Professional Documents

Culture Documents

Biruk Zewdie AFM Assignment

Biruk Zewdie AFM Assignment

Uploaded by

Bura ZeOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Biruk Zewdie AFM Assignment

Biruk Zewdie AFM Assignment

Uploaded by

Bura ZeCopyright:

Available Formats

Name : Biruk Zewdie Mamo

1. Why it is unsound b/c Payback period is simple and fast, but economically unsound. It

ignores all cash flow after the cutoff date, it ignores the time value of money, and it

does not account for risk.

Why is it popular? It is the number of years it takes for a firm to recover its original

investment from net cash flows. The payback period of an investment is the length of

time required for the cumulative total net cash flows from the investment to equal the

total initial cash outlays. At that point in time, the investor has recovered the money

invested in the project. Merits of using Payback period

- This method uses cash flows rather than accounting profits which are more

realistic.

- Computation and usage of this method is simple and

- This method is quite important for those firms which are facing problems of

cash shortage and finance their projects throughout loans.

2. What are mutually exclusive investment projects? What is a dependent project?

Mutually exclusive projects are capital projects which compete directly with each other.

For example, if a manager has to make a choice strictly between undertaking either

project X or Y, but not both of them concurrently, then projects A and B are said to be

mutually exclusive. Project dependencies, also called task dependencies, are relationships

between tasks based on their sequence. Dependent tasks require one or more other tasks

to be completed or started before the team can start work on them.

3. A. Year Cash Flow Present Value Discount factory (15%) Present Value

0 $(700,000) 1.000 $(700,000)

1 (1,000,000) 0.870 (870,000)

2 250,000 0.756 189,000

3 300,000 0.658 197,400

4 350,000 0.572 200,200

5-10 400,000 2.164* 865,600

Net present value=$(117,800)

* PVIFA of 5.019 for 10 years minus PVIFA of 2.855 for 4 years.

* Total for years5-10.

Because the net present value is negative, the project is unacceptable.

The internal rate of return is 13.21

percent. If the trial-and-error method

were used,

we would have the following:

B. The internal rate of return is 13.21 percent. if the trial and error method were used, we

would have the following.

. The internal rate of return is 13.21

percent. If the trial-and-error method

were used,

we would have the following

Year Cash flow 14%d. factory 14%p.value 13%d. factory 13% p.value

0 $(700,000) 1.000 $(700,000) 1.000 $(700,000)

1 (1,000,000) 0.877 (877,000) 0.885 (885,000)

2 250,000 0.769 192,250 0.783 195,750

3 300,000 0.675 202,500 0.693 207,900

4 350,000 0.592 207,200 0.613 214,550

5-10 400,000 2.302 920,800 2.452 980,800

Net present value $(54,250) $14,000

*PVIFA for 10years minus PVIFA for 4 Years

*Total for 5-10

To approximate the actual rate, we interpolate between 13 and 14 Present As follows:

0.01[[0.13 $14,000]$14,000] $68250

IRR 0 =0.0021

0.14 $54250

And IRR=0.13+x=0.13+0.0021=0.01321or 13.21 percent. Because the internal rate of

return is less than the required rate of return, the project would not be acceptable.

. The internal rate of return is 13.21

percent. If the trial-and-error method

were used,

we would have the following

C. The project would be acceptable.

D. Payback period =6 years. (−$700,000 − $1,000,000 +$250,000 +$300,000 +

$350,000+$400,000 +$400,000 =0)

4.

You might also like

- Solution Manual For Financial Management Theory and Practice Brigham Ehrhardt 13th EditionDocument27 pagesSolution Manual For Financial Management Theory and Practice Brigham Ehrhardt 13th EditionKennethOrrmsqi100% (44)

- Capital Investment Appraisal: Basic Investment Appraisal (Does Not Take Into Account Time Value of Money)Document8 pagesCapital Investment Appraisal: Basic Investment Appraisal (Does Not Take Into Account Time Value of Money)Imtiaz AhmedNo ratings yet

- Lecture 8: Rate of Return Analysis: Instructional Material ForDocument20 pagesLecture 8: Rate of Return Analysis: Instructional Material ForAziezah PalintaNo ratings yet

