Professional Documents

Culture Documents

Chapter 4 (B) Past Papers

Chapter 4 (B) Past Papers

Uploaded by

LEARN FROM MEOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 4 (B) Past Papers

Chapter 4 (B) Past Papers

Uploaded by

LEARN FROM MECopyright:

Available Formats

Chapter 4 (b): Definitions

ICAP PAST PAPER QUESTIONS

Question-1

Rose Company Ltd. has a paid up capital of Rs.5,000,000 consisting 500,000 shares of Rs.10 each. On

30.6.2001 the company’s balance sheet shows accumulated profits of Rs.1,500,000. The company has to be

liquidated. The official liquidator realized Rs.6,500,000 and distribution among the shareholders was made at

the rate of Rs.13 per share. Shewani Group owns 200,000 shares in the company.

How much of the amount received by Shewani Group is dividend? Please explain your answer.

(4)

(Q.1 (b)September 2002)

Question-2

Define the following with reference to the Income Tax Ordinance, 2001?

(a) Fee for technical services (3)

(b) Non-profit organization (3)

(c) Income (3)

(d) Taxpayer (2)

(Q.1September 2004)

Question-3

Identify the situations in which two companies shall be considered to be associates within the meaning of the

Income Tax Ordinance 2001. (6)

(Q.5 (a) September 2007)

Question-4

Certain types of payments by a private company to their shareholders can be treated as "dividend" under the

Income Tax Ordinance, 2001. State the conditions necessary for the application of this rule and the exceptions

to it. (5)

(Q.4 (b) March 2008)

Question-5

State the circumstances when two companies shall be considered as associates, under the Income Tax

Ordinance, 2001.

(4)

(Q.5 (b) September 2008)

Question-6

A company engaged in manufacturing activities has decided to provide loan to one of its shareholders.

Explain the tax implication on the company as well as the shareholder if the Company:

(i) is registered under the Companies Act, 2017 as a private limited company.

(ii) is an unlisted public company. (6)

(Q.2 (a) September 2009)

Question-7

Tamba Pakistan (Pvt.) Limited is engaged in the manufacture of pharmaceutical products. Its board of

directors has approved a 3-year loan to one of its major shareholders.

Required:

Explain the tax implications of the above transaction on the company as well as the shareholder.

(4)

(Q.5 (a) March 2012)

Question-8

Under the Income Tax Ordinance 2001, where a person is reasonably expected to act in accordance with the

intentions of another person, both persons are considered as associates.

Required:

(i) Explain the term “person” in the above context. (3)

(ii) State the circumstances in which a company and its shareholder shall be considered as associates.

(4)

(Q.6 (b) March 2012)

Question-9

Differentiate between ‘Public company’ and ‘Private company’ within the meaning of Income Tax Ordinance,

2001. (5)

(Q.5 (a) September 2013)

Sajjad Ahmed Malik

Chapter 4 (b): Definitions

Question-10

Under the provisions of Income Tax Ordinance, 2001:

Explain the term ‘Associates’. State the circumstances under which a shareholder in a company and the

company may be regarded as associates.

(5)

(Q.2 (b) March 2014)

Question-11

Certain payments made by a private limited company to its shareholders can be treated as ‘dividend’. Explain

the above in the context of Income Tax Ordinance, 2001. Also identify the exceptions to this rule.

(7)

(Q.7 March 2014)

Question-12

Briefly discuss the provisions of Income Tax Ordinance, 2001 in respect of the following situation:

ABC (Private) Limited has decided to provide a loan of Rs. 5 million to one of its shareholders, for the

purchase of a house.

(4)

(Q.2 (b) September 2014)

Question-13

Under the provisions of the Income Tax Ordinance, 2001 describe the following:

(i) meaning of the term ‘Associates’. (2)

(ii) circumstances in which a member of an association of persons and the association may be regarded

as associates. (2)

(iii) situation in which members of an association of persons may not be regarded as associates. (2)

(Q.3 (b) September 2016)

Question-14

On 25 August 20X8, the Officer of Inland Revenue has issued a notice to Rahat Foods (Private) Limited (RFPL)

to deposit withholding income tax of Rs. 1,950,000 in respect of loan amounting to Rs. 13,000,000 given to

Nadeem Ahmad, a shareholder of RFPL, by treating the amount of loan as dividend. The notice was served to

the company on 30 August 20X8.

