Professional Documents

Culture Documents

Assignment - DCM1203 - Fundamentals of Accounting II

Assignment - DCM1203 - Fundamentals of Accounting II

Uploaded by

YashTag0 ratings0% found this document useful (0 votes)

106 views3 pagesThis document provides information about an assignment for a Bachelor of Commerce course. It includes:

1) Details about the course such as name, semester, credits, number of assignments, and marks.

2) Two assignment sets with 5 questions each worth a total of 30 marks. The questions cover topics like accounting for partnerships, consignment accounting, and joint ventures.

3) Instructions for students to answer all questions, with answers for 10-mark questions being approximately 400-450 words.

Original Description:

Original Title

Assignment_DCM1203_Fundamentals of Accounting II

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides information about an assignment for a Bachelor of Commerce course. It includes:

1) Details about the course such as name, semester, credits, number of assignments, and marks.

2) Two assignment sets with 5 questions each worth a total of 30 marks. The questions cover topics like accounting for partnerships, consignment accounting, and joint ventures.

3) Instructions for students to answer all questions, with answers for 10-mark questions being approximately 400-450 words.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

106 views3 pagesAssignment - DCM1203 - Fundamentals of Accounting II

Assignment - DCM1203 - Fundamentals of Accounting II

Uploaded by

YashTagThis document provides information about an assignment for a Bachelor of Commerce course. It includes:

1) Details about the course such as name, semester, credits, number of assignments, and marks.

2) Two assignment sets with 5 questions each worth a total of 30 marks. The questions cover topics like accounting for partnerships, consignment accounting, and joint ventures.

3) Instructions for students to answer all questions, with answers for 10-mark questions being approximately 400-450 words.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 3

Directorate of Online Education

ASSIGNMENT

SESSION APRIL 2023

PROGRAM BACHELOR OF COMMERCE (BCOM)

SEMESTER I

COURSE CODE & NAME DCM1203 – FUNDAMENTALS OF ACCOUNTING II

CREDITS 4

NUMBER OF ASSIGNMENTS & 02

MARKS 30 Marks each

Note: Answer all questions. Kindly note that answers for 10 marks questions should be approximately of 400 - 450 words.

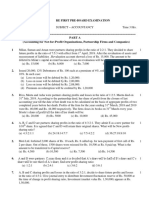

Assignment Set – 1 Marks Total

Q.No

Questions Marks

A. J, K and P are partners sharing profits and losses in the ratio of 3:3:1 respectively. Mr. J died on 31st 5 10

December 2021. Final amount due to her showed a credit balance of ₹ 1,00,000. Pass journal entries if,

(a) The amount due is paid off immediately.

1.

(b) The amount due is not paid immediately.

(c) ₹50, 000 is paid and the balance in future.

C. Discuss the objectives of Partnership Firm. 5

2. Sameer and Yasmin are partners with capitals of ₹ 15,00,000 and ₹ 10,00,000 respectively. They agreed to 5 +5 10

share profits in the ratio of 3:2. The books are closed on March 31, every year. Show how the following

transactions will be recorded in the capital accounts of the partners in case:

(i) the capitals are fixed, and (ii) the capitals are fluctuating.

Particulars Sameer Yasmin

₹ ₹

Capital contributed on 1st Oct 2019 3,00,000 2,00,000

Interest on capital 5 % P. a. 5 % P. a.

Directorate of Online Education

Drawings (during 2019-20) 30,000 20,000

Interest on drawings 1,800 1,200

Salary 20,000

Commission 10,000 7,000

Share in Profit for the year 19-20 60,000 40,000

A. Describe the distinction between dissolution of a firm and dissolution of a partnership 5 10

3. B. P, Q, and R are business partners who split profits in a 3:2:1 ratio. When Q retired, his portion was split 5

evenly between P and R. Calculate P and R's new profit-sharing ratio

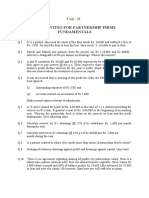

Q.No Assignment Set – 2 Marks Total

Questions Marks

4. A. Explain the differences between Departments and Branches 5 10

B. Pass the journal entries in books of Lessee for the following cases. 5

1. When the royalty is payable

2. For payment to landlord

3. Transferring royalty to P/L A/C

4. When short working is recouped

5. Transfer irrecoverable short working transfer to P/L A/c

5. Sree Traders of Gujrat purchased 10,000 sarees @ ₹ 100 per saree. Out of these, 6000 sarees were sent on 5+5 10

consignment to Nirmala Traders of Kolkata at the selling price of ₹ 120 per saree. The consignors paid ₹

3,000 for packing and freight.

