Professional Documents

Culture Documents

Ca Foundation Accounts

Ca Foundation Accounts

Uploaded by

smartshivenduCopyright:

Available Formats

You might also like

- Luwalhati Sa DiyosDocument5 pagesLuwalhati Sa DiyosDebbie TschirchNo ratings yet

- FABM 210 Fundamentals of Accounting Part 2: Lyceum-Northwestern UniversityDocument10 pagesFABM 210 Fundamentals of Accounting Part 2: Lyceum-Northwestern UniversityAmie Jane MirandaNo ratings yet

- Assignment-Code 438Document5 pagesAssignment-Code 438Alice JasperNo ratings yet

- Parallel Currencies in Asset Accounting: 1. Define Currencies For Leading Ledger: (OB22)Document7 pagesParallel Currencies in Asset Accounting: 1. Define Currencies For Leading Ledger: (OB22)sapeinsNo ratings yet

- FDN J22 - TS 2 - P1 Account - QueDocument5 pagesFDN J22 - TS 2 - P1 Account - QueShantanu JadhavNo ratings yet

- SP - XI - AccountancyDocument3 pagesSP - XI - AccountancyPriyankadevi PrabuNo ratings yet

- BFC 3125 Financial Accounting IDocument5 pagesBFC 3125 Financial Accounting Ikorirenock764No ratings yet

- Accounts Suggested Ans CAF Nov 20Document25 pagesAccounts Suggested Ans CAF Nov 20Anshu DasNo ratings yet

- Paper - 1: Principles and Practice of Accounting: Question No. 1 Is CompulsoryDocument25 pagesPaper - 1: Principles and Practice of Accounting: Question No. 1 Is CompulsorySaurabh JainNo ratings yet

- +1 Accountancy ONLINE Final Examination 2021Document5 pages+1 Accountancy ONLINE Final Examination 2021Rajwinder BansalNo ratings yet

- Vidya Sagar: Foundation Major Test - 1 (Series - 3) Nov - 20 "Principles and Practice of Accounting"Document5 pagesVidya Sagar: Foundation Major Test - 1 (Series - 3) Nov - 20 "Principles and Practice of Accounting"sonubudsNo ratings yet

- Sem 2 - End Sem PapersDocument23 pagesSem 2 - End Sem Paperslalith sasankaNo ratings yet

- 2accounting Questions Nov Dec 2019 CL PDFDocument3 pages2accounting Questions Nov Dec 2019 CL PDFRazib Das RaazNo ratings yet

- Ca Inter, Group I Class Test 5. Test - DT Topic - . PGBP Date-TIME: 1:30 Hours MARKS:40 Total No - of Questions: 7 Total No - of Pages: 00Document5 pagesCa Inter, Group I Class Test 5. Test - DT Topic - . PGBP Date-TIME: 1:30 Hours MARKS:40 Total No - of Questions: 7 Total No - of Pages: 00Shrestha GuptaNo ratings yet

- Test 4Document8 pagesTest 4govarthan1976No ratings yet

- Foundation Accounts Suggested Nov20Document25 pagesFoundation Accounts Suggested Nov20dhanushd0613No ratings yet

- B. Com I All PapersnDocument14 pagesB. Com I All Papersnrahim Abbas aliNo ratings yet

- Accounting IIDocument3 pagesAccounting IIHaseeb Mehmood AwanNo ratings yet

- Accountancy CLASS-XI-WPS OfficeDocument7 pagesAccountancy CLASS-XI-WPS Officemaruthesh.vNo ratings yet

- Bcom TaxDocument6 pagesBcom TaxAditya .cNo ratings yet

- Accounting Round 1Document6 pagesAccounting Round 1Malhar ShahNo ratings yet

- Test Series: November, 2021 Mock Test Paper - 2 Intermediate (New) : Group - I Paper - 1: AccountingDocument8 pagesTest Series: November, 2021 Mock Test Paper - 2 Intermediate (New) : Group - I Paper - 1: Accountingsunil1287No ratings yet

- RTP Dec2023 p1Document32 pagesRTP Dec2023 p1Vaibhav M S100% (1)

- Contentitemfile Clakzz57bxlrw0a21yjksjcx8 PDFDocument4 pagesContentitemfile Clakzz57bxlrw0a21yjksjcx8 PDFJoseph OndariNo ratings yet

- 2019-04 ICMAB FL 001 PAC Year Question April 2019Document3 pages2019-04 ICMAB FL 001 PAC Year Question April 2019Mohammad ShahidNo ratings yet

- CA Foundation Accounts RTP Nov22Document29 pagesCA Foundation Accounts RTP Nov22adityatiwari122006No ratings yet

- Financial Accounting 2019Document8 pagesFinancial Accounting 2019Ivy NinjaNo ratings yet

- Account - 2Document6 pagesAccount - 2kakajumaNo ratings yet

- ISC Accounts 11Document2 pagesISC Accounts 11Sriyaa SunkuNo ratings yet

- Test Paper Ca FoundDocument5 pagesTest Paper Ca FoundSarangapani KaliyamoorthyNo ratings yet

- Paper - 1: Principles & Practice of Accounting Questions True and FalseDocument32 pagesPaper - 1: Principles & Practice of Accounting Questions True and FalseShaindra SinghNo ratings yet

- 23 Accounts-RTP-DecemberDocument32 pages23 Accounts-RTP-Decemberjustinbieberm77No ratings yet

