Professional Documents

Culture Documents

Financial Accounting 1 - Solution 4

Financial Accounting 1 - Solution 4

Uploaded by

mardhiahOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Accounting 1 - Solution 4

Financial Accounting 1 - Solution 4

Uploaded by

mardhiahCopyright:

Available Formats

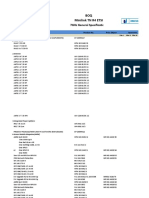

Financial Accounting 1

Solution 4

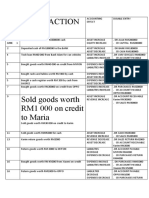

QUESTION 1

Date Transactions Effect on Account toAccount to

Transactions be Debited be

Credited

Apr 1 Started in business with Example: Cash RM Capital RM

RM 750 cash. Increase in cash 750 750

Increase in capital

4 Bought goods for cash RM Increase in Purchase Cash RM

110. purchase RM 110 110

Decrease in cash

5 Bought goods on credit RM Increase in Purchase Account

320 from Herdy. purchase RM 320 Payable –

Increase in Herdy RM

Account Payable 320

7 Sold goods for cash RM 64. Increase in sales Cash RM Sales RM

Increase in cash 64 64

10 Returned goods to Herdy Increase in Account Purchase

RM 50. purchase return/ Payable – return RM

return outwards Herdy RM 50

Decrease in 50

Account payable

13 Received loan RM 10,000 Increase in loan Cash RM Long term

from M Bank and repay Increase in cash 10,000 loan - M

within 2 years. Bank RM

10,000

14 Bought goods on credit RM Increase in Purchase Account

414 from Squire Enterprise. purchase RM 414 payable –

Increase in Squire

account payable Enterprise

RM 414

17 Sold goods to Square Sdn Increase in Account Sales RM

Bhd RM 100 on credit. Account receivable 100

Receivable – Square

Increase in sales Sdn Bhd

RM 100

20 Paid Herdy’s account by Decrease in Account Cash RM

cash RM 270. Account payable Payable – 270

Decrease in cash Herdy RM

270

21 Paid advertising expenses Decrease in cash Advertising Cash RM

RM 60 by cash. Increase in expenses 60

advertising RM 60

expenses

24 Received payment from Decrease in Cash RM Account

Square Sdn Bhd RM 80. account 80 receivable

receivable – Square

Increase in cash Sdn Bhd

RM 80

28 Owner withdraw cash Increase in Drawings Cash RM

amount RM 150 for drawings RM 150 150

personal use. Decrease in cash

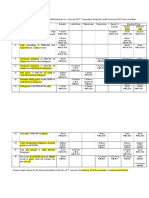

QUESTION 2

Date Transactions Effect on Account to Account to

Transactions be Debited be

Credited

Jan 1 Owner starts a business Example: Cash Capital

with RM 10,000 cash and Increase in cash 10,000 22,000

RM 12,000 of equipment. Increase in Equipment

equipment 12,000

Increase in capital

3 Increase in bank Bank RM Cash 5,000

Deposit cash to bank

Decrease in cash 5,000

account RM 5,000.

4 Increase in Purchase Cash RM

Bought goods RM 500 by Purchase RM 500 500

cash. Decrease in cash

5 Bought goods on credit Purchase Account

from Berjaya Enterprise Increase in RM 1,100 Payable –

RM 1,100 purchase Berjaya

Increase in Enterprise

Account Payable RM 1,100

8 Cash RM Sales RM

Sold goods RM 400 and

Increase in cash 400 400

received cash.

Increase in sales

11 Increase in Rental Bank RM

Paid premise rental RM expenses expenses 300

300 using cheque. Decrease in bank RM 300

12 Increase in Furniture Cash RM

Bought new furniture RM furniture RM 2,000 2,000

2,000 by cash. Decrease in cash

16 Account Sales RM

Sold goods to Amna Increase in sales Receivable 3,200

Enterprise RM 3,200 on Increase in – Amna

credit. Account Enterprise

receivable RM 3,200

23 Increase in Stationery Cash RM

Bought stationery for office

expenses RM 50 50

use RM 50 by cash.

Decrease in cash

27 Sold goods by cash RM Increase in cash Cash RM Sales RM

800. Increase in sales 800 800

28 Increase in Purchase Cash RM

Restock goods RM 500 and

purchase RM 500 500

paid cash.

