Professional Documents

Culture Documents

M - A Block Week Syllabus Summer 2023

M - A Block Week Syllabus Summer 2023

Uploaded by

Christopher JacksonOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

M - A Block Week Syllabus Summer 2023

M - A Block Week Syllabus Summer 2023

Uploaded by

Christopher JacksonCopyright:

Available Formats

COLUMBIA UNIVERSITY GRADUATE SCHOOL OF BUSINESS

Note: Attendance at first class is mandatory for continued enrollment in the course.

Mergers & Acquisitions Block Week Summer 2023

Donna M. Hitscherich

Content and Objective:

This course is designed to be an applications-oriented course and will draw heavily upon real

world change of control case studies. The course builds on the prior courses in corporate

finance. The course will not introduce significantly new finance principles or analytical

techniques other than those to which the student has been exposed to previously in the

prerequisite introductory courses in finance at Columbia. The course will seek to apply basic

finance principles and analytical techniques to actual problems likely to be encountered by senior

management of major corporations or those who are the advisors to such management in the

context of an M&A transaction.

At the conclusion of the course, the student will have gained an appreciation for the role M&A

plays on today’s corporate landscape and have formed an opinion as to whether or not an M&A

transaction “makes sense” for the firm. The student should expect at the conclusion of this

course to have gained a level of competency in M&A commensurate with an entry-level

investment banking associate in M&A. Whether or not the student “practices” M&A, the course

will afford the student with an insider’s look into what is an undeniable major force on today’s

corporate landscape. Accordingly, students who are interested in investment banking,

consulting, equity research, corporate development, corporate lending, strategic planning, private

equity, leveraged finance, or proprietary trading may wish to consider this course.

Major topics covered will include:

• Introduction to M&A: What exactly is M&A? What are the major forces driving each

of domestic and international M&A activity? What is the likely future of M&A activity?

Who are the major players on the M&A landscape and what are their incentives? What, if

any, value does an M&A banker bring to a transaction? What are the “rules” governing

the M&A playing field and do such rules sufficiently “protect” shareholders?

• Strategic and Practical Considerations: What is the process timeline for an M&A

transaction? How is an M&A idea originated and what is the process from origination to

closing? What role do synergies play in M&A analysis? Why is it important to perform

a pro forma “merger consequences” analysis? What are the important tactical

considerations before approaching a potential target?

• Valuation Basics: How is a company valued? What is the purpose of valuation

analysis, including stand-alone value, “synergy” value and break-up value? How do

marketplace dynamics impact valuation? What factors may cause “intrinsic” value and

“realizable” value to diverge?

M&A Syllabus - Donna M. Hitscherich Page 1

• Due Diligence: How do you conduct effective due diligence? Who should you talk to?

What should you ask for? What is the target likely to be looking for in terms of

Confidentiality and Standstill Agreements? What should you be looking for in the

documents produced? Who is responsible for what and how can accountants, bankers,

consultants, and lawyers help? How do the results of due diligence impact valuation?

• Financing Decisions: How does the transaction get financed? What macro and micro

factors impact M&A financing? What are the major financing alternatives from senior

secured debt to high yield? How will an acquisition impact the acquiring company's debt

rating, EPS and stock price and why does it matter?

• Transaction Structures: What forms can a transaction take and how do they differ?

What is a tender offer? What is the difference between a one-step and two-step deal?

How do tax factors influence the choice of transaction structure?

• Anatomy of a Merger Agreement: What are the basic components of the Merger

Agreement? How does the Merger Agreement relate to the due diligence process? How

do you “protect” a friendly deal from interlopers (i.e., lock-ups and “no-shops”)?

• Restructuring Options: What are the alternatives available to the firm to “unlock”

shareholder value, including mechanics of the divestiture process and maximization of

after-tax proceeds, straight sale, leveraged joint ventures, letter stock, rights offerings,

spin-offs, Morris Trusts, spin-outs, and split-offs? When should a firm consider “going

private,” including mechanics of an LBO, what constitutes a good LBO candidate and

exit strategies for the LBO?