- Book Keeping FivDocument6 pagesBook Keeping FivALE MEDIANo ratings yet

- FINANCIAL ACCOUNTING I 2019 MinDocument6 pagesFINANCIAL ACCOUNTING I 2019 MinKedarNo ratings yet

- Practice Questions FADocument13 pagesPractice Questions FApeacegracie140% (1)

- Financial Accounting Question SetDocument24 pagesFinancial Accounting Question SetAlireza KafaeiNo ratings yet

- DT - Test 2 - D23 - NSDocument3 pagesDT - Test 2 - D23 - NSMadhav TailorNo ratings yet

- Institute of Business Management: Lms Based Finalexaminations-Summer 2020 Analytical PartDocument3 pagesInstitute of Business Management: Lms Based Finalexaminations-Summer 2020 Analytical PartSafi SheikhNo ratings yet

- FARAP-4518Document3 pagesFARAP-4518Accounting StuffNo ratings yet

- Paper - 1: Principles & Practice of Accounting Questions True and FalseDocument25 pagesPaper - 1: Principles & Practice of Accounting Questions True and Falsegargee thakareNo ratings yet

- GULF BOARD EXAMINATION-February-2022 Class: XI AccountancyDocument6 pagesGULF BOARD EXAMINATION-February-2022 Class: XI Accountancyneemthas761No ratings yet

- Mock-Iv AccountsDocument6 pagesMock-Iv AccountsAnsh UdainiaNo ratings yet

- 11 April Account Subjective Question'Document3 pages11 April Account Subjective Question'Nishant NepalNo ratings yet

- Mock Questions ICAiDocument7 pagesMock Questions ICAiPooja GalaNo ratings yet

- 11 Sample Papers Accountancy 2020 English Medium Set 3Document10 pages11 Sample Papers Accountancy 2020 English Medium Set 3Joshi DrcpNo ratings yet

- Intermediate Acctg Review-1Document3 pagesIntermediate Acctg Review-1Anonymous QWaWnuMNo ratings yet

- CA-Foundation Accounts Full Syllabus Test For Dec 2023 StudentsDocument4 pagesCA-Foundation Accounts Full Syllabus Test For Dec 2023 Studentsbabu.bhiwadiNo ratings yet

- Test Series: October, 2020 Mock Test Paper Final (Old) Course: Group - Ii Paper - 7: Direct Tax LawsDocument11 pagesTest Series: October, 2020 Mock Test Paper Final (Old) Course: Group - Ii Paper - 7: Direct Tax LawsAnshul JainNo ratings yet

- Xi Accounting Set 3Document6 pagesXi Accounting Set 3aashirwad2076No ratings yet

- Account Test 2Document5 pagesAccount Test 2klaw6048No ratings yet

- Accounts Mega ModelDocument8 pagesAccounts Mega Modellekha ram100% (1)

- 20uafam01 BM01 20ubmam01 Principles of Financial AccountingDocument3 pages20uafam01 BM01 20ubmam01 Principles of Financial AccountingArshath KumaarNo ratings yet

- Pilot TestDocument6 pagesPilot TestNguyễn Thị Ngọc AnhNo ratings yet

- Problems - Cash FlowDocument5 pagesProblems - Cash FlowKevin JoyNo ratings yet

- May 2016 Professional Examination Financial Accounting (1.1) Examiner'S Report, Questions and Marking SchemeDocument24 pagesMay 2016 Professional Examination Financial Accounting (1.1) Examiner'S Report, Questions and Marking SchemeMartn Carldazo DrogbaNo ratings yet

- ACC 281 SEMINAR QUESTIONS Version 2Document8 pagesACC 281 SEMINAR QUESTIONS Version 2Joel SimonNo ratings yet

- Foundation - Eng. Acc Law B 23Document6 pagesFoundation - Eng. Acc Law B 23Sahil SahuNo ratings yet

- SYJC Accounts Board Question Paper of Feb 2019Document6 pagesSYJC Accounts Board Question Paper of Feb 2019sohambhosale606No ratings yet

- Test Series: October, 2020 Mock Test Paper Intermediate (New) : Group - I Paper - 1: AccountingDocument7 pagesTest Series: October, 2020 Mock Test Paper Intermediate (New) : Group - I Paper - 1: AccountingIndhuNo ratings yet

- BBS 110 Introduction To Financial Accounting: Test IIDocument8 pagesBBS 110 Introduction To Financial Accounting: Test IIlloydbwalya588No ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- E-Books - Cash Flow StatementDocument38 pagesE-Books - Cash Flow StatementsmartshivenduNo ratings yet

- E-Books - Buyback of SecuritiesDocument22 pagesE-Books - Buyback of SecuritiessmartshivenduNo ratings yet

- 8 As 21 Consolidated Financial StatementsDocument26 pages8 As 21 Consolidated Financial StatementssmartshivenduNo ratings yet

- E-Books - AS 13 Accounting For InvestmentsDocument32 pagesE-Books - AS 13 Accounting For InvestmentssmartshivenduNo ratings yet

- CH 12 Audit of Item of FSDocument38 pagesCH 12 Audit of Item of FSsmartshivenduNo ratings yet

- Lec 01 CH 1 Nature, Objectives & Scope of Audit Auditing & AssuranceDocument41 pagesLec 01 CH 1 Nature, Objectives & Scope of Audit Auditing & AssurancesmartshivenduNo ratings yet

- 9 Framework For Preparation - Presentation of Financial StatementsDocument13 pages9 Framework For Preparation - Presentation of Financial StatementssmartshivenduNo ratings yet

