Level Business Theme 2zainab kazieNo ratings yet

- CAIIB-Financial Management-Module B Study of Financial Statements C.S.Balakrishnan Faculty Member SPBT CollegeDocument39 pagesCAIIB-Financial Management-Module B Study of Financial Statements C.S.Balakrishnan Faculty Member SPBT Collegesharadggg8309No ratings yet

- FINANCEDocument45 pagesFINANCEnatz2926No ratings yet

- CH 18 Financial ManagementDocument4 pagesCH 18 Financial Managementt.a.240802No ratings yet

- Unit VDocument9 pagesUnit VJayNo ratings yet

- Working Capital ManagementDocument18 pagesWorking Capital ManagementJesiel Naranjo MaringNo ratings yet

- Chapter 8 Sources of Business Finance - 1.6Document9 pagesChapter 8 Sources of Business Finance - 1.6Divyam PatelNo ratings yet

- Project - Financial Apprasial of ITI LTDDocument67 pagesProject - Financial Apprasial of ITI LTDSATHISHNo ratings yet

- BS Unit 3Document4 pagesBS Unit 3Enea NastriNo ratings yet

- Module-1: Introduction To Finance and Financial ManagementDocument99 pagesModule-1: Introduction To Finance and Financial ManagementAswinNo ratings yet

- Finman ReviewerDocument27 pagesFinman Reviewerben yiNo ratings yet

- Financial Management Strategies - NotetakingDocument15 pagesFinancial Management Strategies - NotetakinglouellakayleyNo ratings yet

- Chapter-4 Specialization - Ii FinanceDocument15 pagesChapter-4 Specialization - Ii FinanceRahul ThakurNo ratings yet

- q3 Week1 Business FinanceDocument20 pagesq3 Week1 Business FinanceayaadenipNo ratings yet

- Unit-III Finance FunctionDocument8 pagesUnit-III Finance FunctiondaogafugNo ratings yet

- Notes FMDocument42 pagesNotes FMSneha JayalNo ratings yet

- Agb GayDocument113 pagesAgb Gaymainakroy807No ratings yet

- 9.) Chapter 17 (Financial Management)Document10 pages9.) Chapter 17 (Financial Management)John AustinNo ratings yet

- Financial Management SIR SAIDocument23 pagesFinancial Management SIR SAItekleNo ratings yet

- FM I Chapter 1Document29 pagesFM I Chapter 1ibsaashekaNo ratings yet

- CF NotesDocument5 pagesCF Notes087-Md Arshad Danish KhanNo ratings yet

- Managerial Finance Reviewer (Prelims)Document4 pagesManagerial Finance Reviewer (Prelims)Kendall JennerNo ratings yet

- Financial ManagementDocument5 pagesFinancial ManagementISLAND ROYASNo ratings yet

- Business Finance For Video Module 1Document11 pagesBusiness Finance For Video Module 1Bai NiloNo ratings yet

- Financial Market: 0allocating CapitalDocument5 pagesFinancial Market: 0allocating Capitalharon franciscoNo ratings yet

- PPT2Financial ManagementDocument51 pagesPPT2Financial ManagementAgrim DewanNo ratings yet

- Financial Management: ElementsDocument4 pagesFinancial Management: Elementsharshit mahajanNo ratings yet

- Financial Management - Meaning, Objectives and Functions Meaning of Financial ManagementDocument3 pagesFinancial Management - Meaning, Objectives and Functions Meaning of Financial ManagementGirraj Prasad MinaNo ratings yet

- Financial Management Session 1 2Document12 pagesFinancial Management Session 1 2Khushi HemnaniNo ratings yet

- Financial Management: OverviewDocument13 pagesFinancial Management: OverviewVishal MadlaniNo ratings yet

- The Meaning & Role of Finance Management: Guided By:-Dr. Yogesh A. ChauhanDocument20 pagesThe Meaning & Role of Finance Management: Guided By:-Dr. Yogesh A. ChauhanVenki AdavikolanuNo ratings yet

- Bba 5th First ChapterDocument28 pagesBba 5th First ChapterAnusha carkeyNo ratings yet

- MBA LECTURE-lecture 1Document160 pagesMBA LECTURE-lecture 1takawira chirimeNo ratings yet

- Financial Management 1Document63 pagesFinancial Management 1geachew mihiretuNo ratings yet

- Lesson 1 Business FinanceDocument50 pagesLesson 1 Business FinanceJasmine MendozaNo ratings yet

- HSC Business NotesDocument164 pagesHSC Business Notestiffany100% (1)

