Professional Documents

Culture Documents

CAM-Accounting For Income Taxes - Nike 2020 10K

CAM-Accounting For Income Taxes - Nike 2020 10K

Uploaded by

nofeOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CAM-Accounting For Income Taxes - Nike 2020 10K

CAM-Accounting For Income Taxes - Nike 2020 10K

Uploaded by

nofeCopyright:

Available Formats

Nike 2020 10K

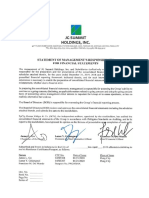

Critical Audit Matters

The critical audit matter communicated below is a matter arising from the current period audit of the consolidated financial

statements that was communicated or required to be communicated to the audit committee and that (i) relates to accounts

or disclosures that are material to the consolidated financial statements and (ii) involved our especially challenging,

subjective, or complex judgments. The communication of critical audit matters does not alter in any way our opinion on the

consolidated financial statements, taken as a whole, and we are not, by communicating the critical audit matter below,

providing a separate opinion on the critical audit matter or on the accounts or disclosures to which it relates.

Accounting for Income Taxes

As described in Note 9 to the consolidated financial statements, the Company recorded income tax expense of $348 million

for the year ended May 31, 2020, and has net deferred tax assets of $732 million, including a valuation allowance of $26

million, and total gross unrecognized tax benefits, excluding related interest and penalties, of $771 million as of May 31,

2020, $536 million of which would affect the Company's effective tax rate if recognized in future periods. The Company is

subject to taxation in the United States, as well as various state and foreign jurisdictions. As disclosed by management, the

use of significant judgment and estimates, as well as the interpretation and application of complex tax laws is required by

management to determine its provision for income taxes.

The principal considerations for our determination that performing procedures relating to the accounting for income taxes is

a critical audit matter are the significant judgment by management when assessing complex tax laws and regulations,

including new temporary regulations and recent court rulings, as it relates to determining the provision for income taxes and

other tax positions. This in turn led to a high degree of auditor judgment, subjectivity and effort in performing procedures and

evaluating audit evidence relating to the provision for income taxes and other tax positions. In addition, the audit effort

involved the use of professionals with specialized skill and knowledge to assist in performing procedures and evaluating the

audit evidence obtained.

Addressing the matter involved performing procedures and evaluating audit evidence in connection with forming our overall

opinion on the consolidated financial statements. These procedures included testing the effectiveness of controls relating to

the provision for income taxes and other tax positions. These procedures also included, among others, evaluating the effect

on the Company's tax provision of changes in its legal entity structure and tax laws, testing management's tax calculations

and considering the Company's compliance with tax laws. We also used professionals with specialized skill and knowledge

to assist in evaluating the application of relevant tax laws, the provision for income taxes and the reasonableness of

management's assessments of whether certain tax positions are more-likely-than-not of being sustained.

You might also like

- VCCGenerator - Valid Credit Card Generator 2021 (Document1 pageVCCGenerator - Valid Credit Card Generator 2021 (Safir JalaliNo ratings yet

- Cincinnatii Southern Railway Investment Advisor Presentation SummaryDocument4 pagesCincinnatii Southern Railway Investment Advisor Presentation SummarySACoolidgeNo ratings yet

- HO 2 - Qualified Audit ReportDocument3 pagesHO 2 - Qualified Audit ReportRheneir Mora100% (1)

- Sample Project Report For Commercial Vehicle LoanDocument18 pagesSample Project Report For Commercial Vehicle LoanRajveer Mahajan40% (5)

- 7) The SWOT Analysis of ITC Limited Is As Follows:: StrengthsDocument2 pages7) The SWOT Analysis of ITC Limited Is As Follows:: Strengthsshalabh100% (2)

- Sample Mortgage ContractDocument5 pagesSample Mortgage ContractJennevy Aivee Barretto Lomibao100% (1)

- Grameenphone Accounts 2020Document62 pagesGrameenphone Accounts 2020JUNAYED AHMED RAFINNo ratings yet