- Vsi Jaipur Clear CA Intermediate May 2022 in First Attempt 7 MonthsDocument4 pagesVsi Jaipur Clear CA Intermediate May 2022 in First Attempt 7 MonthssmartshivenduNo ratings yet

- 1 Financial Statement of CompaniesDocument27 pages1 Financial Statement of CompaniessmartshivenduNo ratings yet

- 5 AmalgamationDocument52 pages5 AmalgamationsmartshivenduNo ratings yet

- Audit SamplingDocument35 pagesAudit SamplingsmartshivenduNo ratings yet

- 4 Internal ReconstructionDocument38 pages4 Internal ReconstructionsmartshivenduNo ratings yet

- 13 - Audit of Different Types of EntititesDocument85 pages13 - Audit of Different Types of EntititessmartshivenduNo ratings yet

- Form 16 & 16aDocument6 pagesForm 16 & 16asmartshivenduNo ratings yet

- 60 Days Master Study Plan For CA Exams 2021 Clear CA & Get AIRDocument4 pages60 Days Master Study Plan For CA Exams 2021 Clear CA & Get AIRsmartshivenduNo ratings yet

- CA Intermediate ABC Analysis AccountingDocument1 pageCA Intermediate ABC Analysis AccountingsmartshivenduNo ratings yet

- Internship Report On HSBCDocument30 pagesInternship Report On HSBCmahanamohitNo ratings yet

- De Tavera Vs Philippine Tuberculosis SocietyDocument10 pagesDe Tavera Vs Philippine Tuberculosis SocietyLeon Milan Emmanuel RomanoNo ratings yet

- White Collar CrimeDocument10 pagesWhite Collar CrimeRimel hossenNo ratings yet

- Republic Vs Li YaoDocument2 pagesRepublic Vs Li YaoKariz Escaño100% (1)

- Legal Technique and Logic - Assignment No. 1Document3 pagesLegal Technique and Logic - Assignment No. 1Syd Geemson ParrenasNo ratings yet

- Adjei v. Grumah: (1982-83) GLR 985. Court of Appeal, Accra 14 December 1982Document3 pagesAdjei v. Grumah: (1982-83) GLR 985. Court of Appeal, Accra 14 December 1982Naa Odoley OddoyeNo ratings yet

- A Butterfly Smile: Author: Mathangi Subramanian Illustrator: Lavanya NaiduDocument22 pagesA Butterfly Smile: Author: Mathangi Subramanian Illustrator: Lavanya NaiduNeyda EspínNo ratings yet

- Clarence Ebin Brisco, Jr. v. United States, 368 F.2d 214, 3rd Cir. (1966)Document3 pagesClarence Ebin Brisco, Jr. v. United States, 368 F.2d 214, 3rd Cir. (1966)Scribd Government DocsNo ratings yet

- Img 0002Document1 pageImg 0002rteyuu fhtgNo ratings yet

- Attention All Police Agents by Kate of GaiaDocument1 pageAttention All Police Agents by Kate of GaiaMassimiliano Maci Marangon100% (1)

- Government of Maharashtra State Common Entrance Test Cell, Mumbai. MAH-MBA/MMS CET 2024 Online Examination Admit CardDocument2 pagesGovernment of Maharashtra State Common Entrance Test Cell, Mumbai. MAH-MBA/MMS CET 2024 Online Examination Admit Cardadityasinghh0621No ratings yet

- Dell Server HCI Midrange DataProtection Update 27th Sept 2023Document87 pagesDell Server HCI Midrange DataProtection Update 27th Sept 2023Trương ĐứcNo ratings yet

- "Customary Land Title and Indigenous Rights in Papua New Guinea, Pacific Dynamics: Journal of Interdisciplinary Research, Volume 2 Number 1 June 2018Document10 pages"Customary Land Title and Indigenous Rights in Papua New Guinea, Pacific Dynamics: Journal of Interdisciplinary Research, Volume 2 Number 1 June 2018matteoxaltroNo ratings yet

- A. C. D. With:: If of Is If If of If IsDocument3 pagesA. C. D. With:: If of Is If If of If IsFerl Diane SiñoNo ratings yet

- How Nation-States Create and RespondDocument22 pagesHow Nation-States Create and RespondSofía G.No ratings yet

- In The Supreme Court of India: Catch Words Mentioned INDocument8 pagesIn The Supreme Court of India: Catch Words Mentioned INVishwam SinghNo ratings yet

- SDS Lithium Werks Safety Data Sheet Cells 013122Document9 pagesSDS Lithium Werks Safety Data Sheet Cells 013122andréNo ratings yet

- People vs. Aruta Case DigestDocument3 pagesPeople vs. Aruta Case DigestRhea Razo-Samuel100% (1)

- Case #5 Republic vs. Quinonez G.R. No. 237412, January 6, 2020 FactsDocument1 pageCase #5 Republic vs. Quinonez G.R. No. 237412, January 6, 2020 FactsJoan Pauline PimentelNo ratings yet

- Dominican Passport - Well Within Your Reach: An Exclusive Report by Mr. D For SM-C ReadersDocument19 pagesDominican Passport - Well Within Your Reach: An Exclusive Report by Mr. D For SM-C ReadersSven LidénNo ratings yet

- Guilty!Document3 pagesGuilty!Positivo2No ratings yet

- 2890.1 2004 - A1 2005Document3 pages2890.1 2004 - A1 2005Tony PedaNo ratings yet

- Mobile Banking in Bangladesh Term PaperDocument8 pagesMobile Banking in Bangladesh Term Paperea8r2tyk100% (1)

