Professional Documents

Culture Documents

Agriculture and Microfinance Syllabus of AIBB Diploma

Agriculture and Microfinance Syllabus of AIBB Diploma

Uploaded by

Arash Ahmed BadhonOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Agriculture and Microfinance Syllabus of AIBB Diploma

Agriculture and Microfinance Syllabus of AIBB Diploma

Uploaded by

Arash Ahmed BadhonCopyright:

Available Formats

Agriculture & Microfinance (AM)

Full Marks: 100

Module A: Agriculture Finance

Nature, Approaches and Need for Agricultural Finance, Institutional and Non-Institutional Sources,

Types of Agri-finance-Crop and Non-Crop, Agro-Based Project Financing - Procedures and

Collaterals in Agri-finance Problems of Agri-finance- Role of Commercial Bank and Bangladesh

Bank in Agri-finance - Monitoring and Recovery of Agricultural Credit - Public Demand Recovery

Act - Sector and Sub-Sector of Agricultural Finance - Methods of Agricultural Credits Disbursements

- Use of IT in Agricultural Credits - Role of Banks in Agriculture Sector Financing - Regulatory

Policies for Agricultural and Farm Sector Financing.

Module B: Micro Credit and Micro Finance: Evolution, Legal Framework and Products

Historical Development of Micro Credit, Micro Credit and Micro Finance, Micro Credit and Poverty

Alleviation. Government Policy and Legal Framework Regarding Micro Finance in Bangladesh,

Micro Credit Regulatory Authority (MRA) in Bangladesh, Requirements of Collateral Security,

Collateral Substitutes, Saving-Compulsory Deposit System, Insurance, Payment Services, Social

Intermediation, Enterprise Development Services.

Module C: Micro Financial Institutions (MFIs)

Micro Financial Institutions and their Objectives, Target Market and Impact Analysis, Formal, Semi-

Formal and Informal Financial Institutions, Institutional Growth and Transformation, Linkages

Among Different Types of MFIs and between Banks and MFIs. Social Services of the MFIs.

Module D: Working Capital, Special and Priority Sector Financing

Working Capital Assessment for Fishery, Poultry, Dairy, etc. Finance in High Value Crops, Tissue

Culture, Oil Palm Cultivation, Nursery, Salt Cultivation, Cereal Cultivation, Silk Cultivation, Roof-

top Gardening, Mushroom Cultivation, Betel Leaf Cultivation, etc.Value Chain - Developing

Commodity Markets.

Module E: Role of Specialized Banks (SBs) and MFIs in Rural Finance and Poverty Alleviation in

Bangladesh

Role of BKB, RAKUB, Grameen Bank, BRAC, ASA, PRASHIKA, BRDB and PKSF as the

Micro/Rural Financial Institutions in poverty alleviation

Module F: Performance Assessment of SBs and MFIs

Repayment Rates, Financial Viability, Profitability, Leverage and Capital Adequacy, Borrowers

Viability and Poverty Alleviation.

References:

1. Bangladesh Bank, BKB, RAKUB & PKSF: Annual Reports.

2. Ledgerwood, Joanna. Micro Finance Handbook- An Institutional and Financial Perspective, The

WorldBank Washington D.C

3. Wood, Geoffrey D and Sharif, Ifath A, (Ed.). Who Needs Credit-Poverty and Finance in Bangladesh,

UPL,Dhaka.

4. Agricultural and Rural Credit Policy and Programme

You might also like

- A Short Report On UCB of HRMDocument23 pagesA Short Report On UCB of HRMPeterson0% (1)

- School Banking in Bangladesh: Present Status and ProspectsDocument18 pagesSchool Banking in Bangladesh: Present Status and Prospectskamrulbony100% (4)

- FXTM - Model Question PaperDocument36 pagesFXTM - Model Question PaperRajiv Warrier0% (1)

- The Term Alternate Delivery ChannelDocument4 pagesThe Term Alternate Delivery ChannelIftekhar Abid Fahim100% (1)

- Banking Notes Functions of BanksDocument17 pagesBanking Notes Functions of Banksbestread67No ratings yet

- Rural Development Scheme of Islami Bank BangladeshDocument66 pagesRural Development Scheme of Islami Bank Bangladeshyeasmin mituNo ratings yet

