Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

30 viewsGST Tax Invoice 2

GST Tax Invoice 2

Uploaded by

yogende kumarCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- The Ultimate Guide To P2P Lending PDFDocument112 pagesThe Ultimate Guide To P2P Lending PDFArthur Liew100% (1)

- Assessment - BSBFIA401Document10 pagesAssessment - BSBFIA401Sabah Khan RajaNo ratings yet

- Volvo TicketDocument1 pageVolvo TicketVipin TiwariNo ratings yet

- Drapur Jalandhar GST - Tax - Invoice - 2Document1 pageDrapur Jalandhar GST - Tax - Invoice - 2ashuwillusinfraNo ratings yet

- GST Tax Invoice 2Document1 pageGST Tax Invoice 2sreeharshanNo ratings yet

- Bangalore To Bellary - Bus TicketDocument2 pagesBangalore To Bellary - Bus Ticketyerrisiddappa KNo ratings yet

- GST Tax Invoice 2Document1 pageGST Tax Invoice 2Rahul GhugeNo ratings yet

- Trip - ErodeDocument1 pageTrip - ErodeS.R.ANEESHNo ratings yet

- GST Tax Invoice 2Document1 pageGST Tax Invoice 2Sant GhoshNo ratings yet

- GST Tax InvoiceDocument1 pageGST Tax InvoiceSunnyNo ratings yet

- GST Tax InvoiceDocument1 pageGST Tax Invoicesuhasmore698No ratings yet

- This Is A Computer Generated Invoice. So No Signature RequiredDocument1 pageThis Is A Computer Generated Invoice. So No Signature Requiredsinghvikram8No ratings yet

- GST - Tax - Invoice - CH To PondyDocument1 pageGST - Tax - Invoice - CH To PondysaranNo ratings yet

- This Is A Computer Generated Invoice. So No Signature RequiredDocument1 pageThis Is A Computer Generated Invoice. So No Signature RequiredHari kantNo ratings yet

- Sanitiser Tax InvoiceDocument1 pageSanitiser Tax InvoiceSanjeev RanjanNo ratings yet

- Ishan Netsol Private Limited: Tax InvoiceDocument2 pagesIshan Netsol Private Limited: Tax InvoiceSunil Patel100% (1)

- Bharat Sanchar Nigam Limited: Telephone Bill/Tax InvoiceDocument1 pageBharat Sanchar Nigam Limited: Telephone Bill/Tax InvoicevirendramehraNo ratings yet

- Bharat Sanchar Nigam Limited: Telephone Bill/Tax InvoiceDocument1 pageBharat Sanchar Nigam Limited: Telephone Bill/Tax InvoiceBSCPLCHDNo ratings yet

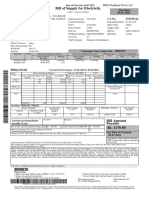

- ElectricityAndMaintenance Bill PDFDocument1 pageElectricityAndMaintenance Bill PDFRaja VasdevanNo ratings yet

- Dem-Soho 2324 208 75508 100469Document2 pagesDem-Soho 2324 208 75508 100469Ayush ChouhanNo ratings yet

- January 2019 BillDocument1 pageJanuary 2019 BillYugandhara Rao NookaNo ratings yet

- Bharat Sanchar Nigam Limited: Duplicate Telephone Bill Name and Address of The CustomerDocument1 pageBharat Sanchar Nigam Limited: Duplicate Telephone Bill Name and Address of The Customersatish kumarNo ratings yet

- Goods & Services Tax (GST) - GSTR2B122Document2 pagesGoods & Services Tax (GST) - GSTR2B122rauniyar97No ratings yet

- SZ Dap 0000150756Document1 pageSZ Dap 0000150756paramessh666No ratings yet

- Inv RJ B1 115172343 118696123851 February 2024Document2 pagesInv RJ B1 115172343 118696123851 February 2024Ishika TiwariNo ratings yet