• Takeover Defense: What makes a company vulnerable? What are the major “defense”

mechanisms, and do they work? How do you launch a hostile bid? How are the recent

SEC and FASB “rules” likely to change the “hostile” landscape?

Class work:

Class topics will be imparted through lectures, assigned reading materials, required written case

studies, and presentations by various investment banking and legal professionals. Students will

be expected to complete each of the assigned readings prior to class and consequently, be in

a position to participate meaningfully in class discussions. Class lectures will focus on the

"mechanics" of M&A, while student discussions will focus on the implications of the

"mechanics" on practical and real-world issues associated with an M&A transaction. While each

student must turn in his/her own individual work, students are encouraged strongly to work in

groups on the required case studies.

Examinations:

This course will require: (1) individual completion of certain materials administered prior to the

start of the first class session (the “Pre-Test”); (2) individual submission of a daily one page

summary of the key ideas (as determined by the student) presented in each class session (the

M&A Syllabus - Donna M. Hitscherich Page 2

“Daily Summaries”), individual postings to the daily Discussion Questions (“Discussion

Questions); (3) group case study presentations and write-ups (the “Assigned Team Case

Presentations”); (4) individual short assignments in preparation for the outside speakers

(“Outside Speaker Prep”); and (5) individual completion of a take-home final exam (the “Final

Exam”). Due dates for the class work will be posted to the course web site in the Class

Schedule. All assignments are due on the date indicated. Late assignments will not be

accepted for credit.

Evaluation of Performance:

Student grades will be based on the following formula: (1) Pre-Test (20%); (2) Daily Summaries,

Discussion Questions and Outside Speaker Prep (30%); (4) Assigned Team Case Presentations

(20%); and (5) Final Exam (30%). All assignments are due on the date indicated. Late

assignments will not be accepted for credit.

Honor Code and Academic Conduct:

All materials distributed for this course whether in hard copy or through the course web site, are

to be used only by students registered for this course and for work in this course only.

Electronic distribution of the materials by the student or other publication thereof (in electronic

form or otherwise) may constitute a legal infringement of certain copyrights held by the

professor and/or other contributors to the materials. Students should also note that in preparing

assignments it will be considered a violation of the Honor Code to utilize solutions prepared by

former students in this class.

Readings:

Reading assignments must be completed prior to class. Before the next class, class time will

be devoted to previewing the next assignment and the key concepts thereof. Reading

assignments are designed to support the case materials, which will form the basis of the class

discussions. Class discussions constitute an integral part of the course and prior

preparation of the assignments is essential.

Necessary Course Materials:

Students must have the following materials for this course:

Case Materials for Mergers and Acquisitions (Donna M. Hitscherich © 2000-2023) (the “M&A

Case Materials”). Available on Canvas.

Reed & Lajoux, The Art of M&A: A Merger Acquisition Buyout Guide (McGraw-Hill)

The M&A Case Materials are designed to be self-contained and to serve as lecture notes for the

designated classes. The textbook readings are suggested for the reference of the students. The

suggested textbook readings should provide additional support for the M&A Case Materials

rather than introduce new material.

M&A Syllabus - Donna M. Hitscherich Page 3

Review Materials:

Students are encouraged to contact the professor with any questions or problems that may arise

during the course. Students may set up an appointment at a mutually convenient time. Contact

information is as follows:

Donna M. Hitscherich

Room 1154 Kravis Hall

Tel: 212-854-0763

E-mail: dmh9@gsb.columbia.edu

Class Schedule:

The Class Schedule will be posted to the course web site. The Class Schedule sets forth the

material covered in each session and the student deliverables for the session.

