Professional Documents

Culture Documents

Apznzabrpyozxz7 Pwk4 m5dkegtgimqdqwzdyhr9q2imwebf9u8xsppryizja6d Ktk6cmw61upss0iriuty Lr2r0d90nregzmkw3y6vtpjvceywnfydwulqxfjltc7mxnnjjmmzcccm4i5ntlt Rzc12saw Akh Jp Ydn31c Onzytgc3s6o5qplm6xo1eo7f4uxeqp 7pr4bbtiyglqu

Apznzabrpyozxz7 Pwk4 m5dkegtgimqdqwzdyhr9q2imwebf9u8xsppryizja6d Ktk6cmw61upss0iriuty Lr2r0d90nregzmkw3y6vtpjvceywnfydwulqxfjltc7mxnnjjmmzcccm4i5ntlt Rzc12saw Akh Jp Ydn31c Onzytgc3s6o5qplm6xo1eo7f4uxeqp 7pr4bbtiyglqu

Uploaded by

Pauline Jasmine Sta AnaCopyright:

Available Formats

You might also like

- Assessment Task 3: Project: Grow Management ConsultantsDocument11 pagesAssessment Task 3: Project: Grow Management Consultantsvinotha ammu100% (4)

- ACCN 304 Revision QuestionsDocument11 pagesACCN 304 Revision Questionskelvinmunashenyamutumba100% (1)

- C10 - PAS 7 Statement of Cash FlowsDocument15 pagesC10 - PAS 7 Statement of Cash FlowsAllaine Elfa100% (2)

- Business Examples 2021Document12 pagesBusiness Examples 2021Faizan HyderNo ratings yet

- What Is Span of ControlDocument7 pagesWhat Is Span of ControlPanda Anjali100% (1)

- Blanchard - Effective Training - Systems Strategies and Practices 5eDocument10 pagesBlanchard - Effective Training - Systems Strategies and Practices 5ebagofgag100% (1)

- Income TaxesDocument37 pagesIncome TaxesAngelaMariePeñarandaNo ratings yet

- Statement of Comprehensive IncomeDocument4 pagesStatement of Comprehensive Incomebobo tangaNo ratings yet

- MOJAKOE AK1 UTS 2012 GasalDocument15 pagesMOJAKOE AK1 UTS 2012 GasalVincenttio le CloudNo ratings yet

- Corporate Taxes Part 1 (VAT, EWT and Income Tax) CaseDocument4 pagesCorporate Taxes Part 1 (VAT, EWT and Income Tax) CaseMikaela L. RoqueNo ratings yet

- Chapter 1 11 IA3Document10 pagesChapter 1 11 IA3ZicoNo ratings yet

- For Revision of Income TaxDocument5 pagesFor Revision of Income TaxMA AttariNo ratings yet

- Revision Pack QuestionsDocument12 pagesRevision Pack QuestionsAmmaarah PatelNo ratings yet

- Ch.6-Tutorial 1Document3 pagesCh.6-Tutorial 1NURSABRINA BINTI ROSLI (BG)No ratings yet

- IT AY 2022-23 Probs On PGBPDocument15 pagesIT AY 2022-23 Probs On PGBPmojesnandas9935No ratings yet

- BT Ias1 (SV)Document3 pagesBT Ias1 (SV)HÀ THỚI NGUYỄN NGÂNNo ratings yet

- Special Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureDocument5 pagesSpecial Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureClarisse AlimotNo ratings yet

- CA-Ipcc Old Course: Advanced AccountingDocument125 pagesCA-Ipcc Old Course: Advanced AccountingAruna Rajappa100% (1)

- Accounting TestDocument4 pagesAccounting Testdinda ardiyaniNo ratings yet

- Assets: Instruction: Write The Solution of The Problems Below (In Good Form)Document5 pagesAssets: Instruction: Write The Solution of The Problems Below (In Good Form)Christine CalimagNo ratings yet