- Bharat Sanchar Nigam Limited: Telephone Bill/Tax Invoice Name and Address of The CustomerDocument1 pageBharat Sanchar Nigam Limited: Telephone Bill/Tax Invoice Name and Address of The CustomerPramod Kumar GuptaNo ratings yet

- PDFstatement 25Document3 pagesPDFstatement 25Navneesh Singh YadavNo ratings yet

- Bharat Sanchar Nigam Limited: Telephone Bill/Tax Invoice Name and Address of The CustomerDocument1 pageBharat Sanchar Nigam Limited: Telephone Bill/Tax Invoice Name and Address of The Customermohammed sahadNo ratings yet

- Bharat Sanchar Nigam Limited: Telephone Bill/Tax InvoiceDocument1 pageBharat Sanchar Nigam Limited: Telephone Bill/Tax InvoicevirendramehraNo ratings yet

- Medplus 2119Document1 pageMedplus 2119Moseen AliNo ratings yet

- Vercomm 01478906Document2 pagesVercomm 01478906SHIVAM KUMARNo ratings yet

- Tax Invoice: Medplus Hospital Solutions (Laxmi Nagar)Document1 pageTax Invoice: Medplus Hospital Solutions (Laxmi Nagar)Moseen AliNo ratings yet

- Telephone No Amount Payable Due Date: Pay NowDocument3 pagesTelephone No Amount Payable Due Date: Pay NowPranav SanadhyaNo ratings yet

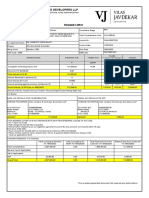

- VJ - Digital Demand For O3INV-00372-23 - 20230218T031404875Document1 pageVJ - Digital Demand For O3INV-00372-23 - 20230218T031404875Hardik RavalNo ratings yet

- Original: N 0006808736 - Issue Date 17.08.2017Document1 pageOriginal: N 0006808736 - Issue Date 17.08.2017Soham ChaudhuriNo ratings yet

- Bharat Sanchar Nigam Limited: Telephone Bill/Tax InvoiceDocument1 pageBharat Sanchar Nigam Limited: Telephone Bill/Tax InvoiceAshish KumarNo ratings yet

- Detailed Computation BDJPS7350C 1870960 Old Regime 20230730161927Document4 pagesDetailed Computation BDJPS7350C 1870960 Old Regime 20230730161927suman.singh08031992No ratings yet

- Invoice 1197533231 I0107P2306071093Document1 pageInvoice 1197533231 I0107P2306071093ankit.kocharNo ratings yet

- Invoice Voucher 000004852 SaTCycGA 614300Document2 pagesInvoice Voucher 000004852 SaTCycGA 614300Tanu Priya SonkarNo ratings yet

- My - Bill - 26 Aug, 2020 - 25 Sep, 2020 - 9306127820Document15 pagesMy - Bill - 26 Aug, 2020 - 25 Sep, 2020 - 9306127820Vivek SharmaNo ratings yet

- Telephone No Amount Payable Due Date: Bill Mail Service Tax InvoiceDocument3 pagesTelephone No Amount Payable Due Date: Bill Mail Service Tax Invoicepravingosavi1011_578No ratings yet

- Bharat Sanchar Nigam Limited: Telephone Bill/Tax Invoice Name and Address of The CustomerDocument1 pageBharat Sanchar Nigam Limited: Telephone Bill/Tax Invoice Name and Address of The CustomerARUN CKNo ratings yet

- Bharat Sanchar Nigam Limited: Telephone Bill/Tax InvoiceDocument1 pageBharat Sanchar Nigam Limited: Telephone Bill/Tax InvoicevirendramehraNo ratings yet

- Telephone Number Amount Payable Due Date: Pay NowDocument3 pagesTelephone Number Amount Payable Due Date: Pay NowtrapatialaNo ratings yet

