Professional Documents

Culture Documents

Shashank Rao CV - Canada Format

Shashank Rao CV - Canada Format

Uploaded by

Shashank RaoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Shashank Rao CV - Canada Format

Shashank Rao CV - Canada Format

Uploaded by

Shashank RaoCopyright:

Available Formats

SHASHANK RAO

Mumbai, Maharashtra, India | (+91) 9833 967 054 | : raoshashank4293@gmail.com

https://www.linkedin.com/in/raoshashank4293/ | Visa Status: Holding PR

ACADEMIC QUALIFICATIONS

PGDM (Banking and Financial Services), National Institute of Bank Management, India, 2019

Master of Commerce (Accounts and Finance), Mumbai University, India, 2016

IPCC, Institute Of Chartered Accountants Of India, India, 2014

Bachelor of Commerce, SIES College Of Commerce And Economics, India, 2014

HSC, SIES College Of Commerce And Economics, India, 2011

SSC, OLPS High School, India, 2009

PROFESSIONAL EXPERIENCE

Indusind Bank, India Nov 2021 – Ongoing

Designation: Credit Analyst (Chief Manager) in the Credit/Risk vertical of Corporate & Investment Banking segment (client

annual turnover > INR 1,500 Crores) of the bank.

Vetting of loan applications initiated by Business team and credit underwriting of the Large Corporate deals by preparation of

detailed credit notes in adherence to RBI and bank policy guidelines, and ensuring clearance from sanctioning committee.

Handling portfolio risk management, annual review, credit monitoring, industry analysis, peer analysis, monitoring economic

and industry developments, and financial parameters of clients to detect potential risk triggers or signs of stress and taking

appropriate steps to mitigate risks.

Coordination with Relationship Managers, legal and Credit Administration teams in the entire lending activity, existing portfolio

management and other day to day activities.

CSB BANK (Formerly known as the Catholic Syrian Bank), India Aug 2019 – Nov 2021

Designation: Credit Analyst/Portfolio Manager in the Wholesale Banking team at CSB Bank, Mumbai.

Handling Credit proposals of ticket size >INR 25 Crores, from corporate clients having annual turnover >INR 500 Crores, both

New to Bank and existing.

Credit risk analysis and underwriting of large corporate /mid-market loan proposals post in-depth discussions with clients. Deal

structuring, due diligence, preparation of the Credit Memo to be placed to the sanctioning authority within desirable TAT.

Assessment of credit quality of the existing borrowers via internal credit rating exercise, conducting annual review/ renewals,

credit portfolio monitoring, early warning signal detection. Also attended consortium meetings, unit visits.

Managing the entire fresh loan lending process end-to-end covering underwriting and obtaining sanction followed by

documentation, valuation, disbursement in coordination with ops, legal and risk personnel, and relationship management/client

servicing thereafter.

Have handled products like Term Loan, Bank Guarantee, Working Capital and analyzed the credit risk in funding potential clients

spread across domains/sectors like NBFC (including Housing finance companies and non-bank lenders in other segments), real

estate, infrastructure construction, solar power, manufacturing etc.

Axis Bank, India Jul 2014 – May 2016

Designation: Officer

Was a part of Central Processing Unit team and handled retail customer onboarding, KYC compliance, timely and error free

CASA opening procedures, thus ensuring customer due diligence

INTERNSHIPS

Summer Internship at HDFC Bank (April-June 2018) on the Project Title “Review of the Money Market, Investment, PD and CSGL

processes at Treasury Operations”

S.Raghunath and Associates Chartered Accountants (December – February 2013) Interned for 2 months at the audit firm and

worked on accounting, auditing, and tax advisory

POSITIONS OF RESPONSIBILITY AND PROJECT DURING POST GRADUATION

Member Of Placement Committee & Student Council during MBA

Project on Assessing the Global impact of IFRS 9 (Financial Instruments) Implementation across European banks

CERTIFICATION

Accounting technician by virtue of clearing CA-CPT, IPCC

Credit Appraisal by CRISIL, Cash flow-based lending by CARE Ratings, Assessment of FB/NFB WC limits by NIBM

Well-versed with RBI guidelines, financial analysis, and MS Office

ACTIVITIES & INTERESTS

Avid follower of various sports, fitness, long-distance running, word games, and a gourmand

You might also like

- Bankers HB On Credit MGMT (Iibf)Document839 pagesBankers HB On Credit MGMT (Iibf)Prafulla Raja NishadNo ratings yet

- Dark Secret of GAOTUDocument21 pagesDark Secret of GAOTUbahbaguru73% (11)