- Income Taxation - Regular Income Tax 2Document5 pagesIncome Taxation - Regular Income Tax 2Drew BanlutaNo ratings yet

- Homework 4題目Document2 pagesHomework 4題目劉百祥No ratings yet

- Advanced Taxation-Previous YearDocument4 pagesAdvanced Taxation-Previous YearObeng CliffNo ratings yet

- Final Activity 3 QuestionDocument2 pagesFinal Activity 3 QuestionSze ChristienyNo ratings yet

- ACC705 Corporate Accounting AssignmentDocument9 pagesACC705 Corporate Accounting AssignmentMuhammad AhsanNo ratings yet

- Classroom Exerisises On Presentation of Financial Statements PDFDocument2 pagesClassroom Exerisises On Presentation of Financial Statements PDFalyssaNo ratings yet

- Questions Business IncomeDocument8 pagesQuestions Business IncomeMbeiza MariamNo ratings yet

- Accounts Home Test 2Document7 pagesAccounts Home Test 2Ashish RaiNo ratings yet

- HI5020 Tutorial Question Assignment T3 2020 FinalDocument7 pagesHI5020 Tutorial Question Assignment T3 2020 FinalAamirNo ratings yet

- Long Quiz P1Document2 pagesLong Quiz P1chonana0408No ratings yet

- Tax ProblemsDocument14 pagesTax Problemsrav dano100% (1)

- Question 6 Chic Homes LTD GroupDocument5 pagesQuestion 6 Chic Homes LTD GroupsavagewolfieNo ratings yet

- Far01 - The Financial Statements PresentationDocument10 pagesFar01 - The Financial Statements PresentationRNo ratings yet

- BFC 3225 Intermediate Accounting I 2 - 2Document6 pagesBFC 3225 Intermediate Accounting I 2 - 2karashinokov siwoNo ratings yet

- ACC 281 SEMINAR QUESTIONS Version 2Document8 pagesACC 281 SEMINAR QUESTIONS Version 2Joel SimonNo ratings yet

- Fa Topic 17-23Document34 pagesFa Topic 17-23MehakpreetNo ratings yet

- Masters Technological Institute of MindanaoDocument3 pagesMasters Technological Institute of MindanaoPang SiulienNo ratings yet

- TY ProfitsfromBusinessDocument9 pagesTY ProfitsfromBusinessVansh ChouhanNo ratings yet

- Financial Accounting AssignmentDocument6 pagesFinancial Accounting Assignmentpunya guptaNo ratings yet

- Prevalidation TaxDocument5 pagesPrevalidation TaxJon Dumagil Inocentes, CPANo ratings yet

- Seminar 4 - QsDocument3 pagesSeminar 4 - QsMaman AbdurrahmanNo ratings yet

- Consolidation/Group Accounts: Example 18: Disposal of SubsidiaryDocument4 pagesConsolidation/Group Accounts: Example 18: Disposal of SubsidiaryMuhammad Sarfraz AsmatNo ratings yet

- Take Home Quiz 2Document6 pagesTake Home Quiz 2Jane Tuazon100% (1)

- 3rd Year Diagnostic TestDocument11 pages3rd Year Diagnostic TestRaizell Jane Masiglat CarlosNo ratings yet

- 1 Partnership-YTDocument7 pages1 Partnership-YTSherwin DueNo ratings yet

- IFRS Week 6Document4 pagesIFRS Week 6AleksandraNo ratings yet

- What Are The Advantages To A Business of Being Formed As A Company? What Are The Disadvantages?Document12 pagesWhat Are The Advantages To A Business of Being Formed As A Company? What Are The Disadvantages?Nguyễn HoàngNo ratings yet

- Fabm2 - Statement of Comprehensive Income (Practice Problems) - Answer KeyDocument3 pagesFabm2 - Statement of Comprehensive Income (Practice Problems) - Answer KeyMounicha Ambayec100% (4)

- Fabm2 Statement of Comprehensive Income Practice Problems Answer KeyDocument3 pagesFabm2 Statement of Comprehensive Income Practice Problems Answer KeyMounicha Ambayec0% (1)

