Professional Documents

Culture Documents

Malaysian Tin Bulletin-Februari'11

Malaysian Tin Bulletin-Februari'11

Uploaded by

malaysianmineralsOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Malaysian Tin Bulletin-Februari'11

Malaysian Tin Bulletin-Februari'11

Uploaded by

malaysianmineralsCopyright:

Available Formats

MALAYSIAN TIN BULLETIN

FEBRUARY 2011

February Tin Market Review

Kuala Lumpur Tin Market (KLTM)

Tin trading on the KLTM during the month of February was on an upward trend backed by supply constraint and increased demand. The opening price for the month was US$30,050 per tonne, unchanged from Januarys closing price, which was also the months lowest price level. It was a short first trading week as the market closed for the Federal Territory Day on 1 February and the Chinese New Year holidays on 3 and 4 of February 2011. The second trading week opened on a further bullish note with the price settling at US$31,049 per tonne, a jump of almost US$1,000. The positive momentum was supported by strong demand, particularly from overseas buyers. Sentiment was upbeat with traders actively participating in the market, which resulted in prices continuing their upward momentum to end the trading week higher at US$31,500 per tonne. Tin prices continued to surge ahead during the third trading week surpassing the US$32,000 per tonne psychological level on 16 February. The local physical tin market recorded its months peak price of US$32,500 per tonne the following day. The market, however, ended the week easier on technical correction. During the fourth trading week, tin prices recovered and stayed unchanged at US$32,400 per tonne for two consecutive days before softening on yet another technical correction. Thereafter, tin prices traded range bound between US$31,550 and US$31,950 per tonne before ending the month slightly higher at US$32,000 per tonne. Trading on the KLTM for the month of February was conducted over 16 days. The average price recorded for the month was at US$31,616 per tonne. The trading volume for the month slid to 878 tonnes from 1,036 tonnes the preceding month. Februarys average trading volume was 55 tonnes, slightly higher than the Januarys average of 52 tonnes. The months highest daily trading volume was 76 tonnes recorded on the final day of the month, while the lowest was 30 tonnes recorded on 24 February.

MALAYSIAN TIN BULLETIN

FEBRUARY 2011

LME and New York Market

Tin trading on the London Metal Exchange (LME) during the month of February was again in line with the movement in the trading of other base metals. Tin metal was traded on the Exchange mostly on a strong note. The months opening price level for cash and 3-month tin were US$29,985 and US$29,900 per tonne, respectively. They also happened to be the months lowest price level. During the first trading week, tin prices rose strongly supported by good buying interest. Tin prices continued to climb higher during the second trading week, but were checked by some technical corrections from rising further. The third trading week saw the market recorded its The Februarys average LME cash and 3-month tin prices were US$31,526 and US$31,545 per tonne, respectively. Tin trading on the New York market in February recorded a similar pattern as tin trading on the LME. The average New York spot tin price for the month rose to US$32,412 per tonne compared to Januarys average of US$28,036 per tonne. The highest and lowest prices recorded for the month of February were US$33,157 and US$30,865 per tonne, respectively. highest price level of the month for cash tin of US$32,550 per tonne and for 3-month tin of US$32,600 per tonne. They were recorded on 15 and 16 February, respectively. Prices eased somewhat thereafter before rebounding slightly during the final trading day of the week. The market strengthened further as it crossed over into the fourth trading week. But the climb was rather shortlived as prices slid afterwards on technical correction and lack of buying interest. Tin prices recovered during the final day of the trading week, and continued to strengthen to end the trading month at US$32,265 and US$32,250 per tonne for cash and 3-month tin, respectively.