- People vs. SalanggaDocument8 pagesPeople vs. SalanggaMyra MyraNo ratings yet

- Role of UlumaDocument19 pagesRole of UlumaMariyam MurtazaNo ratings yet

- Difference Between Cheque Promissory Note and Bill of ExchangeDocument2 pagesDifference Between Cheque Promissory Note and Bill of ExchangeMario Tuliao50% (2)

- Articles of Incorporation - Realty Development CompanyDocument3 pagesArticles of Incorporation - Realty Development Companyrutchel espinosa100% (1)

- Chapter Four: Advanced Financial Accounting Code: ACFN 511 Load:5 ECTS/3 Cr. HRDocument70 pagesChapter Four: Advanced Financial Accounting Code: ACFN 511 Load:5 ECTS/3 Cr. HRRACHEL KEDIRNo ratings yet

Ca Foundation Accounts

Ca Foundation Accounts

Uploaded by

smartshivenduOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ca Foundation Accounts

Ca Foundation Accounts

Uploaded by

smartshivenduCopyright:

Available Formats

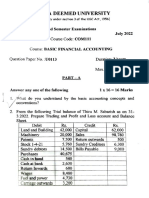

VIDYA SAGAR

CAREER INSTITUTE LIMITED

WHERE ALL INDIA 1ST RANK IS A TRADITION

CA FOUNDATION

For More remaining paper & answer key subscribe following channel :

NOTIFICATION - https://www.instagram.com/vsijaipur/?hl=en

PAPER - https://t.me/vsijaipur

VIDEO SOLUTION - https://www.youtube.com/c/VsijaipurOfficial

Phone No. : 7821821250, 7821821251, 9358900497, 9358999359

Phone No. : 7821821250, 7821821251, 9358900497, 9358999359

VIDYA SAGAR

CAREER INSTITUTE LIMITED

CA FOUNDATION

"PRINCIPLES AND PRACTICE OF ACCOUNTING "

MOCK TEST SERIES

Time : 3 Hours Maximum Marks: 100

========================================================================

Questions 1 is compulsory, attempt any 4 from the remaining

=======================================================================

1(a) State with reasons whether the following statements are True or False: 2x6

= 12

(i) Agreement of Trial balance is a conclusive proof of accuracy.

(ii) ‘Profit & Loss adjustment account’ is opened to rectify the errors detected in

the current accounting period.

(iii) Cost of property, plant and equipment includes purchase price, refundable

taxes & import duties after deducting any discount or rebate.

(iv) Value of the abnormal loss is debited to the consignment account.

(v) The term current asset is used to designate cash and other assets or

resources which are reasonably expected to be realized or sold or consumed

within one year.

(vi) Business of partnership comes to an end on death of a partner.

(b) Define Accounting Principles? 4

(c) Write short note on classification of accounts 4

2 (a) From the following information (as on 31.3.2020), prepare a bank reconciliation 10

statement after making necessary adjustments in the cash book:

Particulars

Bank balances as per the cash book (Dr.) 32,50,000

Cheques deposited, but not yet credited 44,75,000

Cheques issued but not yet presented for payment 35,62,000

Bank charges debited by bank but not recorded in the cash-book 12,500

Dividend directly collected by the bank 1,25,000

Insurance premium paid by bank as per standing instruction not 15,900

intimated

Cash sales wrongly recorded in the Bank column of the cash-book 2,55,000

Customer’s cheque dishonoured by bank not recorded in the cash- 1,30,000

book

Wrong credit given by the bank 1,50,000

Also show the bank balance that will appear in the trial balance as on 31.3.2020.

Phone No. : 7821821250, 7821821251, 9358900497, 9358999359

(b) M/s Roxy purchased a brand new machinery on 1 st January 2017 for ` 3,20,000 and also 10

incurred ` 80,000 on its installation. Another machinery was purchased on 1st July

2017 for ` 1,60,000. On 1st July 2019, the machinery purchased on 1st January 2017

was sold for ` 2,50,000. Another machinery was purchased and installed on 30th

September 2019for `60,000.

Under existing practice, the company provides for depreciation @10% p.a. on

Original cost. However, from the year 2020 it decided to adapt WDV method and

charge the depreciation @ 15% p.a. You are required to show the Machinery

Account for the years 2019 and 2020 considering the books of accounts are

closed on 31st December each year.

3 (a) Prepare Journal entries for the following transactions in Samarth’s books. 10

(i) Samarth’s acceptance to Aarav for ` 1,250 discharged by a cash payment

of ` 500and a new bill for the balance plus `25 for interest.

(ii) G. Gupta’s acceptance for ` 4,000 which was endorsed by Samarth to

Sahni was dishonoured. Sahni paid ` 20 noting charges. Bill withdrawn

against cheque.

(iii) Harshad retires a bill for ` 5,000 drawn on him by Samarth for ` 20

discount.

(iv) Samarth’s acceptance to Patel for ` 19,000 discharged by Sandeep

Chadha’sacceptance to Samarth for a similar amount.

(b) Mr. Divik of Jaipur purchased, 5,000 pieces of sarees at ` 500 per saree. Out of 10

these 3,000 sarees were sent on consignment to Mr. Manoj of Pillani at the

selling price of ` 600 per saree. The consignor paid ` 30,000 for packing and

freight. Mr. Manoj sold 2,500 sarees at ` 625 per saree and incurred ` 10,000 for

selling expenses and remitted ` 5,00,000 to Jaipur on account of Mr. Divik.