- SupplyOutward CE 028Document1 pageSupplyOutward CE 028skgts787737No ratings yet

- Dem-Prkt 2425 209 97921 131893Document2 pagesDem-Prkt 2425 209 97921 131893prakharjain19940904No ratings yet

- The Prince of Little WorldsDocument3 pagesThe Prince of Little WorldserroraNo ratings yet

- QW1OTXI3YjFzd2VhdlJxSXZ4MHRJZz09 InvoiceDocument2 pagesQW1OTXI3YjFzd2VhdlJxSXZ4MHRJZz09 Invoiceomkar daveNo ratings yet

- Taco 200716DF00030038Document1 pageTaco 200716DF00030038Frank Edwin VedamNo ratings yet

- Sales 67Document1 pageSales 67mahendar chuphalNo ratings yet

- E BillDocument1 pageE BillManglesh SinghNo ratings yet

- 3 Dec 2023Document1 page3 Dec 2023krishsaxena20No ratings yet

- PaymentInvoice Pratyuosh9085 404664Document1 pagePaymentInvoice Pratyuosh9085 404664Pratyuosh SrivastavNo ratings yet

- Calibration Lab Assessment Fee InvoiceDocument1 pageCalibration Lab Assessment Fee InvoiceSharad JainNo ratings yet

- Bharat Sanchar Nigam Limited: Telephone Bill/Tax Invoice Name and Address of The CustomerDocument1 pageBharat Sanchar Nigam Limited: Telephone Bill/Tax Invoice Name and Address of The CustomerMichael VladislavNo ratings yet

- Bhitar Gaon PDFDocument1 pageBhitar Gaon PDFNeha SinghNo ratings yet

- Tax Invoice: Order Number Order DateDocument2 pagesTax Invoice: Order Number Order Datemrshivamsingh1999No ratings yet

- SV Roofing-13Document1 pageSV Roofing-13bikkumalla shivaprasadNo ratings yet

- PaymentInvoice Pratyuosh9085 417925Document1 pagePaymentInvoice Pratyuosh9085 417925Pratyuosh SrivastavNo ratings yet

- Bharat Sanchar Nigam Limited: (A Govt. of India Enterprise)Document1 pageBharat Sanchar Nigam Limited: (A Govt. of India Enterprise)virendramehraNo ratings yet

- WEZHeGk3a1hjWERCR05senlFYW9XQT09 InvoiceDocument2 pagesWEZHeGk3a1hjWERCR05senlFYW9XQT09 Invoiceomkar daveNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNo ratings yet

- GENEROSO PCDocument5 pagesGENEROSO PCJar Jorquia100% (1)

- Chap021newDocument36 pagesChap021newNguyễn Cẩm HươngNo ratings yet

- Analytical Study of Growing Adoption of Digital Payments System With Special Reference To Mumbai CityDocument15 pagesAnalytical Study of Growing Adoption of Digital Payments System With Special Reference To Mumbai Citymuskansingh66126No ratings yet

- Presented By: Sujeeth Joishy K SumalathaDocument15 pagesPresented By: Sujeeth Joishy K SumalathaKiran NayakNo ratings yet

- Documents You Need To Make A Valid Claim of InsuranceDocument5 pagesDocuments You Need To Make A Valid Claim of InsuranceEkta singhNo ratings yet

- Chapter 3 - IA and Corporate Governance STDTDocument23 pagesChapter 3 - IA and Corporate Governance STDTNor Syahra AjinimNo ratings yet

- Millennial Money Next Level Personal FinanceDocument5 pagesMillennial Money Next Level Personal FinancejohnNo ratings yet

- Internship Brochure Year 2020-2022Document32 pagesInternship Brochure Year 2020-2022Jagatguru PowerNo ratings yet

- Accountancy Pre BoardDocument15 pagesAccountancy Pre BoardkenaNo ratings yet

- Unit 8. Accounting For ReceivablesDocument20 pagesUnit 8. Accounting For ReceivablesYonasNo ratings yet