MALAYSIAN TIN BULLETIN

FEBRUARY 2011

News Highlights

MB: Mining Licences for all Who Meet Criteria

Perak will issue mining licences to all applicants who meet the criteria set by the state government, said Perak Mentri Besar Datuk Seri Dr Zambry Abdul Kadir. Denying that the state government was unfair when awarding mining licences, he said, even non-mining associations could apply for it. We do not practice any form of discrimination. It is open for everyone to apply, irrespective of whether they are from mining associations or non-mining associations. Every application for a mining licence is subject to stringent rules, he told reporters after chairing the state executive council meeting here yesterday. Dr Zambry was responding to a request by the Perak Chinese Mining Association for the state government to adopt a fair policy in awarding mining licences. Association president Choong Tien Chuan had claimed that only a few of its 50 members were successful in getting such licence. Dr Zambry said the state government had received many applications from former mining companies wishing to revive their operations. (Source: The Star, 3 February 2011)

Ho Wah: Tin Industry Future Good

Ho Wah Genting Bhd sees good prospects in the tin industry, given the recovery in the electrical and electronic sector, particularly with the surging demand from China and Japan. It said the near-term shortage of tin supplies was expected to give further support to the prices, which yesterday hit another historic high of [US$31,400] per tonne on strong technical buying. The company, in a filing to Bursa Malaysia yesterday, said it planned to further develop and upgrade its skills in mining so that it could capitalise on any viable business opportunities either in tin or other similar commodities. Ho Wah said it has appointed Guilin Research of Geology for Mineral Resources, UKM Pakarunding Sdn Bhd and an Australian-consultant geologist to undertake geophysical studies on the mining site in Pengkalan Hulu. (Source: The Star, 11 February 2011)

News Round - Up

2010 Global Top Tin Producers

Eight tin producing companies recorded an increase in their production in 2010, with some even surpassing their earlier projection. The eight producers were Jiangxi Nanshan Tin of China, an increase of 100% (6,000 tonnes), Gejiu Zi-Li of China with 60.7% (9,000 tonnes), Liuzhou China Tin of China with 36.2% (14,300 tonnes), Thaisarco of Thailand with 21.8% (23,505 tonnes), Metallo Chimique of Belgium with 14.4% (9,945 tonnes), Malaysia Smelting Corporation of Malaysia with 6.4% (38,737 tonnes), Minsur of Peru with 6.3% (36,052 tonnes), and Yunnan Tin of China (YTC) with 5.9% (59,180) increases.

MALAYSIAN TIN BULLETIN

FEBRUARY 2011

YTC, Chinas number one tin producer, maintained its position as the worlds largest producer. This would be the companys sixth consecutive year at the top, and it had managed to widen the gap on total annual production from nearest rivals, PT Timah and Minsur.

Timahs 2010 Production Declined

PT Timah, Indonesias largest tin mining company, produced 40,413 tonnes of refined tin in 2010, a decrease of 4,673 tonnes over to its 2009 production. Sales declined to 40,302 tonnes last year in comparison with the 49,240 tonnes recorded in 2009. Timahs 2010 production did not meet the companys projected target due to unfavourable weather condition and other factors. The company recorded an unaudited net profit of US$89.5 million in 2010 compared to US$34.99 million recorded in 2009 due to higher average selling prices. Timahs average selling prices were around US$19,000 per tonne last year, US$3,000 tonnes higher than 2009. Unaudited sales rose from US$0.86 billion in the previous year to US$0.93 billion in 2010, although sales volume for the year declined. Some US$0.14 billion had been allocated by PT Timah this year for capital spending and expanding its tin chemical plant.

Minsurs 2010 Sales and Profits Rose

Compania Minera Minsur SA's, Perus major tin mining company, recorded a huge increase in net profit during the fourth quarter of 2010. The company posted a net profit of US$114 million in the last quarter of 2010, compared to US$73 million in the same quarter of 2009 due to higher tin prices. The companys fourth quarter net sales were US$201 million, compared with US$148 million for the same period a year earlier. For the full year of 2010, the companys net profits rose by 48 per cent to US$0.38 billion from US$0.26 billion in 2009. Some US$0.91 billion worth of sales were made, an increase of 65 per cent. Meanwhile, the companys tin-in-concentrates production at its San Rafael mine declined by almost 10 per cent to 33,848 tonnes in 2010, while its refined tin production rose by 6.3 per cent to 36,052 tonnes.

