Professional Documents

Culture Documents

Taxation Ass 2

Taxation Ass 2

Uploaded by

Jazon GotanghoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Taxation Ass 2

Taxation Ass 2

Uploaded by

Jazon GotanghoCopyright:

Available Formats

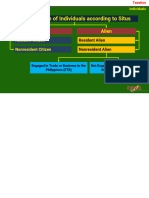

Resident Citizen-All income earned by Filipino citizens with permanent residence in the Philippines,

whether inside or outside the country, is subject to taxation.

Non-Resident Citizen-This person reports himself as having spent 183 days outside of the Philippines and

having received approval from the CIR for his desire to live abroad. OFWs are categorized as NRCs and

are only taxed on income derived from domestic sources in the Philippines.

Resident Aliens-a person residing in the Philippines but not being a citizen of the Philippines People who

have lived in the Philippines for longer than a year are also considered RAs.

Non-Resident Aliens-People who reside in the Philippines but are not citizens

Nonresident aliens engaged in trade/business-NRA who reside in the Philippines for more than 180 days

but less than a year throughout the tax year and generate business income there.

Non-resident aliens not engaged in trade/business- People that spent more than 180 days in the

Philippines without earning a living through their businesses there

Importance of classification-The purpose of classification is to identify the tax payers and the applicable

tax rate.

For tax purposes define who is classified Filipino citizens- Citizens who pay taxes on all of their income

earned within the Philippines are considered resident citizens because they live there permanently.

You might also like

- Income Taxation Lecture Notes.5.Classifications of Individual TaxpayersDocument5 pagesIncome Taxation Lecture Notes.5.Classifications of Individual Taxpayerseinel dc100% (1)

- Income Tax: Chapter 2: Income Taxes For IndividualDocument87 pagesIncome Tax: Chapter 2: Income Taxes For IndividualMaria Maganda MalditaNo ratings yet

- Individual Income Taxation NotesDocument23 pagesIndividual Income Taxation Notescristiepearl100% (3)

- Gross Income (Classification of Taxpayers)Document12 pagesGross Income (Classification of Taxpayers)Michael Thom MacabuhayNo ratings yet

- Mary Joy P. Junio, Cpa Notre Dame of Midsayap College Midsayap, CotabatoDocument8 pagesMary Joy P. Junio, Cpa Notre Dame of Midsayap College Midsayap, CotabatoJonathan JunioNo ratings yet

- Income Taxes For IndividualsDocument30 pagesIncome Taxes For IndividualsDarrr RumbinesNo ratings yet

- What Are The Kinds of TaxpayersDocument4 pagesWhat Are The Kinds of TaxpayersALee Bud100% (1)

- Share Taxpayer and Elements of Gross IncomeDocument24 pagesShare Taxpayer and Elements of Gross IncomeJessa Mae IgotNo ratings yet

- Taxation of IndividualsDocument49 pagesTaxation of IndividualsAnastasha Grey100% (1)

- Basergo, Lovers Mae B. General Classification of Individual TaxpayersDocument2 pagesBasergo, Lovers Mae B. General Classification of Individual Taxpayerslavender kayeNo ratings yet

- 03 Individuals. Study Notes. LectureDocument54 pages03 Individuals. Study Notes. Lecturemarvin.cpa.cmaNo ratings yet

- Corporation and PartnershipDocument1 pageCorporation and PartnershipMichael V. SalubreNo ratings yet

- Lesson 5 Inclusions Exclusions From Gi Final TaxDocument17 pagesLesson 5 Inclusions Exclusions From Gi Final TaxOrduna Mae AnnNo ratings yet

- Income Tax of IndividualsDocument23 pagesIncome Tax of Individualspeter banjaoNo ratings yet

- Features of Philippine Income Tax SystemDocument9 pagesFeatures of Philippine Income Tax SystemPATRICIA ANGELICA VINUYANo ratings yet

- Classification of Tax PayersDocument24 pagesClassification of Tax PayersHilarie JeanNo ratings yet

- Tax-on-Individuals PhilippinesDocument21 pagesTax-on-Individuals PhilippinesMaria Regina Javier100% (2)

- TaxpayersDocument26 pagesTaxpayersJessa Mae IgotNo ratings yet

- 2 Classification of Individual TaxpayersDocument2 pages2 Classification of Individual TaxpayersDiana SheineNo ratings yet

- Template Taxation Unit IIDocument29 pagesTemplate Taxation Unit IINacion, Jaime G.No ratings yet

- Week 3 Income Taxation Individual TaxpayersDocument58 pagesWeek 3 Income Taxation Individual TaxpayersJulienne Untalasco100% (1)

- Report in Taxation Group 3Document25 pagesReport in Taxation Group 3Patricia BacatanoNo ratings yet

