Professional Documents

Culture Documents

General Banking & FCDA

General Banking & FCDA

Uploaded by

Mark clarence Picar0 ratings0% found this document useful (0 votes)

15 views2 pagesThis document outlines key provisions of Philippine banking law, including:

1) Requirements for organizing a bank including minimum capital, board of directors, and limits on individual stock ownership.

2) Regulations on lending practices such as risk-based capital ratios, single borrower limits, and restrictions on lending to directors, officers, stockholders and related interests (DOSRI).

3) Rules regarding banks' real estate investments and loan limits secured by real estate or other assets.

4) Requirements for foreign currency deposits, including their confidentiality and exceptions for disclosure.

Original Description:

Gen. Banking

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document outlines key provisions of Philippine banking law, including:

1) Requirements for organizing a bank including minimum capital, board of directors, and limits on individual stock ownership.

2) Regulations on lending practices such as risk-based capital ratios, single borrower limits, and restrictions on lending to directors, officers, stockholders and related interests (DOSRI).

3) Rules regarding banks' real estate investments and loan limits secured by real estate or other assets.

4) Requirements for foreign currency deposits, including their confidentiality and exceptions for disclosure.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

15 views2 pagesGeneral Banking & FCDA

General Banking & FCDA

Uploaded by

Mark clarence PicarThis document outlines key provisions of Philippine banking law, including:

1) Requirements for organizing a bank including minimum capital, board of directors, and limits on individual stock ownership.

2) Regulations on lending practices such as risk-based capital ratios, single borrower limits, and restrictions on lending to directors, officers, stockholders and related interests (DOSRI).

3) Rules regarding banks' real estate investments and loan limits secured by real estate or other assets.

4) Requirements for foreign currency deposits, including their confidentiality and exceptions for disclosure.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

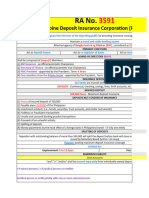

GENERAL BANKING LAW (RA 8791) BOARD OF DIRECTORS

o 5-15 members with 2 of them: independent

ORGANIZATION OF A BANK director (other than bank official/employee)

Is a stock corporation o Monetary board may disqualify, suspend or

Funds are obtained from public remove any director (fit and proper rule)

(at least 20 persons)

Minimum capital req’ts are met LOANS MADE BY BANK

- shall not apply to a cooperative bank to its

STOCKHOLDINGS IN A BANK cooperative shareholders

- Individuals and corporations may own or 1) Risk-based capital

control up to 40% of bank’s stockholdings - Minimum ratio: net worth of a bank must bear to

its total risk assets

TYPES OF BANKS - 10% but 8% recommended internationally

1) Commercial bank – general 2) Single Borrower’s Limit (SBL)

2) Universal bank – general + powers of investment - Maximum limit to a single borrower

house; expanded commercial bank o Per law: ≤ 20% of net worth

3) Thrift bank – savings/mortgage/stock savings; under o Per circular: ≤ 25% of net worth

Thrift Bank Act - Additional limit (if adequately secured)

4) Rural bank – normal credit needs of farmers, o 10% of bank’s net worth

cooperatives; under Rural Bank Act

5) Cooperative Bank – under Cooperative Act RESTRICTIONS ON BANK EXPOSURE TO DOSRI

6) Islamic Bank – under Shariah Law G.R: No bank D/O shall borrow from such bank nor shall

7) Government-owned bank – for public purpose become a guarantor/indorser/surety for loans

Exception: Written approval of majority of BOD

BANKS QUASI-BANKS excluding D concerned

Function Lend funds Borrow funds

LOAN LIMIT TO DOSRI: limited to unencumbered

Sources BANK DEPOSIT

deposits and BV of Paid-In bank contribution

of funds DEPOSITS SUBSITUTES

FOREIGN CURRENCY DEPOSIT ACT

LOAN LIMITS AGAINST REAL ESTATE (RA 6426)

< 75% of appraised value of RE

+ 60% of appraised value of insured improvements GENERAL RULE

- All FCDs are absolutely confidential and cannot be

LOAN LIMITS AGAINST SECURITY OF CHATTELS AND examined

INTANGIBLE PROPERTIES - All FCDs are exempt from attachment, garnishment or

< 75% of appraised value of the security any other order of Court

INVESTMENT IN REAL ESTATE/ASSET BY BANKS EXCEPTIONS

- Allowed if total investment < 50% of combined 1) Foreign Currency Deposit Act

capital accounts Written permission of depositor

2) Jurisprudence on grounds of equity

MINIMUM DEPOSIT RESERVE RATIO OF A BANK TO Account of NRA

THE BSP Account of co-payee of a check

- At least 19% of its total deposit liabilities 3) Other Laws (same with Bank Secrecy)