- IAET TaxationDocument2 pagesIAET TaxationRandy Manzano100% (1)

- Cash Flow 05 With Answers Just Give SolutionsDocument21 pagesCash Flow 05 With Answers Just Give SolutionsEdi wow WowNo ratings yet

- SUMMER 2024 IFACC PROJECTDocument11 pagesSUMMER 2024 IFACC PROJECTRomario AdmanNo ratings yet

- Trial Balance Adjustments Profit or Loss Financial Position Account Title Debit Credit Debit Credit Debit Credit Debit CreditDocument2 pagesTrial Balance Adjustments Profit or Loss Financial Position Account Title Debit Credit Debit Credit Debit Credit Debit CreditMichelle BabaNo ratings yet

- Unit 3 - Business Finance - AppendixDocument5 pagesUnit 3 - Business Finance - Appendixmhmir9.95No ratings yet

- RATIO QuestionsDocument5 pagesRATIO QuestionsikkaNo ratings yet

- Project Information Project 1Document8 pagesProject Information Project 1biniamNo ratings yet

- Intermediate Nov 2019 b4Document24 pagesIntermediate Nov 2019 b4georginageorge254No ratings yet

- I1.2-Financial Reporting QPDocument8 pagesI1.2-Financial Reporting QPConstantin NdahimanaNo ratings yet

- Review For Quiz 3 Part 2Document18 pagesReview For Quiz 3 Part 2Mariah ValizadoNo ratings yet

- Adjusting EntriesDocument5 pagesAdjusting EntriesM Hassan BrohiNo ratings yet

- BU51009 (5BA) - Assessed Coursework - EBT 2019-20Document2 pagesBU51009 (5BA) - Assessed Coursework - EBT 2019-20Sravya MagantiNo ratings yet

- 2ND Year QualiDocument4 pages2ND Year QualiMark Domingo MendozaNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Web-Based Recruitment Process System For The HR Group For A CompanyDocument6 pagesWeb-Based Recruitment Process System For The HR Group For A CompanyHeaven GuyNo ratings yet

- Dubai Recruitment ServicesDocument10 pagesDubai Recruitment ServicesAjay MedikondaNo ratings yet

- DELOITTE Report WITH ORG. STRATEGYDocument27 pagesDELOITTE Report WITH ORG. STRATEGYCzarina CasallaNo ratings yet

- Industrial RelationsDocument76 pagesIndustrial Relationstamilselvanusha100% (1)

- Human Resource Management Unit - 1 Fill in The Blanks: Malla Reddy Inistitute of ManagementDocument30 pagesHuman Resource Management Unit - 1 Fill in The Blanks: Malla Reddy Inistitute of ManagementBindu Sharma100% (2)

- Safety Plan TemplateDocument22 pagesSafety Plan TemplateIsabelle LunaNo ratings yet

- Cosmopolitan Professional Resume Template BlackDocument2 pagesCosmopolitan Professional Resume Template BlackJ LagardeNo ratings yet

- Introduction To Management and Management Process: Hazel Diaz Bsge 4BDocument21 pagesIntroduction To Management and Management Process: Hazel Diaz Bsge 4BHęyselNo ratings yet

- Wolkite University College of Business and Economics Department of ManagementDocument40 pagesWolkite University College of Business and Economics Department of Managementkassahun mesele100% (1)

- HRMDocument5 pagesHRMParul GuptaNo ratings yet

- Econometrics TintnerDocument17 pagesEconometrics TintnerAlexandreNo ratings yet

- Crossing Boundaries, Connecting Communities: Alliance Building For Immigrant Rights and Racial Justice.Document74 pagesCrossing Boundaries, Connecting Communities: Alliance Building For Immigrant Rights and Racial Justice.blackimmigration100% (1)