- Income Tax ConDocument2 pagesIncome Tax ConMaricon EstradaNo ratings yet

- Classification of TaxpayerDocument2 pagesClassification of TaxpayerEduard Morelos100% (1)

- TAX Reviewer FINALSDocument9 pagesTAX Reviewer FINALSLalaine SantiagoNo ratings yet

- Taxation of IndividualsDocument12 pagesTaxation of Individualsaj lopezNo ratings yet

- Introduction To Income Taxation - 625041052Document21 pagesIntroduction To Income Taxation - 625041052ANGELA JOY FLORESNo ratings yet

- Introduction To Individual Income Taxation Chapter Overview and ObjectivesDocument25 pagesIntroduction To Individual Income Taxation Chapter Overview and ObjectivesMatta, Jherrie MaeNo ratings yet

- Classification of Individual TaxpayerDocument4 pagesClassification of Individual TaxpayerJj helterbrandNo ratings yet

- Classification of TaxpayerDocument2 pagesClassification of Taxpayerhannahmousa83% (24)

- Income Taxation: Tabian, Jieza Syra A. 2018-017-4883Document30 pagesIncome Taxation: Tabian, Jieza Syra A. 2018-017-4883WAYNENo ratings yet

- Handout TaxationDocument2 pagesHandout TaxationJohn Oicemen RocaNo ratings yet

- Assignment 2Document2 pagesAssignment 2Caroline Dy DimakilingNo ratings yet

- Classification of Individual TaxpayerDocument4 pagesClassification of Individual TaxpayerJj helterbrandNo ratings yet

- 20240313T061944584 Att 908654264076627Document113 pages20240313T061944584 Att 908654264076627klee042697No ratings yet

- Individual Taxpayers (Ordinary Income and Fringe Benefits)Document86 pagesIndividual Taxpayers (Ordinary Income and Fringe Benefits)ipbsalanguitNo ratings yet

- Types of Income Tax PayersDocument3 pagesTypes of Income Tax PayersAce Fati-igNo ratings yet

- Classification of Individual TaxpayerDocument31 pagesClassification of Individual TaxpayerPatrick BituinNo ratings yet

- Individual TaxpayersDocument2 pagesIndividual TaxpayersKenneth CajileNo ratings yet

- Individual Income TaxationDocument3 pagesIndividual Income TaxationJoAiza DiazNo ratings yet

- Inroduction To Income TaxationDocument20 pagesInroduction To Income TaxationW-304-Bautista,PreciousNo ratings yet

- TAX Outline 2 1Document18 pagesTAX Outline 2 1Master GTNo ratings yet

- TAX Outline 2 1Document18 pagesTAX Outline 2 1Master GTNo ratings yet

- Philippine Tax SystemDocument11 pagesPhilippine Tax SystemJeff LacasandileNo ratings yet

- Individual TaxpayerDocument17 pagesIndividual TaxpayermysterymieNo ratings yet

- Module 2 - Income Taxes For Individuals - Lecture NotesDocument52 pagesModule 2 - Income Taxes For Individuals - Lecture NotesRina Bico Advincula100% (1)

- M2u Classification Individual Taxation P1Document30 pagesM2u Classification Individual Taxation P1Xehdrickke FernandezNo ratings yet

- Individual Income Taxation I. Taxable Individuals A. Resident Citizen (RC)Document23 pagesIndividual Income Taxation I. Taxable Individuals A. Resident Citizen (RC)Ma Yra YmataNo ratings yet

- Train Individual INCOME TAXDocument48 pagesTrain Individual INCOME TAXMeireen Ann100% (2)

- Chapter 2 TaxationDocument79 pagesChapter 2 TaxationBEA CARMONANo ratings yet

- Chapter 2Document9 pagesChapter 2Sheilamae Sernadilla GregorioNo ratings yet

- Individual TaxationDocument113 pagesIndividual TaxationGemmalyn Julaton100% (7)

- Unit 3 - Concepts of Income & Income TaxationDocument10 pagesUnit 3 - Concepts of Income & Income TaxationJoseph Anthony RomeroNo ratings yet

- Basic Principles On Income TaxationDocument7 pagesBasic Principles On Income TaxationMark Kyle P. AndresNo ratings yet

- Classification of Individual Taxpayers - AlienDocument32 pagesClassification of Individual Taxpayers - AlienMarria FrancezcaNo ratings yet

- CLWTAXN NotesDocument7 pagesCLWTAXN NotesErin Leigh Marie SyNo ratings yet

- Annual Income Tax ReturnDocument1 pageAnnual Income Tax ReturnQueenel MabbayadNo ratings yet

- Intax ExerciseDocument26 pagesIntax ExerciseJosh CruzNo ratings yet

- Intro. To Income Tax FTDocument52 pagesIntro. To Income Tax FTJOANA GRACE ALLORINNo ratings yet