- Ndjy UZEqv MEn DoxkDocument14 pagesNdjy UZEqv MEn DoxkKiran KumarNo ratings yet

- An Alternative Opportunity Set For Absolute Return Outcomes Global Institutional White Paper Part 1 of 2Document24 pagesAn Alternative Opportunity Set For Absolute Return Outcomes Global Institutional White Paper Part 1 of 2Liu BoscoNo ratings yet

- A Summer Internship Project (Sip) PDFDocument69 pagesA Summer Internship Project (Sip) PDFReshma PaidalaNo ratings yet

- LSBF Brochure Masters Finance InvestmentDocument16 pagesLSBF Brochure Masters Finance Investmentmohamedsaleem24No ratings yet

- NBE Amends Forex Allocation Priorities: Oromia Bank Rebrands With Excellence in MindDocument32 pagesNBE Amends Forex Allocation Priorities: Oromia Bank Rebrands With Excellence in MindyechaleNo ratings yet

- Application For Closure of BusinessDocument3 pagesApplication For Closure of BusinessNorberto Cercado50% (2)

- The Cpa Licensure Examination Syllabus Complete)Document8 pagesThe Cpa Licensure Examination Syllabus Complete)Ssan DunqueNo ratings yet

- Bayar Di Awal - Annuity DUE Vs Bayar Di Akhir - ANNUITY ORDINARYDocument5 pagesBayar Di Awal - Annuity DUE Vs Bayar Di Akhir - ANNUITY ORDINARYEriko Timothy GintingNo ratings yet

- ICICIDocument24 pagesICICIPaRas ChAuhanNo ratings yet

- Subject Code 303Document17 pagesSubject Code 303Chatan GiriNo ratings yet

- o CQWyh NZa PVQK 8 WDocument4 pageso CQWyh NZa PVQK 8 WHimanshuNo ratings yet

- Calumpiano - Replacement - Che3Document7 pagesCalumpiano - Replacement - Che3Chill CalumpianoNo ratings yet

- 4th Grading w2 Fabm Las 2Document4 pages4th Grading w2 Fabm Las 210 Hour 10 Minute100% (8)

- Estate Planning Seminar BASICSDocument39 pagesEstate Planning Seminar BASICSNotario PrivadoNo ratings yet

- Revised Poripatra (DPP Format)Document81 pagesRevised Poripatra (DPP Format)gazi sharif100% (7)

- Text Solutions - CH8Document16 pagesText Solutions - CH8Josef Galileo SibalaNo ratings yet

- Loan Recovery StrategyDocument7 pagesLoan Recovery Strategyrecovery cellNo ratings yet

- Actuary MagazineDocument32 pagesActuary MagazineanuiscoolNo ratings yet

GST Tax Invoice 2

GST Tax Invoice 2

Uploaded by

yogende kumar0 ratings0% found this document useful (0 votes)

30 views1 pageOriginal Title

GST_Tax_Invoice_2

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

30 views1 pageGST Tax Invoice 2

GST Tax Invoice 2

Uploaded by

yogende kumarCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

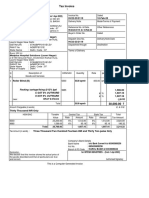

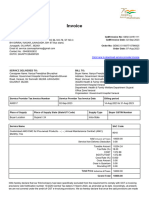

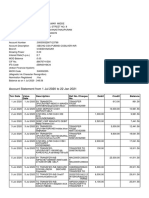

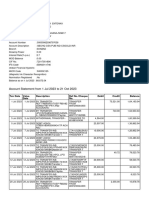

Tax Invoice

ORIGINAL FOR RECIPIENT

Customer Name Invoice No.

vijai RBSC006438650

Customer Address

Jaipur (Rajasthan), Rajasthan

GSTIN (in case of Corporate

Invoice Date

customer)