- Philips ElectronicsDocument4 pagesPhilips Electronicsashish_19No ratings yet

- Case Study of StarbucksDocument3 pagesCase Study of StarbucksAnonymous MZRzaxFgVLNo ratings yet

- Mavar in The Hackney GazetteDocument1 pageMavar in The Hackney GazetteMavar UKNo ratings yet

- Dilki ResearchDocument136 pagesDilki Researchonali jayathilakaNo ratings yet

- Employment Law Short NoteDocument19 pagesEmployment Law Short Notelij jone efremNo ratings yet

- HRM Unit-1Document12 pagesHRM Unit-1Iquesh GuptaNo ratings yet

- HRM Objectives: Dr. Virendra Swaroop Institute of Professional StudiesDocument9 pagesHRM Objectives: Dr. Virendra Swaroop Institute of Professional StudiesArun Kumar JNo ratings yet

- SWOT AnalysisDocument3 pagesSWOT AnalysisMughees Alam100% (2)

- Competency Approach To Human Resource Management: SP Karuppasamy PandianDocument49 pagesCompetency Approach To Human Resource Management: SP Karuppasamy PandianKaruppasamy PandianNo ratings yet

- Responsive Documents - CREW: Department of Education: Regarding For-Profit Education: 8/17/2011 - 11-00026 Ginns Responsive 8-12-11 - PART 1Document825 pagesResponsive Documents - CREW: Department of Education: Regarding For-Profit Education: 8/17/2011 - 11-00026 Ginns Responsive 8-12-11 - PART 1CREWNo ratings yet

- Jurnal 2Document14 pagesJurnal 2aditya kristianto hotamaNo ratings yet

- Girl Scout Gold Award Final Report 2 3 16 FinalDocument24 pagesGirl Scout Gold Award Final Report 2 3 16 Finalapi-274972287No ratings yet

- Accounting 1 (Abm)Document7 pagesAccounting 1 (Abm)ALLIYAH JONES PAIRATNo ratings yet

- Schindler Sabbatical PolicyDocument6 pagesSchindler Sabbatical PolicyShrikant IruleNo ratings yet

- Michael Pugliese's Resumé 04-12-2016Document2 pagesMichael Pugliese's Resumé 04-12-2016Michael_S_PuglieseNo ratings yet

Apznzabrpyozxz7 Pwk4 m5dkegtgimqdqwzdyhr9q2imwebf9u8xsppryizja6d Ktk6cmw61upss0iriuty Lr2r0d90nregzmkw3y6vtpjvceywnfydwulqxfjltc7mxnnjjmmzcccm4i5ntlt Rzc12saw Akh Jp Ydn31c Onzytgc3s6o5qplm6xo1eo7f4uxeqp 7pr4bbtiyglqu

Apznzabrpyozxz7 Pwk4 m5dkegtgimqdqwzdyhr9q2imwebf9u8xsppryizja6d Ktk6cmw61upss0iriuty Lr2r0d90nregzmkw3y6vtpjvceywnfydwulqxfjltc7mxnnjjmmzcccm4i5ntlt Rzc12saw Akh Jp Ydn31c Onzytgc3s6o5qplm6xo1eo7f4uxeqp 7pr4bbtiyglqu

Uploaded by

Pauline Jasmine Sta AnaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Apznzabrpyozxz7 Pwk4 m5dkegtgimqdqwzdyhr9q2imwebf9u8xsppryizja6d Ktk6cmw61upss0iriuty Lr2r0d90nregzmkw3y6vtpjvceywnfydwulqxfjltc7mxnnjjmmzcccm4i5ntlt Rzc12saw Akh Jp Ydn31c Onzytgc3s6o5qplm6xo1eo7f4uxeqp 7pr4bbtiyglqu

Apznzabrpyozxz7 Pwk4 m5dkegtgimqdqwzdyhr9q2imwebf9u8xsppryizja6d Ktk6cmw61upss0iriuty Lr2r0d90nregzmkw3y6vtpjvceywnfydwulqxfjltc7mxnnjjmmzcccm4i5ntlt Rzc12saw Akh Jp Ydn31c Onzytgc3s6o5qplm6xo1eo7f4uxeqp 7pr4bbtiyglqu

Uploaded by

Pauline Jasmine Sta AnaCopyright:

Available Formats

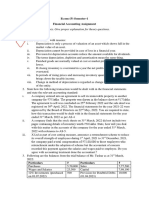

Atty.