According to RFPL’s records, the loan was given to Nadeem Ahmad on 25 May 20X7 when accumulated profit

of the company was Rs. 12,000,000.

In the light of the provisions of the Income Tax Ordinance, 2001 explain whether you agree with the notice

issued to RFPL by the Officer of Inland Revenue. (03)

(Q.4 (a) September 2018)

Question-15

(a) Briefly discuss the difference between a public company and a private company, within the meaning

of Income Tax Ordinance, 2001. (04)

(b) Certain types of payments by a private company to its shareholders can be treated as `dividend'

under the Income Tax Ordinance, 2001. State the conditions necessary for the application of this rule

and the exceptions to such rule.

(05)

(Q.5 March 2019)

Question-16

Explain Industrial Undertaking as specified in the Income Tax Ordinance, 2001.

(5)

(Q.4 (b) September 2011)

Question-17

Dr. Jamal is planning to establish a hospital as a non-profit organization.

Sajjad Ahmed Malik

Chapter 4 (b): Definitions

Required:

Discuss the conditions that should be complied with by Dr. Jamal, under the Income Tax Ordinance, 2001.(03)

(Q.1(b) March 2021)

Question-18

Following information pertains to three unlisted companies:

Paid up Total Annual

Company Shareholders

capital reserves turnover

Rs. in million

60% shares are held by a

A Limited 30 80 150

foreign company

40% shares are held by the

B Limited 80 (35) 220 Provincial and Federal

governments

100% shares are held by a

C Limited 40 5 500

local group

Required:

Under the provisions of the Income Tax Ordinance, 2001 briefly discuss whether each of the above companies

can be classified as small, public or private. Also state the additional information, if any, which may be

required for determining the classification of these companies. (07)

(Q.4 (c) March 2022)

ICAP PAST PAPER SOLUTIONS

Note: Few of the questions are not answered below.

Answer-1

Any distribution made to the shareholders of a company on its liquidation, to the extent to which the

distribution is from the accumulated profits of the company whether capitalised or not is treated as dividend.

Therefore Rs. 3 x 200,000 = 600,000 will be treated as dividend in the hands of Shewani Group. Rs. 3 is

calculated as (1,500,000/500,000)

Answer-3

S. 85(3) (f)

Answer-4

The payment made (from accumulated profits) by a private company as defined in the Companies Act, 2017

of any amount (whether it is a part of the assets of the company or trust, or otherwise)

by way of advance or loan to a shareholder

for the individual benefit of a shareholder

shall be treated as dividend under the Income Tax Ordinance, 2001.

Exception

Following payments will not be considered as dividend:

(i) any advance/loan by a company involved in lending business;

(ii) any dividend paid by a company which is set off against amount previously paid by it and treated as a

dividend.

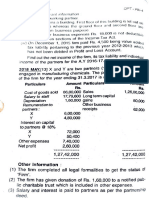

Answer-6

i. If the company is private limited company.

Tax implications on shareholders

The term dividend includes any payment by a private limited company by way of loan to its

shareholder for the individual benefit of shareholder to the extent of accumulated profits.

Accordingly, amount received by the shareholder shall be construed as dividend in the hands of the

shareholder and taxable under the provisions of the ITO-2001.

Sajjad Ahmed Malik

Chapter 4 (b): Definitions

Tax implications on private limited company

Being a private company, it is responsible to deduct withholding tax on the payment of dividend at

the rates specified in the First Schedule.

ii. If the company is an unlisted public company, the payment made to the shareholders will not be

construed as dividend. So no tax implication on the company or the shareholder.

Answer-7

Implications from point of view of shareholder

The payment made by a private company as defined in the Companies Act, 2017 of any amount by way of

advance or loan to a shareholder shall be considered as dividend.

Therefore the amount received by shareholder will be treated as dividend income in his hands.

Implications from point of view of company

Every person paying a dividend shall deduct tax from the gross amount of the dividend paid at the rate of

15% of gross amount of dividend. Therefore company is required to deduct tax @ 15% of gross amount of

dividend.

Answer-8

i) Refer Chapter-4

ii) S. 85(3)(e)

Answer-9

Refer definitions.

Answer-10

Two persons shall be associates where the relationship between the two is such that one is expected to act in

accordance with the intentions of the other, or both are expected to act in accordance with the intentions of a

third person.