N/A 28/04/2023

Against Advance receipt

RBAR006947820

HSN Place of Supply

998551 Rajasthan

Description of Services Ticket Number Booked Date

Reservation services for transportation TS5T52006838 27/04/2023

Particulars Amount (in INR) Amount (in INR)

Bus Operator Fare (a) 1,680.00

Insurance Charges (b) 0.51

Relief Fund (c) N/A

redBus charges and fees (d) 15.67

redBus Assurance Program 15.67

redPass

Convenience Fees 0.00

Less: Reversal 0.00

CGST @ 9% 0.0

SGST @ 9% 0.0

IGST @ 18% 2.82

Total Discount 0.00

Net amount (a+b+c+d) 1,695.67

Tax is payable on reverse charge mechanism -

NO

For IBIBO GROUP PRIVATE LIMITED

PAN AAHCP1178L

GSTIN 29AAHCP1178L1ZW

CIN U72200DL2006PTC271373

IBIBO GROUP PVT LTD(redbus), leela

galleria, 5th floor, leela galleria,

Reg. Address municipal 23, airport road, hal II stage,

Kodihalli, Bengaluru (Bangalore) Urban,

Karnataka, 560008

Email Id hq_finance@redbus.in

Website www.redbus.in, www.seatseller.travel

"We hereby declare that though our aggregate turnover in any preceding financial year from 2017-18 onwards is more than

the aggregate turnover notified under sub-rule (4) of rule 48 , we are not required to prepare an invoice in terms of the

provisions of the said sub-rule."

This is a computer generated invoice. So no signature required

You might also like

- The Ultimate Guide To P2P Lending PDFDocument112 pagesThe Ultimate Guide To P2P Lending PDFArthur Liew100% (1)

- Assessment - BSBFIA401Document10 pagesAssessment - BSBFIA401Sabah Khan RajaNo ratings yet

- Volvo TicketDocument1 pageVolvo TicketVipin TiwariNo ratings yet

- Drapur Jalandhar GST - Tax - Invoice - 2Document1 pageDrapur Jalandhar GST - Tax - Invoice - 2ashuwillusinfraNo ratings yet

- GST Tax Invoice 2Document1 pageGST Tax Invoice 2sreeharshanNo ratings yet

- Bangalore To Bellary - Bus TicketDocument2 pagesBangalore To Bellary - Bus Ticketyerrisiddappa KNo ratings yet

- GST Tax Invoice 2Document1 pageGST Tax Invoice 2Rahul GhugeNo ratings yet

- Trip - ErodeDocument1 pageTrip - ErodeS.R.ANEESHNo ratings yet

- GST Tax Invoice 2Document1 pageGST Tax Invoice 2Sant GhoshNo ratings yet

- GST Tax InvoiceDocument1 pageGST Tax InvoiceSunnyNo ratings yet

- GST Tax InvoiceDocument1 pageGST Tax Invoicesuhasmore698No ratings yet

- This Is A Computer Generated Invoice. So No Signature RequiredDocument1 pageThis Is A Computer Generated Invoice. So No Signature Requiredsinghvikram8No ratings yet

- GST - Tax - Invoice - CH To PondyDocument1 pageGST - Tax - Invoice - CH To PondysaranNo ratings yet

- This Is A Computer Generated Invoice. So No Signature RequiredDocument1 pageThis Is A Computer Generated Invoice. So No Signature RequiredHari kantNo ratings yet

- Sanitiser Tax InvoiceDocument1 pageSanitiser Tax InvoiceSanjeev RanjanNo ratings yet

- Ishan Netsol Private Limited: Tax InvoiceDocument2 pagesIshan Netsol Private Limited: Tax InvoiceSunil Patel100% (1)

- Bharat Sanchar Nigam Limited: Telephone Bill/Tax InvoiceDocument1 pageBharat Sanchar Nigam Limited: Telephone Bill/Tax InvoicevirendramehraNo ratings yet