M&A Syllabus - Donna M. Hitscherich Page 4

M&A Syllabus - Donna M. Hitscherich Page 5

You might also like

- 15-445 Mergers & Buyouts Course Information and Syllabus: Preliminary & Subject To ChangeDocument9 pages15-445 Mergers & Buyouts Course Information and Syllabus: Preliminary & Subject To ChangeBrijNo ratings yet

- Strategies For Long-Term Growth (Sherman) FA2021Document18 pagesStrategies For Long-Term Growth (Sherman) FA2021AladinNo ratings yet

- MGMT E-5805 - Syllabus - 16.08.22Document15 pagesMGMT E-5805 - Syllabus - 16.08.22Shesharam ChouhanNo ratings yet

- Fie443 2015Document8 pagesFie443 2015jamn1979No ratings yet

- Value Optimization for Project and Performance ManagementFrom EverandValue Optimization for Project and Performance ManagementNo ratings yet

- Mergers & AcquisitionsDocument4 pagesMergers & AcquisitionsdikpalakNo ratings yet

- M&A Course SyllabusDocument8 pagesM&A Course SyllabusMandip LuitelNo ratings yet

- The Modern Global EconomyDocument10 pagesThe Modern Global EconomyLinh HoangNo ratings yet

- Corporate Finance Topics: Juan-Pedro GómezDocument4 pagesCorporate Finance Topics: Juan-Pedro GómezAkki ChoudharyNo ratings yet

- Syllabus Finc313-Barnes-Spring2014Document14 pagesSyllabus Finc313-Barnes-Spring2014Gonzalo CamargoNo ratings yet

- Strategy - Mergers and Acquisitions - AnandDocument14 pagesStrategy - Mergers and Acquisitions - AnandAnil Kumar Singh100% (1)

- Fbe 560Document7 pagesFbe 560socalsurfyNo ratings yet

- 21746Document9 pages21746Thanh NguyenNo ratings yet

- Business Fundamentals 2014Document6 pagesBusiness Fundamentals 2014Di ShaNo ratings yet

- FIN9792: Advanced Managerial Finance (3 Units)Document6 pagesFIN9792: Advanced Managerial Finance (3 Units)gfybyg yg yNo ratings yet

- HBA Course Outline Sept - Dec 2023 - BUS4574Document11 pagesHBA Course Outline Sept - Dec 2023 - BUS4574SimplyNo ratings yet

- Technology Products and Innovations, 3: Jakki - Mohr@business - Umt.eduDocument9 pagesTechnology Products and Innovations, 3: Jakki - Mohr@business - Umt.eduKrishna PokhrelNo ratings yet

- 15472Document12 pages15472baskarbaju1No ratings yet

- CB4303 Strategy & Policy: Department of ManagementDocument6 pagesCB4303 Strategy & Policy: Department of ManagementhaileyNo ratings yet

- Course Outlines of Elective Courses - PGPPMDocument61 pagesCourse Outlines of Elective Courses - PGPPMBinoj GulalkaiNo ratings yet

- Syllabus B7345-001 Entrepreneurial FinanceDocument7 pagesSyllabus B7345-001 Entrepreneurial FinanceTrang TranNo ratings yet

- FINS1612 Capital Markets and Institutions S12016Document15 pagesFINS1612 Capital Markets and Institutions S12016fakableNo ratings yet

- Disstressed AnalysisDocument5 pagesDisstressed Analysisrafael castro ruiz100% (1)

- FIN333 2012 Spring - REVISEDDocument5 pagesFIN333 2012 Spring - REVISEDHa MinhNo ratings yet

- Finance Thesis TopicsDocument7 pagesFinance Thesis Topicsteresaoakmanevansville100% (2)

- Syllabus Final Version.1Document6 pagesSyllabus Final Version.1Gabriel MariniNo ratings yet

- MACourseSyllabus2005v2 6Document27 pagesMACourseSyllabus2005v2 6usmanjee123No ratings yet

- Project Appraisal - FIN513/608 FacultyDocument14 pagesProject Appraisal - FIN513/608 FacultyArsalan AqeeqNo ratings yet

- Financial Analysis and Decision Making OutlineDocument8 pagesFinancial Analysis and Decision Making OutlinedskymaximusNo ratings yet

- Finance Thesis Topic IdeasDocument8 pagesFinance Thesis Topic Ideasninavazquezhartford100% (2)

- Indian School of Business Corporate Control, Mergers and AcquisitionsDocument8 pagesIndian School of Business Corporate Control, Mergers and AcquisitionsAranab RayNo ratings yet

- COMM 2012 Syllabus PDFDocument9 pagesCOMM 2012 Syllabus PDFKARTHIK145No ratings yet