Indonesias January Tin Exports Rose

Recent data from Indonesias Ministry of Trade showed that refined tin exports from the country in January 2011 rose by 560 tonnes to 7,334 tonnes compared to 6,774 tonnes recorded in January last year. The higher figure was due to exporters expediting their shipment because of the present high global tin price. Traditionally, tin production and exports in January were comparatively low due to the after effects of the monsoon season. Between January 2010 and January 2011, a total of 93,047 tonnes of tin were checked for exports. The tin exports check system was first introduced in 2007, and Indonesias Ministry of Trade obtains its figures from checks conducted by several appointed surveying companies before the metal were exported. (Source: Tin in the News, ITRI Ltd. UK)

MALAYSIAN TIN BULLETIN

FEBRUARY 2011

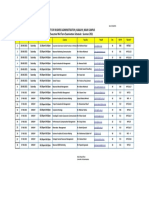

Tin Statistics

MALAYSIAN TIN BULLETIN

FEBRUARY 2011

MALAYSIAN TIN BULLETIN

FEBRUARY 2011

MALAYSIAN TIN BULLETIN

FEBRUARY 2011

MALAYSIAN TIN BULLETIN

FEBRUARY 2011

MALAYSIAN TIN BULLETIN

FEBRUARY 2011

10

MALAYSIAN TIN BULLETIN

FEBRUARY 2011

11

MALAYSIAN TIN BULLETIN

FEBRUARY 2011

12

MALAYSIAN TIN BULLETIN

FEBRUARY 2011

13

MALAYSIAN TIN BULLETIN

FEBRUARY 2011

14

MALAYSIAN TIN BULLETIN

FEBRUARY 2011

15

MALAYSIAN TIN BULLETIN

FEBRUARY 2011

16

MALAYSIAN TIN BULLETIN

FEBRUARY 2011

17

MALAYSIAN TIN BULLETIN

FEBRUARY 2011

18

You might also like

- An Insider's Guide to the Mining Sector: An in-depth study of gold and mining sharesFrom EverandAn Insider's Guide to the Mining Sector: An in-depth study of gold and mining sharesRating: 4.5 out of 5 stars4.5/5 (4)

- Bergerac Case AnalysisDocument12 pagesBergerac Case Analysissiddhartha tulsyan100% (1)

- Assignment 2 - Capital Investment AppraisalDocument20 pagesAssignment 2 - Capital Investment AppraisalChazNo ratings yet

- Minerals and Metal Review August 2012 - 3Document20 pagesMinerals and Metal Review August 2012 - 3Sundaravaradhan IyengarNo ratings yet

- For Private Circulation OnlyDocument8 pagesFor Private Circulation OnlyNadeem KhanNo ratings yet

- Minerals and Metal Review August 2012 - 4Document20 pagesMinerals and Metal Review August 2012 - 4Sundaravaradhan IyengarNo ratings yet

- Development of World Coal Market During The Financial Crisis of 2008 - 2010Document8 pagesDevelopment of World Coal Market During The Financial Crisis of 2008 - 2010rajNo ratings yet

- Gold Demand Trends: First Quarter 2011Document0 pagesGold Demand Trends: First Quarter 2011Jesus SalamancaNo ratings yet

- Minerals and Metal Review July 2012 - 3Document20 pagesMinerals and Metal Review July 2012 - 3Sundaravaradhan IyengarNo ratings yet

- Daily Report 20141223Document3 pagesDaily Report 20141223Joseph DavidsonNo ratings yet

- Daily Report 20150112Document3 pagesDaily Report 20150112Joseph DavidsonNo ratings yet

- Commodity Research Report: Copper Fundamental AnalysisDocument18 pagesCommodity Research Report: Copper Fundamental AnalysisarathyachusNo ratings yet