Mr. Manoj is entitled to a commission of 5%

on total sales plus a further commission at 20% of surplus price realized over

invoice price.

You are required to prepare Consignment Account in the books of Mr. Divik

and Mr. Divik’s account in the books of agent Mr. Manoj.

4 (a) The profits and losses for the previous years are: 2017 Profit ` 5,000, 2018 Loss 10

` 8,500, 2019 Profit ` 25,000, 2020 Profit ` 37,500. The average Capital

employed in the business is ` 1,00,000. The rate of interest expected from capital

invested is 10%. The remuneration from alternative employment of the proprietor

` 3,000 p.a. Calculate the value of goodwill on the basis of 3 years’ purchases of

Super Profits based on the average of 4 years.

Phone No. : 7821821250, 7821821251, 9358900497, 9358999359

(b) The following is the Receipts and payments account of Rotary Club for the year 10

ended on 31st March, 2020

Dr Receipts and payments A/c for the year ended on 31st march 2020 Cr

Receipts Amt. Payments Amt.

(`) (`)

To balance b/d 8,450 By Salaries and wages 12,250

To Subscription 23,000 By Supply of 18,250

To Sale of refreshments 22,000 refreshment 27,500

To Entrance fees 26,000 By Sports equipment 2,800

By Telephone Charges

To interest on investments 4,550 By Electricity charges 15,600

@ 7%

By Honorarium charges 6,500

By balance c/d 1,100

84,000 84,000

Additional information:

1. Following are the assets and liabilities on 31st March, 2019:

Assets- Sports equipment- ` 32,000; Subscription in arrears- ` 7,600;

furniture- ` 12,480

Liabilities- Outstanding Electricity charges- ` 5,400; Subscription in

advance- ` 6,250

2. Following are the assets and liabilities on 31st March, 2020-

Assets- Sports equipment- ` 50,500; Subscription in arrears- ` 5,200;

furniture-` 11,180

Liabilities- Outstanding Electricity charges- ` 3,800; Subscription in

advance- ` 4,850

3. 50% of the entrance fees to be capitalized.

4. Interest on the investments is being received in full, and the investments

have been made on 1.4.2019

You are required to prepare Income and Expenditure account and the Closing

balancesheet as of 31st March 2020 in the books of Rotary Club.

5(a) Write out the Journal Entries to rectify the following errors, using a Suspense Account. 10

(1) Goods of the value of `5,000 returned by Mr. Sharma were entered in the

Sales Day Book and posted therefrom to the credit of his account;

(2) An amount of `7,500 entered in the Sales Returns Book, has been posted

tothe debit of Mr. Hari, who returned the goods;

(3) A sale of `20,000 made to Mr. Amit was correctly entered in the Sales

DayBook but wrongly posted to the debit of Mr. Sumit as ` 2,000;

(4) Bad Debts aggregating `15,000 were written off during the year in the

Salesledger but were not adjusted in the General Ledger; and

(5) The total of “Discount Allowed” column in the Cash Book for the month of

September, 2020 amounting to `12,500 was not posted.

Phone No. : 7821821250, 7821821251, 9358900497, 9358999359

(b) Konica Limited registered with an authorised equity capital of ` 2,00,000 divided into 10

2,000 shares of `100 each, issued for subscription of 1,000 shares payable at ` 25 per

share on application, ` 30 per share on allotment, ` 20 per share on first call and the

balance as and when required. Application money on 1,000 shares was duly received and

allotment was made to them. The allotment amount was received in full, but when the first

call was made, one shareholder failed to pay the amount on 100 shares held by him and

another shareholder with 50 shares, paid the entire amount on his shares. The company

did not make any other call. Give the necessary journal entries in the books of the

company to record these transactions.

6(a) From the following details calculate the average due date: 5

Date of Bill Amount (`) Usance of Bill

28th January, 2020 2,500 1 month

20th March, 2020 2,000 2 months

12th July, 2020 3,500 1 month

10th August, 2020 3,000 2 months

.

(b) B Limited issued 50,000 equity shares of ` 10 each payable as ` 3 per share on 10

application, ` 5 per share (including ` 2 as premium) on allotment and ` 4 per share on

call. All these shares were subscribed. Money due on all shares was fully received except

from X, holding 1000 shares who failed to pay the allotment and call money and Y, holding

2000 shares, failed to pay the call money. All those 3,000 shares were forfeited. Out of

forfeited shares, 2,500 shares (including whole of X's shares) were subsequently re-issued

to Z as fully paid up at a discount of ` 2 per share.

Pass necessary journal entries in the books of B limited. Also prepare Balance

Sheet and notes to accounts of the company.

(c) Distinguish between Periodic Inventory System and Perpetual Inventory System. 5

Phone No. : 7821821250, 7821821251, 9358900497, 9358999359

Phone No. : 7821821250, 7821821251, 9358900497, 9358999359

You might also like

- Luwalhati Sa DiyosDocument5 pagesLuwalhati Sa DiyosDebbie TschirchNo ratings yet

- FABM 210 Fundamentals of Accounting Part 2: Lyceum-Northwestern UniversityDocument10 pagesFABM 210 Fundamentals of Accounting Part 2: Lyceum-Northwestern UniversityAmie Jane MirandaNo ratings yet

- Assignment-Code 438Document5 pagesAssignment-Code 438Alice JasperNo ratings yet

- Parallel Currencies in Asset Accounting: 1. Define Currencies For Leading Ledger: (OB22)Document7 pagesParallel Currencies in Asset Accounting: 1. Define Currencies For Leading Ledger: (OB22)sapeinsNo ratings yet