And S. 85(3) (e)

Answer-11

The payment by a private company as defined in the Companies Act, 2017 or trust by way of advance or loan

to a shareholder or for the individual benefit of a shareholder shall be considered as dividend. The payment

should be from accumulated profits.

Following payments will not be considered as dividend:

(i) any advance/loan by a company involved in lending business;

(ii) any dividend paid by a company which is set off against amount previously paid by it and treated as a

dividend.

Answer-12

The payment by a private company as defined in the Companies Act, 2017 or trust by way of advance or loan

to a shareholder or for the individual benefit of a shareholder. The payment should be from accumulated

profits.

Therefore it is considered as dividend in the hands of shareholder and company is required to deduct tax at

the rate of 15% on the gross amount of dividend.

Answer-13

i. Associates

Two persons shall be associates where the relationship between the two is such that:

One is expected to act in accordance with the intentions of the other, or

Both are expected to act in accordance with the intentions of a third person.

ii. A member of an AOP and the AOP, where the member,

either alone or

Sajjad Ahmed Malik

Chapter 4 (b): Definitions

together with an associate or associates under another application of this section controls 50% or

more of the rights to income or capital of the association

iii. Members of an AOP shall not be associates where Commissioner is satisfied that no one is expected to act

in accordance with the intentions of the other.

Answer-14

“Dividend” includes the payment by a private company as defined in the Companies Act, 2017 or trust:

by way of advance or loan to a shareholder or

for the individual benefit of a shareholder,

The payment should be from accumulated profits.

Considering the above definition of dividend, the tax officer is correct to the extent of treating the loan

payment as dividend. However, he made error in treating the entire amount of Rs.13 million as dividend

because the amount of accumulated profit was Rs.12 million on that date. Therefore, only Rs.12 million can be

treated as dividend.

Answer-15

a) S. 2 (45), (47)

b) Dividend includes the payment by a private company as defined in the Companies Act, 2017 or trust:

by way of advance or loan to a shareholder or

for the individual benefit of a shareholder,

The payment should be from accumulated profits.

Following payments will not be considered as dividend:

(i) any advance/loan by a company involved in lending business;

(ii) any dividend paid by a company which is set off against amount previously paid by it and

treated as a dividend.

Answer-16

Refer the chapter above.

Answer-17

An individual cannot form a non-profit organization. However Dr. Jamal can run his clinic as a non-profit

organization:

(a) established for charitable purpose

(b) formed under a law as a non-profit organization;

(c) approved by the Commissioner for specified period, on an appeal in prescribed form, accompanied

by the prescribed documents and

(d) the person do not derive any benefit from the assets.

Answer-18

A Limited:

A Limited cannot be classified as small company. Though its turnover is less than Rs. 250 million but it’s share

capital and reserves are Rs. 110 million (30 +80) which is more than threshold of Rs. 50 million.

A Limited can be classified as private company. 60% of shares of A Limited are held by foreign company. If

foreign company is 100% owned by foreign government, then A Limited would be classified as public

company. As the ownership structure of foreign company is not known, we cannot classify it as public

company.

B Limited:

B Company can be classified as small company. Its turnover is less than Rs. 250 million and it’s share capital

and reserves are Rs. 45 million (80 - 35) which is less than threshold of Rs. 50 million. Additional information

Sajjad Ahmed Malik

Chapter 4 (b): Definitions

regarding number of employees and constitution of company should have been given to reach a conclusive

decision.

B Limited can be classified as private company because neither the Provincial Government and nor the

Federal Government solely own 50% or more of the shareholding of company B.

C Limited:

C Limited cannot be classified as small company. Though its share capital and reserves are less than Rs. 50

million but its turnover is greater than Rs. 250 million.

C Limited can be classified as private company as 100% shareholding of the company is with local group

(non-government) and the Provincial, Federal or Foreign Government does not own 50% or more of the

shareholding of company C.

OTHER QUESTIONS

Questions Treatment

a) A person has employed 17 persons for the manufacturing of room

carpets. Explain under two independent scenarios whether he will

be considered as industrial undertaking or not. [Sec.2(29C)(a)(i)(ii))

He uses human energy. Not an industrial undertaking

He uses electrical energy. It is an industrial Undertaking

b) Company XYZ a listed company has 70% shareholding in both of Following are associates:

two companies: ABC and XYZ [S. 85(3)(e)]

ABC Private limited company DEF and XYZ [S. 85(3)(e)]

DEF Private limited company ABC and DEF [S. 85(3)(f)]

What is the status of all of the above three companies under the

law?

c) What would be your answer if the company XYZ in above example No change in answer

is a private company?