Nirmala Traders sold 5,000 sarees @ ₹ 125 per saree and incurred ₹ 1,000 for selling expenses and

remitted ₹ 5,00,000 to Sree Gujrat on account. They are entitled to a commission of 5% on total sales plus

a further of 25% commission on any surplus price realized over ₹ 120 per saree.

3,000 sarees were sold at Gujrat @ ₹ 110 per saree.

Directorate of Online Education

Owing to fall in market price, the value of stock of saree in hand is to be reduced by 5%. You are required

to prepare (i) Consignment Account, and ii) Nirmala Traders Account in the book of consignor.

6. Explain the Features of Joint Ventures 10 10

You might also like

- The Balance Sheet and Income StatementDocument3 pagesThe Balance Sheet and Income Statementdhanya1995100% (1)

- Chapter 12 HW SolutionDocument5 pagesChapter 12 HW SolutionZarifah Fasihah67% (3)

- Tutorial 7 Trade Receivables (Q)Document3 pagesTutorial 7 Trade Receivables (Q)lious liiNo ratings yet

- Questions CH 8Document5 pagesQuestions CH 8Anonymous Jf9PYY2E8No ratings yet

- AFA Assingments II Sem PDFDocument3 pagesAFA Assingments II Sem PDFmartin santuroNo ratings yet

- Class - XII CommerceDocument8 pagesClass - XII CommercehardikNo ratings yet

- Acc Xii Pt1 PreptDocument5 pagesAcc Xii Pt1 PreptNishi AroraNo ratings yet

- Accounts..std 12Document3 pagesAccounts..std 12Abhishek SharmaNo ratings yet

- RERETESTDocument4 pagesRERETESTshveta0% (1)

- Kendriya Vidyalaya Sangathan, Delhi Region Pre-Board Examination 2020-21 Class XII - AccountancyDocument9 pagesKendriya Vidyalaya Sangathan, Delhi Region Pre-Board Examination 2020-21 Class XII - Accountancyraghu monnappaNo ratings yet

- 12 Accountancy 2023-24Document37 pages12 Accountancy 2023-24chiragdahiya0602No ratings yet

- Poa T - 7Document3 pagesPoa T - 7SHEVENA A/P VIJIANNo ratings yet

- Assignment - DCM1103 - Fundamentals of Acccounting IDocument3 pagesAssignment - DCM1103 - Fundamentals of Acccounting Itaniya thakurNo ratings yet

- Dileep PreboardDocument10 pagesDileep PreboardmktknpNo ratings yet

- Accountancy FinalDocument13 pagesAccountancy FinalVikram KaushalNo ratings yet

- 12 Ac 3 CH Test1oDocument6 pages12 Ac 3 CH Test1orohitmahto18158920No ratings yet

- Premium Mock 03Document13 pagesPremium Mock 03Rahul MajumdarNo ratings yet

- II PU Accountancy QPDocument13 pagesII PU Accountancy QPLokesh RaoNo ratings yet

- 07 Sample PaperDocument42 pages07 Sample Papergaming loverNo ratings yet

- Financial Accounting Question BankDocument10 pagesFinancial Accounting Question BankLAKSHMIKANTH.B MEC-AP/MCNo ratings yet

- Adv Accounts MTP M19 S2Document22 pagesAdv Accounts MTP M19 S2Harshwardhan PatilNo ratings yet

- Cainterseries 2 CompleteDocument70 pagesCainterseries 2 CompleteNishanthNo ratings yet

- CBSE Class 12 Accountancy Accounting For Partnership Firms Sure Shot QuestionsDocument6 pagesCBSE Class 12 Accountancy Accounting For Partnership Firms Sure Shot Questionsdakshrwt06No ratings yet

- DR GR Public School, Neyyattinkara PRE-BOARD EXAM 2021-22 AccountancyDocument17 pagesDR GR Public School, Neyyattinkara PRE-BOARD EXAM 2021-22 AccountancyPiyush HazraNo ratings yet

- Pre-Board 22-23 PDFDocument13 pagesPre-Board 22-23 PDFAdrian D'souzaNo ratings yet

- Question 1288284Document11 pagesQuestion 1288284groverpankaj04No ratings yet

- CBSE 12th Accountancy 2009 Unsolved Paper Delhi BoardDocument7 pagesCBSE 12th Accountancy 2009 Unsolved Paper Delhi Boardbrainhub50No ratings yet

- Holiday Homework Accountancy Class 12Document15 pagesHoliday Homework Accountancy Class 12Sambhav GargNo ratings yet