- FDN J22 - TS 2 - P1 Account - QueDocument5 pagesFDN J22 - TS 2 - P1 Account - QueShantanu JadhavNo ratings yet

- SP - XI - AccountancyDocument3 pagesSP - XI - AccountancyPriyankadevi PrabuNo ratings yet

- BFC 3125 Financial Accounting IDocument5 pagesBFC 3125 Financial Accounting Ikorirenock764No ratings yet

- Accounts Suggested Ans CAF Nov 20Document25 pagesAccounts Suggested Ans CAF Nov 20Anshu DasNo ratings yet

- Paper - 1: Principles and Practice of Accounting: Question No. 1 Is CompulsoryDocument25 pagesPaper - 1: Principles and Practice of Accounting: Question No. 1 Is CompulsorySaurabh JainNo ratings yet

- +1 Accountancy ONLINE Final Examination 2021Document5 pages+1 Accountancy ONLINE Final Examination 2021Rajwinder BansalNo ratings yet

- Vidya Sagar: Foundation Major Test - 1 (Series - 3) Nov - 20 "Principles and Practice of Accounting"Document5 pagesVidya Sagar: Foundation Major Test - 1 (Series - 3) Nov - 20 "Principles and Practice of Accounting"sonubudsNo ratings yet

- Sem 2 - End Sem PapersDocument23 pagesSem 2 - End Sem Paperslalith sasankaNo ratings yet

- 2accounting Questions Nov Dec 2019 CL PDFDocument3 pages2accounting Questions Nov Dec 2019 CL PDFRazib Das RaazNo ratings yet

- Ca Inter, Group I Class Test 5. Test - DT Topic - . PGBP Date-TIME: 1:30 Hours MARKS:40 Total No - of Questions: 7 Total No - of Pages: 00Document5 pagesCa Inter, Group I Class Test 5. Test - DT Topic - . PGBP Date-TIME: 1:30 Hours MARKS:40 Total No - of Questions: 7 Total No - of Pages: 00Shrestha GuptaNo ratings yet

- Test 4Document8 pagesTest 4govarthan1976No ratings yet

- Foundation Accounts Suggested Nov20Document25 pagesFoundation Accounts Suggested Nov20dhanushd0613No ratings yet

- B. Com I All PapersnDocument14 pagesB. Com I All Papersnrahim Abbas aliNo ratings yet

- Accounting IIDocument3 pagesAccounting IIHaseeb Mehmood AwanNo ratings yet

- Accountancy CLASS-XI-WPS OfficeDocument7 pagesAccountancy CLASS-XI-WPS Officemaruthesh.vNo ratings yet

- Bcom TaxDocument6 pagesBcom TaxAditya .cNo ratings yet

- Accounting Round 1Document6 pagesAccounting Round 1Malhar ShahNo ratings yet

- Test Series: November, 2021 Mock Test Paper - 2 Intermediate (New) : Group - I Paper - 1: AccountingDocument8 pagesTest Series: November, 2021 Mock Test Paper - 2 Intermediate (New) : Group - I Paper - 1: Accountingsunil1287No ratings yet

- RTP Dec2023 p1Document32 pagesRTP Dec2023 p1Vaibhav M S100% (1)

- Contentitemfile Clakzz57bxlrw0a21yjksjcx8 PDFDocument4 pagesContentitemfile Clakzz57bxlrw0a21yjksjcx8 PDFJoseph OndariNo ratings yet

- 2019-04 ICMAB FL 001 PAC Year Question April 2019Document3 pages2019-04 ICMAB FL 001 PAC Year Question April 2019Mohammad ShahidNo ratings yet

- CA Foundation Accounts RTP Nov22Document29 pagesCA Foundation Accounts RTP Nov22adityatiwari122006No ratings yet

- Financial Accounting 2019Document8 pagesFinancial Accounting 2019Ivy NinjaNo ratings yet

- Account - 2Document6 pagesAccount - 2kakajumaNo ratings yet

- ISC Accounts 11Document2 pagesISC Accounts 11Sriyaa SunkuNo ratings yet

- Test Paper Ca FoundDocument5 pagesTest Paper Ca FoundSarangapani KaliyamoorthyNo ratings yet

- Paper - 1: Principles & Practice of Accounting Questions True and FalseDocument32 pagesPaper - 1: Principles & Practice of Accounting Questions True and FalseShaindra SinghNo ratings yet

- 23 Accounts-RTP-DecemberDocument32 pages23 Accounts-RTP-Decemberjustinbieberm77No ratings yet

- Book Keeping FivDocument6 pagesBook Keeping FivALE MEDIANo ratings yet

- FINANCIAL ACCOUNTING I 2019 MinDocument6 pagesFINANCIAL ACCOUNTING I 2019 MinKedarNo ratings yet

- Practice Questions FADocument13 pagesPractice Questions FApeacegracie140% (1)

- Financial Accounting Question SetDocument24 pagesFinancial Accounting Question SetAlireza KafaeiNo ratings yet

- DT - Test 2 - D23 - NSDocument3 pagesDT - Test 2 - D23 - NSMadhav TailorNo ratings yet

- Institute of Business Management: Lms Based Finalexaminations-Summer 2020 Analytical PartDocument3 pagesInstitute of Business Management: Lms Based Finalexaminations-Summer 2020 Analytical PartSafi SheikhNo ratings yet