Decrease in cash

31 Decrease in bank Account Bank RM

Decrease in Payable – 1,100

Paid to Berjaya Enterprise

Account payable Berjaya

full amount by cheque.

Enterprise

RM 1,100

You might also like

- BAAB1014 Accounting - (Group 1 Assignment)Document10 pagesBAAB1014 Accounting - (Group 1 Assignment)Hareen Junior100% (1)

- C - TS4FI - 2021: Answer: ADocument23 pagesC - TS4FI - 2021: Answer: AThigh100% (3)

- CruzJoaquin - ACCCOB1 - Chapter 1 Review of The Accounting CycleDocument37 pagesCruzJoaquin - ACCCOB1 - Chapter 1 Review of The Accounting CycleInigo CruzNo ratings yet

- BAAB1014 Quiz 1 (B) AnswersDocument4 pagesBAAB1014 Quiz 1 (B) AnswersHareen JuniorNo ratings yet

- Test 2Document1 pageTest 2Saranya DeviNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionNo ratings yet

- 06 Months Bank StatementDocument7 pages06 Months Bank StatementGSAINTSSANo ratings yet

- Tutorial 6 ITADocument2 pagesTutorial 6 ITAadifaaharefeenNo ratings yet

- ACC106Document12 pagesACC106Aneesah RaziNo ratings yet

- Effects and Equation-Individual AssignmentDocument8 pagesEffects and Equation-Individual AssignmentAbduzzahir Bin Mohd SaidNo ratings yet

- Acc 106 Ebook Answer Topic 4Document13 pagesAcc 106 Ebook Answer Topic 4syifa azhari 3BaNo ratings yet

- ACC 406 Intermediate Financial Accounting and Reporting Nbs3ADocument10 pagesACC 406 Intermediate Financial Accounting and Reporting Nbs3AKeyo BintajolNo ratings yet

- Group AssignmentDocument10 pagesGroup AssignmentKeyo BintajolNo ratings yet

- DATEDocument2 pagesDATEMUHAMMAD DANISH ANIQ ABDUL JALILNo ratings yet

- Effects of Transactions and Double Entry Question 2 Page 65Document2 pagesEffects of Transactions and Double Entry Question 2 Page 65azra balqisNo ratings yet

- Acc Double EntryDocument2 pagesAcc Double Entryk84mpbvcnvNo ratings yet

- Solution Chapter 3Document3 pagesSolution Chapter 3arha_86867820No ratings yet

- CA AccountingDocument12 pagesCA AccountingMuhd ZafranNo ratings yet

- Problems Accounting Variation Proforma 1 5 SolvedDocument5 pagesProblems Accounting Variation Proforma 1 5 SolvedSHORT VIDZNo ratings yet

- BAABDocument8 pagesBAABaqilahNo ratings yet

- Effects of Transactions and Double Entry Question 1 Page 65Document2 pagesEffects of Transactions and Double Entry Question 1 Page 65azra balqisNo ratings yet

- Introduction To Financial Accounting and Reporting (Acc106)Document8 pagesIntroduction To Financial Accounting and Reporting (Acc106)ammarNo ratings yet

- IGCSE & OL Accounting Worksheets AnswersDocument53 pagesIGCSE & OL Accounting Worksheets Answerssana.ibrahimNo ratings yet

- Acc030 Exercise Double EntryDocument2 pagesAcc030 Exercise Double EntryAqilahNo ratings yet

- Acc106 Group ReportDocument5 pagesAcc106 Group ReportAina AsgaliNo ratings yet

- Chapter 3 - Double EntryDocument13 pagesChapter 3 - Double EntryshasmitaavalanNo ratings yet

- Ex. 8.11 - B2 - A. Fuentes - Palacios - Lobangco - RonaCoDocument13 pagesEx. 8.11 - B2 - A. Fuentes - Palacios - Lobangco - RonaCoShwn Mchl SbynNo ratings yet

- Contoh Tugasan AccountDocument20 pagesContoh Tugasan AccountMuhammad IddinNo ratings yet

- Dat e Effects Account To Debited or Credited Book of Prime EntryDocument1 pageDat e Effects Account To Debited or Credited Book of Prime EntryNoor asrafNo ratings yet