- Business Talk: - Namita NaikDocument5 pagesBusiness Talk: - Namita NaikakmullickNo ratings yet

- Do April'11Document7 pagesDo April'11Satyabrata BeheraNo ratings yet

- Daily Report 20141230-1Document2 pagesDaily Report 20141230-1Joseph DavidsonNo ratings yet

- MMR - June-15 PDFDocument20 pagesMMR - June-15 PDFBrahmpal BhardwajNo ratings yet

- Investment Options FinalDocument94 pagesInvestment Options Finalswapnil_jadhav_8No ratings yet

- Script Commodity Noon Session NewDocument13 pagesScript Commodity Noon Session Newvinod1695No ratings yet

- Daily Report 20150107Document3 pagesDaily Report 20150107Joseph DavidsonNo ratings yet

- Premium Weekly Commodity Market TipsDocument6 pagesPremium Weekly Commodity Market TipsRahul SolankiNo ratings yet

- China'S Mixed Slowdown: KWH (BN) 230.5 250.5 BN MT KMDocument7 pagesChina'S Mixed Slowdown: KWH (BN) 230.5 250.5 BN MT KMfakepocNo ratings yet

- Central Bank Considers Importing GoldDocument6 pagesCentral Bank Considers Importing GoldTran Trong VietNo ratings yet

- Gold Physical Demand: YTD Run Rate: Source: Standard Bank Research, SGE Source: Standard Bank ResearchDocument7 pagesGold Physical Demand: YTD Run Rate: Source: Standard Bank Research, SGE Source: Standard Bank ResearchKashmira RNo ratings yet

- Africa Power and Politics - The Investment and Business Environment For Gold Exploration and Mining in TanzaniaDocument102 pagesAfrica Power and Politics - The Investment and Business Environment For Gold Exploration and Mining in TanzaniaMihailo BjelicNo ratings yet

- Coal Deficit Widens On Rising DemandDocument4 pagesCoal Deficit Widens On Rising DemandSumanth KumarNo ratings yet

- Self Study 2Document48 pagesSelf Study 2siyammbaNo ratings yet

- JP Morgan - North America Metals & MiningDocument17 pagesJP Morgan - North America Metals & MiningPT Ujatek BaruNo ratings yet

- Long-Term Trends and Outlook For Global Coal Supply and DemandDocument28 pagesLong-Term Trends and Outlook For Global Coal Supply and DemandRdy SimangunsongNo ratings yet

- Daily Report 20141111Document3 pagesDaily Report 20141111Joseph DavidsonNo ratings yet

- Nikl Metals WeeklyDocument7 pagesNikl Metals WeeklybodaiNo ratings yet

- What Is The Limit of Chinese Coal Supplies-A STELLA Model of Hubbert PeakDocument10 pagesWhat Is The Limit of Chinese Coal Supplies-A STELLA Model of Hubbert PeakAsolorio ValdezNo ratings yet

- State of The Market PresentationDocument22 pagesState of The Market PresentationMichael McCraeNo ratings yet

- Daily Report 20141225Document3 pagesDaily Report 20141225Joseph DavidsonNo ratings yet

- The Copper Report 2006Document18 pagesThe Copper Report 2006turtlelordNo ratings yet

- Base Metals Weekly - 03102011Document6 pagesBase Metals Weekly - 03102011luckydhruvNo ratings yet

- Glen Mpufane ICEM State of Current Global Minerals and Extractive IndustriesDocument50 pagesGlen Mpufane ICEM State of Current Global Minerals and Extractive IndustriesminingmaritimeNo ratings yet

- Global Investor: Highlights of The International Arena: Executive SummaryDocument7 pagesGlobal Investor: Highlights of The International Arena: Executive SummarySulakshana De AlwisNo ratings yet

- Overview of Iron and Steel Industry: Chapter-IiDocument24 pagesOverview of Iron and Steel Industry: Chapter-IiRahul NiranwalNo ratings yet