- Bharat Sanchar Nigam Limited: Telephone Bill/Tax InvoiceDocument1 pageBharat Sanchar Nigam Limited: Telephone Bill/Tax InvoiceBSCPLCHDNo ratings yet

- ElectricityAndMaintenance Bill PDFDocument1 pageElectricityAndMaintenance Bill PDFRaja VasdevanNo ratings yet

- Dem-Soho 2324 208 75508 100469Document2 pagesDem-Soho 2324 208 75508 100469Ayush ChouhanNo ratings yet

- January 2019 BillDocument1 pageJanuary 2019 BillYugandhara Rao NookaNo ratings yet

- Bharat Sanchar Nigam Limited: Duplicate Telephone Bill Name and Address of The CustomerDocument1 pageBharat Sanchar Nigam Limited: Duplicate Telephone Bill Name and Address of The Customersatish kumarNo ratings yet

- Goods & Services Tax (GST) - GSTR2B122Document2 pagesGoods & Services Tax (GST) - GSTR2B122rauniyar97No ratings yet

- SZ Dap 0000150756Document1 pageSZ Dap 0000150756paramessh666No ratings yet

- Inv RJ B1 115172343 118696123851 February 2024Document2 pagesInv RJ B1 115172343 118696123851 February 2024Ishika TiwariNo ratings yet

- Bharat Sanchar Nigam Limited: Telephone Bill/Tax Invoice Name and Address of The CustomerDocument1 pageBharat Sanchar Nigam Limited: Telephone Bill/Tax Invoice Name and Address of The CustomerPramod Kumar GuptaNo ratings yet

- PDFstatement 25Document3 pagesPDFstatement 25Navneesh Singh YadavNo ratings yet

- Bharat Sanchar Nigam Limited: Telephone Bill/Tax Invoice Name and Address of The CustomerDocument1 pageBharat Sanchar Nigam Limited: Telephone Bill/Tax Invoice Name and Address of The Customermohammed sahadNo ratings yet

- Bharat Sanchar Nigam Limited: Telephone Bill/Tax InvoiceDocument1 pageBharat Sanchar Nigam Limited: Telephone Bill/Tax InvoicevirendramehraNo ratings yet

- Medplus 2119Document1 pageMedplus 2119Moseen AliNo ratings yet

- Vercomm 01478906Document2 pagesVercomm 01478906SHIVAM KUMARNo ratings yet

- Tax Invoice: Medplus Hospital Solutions (Laxmi Nagar)Document1 pageTax Invoice: Medplus Hospital Solutions (Laxmi Nagar)Moseen AliNo ratings yet

- Telephone No Amount Payable Due Date: Pay NowDocument3 pagesTelephone No Amount Payable Due Date: Pay NowPranav SanadhyaNo ratings yet

- VJ - Digital Demand For O3INV-00372-23 - 20230218T031404875Document1 pageVJ - Digital Demand For O3INV-00372-23 - 20230218T031404875Hardik RavalNo ratings yet

- Original: N 0006808736 - Issue Date 17.08.2017Document1 pageOriginal: N 0006808736 - Issue Date 17.08.2017Soham ChaudhuriNo ratings yet

- Bharat Sanchar Nigam Limited: Telephone Bill/Tax InvoiceDocument1 pageBharat Sanchar Nigam Limited: Telephone Bill/Tax InvoiceAshish KumarNo ratings yet

- Detailed Computation BDJPS7350C 1870960 Old Regime 20230730161927Document4 pagesDetailed Computation BDJPS7350C 1870960 Old Regime 20230730161927suman.singh08031992No ratings yet

- Invoice 1197533231 I0107P2306071093Document1 pageInvoice 1197533231 I0107P2306071093ankit.kocharNo ratings yet

- Invoice Voucher 000004852 SaTCycGA 614300Document2 pagesInvoice Voucher 000004852 SaTCycGA 614300Tanu Priya SonkarNo ratings yet