New Central Bank Act for DOSRI who contract

OTHER NOTES a loan

>> A bank shall not directly engage in insurance CIR

business as the insurer AMLC

>> DILIGENCE REQUIRED: BSP

- Extra-ordinary for deposits (demand, savings COA

and time deposit) PCGG

- Ordinary for other services/contracts

>> LIMITATION OF FOREIGN OWNERSHIP PENALTY FOR VIOLATION

- Up to 40% of voting stock Imprisonment for 1-5 years; or

Fine > 5,000 but < 25,000; or both

You might also like

- RA 8791 General Banking LawDocument33 pagesRA 8791 General Banking LawAngelo Christian100% (2)

- BANKING Reviewer AlphaDocument3 pagesBANKING Reviewer AlphaAngelo NavarroNo ratings yet

- Notes - General Banking LawDocument4 pagesNotes - General Banking LawJingle BellsNo ratings yet

- BAR QnA BankingDocument4 pagesBAR QnA BankingCzarina BantayNo ratings yet

- Banking and AMLADocument26 pagesBanking and AMLAMosarah AltNo ratings yet

- (Finals) General Banking LawDocument3 pages(Finals) General Banking LawJohn Rick Dayondon100% (1)

- Laws On Banks-A4Document16 pagesLaws On Banks-A4Steven OrtizNo ratings yet

- Laws On BanksDocument17 pagesLaws On BanksMay Alili SangalangNo ratings yet

- Spec Com PassDocument410 pagesSpec Com PassDwrd GBNo ratings yet

- Notes On Secerecy of Bank DepositsDocument6 pagesNotes On Secerecy of Bank DepositsJv FerminNo ratings yet

- ReviewerDocument3 pagesReviewergirlNo ratings yet

- 6.0 Banking Laws and Other LawsDocument12 pages6.0 Banking Laws and Other Lawsangelo eleazarNo ratings yet

- AMLA Complete With R.A. No. 11521 Latest Amendment SPEC COM NotesDocument255 pagesAMLA Complete With R.A. No. 11521 Latest Amendment SPEC COM NotesAubrey CortezNo ratings yet

- Classification of BanksDocument7 pagesClassification of BanksBrian PapellerasNo ratings yet

- Prudential Regulations For Microfinance Banks (MFBS)Document23 pagesPrudential Regulations For Microfinance Banks (MFBS)Abid RasheedNo ratings yet

- SPCL (11 - 08)Document6 pagesSPCL (11 - 08)Katrina San MiguelNo ratings yet

- UntitledDocument6 pagesUntitledWag mong ikalatNo ratings yet

- Answers To Bar Questions in Banking 2003 To 1990Document10 pagesAnswers To Bar Questions in Banking 2003 To 1990Maricar Corina CanayaNo ratings yet

- Module in General Banking Law of 2000Document9 pagesModule in General Banking Law of 2000Nieves GalvezNo ratings yet

- Banking-Law-Mid NotesDocument11 pagesBanking-Law-Mid NotesVince Clarck F. AñabiezaNo ratings yet

- Capital Adequacy Norms Capital Adequacy NormsDocument37 pagesCapital Adequacy Norms Capital Adequacy Normsarpitasharma_301No ratings yet

- Banking AUG 31Document20 pagesBanking AUG 31MorphuesNo ratings yet

- Special LawsDocument5 pagesSpecial LawsMarian's PreloveNo ratings yet

- LizaDocument12 pagesLizaRodeliza DuncanNo ratings yet

- BANKING LAWS - CommercialDocument45 pagesBANKING LAWS - CommercialGenelle Mae MadrigalNo ratings yet

- Banking LawDocument10 pagesBanking Lawtuemedose.12No ratings yet

- SUMMARYDocument44 pagesSUMMARYGenelle Mae MadrigalNo ratings yet

- Banking Regulation Act 1949Document35 pagesBanking Regulation Act 1949sidd2450No ratings yet

- Prudential Regulations For Microfinance Banks/ Institutions: Page # 1Document15 pagesPrudential Regulations For Microfinance Banks/ Institutions: Page # 1Muskan94No ratings yet