- FARAP-4518Document3 pagesFARAP-4518Accounting StuffNo ratings yet

- Paper - 1: Principles & Practice of Accounting Questions True and FalseDocument25 pagesPaper - 1: Principles & Practice of Accounting Questions True and Falsegargee thakareNo ratings yet

- GULF BOARD EXAMINATION-February-2022 Class: XI AccountancyDocument6 pagesGULF BOARD EXAMINATION-February-2022 Class: XI Accountancyneemthas761No ratings yet

- Mock-Iv AccountsDocument6 pagesMock-Iv AccountsAnsh UdainiaNo ratings yet

- 11 April Account Subjective Question'Document3 pages11 April Account Subjective Question'Nishant NepalNo ratings yet

- Mock Questions ICAiDocument7 pagesMock Questions ICAiPooja GalaNo ratings yet

- 11 Sample Papers Accountancy 2020 English Medium Set 3Document10 pages11 Sample Papers Accountancy 2020 English Medium Set 3Joshi DrcpNo ratings yet

- Intermediate Acctg Review-1Document3 pagesIntermediate Acctg Review-1Anonymous QWaWnuMNo ratings yet

- CA-Foundation Accounts Full Syllabus Test For Dec 2023 StudentsDocument4 pagesCA-Foundation Accounts Full Syllabus Test For Dec 2023 Studentsbabu.bhiwadiNo ratings yet

- Test Series: October, 2020 Mock Test Paper Final (Old) Course: Group - Ii Paper - 7: Direct Tax LawsDocument11 pagesTest Series: October, 2020 Mock Test Paper Final (Old) Course: Group - Ii Paper - 7: Direct Tax LawsAnshul JainNo ratings yet

- Xi Accounting Set 3Document6 pagesXi Accounting Set 3aashirwad2076No ratings yet

- Account Test 2Document5 pagesAccount Test 2klaw6048No ratings yet

- Accounts Mega ModelDocument8 pagesAccounts Mega Modellekha ram100% (1)

- 20uafam01 BM01 20ubmam01 Principles of Financial AccountingDocument3 pages20uafam01 BM01 20ubmam01 Principles of Financial AccountingArshath KumaarNo ratings yet

- Pilot TestDocument6 pagesPilot TestNguyễn Thị Ngọc AnhNo ratings yet

- Problems - Cash FlowDocument5 pagesProblems - Cash FlowKevin JoyNo ratings yet

- May 2016 Professional Examination Financial Accounting (1.1) Examiner'S Report, Questions and Marking SchemeDocument24 pagesMay 2016 Professional Examination Financial Accounting (1.1) Examiner'S Report, Questions and Marking SchemeMartn Carldazo DrogbaNo ratings yet

- ACC 281 SEMINAR QUESTIONS Version 2Document8 pagesACC 281 SEMINAR QUESTIONS Version 2Joel SimonNo ratings yet

- Foundation - Eng. Acc Law B 23Document6 pagesFoundation - Eng. Acc Law B 23Sahil SahuNo ratings yet

- SYJC Accounts Board Question Paper of Feb 2019Document6 pagesSYJC Accounts Board Question Paper of Feb 2019sohambhosale606No ratings yet

- Test Series: October, 2020 Mock Test Paper Intermediate (New) : Group - I Paper - 1: AccountingDocument7 pagesTest Series: October, 2020 Mock Test Paper Intermediate (New) : Group - I Paper - 1: AccountingIndhuNo ratings yet

- BBS 110 Introduction To Financial Accounting: Test IIDocument8 pagesBBS 110 Introduction To Financial Accounting: Test IIlloydbwalya588No ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- E-Books - Cash Flow StatementDocument38 pagesE-Books - Cash Flow StatementsmartshivenduNo ratings yet

- E-Books - Buyback of SecuritiesDocument22 pagesE-Books - Buyback of SecuritiessmartshivenduNo ratings yet

- 8 As 21 Consolidated Financial StatementsDocument26 pages8 As 21 Consolidated Financial StatementssmartshivenduNo ratings yet

- E-Books - AS 13 Accounting For InvestmentsDocument32 pagesE-Books - AS 13 Accounting For InvestmentssmartshivenduNo ratings yet

- CH 12 Audit of Item of FSDocument38 pagesCH 12 Audit of Item of FSsmartshivenduNo ratings yet

- Lec 01 CH 1 Nature, Objectives & Scope of Audit Auditing & AssuranceDocument41 pagesLec 01 CH 1 Nature, Objectives & Scope of Audit Auditing & AssurancesmartshivenduNo ratings yet

- 9 Framework For Preparation - Presentation of Financial StatementsDocument13 pages9 Framework For Preparation - Presentation of Financial StatementssmartshivenduNo ratings yet

- Vsi Jaipur Clear CA Intermediate May 2022 in First Attempt 7 MonthsDocument4 pagesVsi Jaipur Clear CA Intermediate May 2022 in First Attempt 7 MonthssmartshivenduNo ratings yet

- 1 Financial Statement of CompaniesDocument27 pages1 Financial Statement of CompaniessmartshivenduNo ratings yet

- 5 AmalgamationDocument52 pages5 AmalgamationsmartshivenduNo ratings yet

- Audit SamplingDocument35 pagesAudit SamplingsmartshivenduNo ratings yet

- 4 Internal ReconstructionDocument38 pages4 Internal ReconstructionsmartshivenduNo ratings yet

- 13 - Audit of Different Types of EntititesDocument85 pages13 - Audit of Different Types of EntititessmartshivenduNo ratings yet