- CAM-Acquisition of Business and Uncertain Tax Positions - IBM 2019 10KDocument2 pagesCAM-Acquisition of Business and Uncertain Tax Positions - IBM 2019 10KnofeNo ratings yet

- Robi Axiata Limited: Report and Financial Statements As at and For The Year Ended 31 December 2019Document97 pagesRobi Axiata Limited: Report and Financial Statements As at and For The Year Ended 31 December 2019Anika hossainNo ratings yet

- Optiva Inc. Q4 2021 Financial Statements FinalDocument63 pagesOptiva Inc. Q4 2021 Financial Statements FinaldivyaNo ratings yet

- Unilever Financial StatementDocument77 pagesUnilever Financial StatementIrene CapilitanNo ratings yet

- Illustrative Audit OpinionDocument6 pagesIllustrative Audit OpinionCaleb NewquistNo ratings yet

- Tyco Form10K 2002 3Document10 pagesTyco Form10K 2002 3TranNo ratings yet

- JG Summit Annual - FS 2019 PDFDocument210 pagesJG Summit Annual - FS 2019 PDFZo ThelfNo ratings yet

- E MFC Afs 2019Document84 pagesE MFC Afs 2019Cassandra Ivana BermudezNo ratings yet

- Auditors Report StandaloneDocument12 pagesAuditors Report StandalonezendeexNo ratings yet

- Report of Independent Registered Public Accounting FirmDocument4 pagesReport of Independent Registered Public Accounting FirmfifiNo ratings yet

- City of Hyattsville, Maryland - Final Report - Final Auc260 Conclusion - 2020Document4 pagesCity of Hyattsville, Maryland - Final Report - Final Auc260 Conclusion - 2020route1financeNo ratings yet

- Auditor' Report.Document8 pagesAuditor' Report.Johan GutierrezNo ratings yet

- Accounting StandardsDocument24 pagesAccounting Standardslakhan619No ratings yet

- Cellnex Individual Annual Accounts and Management Report 2020 1Document234 pagesCellnex Individual Annual Accounts and Management Report 2020 1Fauzi Al nassarNo ratings yet

- Ashbourne Industries Audit OpinionDocument4 pagesAshbourne Industries Audit OpinionFanix Yostina DaelyNo ratings yet

- Standalone Statement On Impact of Audit Qualifications For The Period Ended March 31, 2016 (Company Update)Document2 pagesStandalone Statement On Impact of Audit Qualifications For The Period Ended March 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Financial StatementsDocument181 pagesFinancial StatementsDivitya ChaudharyNo ratings yet

- ASE Technology Holding Co., Ltd. and SubsidiariesDocument122 pagesASE Technology Holding Co., Ltd. and SubsidiariesSjdnxbjzjs SbsbsjsjsNo ratings yet

- LG Chem, LTD.: Separate Financial Statements and Internal Control Over Financial Reporting December 31, 2019 and 2018Document97 pagesLG Chem, LTD.: Separate Financial Statements and Internal Control Over Financial Reporting December 31, 2019 and 2018Ayushika SinghNo ratings yet

- Natura 2016 AR Engl PDFDocument140 pagesNatura 2016 AR Engl PDFManuel CámacNo ratings yet

- E - MFC English Q423 FSDocument123 pagesE - MFC English Q423 FSEvan LoirtNo ratings yet

- US GAO Management Report: Improvements Are Needed To Enhance The Internal Revenue Service's Internal Control Over Financial ReportingDocument29 pagesUS GAO Management Report: Improvements Are Needed To Enhance The Internal Revenue Service's Internal Control Over Financial ReportingximentaNo ratings yet

- Report of Independent Auditors: The Shareholders and Board of DirectorsDocument5 pagesReport of Independent Auditors: The Shareholders and Board of Directorsx 1No ratings yet

- Consolidated Financial StatementsDocument136 pagesConsolidated Financial Statementsganesh PALNo ratings yet

- LG Chem 2020 Contingent Financial StatementsDocument102 pagesLG Chem 2020 Contingent Financial StatementsAyushika SinghNo ratings yet