- 2001-Gb2380-Derose - Foundation of Fintech - 020920Document16 pages2001-Gb2380-Derose - Foundation of Fintech - 020920aakashchandraNo ratings yet

- Best Thesis Topics For FinanceDocument7 pagesBest Thesis Topics For Financesprxzfugg100% (2)

- CLAWD Programme Specification 2009Document7 pagesCLAWD Programme Specification 2009Jaber KnowlesNo ratings yet

- Finance 351Document5 pagesFinance 351Bhavana KiranNo ratings yet

- Advanced MergersDocument18 pagesAdvanced Mergersveda20No ratings yet

- Advanced Corporate Finance (Moon) SP2016Document7 pagesAdvanced Corporate Finance (Moon) SP2016darwin12100% (1)

- Sample PHD Thesis Topics in FinanceDocument8 pagesSample PHD Thesis Topics in Financechristinewhitebillings100% (2)

- Course Outline - CRM Gurgaon - PGPMDocument8 pagesCourse Outline - CRM Gurgaon - PGPMShiva Kumar DunaboinaNo ratings yet

- 16692Document24 pages16692Ar Rishabh JainNo ratings yet

- MergerDocument7 pagesMergerivan rickyNo ratings yet

- Finance Management Thesis TopicsDocument5 pagesFinance Management Thesis Topicsbk32j4wn100% (2)

- Thesis Topics in Business and FinanceDocument8 pagesThesis Topics in Business and FinanceVernette Whiteside100% (2)

- Negotiation and Influencing SkillsDocument8 pagesNegotiation and Influencing SkillsMahmoud Rabti100% (1)

- Project Feasibility StudyDocument2 pagesProject Feasibility StudyMARK ANGELO PARAISONo ratings yet

- Course SyllabusDocument7 pagesCourse Syllabus911elieNo ratings yet

- Accounting and Financial Management Dissertation TopicsDocument4 pagesAccounting and Financial Management Dissertation TopicsPaperWritingServiceCollegeBuffaloNo ratings yet

- BUSI1692 IE Module Handbook Jan 2022 Term PT (Draft)Document13 pagesBUSI1692 IE Module Handbook Jan 2022 Term PT (Draft)Chia Xin JenNo ratings yet

- #Acctg 325 Spg2016 Oestreich Williamson Syllabus-3Document6 pages#Acctg 325 Spg2016 Oestreich Williamson Syllabus-3SaradeMiguelNo ratings yet

- DC Course Syllabus BU.231.740.51Document4 pagesDC Course Syllabus BU.231.740.51Ryan CrunkletonNo ratings yet

- Fundamentals of Financial Management 2: Mamduhmh@ugm - Ac.idDocument6 pagesFundamentals of Financial Management 2: Mamduhmh@ugm - Ac.idNiken Arya AgustinaNo ratings yet

- FINS3616 - Course OutlineDocument15 pagesFINS3616 - Course OutlineJulie ZhuNo ratings yet

- International Business FundamentalsDocument4 pagesInternational Business FundamentalsMohammed RahmanNo ratings yet

- Rikkyo Syllabus (Undergrad Version)Document6 pagesRikkyo Syllabus (Undergrad Version)SteffenNo ratings yet

- B40Document7 pagesB40ambujg0% (1)

- AcquisitionsDocument8 pagesAcquisitionsveda20No ratings yet

- Construction Management Course WorkDocument5 pagesConstruction Management Course Workgbfcseajd100% (2)

- An Introduction to Stocks, Trading Markets and Corporate Behavior: Student EditionFrom EverandAn Introduction to Stocks, Trading Markets and Corporate Behavior: Student EditionRating: 3 out of 5 stars3/5 (2)

- POA GR 10 Weeks 1-5 - Term 3Document29 pagesPOA GR 10 Weeks 1-5 - Term 3ZeeLazMursalinNo ratings yet

- Batch 6 PARTIAL COMPILATIONDocument52 pagesBatch 6 PARTIAL COMPILATIONAstrid Gopo BrissonNo ratings yet

- Earmark Request For U.S. 1 Underground Utilities & Giles Run BridgeDocument3 pagesEarmark Request For U.S. 1 Underground Utilities & Giles Run BridgeScott A. SurovellNo ratings yet