- My - Bill - 26 Aug, 2020 - 25 Sep, 2020 - 9306127820Document15 pagesMy - Bill - 26 Aug, 2020 - 25 Sep, 2020 - 9306127820Vivek SharmaNo ratings yet

- Telephone No Amount Payable Due Date: Bill Mail Service Tax InvoiceDocument3 pagesTelephone No Amount Payable Due Date: Bill Mail Service Tax Invoicepravingosavi1011_578No ratings yet

- Bharat Sanchar Nigam Limited: Telephone Bill/Tax Invoice Name and Address of The CustomerDocument1 pageBharat Sanchar Nigam Limited: Telephone Bill/Tax Invoice Name and Address of The CustomerARUN CKNo ratings yet

- Bharat Sanchar Nigam Limited: Telephone Bill/Tax InvoiceDocument1 pageBharat Sanchar Nigam Limited: Telephone Bill/Tax InvoicevirendramehraNo ratings yet

- Telephone Number Amount Payable Due Date: Pay NowDocument3 pagesTelephone Number Amount Payable Due Date: Pay NowtrapatialaNo ratings yet

- SupplyOutward CE 028Document1 pageSupplyOutward CE 028skgts787737No ratings yet

- Dem-Prkt 2425 209 97921 131893Document2 pagesDem-Prkt 2425 209 97921 131893prakharjain19940904No ratings yet

- The Prince of Little WorldsDocument3 pagesThe Prince of Little WorldserroraNo ratings yet

- QW1OTXI3YjFzd2VhdlJxSXZ4MHRJZz09 InvoiceDocument2 pagesQW1OTXI3YjFzd2VhdlJxSXZ4MHRJZz09 Invoiceomkar daveNo ratings yet

- Taco 200716DF00030038Document1 pageTaco 200716DF00030038Frank Edwin VedamNo ratings yet

- Sales 67Document1 pageSales 67mahendar chuphalNo ratings yet

- E BillDocument1 pageE BillManglesh SinghNo ratings yet

- 3 Dec 2023Document1 page3 Dec 2023krishsaxena20No ratings yet

- PaymentInvoice Pratyuosh9085 404664Document1 pagePaymentInvoice Pratyuosh9085 404664Pratyuosh SrivastavNo ratings yet

- Calibration Lab Assessment Fee InvoiceDocument1 pageCalibration Lab Assessment Fee InvoiceSharad JainNo ratings yet

- Bharat Sanchar Nigam Limited: Telephone Bill/Tax Invoice Name and Address of The CustomerDocument1 pageBharat Sanchar Nigam Limited: Telephone Bill/Tax Invoice Name and Address of The CustomerMichael VladislavNo ratings yet

- Bhitar Gaon PDFDocument1 pageBhitar Gaon PDFNeha SinghNo ratings yet

- Tax Invoice: Order Number Order DateDocument2 pagesTax Invoice: Order Number Order Datemrshivamsingh1999No ratings yet

- SV Roofing-13Document1 pageSV Roofing-13bikkumalla shivaprasadNo ratings yet

- PaymentInvoice Pratyuosh9085 417925Document1 pagePaymentInvoice Pratyuosh9085 417925Pratyuosh SrivastavNo ratings yet

- Bharat Sanchar Nigam Limited: (A Govt. of India Enterprise)Document1 pageBharat Sanchar Nigam Limited: (A Govt. of India Enterprise)virendramehraNo ratings yet

- WEZHeGk3a1hjWERCR05senlFYW9XQT09 InvoiceDocument2 pagesWEZHeGk3a1hjWERCR05senlFYW9XQT09 Invoiceomkar daveNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNo ratings yet

- GENEROSO PCDocument5 pagesGENEROSO PCJar Jorquia100% (1)