Sajjad Ahmed Malik

You might also like

- Topic Wise Taxation Icap Past Papers (Pak) of C.ADocument30 pagesTopic Wise Taxation Icap Past Papers (Pak) of C.AIrfan50% (4)

- Case StudyDocument2 pagesCase StudyExcel Joy Marticio56% (16)

- 012-Practice Questions - Income TaxDocument106 pages012-Practice Questions - Income Taxalizaidkhan29% (7)

- ICAP Past 20 Attempts Questions - Topic WiseDocument38 pagesICAP Past 20 Attempts Questions - Topic Wisesohail merchant100% (1)

- 05 JUNE QuestionDocument10 pages05 JUNE Questionkhengmai100% (1)

- Emailing Audit Asuncion PDFDocument410 pagesEmailing Audit Asuncion PDFVenus Marieee100% (2)

- Chapter 4 Past PapersDocument9 pagesChapter 4 Past PapersLEARN FROM MENo ratings yet

- 06-Spring 2014 - BTDocument4 pages06-Spring 2014 - BTpabloescobar11yNo ratings yet

- Business Laws (70) : Summer Exam-2013Document21 pagesBusiness Laws (70) : Summer Exam-2013Khalid MahmoodNo ratings yet

- B Law-MockDocument3 pagesB Law-MockMuhammad Mazhar YounusNo ratings yet

- CorporateS18 PDFDocument30 pagesCorporateS18 PDFMohammad FaisalNo ratings yet

- Cfap 2 Cls Summer 2018Document4 pagesCfap 2 Cls Summer 2018Jawad TariqNo ratings yet

- New Syllabus: Answer ALL Questions. 2Document11 pagesNew Syllabus: Answer ALL Questions. 2Nitesh MamgainNo ratings yet

- D9 CLWDocument3 pagesD9 CLWadnanNo ratings yet

- 2-Final Tohfa SEPTEMBER 2022 AttemptDocument6 pages2-Final Tohfa SEPTEMBER 2022 AttemptGhulam Mohyudin KharalNo ratings yet

- C. Law Answers in Addition To 3rd EditionDocument17 pagesC. Law Answers in Addition To 3rd EditionMuhammad Hassan TahirNo ratings yet

- CFAP 2 CLS Summer 2017 PDFDocument4 pagesCFAP 2 CLS Summer 2017 PDFJawad TariqNo ratings yet

- New Syllabus: Answer ALL Questions. 2Document10 pagesNew Syllabus: Answer ALL Questions. 2Vipul TalrejaNo ratings yet

- Company Law: T I C A PDocument2 pagesCompany Law: T I C A PadnanNo ratings yet

- CR CS Professional Past PaperDocument7 pagesCR CS Professional Past PaperAkanksha PareekNo ratings yet

- SFM ScannerDocument23 pagesSFM ScannerArchana KhapreNo ratings yet

- Pakistan Institute of Public Finance Accountants: Summer Exam-2016Document27 pagesPakistan Institute of Public Finance Accountants: Summer Exam-2016RALFNo ratings yet

- Accounts - Full FledgedDocument5 pagesAccounts - Full FledgedSukhrut MNo ratings yet

- Note: 1Document4 pagesNote: 1Ankur GuptaNo ratings yet

- (Marks 15) : DPT - Pbi-4Document22 pages(Marks 15) : DPT - Pbi-4chandrani4029No ratings yet

- Fundamentals Level - Skills ModuleDocument4 pagesFundamentals Level - Skills ModulekhengmaiNo ratings yet

- Taxation: The Institute of Chartered Accountants of PakistanDocument4 pagesTaxation: The Institute of Chartered Accountants of PakistanadnanNo ratings yet

- Audit Questions 6Document20 pagesAudit Questions 6Humayun KhanNo ratings yet

- CH 20 Incorporation of CompanyDocument6 pagesCH 20 Incorporation of CompanyInam Ul Haq MinhasNo ratings yet

- Corporate and Business Law: (Malaysia)Document6 pagesCorporate and Business Law: (Malaysia)Mi ZanNo ratings yet