- BTG Q4 FS 2019Document48 pagesBTG Q4 FS 2019Oumar KoneNo ratings yet

- Gla Epecerie Merch Inc Notes To Fs 2022 MsDocument16 pagesGla Epecerie Merch Inc Notes To Fs 2022 MsPaolo Martin Lagos AdrianoNo ratings yet

- Indian Accounting StandardsDocument7 pagesIndian Accounting StandardsAnand MakhijaNo ratings yet

- Indian Accounting StandardsDocument6 pagesIndian Accounting StandardsNinad DaphaleNo ratings yet

- Latest Sample Auditors ReportDocument5 pagesLatest Sample Auditors ReportABDUL REHMAN WARRIACHNo ratings yet

- RRHIS A1.1.0 CFS1219 Robinsons Retail Holdings IncDocument98 pagesRRHIS A1.1.0 CFS1219 Robinsons Retail Holdings Incherrera.angelaNo ratings yet

- BAT AR20 F 2018 Financial StatementsDocument138 pagesBAT AR20 F 2018 Financial StatementsK DonovichNo ratings yet

- 2021 Audit ReportDocument79 pages2021 Audit ReportvishalNo ratings yet

- Year End Financial Statements PDFDocument38 pagesYear End Financial Statements PDFCasualKillaNo ratings yet

- Financial Statements - 2Document199 pagesFinancial Statements - 2Liliana MNo ratings yet

- 2023 Con Quarter04 AllDocument87 pages2023 Con Quarter04 AllMohammad Hyder AliNo ratings yet

- Kapco FinancialsDocument63 pagesKapco FinancialsGhulam MustafaNo ratings yet

- AuditDocument10 pagesAuditlucinossNo ratings yet

- Auditing and Corporate GovernanceDocument4 pagesAuditing and Corporate Governancesuraj agarwalNo ratings yet

- Audit OpinionsDocument16 pagesAudit Opinionsd.pagkatoytoyNo ratings yet

- TCS (Tata Consultancy Services) Standalone Audit Report Summary For 2021-22Document13 pagesTCS (Tata Consultancy Services) Standalone Audit Report Summary For 2021-22Labdhi JainNo ratings yet

- 2020 Audited Consolidated Financial StatementsDocument140 pages2020 Audited Consolidated Financial Statements채문길No ratings yet

- Letter of RepresentationDocument5 pagesLetter of Representationafiq.rzforceNo ratings yet

- NOTES 12 InterimDocument6 pagesNOTES 12 InterimWinny PoeNo ratings yet

- Assignment 2Document7 pagesAssignment 2Dawna Lee BerryNo ratings yet

- Financial Accounting & AnalysisDocument10 pagesFinancial Accounting & AnalysisBijesh SiwachNo ratings yet

- Disclosure of Accounting PoliciesDocument9 pagesDisclosure of Accounting Policieskisser141No ratings yet

- Sleep Country Canada Holding IncDocument44 pagesSleep Country Canada Holding IncSunira PaudelNo ratings yet

- 1197astra AR 19-20 Final Organized PDFDocument8 pages1197astra AR 19-20 Final Organized PDFelenaNo ratings yet

- LGE - 21 4Q - Consolidated - F - SignedDocument141 pagesLGE - 21 4Q - Consolidated - F - SignedBobby SNo ratings yet

- February 12, 2021: Consolidated Financial Statements and NotesDocument77 pagesFebruary 12, 2021: Consolidated Financial Statements and NotesAnujaNo ratings yet

- Indian Accounting StandardsDocument7 pagesIndian Accounting StandardsVishal JoshiNo ratings yet

- Smc-Sec Form 17-A (04.17.2023) Part2-FinalDocument305 pagesSmc-Sec Form 17-A (04.17.2023) Part2-FinalRenneth Ena OdeNo ratings yet

- Accounting Is The Art of Recording Transactions in The Best MannerDocument22 pagesAccounting Is The Art of Recording Transactions in The Best MannerSunny PandeyNo ratings yet