- 166-2020 Roi PDFDocument47 pages166-2020 Roi PDFANJAN SINGH 3ANo ratings yet

- Dena Retail BankingDocument16 pagesDena Retail BankingSunil Kumar ChauhanNo ratings yet

- Valeroso Vs People of The Philippines GR 164815 February 22Document11 pagesValeroso Vs People of The Philippines GR 164815 February 22Ela A100% (2)

- BLM Lesson - Grade 5 PDFDocument5 pagesBLM Lesson - Grade 5 PDFAlex PfeifferNo ratings yet

- Resume (CV)Document2 pagesResume (CV)Shashank RaoNo ratings yet

- Prashant C VDocument4 pagesPrashant C VM Praveen KumarNo ratings yet

- VIL Bill 9833967054 2023-05-28Document4 pagesVIL Bill 9833967054 2023-05-28Shashank RaoNo ratings yet

- My Project of Vijaya BankDocument103 pagesMy Project of Vijaya Banktamizharasid100% (1)

- Bank of Baroda FY 14 Financial AnalysisDocument33 pagesBank of Baroda FY 14 Financial Analysisp2488100% (1)

- Reading Material For Promotion Exercise of OfficersDocument502 pagesReading Material For Promotion Exercise of OfficerssiddNo ratings yet

- Loan Against PropertyDocument5 pagesLoan Against Propertysandeep11661No ratings yet

- Apac Financial: Aditi Joshi: PR & Marketing InternDocument12 pagesApac Financial: Aditi Joshi: PR & Marketing InternPari SethNo ratings yet

- Indian Institute of Banking & Finance: Certificate Course On MSMEDocument6 pagesIndian Institute of Banking & Finance: Certificate Course On MSMEsonigaurav22No ratings yet

- Rohini PayyrollDocument4 pagesRohini Payyrollshubham agarwalNo ratings yet

- Statutory Audit of Bank Branches (Certain Aspects)Document43 pagesStatutory Audit of Bank Branches (Certain Aspects)Nivedita SharmaNo ratings yet

- Dhiraviyaraja G Villupuram PDFDocument4 pagesDhiraviyaraja G Villupuram PDFkasyapNo ratings yet

- Resume - Dhanushi EdirisooriyaDocument3 pagesResume - Dhanushi EdirisooriyaModi EmNo ratings yet

- CIBIL Score in DetailDocument11 pagesCIBIL Score in DetailOmkar BhoyeNo ratings yet

- Non - Performing Assests (Npa'S)Document12 pagesNon - Performing Assests (Npa'S)Suhit SarodeNo ratings yet

- IndusInd BankDocument67 pagesIndusInd BankCHITRANSH SINGHNo ratings yet

- TAT Tracker Q4Document22 pagesTAT Tracker Q4Shashank RaoNo ratings yet

- Credit Monitoring Arrangement Cma Data Mirror of Creditworthiness PDFDocument2 pagesCredit Monitoring Arrangement Cma Data Mirror of Creditworthiness PDFभगवा समर्थकNo ratings yet

- Internship Report On General Banking Activities of Basic BankDocument55 pagesInternship Report On General Banking Activities of Basic BankAfroza KhanomNo ratings yet

- 6.chapter 4 Research MethodologyDocument6 pages6.chapter 4 Research MethodologySmitha K BNo ratings yet

- HDFC Bank PresentationDocument14 pagesHDFC Bank PresentationvinaytoshchoudharyNo ratings yet

- Sbi Card Flip Form - 200510Document3 pagesSbi Card Flip Form - 200510Prabhakar Mishra0% (1)

- Agreement For Personal Power Loan: Asset Sales CentreDocument15 pagesAgreement For Personal Power Loan: Asset Sales CentreRAM GOPAL100% (1)

- Policy Guidelines HDFCDocument3 pagesPolicy Guidelines HDFCkwangdidNo ratings yet

- Doucmentation Manual of Bank PDFDocument518 pagesDoucmentation Manual of Bank PDFSamsul ArfinNo ratings yet

- MSME Application Up To Rs.2.00 CRDocument9 pagesMSME Application Up To Rs.2.00 CRsayanNo ratings yet

- SAI I-Pru MFDocument429 pagesSAI I-Pru MFDirgha ShertukdeNo ratings yet

- NPA & Categories Provisioning NormsDocument26 pagesNPA & Categories Provisioning NormsSarabjit KaurNo ratings yet

- Chapter # 1: 1.1 Study BackgroundDocument61 pagesChapter # 1: 1.1 Study Backgroundsamreen kNo ratings yet

- Msme Advances: Canara Bank Officers' Association Promotion Study Material - 2018Document67 pagesMsme Advances: Canara Bank Officers' Association Promotion Study Material - 2018Majhar HussainNo ratings yet