- Corporate and Business Law (Malaysia) : Tuesday 4 December 2007Document4 pagesCorporate and Business Law (Malaysia) : Tuesday 4 December 2007api-19836745No ratings yet

- Chapter 12 - DebenturesDocument3 pagesChapter 12 - Debenturesmian UmairNo ratings yet

- T.Marks 100 C L Time: 3 H (+15 R)Document4 pagesT.Marks 100 C L Time: 3 H (+15 R)Nouman RashidNo ratings yet

- E15 CLSDocument2 pagesE15 CLSnabeelniniNo ratings yet

- b3 Economics and FinanceDocument35 pagesb3 Economics and FinanceAnonymous YkMptv9jNo ratings yet

- Guideline Answers: Executive ProgrammeDocument92 pagesGuideline Answers: Executive Programmeblack horseNo ratings yet

- Chapter 6 Legal Requirements (Revised Practice Set)Document18 pagesChapter 6 Legal Requirements (Revised Practice Set)M Azeem IqbalNo ratings yet

- Business and Corporate Law - PDF Nov 2012Document3 pagesBusiness and Corporate Law - PDF Nov 2012Denvor Chris MunesiNo ratings yet

- Pakistan Institute of Public Finance Accountants: TaxationDocument3 pagesPakistan Institute of Public Finance Accountants: TaxationAzfar AliNo ratings yet

- F1 FIOO - L-December-2020Document8 pagesF1 FIOO - L-December-2020Laskar REAZNo ratings yet

- Company Law: The Institute of Chartered Accountants of PakistanDocument3 pagesCompany Law: The Institute of Chartered Accountants of PakistanadnanNo ratings yet

- The Chartered Insurance Institute Diploma April 2010 Examination PaperDocument8 pagesThe Chartered Insurance Institute Diploma April 2010 Examination PaperSultan AlrasheedNo ratings yet

- Corporate and Business Law: (English)Document4 pagesCorporate and Business Law: (English)Jahangir DogarNo ratings yet

- Institute of Cost and Management Accountants of Pakistan Fall (Winter) 2009 ExaminationsDocument2 pagesInstitute of Cost and Management Accountants of Pakistan Fall (Winter) 2009 ExaminationsSyed Mohammad Ali Zaidi KarbalaiNo ratings yet

- Caf 2 Tax Autumn 2021Document6 pagesCaf 2 Tax Autumn 2021Mueez NaseerNo ratings yet

- Company Law: T I C A PDocument3 pagesCompany Law: T I C A PadnanNo ratings yet

- Company Law PDFDocument8 pagesCompany Law PDFGajanan PanchalNo ratings yet

- Question Analysis ICAB Application Level TAXATION-II (Syllabus Weight Based) PDFDocument50 pagesQuestion Analysis ICAB Application Level TAXATION-II (Syllabus Weight Based) PDFTwsif Tanvir Tanoy92% (13)

- Question Analysis ICAB Application Level TAXATION-II (Syllabus Weight Based)Document68 pagesQuestion Analysis ICAB Application Level TAXATION-II (Syllabus Weight Based)Optimal Management SolutionNo ratings yet

- MBAG-204 - 21 May 2021Document2 pagesMBAG-204 - 21 May 2021Abhishake ChhetriNo ratings yet

- CA Inter Law Ans Dec 2021Document21 pagesCA Inter Law Ans Dec 2021Punith KumarNo ratings yet

- Federal Public Service CommissionDocument5 pagesFederal Public Service CommissionSaad GulzarNo ratings yet

- P13 QpmaDocument4 pagesP13 QpmaOmkar PednekarNo ratings yet

- Test 6Document3 pagesTest 6eimannaveed6No ratings yet

- 2017 - 6 - 10 - 106 - KB3-Business Taxation and Law June 2017 - EnglishDocument12 pages2017 - 6 - 10 - 106 - KB3-Business Taxation and Law June 2017 - Englishkasun SenadheeraNo ratings yet

- QP 2nd YearDocument13 pagesQP 2nd YearAmalsudheeshNo ratings yet

- Aclp PPDocument500 pagesAclp PPDawood ZahidNo ratings yet

- 29240rtp - May13 - Ipcc Atc 5Document49 pages29240rtp - May13 - Ipcc Atc 5adityatiwari122006No ratings yet