- VCE Economics: Australia's Mineral Commodity Market Case StudyDocument6 pagesVCE Economics: Australia's Mineral Commodity Market Case StudygavansharplesNo ratings yet

- Research of Business: Evaluating The Production Trends and Sustainability of The Australian Mining IndustryDocument11 pagesResearch of Business: Evaluating The Production Trends and Sustainability of The Australian Mining IndustryRavi KumawatNo ratings yet

- Relationship Between Gold Price and Stock MarketDocument9 pagesRelationship Between Gold Price and Stock MarketSandeep Madival0% (1)

- Feasibilty Study: Gold SupplyDocument8 pagesFeasibilty Study: Gold SupplyRuffy SGNo ratings yet

- Energy & Commodities - October 16, 2012Document4 pagesEnergy & Commodities - October 16, 2012Swedbank AB (publ)No ratings yet

- Copper Report IIFLDocument14 pagesCopper Report IIFLAmish AggarwalNo ratings yet

- Commodity Weekly Outlook Dec 1211Document8 pagesCommodity Weekly Outlook Dec 1211Aparna RajputNo ratings yet

- Gold: - A Commodity Like No OtherDocument6 pagesGold: - A Commodity Like No OtherVeeresh MenasigiNo ratings yet

- Energy & Commodities - November 16, 2012Document4 pagesEnergy & Commodities - November 16, 2012Swedbank AB (publ)No ratings yet

- Stainless Scrap - Market Review For MarchDocument1 pageStainless Scrap - Market Review For Marchapi-139281121No ratings yet

- Commodity Weekly Market News 07 April To 11 AprilDocument6 pagesCommodity Weekly Market News 07 April To 11 AprilSunil MalviyaNo ratings yet

- Site Visit: Mogalakwena Mine and Polokwane Smelter: April 12 2010Document39 pagesSite Visit: Mogalakwena Mine and Polokwane Smelter: April 12 2010pldevNo ratings yet

- Weekly Commodity Market Report For TradersDocument6 pagesWeekly Commodity Market Report For TradersRahul SolankiNo ratings yet

- Commodities 2011 Craig DrakeDocument1 pageCommodities 2011 Craig DrakecsdrakeNo ratings yet

- Final RulesDocument5 pagesFinal Rulesjimmy_9126No ratings yet

- GDT Q1 2016Document29 pagesGDT Q1 2016Idra HoNo ratings yet

- ANZ Commodity Daily 720 081012Document8 pagesANZ Commodity Daily 720 081012anon_370534332No ratings yet

- IIF-News .: T H e M e o F T H e y e A R - " Working Together For Value Creation"Document6 pagesIIF-News .: T H e M e o F T H e y e A R - " Working Together For Value Creation"tushak mNo ratings yet

- The Article Identifies Five Factors Affecting The World Demand For Gold. List at Least Two of ThemDocument4 pagesThe Article Identifies Five Factors Affecting The World Demand For Gold. List at Least Two of ThemAmit JindalNo ratings yet

- Terms of Reference: Sr. No Name Roll No. 1 2 3 4 5 6Document9 pagesTerms of Reference: Sr. No Name Roll No. 1 2 3 4 5 6wolverine987No ratings yet

- How to Invest in Gold: A guide to making money (or securing wealth) by buying and selling goldFrom EverandHow to Invest in Gold: A guide to making money (or securing wealth) by buying and selling goldRating: 3 out of 5 stars3/5 (1)

- The Economist Guide to Commodities 2nd edition: Producers, players and prices; markets, consumers and trendsFrom EverandThe Economist Guide to Commodities 2nd edition: Producers, players and prices; markets, consumers and trendsRating: 3 out of 5 stars3/5 (1)

- The Commodities Investor: A beginner's guide to diversifying your portfolio with commoditiesFrom EverandThe Commodities Investor: A beginner's guide to diversifying your portfolio with commoditiesRating: 5 out of 5 stars5/5 (1)