- Avanse Education Loan For Abroad StudyDocument16 pagesAvanse Education Loan For Abroad StudyGurbani Kaur SuriNo ratings yet

- Curriculum Vitae TemplateDocument3 pagesCurriculum Vitae TemplateSami Ullah Nisar100% (1)

- An Analysis of Credit Risk Management of Mutual Trust Bank LimitedDocument49 pagesAn Analysis of Credit Risk Management of Mutual Trust Bank LimitedHarunur RashidNo ratings yet

- Change of Address FormDocument1 pageChange of Address FormgenesissinghNo ratings yet

- Crisil Yearbook On The Indian Debt Market 2018 PDFDocument108 pagesCrisil Yearbook On The Indian Debt Market 2018 PDFafaque khanNo ratings yet

- Resume - Sheetal Khandelwal 2yr Exp TGT - Maths and ScienceDocument4 pagesResume - Sheetal Khandelwal 2yr Exp TGT - Maths and Sciencekamal khandelwalNo ratings yet

- AttachmentDocument60 pagesAttachmentTahseen banuNo ratings yet

- Iffco-Tokio General Insurance Co. LTD: Regd. Office: IFFCO Sadan, C-1, Distt. Centre, Saket, New Delhi-110017Document3 pagesIffco-Tokio General Insurance Co. LTD: Regd. Office: IFFCO Sadan, C-1, Distt. Centre, Saket, New Delhi-110017vikrant sehgalNo ratings yet

- India Bulls Housing Finance LimitedDocument67 pagesIndia Bulls Housing Finance LimitedslohariNo ratings yet

- HL Pni V1 NTR 3596132948944013913 NTR 7818877607244788448Document2 pagesHL Pni V1 NTR 3596132948944013913 NTR 7818877607244788448KanakaReddyKannaNo ratings yet

- 2023 29 11 23 31 56 Pre ClosestatementDocument4 pages2023 29 11 23 31 56 Pre Closestatementakash khokharNo ratings yet

- NBFC CrisisDocument12 pagesNBFC CrisisvikuNo ratings yet

- Sanction LetterDocument6 pagesSanction Letterpssahoo1334No ratings yet

- Bandhan Case Study: Prepared By: Bakshi Satpreet Singh (10MBI1005)Document17 pagesBandhan Case Study: Prepared By: Bakshi Satpreet Singh (10MBI1005)Sachit MalikNo ratings yet

- HdbfsDocument34 pagesHdbfsMounicaNo ratings yet

- Vidya Deepam Circ Gist Mar20 - Mar21Document105 pagesVidya Deepam Circ Gist Mar20 - Mar21pradeep kumar0% (1)

- Direst Selling Agent Policy-Retail & Consumer LendingDocument13 pagesDirest Selling Agent Policy-Retail & Consumer LendingVijay DubeyNo ratings yet

- Political Risk-Concept, Measurement and Management of Political RiskDocument10 pagesPolitical Risk-Concept, Measurement and Management of Political Riskshreya26janNo ratings yet

- Sbi P&SDocument2 pagesSbi P&SvmktptNo ratings yet

- Sme Study Modules For Quick Reference PDFDocument180 pagesSme Study Modules For Quick Reference PDFNilima ChowdhuryNo ratings yet

- A Report On Merchant Banking and Portfolio Management Rules: A Comparison of Bangladesh and IndiaDocument49 pagesA Report On Merchant Banking and Portfolio Management Rules: A Comparison of Bangladesh and IndiaYeasir ArafatNo ratings yet

- KalupurDocument70 pagesKalupuranushree100% (5)

- UCG7p2g3rF SBICAPsDocument31 pagesUCG7p2g3rF SBICAPsHarapriyaPandaNo ratings yet

- Overall Analysis of E-Banking and Information Management System of Sonali BankDocument71 pagesOverall Analysis of E-Banking and Information Management System of Sonali BankRola HaddadNo ratings yet

- Shashank Rao CV - CanadaDocument2 pagesShashank Rao CV - CanadaShashank RaoNo ratings yet

- Shashank CVDocument2 pagesShashank CVShashank RaoNo ratings yet

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)From EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)No ratings yet

- Shashank ResumeDocument2 pagesShashank ResumeShashank RaoNo ratings yet

- VIL Bill 9833967054 2023-05-28Document4 pagesVIL Bill 9833967054 2023-05-28Shashank RaoNo ratings yet