- June 2022 CsexamDocument11 pagesJune 2022 CsexamDiksha AroraNo ratings yet

- Company Law: The Institute of Chartered Accountants of PakistanDocument2 pagesCompany Law: The Institute of Chartered Accountants of PakistanadnanNo ratings yet

- The Red Dream: The Chinese Communist Party and the Financial Deterioration of ChinaFrom EverandThe Red Dream: The Chinese Communist Party and the Financial Deterioration of ChinaNo ratings yet

- Business Development Strategy for the Upstream Oil and Gas IndustryFrom EverandBusiness Development Strategy for the Upstream Oil and Gas IndustryRating: 5 out of 5 stars5/5 (1)

- Transaction Processing Systems and Transacyion Processing CycleDocument14 pagesTransaction Processing Systems and Transacyion Processing CycleChirag GoyalNo ratings yet

- Detailed StatementDocument19 pagesDetailed StatementDinesh GnanamoorthyNo ratings yet

- The Swiss Medical Technology Industry 2010 Report - "Medtech at The Crossroads"Document97 pagesThe Swiss Medical Technology Industry 2010 Report - "Medtech at The Crossroads"Mohit SinghNo ratings yet

- Market Analysis of Everyuth Derma Care RangeDocument58 pagesMarket Analysis of Everyuth Derma Care RangeHarsha SilanNo ratings yet

- Chapter#02 BigDataApplicationDocument12 pagesChapter#02 BigDataApplicationMỹ LinhNo ratings yet

- Group Health Insurance - Product BenefitsDocument26 pagesGroup Health Insurance - Product Benefitsgaurav.20230rbNo ratings yet

- MT Quiz 1 MasterDocument2 pagesMT Quiz 1 MasterChristine Dela Rosa CarolinoNo ratings yet

- Section 8 of Unclaimed Moneys Act 1965Document3 pagesSection 8 of Unclaimed Moneys Act 1965Syazwani RazakNo ratings yet

- Business 18: Introduction To Business Law: Chapter 35: AGENCYDocument8 pagesBusiness 18: Introduction To Business Law: Chapter 35: AGENCYSurajit GoswamiNo ratings yet

- Acct Statement - XX7582 - 10032022Document1 pageAcct Statement - XX7582 - 10032022Tradingideas2456No ratings yet

- VN CB Retail in Vietnam 2022Document14 pagesVN CB Retail in Vietnam 2022Linh Phùng Thị ThùyNo ratings yet

- Sap MM Invoice VerificationDocument6 pagesSap MM Invoice VerificationAnonymous NhgstfxoNo ratings yet

- MascoDocument4 pagesMascoShovon MondalNo ratings yet

- The Enterprise Development Programme Annual Review 2012Document29 pagesThe Enterprise Development Programme Annual Review 2012OxfamNo ratings yet

- G.R. No. 177556Document3 pagesG.R. No. 177556Arly Mae ArellanoNo ratings yet

- Dcco ExtensionDocument6 pagesDcco ExtensionTinyZuneNo ratings yet

- In ShippingDocument8 pagesIn Shippingprashant kumarNo ratings yet

- Corporate WORD FileDocument9 pagesCorporate WORD FileArbaz KhanNo ratings yet

- Marketing Balaji 111111Document10 pagesMarketing Balaji 111111Hařsh Thakkar HťNo ratings yet

- RedLion RL30E - 2005 PDFDocument12 pagesRedLion RL30E - 2005 PDFEd FalckNo ratings yet

- Marketing Plan Template v3Document44 pagesMarketing Plan Template v3Sophia FiloteoNo ratings yet

- Jzanzig - Acc 512 - Chapter 12Document27 pagesJzanzig - Acc 512 - Chapter 12lehvrhon100% (1)

- Operations Planning and Control: Chapter FourDocument16 pagesOperations Planning and Control: Chapter FourBeka AsraNo ratings yet

- RA 9184 Slides (1) - Atty. TomDocument86 pagesRA 9184 Slides (1) - Atty. TomrickmortyNo ratings yet

- Audit Program-MSBPLDocument21 pagesAudit Program-MSBPLTasdik MahmudNo ratings yet

- 9780 DatDocument4 pages9780 DatMASTER PERFECTNo ratings yet

- How To Attack The Leader - FinalDocument14 pagesHow To Attack The Leader - Finalbalakk06No ratings yet