- Daily Nickel Price May 2012Document2 pagesDaily Nickel Price May 2012malaysianmineralsNo ratings yet

- Daily Tin Price May 2012Document2 pagesDaily Tin Price May 2012malaysianmineralsNo ratings yet

- Daily Silver Price May 2012Document2 pagesDaily Silver Price May 2012malaysianmineralsNo ratings yet

- Daily Copper Price May 2012Document2 pagesDaily Copper Price May 2012malaysianmineralsNo ratings yet

- Daily Gold Price May 2012Document2 pagesDaily Gold Price May 2012malaysianmineralsNo ratings yet

- Daily Aluminium Price Apr 2012Document2 pagesDaily Aluminium Price Apr 2012malaysianmineralsNo ratings yet

- Daily Aluminium Price May 2012Document2 pagesDaily Aluminium Price May 2012malaysianmineralsNo ratings yet

- Daily Tin Price Jan 2012Document2 pagesDaily Tin Price Jan 2012malaysianmineralsNo ratings yet

- Daily Tin Price Apr 2012Document2 pagesDaily Tin Price Apr 2012malaysianmineralsNo ratings yet

- Daily Gold Price Apr 2012Document2 pagesDaily Gold Price Apr 2012malaysianmineralsNo ratings yet

- Daily Nickel Price Apr 2012Document2 pagesDaily Nickel Price Apr 2012malaysianmineralsNo ratings yet

- Daily Copper Price Apr 2012Document2 pagesDaily Copper Price Apr 2012malaysianmineralsNo ratings yet

- Daily Copper Price Mar 2012Document2 pagesDaily Copper Price Mar 2012malaysianmineralsNo ratings yet

- Daily Tin Price Mar 2012Document2 pagesDaily Tin Price Mar 2012malaysianmineralsNo ratings yet

- Daily Nickel Price Mar 2012Document2 pagesDaily Nickel Price Mar 2012malaysianmineralsNo ratings yet

- Daily Silver Price Mar 2012Document2 pagesDaily Silver Price Mar 2012malaysianmineralsNo ratings yet

- Daily Gold Price Mar 2012Document2 pagesDaily Gold Price Mar 2012malaysianmineralsNo ratings yet

- Daily Aluminium Price Mar 2012Document2 pagesDaily Aluminium Price Mar 2012malaysianmineralsNo ratings yet

- Daily Gold Price Sept 2011Document2 pagesDaily Gold Price Sept 2011malaysianmineralsNo ratings yet

- Daily Tin Price Feb 2012Document2 pagesDaily Tin Price Feb 2012malaysianmineralsNo ratings yet

- Daily Gold Price Dec 2011Document2 pagesDaily Gold Price Dec 2011malaysianmineralsNo ratings yet

- Daily Copper Price Jan 2012Document2 pagesDaily Copper Price Jan 2012malaysianmineralsNo ratings yet

- Daily Nickel Price Jan 2012Document2 pagesDaily Nickel Price Jan 2012malaysianmineralsNo ratings yet

- Daily Aluminium Price Jan 2012Document2 pagesDaily Aluminium Price Jan 2012malaysianmineralsNo ratings yet

- Daily Gold Price Jan 2012Document2 pagesDaily Gold Price Jan 2012malaysianmineralsNo ratings yet

- Daily Silver Price Jan 2012Document2 pagesDaily Silver Price Jan 2012malaysianmineralsNo ratings yet

- Daily Silver Price Feb 2012Document2 pagesDaily Silver Price Feb 2012malaysianmineralsNo ratings yet

- Daily Nickel Price Feb 2012Document2 pagesDaily Nickel Price Feb 2012malaysianmineralsNo ratings yet

- Daily Copper Price Feb 2012Document2 pagesDaily Copper Price Feb 2012malaysianmineralsNo ratings yet

- Daily Aluminium Price Feb 2012Document2 pagesDaily Aluminium Price Feb 2012malaysianmineralsNo ratings yet