- Functions of FinANCEDocument39 pagesFunctions of FinANCEPalak WadhwaNo ratings yet

- EntrepreneurshipDocument3 pagesEntrepreneurshipXty CtyiuNo ratings yet

- Non Bank OperationsDocument78 pagesNon Bank OperationschingNo ratings yet

- The Finace Master: What you Need to Know to Achieve Lasting Financial FreedomFrom EverandThe Finace Master: What you Need to Know to Achieve Lasting Financial FreedomNo ratings yet

- Chapter 4 Audit Evidence: Learning ObjectivesDocument20 pagesChapter 4 Audit Evidence: Learning ObjectivesNik Nur Azmina AzharNo ratings yet

- Audit Planning - Long QuizDocument15 pagesAudit Planning - Long QuizKathleenNo ratings yet

- Deposit Account: DR LM Ndlovu 7 Hi Llhead Dri Ve Mount Edgecombe 4302Document3 pagesDeposit Account: DR LM Ndlovu 7 Hi Llhead Dri Ve Mount Edgecombe 4302Threshing FlowNo ratings yet

- Unit-2 IBDocument42 pagesUnit-2 IBTanya gargNo ratings yet

- Cash Rebate Visa Platinum TN CDocument18 pagesCash Rebate Visa Platinum TN CGiy IngNo ratings yet

- Swift MT940 DocDocument27 pagesSwift MT940 DocGNV Engg ServicesNo ratings yet

- Lecture 1Document15 pagesLecture 1Rahul KhobragadeNo ratings yet

- Banking Mcqs PDF For B.com 3rd SemDocument16 pagesBanking Mcqs PDF For B.com 3rd Semraiyuvraj082No ratings yet

- Warren SM Ch.09 FinalDocument23 pagesWarren SM Ch.09 FinalAA BB MMNo ratings yet

- The OSI Model and The TCP/IP Protocol SuiteDocument39 pagesThe OSI Model and The TCP/IP Protocol SuiteS JNo ratings yet

- Audit of Cash and Cash EquivalentsDocument3 pagesAudit of Cash and Cash EquivalentsJesebel AmbalesNo ratings yet

- Pashchimanchal Vidyut Vitran Nigam Ltd. - PAYMENTDocument1 pagePashchimanchal Vidyut Vitran Nigam Ltd. - PAYMENTAkriti DhimanNo ratings yet

- Chapter 1Document50 pagesChapter 1Gabriela MariaNo ratings yet

- Computer Accounting With Quickbooks Online A Cloud Based Approach 1st Edition Yacht Solutions ManualDocument10 pagesComputer Accounting With Quickbooks Online A Cloud Based Approach 1st Edition Yacht Solutions Manualjubasticky.vlvus2100% (27)

- Emerging PaymentsDocument24 pagesEmerging PaymentsHương MaiNo ratings yet

- Accounting EquationsDocument6 pagesAccounting EquationsSuraj KumarNo ratings yet

- Road To NC3 - 1Document1 pageRoad To NC3 - 1Mabelle Dabu Facturanan100% (2)

- 6 XFL 1621587920041Document79 pages6 XFL 1621587920041Gajendra AudichyaNo ratings yet

- Stock Associate ResumeDocument7 pagesStock Associate Resumerqaeibifg100% (2)

- Provider ICdetectionDocument22 pagesProvider ICdetectionMario CordinaNo ratings yet

- Adult Expansion Comparison Chart - FINALDocument1 pageAdult Expansion Comparison Chart - FINALMcKenzie StaufferNo ratings yet

- Why Migrate To p25 Digital LMR White Paper GlobalDocument8 pagesWhy Migrate To p25 Digital LMR White Paper Global北梦No ratings yet

- Fee Acknowledgement - Academic Session:2022-23: Form No.:22651356Document1 pageFee Acknowledgement - Academic Session:2022-23: Form No.:22651356haleyNo ratings yet

- FIN512 Chapter 8 - Life InsuranceDocument25 pagesFIN512 Chapter 8 - Life InsuranceAmandaNo ratings yet

- BGP WeaknessDocument21 pagesBGP WeaknessYaw NyameNo ratings yet

- Blackbook ProjectDocument19 pagesBlackbook ProjectDhruv Rocksta100% (1)

- Attachment 1577791792Document3 pagesAttachment 1577791792fahad chaudhryNo ratings yet

- Insurance PremiumDocument2 pagesInsurance PremiumRhows BuergoNo ratings yet

- VANET Security Research and Development EcosystemDocument11 pagesVANET Security Research and Development EcosystemDr.Irshad Ahmed SumraNo ratings yet