- Why Joint Ventures Fail - and How To Prevent ItDocument4 pagesWhy Joint Ventures Fail - and How To Prevent Itaashima chopraNo ratings yet

- Mins 08120809Document54 pagesMins 08120809James LindonNo ratings yet

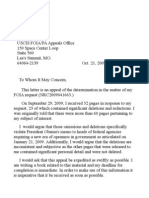

- Sally Jacobs Obama SR USCIS File FOIA AppealDocument60 pagesSally Jacobs Obama SR USCIS File FOIA AppealhsmathersNo ratings yet

- 03 Handout 2Document9 pages03 Handout 2Hezrone OcampoNo ratings yet

- DLP Tve-Tle Css q1 Act 1-1Document2 pagesDLP Tve-Tle Css q1 Act 1-1Marivic Omosura ItongNo ratings yet

- House Hearing, 108TH Congress - Gaming On Off-Reservation Restored and Newly-Acquired LandsDocument95 pagesHouse Hearing, 108TH Congress - Gaming On Off-Reservation Restored and Newly-Acquired LandsScribd Government DocsNo ratings yet

- Impasse Is A FallacyDocument7 pagesImpasse Is A FallacyLee Jay BermanNo ratings yet

- Report On KQDocument71 pagesReport On KQmunishka abdille25No ratings yet

- Thomas Edgeworth CourtenayDocument4 pagesThomas Edgeworth CourtenayM. KorhonenNo ratings yet

- Accounting For Corporate Combinations and Associations Australian 7th Edition Arthur Solutions ManualDocument25 pagesAccounting For Corporate Combinations and Associations Australian 7th Edition Arthur Solutions Manualnicholassmithyrmkajxiet100% (28)

- Top VerbsDocument31 pagesTop Verbsuma maheshNo ratings yet

- RT Why Human Rights Matter enDocument100 pagesRT Why Human Rights Matter enJohn KalvinNo ratings yet

- Assign 1 - Sem II 12-13Document8 pagesAssign 1 - Sem II 12-13Anisha ShafikhaNo ratings yet

- Alternative Dispute Resolution ReviewerDocument8 pagesAlternative Dispute Resolution ReviewerBerniceAnneAseñas-ElmacoNo ratings yet

- Rafael Trujillo Research PaperDocument6 pagesRafael Trujillo Research Paperhyavngvnd100% (1)

- Celdran y Pamintuan v. PeopleDocument10 pagesCeldran y Pamintuan v. PeopleRoveelaine Eve CastilloNo ratings yet

- BM Study Guide HLDocument70 pagesBM Study Guide HLKirsten Dell GayataoNo ratings yet

- Assignment #1 - Fundamentals and Governance - Attempt ReviewDocument34 pagesAssignment #1 - Fundamentals and Governance - Attempt ReviewLeo M. SalibioNo ratings yet

- Hindu or SindhuDocument11 pagesHindu or SindhuAnonymous 4yXWpD0% (1)

- Milman. The History of Christianity: From The Birth of Christ To The Abolition of Paganism in The Roman Empire. 1840. Volume 2.Document508 pagesMilman. The History of Christianity: From The Birth of Christ To The Abolition of Paganism in The Roman Empire. 1840. Volume 2.Patrologia Latina, Graeca et OrientalisNo ratings yet

- Case Digest by Adonis PDFDocument172 pagesCase Digest by Adonis PDFCarmela BautistaNo ratings yet

- PRMO2Document1 pagePRMO2Aarya AttreyNo ratings yet

- Bayes Problems1Document2 pagesBayes Problems1InduNo ratings yet

- 4 History of The Muslim - Study of Aqidah and FirqahDocument15 pages4 History of The Muslim - Study of Aqidah and FirqahLaila KhalidNo ratings yet

- Criminal Procedure Act of TanzaniaDocument158 pagesCriminal Procedure Act of TanzaniaCamille JunioNo ratings yet

- TDCAA DWI Caselaw Update 120621Document206 pagesTDCAA DWI Caselaw Update 120621Charles SullivanNo ratings yet