- All MCQDocument6 pagesAll MCQChabala LwandoNo ratings yet

- MCQ of Banking CompanyDocument2 pagesMCQ of Banking Companydr SanjayNo ratings yet

- Women Entrepreneurs in Smes Bangladesh PerspectiveDocument332 pagesWomen Entrepreneurs in Smes Bangladesh PerspectiveUsa 2021No ratings yet

- Banking Reforms - 1991Document9 pagesBanking Reforms - 1991Ashley MathewNo ratings yet

- Branch Banking PDFDocument4 pagesBranch Banking PDFAbdul BasitNo ratings yet

- B2B L - CDocument25 pagesB2B L - C12-057 MOHAMMAD MUSHFIQUR RAHMANNo ratings yet

- EBL Annual Report 2018Document308 pagesEBL Annual Report 2018TasnimulNo ratings yet

- Governance in Financial Institutions (GFI) - Question SolutionDocument11 pagesGovernance in Financial Institutions (GFI) - Question Solutionnajneen khatunNo ratings yet

- Question Bank 1 Jan 2019Document5 pagesQuestion Bank 1 Jan 2019jitendra singhNo ratings yet

- Banking NotesDocument12 pagesBanking NotesChiranjive Ravindra JagadalNo ratings yet

- SME Division of DBBLDocument19 pagesSME Division of DBBLerfan441790100% (6)

- 1673157644sample Business Letters Promo FormatDocument5 pages1673157644sample Business Letters Promo FormatIshan PalNo ratings yet

- Digital Banking QuestionsDocument8 pagesDigital Banking QuestionsRakesh KushwahaNo ratings yet

- Du OMR Sheet PDFDocument2 pagesDu OMR Sheet PDFfarhanmajumder420No ratings yet

- Corruption in Banking Sector of BangladeshDocument3 pagesCorruption in Banking Sector of BangladeshMezbaul Haider Shawon50% (4)

- Role of Financial Intelligence in Resolving CrimeDocument4 pagesRole of Financial Intelligence in Resolving CrimeChawandanNo ratings yet

- Payyyyyying Banker and Collllllecting Banker by Chu PersonDocument59 pagesPayyyyyying Banker and Collllllecting Banker by Chu PersonSahirAaryaNo ratings yet

- Study Material Updated (30.01.16) .Doc - 1541698900069Document37 pagesStudy Material Updated (30.01.16) .Doc - 1541698900069vikasm4uNo ratings yet

- This Report Is To Analysis Credit Risk Management of Eastern Bank LimitedDocument30 pagesThis Report Is To Analysis Credit Risk Management of Eastern Bank Limitedশফিকুল ইসলাম লিপুNo ratings yet

- General Banking Activities of Mutual Trust Bank LTD.: A Comparative Study On Five Commercial Banks in BangladeshDocument47 pagesGeneral Banking Activities of Mutual Trust Bank LTD.: A Comparative Study On Five Commercial Banks in BangladeshMoyan HossainNo ratings yet

- Risk Management in BanksDocument26 pagesRisk Management in BanksDivya Keswani0% (1)

- DAY - NULM (DAY - National Urban Livelihoods Mission) 'राष्ट्रीय शहरी आजीविका मिशन'Document9 pagesDAY - NULM (DAY - National Urban Livelihoods Mission) 'राष्ट्रीय शहरी आजीविका मिशन'Abinash MandilwarNo ratings yet

- Credit Questions Summarized (Final Dose)Document40 pagesCredit Questions Summarized (Final Dose)uttamdas79No ratings yet

- Consumer Banking - BNK603 Spring 2010 Final Term PaperDocument4 pagesConsumer Banking - BNK603 Spring 2010 Final Term PaperBint e HawaNo ratings yet

- Final Digital Banking of Services The City Bank Limited-Mahfuz RahmanDocument48 pagesFinal Digital Banking of Services The City Bank Limited-Mahfuz Rahmanhitech.mahfuzNo ratings yet

- 1001 Questions For Last Moment Banking PreparationsDocument35 pages1001 Questions For Last Moment Banking PreparationsAparajito SethNo ratings yet