- Form 16 & 16aDocument6 pagesForm 16 & 16asmartshivenduNo ratings yet

- 60 Days Master Study Plan For CA Exams 2021 Clear CA & Get AIRDocument4 pages60 Days Master Study Plan For CA Exams 2021 Clear CA & Get AIRsmartshivenduNo ratings yet

- CA Intermediate ABC Analysis AccountingDocument1 pageCA Intermediate ABC Analysis AccountingsmartshivenduNo ratings yet

- Internship Report On HSBCDocument30 pagesInternship Report On HSBCmahanamohitNo ratings yet

- De Tavera Vs Philippine Tuberculosis SocietyDocument10 pagesDe Tavera Vs Philippine Tuberculosis SocietyLeon Milan Emmanuel RomanoNo ratings yet

- White Collar CrimeDocument10 pagesWhite Collar CrimeRimel hossenNo ratings yet

- Republic Vs Li YaoDocument2 pagesRepublic Vs Li YaoKariz Escaño100% (1)

- Legal Technique and Logic - Assignment No. 1Document3 pagesLegal Technique and Logic - Assignment No. 1Syd Geemson ParrenasNo ratings yet

- Adjei v. Grumah: (1982-83) GLR 985. Court of Appeal, Accra 14 December 1982Document3 pagesAdjei v. Grumah: (1982-83) GLR 985. Court of Appeal, Accra 14 December 1982Naa Odoley OddoyeNo ratings yet

- A Butterfly Smile: Author: Mathangi Subramanian Illustrator: Lavanya NaiduDocument22 pagesA Butterfly Smile: Author: Mathangi Subramanian Illustrator: Lavanya NaiduNeyda EspínNo ratings yet

- Clarence Ebin Brisco, Jr. v. United States, 368 F.2d 214, 3rd Cir. (1966)Document3 pagesClarence Ebin Brisco, Jr. v. United States, 368 F.2d 214, 3rd Cir. (1966)Scribd Government DocsNo ratings yet

- Img 0002Document1 pageImg 0002rteyuu fhtgNo ratings yet

- Attention All Police Agents by Kate of GaiaDocument1 pageAttention All Police Agents by Kate of GaiaMassimiliano Maci Marangon100% (1)

- Government of Maharashtra State Common Entrance Test Cell, Mumbai. MAH-MBA/MMS CET 2024 Online Examination Admit CardDocument2 pagesGovernment of Maharashtra State Common Entrance Test Cell, Mumbai. MAH-MBA/MMS CET 2024 Online Examination Admit Cardadityasinghh0621No ratings yet

- Dell Server HCI Midrange DataProtection Update 27th Sept 2023Document87 pagesDell Server HCI Midrange DataProtection Update 27th Sept 2023Trương ĐứcNo ratings yet

- "Customary Land Title and Indigenous Rights in Papua New Guinea, Pacific Dynamics: Journal of Interdisciplinary Research, Volume 2 Number 1 June 2018Document10 pages"Customary Land Title and Indigenous Rights in Papua New Guinea, Pacific Dynamics: Journal of Interdisciplinary Research, Volume 2 Number 1 June 2018matteoxaltroNo ratings yet

- A. C. D. With:: If of Is If If of If IsDocument3 pagesA. C. D. With:: If of Is If If of If IsFerl Diane SiñoNo ratings yet

- How Nation-States Create and RespondDocument22 pagesHow Nation-States Create and RespondSofía G.No ratings yet

- In The Supreme Court of India: Catch Words Mentioned INDocument8 pagesIn The Supreme Court of India: Catch Words Mentioned INVishwam SinghNo ratings yet

- SDS Lithium Werks Safety Data Sheet Cells 013122Document9 pagesSDS Lithium Werks Safety Data Sheet Cells 013122andréNo ratings yet

- People vs. Aruta Case DigestDocument3 pagesPeople vs. Aruta Case DigestRhea Razo-Samuel100% (1)

- Case #5 Republic vs. Quinonez G.R. No. 237412, January 6, 2020 FactsDocument1 pageCase #5 Republic vs. Quinonez G.R. No. 237412, January 6, 2020 FactsJoan Pauline PimentelNo ratings yet

- Dominican Passport - Well Within Your Reach: An Exclusive Report by Mr. D For SM-C ReadersDocument19 pagesDominican Passport - Well Within Your Reach: An Exclusive Report by Mr. D For SM-C ReadersSven LidénNo ratings yet

- Guilty!Document3 pagesGuilty!Positivo2No ratings yet

- 2890.1 2004 - A1 2005Document3 pages2890.1 2004 - A1 2005Tony PedaNo ratings yet

- Mobile Banking in Bangladesh Term PaperDocument8 pagesMobile Banking in Bangladesh Term Paperea8r2tyk100% (1)

- People vs. SalanggaDocument8 pagesPeople vs. SalanggaMyra MyraNo ratings yet

- Role of UlumaDocument19 pagesRole of UlumaMariyam MurtazaNo ratings yet

- Difference Between Cheque Promissory Note and Bill of ExchangeDocument2 pagesDifference Between Cheque Promissory Note and Bill of ExchangeMario Tuliao50% (2)

- Articles of Incorporation - Realty Development CompanyDocument3 pagesArticles of Incorporation - Realty Development Companyrutchel espinosa100% (1)

- Chapter Four: Advanced Financial Accounting Code: ACFN 511 Load:5 ECTS/3 Cr. HRDocument70 pagesChapter Four: Advanced Financial Accounting Code: ACFN 511 Load:5 ECTS/3 Cr. HRRACHEL KEDIRNo ratings yet