- Assignment 2 Far110Document4 pagesAssignment 2 Far110AisyahNo ratings yet

- Variation Proforma For Journal Entries: S.No Transactions Chart of Accounts Accounting Pillars Reasons Debit CreditDocument11 pagesVariation Proforma For Journal Entries: S.No Transactions Chart of Accounts Accounting Pillars Reasons Debit CreditZaheer Ahmed SwatiNo ratings yet

- Account CHP 2Document9 pagesAccount CHP 2LOW YAN QINNo ratings yet

- General JournalDocument10 pagesGeneral JournalsameerdsportsmanNo ratings yet

- Journal EntriesDocument6 pagesJournal EntriesJermaine M. SantoyoNo ratings yet

- Chapter 5 Caselette Audit of InventoryDocument33 pagesChapter 5 Caselette Audit of InventoryAnna Taylor100% (1)

- Chapter 1 Extra ExercisesDocument9 pagesChapter 1 Extra ExercisesTerenceLeoNo ratings yet

- QUESTION 3-5 TutorialDocument3 pagesQUESTION 3-5 TutorialFaiz Ghazali100% (1)

- Acc030 Accounting EquationDocument3 pagesAcc030 Accounting EquationAqilahNo ratings yet

- Topic 6.Document5 pagesTopic 6.Ernie AbeNo ratings yet

- Amalgamation - Example 1 To 4Document4 pagesAmalgamation - Example 1 To 4Zhong HanNo ratings yet

- Tutorial Chapter 4 (TRIAL BALANCE)Document2 pagesTutorial Chapter 4 (TRIAL BALANCE)azra balqisNo ratings yet

- Transaction AccDocument2 pagesTransaction AccxuanylimNo ratings yet

- Intro To Financial Accounting 2Document3 pagesIntro To Financial Accounting 2Brute1989No ratings yet

- Audit of Inventory: Download NowDocument1 pageAudit of Inventory: Download NowMariz Julian Pang-aoNo ratings yet

- Template Tutorial EFFECTDocument2 pagesTemplate Tutorial EFFECTkopayied 07No ratings yet

- Group Project 1 (Examples of Transactions)Document12 pagesGroup Project 1 (Examples of Transactions)Fadilah JefriNo ratings yet

- MB0025 Financial and Management AccountingDocument7 pagesMB0025 Financial and Management Accountingvarsha100% (1)

- Homework 1Document2 pagesHomework 1Hasmieza AlieyaNo ratings yet

- L2 - Cashbook and Petty Cash BookDocument10 pagesL2 - Cashbook and Petty Cash BookSEVITHARNE A/P HARI SHANKERNo ratings yet

- COPY1Document30 pagesCOPY1kimberlynroqueNo ratings yet

- S4 Basson Traders - Copy (1)Document2 pagesS4 Basson Traders - Copy (1)Bucie MtshallyNo ratings yet

- Compiled Excel Report of Group 3 - Fabm2Document27 pagesCompiled Excel Report of Group 3 - Fabm2Dianna EsmerayNo ratings yet

- Audit-of-Inventory Homework AnswersDocument5 pagesAudit-of-Inventory Homework AnswersMarnelli Catalan100% (1)

- Transaction MerchandiseDocument8 pagesTransaction MerchandiseMichaela DeriloNo ratings yet

- Inv AudDocument32 pagesInv AudAud Balanzi100% (1)

- 高一簿记模拟试卷Document6 pages高一簿记模拟试卷Carpenters ForeverNo ratings yet

- Financial and Management Accounting MB0025Document27 pagesFinancial and Management Accounting MB0025manuunamNo ratings yet

- SET 1. Q.1 Explain Any Two Accounting Concepts With Example? AnsDocument9 pagesSET 1. Q.1 Explain Any Two Accounting Concepts With Example? AnsmuravbookNo ratings yet

- Question: Ledger, TB: Dr cash 变多5000Document2 pagesQuestion: Ledger, TB: Dr cash 变多5000S1X 32 許詠棋 KohYongKeeNo ratings yet

- Acc 1013 Trial Quiz 1Document2 pagesAcc 1013 Trial Quiz 1Imran FarhanNo ratings yet

- Merchandising Handout - Perpetual Vs PeriodicDocument1 pageMerchandising Handout - Perpetual Vs PeriodicTineNo ratings yet