- Girum Tsega PerfectDocument13 pagesGirum Tsega PerfectMesi YE GINo ratings yet

- Question OneDocument16 pagesQuestion OneShesha Nimna GamageNo ratings yet

- 9 - Chapter-7-Discounted-Cashflow-Techniques-with-AnswerDocument15 pages9 - Chapter-7-Discounted-Cashflow-Techniques-with-AnswerMd SaifulNo ratings yet

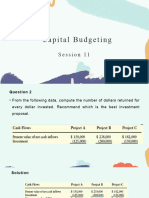

- Financial Management Session 11Document17 pagesFinancial Management Session 11vaidehirajput03No ratings yet

- Internal Rate of ReturnDocument14 pagesInternal Rate of ReturnHenna GautamNo ratings yet

- Lec 3 After Mid TermDocument11 pagesLec 3 After Mid TermsherygafaarNo ratings yet

- Managerial Accounting An Introduction To Concepts Methods and Uses 11th Edition Maher Solutions ManualDocument38 pagesManagerial Accounting An Introduction To Concepts Methods and Uses 11th Edition Maher Solutions Manualc03a8stone100% (20)

- Managerial Accounting An Introduction To Concepts Methods and Uses 11Th Edition Maher Solutions Manual Full Chapter PDFDocument38 pagesManagerial Accounting An Introduction To Concepts Methods and Uses 11Th Edition Maher Solutions Manual Full Chapter PDFKimberlyLinesrb100% (12)

- 3 - Case Study PT Layara - Capital Budgeting - Smemba 7Document3 pages3 - Case Study PT Layara - Capital Budgeting - Smemba 7CANo ratings yet

- Financial Management Session 10Document20 pagesFinancial Management Session 10vaidehirajput03No ratings yet

- Topic 8 - Inv App 1 Ans 2019-20Document4 pagesTopic 8 - Inv App 1 Ans 2019-20Gaba RieleNo ratings yet

- 2.1 - Case Study PT Layara - Capital BudgetingDocument3 pages2.1 - Case Study PT Layara - Capital BudgetingDaniel TjeongNo ratings yet

- Corporate Finance Solution Chapter 6Document9 pagesCorporate Finance Solution Chapter 6Kunal KumarNo ratings yet

- Net Present Value: Time Value of MoneyDocument4 pagesNet Present Value: Time Value of MoneyChris tine Mae MendozaNo ratings yet

- Financial Management Tutorial 2 AnswersDocument6 pagesFinancial Management Tutorial 2 AnswersDelfPDF100% (2)

- Corporate Finance: Answer 1Document12 pagesCorporate Finance: Answer 1shubhmNo ratings yet

- Sesi 11 BDocument22 pagesSesi 11 BTata JanetaNo ratings yet

- Capital Investment DecisionsDocument23 pagesCapital Investment DecisionsLindinkosi MdluliNo ratings yet

- Capital Rationing: Reporter: Celestial C. AndradaDocument13 pagesCapital Rationing: Reporter: Celestial C. AndradaCelestial Manikan Cangayda-AndradaNo ratings yet

- Chapter 7: Net Present Value and Capital BudgetingDocument6 pagesChapter 7: Net Present Value and Capital BudgetingViswanath KapavarapuNo ratings yet

- Final Exam Answer Scheme A141Document9 pagesFinal Exam Answer Scheme A141Hooi CheeNo ratings yet

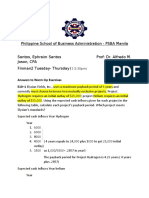

- Philippine School of Business Administration - PSBA ManilaDocument12 pagesPhilippine School of Business Administration - PSBA ManilaephraimNo ratings yet

- Internal Rate of ReturnDocument14 pagesInternal Rate of ReturnAnshul GuptaNo ratings yet

- Mod 4 Valuation and ConceptsDocument5 pagesMod 4 Valuation and Conceptsvenice cambryNo ratings yet

- CH 15Document20 pagesCH 15grace guiuanNo ratings yet

- 3.EF232. FIM IL II Solution CMA September 2022 Exam.Document5 pages3.EF232. FIM IL II Solution CMA September 2022 Exam.nobiNo ratings yet

- Present-Worth Analysis Example 5.1: Conventional-Payback Period: PP 195 - 196Document11 pagesPresent-Worth Analysis Example 5.1: Conventional-Payback Period: PP 195 - 196tan lee huiNo ratings yet