Miguel Legazpi, with TIN 331-875-803-0000, is employed as a rank-and-file corporate lawyer

of EFG International. In 2023, he received the following from his employment:

Salary (gross of deductions) P 1,800,000

Profit sharing 300,000

13th month pay (excluded from salary) 150,000

De Minimis Benefits:

Clothing allowance 15,000

Laundry allowance 12,000

Christmas gift 25,000

Monetized unused VL credits (15 days) 90,000

Monetized unused SL credits (10 days) 60,000

Mandatory Deductions:

SSS Employee Contributions 22,000

HDMF Employee Contributions 1,200

PHIC Employee Contributions 7,200

Tax withheld by EFG International 402,500

The following were also reported by his pet shop business in 2023 registered as sole

proprietorship:

Sales Revenues P 950,000

Cost of Goods Sold 400,000

Salaries Expense 195,000

Rent Expense 50,000

Utilities Expense 25,000

Atty. Legazpi also earned the following income in 2023:

PCSO Lotto Winnings P 10,000

Interest Income from bank deposit – BPI Marilao 9,600

(amount received)

1. How much is the taxable compensation income of Atty. Legazpi?

2. How much is the exempt compensation income of Atty/ Legazpi?

3. How much is the income subject to final tax?

4. How much is the income subject to normal tax?

5. How much is the total income tax due assuming Atty. Legazpi opted to be taxed under

the graduated income tax regime (Sec. 24A)?

6. How much is the total income tax due assuming Atty. Legazpi opted to be taxed at 8%

income tax?

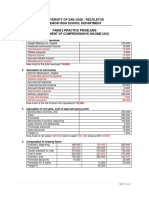

Marites Corporation is engaged in the business of manufacturing candies. Marites Corporation

was incorporated in the year 2020 at Bocaue, Bulacan. It commenced its operations in the same

year. The Corporation is employing a calendar-year basis.

During the year 2024, Marites Corporation reported the following:

Sales P 9,000,000

Sales Returns 100,000

Cost of Sales 2,700,000

Depreciation of equipment 250,000

Rent expense 150,000

Utilities expense 100,000

Salaries expense 320,000

Business permit and other licenses 20,000

Mandatory contributions for employees paid by Marites Corp. 55,000

Tax withheld by customers 790,000

1. Determine the taxable income and tax due assuming that Marites is employing itemized

deduction.

2. Determine the tax benefit or tax cost of employing itemized deduction over OSD in the

case of Marites Corporation.

You might also like

- Assessment Task 3: Project: Grow Management ConsultantsDocument11 pagesAssessment Task 3: Project: Grow Management Consultantsvinotha ammu100% (4)

- ACCN 304 Revision QuestionsDocument11 pagesACCN 304 Revision Questionskelvinmunashenyamutumba100% (1)

- C10 - PAS 7 Statement of Cash FlowsDocument15 pagesC10 - PAS 7 Statement of Cash FlowsAllaine Elfa100% (2)

- Business Examples 2021Document12 pagesBusiness Examples 2021Faizan HyderNo ratings yet

- What Is Span of ControlDocument7 pagesWhat Is Span of ControlPanda Anjali100% (1)

- Blanchard - Effective Training - Systems Strategies and Practices 5eDocument10 pagesBlanchard - Effective Training - Systems Strategies and Practices 5ebagofgag100% (1)

- Income TaxesDocument37 pagesIncome TaxesAngelaMariePeñarandaNo ratings yet

- Statement of Comprehensive IncomeDocument4 pagesStatement of Comprehensive Incomebobo tangaNo ratings yet