- Chap021newDocument36 pagesChap021newNguyễn Cẩm HươngNo ratings yet

- Analytical Study of Growing Adoption of Digital Payments System With Special Reference To Mumbai CityDocument15 pagesAnalytical Study of Growing Adoption of Digital Payments System With Special Reference To Mumbai Citymuskansingh66126No ratings yet

- Presented By: Sujeeth Joishy K SumalathaDocument15 pagesPresented By: Sujeeth Joishy K SumalathaKiran NayakNo ratings yet

- Documents You Need To Make A Valid Claim of InsuranceDocument5 pagesDocuments You Need To Make A Valid Claim of InsuranceEkta singhNo ratings yet

- Chapter 3 - IA and Corporate Governance STDTDocument23 pagesChapter 3 - IA and Corporate Governance STDTNor Syahra AjinimNo ratings yet

- Millennial Money Next Level Personal FinanceDocument5 pagesMillennial Money Next Level Personal FinancejohnNo ratings yet

- Internship Brochure Year 2020-2022Document32 pagesInternship Brochure Year 2020-2022Jagatguru PowerNo ratings yet

- Accountancy Pre BoardDocument15 pagesAccountancy Pre BoardkenaNo ratings yet

- Unit 8. Accounting For ReceivablesDocument20 pagesUnit 8. Accounting For ReceivablesYonasNo ratings yet

- Ndjy UZEqv MEn DoxkDocument14 pagesNdjy UZEqv MEn DoxkKiran KumarNo ratings yet

- An Alternative Opportunity Set For Absolute Return Outcomes Global Institutional White Paper Part 1 of 2Document24 pagesAn Alternative Opportunity Set For Absolute Return Outcomes Global Institutional White Paper Part 1 of 2Liu BoscoNo ratings yet

- A Summer Internship Project (Sip) PDFDocument69 pagesA Summer Internship Project (Sip) PDFReshma PaidalaNo ratings yet

- LSBF Brochure Masters Finance InvestmentDocument16 pagesLSBF Brochure Masters Finance Investmentmohamedsaleem24No ratings yet

- NBE Amends Forex Allocation Priorities: Oromia Bank Rebrands With Excellence in MindDocument32 pagesNBE Amends Forex Allocation Priorities: Oromia Bank Rebrands With Excellence in MindyechaleNo ratings yet

- Application For Closure of BusinessDocument3 pagesApplication For Closure of BusinessNorberto Cercado50% (2)

- The Cpa Licensure Examination Syllabus Complete)Document8 pagesThe Cpa Licensure Examination Syllabus Complete)Ssan DunqueNo ratings yet

- Bayar Di Awal - Annuity DUE Vs Bayar Di Akhir - ANNUITY ORDINARYDocument5 pagesBayar Di Awal - Annuity DUE Vs Bayar Di Akhir - ANNUITY ORDINARYEriko Timothy GintingNo ratings yet

- ICICIDocument24 pagesICICIPaRas ChAuhanNo ratings yet

- Subject Code 303Document17 pagesSubject Code 303Chatan GiriNo ratings yet

- o CQWyh NZa PVQK 8 WDocument4 pageso CQWyh NZa PVQK 8 WHimanshuNo ratings yet

- Calumpiano - Replacement - Che3Document7 pagesCalumpiano - Replacement - Che3Chill CalumpianoNo ratings yet

- 4th Grading w2 Fabm Las 2Document4 pages4th Grading w2 Fabm Las 210 Hour 10 Minute100% (8)

- Estate Planning Seminar BASICSDocument39 pagesEstate Planning Seminar BASICSNotario PrivadoNo ratings yet

- Revised Poripatra (DPP Format)Document81 pagesRevised Poripatra (DPP Format)gazi sharif100% (7)

- Text Solutions - CH8Document16 pagesText Solutions - CH8Josef Galileo SibalaNo ratings yet

- Loan Recovery StrategyDocument7 pagesLoan Recovery Strategyrecovery cellNo ratings yet

- Actuary MagazineDocument32 pagesActuary MagazineanuiscoolNo ratings yet