- Banking Regulation Act 1949Document4 pagesBanking Regulation Act 1949sunil_mishra04No ratings yet

- Commercial Law Areas 2019 PDFDocument27 pagesCommercial Law Areas 2019 PDFMark Ervin AbanciaNo ratings yet

- Capital Adequacy Regulations - PresentationDocument21 pagesCapital Adequacy Regulations - PresentationgeminiNo ratings yet

- DipataposDocument9 pagesDipataposFiona MiralpesNo ratings yet

- Quamto Ipl 2017Document10 pagesQuamto Ipl 2017cathy mendoza100% (2)

- Legal Aspects of Banking: Module A: Unit 1Document30 pagesLegal Aspects of Banking: Module A: Unit 1anki2986No ratings yet

- BankingLaws BEQDocument7 pagesBankingLaws BEQAnastasia ZaitsevNo ratings yet

- By: Shashi Bhushan REG. NO. - 10907626 Section Q1R01 Roll No. B11Document15 pagesBy: Shashi Bhushan REG. NO. - 10907626 Section Q1R01 Roll No. B11Shashi BhushanNo ratings yet

- Banking FinalsDocument4 pagesBanking Finalsfxsjhhcc6cNo ratings yet

- RFM Notes-Commercial and SMEDocument8 pagesRFM Notes-Commercial and SMEmuneebmateen01No ratings yet

- IGL, General Banking Law (Riguera Lec)Document12 pagesIGL, General Banking Law (Riguera Lec)Ivan LeeNo ratings yet

- NBFCs MAT 3Document23 pagesNBFCs MAT 3Prashant RatnpandeyNo ratings yet

- What Is The Purpose of PDIC Law? 4. Define A. DepositDocument5 pagesWhat Is The Purpose of PDIC Law? 4. Define A. DepositJoshel MaeNo ratings yet

- SPCL Thrift Bank MOJICADocument2 pagesSPCL Thrift Bank MOJICARobinson MojicaNo ratings yet

- Cheat Notes-GblDocument4 pagesCheat Notes-GblMhiletNo ratings yet

- Short Notes-Principles and Practices of Banking PDFDocument57 pagesShort Notes-Principles and Practices of Banking PDFhirtik50% (2)

- Central Banking Indian Specific Issue - 0f6a19f9 9d1e 4830 87be 8557fe576fdbDocument13 pagesCentral Banking Indian Specific Issue - 0f6a19f9 9d1e 4830 87be 8557fe576fdbprachi bhattNo ratings yet

- DBF 3rd Exam Materials UpdatedDocument17 pagesDBF 3rd Exam Materials UpdatedSreedev SureshbabuNo ratings yet

- Banking Notes 1st MeetingDocument10 pagesBanking Notes 1st MeetingPaul SarangayaNo ratings yet

- Dr. Pradiptarathi Panda Lecturer, NismDocument26 pagesDr. Pradiptarathi Panda Lecturer, NismMaunil OzaNo ratings yet

- U Ii NBFCDocument272 pagesU Ii NBFCDeepshi GargNo ratings yet

- BNK 601 Midterm Solved Mcqs With ReferenceDocument3 pagesBNK 601 Midterm Solved Mcqs With ReferenceRimsha TariqNo ratings yet

- Indonesian Banking Law - AK002Document13 pagesIndonesian Banking Law - AK002abelNo ratings yet

- Bcc:Br:104:404 20.11.2012 Circular To All Branches and Offices in IndiaDocument12 pagesBcc:Br:104:404 20.11.2012 Circular To All Branches and Offices in IndiaamilcarNo ratings yet

- Abhivrudhi - Scheme Guidelines: Parameter Guideline AbhivrudhiDocument4 pagesAbhivrudhi - Scheme Guidelines: Parameter Guideline AbhivrudhianuragmwwNo ratings yet

- Banking - Nature and Concept of Banking LawsDocument43 pagesBanking - Nature and Concept of Banking LawsMary Megan TaboraNo ratings yet

- Integs2024 RFBT NotesDocument39 pagesIntegs2024 RFBT NotesETTORE JOHN DE VERANo ratings yet

- Chapter 10 Bank ReservesDocument5 pagesChapter 10 Bank ReservesMariel Crista Celda MaravillosaNo ratings yet

- General Banking Law of 2000Document13 pagesGeneral Banking Law of 2000JyNo ratings yet