- Capital Budgeting HandoutsDocument13 pagesCapital Budgeting HandoutsCoke Aidenry SaludoNo ratings yet

- Nestle Lanka PLC Project Eco Packaging: 1. Capital BudgetingDocument5 pagesNestle Lanka PLC Project Eco Packaging: 1. Capital BudgetingSara100% (1)

- Managerial Economics (Chapter 14)Document28 pagesManagerial Economics (Chapter 14)api-3703724100% (1)

- Me 5.4 RMDocument12 pagesMe 5.4 RMPawan NayakNo ratings yet

- A. B. C. D. E.: Capital Costs, Operating Costs, Revenue, Depreciation, and Residual ValueDocument30 pagesA. B. C. D. E.: Capital Costs, Operating Costs, Revenue, Depreciation, and Residual ValueAfroz AlamNo ratings yet

- Further Practice On Interim Test (Soln)Document4 pagesFurther Practice On Interim Test (Soln)Lê ĐạtNo ratings yet

- Ty SPM L7Document15 pagesTy SPM L7sanilNo ratings yet

- Chapter 4 Capital Budgeting Techniques 2021 - Practice ProblemsDocument20 pagesChapter 4 Capital Budgeting Techniques 2021 - Practice ProblemsAkshat SinghNo ratings yet

- Project MGT AssgnmntDocument13 pagesProject MGT AssgnmntIsuu JobsNo ratings yet

- Week 7&8: AssignmentDocument11 pagesWeek 7&8: AssignmentkmarisseeNo ratings yet

- Tugas AKM III - Week 3Document6 pagesTugas AKM III - Week 3Rifda AmaliaNo ratings yet

- XYZ Energy ROIDocument27 pagesXYZ Energy ROIWei ZhangNo ratings yet

- Calculating IRRDocument2 pagesCalculating IRRZiwho NaNo ratings yet

- Corporate Finance 3Document15 pagesCorporate Finance 3Assignment HuntNo ratings yet

- Lecture No20Document14 pagesLecture No20Ali ShamsheerNo ratings yet

- Abm 460 Chapter Four (4) Capital BudgetingDocument33 pagesAbm 460 Chapter Four (4) Capital BudgetingphaniezaongoNo ratings yet

- Finance Student 7Document13 pagesFinance Student 7yany kamalNo ratings yet

- Financial Management-Coursework 2Document11 pagesFinancial Management-Coursework 2Tariq KhanNo ratings yet

- IM Chapter 6 and 7Document48 pagesIM Chapter 6 and 7Kasahun MekonnenNo ratings yet

- Manajemen Keuangan: Chapter 6: Making Capital Investment DecisionDocument9 pagesManajemen Keuangan: Chapter 6: Making Capital Investment Decision21. Syafira Indi KhoirunisaNo ratings yet

- Acctg. 9 Prefi Quiz 1 KeyDocument3 pagesAcctg. 9 Prefi Quiz 1 KeyRica CatanguiNo ratings yet

- BA4202 Capital Budgeting Solved ProblemsDocument9 pagesBA4202 Capital Budgeting Solved ProblemsVasugi KumarNo ratings yet

- Financial Management Session 14Document24 pagesFinancial Management Session 14Shivangi MohpalNo ratings yet

- Handouts 5-6 - Review - Exercises and SolutionsDocument6 pagesHandouts 5-6 - Review - Exercises and Solutions6kb4nm24vjNo ratings yet

- Project Free Cash FlowsDocument8 pagesProject Free Cash FlowsIkhaa AlbashNo ratings yet

- Chapter 2 SolutionsDocument3 pagesChapter 2 SolutionsMuhammad AimanNo ratings yet

- FinanceDocument6 pagesFinanceAbdullah ghauriNo ratings yet

- Lecture 27 Rate of Return AnalysisDocument32 pagesLecture 27 Rate of Return AnalysisDevyansh GuptaNo ratings yet

- Acct 3503 Test 2 Format, Instuctions and Review Section A FridayDocument22 pagesAcct 3503 Test 2 Format, Instuctions and Review Section A Fridayyahye ahmedNo ratings yet

- Xi - Financial Feasibility: Salaries Expense 400,000 Installation Expense Miscellaneous Expense Depreciation ExpenseDocument6 pagesXi - Financial Feasibility: Salaries Expense 400,000 Installation Expense Miscellaneous Expense Depreciation ExpenseMwale EdgarNo ratings yet