- Accountancy QP-Term II-Pre Board 1 - Class XIIDocument6 pagesAccountancy QP-Term II-Pre Board 1 - Class XIIRaunofficialNo ratings yet

- Accountancy Pre BoardDocument15 pagesAccountancy Pre BoardkenaNo ratings yet

- Retest For ToppersDocument3 pagesRetest For Toppersbhumika aggarwalNo ratings yet

- CBSE Class 12 Accountancy Question Paper & Solutions 2015 Delhi SchemeDocument39 pagesCBSE Class 12 Accountancy Question Paper & Solutions 2015 Delhi SchemeSuman PaswanNo ratings yet

- Test-chapter-1-Accountancy 12Document5 pagesTest-chapter-1-Accountancy 12Umesh JaiswalNo ratings yet

- 588c69bdc763b - Sample Paper Accountancy - 230102 - 185610Document7 pages588c69bdc763b - Sample Paper Accountancy - 230102 - 185610sanchitchaudhary431No ratings yet

- 12 Acc SP 01aDocument30 pages12 Acc SP 01asainiyuwakshiNo ratings yet

- Hsslive-march-2023-qn-SY-549 (Accounts With AFS) - Pages-DeletedDocument8 pagesHsslive-march-2023-qn-SY-549 (Accounts With AFS) - Pages-DeletednadidawaunionthekkekadNo ratings yet

- Accountancy-SQP 23-24Document12 pagesAccountancy-SQP 23-24Ashutosh SinghNo ratings yet

- Admission of A Partner - 1Document2 pagesAdmission of A Partner - 1Tera baapNo ratings yet

- Allama Iqbal Open University, Islamabad: (Department of Commerce)Document4 pagesAllama Iqbal Open University, Islamabad: (Department of Commerce)ilyas muhammadNo ratings yet

- Screenshot 2023-03-11 at 12.52.38 PM PDFDocument56 pagesScreenshot 2023-03-11 at 12.52.38 PM PDFpalak sanghviNo ratings yet

- XII Accts Re First Board Exam 20-21Document9 pagesXII Accts Re First Board Exam 20-21Sagar SharmaNo ratings yet

- Class Test Fundamentals and Goodwill Set A 01.05.2023 1Document2 pagesClass Test Fundamentals and Goodwill Set A 01.05.2023 1ANTECNo ratings yet

- Acounts Papaer II Preliminary Examination 2008 - 09Document5 pagesAcounts Papaer II Preliminary Examination 2008 - 09AMIN BUHARI ABDUL KHADERNo ratings yet

- Ajanta Public School: General InstructionsDocument3 pagesAjanta Public School: General Instructionsbhumika aggarwalNo ratings yet

- 12 Accountancy SQP 4Document11 pages12 Accountancy SQP 4KandaroliNo ratings yet

- Vijaygarh Jyotish Ray College: Financial Accounting - Ii Internal Examinations-2021Document2 pagesVijaygarh Jyotish Ray College: Financial Accounting - Ii Internal Examinations-2021Aditya GanoriaNo ratings yet

- Sample Paper - 2008 Class - XII Subject - Accountancy MM 80 Time 3Hrs Part ADocument5 pagesSample Paper - 2008 Class - XII Subject - Accountancy MM 80 Time 3Hrs Part Apawankumar311No ratings yet

- Unit 2 Partmership Firms FundamentsDocument10 pagesUnit 2 Partmership Firms FundamentsSunlight SirSundeepNo ratings yet

- Monthly Test Xii Acc September 2023-24Document2 pagesMonthly Test Xii Acc September 2023-24Deepak patidarNo ratings yet

- 12 Acc 1 ModelDocument11 pages12 Acc 1 ModeljessNo ratings yet

- 10 Sample PaperDocument41 pages10 Sample Papergaming loverNo ratings yet

- Account Ch-1 Partnership Firm - FundamentalsDocument19 pagesAccount Ch-1 Partnership Firm - Fundamentalsapsonline8585No ratings yet

- De CV62 S NX QSB Tetgkk WaDocument24 pagesDe CV62 S NX QSB Tetgkk WaShabanaNo ratings yet

- 12 23 24sp Accountancy ExportDocument12 pages12 23 24sp Accountancy Exportdheeru2197No ratings yet

- Marking Scheme PRE-BOARD (2009-10) : Part ADocument9 pagesMarking Scheme PRE-BOARD (2009-10) : Part AIsha KembhaviNo ratings yet

- Accountancy SQPDocument13 pagesAccountancy SQPDeepak Kr. VishwakarmaNo ratings yet

- Xii Acc Worksheetss-1-29Document29 pagesXii Acc Worksheetss-1-29Unknown patelNo ratings yet