- MOJAKOE AK1 UTS 2012 GasalDocument15 pagesMOJAKOE AK1 UTS 2012 GasalVincenttio le CloudNo ratings yet

- Corporate Taxes Part 1 (VAT, EWT and Income Tax) CaseDocument4 pagesCorporate Taxes Part 1 (VAT, EWT and Income Tax) CaseMikaela L. RoqueNo ratings yet

- Chapter 1 11 IA3Document10 pagesChapter 1 11 IA3ZicoNo ratings yet

- For Revision of Income TaxDocument5 pagesFor Revision of Income TaxMA AttariNo ratings yet

- Revision Pack QuestionsDocument12 pagesRevision Pack QuestionsAmmaarah PatelNo ratings yet

- Ch.6-Tutorial 1Document3 pagesCh.6-Tutorial 1NURSABRINA BINTI ROSLI (BG)No ratings yet

- IT AY 2022-23 Probs On PGBPDocument15 pagesIT AY 2022-23 Probs On PGBPmojesnandas9935No ratings yet

- BT Ias1 (SV)Document3 pagesBT Ias1 (SV)HÀ THỚI NGUYỄN NGÂNNo ratings yet

- Special Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureDocument5 pagesSpecial Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureClarisse AlimotNo ratings yet

- CA-Ipcc Old Course: Advanced AccountingDocument125 pagesCA-Ipcc Old Course: Advanced AccountingAruna Rajappa100% (1)

- Accounting TestDocument4 pagesAccounting Testdinda ardiyaniNo ratings yet

- Assets: Instruction: Write The Solution of The Problems Below (In Good Form)Document5 pagesAssets: Instruction: Write The Solution of The Problems Below (In Good Form)Christine CalimagNo ratings yet

- Income Taxation - Regular Income Tax 2Document5 pagesIncome Taxation - Regular Income Tax 2Drew BanlutaNo ratings yet

- Homework 4題目Document2 pagesHomework 4題目劉百祥No ratings yet

- Advanced Taxation-Previous YearDocument4 pagesAdvanced Taxation-Previous YearObeng CliffNo ratings yet

- Final Activity 3 QuestionDocument2 pagesFinal Activity 3 QuestionSze ChristienyNo ratings yet

- ACC705 Corporate Accounting AssignmentDocument9 pagesACC705 Corporate Accounting AssignmentMuhammad AhsanNo ratings yet

- Classroom Exerisises On Presentation of Financial Statements PDFDocument2 pagesClassroom Exerisises On Presentation of Financial Statements PDFalyssaNo ratings yet

- Questions Business IncomeDocument8 pagesQuestions Business IncomeMbeiza MariamNo ratings yet

- Accounts Home Test 2Document7 pagesAccounts Home Test 2Ashish RaiNo ratings yet

- HI5020 Tutorial Question Assignment T3 2020 FinalDocument7 pagesHI5020 Tutorial Question Assignment T3 2020 FinalAamirNo ratings yet

- Long Quiz P1Document2 pagesLong Quiz P1chonana0408No ratings yet

- Tax ProblemsDocument14 pagesTax Problemsrav dano100% (1)

- Question 6 Chic Homes LTD GroupDocument5 pagesQuestion 6 Chic Homes LTD GroupsavagewolfieNo ratings yet

- Far01 - The Financial Statements PresentationDocument10 pagesFar01 - The Financial Statements PresentationRNo ratings yet

- BFC 3225 Intermediate Accounting I 2 - 2Document6 pagesBFC 3225 Intermediate Accounting I 2 - 2karashinokov siwoNo ratings yet

- ACC 281 SEMINAR QUESTIONS Version 2Document8 pagesACC 281 SEMINAR QUESTIONS Version 2Joel SimonNo ratings yet

- Fa Topic 17-23Document34 pagesFa Topic 17-23MehakpreetNo ratings yet

- Masters Technological Institute of MindanaoDocument3 pagesMasters Technological Institute of MindanaoPang SiulienNo ratings yet