- CRM in Banking IndustryDocument16 pagesCRM in Banking IndustrypriteshhegdeNo ratings yet

- Asset Liability Management in BanksDocument8 pagesAsset Liability Management in Bankskpved92No ratings yet

- Basel NormsDocument16 pagesBasel Normsdeeksha vNo ratings yet

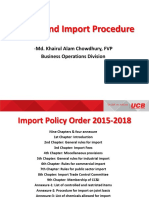

- Export and Import Procedure PDFDocument18 pagesExport and Import Procedure PDFJubaida Alam JuthyNo ratings yet

- Promn Exam MCQs 23-01-2022 - 5470497Document17 pagesPromn Exam MCQs 23-01-2022 - 5470497Ghanshyam KumarNo ratings yet

- Banking and Financial Services - Vi Sem - BbaDocument24 pagesBanking and Financial Services - Vi Sem - BbaGowthamSathyamoorthySNo ratings yet

- Strategic Credit Management - IntroductionDocument14 pagesStrategic Credit Management - IntroductionDr VIRUPAKSHA GOUD G50% (2)

- RECALLED QUESTIONS (2016-18) : (Ibps Different Banks Promotion Test)Document11 pagesRECALLED QUESTIONS (2016-18) : (Ibps Different Banks Promotion Test)Arun PrakashNo ratings yet

- SME Financing in Bangladesh NewDocument42 pagesSME Financing in Bangladesh NewDrubo Sobur100% (1)

- RATIO ANALYSIS MCQsDocument9 pagesRATIO ANALYSIS MCQsAS GamingNo ratings yet

- SME Business Division: Question BankDocument26 pagesSME Business Division: Question BankKawoser AhammadNo ratings yet

- Growth of Private Commercial Banks in BangladeshDocument15 pagesGrowth of Private Commercial Banks in Bangladeshantara nodiNo ratings yet

- Day 1 1.1 Session-1 1.2 Banking System in India: AnswersDocument51 pagesDay 1 1.1 Session-1 1.2 Banking System in India: AnswersAkella LokeshNo ratings yet

- Banking Law and Practice Units-2Document52 pagesBanking Law and Practice Units-2പേരില്ലോക്കെ എന്തിരിക്കുന്നുNo ratings yet

- Material For Pre-Prom-Officers-2018 - Final PDFDocument292 pagesMaterial For Pre-Prom-Officers-2018 - Final PDFRahulNo ratings yet

- Mrunal Sir Latest 2020 Handout 3 PDFDocument19 pagesMrunal Sir Latest 2020 Handout 3 PDFdaljit singhNo ratings yet

- Jaiib Sample QuestionsDocument4 pagesJaiib Sample Questionskubpyg100% (1)

- Syllabus Banking Diploma, IBB 5Document2 pagesSyllabus Banking Diploma, IBB 5sohanantashaNo ratings yet

- Mobilization of FundsDocument2 pagesMobilization of FundsSidra SidNo ratings yet

- Economy of BangladeshDocument15 pagesEconomy of BangladeshMohaiminul Islam TalhaNo ratings yet

- Prudential Regulations For Corporate BankingDocument97 pagesPrudential Regulations For Corporate BankingWaqas ShaikhNo ratings yet

- Principles and Practices of Banking - JAIIB: Timing: 3 HoursDocument20 pagesPrinciples and Practices of Banking - JAIIB: Timing: 3 HoursMallikarjuna RaoNo ratings yet

- Promotion March2016 Final Updated Upto 24-02-2016Document147 pagesPromotion March2016 Final Updated Upto 24-02-2016pankaj gargNo ratings yet

- Recent Trend of NPL in Banking SectorDocument14 pagesRecent Trend of NPL in Banking SectorAbid HasanNo ratings yet

- MCQ For Bank PromotionDocument12 pagesMCQ For Bank PromotionRahul GadheNo ratings yet

- AgricultureDocument2 pagesAgriculturemajidmamunsirajulNo ratings yet

- UntitledDocument220 pagesUntitledPallabKumarNo ratings yet

- Rural FinanceDocument6 pagesRural FinancepantsonupantNo ratings yet

- Push Pull System Spring 2014Document25 pagesPush Pull System Spring 2014Mohammad OkourNo ratings yet