- e-StatementBRImo 422901012590530 Dec2023 20231226 173853Document3 pagese-StatementBRImo 422901012590530 Dec2023 20231226 173853abieyandrasusantoNo ratings yet

- Financial ReportingDocument156 pagesFinancial ReportingAkanksha singhNo ratings yet

- BCGE Rapport Annuel 2021 enDocument148 pagesBCGE Rapport Annuel 2021 enJayesh KaleNo ratings yet

- Kelompok 2 Analisis RasioDocument10 pagesKelompok 2 Analisis Rasio12A4-29-Yulita Fatma SariNo ratings yet

- Airthreads Valuation Case Study Excel File PDF FreeDocument18 pagesAirthreads Valuation Case Study Excel File PDF Freegoyalmuskan412No ratings yet

- Capital GainDocument4 pagesCapital GainqwertyNo ratings yet

- 31248mtestpaper Ipcc Ans sr2 p1Document17 pages31248mtestpaper Ipcc Ans sr2 p1Sundeep MogantiNo ratings yet

- MerchandisingDocument13 pagesMerchandisingairanicolebrugada08No ratings yet

- LG Corp Discussion Material EngDocument17 pagesLG Corp Discussion Material EngennuvijaykumarNo ratings yet

- College Accounting Chapters 1-27-21st Edition Heintz Solutions ManualDocument25 pagesCollege Accounting Chapters 1-27-21st Edition Heintz Solutions ManualJenniferGallagherrkoj98% (62)

- Super 30 by BB Sir May 24 - Part 1Document40 pagesSuper 30 by BB Sir May 24 - Part 1Sach SahuNo ratings yet

- LH 9 - Final Accounts ProblemsDocument29 pagesLH 9 - Final Accounts ProblemsHarshavardhanNo ratings yet

- Techniques of Capital Budgeting SumsDocument15 pagesTechniques of Capital Budgeting Sumshardika jadavNo ratings yet

- Resume 0462 A D3 For Shambhvi JaiswalDocument1 pageResume 0462 A D3 For Shambhvi Jaiswalhevobem530No ratings yet

- 2017 23-August Part-4 MemorandumDocument7 pages2017 23-August Part-4 MemorandumLucky NetshamutavhaNo ratings yet

- State Street:-: Information Classification: Limited AccessDocument8 pagesState Street:-: Information Classification: Limited AccessOmkar DeshmukhNo ratings yet

- Ind As & Ifrs Unit 3Document10 pagesInd As & Ifrs Unit 3Dhatri LNo ratings yet

- Presentation - Valuation and Income Tax Act 1961Document71 pagesPresentation - Valuation and Income Tax Act 1961Vaibhav JainNo ratings yet

- Lembar Kerja Ud AbadiDocument40 pagesLembar Kerja Ud AbadiMelianaWanda041 aristaNo ratings yet

- NASDAQDocument112 pagesNASDAQparaoaltoeavante100% (1)

- Partnership Class ExercisesDocument2 pagesPartnership Class ExercisesPetrinaNo ratings yet

- Financial Management CH 1Document22 pagesFinancial Management CH 1Gadisa TarikuNo ratings yet

- Practice Quiz - Chapter 6 - Alan Melville, International Financial Reporting, 8 - eDocument6 pagesPractice Quiz - Chapter 6 - Alan Melville, International Financial Reporting, 8 - echiahajuliet8No ratings yet

- Avenue Supermarts-Investment ThesisDocument1 pageAvenue Supermarts-Investment Thesisnageswar.pattipatiNo ratings yet

- Assignment 1Document13 pagesAssignment 1Elin EkströmNo ratings yet

- Exim Bank 2020 Financial StatementDocument1 pageExim Bank 2020 Financial StatementLucas MgangaNo ratings yet

- ABM FABM1 AIRs LM Q4-M12Document12 pagesABM FABM1 AIRs LM Q4-M12ajcervantes065No ratings yet

- Stock Market Extra QDocument2 pagesStock Market Extra QNick OoiNo ratings yet

- 05 - Task - Performance - 1 MathDocument2 pages05 - Task - Performance - 1 Mathaby marieNo ratings yet