- TY ProfitsfromBusinessDocument9 pagesTY ProfitsfromBusinessVansh ChouhanNo ratings yet

- Financial Accounting AssignmentDocument6 pagesFinancial Accounting Assignmentpunya guptaNo ratings yet

- Prevalidation TaxDocument5 pagesPrevalidation TaxJon Dumagil Inocentes, CPANo ratings yet

- Seminar 4 - QsDocument3 pagesSeminar 4 - QsMaman AbdurrahmanNo ratings yet

- Consolidation/Group Accounts: Example 18: Disposal of SubsidiaryDocument4 pagesConsolidation/Group Accounts: Example 18: Disposal of SubsidiaryMuhammad Sarfraz AsmatNo ratings yet

- Take Home Quiz 2Document6 pagesTake Home Quiz 2Jane Tuazon100% (1)

- 3rd Year Diagnostic TestDocument11 pages3rd Year Diagnostic TestRaizell Jane Masiglat CarlosNo ratings yet

- 1 Partnership-YTDocument7 pages1 Partnership-YTSherwin DueNo ratings yet

- IFRS Week 6Document4 pagesIFRS Week 6AleksandraNo ratings yet

- What Are The Advantages To A Business of Being Formed As A Company? What Are The Disadvantages?Document12 pagesWhat Are The Advantages To A Business of Being Formed As A Company? What Are The Disadvantages?Nguyễn HoàngNo ratings yet

- Fabm2 - Statement of Comprehensive Income (Practice Problems) - Answer KeyDocument3 pagesFabm2 - Statement of Comprehensive Income (Practice Problems) - Answer KeyMounicha Ambayec100% (4)

- Fabm2 Statement of Comprehensive Income Practice Problems Answer KeyDocument3 pagesFabm2 Statement of Comprehensive Income Practice Problems Answer KeyMounicha Ambayec0% (1)

- IAET TaxationDocument2 pagesIAET TaxationRandy Manzano100% (1)

- Cash Flow 05 With Answers Just Give SolutionsDocument21 pagesCash Flow 05 With Answers Just Give SolutionsEdi wow WowNo ratings yet

- SUMMER 2024 IFACC PROJECTDocument11 pagesSUMMER 2024 IFACC PROJECTRomario AdmanNo ratings yet

- Trial Balance Adjustments Profit or Loss Financial Position Account Title Debit Credit Debit Credit Debit Credit Debit CreditDocument2 pagesTrial Balance Adjustments Profit or Loss Financial Position Account Title Debit Credit Debit Credit Debit Credit Debit CreditMichelle BabaNo ratings yet

- Unit 3 - Business Finance - AppendixDocument5 pagesUnit 3 - Business Finance - Appendixmhmir9.95No ratings yet

- RATIO QuestionsDocument5 pagesRATIO QuestionsikkaNo ratings yet

- Project Information Project 1Document8 pagesProject Information Project 1biniamNo ratings yet

- Intermediate Nov 2019 b4Document24 pagesIntermediate Nov 2019 b4georginageorge254No ratings yet

- I1.2-Financial Reporting QPDocument8 pagesI1.2-Financial Reporting QPConstantin NdahimanaNo ratings yet

- Review For Quiz 3 Part 2Document18 pagesReview For Quiz 3 Part 2Mariah ValizadoNo ratings yet

- Adjusting EntriesDocument5 pagesAdjusting EntriesM Hassan BrohiNo ratings yet

- BU51009 (5BA) - Assessed Coursework - EBT 2019-20Document2 pagesBU51009 (5BA) - Assessed Coursework - EBT 2019-20Sravya MagantiNo ratings yet

- 2ND Year QualiDocument4 pages2ND Year QualiMark Domingo MendozaNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Web-Based Recruitment Process System For The HR Group For A CompanyDocument6 pagesWeb-Based Recruitment Process System For The HR Group For A CompanyHeaven GuyNo ratings yet