- Annual Update and Practice Issues for Preparation, Compilation, and Review EngagementsFrom EverandAnnual Update and Practice Issues for Preparation, Compilation, and Review EngagementsNo ratings yet

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"From Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"No ratings yet

- Dal Mill Report IndiaDocument12 pagesDal Mill Report Indiarituverma587No ratings yet

- Candle Making Business Budget: Items Variance Budgeted Amount Actual AmountDocument4 pagesCandle Making Business Budget: Items Variance Budgeted Amount Actual AmountAisyah ZulzurinNo ratings yet

- Nature of Capital Budgeting & Types of Capital ProjectsDocument11 pagesNature of Capital Budgeting & Types of Capital ProjectsMitesh KumarNo ratings yet

- Syllabus Corporate Finance 2021-2022Document5 pagesSyllabus Corporate Finance 2021-2022Mohd OzairNo ratings yet

- QS Invoice-Rev.1Document1 pageQS Invoice-Rev.1Lusac EIRLNo ratings yet

- Technical AnalysisDocument65 pagesTechnical Analysisaurorashiva1No ratings yet

- Chapter One History of Banking Evolution of Banking The Origin of The Word "Bank"Document60 pagesChapter One History of Banking Evolution of Banking The Origin of The Word "Bank"sheikhkhalidNo ratings yet

- The Profitability of Technical Trading Rules in US Futures Markets: A Data Snooping Free TestDocument36 pagesThe Profitability of Technical Trading Rules in US Futures Markets: A Data Snooping Free TestCodinasound CaNo ratings yet

- Insider Trading June 15Document2 pagesInsider Trading June 15Mark FidelmanNo ratings yet

- Bank Reconciliation Exercises and Answers: Step-By-Step Tutorial ExerciseDocument20 pagesBank Reconciliation Exercises and Answers: Step-By-Step Tutorial ExerciseTạ Tuấn DũngNo ratings yet

- Ch11 Homework SolutionDocument5 pagesCh11 Homework Solutionashwn17No ratings yet

- Vitrox q42022Document16 pagesVitrox q42022Dennis AngNo ratings yet

- Accounting in BanksDocument27 pagesAccounting in BankssaktipadhiNo ratings yet

- Solution PinnacleDocument25 pagesSolution PinnacleMaria GabriellaNo ratings yet

- Asset AllocationDocument25 pagesAsset AllocationRafia NaveedNo ratings yet

- Set-Iii Section - A: XII - EconomicsDocument4 pagesSet-Iii Section - A: XII - EconomicsSoniya Omir VijanNo ratings yet

- Us Gaap Ifrs Cash FlowsDocument2 pagesUs Gaap Ifrs Cash FlowsenesteeNo ratings yet

- Financial Engineering AssignmentDocument8 pagesFinancial Engineering AssignmentrakibajahidNo ratings yet

- Chapter Twelve: Managing and Pricing Deposit ServicesDocument17 pagesChapter Twelve: Managing and Pricing Deposit ServicesTarique AdnanNo ratings yet

- Reparations 2Document2 pagesReparations 2rahulNo ratings yet

- Income Statement: Alladin Travel Inc. Statement of Profit and Loss As of April 30, 2018Document2 pagesIncome Statement: Alladin Travel Inc. Statement of Profit and Loss As of April 30, 2018Jasmine ActaNo ratings yet

- Arens14e ch08 PPTDocument48 pagesArens14e ch08 PPTSekar Ayu Kartika SariNo ratings yet

- ReportHistory 732xxxDocument8 pagesReportHistory 732xxxdandy119No ratings yet

- WWW Acowtancy Com Textbook Acca MaDocument11 pagesWWW Acowtancy Com Textbook Acca MaSameer BhattaraiNo ratings yet

- U Uu Uupdate Pdate Pdate Pdate Pdate: B BB Bbanking Anking Anking Anking AnkingDocument16 pagesU Uu Uupdate Pdate Pdate Pdate Pdate: B BB Bbanking Anking Anking Anking AnkingAnjuRoseNo ratings yet