- Resume (CV)Document2 pagesResume (CV)Shashank RaoNo ratings yet

- TAT Tracker Q4Document22 pagesTAT Tracker Q4Shashank RaoNo ratings yet

- WABAG Output Sheet FY22 13032023Document8 pagesWABAG Output Sheet FY22 13032023Shashank RaoNo ratings yet

- Sample CLDocument1 pageSample CLShashank RaoNo ratings yet

- Resume Template For Canada & USADocument2 pagesResume Template For Canada & USAShashank RaoNo ratings yet

- VIL Bill 9833967054 2023-02-28Document5 pagesVIL Bill 9833967054 2023-02-28Shashank RaoNo ratings yet

- The Industries (Development and Regulation) Act 1951Document21 pagesThe Industries (Development and Regulation) Act 1951Sumanth JairajNo ratings yet

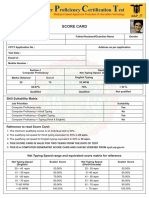

- CPCT - Score Card - CDRDocument1 pageCPCT - Score Card - CDRmuskan onlineNo ratings yet

- SubjunctiveDocument6 pagesSubjunctiveStathis PapageorgiouNo ratings yet

- Mondano Vs SilvosaDocument2 pagesMondano Vs SilvosaSheree TampusNo ratings yet

- DsddsdsdsdsDocument7 pagesDsddsdsdsdsLemuel Jay MananapNo ratings yet

- Affidavit of Successor: (One Box MUST Be Checked or The Form Will Be Rejected)Document2 pagesAffidavit of Successor: (One Box MUST Be Checked or The Form Will Be Rejected)johnbbb111No ratings yet

- A Critical Insight, Analysis and Comparative of Health Care Provision in The United Kingdom and United States of America.Document19 pagesA Critical Insight, Analysis and Comparative of Health Care Provision in The United Kingdom and United States of America.Abiola AbrahamNo ratings yet

- K.P.R. Sugar Mill LimitedDocument7 pagesK.P.R. Sugar Mill LimitedKarthikeyan RK SwamyNo ratings yet

- Salary GUIDE 2021Document25 pagesSalary GUIDE 2021Mohammed Aljoaib100% (1)

- IJTech - ME 1464 - Implementation of Traffic Separation Scheme For PRDocument8 pagesIJTech - ME 1464 - Implementation of Traffic Separation Scheme For PRIbnu FauziNo ratings yet

- Bioethics MidtermDocument51 pagesBioethics MidtermHello TalkNo ratings yet

- Marpol Annex Vi: Countries and Territories That Have RatifiedDocument1 pageMarpol Annex Vi: Countries and Territories That Have RatifiedMostafa ShaheenNo ratings yet

- Grc330 en Col17 Ilt FV Co A4Document33 pagesGrc330 en Col17 Ilt FV Co A4kiranbhumaNo ratings yet

- 3 Crisis of Secularism by Rajeev BhargavaDocument12 pages3 Crisis of Secularism by Rajeev Bhargavakumar030290No ratings yet

- KPI ReferenceDocument60 pagesKPI ReferenceKAMALI82No ratings yet

- Clarence Darrow Rhetorical Analysis EssayDocument1 pageClarence Darrow Rhetorical Analysis EssayMarcus PoseyNo ratings yet

- PuzzlesDocument2 pagesPuzzlesManvir SinghNo ratings yet

- Financial Projection Report On Attock Cement, Pakistan: Financial Management Assignment Submitted To Sir Asim ShaikhDocument7 pagesFinancial Projection Report On Attock Cement, Pakistan: Financial Management Assignment Submitted To Sir Asim ShaikhSyed Atiq TurabiNo ratings yet

- King Bhumibol Adulyadej of Thailand, 1927-2016Document5 pagesKing Bhumibol Adulyadej of Thailand, 1927-2016Tom ElderNo ratings yet

- Jefferson Starship Order Re Motion To DismissDocument15 pagesJefferson Starship Order Re Motion To DismissTHROnlineNo ratings yet

- Colombia Banco de BogotáDocument2 pagesColombia Banco de BogotáM YNo ratings yet

- Hse Plan - Rev-1Document81 pagesHse Plan - Rev-1srirambaskyNo ratings yet

- Financial ManagementDocument76 pagesFinancial ManagementJulio RendyNo ratings yet

- History 49Document1 pageHistory 49CrissaNo ratings yet

- 02-07-2021 HMB EnglishDocument36 pages02-07-2021 HMB EnglishKiran SNNo ratings yet

- FT-1 Practice PaperDocument24 pagesFT-1 Practice PaperAviral ShuklaNo ratings yet

- JHPAC V Lim FinalDocument1 pageJHPAC V Lim FinalNikko SterlingNo ratings yet