- L01 - Introduction To Financial AccountingDocument12 pagesL01 - Introduction To Financial AccountingmardhiahNo ratings yet

- L06 - Capital ExpenditureDocument7 pagesL06 - Capital ExpendituremardhiahNo ratings yet

- CH 04Document77 pagesCH 04mardhiah100% (1)

- Financial Accounting 1 - Solution 2Document3 pagesFinancial Accounting 1 - Solution 2mardhiahNo ratings yet

- Financial Accounting 1 - Solution 3Document2 pagesFinancial Accounting 1 - Solution 3mardhiahNo ratings yet

- Traffic ManagementDocument40 pagesTraffic ManagementVANILLI REIN AGUILARNo ratings yet

- Account Statement 151222 140123Document26 pagesAccount Statement 151222 140123Anup SharmaNo ratings yet

- Az900 Notes2Document2 pagesAz900 Notes2Akash PrasanthNo ratings yet

- Answer No. 1Document5 pagesAnswer No. 1Anurag GuptaNo ratings yet

- Fiot Unit 2Document37 pagesFiot Unit 2Anusha Penchala100% (1)

- Modul A - Integration Systems Day 1 - Itnsa - LKSN 2021Document9 pagesModul A - Integration Systems Day 1 - Itnsa - LKSN 2021MUHAMMAD TAUFIQ AL QARDAFINo ratings yet

- Lecture 2 Wireless Application ProtocolDocument3 pagesLecture 2 Wireless Application ProtocolzekariasNo ratings yet

- FitzMark Acquires Mannings Truck Brokerage From OIGDocument2 pagesFitzMark Acquires Mannings Truck Brokerage From OIGPR.comNo ratings yet

- LovenseDocument4 pagesLovenseDrava ChandraNo ratings yet

- Vehicles CAD Blocks - Cars in Plan ViewDocument3 pagesVehicles CAD Blocks - Cars in Plan Viewvignesh kumarNo ratings yet

- Helcim CONSDocument3 pagesHelcim CONSshivsagar1No ratings yet

- Daftar PustakaDocument5 pagesDaftar PustakaWinda AyuNo ratings yet

- Quotation: Marketing & AdvertisingDocument1 pageQuotation: Marketing & Advertisingblue lineNo ratings yet

- Jan Cge201 Student Version 2021-2Document7 pagesJan Cge201 Student Version 2021-2ScribdTranslationsNo ratings yet

- New Schedule of Charges For Current AccountDocument2 pagesNew Schedule of Charges For Current AccountKishan DhootNo ratings yet

- Tl-Wpa8631p Kit - Qig - V3Document2 pagesTl-Wpa8631p Kit - Qig - V3Drax ReddNo ratings yet

- SCM Ec3Document6 pagesSCM Ec3Nishant BandaruNo ratings yet

- Dmitri CrocusDocument1 pageDmitri Crocusink.ink2013No ratings yet

- Clinical ExemplarDocument5 pagesClinical Exemplarapi-283407010No ratings yet

- Assignment No 1Document2 pagesAssignment No 1hamza syedNo ratings yet

- Community Based Health Insurance SchemeDocument25 pagesCommunity Based Health Insurance SchemeGbemigaNo ratings yet

- Boq Minilink TN R4 Etsi: 7Ghz General SpecificationsDocument9 pagesBoq Minilink TN R4 Etsi: 7Ghz General SpecificationsAkhtar RasoolNo ratings yet

- Hire Purchase Accounting & Instalment Purchase SystemDocument47 pagesHire Purchase Accounting & Instalment Purchase SystemSiddharth SalgaonkarNo ratings yet

- Chapter 3 - Management of DepositDocument3 pagesChapter 3 - Management of DepositDewan AlamNo ratings yet

- Unit 1Document4 pagesUnit 1Liviana ElenaNo ratings yet

- Trade Finance Presentation - 24-01-2024Document22 pagesTrade Finance Presentation - 24-01-2024Anup KhanalNo ratings yet

- Marksheet PDFDocument1 pageMarksheet PDFD igg v D oh vNo ratings yet

- Article 1 - Best Crypto Wallet AustraliaDocument11 pagesArticle 1 - Best Crypto Wallet AustraliaNelsonCecereNo ratings yet