- NIMS University Jaipur - B.sc. Economics Course Fees, Eligibility, ScholarshipDocument8 pagesNIMS University Jaipur - B.sc. Economics Course Fees, Eligibility, ScholarshipstepincollegeNo ratings yet

- 1-Introduction To Energy Audit-20!07!2022 (20-Jul-2022) Material I 20-07-2022 1-Introduction and Module 1 FullDocument56 pages1-Introduction To Energy Audit-20!07!2022 (20-Jul-2022) Material I 20-07-2022 1-Introduction and Module 1 FullDaman RajNo ratings yet

- Build Relationship With CustomersDocument69 pagesBuild Relationship With CustomersFelekePhiliphosNo ratings yet

- Cartilla de Ingles FinalDocument10 pagesCartilla de Ingles Finalapi-383779957No ratings yet

- Chapter 3 Performance EvaluationDocument26 pagesChapter 3 Performance EvaluationHafeezNo ratings yet

- Fundamentals of Islamic BankingDocument63 pagesFundamentals of Islamic Bankingzain_hassan_8No ratings yet

- Impact Assessment of Personal Income Tax Reduction in The Philippines by IDEADocument44 pagesImpact Assessment of Personal Income Tax Reduction in The Philippines by IDEAVoltaire Veneracion100% (1)

- Group A FinalDocument2 pagesGroup A Finalapi-380281979No ratings yet

- Itaewon Class Is More Than Just A Revenge Story. The Series Portrays How We Get Through Life MistakesDocument4 pagesItaewon Class Is More Than Just A Revenge Story. The Series Portrays How We Get Through Life Mistakesmarichu apiladoNo ratings yet

- Case StudyDocument3 pagesCase Studynazia malikNo ratings yet

- Lesson 1Document39 pagesLesson 1ncncNo ratings yet

- 1702 Ghai2011Document5 pages1702 Ghai2011Janice CarridoNo ratings yet

- Dandot 2008 AnnualDocument39 pagesDandot 2008 AnnualMuhammad haseebNo ratings yet

- FRI AssignmentDocument18 pagesFRI AssignmentHaider SaleemNo ratings yet

- Study On Urbanization People Mobility Inclusive Development FINALDocument182 pagesStudy On Urbanization People Mobility Inclusive Development FINALBrenda Shania LombuNo ratings yet

- LFLTDocument3 pagesLFLTYsah CorreaNo ratings yet

- Chapter 2 Working Capital MGT ModularDocument21 pagesChapter 2 Working Capital MGT ModulardeguNo ratings yet

- FM Quiz #3 SET 1Document2 pagesFM Quiz #3 SET 1Cjhay MarcosNo ratings yet

- MBA EX. Mid Term Examination Schedule - Summer 2021Document1 pageMBA EX. Mid Term Examination Schedule - Summer 2021Shehreiz SiddiquiNo ratings yet

- Annual Report 2021: Indian Energy ExchangeDocument289 pagesAnnual Report 2021: Indian Energy Exchangerahul rajNo ratings yet

- Manufacturing Planning PresentationDocument14 pagesManufacturing Planning PresentationMaheer SohbatNo ratings yet

- All English Editorials 24 - 11Document19 pagesAll English Editorials 24 - 11Anjali AgarwalNo ratings yet

- Know The Pulse Masterclass 4 PatternsDocument2 pagesKnow The Pulse Masterclass 4 Patternsstoinis harshitNo ratings yet

- INSPECTIONDocument43 pagesINSPECTIONdharampurhaNo ratings yet

- M&A - CH 29Document10 pagesM&A - CH 29Frizky PutraNo ratings yet

- Operational AuditDocument18 pagesOperational AuditAnkur GoyalNo ratings yet

- Chapter 8 ProductDocument48 pagesChapter 8 Productqdrsnbk85mNo ratings yet

- Aue2602 SummaryDocument73 pagesAue2602 SummaryDenver Cordon100% (1)