- Dubai Recruitment ServicesDocument10 pagesDubai Recruitment ServicesAjay MedikondaNo ratings yet

- DELOITTE Report WITH ORG. STRATEGYDocument27 pagesDELOITTE Report WITH ORG. STRATEGYCzarina CasallaNo ratings yet

- Industrial RelationsDocument76 pagesIndustrial Relationstamilselvanusha100% (1)

- Human Resource Management Unit - 1 Fill in The Blanks: Malla Reddy Inistitute of ManagementDocument30 pagesHuman Resource Management Unit - 1 Fill in The Blanks: Malla Reddy Inistitute of ManagementBindu Sharma100% (2)

- Safety Plan TemplateDocument22 pagesSafety Plan TemplateIsabelle LunaNo ratings yet

- Cosmopolitan Professional Resume Template BlackDocument2 pagesCosmopolitan Professional Resume Template BlackJ LagardeNo ratings yet

- Introduction To Management and Management Process: Hazel Diaz Bsge 4BDocument21 pagesIntroduction To Management and Management Process: Hazel Diaz Bsge 4BHęyselNo ratings yet

- Wolkite University College of Business and Economics Department of ManagementDocument40 pagesWolkite University College of Business and Economics Department of Managementkassahun mesele100% (1)

- HRMDocument5 pagesHRMParul GuptaNo ratings yet

- Econometrics TintnerDocument17 pagesEconometrics TintnerAlexandreNo ratings yet

- Crossing Boundaries, Connecting Communities: Alliance Building For Immigrant Rights and Racial Justice.Document74 pagesCrossing Boundaries, Connecting Communities: Alliance Building For Immigrant Rights and Racial Justice.blackimmigration100% (1)

- Philips ElectronicsDocument4 pagesPhilips Electronicsashish_19No ratings yet

- Case Study of StarbucksDocument3 pagesCase Study of StarbucksAnonymous MZRzaxFgVLNo ratings yet

- Mavar in The Hackney GazetteDocument1 pageMavar in The Hackney GazetteMavar UKNo ratings yet

- Dilki ResearchDocument136 pagesDilki Researchonali jayathilakaNo ratings yet

- Employment Law Short NoteDocument19 pagesEmployment Law Short Notelij jone efremNo ratings yet

- HRM Unit-1Document12 pagesHRM Unit-1Iquesh GuptaNo ratings yet

- HRM Objectives: Dr. Virendra Swaroop Institute of Professional StudiesDocument9 pagesHRM Objectives: Dr. Virendra Swaroop Institute of Professional StudiesArun Kumar JNo ratings yet

- SWOT AnalysisDocument3 pagesSWOT AnalysisMughees Alam100% (2)

- Competency Approach To Human Resource Management: SP Karuppasamy PandianDocument49 pagesCompetency Approach To Human Resource Management: SP Karuppasamy PandianKaruppasamy PandianNo ratings yet

- Responsive Documents - CREW: Department of Education: Regarding For-Profit Education: 8/17/2011 - 11-00026 Ginns Responsive 8-12-11 - PART 1Document825 pagesResponsive Documents - CREW: Department of Education: Regarding For-Profit Education: 8/17/2011 - 11-00026 Ginns Responsive 8-12-11 - PART 1CREWNo ratings yet

- Jurnal 2Document14 pagesJurnal 2aditya kristianto hotamaNo ratings yet

- Girl Scout Gold Award Final Report 2 3 16 FinalDocument24 pagesGirl Scout Gold Award Final Report 2 3 16 Finalapi-274972287No ratings yet

- Accounting 1 (Abm)Document7 pagesAccounting 1 (Abm)ALLIYAH JONES PAIRATNo ratings yet

- Schindler Sabbatical PolicyDocument6 pagesSchindler Sabbatical PolicyShrikant IruleNo ratings yet

- Michael Pugliese's Resumé 04-12-2016Document2 pagesMichael Pugliese's Resumé 04-12-2016Michael_S_PuglieseNo ratings yet