- Xii Acc WorksheetssDocument55 pagesXii Acc WorksheetssUnknown patelNo ratings yet

- CBSE Gulf Board Class 12 ACCOUNTANCY Exam Sample Question Paper 2020Document13 pagesCBSE Gulf Board Class 12 ACCOUNTANCY Exam Sample Question Paper 2020Kunal KapoorNo ratings yet

- Class Xii Summer Holiday Homework All MergedDocument97 pagesClass Xii Summer Holiday Homework All MergedRevathi KalyanasundaramNo ratings yet

- XII Holiday HW 2024-25Document83 pagesXII Holiday HW 2024-25shipra bataviaNo ratings yet

- Sem5 Acyg CC9Document3 pagesSem5 Acyg CC9Amrita RoyNo ratings yet

- Intaudp - Mem02Document2 pagesIntaudp - Mem02Cal PedreroNo ratings yet

- Series AA Amended and Restated Certificate of IncorporationDocument10 pagesSeries AA Amended and Restated Certificate of IncorporationY Combinator100% (1)

- Top 25 Valuation Interview Questions With Answers (Must Know!)Document19 pagesTop 25 Valuation Interview Questions With Answers (Must Know!)Łukasz MielcarekNo ratings yet

- Final Corpo Midterm CoverageDocument29 pagesFinal Corpo Midterm CoverageRedd ClosaNo ratings yet

- Free Cash FlowsDocument51 pagesFree Cash FlowsYagyaaGoyalNo ratings yet

- Invt03 AP - Models 0823Document58 pagesInvt03 AP - Models 0823Huang XinNo ratings yet

- Financial Statements of Electricity CompaniesDocument7 pagesFinancial Statements of Electricity Companiesradhey3993No ratings yet

- Partnership Corp. Chapter3Document17 pagesPartnership Corp. Chapter3deniseanne clementeNo ratings yet

- 2024 CFA Level 2 Review Study NotesDocument18 pages2024 CFA Level 2 Review Study NotescraigsappletreeNo ratings yet

- Ebook Corporate Finance Asia Pacific Edition PDF Full Chapter PDFDocument67 pagesEbook Corporate Finance Asia Pacific Edition PDF Full Chapter PDFmyrtle.sampson431100% (34)

- Module 22Document60 pagesModule 22Pedro JNo ratings yet

- Mutual Funds SeriesD enDocument20 pagesMutual Funds SeriesD enHappySinghNo ratings yet

- DAGALA - Lets AnalyzeDocument4 pagesDAGALA - Lets AnalyzeJeric TorionNo ratings yet

- CMA Inter Paper 12 MCQDocument19 pagesCMA Inter Paper 12 MCQloveyouthreethousand90No ratings yet

- Entrep Q4 - Module 6Document13 pagesEntrep Q4 - Module 6Paula DT Pelito100% (1)

- Chapter 4-2Document26 pagesChapter 4-2Asmaa MaamounNo ratings yet

- Dividend PolicyDocument3 pagesDividend PolicyJaspreet KaurNo ratings yet

- RHB Equity 360° - 8 October 2010 (Ann Joo, Dialog, Paramount, LPI Technical: Affin)Document3 pagesRHB Equity 360° - 8 October 2010 (Ann Joo, Dialog, Paramount, LPI Technical: Affin)Rhb InvestNo ratings yet

- Finance Placement Preparation GuideDocument14 pagesFinance Placement Preparation GuideYash NyatiNo ratings yet

- PHD Thesis Stock MarketDocument7 pagesPHD Thesis Stock Marketgjgcnp6z100% (2)

- Tribhuvan University: QuestionsDocument2 pagesTribhuvan University: QuestionsSabin ShresthaNo ratings yet

- Brochure Internacional Ene2018 (v.2)Document27 pagesBrochure Internacional Ene2018 (v.2)Darío Guiñez ArenasNo ratings yet

- 1 Subprime Mortgages Targeted Lower Income Americans New Immigrants and PeopleDocument1 page1 Subprime Mortgages Targeted Lower Income Americans New Immigrants and PeopleAmit PandeyNo ratings yet

- International Money MarketDocument18 pagesInternational Money Markeths927071No ratings yet

- Chapter 8 - End - of - Chapter - Problems - SolDocument18 pagesChapter 8 - End - of - Chapter - Problems - SolGaby TaniosNo ratings yet

- Wilmar Cahaya Indonesia Tbk. (S)Document3 pagesWilmar Cahaya Indonesia Tbk. (S)Solihul HadiNo ratings yet

- Chapter 9Document21 pagesChapter 9kumikooomakiNo ratings yet