- Counterparty Credit Exposure and CVA - An Intergrated Approch (UBS)Document34 pagesCounterparty Credit Exposure and CVA - An Intergrated Approch (UBS)Mo MokNo ratings yet

- RCM Base Development With Equipment Asset Management&Diagnostic Strategy & Integration With Industry / Maintenance 4.0 ModuleDocument5 pagesRCM Base Development With Equipment Asset Management&Diagnostic Strategy & Integration With Industry / Maintenance 4.0 Modulearunava1No ratings yet

- Adsense Tips: (Collection of Adsense Tips and How To Articles) This Book Is Compiled byDocument46 pagesAdsense Tips: (Collection of Adsense Tips and How To Articles) This Book Is Compiled byJ.Ulrich Mamphayssou N'GUESSANNo ratings yet

- Developing Sustainable Tourism Product For Sailing Sapa Homestay - Rational ReportDocument73 pagesDeveloping Sustainable Tourism Product For Sailing Sapa Homestay - Rational ReportQTKD 4D-18 Vuong Thuy TrangNo ratings yet

- Curriculam Vitae: Vemula Govinda Raju Personal DataDocument3 pagesCurriculam Vitae: Vemula Govinda Raju Personal DataAJAYNo ratings yet

- Sad ProjectDocument48 pagesSad Projectsamidabala2No ratings yet

- Bs en 12Document10 pagesBs en 12Alvin BadzNo ratings yet

- Expiry Product ManagementDocument1 pageExpiry Product Managementahsanuladib018No ratings yet

- Online Voting SystemDocument73 pagesOnline Voting SystemselbalNo ratings yet

- Capability Statement July 2020 A4Document6 pagesCapability Statement July 2020 A4Nuraiym NetullinaNo ratings yet

- FortiGate-70D 17 PDFDocument4 pagesFortiGate-70D 17 PDFalejo8888No ratings yet

- Final Tax Rates 2023Document1 pageFinal Tax Rates 2023Mycah AliahNo ratings yet

- Digest - Mendiola Vs CADocument1 pageDigest - Mendiola Vs CAremraseNo ratings yet

- IBYBDocument615 pagesIBYBgraphicartistNo ratings yet

- Gratittude Manufacturing Company Post-Closing Trial Balance DECEMBER 31, 2017Document3 pagesGratittude Manufacturing Company Post-Closing Trial Balance DECEMBER 31, 2017Charles TuazonNo ratings yet

- Spa BretañaDocument1 pageSpa BretañaPascual Law OfficeNo ratings yet

- Kalkidan Melaku Assignment 2Document5 pagesKalkidan Melaku Assignment 2KalkidanNo ratings yet

- Class PPT DesignsDocument78 pagesClass PPT DesignsZubairNo ratings yet

- SISUWA SISAGHAT-Final-Report-finalDocument94 pagesSISUWA SISAGHAT-Final-Report-finalSaugat ThapaNo ratings yet

- BSBHRM415 Assessment 3Document24 pagesBSBHRM415 Assessment 3Michael FelixNo ratings yet

- Managing Public Money: July 2013 With Annexes Revised As at March 2018Document61 pagesManaging Public Money: July 2013 With Annexes Revised As at March 2018librekaNo ratings yet

- Rek AprDocument2 pagesRek AprekapilarahayuNo ratings yet

- Azure Migrate Secrets by FerryDocument17 pagesAzure Migrate Secrets by FerryFaherNo ratings yet

- 11 CGP Module 3Document8 pages11 CGP Module 3John Paul ColibaoNo ratings yet

- 8 - PP V Diaz Conde Digest 1922Document2 pages8 - PP V Diaz Conde Digest 1922Digesting FactsNo ratings yet

- 20230225DSLG2088Document33 pages20230225DSLG2088Tubai BhattacharjeeNo ratings yet

- Pfrs 13 Fair Value MeasurementDocument22 pagesPfrs 13 Fair Value MeasurementShane PasayloNo ratings yet

- Esewa Final Project 1Document31 pagesEsewa Final Project 1spikerohit44No ratings yet

- Fashion Services and Resources NotesDocument11 pagesFashion Services and Resources Notesben makoreNo ratings yet